精选观点 & Webinar

As cyclical movements would revert and short-term volatility hikes would calm, long-term strategic investors often look out for overarching secular or structural trends. Yet by definition, structural shifts and new innovations often take time. However, there can be catalysts! Witnessing a black swan can be a crisis, but like Winston Churchill advised – let’s not waste a crisis. So where do we look for growth opportunities?

Jun 12, 2020

The Two Sessions are always of interest to the market for the key economic policies unveiled by Chinese leaders. At this year’s Two Sessions, China decided not to set a GDP growth target for the first time in decades, raised the budget deficit ratio above a long-held “red line,” issued special treasury bonds for the first time in the last 2 decades, and rolled out a host of measures to buoy employment and support economic recovery from Covid-19.

Jun 10, 2020

随着联网汽车和智能家电等消费领域的应用日益普及,物联网(IoT,Internet of Things)已逐渐为人所熟知。 而在工业领域,正如我们一再强调与关注的话题——企业数字化转型将重写产业游戏规则,而工业互联网(IIoT,Industrial IoT)正是其中的重要环节。 事实上,工业互联网即是中国新基建七大重点投资领域之一,受到中国官方政策的大力支持。 所以,工业互联网是什么? 为何其中的行业领导者在疫情期间更具弹性? 在本篇文章中,我们将分享工业互联网的概念,以及该领域的发展进程和投资机会。

May 26, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. In this webinar, our co-CIO David Lai shares our research and insights on investing into ASEAN markets in light of the late COVID crisis, re-escalating US-China trade dispute and more importantly the gradual global supply chain reconfiguration.

May 26, 2020

China is in the early stage of restarting its economy, and China A shares market has held up relatively well compared to other global equities markets amid the COVID. In particular, our Premia China New Economy strategy has been very resilient throughout the crisis with YTD NAV performance of 10.7% (in CNY, as of May 26th, 2020). It has been consistently seeing inflows over the past months and is also among the best performing broad market China A ETFs globally. In this webinar, our co-CIO David Lai shares first-hand insights on the post-COVID impact, policy developments, and capital market flows of the Chinese market. As China recovers from the pandemic, how shall investors watch out for opportunities from the post-COVID recoveries, policy supports and new norms?

May 26, 2020

越南防疫佳绩有目共睹,政府自4月23日以来循序渐进地松绑封锁政策,尽管受全球疫情影响,其宏观数据仍不如预期。 越南政府于上周(5月15日)调整了原先设定的5%经济增长率目标,根据不同假设情境制订两个方案:若主要贸易伙伴的疫情在今年第三季得到控制,则增长目标为4.4%%-5.2%;若主要贸易伙伴的疫情迟至第四季才得到控制,则增长目标为3.6%%-4.4%。 越南目前的情况究竟为何? 是时候复苏了吗? 本篇文章我们将针对多方面进行简要更新。

May 18, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. And as a result of the increased tension and US protectionist measures targeting China, and pressure for MNCs to choose which one they side with under the pretext of protection against production disruptions in China, ASEAN and notably Vietnam are clear winners. But a more nuanced picture is closer to the truth. That is, the shifts in supply chains are more likely to be gradual than dramatic.

May 18, 2020

Yes, possibly. The different approaches taken by the US and China towards managing COVID-19 has likely set the stage for a widening of the growth differential between the two countries. Immediately, the earlier reopening of the Chinese economy means China’s GDP will still show a bit of growth this year. This compares to the controversial, tentative easing of restrictions in the US, only in May. Even if the US gradually normalizes from here, its GDP for will end 2020 with a big hole, which will take three to four years to fill. If China maintains its productivity growth, it should be able to manage a long-term average GDP growth rate of around 5.8% a year. Meanwhile, long-term US GDP growth from 2022 onwards could ease to 1.5% on lower investment/lower productivity growth. Taking into account IMF projected growth rates for 2020 and 2021, China could overtake the US in Dollar terms by 2029.

May 13, 2020

We previously highlighted the gaming industry just after the coronavirus outbreak in Account of an atypical, tech-enabled CNY holiday. With the COVID-19 pandemic raging on globally and people spend more time at home social distancing, the gaming industry has shown greater potential of booming opportunities. The large demographic base of tech-savvy and mobile-first youths born in the digital era provided a strong head start for China, especially in eSports.

May 11, 2020

即使是不玩游戏的人,也肯定会知道最近在全球大爆红的switch游戏动物森友会。事实上,电玩产业的规模非常巨大,市场规模已经超过10亿美元,受疫情影响,人们持续保持社交距离且居家时间拉长,电玩也成为大家排忧解闷的重要途径。截止2019年底,全球游戏市场收入已经超过1500亿美元,而其中45%来自智慧型手机和平板电脑上的手游。在电玩产业中,电子竞技,简称电竞,在过去十年已经发展成一个重要的专业行业。全球电子竞技收入估计在今年会超过10亿美元,而中国目前佔其中的20%。本期webinar,我们将与大家分享「社交距离」下的虚拟世界:中国的游戏、电竞和直播产业。

May 08, 2020

Premia 图说

赖子健 , CFA

CFA

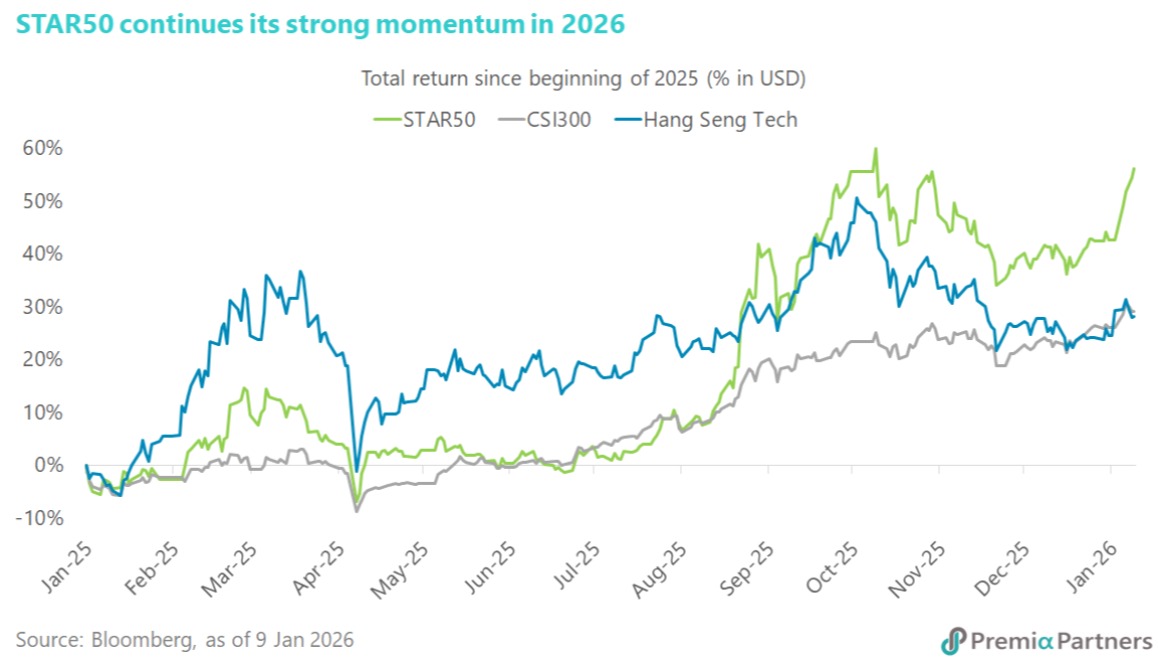

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026