精選觀點 & Webinar

本期財新國際圓桌主題為“抗擊新冠疫情:政策分析與實踐經驗”,會議包含宏觀解讀與實踐分析兩方面內容,主要結合新冠疫情背景下各國政策與復工復產經驗。

Jun 15, 2020

As cyclical movements would revert and short-term volatility hikes would calm, long-term strategic investors often look out for overarching secular or structural trends. Yet by definition, structural shifts and new innovations often take time. However, there can be catalysts! Witnessing a black swan can be a crisis, but like Winston Churchill advised – let’s not waste a crisis. So where do we look for growth opportunities?

Jun 12, 2020

The Two Sessions are always of interest to the market for the key economic policies unveiled by Chinese leaders. At this year’s Two Sessions, China decided not to set a GDP growth target for the first time in decades, raised the budget deficit ratio above a long-held “red line,” issued special treasury bonds for the first time in the last 2 decades, and rolled out a host of measures to buoy employment and support economic recovery from Covid-19.

Jun 10, 2020

隨著聯網汽車和智能家電等消費領域的應用日益普及,物聯網(IoT,Internet of Things)已逐漸為人所熟知。而在工業領域,正如我們一再強調與關注的話題——企業數位化轉型將重寫產業遊戲規則,而工業互聯網(IIoT,Industrial IoT)正是其中的重要環節。事實上,工業互聯網即是「中國新基建」七大重點投資領域之一,受到中國官方政策的大力支持。所以,工業互聯網是甚麼?為何其中的行業領導者在疫情期間更具彈性?在本篇文章中,我們將分享工業互聯網的概念,以及該領域的發展進程和投資機會。

May 26, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. In this webinar, our co-CIO David Lai shares our research and insights on investing into ASEAN markets in light of the late COVID crisis, re-escalating US-China trade dispute and more importantly the gradual global supply chain reconfiguration.

May 26, 2020

China is in the early stage of restarting its economy, and China A shares market has held up relatively well compared to other global equities markets amid the COVID. In particular, our Premia China New Economy strategy has been very resilient throughout the crisis with YTD NAV performance of 10.7% (in CNY, as of May 26th, 2020). It has been consistently seeing inflows over the past months and is also among the best performing broad market China A ETFs globally. In this webinar, our co-CIO David Lai shares first-hand insights on the post-COVID impact, policy developments, and capital market flows of the Chinese market. As China recovers from the pandemic, how shall investors watch out for opportunities from the post-COVID recoveries, policy supports and new norms?

May 26, 2020

越南防疫佳績有目共睹,政府自4月23日以來循序漸進地鬆綁封鎖政策,儘管受全球疫情影響,其宏觀數據仍不如預期。越南政府於上週(5月15日)調整了原先設定的5%經濟增長率目標,根據不同假設情境制訂兩個方案:若主要貿易夥伴的疫情在今年第三季得到控制,則增長目標為4.4%-5.2%;若主要貿易夥伴的疫情遲至第四季才得到控制,則增長目標為3.6%-4.4%。越南目前的情況究竟為何?是時候復甦了嗎?本篇文章我們將針對多方面進行簡要更新。

May 18, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. And as a result of the increased tension and US protectionist measures targeting China, and pressure for MNCs to choose which one they side with under the pretext of protection against production disruptions in China, ASEAN and notably Vietnam are clear winners. But a more nuanced picture is closer to the truth. That is, the shifts in supply chains are more likely to be gradual than dramatic.

May 18, 2020

Yes, possibly. The different approaches taken by the US and China towards managing COVID-19 has likely set the stage for a widening of the growth differential between the two countries. Immediately, the earlier reopening of the Chinese economy means China’s GDP will still show a bit of growth this year. This compares to the controversial, tentative easing of restrictions in the US, only in May. Even if the US gradually normalizes from here, its GDP for will end 2020 with a big hole, which will take three to four years to fill. If China maintains its productivity growth, it should be able to manage a long-term average GDP growth rate of around 5.8% a year. Meanwhile, long-term US GDP growth from 2022 onwards could ease to 1.5% on lower investment/lower productivity growth. Taking into account IMF projected growth rates for 2020 and 2021, China could overtake the US in Dollar terms by 2029.

May 13, 2020

We previously highlighted the gaming industry just after the coronavirus outbreak in Account of an atypical, tech-enabled CNY holiday. With the COVID-19 pandemic raging on globally and people spend more time at home social distancing, the gaming industry has shown greater potential of booming opportunities. The large demographic base of tech-savvy and mobile-first youths born in the digital era provided a strong head start for China, especially in eSports.

May 11, 2020

Premia 圖說

賴子健 , CFA

CFA

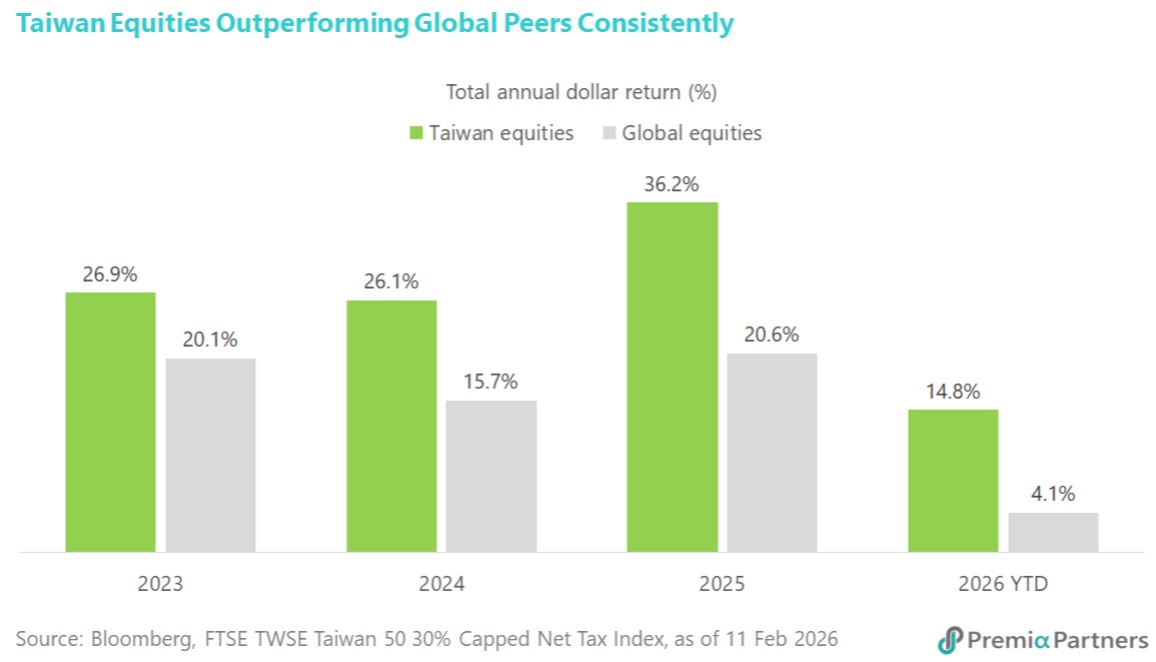

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026

![[財新國際圓桌] 抗擊新冠疫情:政策分析與實踐經驗 (回放)](https://etfprod.premia-partners.com/articleImg/pic/200615130125380.jpg)