There is little disagreement that global tech is in a supercycle driven by artificial intelligence. Yet, as the market for AI-stocks matures and rotates, investors are looking beyond the US “foundational model builders”, such as Meta, Microsoft and Alphabet. The Taiwanese market features prominently in the search for “next line” beneficiaries of the AI revolution, among “core enablers” or “picks and shovels” stocks.

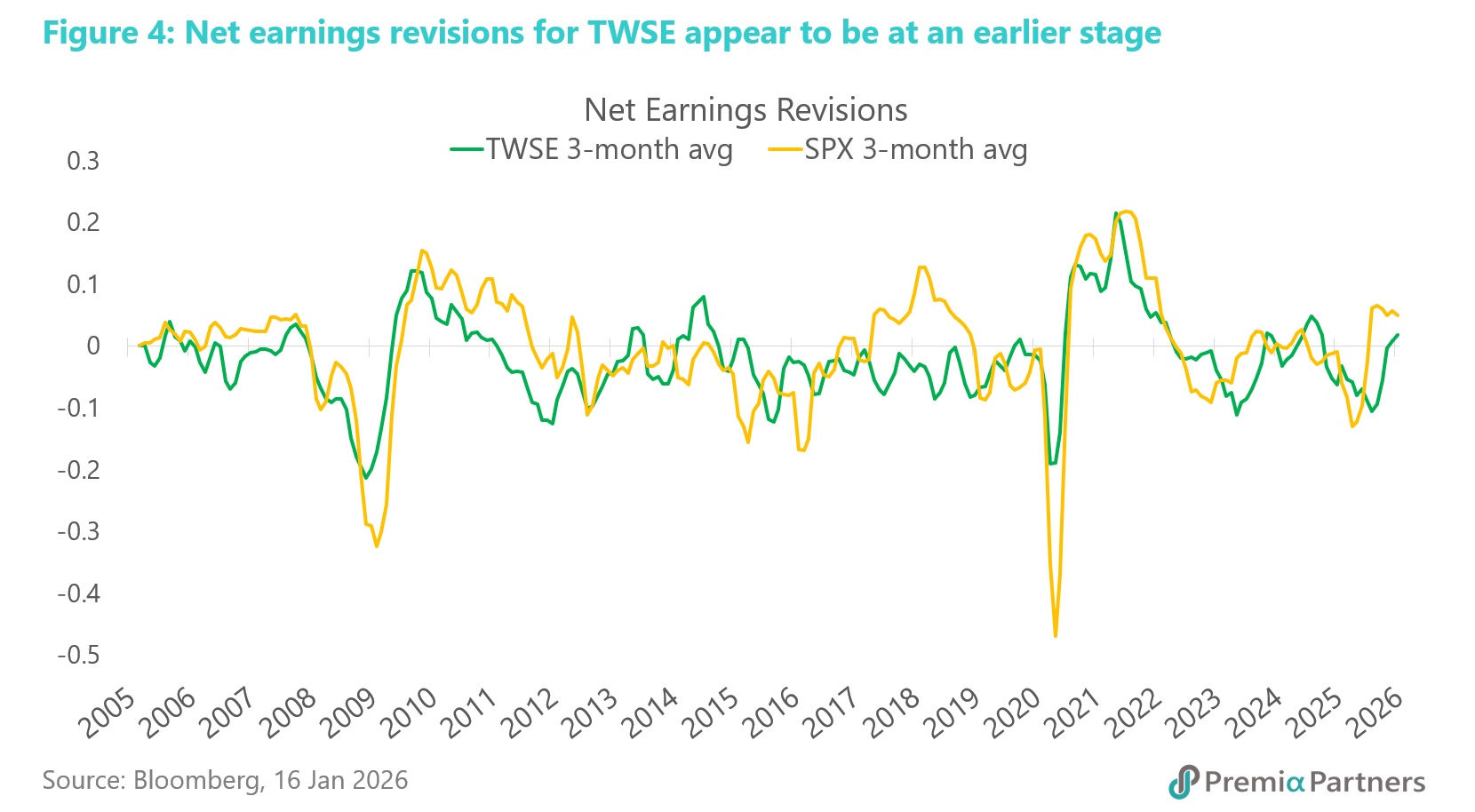

The strong earnings growth that supported Taiwanese stocks in 2025 will likely continue in 2026, with the forward 12-months FTSE TWSE Taiwan 50’s earnings expected to grow by a stunning 22%. Note that earnings are expected to rise faster than sales, reflecting a significant strengthening of margins over the next 12 months. While net earnings revisions have peaked in the US and have been retreating, they have only recently emerged into positive in Taiwan from deep negative in 2025. That is, the Taiwan market appears to be in the early stages of its earnings expectations cycle.

Taiwan Semiconductor Manufacturing Company (TSMC) leads the way, recently reporting a gross margin of 62% for Q4, 2025, continuing the margin increases from 53% in 2024. It also demonstrated continued pricing power due to tight supply, with price increases of 3%-10% reported for its most advanced nodes for 2026.

Looking ahead, the rise of bespoke, “custom silicon” will create new opportunities for a broader set of Taiwanese tech companies as AI grows from the cloud to the “edge”, that is, to users’ local devices.

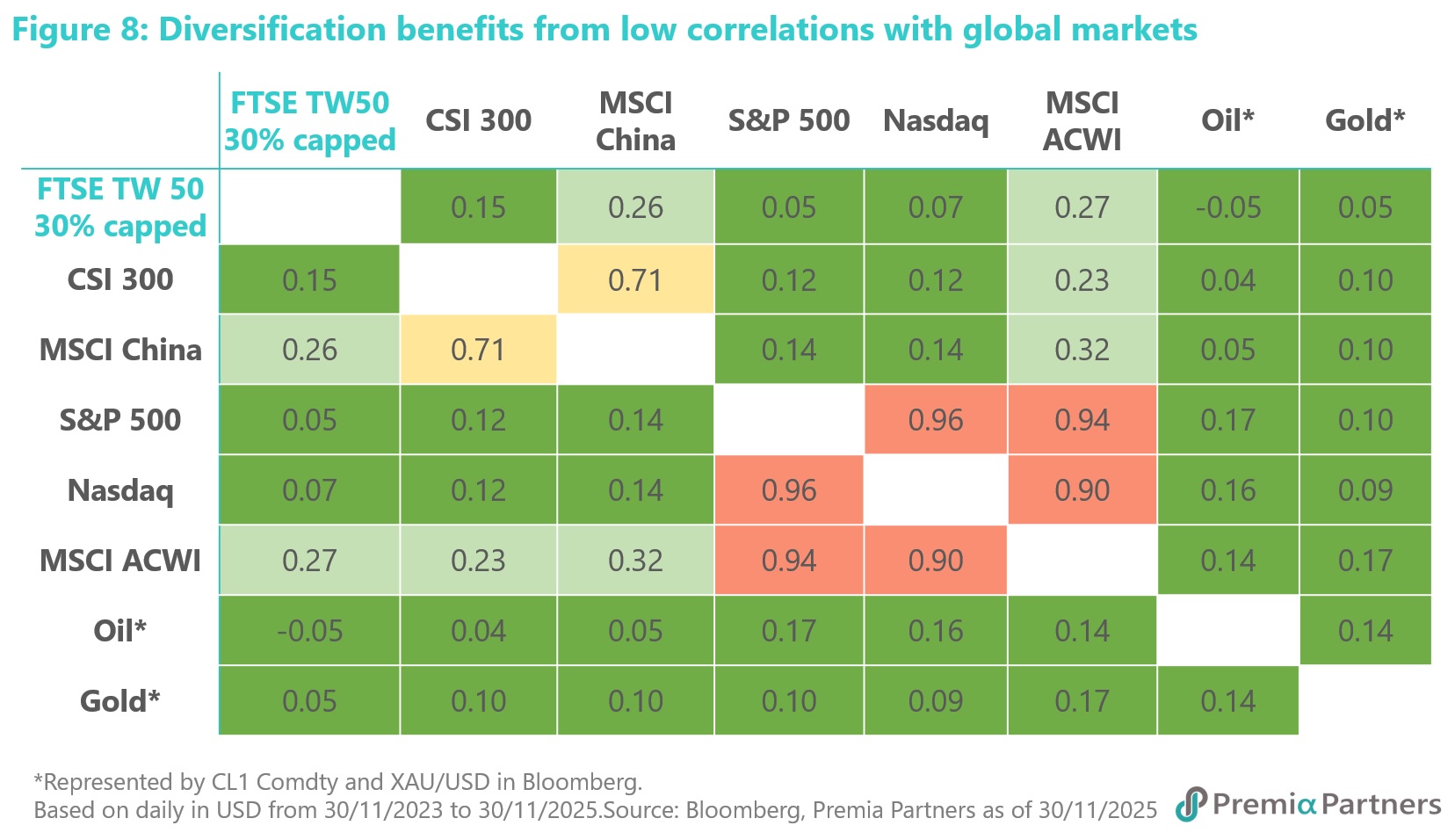

The Taiwan market offers global investors both growth and value in the search for diversification opportunities away from US Big Tech, and its high dividend payout culture offers a buffer against market volatility and drives low correlations against other major markets and asset classes.

Supported by tech, the economy is forecast by the Government to grow by 3.5% in 2026, exceeding the IMF forecast of 2.1% and the market consensus of 2.7%. While that would be a strong growth rate for any mature economy, the GDP growth understates the amount of wealth created by the ongoing boom in the tech sector. International banks are reported to be “aggressively hiring” to gain shares in the world’s third fastest growing wealth management market, estimated to be worth US$8 trillion. That has positive implications for Taiwanese banks, which are expected to grow earnings at double the rate of Singapore banks.

The recent announcement of a reduced 15% broad tariff on Taiwanese exports to the US puts Taiwan on the same level as South Korea and Japan and removes trade uncertainties.

The prevailing weak US Dollar and high growth global environment has accelerated Emerging Markets outperformance versus Developed Markets. If investors continue to pivot from DM to EM in search of diversification and higher returns, Taiwan, with a 21% weight in the MSCI Emerging Markets, is well placed to benefit from its position at the confluence of global tech, high earnings growth, and moderate valuations.

With index forward earnings growth estimated at 22.1%, and a forward PE multiple of 19.7x, the FTSE TWSE Taiwan 50 Index PEG ratio is a very modest 0.9x, compared with a PEG ratio of 2.0x for the S&P 500 index. Further, it offers growth with income: The FTSE TWSE Taiwan 50 Index’s forward 12-months dividend yield is almost double the S&P 500 offering – at 2.1% versus 1.2%.

The pivot from AI “foundational builders” to “picks and shovels” has been accelerating. Tech will likely remain the biggest story in global investment for a long time. Network infrastructure group Nokia described the AI Supercycle as “the latest major technology wave - a multi-decade period where artificial intelligence becomes embedded in every industry, service and device.”

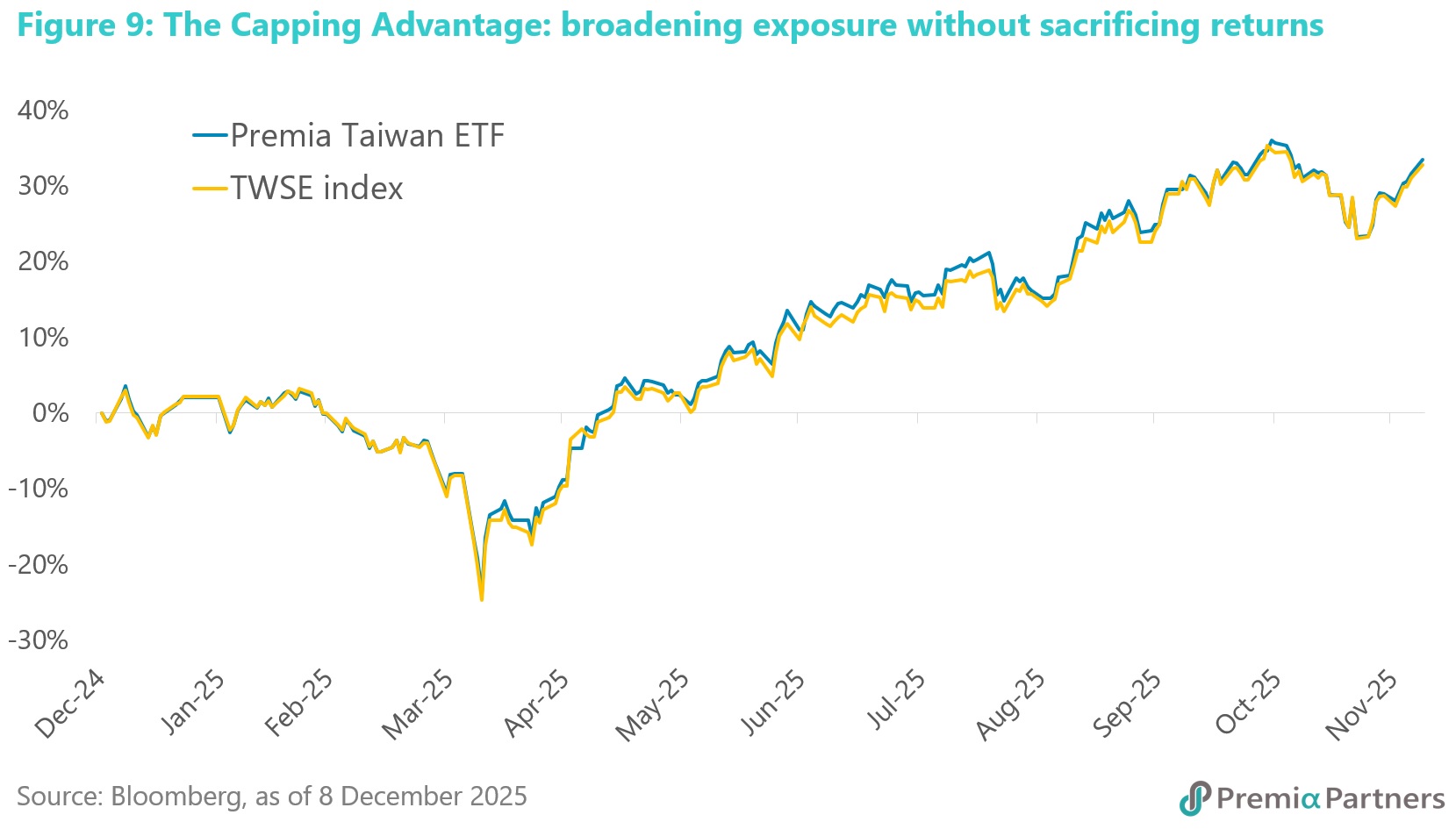

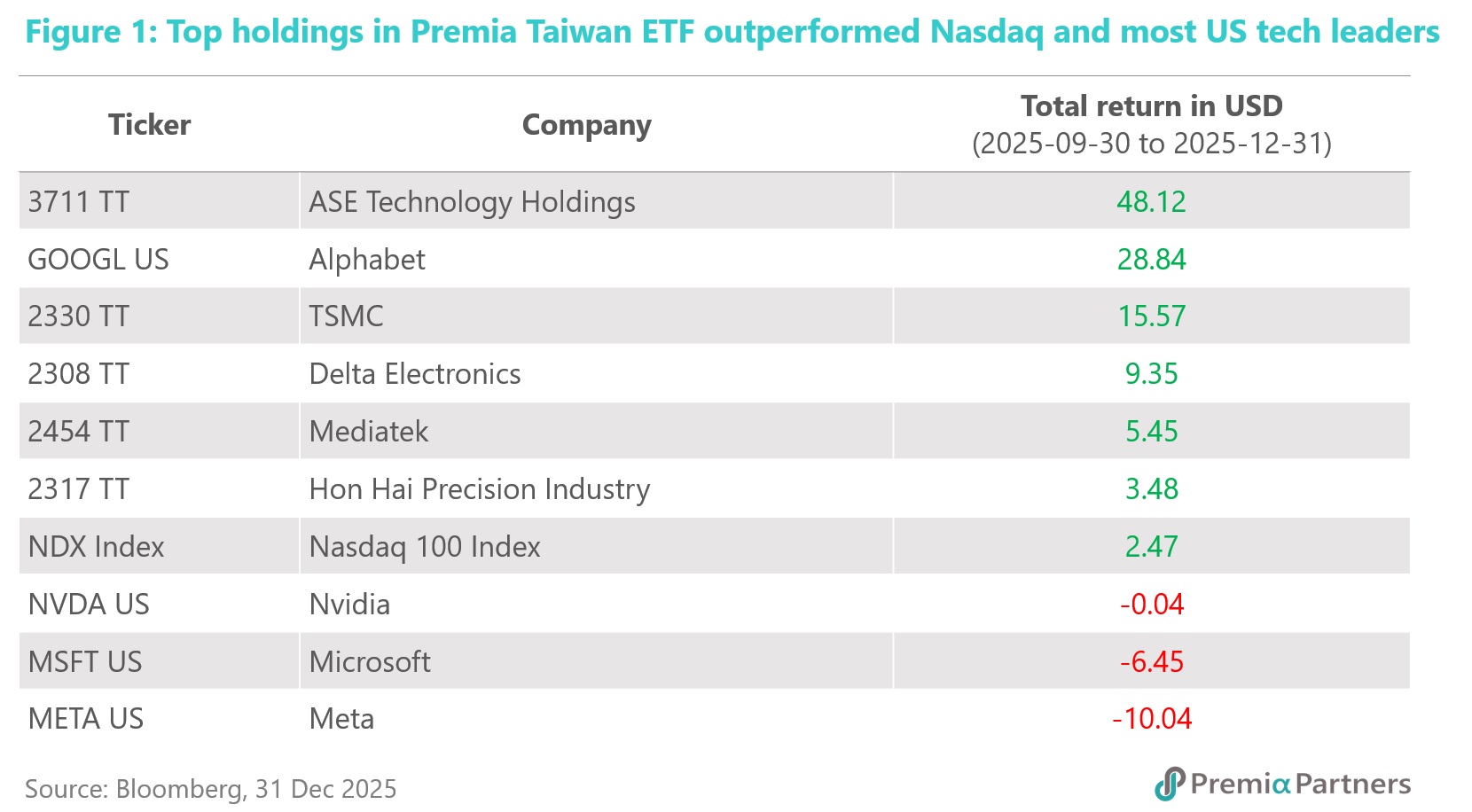

However, within tech, investor focus is shifting, with outperformance moving from AI foundational builders to “picks and shovels” stocks. Taiwan tech stocks are part of that cohort of “core enablers” that are increasingly in global investors’ sights. Indeed, the five biggest holdings in Premia FTSE TWSE Taiwan 50 ETF (that is, TSMC, Hon Hai Precision Industry, Mediatek, Delta Electronics and ASE Technology) outperformed the Nasdaq 100 and most of the hyperscalers in 4Q25 (Figure 1) and has continued to outpace them in the first two weeks of trading in 2026 (Figure 2).

Taiwan’s superior supply chain capabilities are well positioned to capture the broadening of the AI theme. Beyond the US builders of LLMs and foundries, the AI-rally should eventually broaden to the wider ecosystem of custom silicon (ASICs), server assembly and thermal management. Taiwan’s superior supply chain capabilities in these domains offer opportunities to capture such a widening of investor interest.

The role of Taiwan tech in the rise of “custom silicon” and the diversification opportunities. 2026 will likely see the rise of bespoke, “custom silicon” (that is, Application-Specific Integrated Circuits or ASICs) and the expansion of AI from the cloud to the “edge”, that is, to users’ local devices.

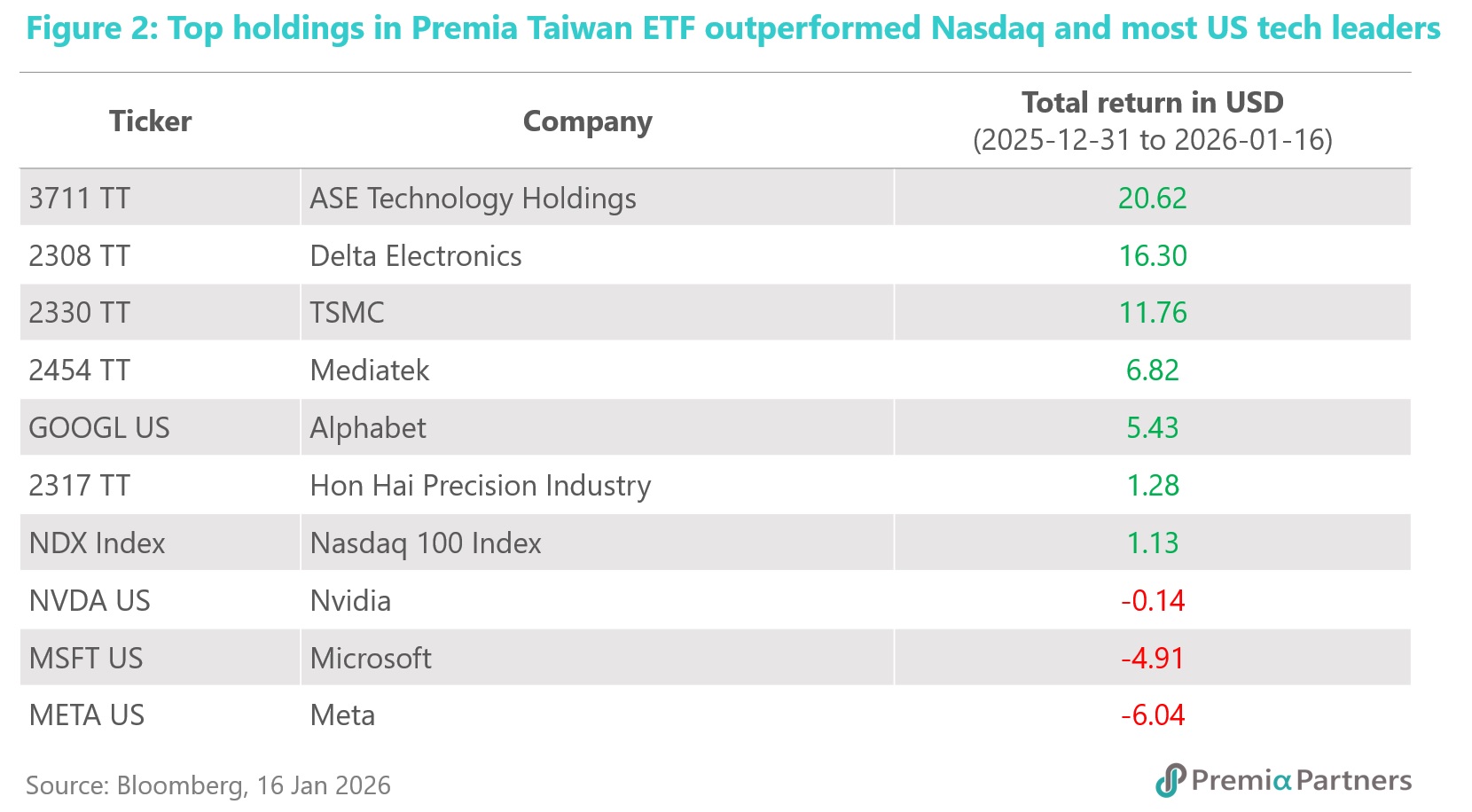

Google’s emergence as a rival to Nvidia—highlighted by its Gemini models and TPU chips—demonstrates the industry shift towards custom solutions, with Goldman Sachs forecasting ASIC solutions to rise from 36% of AI server contribution in 2024 to 45% in 2027 (Figure 3).

Crucially, this technology extends beyond the data center into Edge AI, enabling complex models to run locally on smartphones and laptops. We view this shift from centralized servers to personal devices (AI PCs and AI Smartphones) as the next major hardware growth cycle.

Companies like MediaTek stand out in this environment, leveraging their dual expertise in mobile processing and high-performance ASIC design to capture value across both the cloud and the edge. Component makers like Accton Technology and Elite Material are also benefiting, having outperformed TSMC recently by levering this broader ASIC boom.

Apart from the above, investors seeking diversification should also note Hon Hai Precision Industry (Foxconn), whose strategic partnership to manufacture hardware for OpenAI’s data centers underscores its vital role. Investing in this broader basket mitigates single-stock risk while capturing the full "picks and shovels" expansion of the AI infrastructure build-out.

What next – can Taiwanese stocks sustain the outperformance? The answer might lie in both growth and valuations, and the outlook for both suggests this is sustainable.

The consensus estimate puts the forward 12- months earnings growth for the FTSE TWSE Taiwan 50 at a stunning 22.1%. This is double the 11.4% earnings growth estimated for the S&P 500 over the same time frame. The valuation for the FTSE TWSE Taiwan 50 is lower despite the much higher earnings growth outlook – at 19.7x versus 23.2x for the S&P 500. That translates to a PEG ratio of 0.9x for the TWSE compared to a PEG ratio of 2.0x for the S&P 500.

Looking below the hood of headline index earnings growth, it is worth noting that some of the biggest names in US tech – Meta, Alphabet and , and this could be a factor in investors seeking diversification outside of the big US tech names, even while staying invested in tech.

Note also the apparently higher risk for S&P 500 earnings compared to earnings for the TWSE, as mirrored in net earnings revisions. Net earnings revisions for the S&P 500 have peaked and are declining, while those for the TWSE appear to be at an earlier stage in the cycle (Figure 4).

TSMC’s promising outlook augurs well for the Taiwan market. TSMC metaphorically “shot the lights out” with its 4Q25 results, reporting 35% y/y earnings growth, beating market expectations by a wide margin, and stunning the market with a 62.3% gross margin. Management raised TSMC’s long-range gross margin to “56% and higher”, from its previous target of “53% and higher”. But that may be modest. Goldman Sachs, in a recent report on TSMC, described “above 60% GM level as a new norm”. Indeed, TSMC’s gross margin has been on an uptrend from 2019 (Figure 5).

This is pricing power on display. Indeed, according to recent media reports, TSMC has informed clients of price hikes for its advanced nodes from 2026 through to 2029. Advanced node prices are expected to rise 3%–10% in 2026 alone, according to the reports.

On the matter of sustainability, the Goldman Sachs report noted TSMC Management “acknowledged that the AI-driven supply-demand imbalance remains unresolved with leading-edge capacity still constrained, reinforcing our view that the supply-demand gap is likely to persist through 2027.” Structural AI-demand uptrend is “paving the way for multi-year growth,” GS said.

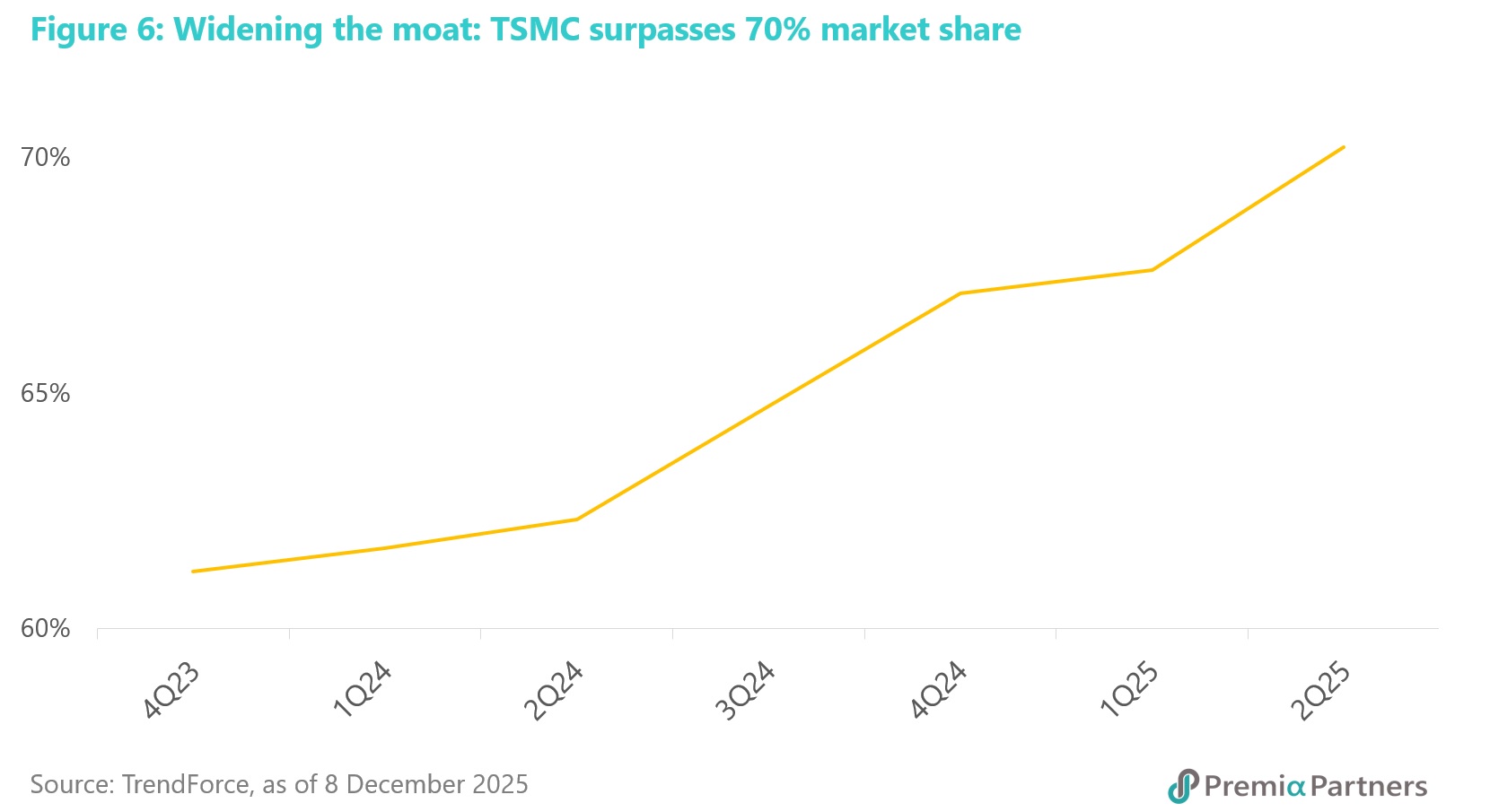

The fundamentals underpinning TSMC’s dominance of its industry. TSMC remains the bedrock of the global tech economy. Over the past two years, TSMC has widened its lead over Intel and Samsung, commanding premium pricing that fuels robust cash generation. According to TrendForce, TSMC’s share of the global pure-play wafer foundry market reached 70.2% in Q2 2025, a dominance cemented by its technological roadmap (Figure 6).

TSMC continues to lead the industry in 2nm production—adopting the cutting-edge Gate-All-Around (GAA) transistor architecture—and critical advanced packaging technologies like CoWoS. Reflecting strong demand, TSMC plans to add further N2 fabrication facilities domestically, highlighting the indispensable status of Taiwan’s specialized human capital and integrated supply chains.

While TSMC is diversifying globally, it continues to prioritize its home base for the most advanced nodes. Bloomberg projects that TSMC will retain more than 75% of its sub-10nm manufacturing capacity in Taiwan through 2033, consolidating its competitive moat.

Taiwan will likely be the fastest growing “Advanced Economy” in Asia this year. Taiwan was likely the fastest growing economy in Asia in 2025, with a GDP growth rate estimated by the Government at 7.4%. Looking ahead to 2026, even on the IMF’s relatively low forecast of 2.1% GDP growth, Taiwan will likely be growing faster than Japan, South Korea and Singapore, and on par with Hong Kong. But we note that the Government in Taiwan is forecasting a much higher growth at 3.5%.

This will provide support for other areas of the stock market, particularly the banking/finance sector, where earnings growth is expected to be vastly higher than in Hong Kong and Singapore. Helped by the wealth generated in Taiwan by the tech boom, Taiwanese banks are expected to post earnings growth for the next 12 months at roughly 77% to 100% higher than the growth figures expected for Hong Kong and Singapore banks. It is estimated that the MSCI Singapore Banks Index will turn in forward 12-months earnings growth of 4.2%. The MSCI Hong Kong Banks Index shows a forward earnings growth rate of 4.8%. The MSCI Taiwan Banks Index is expected to turn in 8.5% earnings growth over the same time frame.

Trade deal with the US removes the overhang of uncertainty. The US has agreed to lower its broad tariff on imports from Taiwan, from 20% to 15%, putting Taiwan on par with South Korea and Japan. Further, there are carve-outs: Taiwanese semiconductor companies that expand production in the US can claim even lower tariffs for semiconductors and related manufacturing equipment they import into the US, and generic pharmaceuticals, aircraft components and "unavailable natural resources" will be allowed in duty free.

It is worth noting that even with the tariff uncertainty, Taiwan’s tech dominance drove Taiwan’s exports to the US in October up a staggering 144% y/y. Overall, total exports rose 50% y/y in October.

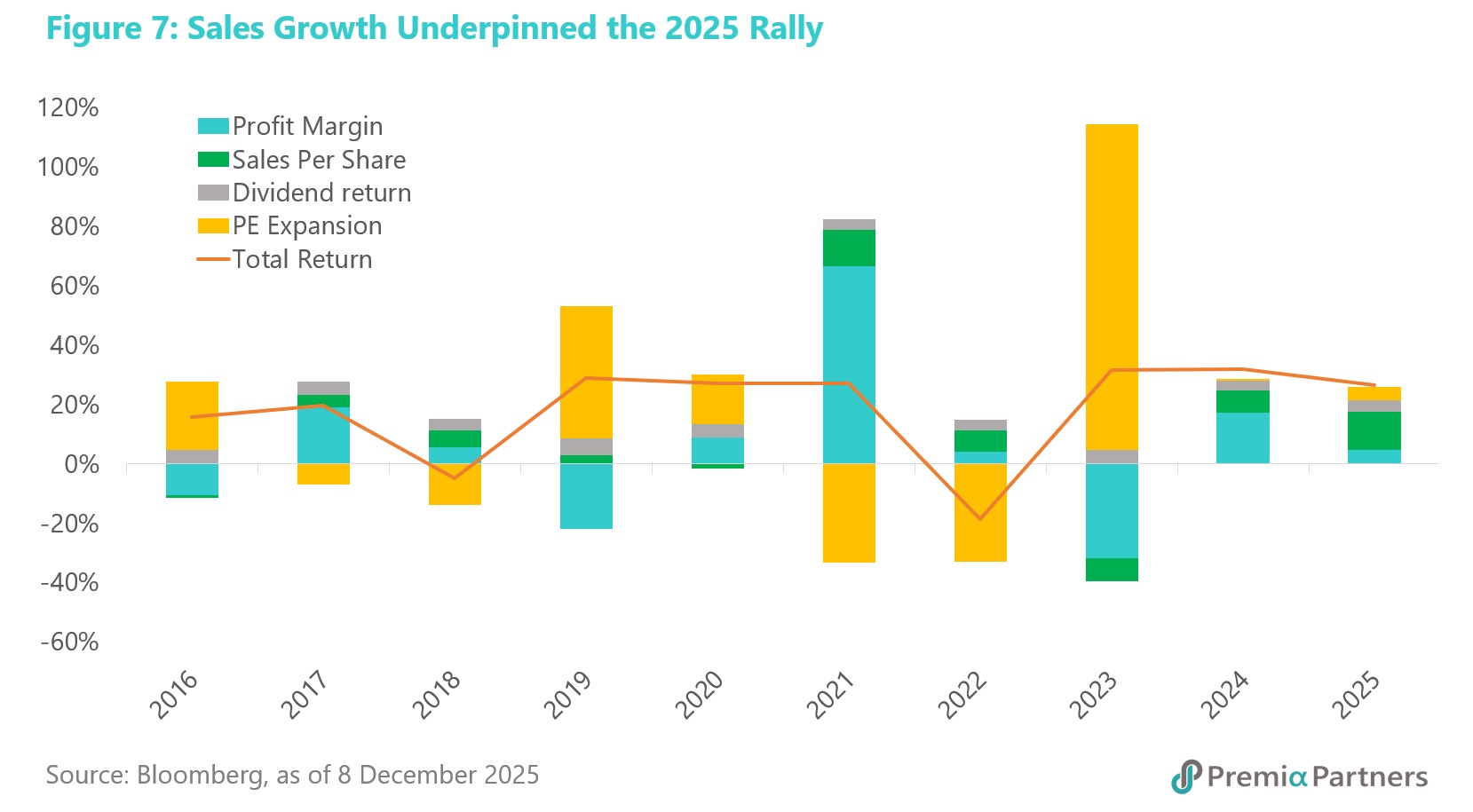

Attractive valuation reflects fundamental growth rather than speculative multiple expansion. Analysis of 2025 performance reveals a crucial insight: The ~24% total retur n in the TWSE Weighted Index was driven overwhelmingly by fundamentals of strong revenue growth, rather than speculative fervour. Specifically, the rally was propelled by a 15.6% surge in sales per share, while P/E multiples contracted slightly (-0.5%). (Figure 7).

Despite the strong price performance in 2025, the FTSE TWSE Taiwan 50 Index is still trading at a PE of 19.7x forward 12-months earnings. Those earnings are estimated to grow at 22.1%, giving investors a PEG ratio of 0.9x, compared to the equivalent S&P 500 PEG ratio of 2.1x.

And it’s lower valuation is despite higher quality hallmarks: As a whole, the constituents of the index are in net cash rather than debt; they are growing cashflow faster than S&P 500 companies; and they are paying out more in dividend (2.1% yield estimated for the forward 12-months for the FTSE TWSE Taiwan 50 versus 1.2% for the S&P 500).

Strategic Portfolio Utility: A Unique Diversifier. In addition to the attractions of its low valuation and fundamental strengths, the Taiwanese market serves a critical function in portfolio construction with its low correlation with other major asset classes (Figure 8).

This is helped by Taiwan’s strong corporate culture of returning cash to shareholders. Unlike the US Nasdaq or other pure-play growth indices where returns rely almost exclusively on capital appreciation, Taiwan’s high dividend payout ratio provides a substantial income component. This income stream acts as a stabilizer during periods of global volatility, creating a unique return profile that combines the upside of AI growth with the defensive characteristics of high-yield equities.

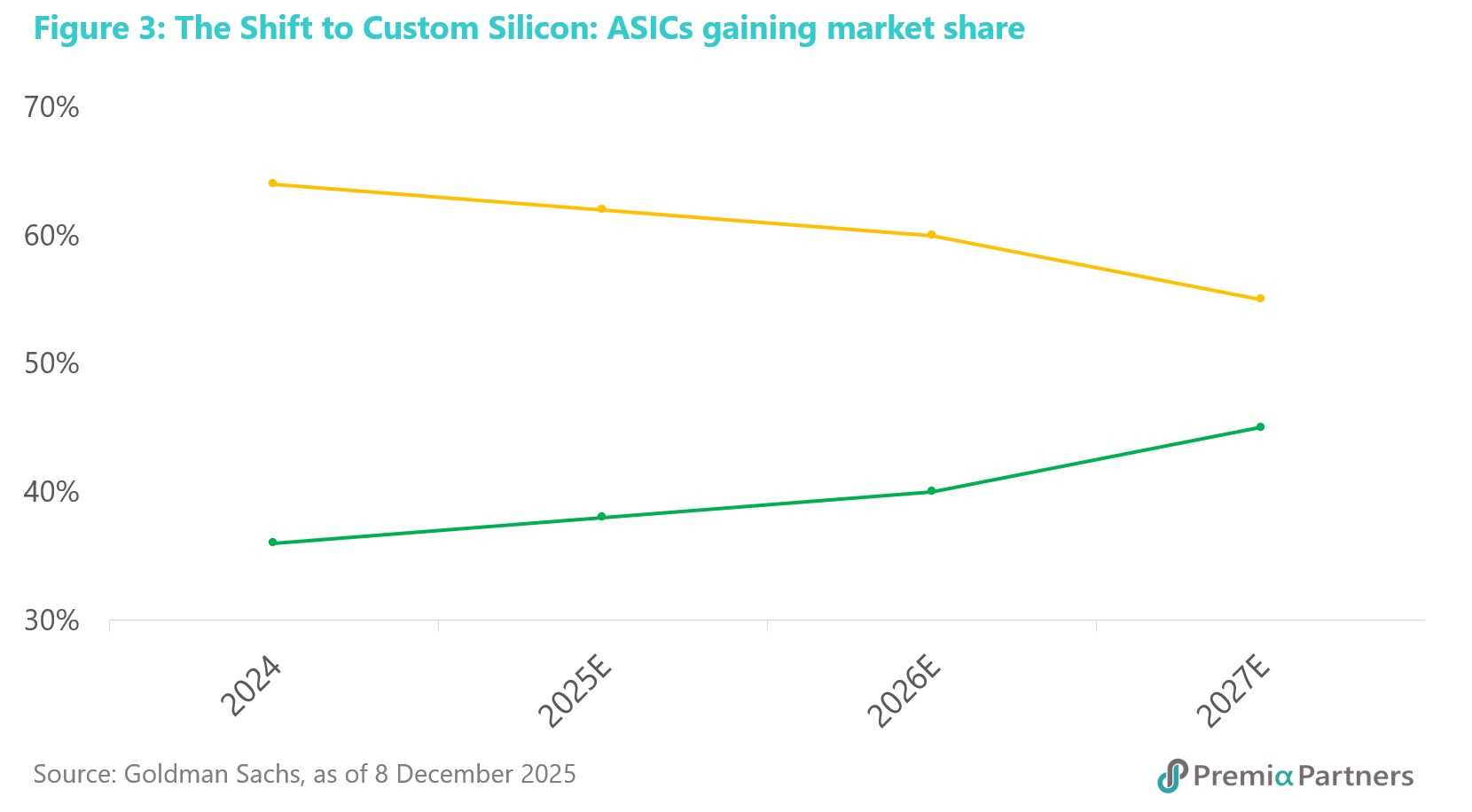

The Premia FTSE TWSE Taiwan 50 ETF employs a 30% cap on TSMC. (TSMC otherwise represents >50% of the index). This structural feature allows for significantly higher weightings in the wider AI supply chain—the "picks and shovels" of the next growth phase—while still retaining TSMC as a high-conviction anchor. This offers investors a "best of both worlds" vehicle to capture the full spectrum of Taiwan’s technology leadership (Figure 9).