精选观点 & Webinar

当全球投资者泛泛地将整体新兴市场视为单一的风险,新兴东盟早已悄悄地从全球新兴市场中脱颖而出,并且自今年七月的谷底反弹回升。之所以说”悄悄地”是因为几乎没有人谈论它,大多数的财经媒体更关注中美贸易战、土耳其货币剧贬、阿根廷经济危机或其他存在潜在风险的议题。东盟很少成为媒体的宠儿,或许是因为东盟的故事无关乎动荡或危机,而是持续性的成长和投资机会。

Sep 27, 2018

中国A股在今年6月被纳入摩根士丹利指数(第二阶段将在两週后落实),然而,年初迄今的中国市场却持续走软,这不禁使许多投资者感到疑惑——中国发生了什麽事?疲软的股市是由于宏观经济数据下滑、公司基本面的恶化,还是全球贸易战引发的避险情绪?在本篇文章中,我们将分析回顾年初迄今的中国市场,并展望下半年的投资情势:

Aug 17, 2018

每天清晨,我的小米人工智能音箱“小爱”会准时叫醒我并播放新闻和天气预报,我会透过美团订购早餐到公司,并以支付宝付款。有时候,我会骑摩拜单车出门到附近的地铁站,或用百度地图直接打车。百度会找到最近距离的滴滴出行或其他打车服务平台司机,并为司机选择从家到公司的最佳出行路线。路上,我会翻阅我的微信朋友圈和常用的微信公众号;此外,我还可以透过我的手机,查看我的智能手表和智能秤同步的最新健身成效数据,甚至远端重设家门密码给清洁工人或遥控居家各种智能电器。 随着物联网时代的来临,数字转型正迅速地将那些我们曾经在电影里幻想的未来科技,实现在我们的日常生活中。例如,中国科技巨头腾讯透过其微信平台将通讯应用程序的概念提升到一个全新的水平,该平台结合了即时通讯、社群网络、搜索引擎、电子商务购物平台、缴费支付系统等多项功能,为用户建立了集合衣食住行的生态系统,使用户几乎可以在微信平台上解决生活中的大小事。根据微软最新研究预测,2021年亚太地区将有超过60%的国内生产总值(GDP)来自数字产品和服务。在本文中,我们将深入探讨Premia亚洲创新技术ETF(3181HK)所着重的3个数字技术相关领域:• 电子商务 • 大数据和云计算 • 人工智能电子商务 — 阿里巴巴、京东正如我们先前发布的文章〈China Consumer is King〉中提到,阿里巴巴旗下电子商务平台天猫在2017年"双11购物节"创下单日销售额250亿美元的超高纪录,是美国黑色星期五和网络星期一(2个美国重要的购物节)总销售额的3倍。天猫在11月11日在24小时内共完成8.12亿份订单,相当于每秒涌入9,400份订单。而中国另一家电子商务巨头京东也在当天以及京东平台的6.18购物节创造了巨大的销售业绩。除了惊人的销售数据外,整个电子商务生态系统的扩张其实更值得关注。首先,移动支付已成为主流,90%的支付是通过手机支付,相比3年前此占比仅约40%,这主要归功于支付宝和微信支付等工具的日益普及。另外,大数据和自动化技术也充分地应用在供应链物流中,使电子商务生态系统如虎添翼。如天猫利用智慧物流,计算距离顾客地点最近的仓库发货,"双11购物节"的首张订单仅花12分钟就送到顾客手上;而京东也已正式启用无人机配送计画,并为未来实现从仓储管理到最终配送交付的一条龙自动化网路做了大量投研和基础建设。大数据和云计算 — 百度、Naver、腾讯、阿里巴巴、乐天在这个变化快速的科技世代,大数据在业务分析、深度学习和人工智能的进展皆扮演了至关重要的角色。根据国际数据资讯公司预测,2020年亚太地区的大数据商机将高达650亿美元,而根据此趋势未来将带来更巨大的收益。在大数据分析的产业生态中,经营搜寻引擎、社群媒体网站及电子商务平台的企业无疑收集了海量数据——百度、Naver、腾讯、阿里巴巴和乐天,也毫不意外地成为大数据分析领域的领先企业。与此同样自然衍生的业务扩展还包括这些企业不约而同地进入云服务和云计算领域,利用其数据与平台为其他机构提供服务,包括软件即服务(SaaS),平台即服务(PaaS)和基础架构即服务(IaaS)等产品。虽然与亚马逊或微软相比,百度、Naver、腾讯、阿里巴巴和乐天合总计的市场份额仍然很小,但这些亚洲平台对于亚洲当地大数据分析和人工智能发展仍然是重要的基础设施。应用层面来说,行为预测是大数据与人工智能、机器学习等技术应用最广泛的领域,从电子商务基于消费者过去浏览纪录以推销相关商品,到地图应用程式在使用者经常的下班时间推送常用路线交通状况,这些科技的应用早已渗透在我们的日常生活。人工智能 — 一种赋能技术,而非产品人工智能的研究已发展逾半个世纪,自理论计算机和人工智能之父阿兰.图灵(Alan Turing)于1950年发表了催生人工智能发展的论文《计算机械与智慧》,并提问"机器会思考吗?",人工智能已走过数十年漫长的发展历程。"人工智能(AI)"是一个相当广泛的概念,其范围从游戏、机器人、营销至金融科技、交通、医疗保健和教育等领域应有尽有,另外,概念上也包含上述的云计算及支持人工智能所需要的各种硬组件,如传感器、半导体、数据基础设施等等。为此,我们撰写了〈人工智能和机器人技术领域的领先企业〉一文进一步以案例研究,向大家介绍人工智能和机器人技术领域中领先的亚洲公司:- 安全和监控:海康威视 - 医疗保健:科大讯飞 - 消费电子:索尼 - 工业自动化:发那科 - 联网汽车:三星、百度

Aug 13, 2018

人工智能(AI)和机器人技术代表着一个长期的变革性转变,会影响到企业运营和人们生活的方式。最近几年,人工智能和机器人技术的迅速发展已经颠覆了从制造业到医疗保健,运输业等的各行各业,并正持续扩展到各个领域。世界经济论坛指出人工智能和机器人自动化技术正在从根本上改变全球经济,可视为蒸气,大规模生产和电子产品之后的第四次工业革命。先前我们曾讨论数字化转型正在如何改变我们的生活方式。在这篇文章中,我们将进一步探讨机器人技术,人工智能及其应用领域,并以我们最近推出的Premia亚洲创新科技ETF(3181 HK)中的领先企业为例。人工智能和机器人技术是什么?机器人技术是一项集工程学与计算机科学的跨学科技术,它涵盖了机器人的设计、构造、操作、使用,以及用于控制、感测回授和信息处理的计算机系统。机器人技术催生出能够取代人力的自动化机器,能在工厂里或危险环境运作,并进一步提升生产力。根据国际机器人协会统计数据,2017年全球机器人销售数量超过38万台,较五年前已成长逾两倍。全球工业机器人的前三大市场更集中于亚洲——中国、韩国和日本,其销售总和占全球比近60%。全球工业机器人销售数量资料来源:国际机械人协会,Premia Partners整理人工智能对许多人来说是一个因谷歌AlphaGo而变得为人熟悉的新兴主题。然而,它已经发展了很长时间,并且是个广泛的概念。维基百科定义说:“人工智能亦称机器智能,指由人制造出来的机器所表现出来的智能个体,展现相当于人类和其他动物的智能水平。”人工智能(AI)、机器学习(Machine Learning)和深度学习(Deep Learning)等术语并不相同,但却时常被混淆;简单来说,人工智能是机器智能,执行以往必须人类才能完成的任务,它广泛地涵盖了机器学习(ML)和深度学习(DL)两个子研究领域。愈来愈聪明的人工智能大脑,结合愈来愈敏捷的机器人身体——这两项技术领域的进步,正在共同改变我们实行操作、分析数据及思考决策的方式。以下我们将更深入了解几个亚洲领先企业案例:人工智能与视频监控:图像识别领导企业 —— 海康威视资料来源:海康威视海康威视是一家致力于提供智能视频监控解决方案的中国公司,是目前全球最大的安防监控设备制造商之一。自2001年成立以来,海康威视在视频监控行业的领导地位不断巩固,不仅拥有视频编码及视频图像处理等核心技术,更长期投入高额研发资金。近期推出的旗舰产品HikCentral视频管理系统,具有人脸识别,人脸配对,人脸搜索和人数统计功能,并结合安全访问控制和警报系统,融合多项技术至单一智能平台,提供更完整的商业安防智能解决方案。在过去几年中,海康威视已将业务扩展至众多其他领域,如运输,教育,医疗保健和工业自动化。海康威视以视频监控为核心的人工智能技术,使其在物联网时代下的智能城市和智能家居发展中,皆扮演重要的参与角色。人工智能与医疗保健:语音识别领导企业 —— 科大讯飞资料来源:科大讯飞科大讯飞是中国语音识别科技领域首屈一指的领导者,亦是全球语音人工智能技术的领先企业。科大讯飞在2017年《麻省理工科技评论》公布的"全球50大最聪明公司"名单中名列第6位,亦是全亚洲排名最高的公司。在技术方面,科大讯飞利用深度学习进行语音识别、自然语音处理及机器翻译等领域的研发,其技术已达国际顶尖水平。该公司技术在中国得到广泛的应用,如法院使用其语音识别技术转录冗长的诉讼程序;商业传呼中心使用其语音合成技术产生自动回复;中国最大叫车平台滴滴出行也使用其语音技术向司机广播订单。科大讯飞持续拓展人工智能领域,近期更投入大量资源拓展医疗保健领域,旗下"智医助理"机器人以中高级水淮成绩通过中国国家临床执业医师考试,目前已在多家医院投入使用。这款人工智能机器人可根据患者描述的症状,指引患者至正确的门诊部门,并且以语音听写技术协助医生获取患者信息,甚至分析病人资讯进行初步诊断。机器人技术与家庭娱乐:消费电子领导企业 —— 索尼尽管机器人技术于生活上的应用近年来才受到各界的高度关注,日本消费电子巨头索尼公司早自上个世纪已经致力于人工智能及机器人技术的发展。该公司自1999年发布居家娱乐型机器狗AIBO后,不断研发其核心人工智能技术,近期推出重新设计的进化版电子宠物狗AIBO,这款进化版AIBO具有先进的人工智能核心系统,是一只娱乐型自动机器狗,可以与主人形成情感连结并取悦主人。此外,通过人脸辨识技术,AIBO还可以自主学习适应主人的独特性格并熟悉居家环境,甚至可以随着时间的推移发展自己的个性。最近,索尼公司更与卡内基梅隆大学合作开发餐饮机器人,应用于食材制备、烹饪和运送,其成果可以拓展到研发可处理复杂多变任务的机器人,预期未来将能有更广泛的技能和行业应用。索尼的居家娱乐型机器狗 — 智能AIBO的设计资料来源:索尼机器人技术与制造业升级:工业自动化的领导企业 —— 发那科资料来源:发那科自1970年代初期以来,发那科就已经是机器人及自动化领域的领军企业,该公司专注于开发电脑数值控制(CNC)系统,是一种应用机器人技术的机器,可以以高精淮度和高效率执行馈送指令。发那科作为产业先驱,一直致力于透过机器人技术优化工业制造流程。自2001年以来,该公司就已倡导并全方面运营”关灯工厂”模式(即没有工人,不需要开灯也可以运作的工场)。它们的机器人以每24小时制造50个机器人的速度运作,并且可以在无人监管下运行长达30天。最近,发那科更与美国半导体巨头英伟达合作,利用人工智能技术使工业机器人具备自主学习能力,进一步提升工厂生产力。人工智能与网联汽车:三星、百度资料来源:三星、百度人工智能驱动的破坏式创新,普遍被认为将对运输业造成大规模的变革,自动驾驶是近年来最热门的研究和讨论话题之一。尽管完全自动化驾驶汽车目前仍存在障碍,但电动汽车和智能汽车的成长趋势十分强劲。亚洲科技巨头如三星和百度一直处于亚洲智能汽车技术开发的前沿,不仅能有效利用先进的传感器、全球定位系统和雷达系统获取数据,更能有效辅助驾驶系统;并且透过虚拟助理及智能物联网设备,使智能汽车成为个性化的工作场所、娱乐中心及数字化生活生态系统的重要角色。百度和哈曼国际(三星的全资子公司)专注于物联网技术,双方正携手合作为中国汽车厂商开发基于云计算的人工智能解决方案,这项战略合作将使智能车具备中英双语自动语音识别、自然语言处理及语音合成功能。相关投资策略:Premia 亚洲创新科技ETF(3181 HK)其它相关文章:科技驱动创新:冲击重塑亚洲成长亚洲「数位革命」如何改变我们的生活

Aug 13, 2018

亚洲科技公司迅速掘起,并持续以颠覆性的创新衝击全球传统产业。以前提起科技创新,最先想到的是美国五大科技龙头FAANG(脸书、亚马逊、苹果、网飞、谷歌),而现在许多投资者已经将眼光移至中国互联网三巨头BAT(百度、阿里巴巴、腾讯)。事实上,科技创新对我们生活已经带来了巨大的改变 —— 在这个日新月异的变革时代,我认为「重塑」比「冲击」这个词语更贴切,因为许多创新和所谓的「破坏性衝击 (Disruption)」早已潜移默化渗透进我们的日常生活中。例如,在〈亚洲「数字革命」如何改变我们的生活〉一文中提到,数位科技几乎每分每秒存在于我们四周,而我们的生活也已经离不开许多数位科技产品。大数据、人工智能(AI)和物联网(IoT)的飞速进展,成就了互联网和信息技术之外很多具深远影响的创新变革。在这篇文章中,我们将以下列主题探讨亚洲科技创新:• 亚洲创新发展现况 • 科技创新对哪些行业影响最大? • 科技创新如何颠覆传统行业分类、影响投资策略?亚洲创新发展现况亚洲目前拥有50%的全球互联网用户、18亿社交媒体活跃用户,以及市值约750亿美元的新创独角兽公司。根据联合国教科文组织统计数据,世界前5大研发投入国中有3个是亚洲国家——排名第二的中国、排名第三的日本和排名第五的韩国,这3个国家的研究人员合计佔全球约40%。此外,这3个国家也都是全球前五大的机器人市场。资料来源: 联合国教科文组织根据《哈佛商业评论》报告,很多全球领先的公司看中亚洲的创新动能及专业的技术人才,纷纷到亚洲来开发新产品、新服务和新商业模式,甚至许多公司已经在亚洲建立其创新研发的生态系统。在创新发展的进程中,亚洲之所以能在世界各地区脱颖而出,主要因素被认为包括:1)亚洲经济成长速度高于西方发达国家;2)各种各样大量的製造商和快速成长的中产消费阶级,成就了亚洲强劲且不断扩张的消费需求;3)政府对创新行业的发展高度重视并积极支持。科技创新对哪些行业影响最大?儘管信息技术本身即属一门行业类别的称呼,但随著科技革新和时代发展,技术不再只是一种单独的行业,而是一种赋能的工具。不论是提高产量还是降低成本,几乎每个行业都可以利用创新技术获益。除了传统的信息技术行业(如软件,硬件等)外,以下行业预期将在亚洲科技驱动的迅速成长趋势下受到最大的影响:零售业:随著互联网的迅速发展与普及,线上购物以及线上到线下(O2O)的营销模式所带来的便捷与实惠,使电子商务愈受衝击并取代传统零售业成为消费者的首选。这种衝击来自互联网技术为企业带来较低的成本结构及较高效的物流配送。在〈亚洲「数位革命」如何改变我们的生活〉文章中,我们也谈到中国两大电子商务平台阿里巴巴天猫和京东缔造出的惊人的销售额,一次次刷新全球零售史上的纪录。此外,无论是电子商务或传统零售业,愈来愈多企业正在利用人工智能及大数据来分析消费趋势并预测顾客的消费偏好与需求。工业:在亚洲,物联网发展及人工智能应用的最前沿体现在机器人和工业自动化上。随著机械手臂变得愈敏捷俐落再结合人工智能,机器人技术的进步将创造出更具智慧、更有能耐的工业机器人,以补充或取代许多领域因作业环境危险或是人口老化而短缺的人力资源。此外,科技的进展也推动了操作流程优化、预测性维护等工业领域实现更好的表现。在〈人工智能和机器人技术领域领先企业〉一文中我们会深入举例一些在人工智能以及工业机器人领域领先的应用案例。医疗保健:亚洲人口老化趋势以及快速成长中产阶级催生了对医疗保健产品的巨大需求,2017年亚洲生命科学项目筹集投资金额高达约400亿美元。先进的数据分析技术已为製药公司的药物研发及临床实验带来巨大效益,如生理模拟可以加速药物产品的开发,基于3D打印或虚拟实境的组织建模可以协助评估潜在风险,而人工智能也已应用于诊断成像和机器人手术。此外,医疗保健的创新发展也使患者更具医疗知识且充分瞭解自身状况,如数位药丸或纳米机器人可以进入患者的身体(和血液),透过智能设备检查并提供即时数据给患者和医生。交通运输:交通运输领域正在以多种不同的形式发生变革,并影响许多分支行业。在空中,具有智能传感器和精确全球定位系统的无人机,已经实现了新的物流配送和农地耕作的形式;在路上,得益于电池储能、图像传感和人工智能算法等技术的提升,电动车和无人驾驶技术也在不断进展。此外,物联网时代也促进了交通运输中从汽车到自行车的共享经济概念。科技创新如何颠覆传统行业分类、影响投资策略? 接近20年前,标准普尔及摩根士丹利公司联合推出目前全球最常用的全球行业分类标准,即GICS®;此套分类标准目前正在进行一次大规模的更新,并预计在今年9月生效。该修订是为了使分类能更准确反映现代公司的主要运营业务,但随之也伴随著一些问题,例如:电子商务公司如亚马逊或阿里巴巴,是否该归类为非必需消费品?美国科技龙头FANG(脸书、亚马逊、网飞、谷歌)中,网飞是否应归类为非必需消费品,而脸书、谷歌则与及其他媒体业者如迪士尼等一起归类为电信服务业?基于GICS分类的信息技术主题ETF一直是捕捉该领域成长的常见投资方法,随著科技创新的广泛应用,几乎所有行业都因著科技赋能创新与成长。因此,说以「GICS = 信息技术」来投资科技领域已经过时或者被颠覆并不为过,理性精明的投资者早已将资金从传统定义的科技ETF转向更定制化的主题型 ETF,特别是在人工智能、机器人自动化、社群媒体、半导体及生物科技等领域。儘管仍有许多ETF投资经理人以广泛GICS或行业分类基准(ICB)建构其投资组合,越来越多ETF发行商,包括我们 (Premia Partners) ,已经与指数供应商合作,重新定义行业分类标准,特别是在面临传统产业分类还无法有效描述新型经济结构下的颠覆性创新主题的情况下。我们已推出的亚洲创新科技主题ETF正是与领先数据供应商FactSet合作,用其特有的精细行业分类层级辨别相关公司收入来源的具体运营业务是否属于创新科技范畴。 在〈Targeting Asian Growth Through Innovation〉文章中,我们详细讨论了指数建构的方法,而您也可以在产品详情页面上了解更多有关Premia 亚洲创新科技ETF(3181 HK)的信息

Aug 13, 2018

Every investor is worried about a new round of depreciation of renminbi (Yes, again!). Seems this topic is always an easy sell among news headlines. Renminbi began to weaken, dropping from an exchange rate (USD/CNY) of 6.24 in late March to 6.82 as of July 24, since the breakout of a trade conflict between the US and China. The latest proposal from China central bank to incentivize banks to expand lending to companies created another worry among investors on monetary easing. The million-dollar question will be how far the depreciation can go. Let’s examine this matter from a few different perspectives and get a better understanding of the current situation.

Aug 02, 2018

东南亚国家联盟(Association of Southeast Asian Nations, 简称“东盟”)是由10个东南亚会员国共同组成的经济体,包括印度尼西亚、新加坡、泰国、菲律宾、马来西亚、文莱、越南、老挝、缅甸和柬埔寨。 目前,东盟成员国已涵盖了东南亚地区超过6亿的人口,合计国内生产总值约2.8万亿美金,位列全球第六大经济体。资料来源: 大华银行 (2018年5月)投资东盟市场的机遇与挑战全球许多投资者都在不断寻找高成长市场。继中国与印度的成长故事变得广为人知,增速也逐渐趋向平缓之后,东盟是逐渐进入视线的下一个高成长市场。我们将通过以下几点深入阐述东盟市场的投资机遇与挑战:1. 人口红利与城市化程度提高2. 经济增长正处于加速转折点3. “一带一路”促进贸易与投资4. 成员国发展差异带来的启示1.人口红利与城市化程度提高东盟已超越欧盟成为世界第三大人口地区,仅次于中国及印度。更值得一提是,东盟人口的平均年龄不到29岁,是全球最年轻的地区之一 (相比于中国与美国约37-38岁的平均年龄)。 此外,东盟的平均都市化程度不到55%,而每年增长率却高达6%。大量年轻人口带来的持续劳动力增长,以及城市化水平的提高都将对东盟未来五至十年的发展产生巨大推动作用。此外,东盟目前大约有6千万中产阶级家庭具有可自由支配支出的能力,即消费阶层。有统计预测这个数字将会在2025年增加一倍,达到约1.25亿,这将使东盟成为除中国以外最具成长潜力的消费市场,而城市化及生活水平提高也将会带来显著的消费升级趋势。资料来源: 世界银行 (截至2017年12月)2.经济增长正处于加速转折点东盟中大多数国家的国内生产总值(GDP)还处于一个较低的水平。除新加坡和文莱外,其余8个东盟国家的人均国内生产总值皆低于1万美元。然而,东盟整体的人口、技术、经济发展与中国过去几年趋同。很多时候历史总是惊人的相似,如果我们代入中国的经济发展历程,在下图中可以看到,很多东盟国家现在的人均GDP水平好比处在10多年前的中国,而这样的增长速度正是一个经济即将或正在快速崛起的转折点!资料来源: 世界银行 (截至2017年12月)3. “一带一路” 促进贸易与投资东盟地区2017年的全球贸易达到2.6万亿美元,位列全球第四,其中有近8成来自于东盟成员国以外的国家或地区。随着“一带一路”计划的发展,中国及“一带一路”其它沿线国在东南亚地区的投资及贸易往来也将持续增长。资料来源: 大华银行 (2018年5月)中国作为“21世纪海上丝绸之路”的第一站,与东盟各成员国自“一带一路”倡议以来在基础设施、商贸等多个领域都在展开合作, 其中包括约52亿美元的中泰铁路工程、约10亿美元的中国越南经济贸易合作区等。 除了政府间合作项目,私募投资在东盟地区也迅猛增长。不同于零售投资者受限于投资工具与投资门槛,很多机构投资者已经通过战略并购或者私募股权的方式抢先布局东南亚市场投资机遇。2017年东盟地区获私募股权投资总额较5前年成长了182%,达到了200亿美元的历史新高点,其中也包括许多中国企业参与的项目。例如电商巨头阿里巴巴在对东南亚最大电商平台Lazada持股增加到83%后,对印尼本土最大电商Tokopedia也注资了11亿美元投资,此外阿里与软银共同投资了东南亚打车平台Grab; 腾讯除了收购泰国媒体公司Sanook之外,也与京东、谷歌、淡马锡等共同投资了印尼共享出行平台Go-Jek。4. 成员国发展差异带来的启示虽然东盟有强大的经济增长潜力,但投资者也应当注意到,东盟各成员国在经济发展水平、人口规模及重要经济领域等方面还是存在不少差异。例如:新加坡的城市化水平达到100%,且属于发达国家行业;经济体量上,已经属于MSCI新兴市场定义的马来西亚、泰国、印尼、菲律宾以及前沿市场的越南都已经在2000-3000亿美元左右,而文莱、老挝、柬埔寨都不到200亿美元;行业方面,较为落后的老挝、缅甸、柬埔寨仍然以自然资源与农业为主,而其他国家则已经趋于制造业、消费品行业主导的经济结构。资料来源: 安永 (2017年4月)综合东盟市场的整体机遇以及成员国间存在的差异,我们认为对于投资者而言,最适合的“新兴”东盟市场为马来西亚、泰国、印尼、菲律宾以及越南。这五个发展中国家在经济发展水平与经济体量上相对较为成熟,在制造业、消费品行业上的发展也更有机会带来增长驱动力。相关投资策略:Premia 道琼斯新兴东盟顶尖100ETF (2810 HK)其它相关文章:Emerging ASEAN - Finding Economic Growth Beyond China and India

Jul 10, 2018

创新逐渐成为经济增长的关键要素——"中国山寨"成功转型为"中国制造",而亚洲地区的整体趋势亦如是。然而,目前为止,市场上仍缺乏简单有效的方法投资亚洲创新机遇。本篇文章,我们将讨论亚洲创新发展的现况即行业影响,并介绍Premia与FactSet合作推出的亚洲创新科技策略,亚洲创新科技指数为投资者系统化、精确地捕捉亚洲创新科技大趋势——数位转型、生物科技与医疗创新、人工智能与机械自动化。

Jun 29, 2018

The indices followed by our 2 Premia China A-shares ETFs (2803.HK and 3173.HK ) went through their first rebalance since the ETFs launched late last year. In this post, we recap the rebalance, the resulting exposure, the newest additions and everything else you need to know.

Jun 15, 2018

MSCI China A-shares inclusion is happening this week, but there are still a lot of global investors who hesitate to add China A to their portfolios. Over the last 12 months we’ve heard multiple reasons cited for this aversion to A-shares. In this post, we debunk the 10 most popular myths and highlight why the rational investor not only can, but should, allocate to A-shares, perhaps even ahead of MSCI’s multi-year inclusion plan.The 10 myths behind A-shares avoidance:1. China exposure is already covered via Chinese equities in HK & the US (offshore)2. All quality companies are listed offshore3. A-shares are trading at a premium to offshore Chinese equities4. A-shares have poor corporate governance5. A-shares are mainly SOEs whose interests do not align with shareholders6. A-shares add volatility only, without producing any long-term performance7. Renminbi is too volatile and always depreciates8. Rational investors should steer clear due to A-shares’ massive retail participation9. A-shares investment requires quotas and other complex processes 10. There isn’t enough research coverage.1. China exposure is already covered via Chinese equities in HK & the USFirst, the A-shares market has 3x the number of stocks available offshore. The daily turnover is 5x greater than both H-shares (HK) and ADRs (US) combined. In other words, the onshore market is the primary market, no matter what the global community may think. Some sub-sectors are even unique to the A-shares market only, namely aerospace and defense, Chinese distillers, entertainment & publishing, cable & satellite, precious metals, and many others. They are listed only onshore and include companies that many investors should be reviewing as part of their allocation to China in the 21st century. Conclusion: MythSource: Bloomberg as of May 21, 20182. All quality companies are listed offshoreFirst and foremost, this doesn’t hold up to scrutiny. China A-shares score similarly to many other global markets on metrics such as profit margin, ROA, ROE and current ratio. In fact, on all but ROA, China A-shares have a bigger quality exposure than MSCI World. In addition, many industry leaders are only listed in either Shanghai or Shenzhen, not offshore: Jiangsu Hengrui (pharmaceuticals), Midea (home appliances), Kweichow Moutai (beverages), China International Travel Services (leisure), and Shenzhen Inovance (automation), etc. If investors keep excluding A-shares from their radar screens, then they exclude many of the most recognized domestic consumer brands. Beyond the existing onshore listings, the launch of China Depositary Receipts (CDRs) in the coming months will encourage some offshore listed national champions to return home. In addition, the China Securities Regulatory Commission (CSRC) is speeding up IPOs of qualified unicorn companies in biotechnology, cloud computing, artificial intelligence, and high-end manufacturing. By then, the domestic markets will look even more complete and attractive. Conclusion: MythSource: Bloomberg as of May 21, 20183. A-shares are trading at a premium to offshore Chinese equitiesA-shares are trading at a premium? Yes, but only if looking at dual-listed A/H shares (the companies that are listed both onshore and offshore). The overall premium of dual-listed A-shares is ~20% over their dual-listed H-shares counterparts. But that is only part of the story.When looking at the overall market, the story is quite different. CSI 300, the main benchmark for China A, is trading at ~13.0x of forward PER versus MSCI China, the main benchmark for offshore Chinese equities, which is trading at ~13.4x. A-shares have a lower Price to Book and a higher Dividend Yield as well. Basically, both onshore and offshore China plays are trading at similar valuations. But that’s assuming mainstream benchmarks. At Premia, we follow the CSI Caixin Rayliant Bedrock Economy Index for our traditional economy ETF, 2803 HK (product page). A-shares investment looks even more attractive from a valuation point of view, when utilizing our approach. Conclusion: Partial MythHere’s another way to look at the dispersion. Mid/small-caps are currently trading in the ~10th-20th percentile in valuations relative to their own history. In contrast, mega/large-caps are trading in the 50th-60th percentile vs the last 10 years. Over a shorter horizon, mega-caps in particular look rich in the 75th-85th percentile vs the last 3-5 years.Source: Bloomberg as of May 21, 2018; China A: CSI300; Offshore China: MSCI China; Bedrock China A: CSI Caixin Rayliant Bedrock Economy4. A-shares have poor corporate governanceCorporate governance issues are not new or unique to China. They exist in every emerging market and developed market. Think about the recent global scandals such as Facebook’s leak of personal data, Samsung’s bribery issues resulting in the heir going to jail, the collapse of Lehman Brothers and AIG during the financial crisis, etc. The Chinese government and regulators have been stepping up efforts to ensure that a fit and proper corporate governance is in place for listed companies. A cumulative voting mechanism to protect minorities’ interests, a minimum proportion of independent directors and International Financial Reporting Standards have all been gradually introduced in the past. Even now, one could argue that corporate governance in China is no worse than in other EM markets, and is in fact getting better as the government has made tackling the issue a priority. Increasing foreign ownership can only help push the market in the right direction. Conclusion: Partial Myth5. A-shares are mainly SOEs whose interests do not align with shareholdersA-shares are mainly SOEs whose interests do not align with shareholdersAmong 3,608 listed companies in Shanghai and Shenzhen, there are only ~1,000 central or local SOEs, accounting for less than one-third of the total number of A-shares. Investors have plenty of choice when putting their money in non-SOE companies. That said, it is also overly simplistic to say that all SOEs are in bad shape, mismanaged or over-geared without proper due diligence. Corporate governance goes hand in hand with SOE reform, a priority for the government going forward. Some SOEs like Gree and Shanghai Auto already deliver good operating results and manage to outperform the broader market. Effective screening tools for selecting the right stocks is important, regardless of their SOE or non-SOE status. For more info on our approach, click here. Conclusion: Myth6. A-shares add volatility only, without producing any long-term performanceGiven the nature of emerging markets, China A-shares do have higher volatility compared to most developed markets such as the US, Europe and Japan. However, A-shares have also outperformed those markets over the last ~15 years. So while the volatility is higher, so too is long-term return, in line with modern portfolio theory. More recently, volatility has decreased and we expect it to trend down as the market becomes more institutionally driven. Besides, looking at volatility only without considering correlations is a largely irrelevant asset allocation exercise. Adding A-shares into one’s portfolio helps increase diversification due to the low correlation of A-shares with other markets. Conclusion: MythSource: Bloomberg, Premia Partners, as of December 31, 20177. Renminbi is too volatile and always depreciatesFollowing the internationalization of the renminbi, the IMF voted to designate the renminbi as one of several main world currencies, thus including it in the basket of special drawing rights. An ongoing renminbi devaluation for the sake of increased exports is a misleading accusation. China is in the middle of transforming its economy from being export-oriented to domestically focused. Currency depreciation does not make long-term sense in that context. This is one of the reasons why the basket of currencies maintained by the State Administration of Foreign Exchange has been expanded to all their trading partners, rather than just USD. But all these points pale in comparison to an even simpler way of proving this concern false – the data. The renminbi appreciated by more than 7.4% in USD term in the past 12 months. Conclusion: MythSource: Bloomberg as of May 21, 20188. Rational investors should steer clear due to A-shares’ massive retail participation90% of daily turnover comes from individual investors in China A whilst less than 10% in the US. This is true. Similar to individual investor behavior in developed markets, retail flows in China lean toward stocks that are small, growth biased, lottery in nature and high beta, etc. These elements lead to higher volatility and unpredictability. That said, retail investors in China offer opportunities for professional investors to outperform, just like in developed markets. Inefficiency and behavioral errors create opportunity for capturing alpha, both through capable active management and through well-researched smart beta strategies. Conclusion: Partial MythSource: Rayliant Global Advisors, Premia Partners as of May 31, 20179. A-shares investment requires quotas and other complex processesForeign investors used to invest in China A through either Qualified Foreign Institutional Investors (QFII) or Renminbi QFII. Each institution had to apply for its own quota to trade physical A-shares. But as Chinese regulators decided to open their capital markets to global investors, the Stock Connect program was introduced in November 2014. It is a more flexible scheme that does not require individual investor quotas. No applications or complex processes are required – a total of 1,485 A-shares listed in either Shanghai or Shenzhen is available for trading through Stock Connect on the Hong Kong Stock Exchange. Conclusion: Myth10. There isn’t enough research coverageThere are 3,608 A-shares listed in either Shanghai or Shenzhen with most of the names not recognizable by many foreign investors. Given the above concerns, it’s understandable that global investors wouldn’t be satisfied with a passive approach and prefer active management instead. But with so many stocks, it’s easy to get lost without investing material resources in research. This is where Premia can step in and help. 7 months ago we built two solutions to tap into different segments in China whilst capturing excess return. The Bedrock Economy strategy (2803 HK) focuses on stocks that are the backbone of the Chinese economy whilst the New Economy strategy (3173 HK) taps into the future growth story of China including consumption upgrades, technological advancement and aging population. Both strategies not only focus on those two different aspects of China A-shares, but then screen each universe to identify stocks that offer long-term excess return. Bedrock focuses on value, quality, low size and low volatility companies while New Economy prioritizes asset-light, quality and R&D focused firmsComparing the latest disclosure of the 234 index constituents for MSCI China A Inclusion, the following is an analysis of index correlation, stock and sector overlap with the underlying indexes of Bedrock Economy and New Economy. Bedrock Economy (2803 HK) has a much higher correlation and more stock overlap with MSCI China A Inclusion. If you’re aiming for excess return vs MSCI China A Inclusion but don’t want to deviate significantly from that benchmark, the 2803 HK would be the right choice. On the other hand, New Economy (3173 HK) offer a drastically different exposure, focusing more on Information Technology, Consumer Discretionary and Healthcare sectors. If you’re aiming to steer clear from large-cap SOEs and to prioritize China’s future rather than today’s economy, than 3173 HK may be the exposure for you. Conclusion: Partial MythSource: Bloomberg as of May 21, 2018Out of 10 common reasons for not investing in A-shares, we score 6 as complete myths, not based on current facts about A-shares. The other 4 are partial myths, where choices of data drive the outcome or where the facts are true, but the implication isn’t. In our view, gone are the days when A-shares as a market can be ignored. Investors need to allocate to A-shares in their portfolios, or risk decreasing their diversification and leaving opportunities for alpha on the table.Regards,David

May 28, 2018

Premia 图说

赖子健 , CFA

CFA

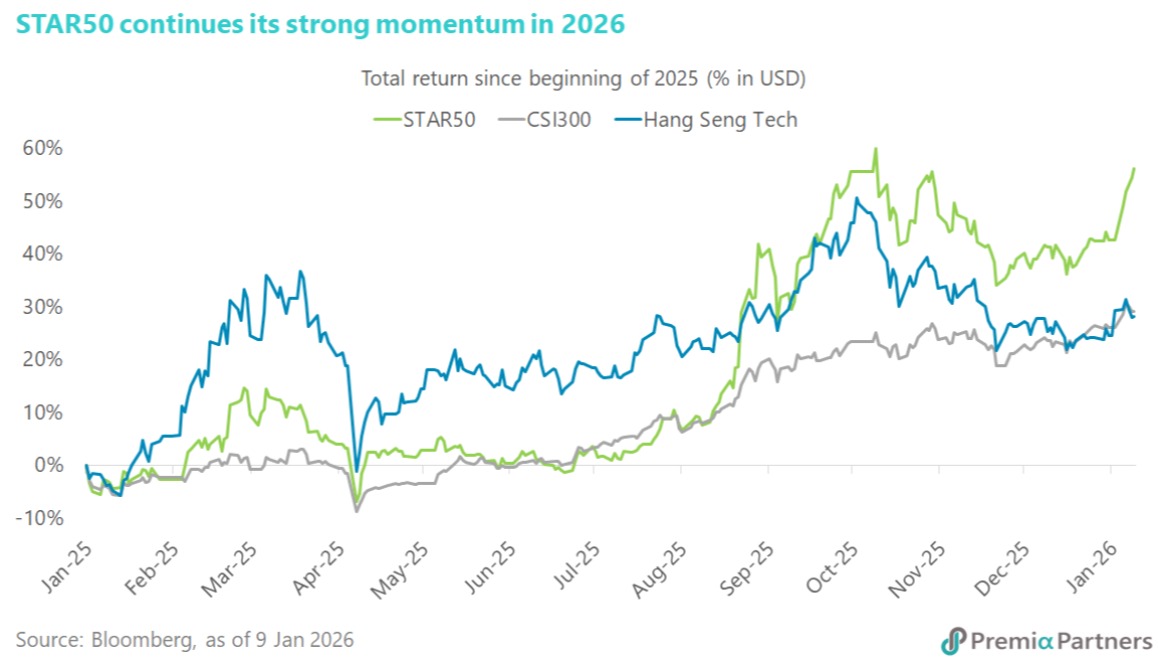

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026