精选观点 & Webinar

As China markets reacted to expansionary policy news, familiar criticism of China’s debt and leverage concerns has begun to emerge from global investors. Separating myths from reality, our advisor Say Boon Lim shares his thoughts on the 5 biggest myths about China’s economy.

Mar 13, 2019

So far in 2019, markets have moved positively and our worst fears from Q4 remain unfounded. However, investors should not be complacent and interpret this period of good news as predictive of the rest of 2019. Markets are likely to again fear the future. In this week’s post, our advisor Say Boon Lim shares his thoughts about the current period of benign market activity.

Feb 18, 2019

As we pass the 6-month anniversary of our latest ETFs, we review their performance since launch, the underlying story behind the exposures and the potential for returns going forward.

Feb 13, 2019

今年,我们正在进入市场的一个交叉路口,许多周期即将告一段落。本文是林哲文先生作为我司资深指导顾问的首篇撰文。林先生在下文中提出了他在当下错综复杂的经济、市场和货币周期中对于资产配置的见解。以此配置建议为指引,我们在股票、固定收益、大宗商品和货币方面分享了投资者在 2019年可以采用ETF为实践工具的投资策略。

Jan 25, 2019

Emerging markets seem to be one of the top picks among both sell-side strategies and well-known investors in 2019. We would like to examine if their views are valid and understand better about the reasons behind. To make it into an actionable advice, we also share our thought why emerging ASEAN maybe the crème de la crème and update our readers on the performance of Premia Dow Jones Emerging ASEAN Titans 100 ETF.

Jan 14, 2019

As we wrap up 2018, it’s hard not to reflect on a -25% year in A-shares. As investors, however, we have to look forward and ask ourselves – what’s in store for 2019? Will the trade war result in continued downward momentum? Or will policy accommodation and an improved trade environment result in a massive upside reversal? Looking back 10 years to the global financial crisis, we examine a potential path forward for A-shares in 2019.

Dec 17, 2018

Below is a quick summary of what you need to know regarding this weekend’s G20 Xi-Trump meeting and our thoughts on impact for Asian and Chinese equities.

Dec 03, 2018

For the past 5 years, the surest trade in finance was to bet on US technology stocks and watch market caps double and portfolio returns roll in. However, the last few months have shaken that confidence and now many investors are asking what’s next, given the diminishing growth picture globally. Asian companies focused on innovation offer an interesting opportunity in this regard, especially considering the correction so far and their potential going forward. Though many VC and tech investors have already made the shift to Asia, that move is yet to occur in public equity markets. We believe our Premia Factset Asia Innovative Technology Index, and its corresponding ETF, 3173 HK, should be in every global and tech investors toolkit.

Nov 27, 2018

On the 1 year anniversary of our China A smart beta ETFs, we thought it prudent to reflect on how 2803 HK and 3173 HK have done since launch, as well as take stock of China A-shares markets overall. In this note, we’ll recap the ETF performance and tracking, review China A-shares over the last 12 months, explore which factors worked and didn’t and offer a few thoughts about our expectations going forward. Thanks as always for reading and trusting us with your investments.

Nov 08, 2018

您的科技主题ETF仍然持有谷歌和脸书吗?您是否想知道全球行业分类标准(GICS)、标准普尔及摩根斯坦利在行业分类重新调整后的变动?在接下来的线上研讨会中,我们的合伙人赖子建先生及麦睿康先生将为您阐述此主题,包含行业重新分类对科技主题ETF及亚洲的影响,以及Premia Partners挑选新经济和创新科技成分股的策略如何快人一步,而且早已超越GICS对全球行业分类的定义。

Oct 22, 2018

Premia 图说

赖子健 , CFA

CFA

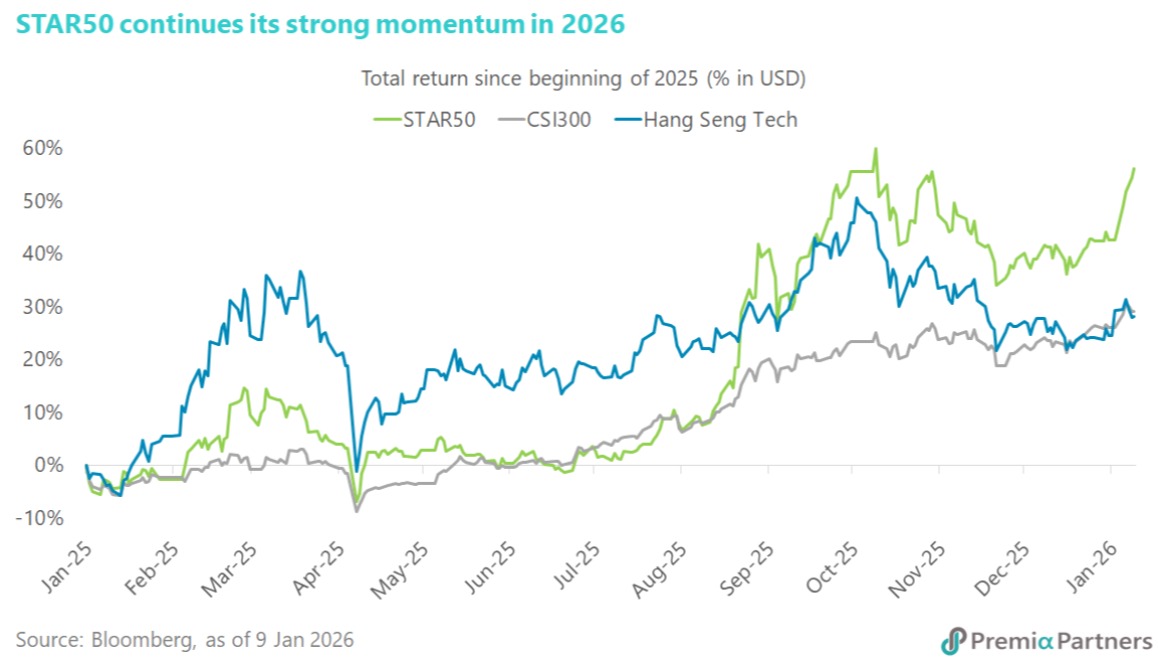

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026