精選觀點 & Webinar

客戶時常和我們反映,他們非常喜歡Premia旗下的亞洲策略,不過由於ETF的流動性不高,因此僅能尋求一些美國或歐洲上市的類似的ETF。不過,其實投資者真正在意的並不是流動性本身,而是流動性成本。流動性和成本息息相關——流動性愈低,交易進出的成本就愈高,特別是在金融危機或市場失衡時期,其流動性可能跌至零。目前仍有許多投資者選擇在美國或歐洲交易亞洲資產,認為這樣的交易方式較為高效且便宜,不過這可能並不是一個明智的選擇。在這次的網路研討會中,我們將與您分享對於評估ETF流動性的觀點,並分別以在紐約、倫敦和香港上市的ETF,比較投資越南市場的優劣。

Mar 10, 2020

Relief rally unlikely to last Beyond COVID-19, economies could flatline or enter recession Corporate earnings could stop growing at a time of heightened valuations There is a tail risk of credit defaults on liquidity and cashflow squeeze

Mar 03, 2020

As we expected, markets did bounce on policy stimulus hopes. While rate cuts and liquidity injections will make markets feel better for a while at least, what is it likely to do for the economy?

Mar 03, 2020

在疫情爆發的艱難時刻下,我們看到了一個不同的社會運作生態。即使隔離在家,我們看到數億人在通過網絡購物、遠程辦公、雲直播學習,人們的日常生活行為在被動或主動地轉變到一個不可思議的“新常態”。在本期網絡直播中,我們將分享科技所賦予的結構性大趨勢、所創造的更聯結包容的社會形態、以及投資者可以如何通過我們的亞洲創新科技策略捕捉這些驅動亞洲乃至全球可持續生產力的創新領導企業。

Mar 03, 2020

The sharp pullback in developed markets could see 10% knocked off the S&P 500 The correction was due to a more complex mix of factors than just COVID-19 A rebound could emerge on monetary stimulus hopes But deeper problems of overvaluation and negligible earnings growth will remain to trouble markets later in the year

Feb 25, 2020

Recent market rallies, despite COVID-19, are neither “ill informed” nor “complacent” Markets are looking past the viral outbreak Stocks will likely return to being driven by whatever the trends were before the outbreak Developed markets are at the tail end of bull moves – they could edge a bit higher but the risks are on the downside, and that's got nothing to do with COVID-19 either Chinese equities could ironically outperform developed market stocks this year

Feb 24, 2020

On account of an atypical, tech-enabled start of the Year of the Rat, what are people doing during this very unusual Chinese New Year holiday period? While the roads are empty and quiet, we see extremely busy traffic online from social gathering and entertainment to post-holiday work arrangements all thanks to technology - which enabled an unconventional time of family reunion, and possibly fast-tracked development of enterprise digital transformation in the way.

Feb 03, 2020

The geopolitical risks that dominated global markets for much of 2019 faded in the last quarter as the US and China reaching a phase one trade deal (which happened on Jan 15th and we discussed in China: Beyond Trade Deal Phase 1). As a result, global equity markets posted gains and China A shares also performed strongly in Q4 2019 against this backdrop.FACTOR PERFORMANCEProductivity Growth was the best performing factor in Q4, followed by Quality. The two factors were the best performing factors in 2018 and they kept the trend in 2019. Value showed a slight sign of reversion in Q4 but remained the worst performing factor throughout the year.As a result, the two Premia multi-factor China A shares ETF saw different performances in 2019. Premia CSI Caixin China Bedrock Economy ETF, which is a defensive play with active Value and LowRisk exposures by design, trailed the broad CSI 300 market performance. On the other hand, Premia CSI Caixin China New Economy ETF, a quality growth play designed to capture high quality, high productive growth new economy companies, was among the top performing broad market China equity ETFs listed outside of China in the full year of 2019 with 43% total return in CNY terms (41% total return in USD).What is Quality & Productivity Growth? - To recap, the factor definitions employed in the Premia multi-factor China A shares indexes, designed by Dr. Jason Hsu’s team at Rayliant Global Advisors are as follows –· Balance Sheet Health (aka Quality in our usual definition): Debt Coverage Ratio, Cash Ratio, Net Profit Margin, negative Accruals, negative Net Operating Assets· Productivity Growth: Gross profitability, Operating Profitability, negative Change in Total Assets, negative Change in Total Book Assets, R&D expense over AssetsBoth of the two factors entail component metrics that are broadly considered as “Quality”, despite the fact that this late popular factor does not really have a commonly agreed definition compared to the widely accepted original Fama-French Size and Value. Dr. Jason Hsu recently published a paper titled “What is Quality”. The paper published in the Financial Analysts Journal won the 2019 Graham and Dodd Top Award, and for those interested can find it on SSRN.2019 was firstly a year of recovery from 2018, but also a year of P/E multiple expansion across industries. New economy sectors, in particular, had a strong year as the government continue to drive policies around its reconfiguration toward a service-oriented, consumption-led, technology first economy despite the headwinds from the US-China trade dispute, or even to a greater extent with the conflict as an alarming catalyst.Our Premia CSI Caixin China New Economy ETF (3173/9173 HK) saw active return not only in the style factors but also from such new economy industry allocation and selection compared to peer ETFs tracking the broad CSI 300 index, as shown in Figure 3.2020: VALUE MIGHT REVERT, BUT QUALITY (NEW ECONOMY) GROWTH WILL CONTINUE TO SHINEHeading into 2020, we believe the price multiple expansion would continue but at a slower speed and be more selective on sectors, especially as China further develops into a two-speed economy. From an industry perspective, new economy sectors such as technology services, advanced manufacturing, new energy and healthcare will continue to be the megatrend growth opportunities and key drivers of China’s overall economic and productivity growth in the long term. On the other hand, as earnings play a bigger role in the P/E * EPS formula for market value, sector leaders with solid profitability and earnings capabilities stand better chances to outperform. From a style factor perspective, the broad set of Quality factors are best positioned to continue generating positive risk premia. The quality growth play would remain ideal for investors looking for megatrend growth opportunities in A-shares, while allocators more concerned about potential downside risk or wish to take a contrarian approach may consider the value strategy. Further readingsChina: Beyond Trade Deal Phase 1Insights from the revenue forecast in China marketChina A Factor Review: 2019 Q3

Feb 02, 2020

Markets are forward looking and they follow the money Pandemics/Epidemics have had little discernible impacts on markets Hang Seng and S&P 500 rallied in the face of SARS 2002-2003 - they were focused on recovery from the Nasdaq Crash S&P 500 rallied despite devastating Swine Flu in 2009-2010 - it was more focused on recovery from the global financial crisis Even the Spanish Flu pandemic, which killed between 50 million and 100 million people, did little to drive the Dow Jones China's GDP will be dented in 1Q2020 but should recover later in the year

Jan 29, 2020

The deal is containment of conflict, not cessation of hostilities US demands against China’s subsidies for State-Owned Enterprises (SOE) and control over the Renminbi remain unresolved core issuesUS targets for Chinese purchases over the next two years are extremely ambitious and at risk of not being metChina has bought some time to reduce its technology and trade dependence on the USChinese policy makers will likely maintain a cautious monetary and fiscal policy stance to avoid a “Japanese Bubble” outcome

Jan 16, 2020

Premia 圖說

賴子健 , CFA

CFA

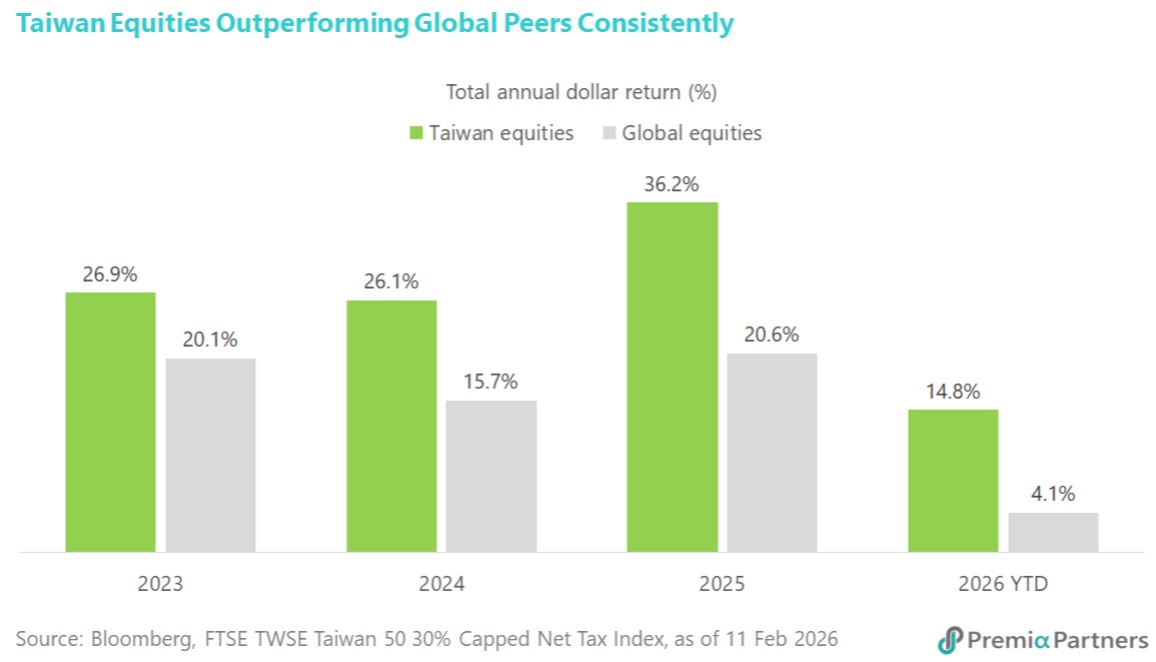

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026