As our Senior Advisor Sayboon Lim stated in the article “Gimme shelter” that it is essential for investors to have China sovereign bonds in their asset allocation, it would be timely for us to introduce the newly launched Premia China Treasury and Policy Bank Bond Long Duration ETF for your consideration. The fund’s key features are as follows:

- Strong sovereign credit: Invests in bonds issued by The Ministry of Finance of the People’s Republic of China and three policy banks, namely China Development Bank, Export-Import Bank of China and Agricultural Development Bank of China with A1 rating and stable outlook.

- Access to long end of the yield curve: Offers unique exposure for investors with long duration asset-liability management or diversification needs whilst capturing a higher yield in an upward sloping curve.

- Operational efficiency: Listed on Hong Kong Stock Exchange with intraday liquidity and minimal operational hassle. Both primary and secondary markets are available with our in-house capital market team standing by for assistance.

- Flexible trading arrangement: Trading counters in Hong Kong dollar, US dollar and renminbi enable investments with a preferred currency. The round lot size of 20 shares help investors gain exposure even with small tickets.

- Minimizing cost structure: The flat ongoing total expense ratio of 28 basis-point per annum was among the lowest offerings for any China fixed income trackers listed globally.

- Attractive yield potential: Long duration China government bonds consistently provide attractive yield, which currently offers ~3.7%, and favourable yield differential with major government bonds.

- High transparency with all physical holdings: Daily disclosure of full holdings and intraday net asset value is provided on every trading day. No derivative and related hidden cost/counterparty risk.

- Low correlation with other assets: China Treasury and Policy Bank long duration bonds have correlations as low as 0.02 with the US Treasury, -0.03 with the US Aggregate, and 0.1 with China Treasury Aggregate, and this helps diversify investors’ portfolio.

STRONG PEROFRMANCE

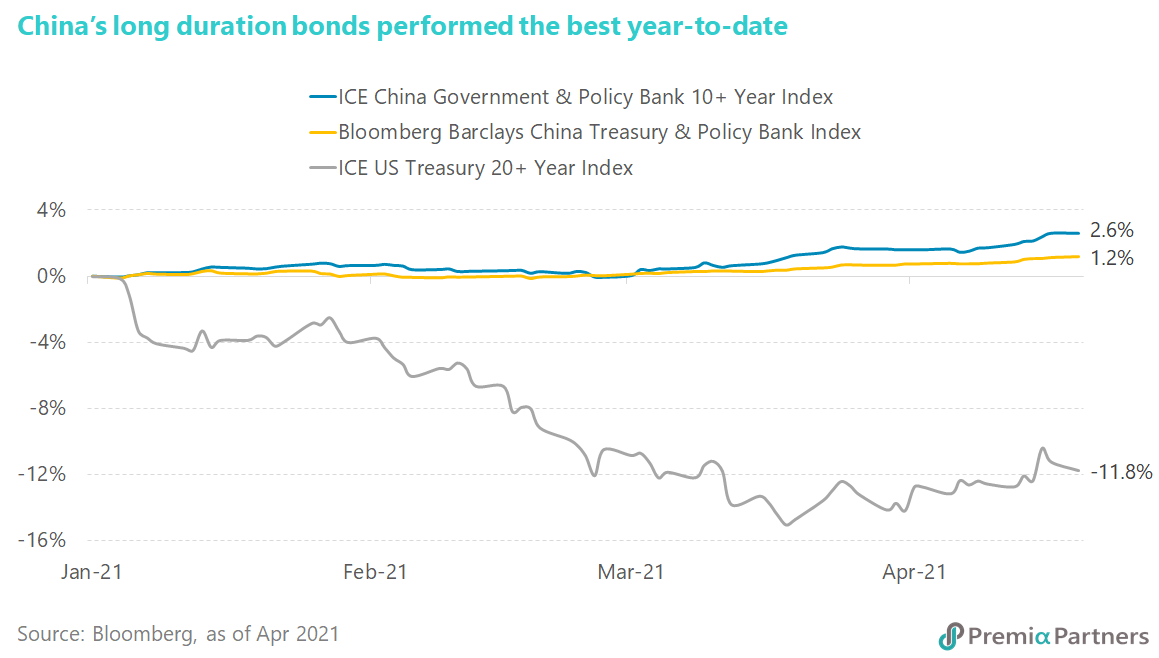

From the performance perspectives, ICE 10+ Year China Government & Policy Bank Index, the underlying benchmark of Premia China Treasury and Policy Bank Bond Long Duration ETF, has done well year-to-date, outperforming Bloomberg Barclays China Treasury & Policy Bank Total Return Index by more than 140 basis points. Its positive absolute gain of 2.6% points is way better than the loss of 11.8% points recorded by ICE US Treasury 20+ Year Total Return Index, while both indexes have a similar duration of mid-to-high-teen.

NO RATE HIKE EXPECTATION IN CHINA

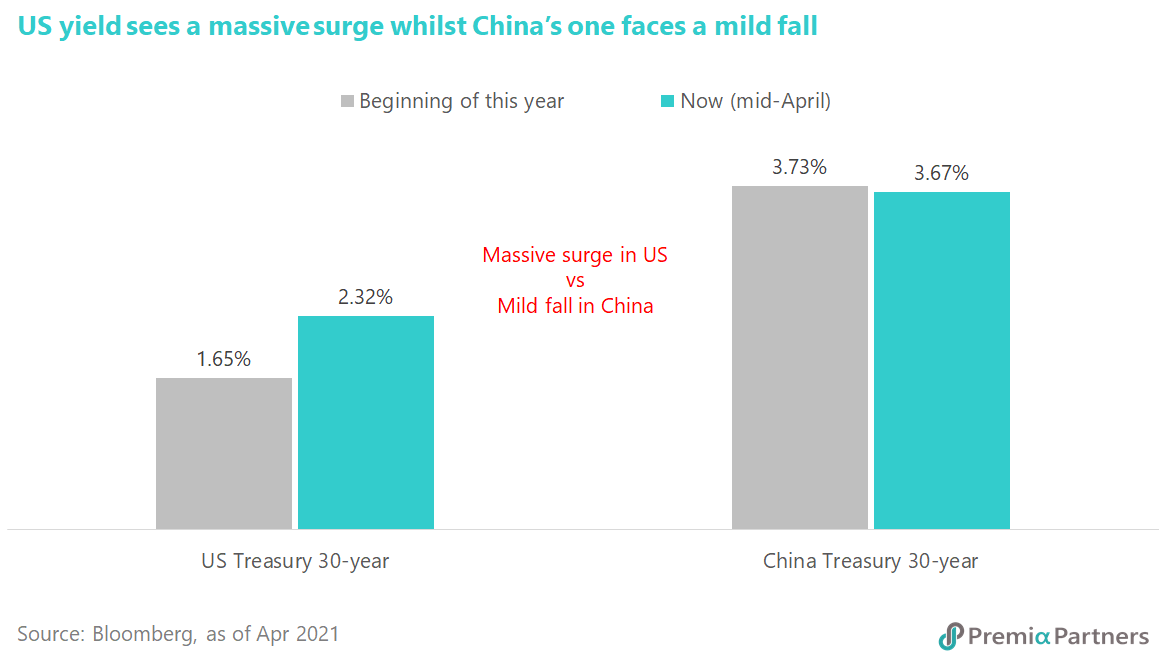

Some may wonder whether the long duration nature may translate into higher volatility directly. That maybe the case in the US, but not in China. US yield rose rapidly in the past few months, e.g., the 30-year US Treasury was trading at a yield of 1.65% at the beginning of this year and now stood at 2.32%, rising 67 basis points in less than 4 months. This kind of dramatic change may result in a significant price drop and a negative mark-to-market return. On the contrary, given the much measured and moderate monetary policies with consistent expectation setting, China yield curve stayed quite stable with the 30-year China Treasury edged down 6 basis points so far this year and now traded at the historical average. In addition, the duration risk for the long-end China government bonds seems manageable due to their relative high yield, limiting the magnitude of any pricing fluctuation. In fact, some analysts expect as allocation for China Treasury expands for international investors, the yield of the long end may come down whilst price goes up, partly driven by demand and supply, as compared to US Treasury which has abundant supply, access to China Treasury especially the long duration one is also more difficult for offshore investors.

STABLE YIELD CURVE HERE

STABLE YIELD CURVE HERE

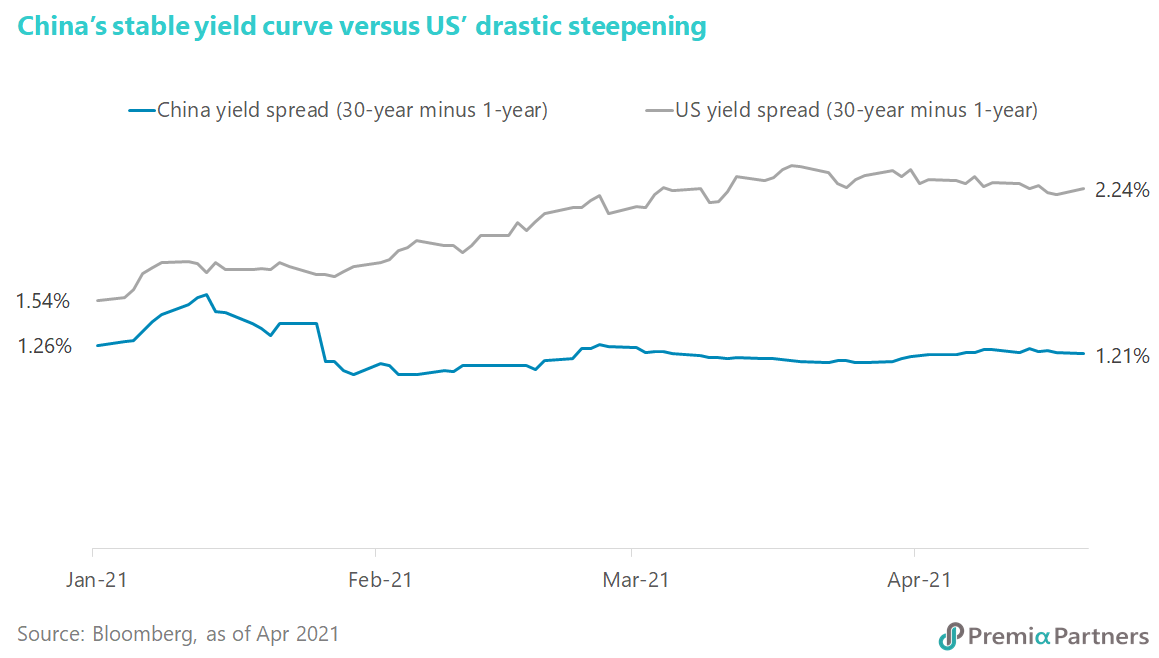

The yield spread between the 30-year US Treasury bond and the 1-year Treasury bill has widened from 1.54% at the beginning of this year to the recent 2.24%. At the same time, the yield spread in China has stayed largely flat with a few basis-point movement only. The fundamentals of two economies facing may explain the different reaction in the bond markets. The steepening in the US is pricing in higher inflation expectation as the economy is set to rebound strongly along with the vaccination rolling out smoothly. In addition to the near-term imbalance in general commodities and raw materials for manufacturing, the record high COVID relief package of USD 1.9 trillion and the proposed bold infrastructure plan of USD 2.3 trillion have triggered the market’s nerve to foresee a higher inflation pressure. Indeed, the CPI has already been rising from 0.3% a year ago to the latest reading of 2.6% in March in the US.

INFLATION? WHAT INFLATION!

INFLATION? WHAT INFLATION!

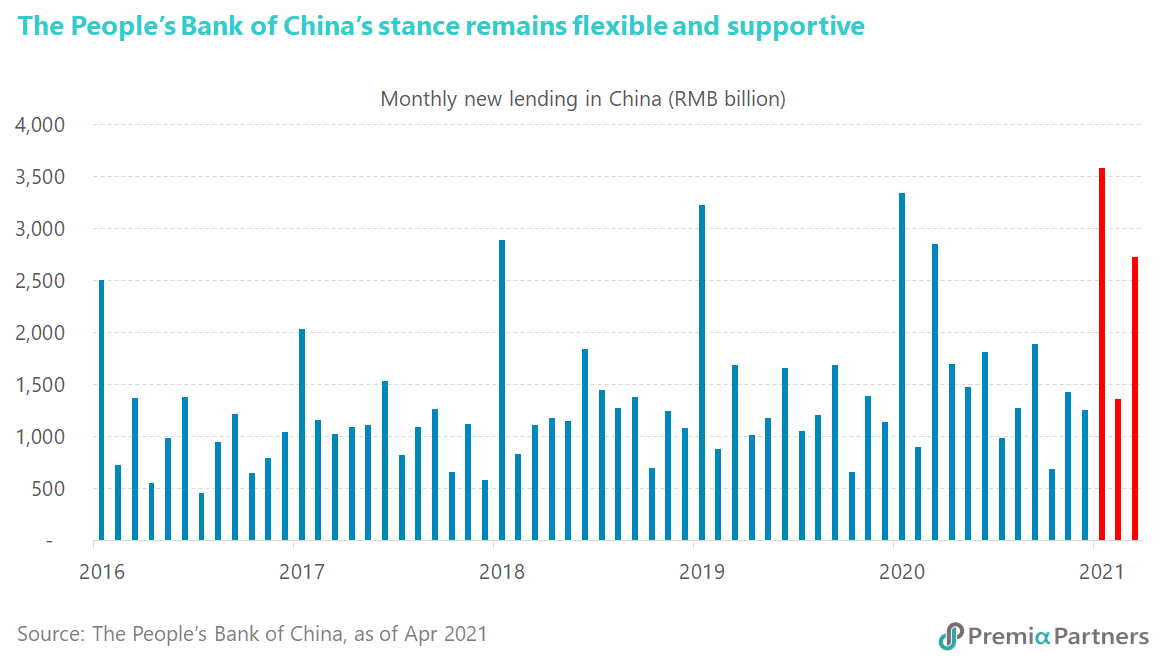

China does not see a similar threat. China’s CPI fell from 3.3% to 0.4% during the same period, contributing to the steadiness of China yield curve. Although China has reported an astounding 18.3% in the first quarter this year, any rate hike amid an overheating concern should be a remote issue. Closer examination shows that the economy may still need support. The normalized annual growth rate of 1Q GDP was simply 5% after adjusting the slump in 2020, below the full-year expansion of 6% in 2019. The People’s Bank of China, therefore, has reiterated that the monetary policy will remain accommodative, ensuring the economic recovery and protecting all the green shoots. The central bank kept both short-term and medium-term loan prime rate unchanged for 12 straight months, while the overall new renminbi loan increased by 8% to RMB 7.67 trillion in the first three months of 2021.

FIRM RENMINBI

FIRM RENMINBI

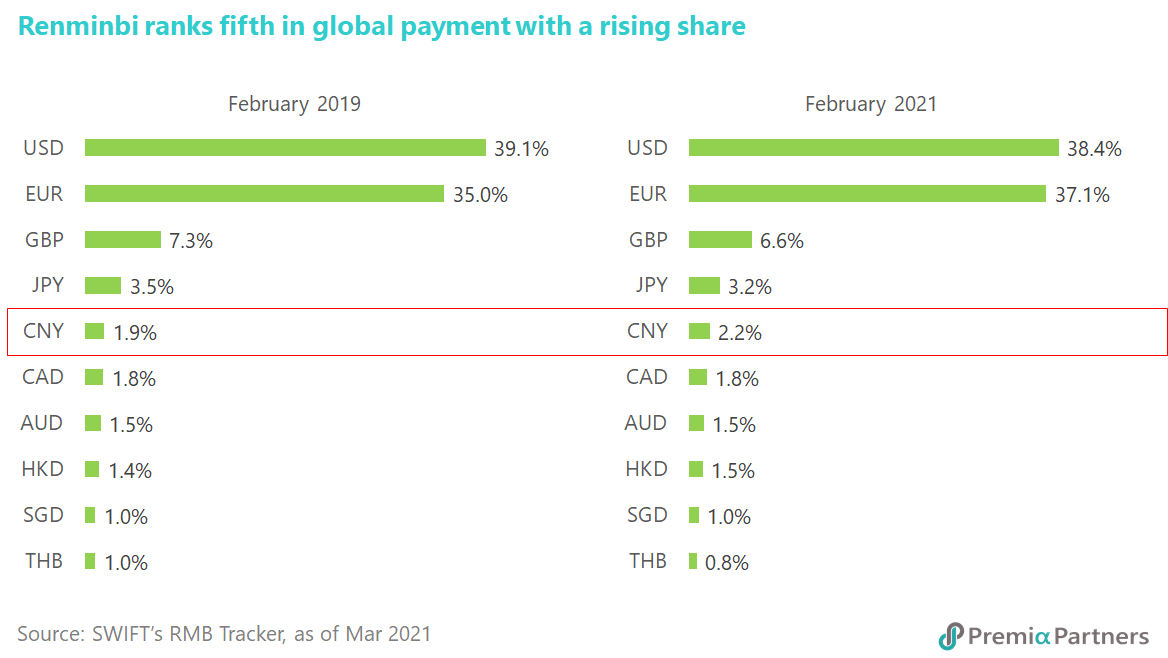

The US dollar strengthening so far this year is a surprise to the market. Instead of continuing the downtrend as widely expected by analysts a few months ago, the dollar index went up by 1.4%. Most emerging market currencies depreciated with Argentine peso, Turkish lira and Brazilian real as the major losers, but renminbi held up firmly with even a slightly upward move of 0.4% against the dollar. Renminbi was always an eye-catching topic in the market with noise suggesting manipulation of the currency in either significant appreciation or dramatic depreciation. Still, the currency has been behaving quite predictable in the first ten years since the foreign exchange reform began in mid-2005. The volatility increased in the past few years, but renminbi managed to trade in a reasonable range between 6.2 and 7.2 per dollar. In medium-term, there is a higher likelihood for the currency to appreciate on the country’s strong macro growth, high fiscal discipline, prudent monetary policies, steady foreign direct investment and renminbi internationalization. The Society for Worldwide Interbank Financial Telecommunications (SWIFT) released the data in its monthly RMB Tracker on the renminbi’s progress toward becoming an international currency. The Chinese currency was ranked 35th in October 2010, when Swift started tracking currencies. It progressed and became the fifth spot lately with a 2.2% share in global payment.

Investors may not need to search more in case ones are looking for an investment instrument which is equipped with attractive yields in solid sovereign credits, renminbi exposure, high transparency with physical holdings, cost efficiency, ease in trading and strong diversification effects with low correlation with other assets. Premia China Treasury and Policy Bank Bond Long Duration ETF is available for trading counters in Hong Kong dollar (2817.HK), US dollar (9817.HK), and renminbi (82817.HK).

Investors may not need to search more in case ones are looking for an investment instrument which is equipped with attractive yields in solid sovereign credits, renminbi exposure, high transparency with physical holdings, cost efficiency, ease in trading and strong diversification effects with low correlation with other assets. Premia China Treasury and Policy Bank Bond Long Duration ETF is available for trading counters in Hong Kong dollar (2817.HK), US dollar (9817.HK), and renminbi (82817.HK).