精选观点 & Webinar

The COVID-19 pandemic has slowed down productivity and daily lives, stagnated the global supply chain, and affected financial market returns across almost all asset classes. In the first quarter of 2020, all markets around the world reported negative returns with varying degrees. While it seems that all is going the same direction, especially in the equities’ world, the fundamental risk factors were not. Among the fundamental factors we employ for China A shares, some has performed better than others amidst the market drawdown.

Apr 28, 2020

Premia CSI Caixin China New Economy ETF performed well and went up by 3% in a down market. In this article, we would like to share with you the reasons behind the strong performance and the comparison of this strategy with the other mainstream indexes that investors usually track in respect to performance attribution, sector allocation, niche thematic exposure and top drivers.

Apr 24, 2020

疫情冲击下,中国推出40万亿人民币的"新基建"计划振兴当前经济,"#新基建"因而频频炒上热搜榜,点燃市场广泛关注及业界讨论。 "新基建"到底为何? "新基建"概念股又该从何下手?

Apr 17, 2020

The market performance of gold in the midst of the COVID-19 crisis has left its fans a little puzzled. From a peak of USD 1703 on 9 March, it retreated to USD 1451 on 16 March - a 15% decline. Should one hold gold now, or rather park in cash tools? Our senior advisor Say Boon Lim demystifies in this piece.

Apr 14, 2020

As global asset prices have slumped on the back of the COVID-19 outbreak, concerns have arisen from supply chain disruptions to about global recession and a liquidity crisis. In this webinar, David Lai and Larry Kwok would discuss the lessons learned from the GFC, share our observations of some pandemic-led trends and implications, and suggest a few related investment ideas.

Apr 13, 2020

The COVID-19 outbreak has led to a worldwide pandemic, a global slowdown, arguably a recession and hopefully not a depression. Business activities globally have been halted due to the outbreak and demand has been shrinking significantly as well. Apart from some of the Asian countries including China, we have yet seen an inflection point of the case curves in most countries. In this article, we’d like to share some notable leading Chinese players in the space that have been working hard to fight against the virus for the domestic and global community.

Apr 03, 2020

The virous outbreak becomes one of the largest threats to the global economy and financial markets in decades. Will China, the one which has been suffered from the pandemic first, be able to bounce back first and lead the recovery worldwide like the Global Financial Crisis back in 2008? The latest call in new infrastructure investment maybe the key.

Mar 20, 2020

COVID-19 spread accelerating in the US, even as the number of new infections in China eases Impact will be significant on the largely consumer-driven US economy Markets are either in or on the brink of bear territory, and this is an angry bear Recession likely already in progress in Japan; possible recession in Europe; near zero GDP growth likely in the US by 2Q20 Corporate credit protection costs have started rising – more trouble ahead Seek safety in cash and US Treasury-related instruments

Mar 10, 2020

The coronavirus situation in China seems to have improved a lot, and now many are worried about what will happen as the factories get back on their feet. How's the progress so far?

Mar 10, 2020

客户时常和我们反映,他们非常喜欢Premia旗下的亚洲策略,不过由于ETF的流动性不高,因此仅能寻求一些美国或欧洲上市的类似的ETF。不过,其实投资者真正在意的并不是流动性本身,而是流动性成本。流动性和成本息息相关——流动性愈低,交易进出的成本就愈高,特别是在金融危机或市场失衡时期,其流动性可能跌至零。目前仍有许多投资者选择在美国或欧洲交易亚洲资产,认为这样的交易方式较为高效且便宜,不过这可能并不是一个明智的选择。在这次的网路研讨会中,我们将与您分享对于评估ETF流动性的观点,并分别以在纽约、伦敦和香港上市的ETF,比较投资越南市场的优劣。

Mar 10, 2020

Premia 图说

赖子健 , CFA

CFA

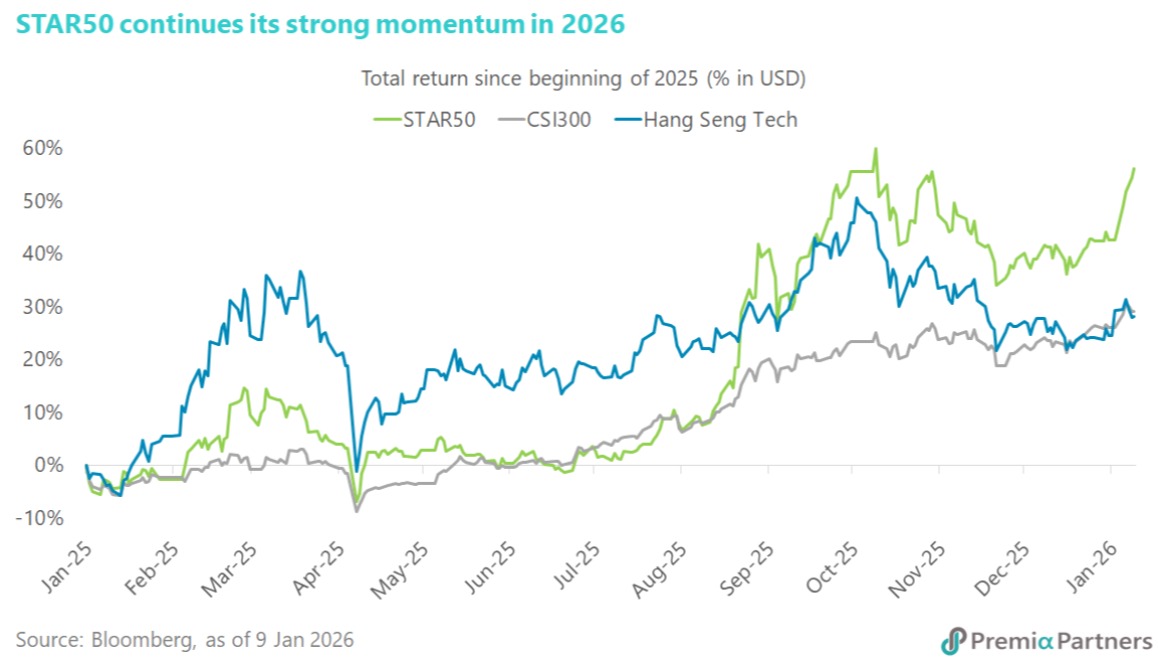

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026