It is inevitable that the traditional 60/40 asset allocation split between bond and equity no longer work well as the fixed income portion is not generating sufficient stable income. With interest rates at an all-time low, following a multi-decade bull-market of bonds in the developed markets, there is significant downside risk. That means the low yields and low expected returns of bonds will unlikely contribute to the overall performance in the model. There are a few ways to fix the problem: (1) increasing the riskier equity portion, so that the potential return profile would be higher; (2) adding alternative asset classes such as private equity, real estate, hedge funds, commodity or even crypto to enhance performance at an expense of liquidity and transaction cost; (3) switching the fixed income elements from holding the usual sovereign and investment grade debts only in developed markets to include high yield and emerging markets bonds. We would like to focus on the last consideration here and explain how Premia China USD Property Bond ETF can help.

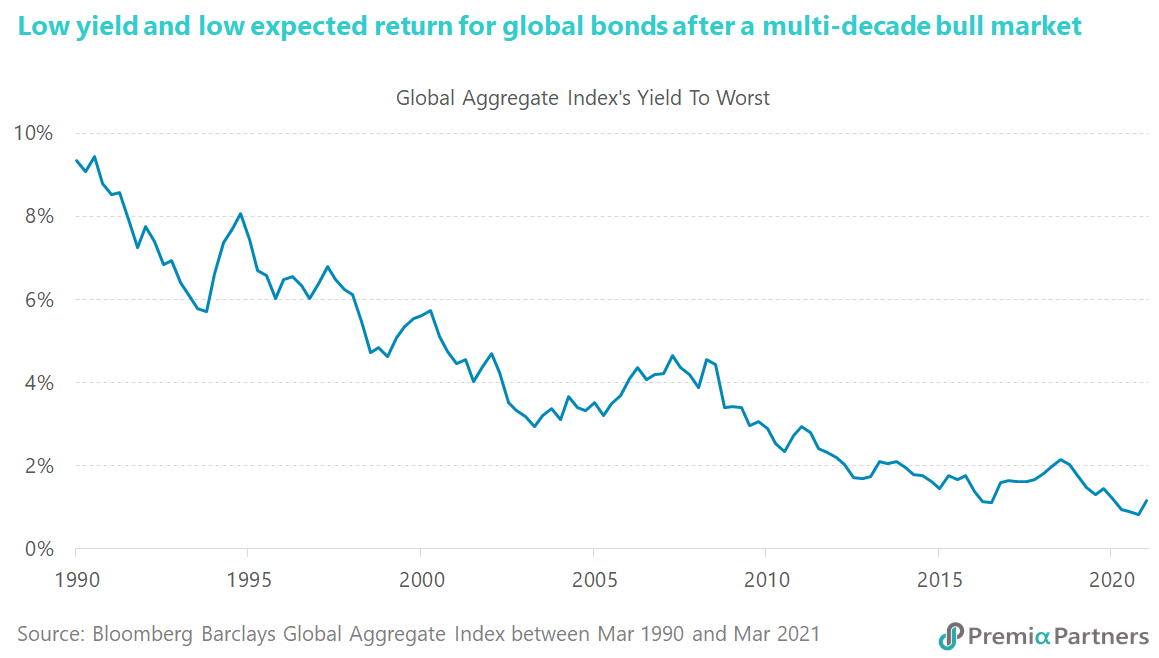

Let’s take a look at the current fixed income market before diving into the solution. The negative yield debts first showed up in 2014 with the European Central Bank lowered a key interest rate into negative territory. Essentially, the goal was to stimulate economic growth by lowering the cost of debt to stimulate borrowing. Simultaneously, banks were penalized for holding too much cash at negative rates. Since then, several central banks including Swiss National Bank and Bank of Japan joined the camp, issued sovereign debts at negative rates. The total amount of negative yielding debts ballooned to USD 18.38 trillion last December, accounting for 27% of total investment grade issues around the globe. Amid the rising inflation expectation and yield curve steepening in most developed markets, sub-zero bonds fell from the peak a few months ago to the latest USD 13.7 trillion. It is still a staggering high level, meaning one-fifth of global investment grade bonds are not producing a positive yield. The Bloomberg Barclays Global Aggregate Index, one of the most commonly used benchmarks for bond investors which measures all investment grade debt from twenty-four local currency markets, is simply paying a weighted average yield of 1.11% now. It is hard to believe that the same underlying was paying a yield of 2.95% 10 years ago, 4.45% two decades ago, and 8.53% back in early 90s.

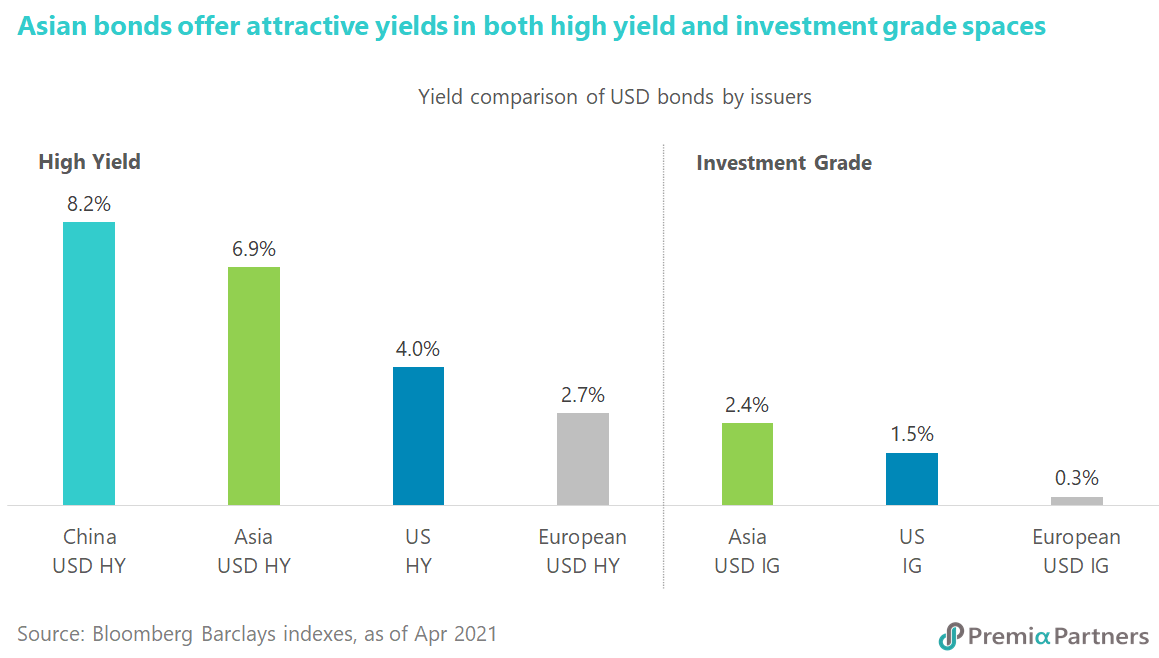

Since bonds have a role to play for portfolio resilience in managing volatility and providing liquidity, it may be sensible for most investors to twist their bond exposure instead of an outright reduction. Emerging market bonds were recommended by most advisors at the beginning of this year as investors were optimistic with successful rollout of vaccination programs globally and improving business condition amid economies reopening. The view was further supported by the expectation of global coordinated fiscal expansionary policy underpinned by accommodative monetary policy. The US dollar strengthening and the resurgence of COVID in a few developing countries ruined the party though. Argentine peso and Turkish lira have depreciated by ~10% year-to-date, while India and Brazil continue to see rising daily infection unfortunately. It reveals that not all emerging markets investment should be treated as equal. China once again shows superior class of stability in both virus control and economic recovery, so that the USD high yield offerings from Chinese corporates become the sweet spot in the bond market. The attractive yield spread offered by Chinese borrowers over their peers in the US and Europe seems unjustified given the strong macroeconomic support.

China’s economic recovery remains intact with the first quarter GDP recording a stunning growth rate of 18.3% and retail sales expansion of 34.2%. If considering the negative impact from the pandemic last year, the normalized annual growth would have been 5% for GDP and 6.3% for the domestic consumption. As the macro environment is finding a firm foothold, most economists are optimistic on Chinese economy in 2021, the year marks the beginning of the 14th five-year plan and the century anniversary of the Chinese Communist Party. Meanwhile the concern of tightening was exaggerated. The People’s Bank of China has mentioned explicitly a few times that monetary policy will stay supportive as shown by the recently released new bank loans and steady lending rates.

The fundamentals of China’s property market are important to any investor interested in Asian USD bonds, since property companies are the largest issuers in the high yield space. According to the National Bureau of Statistics data, China’s home prices grew at the fastest pace in seven months in March as a fear of missing out among buyers persisted in a traditionally fast season for sales. New home prices in 70 major Chinese cities rose 0.41% month-on-month or 4.37% year-on-year lately, in which first-tier markets performed the best. The bullish sentiment in housing market is no different from those witnessing in the US, the UK, Germany, Korea, Singapore and Hong Kong. The pent-up demand from the pandemic and the inflation-hedge driven purchase fueled the residential market worldwide.

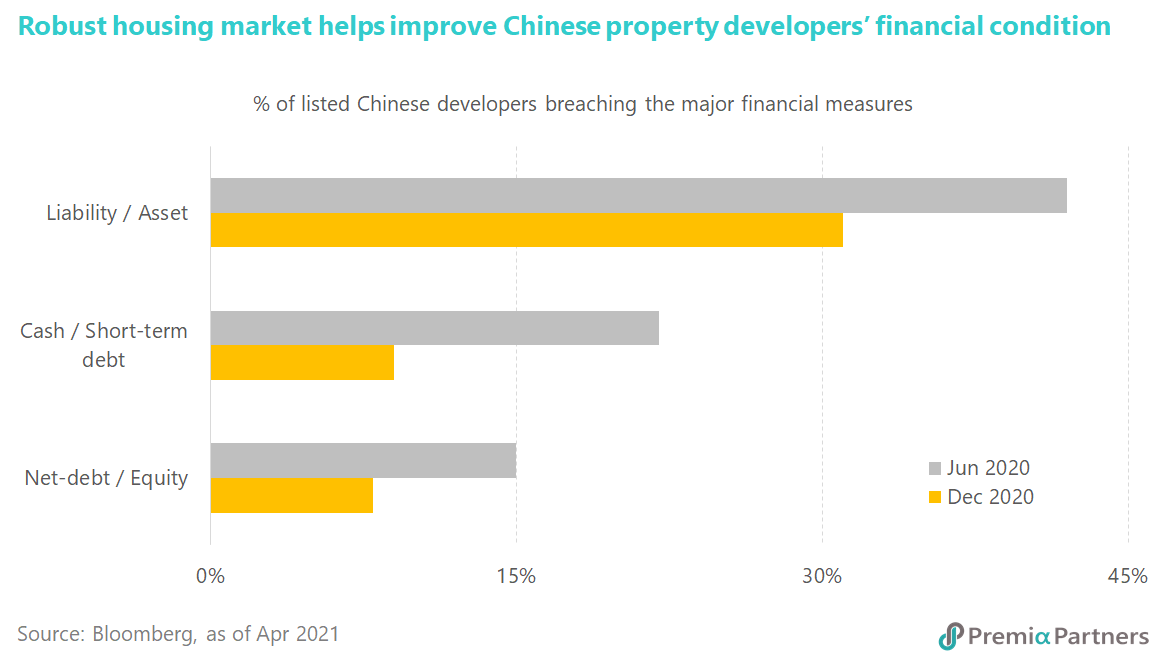

In China, the flooding demand helped developers push ahead with project sales raising cash needed to bolster balance sheets under stricter new borrowing rules. By the end of last year, fewer listed Chinese developers were in breach of three red lines, which refer to liability-to-asset-ratio below 70%, net gearing ratio below 100%, and cash-to-short-term-loan ratio above 100%. With strong sales expectation and pricing trend so far this year, the financial situation of most Chinese developers should turn healthier, reducing the systematic risk of default in medium-term. Besides, the leading property companies are finding various ways to strengthen their financial positions, including Cifi Holdings aiming to list its rental residence business and Vanke seeking an IPO for its property management unit.

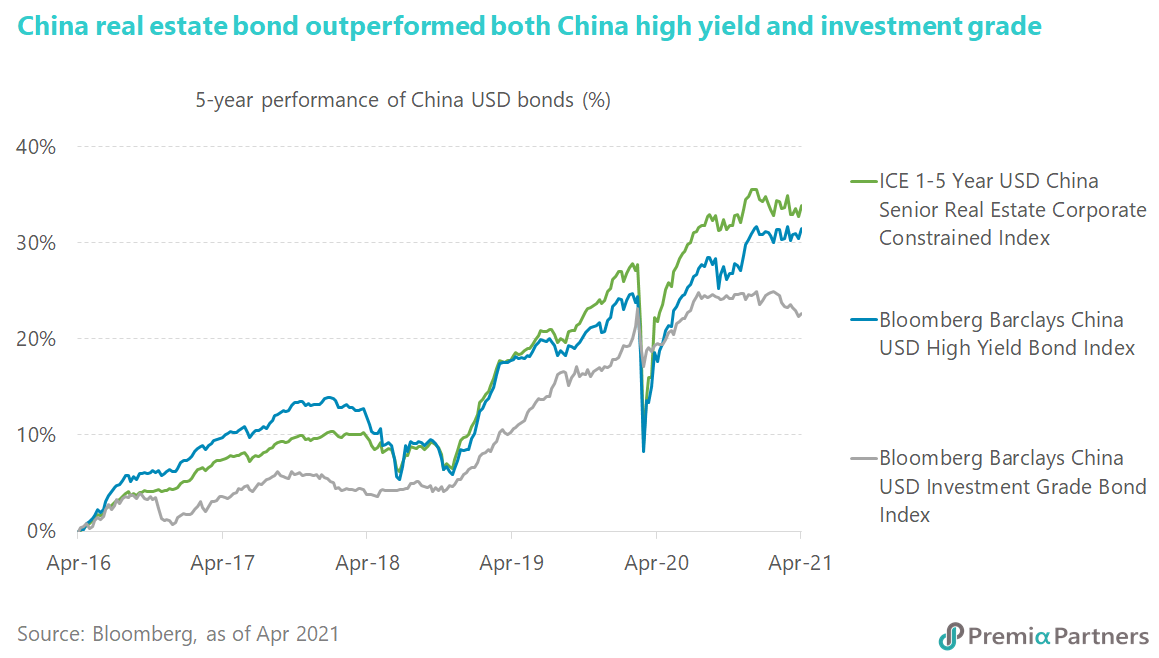

The recent tumble of China USD bonds triggered by Huarong’s failure to publish 2020 preliminary earnings may provide a buy-on-dip window to accumulate quality exposure issued by Chinese property developers. Premia China USD Property Bond ETF (3001.HK) could be a handy instrument, which invests in a diversified basket of bonds issued by China real estate firms offering a yield of ~7%. The fund’s underlying index, ICE 1-5 Year USD China Senior Real Estate Corporate Constrained Index, has performed rather resiliently with only a mild loss of 1.56% year-to-date given all the hiccups in the market. In a 5-year horizon, it outperformed indexes tracking China USD high yield and investment grade bonds.

The key features of the ETF are as follows:

· Attractive yield pick-up: In a low interest rate environment, the ETF’s current yield of ~7% compares favorably not just among other USD bonds in Asia or globally, but also vis a vis onshore Chinese corporate bonds on a currency hedged basis.

· Solid risk mitigation: Only selected secured and senior unsecured issued with credit ratings from S&P, Moody’s and Fitch only, excluding local government financing vehicles (LGFVs) and subordinated debts for better credit risk and default recovery management.

· Diversified baskets: Each individual issuing group will be capped at 5% weight, ensuring the ETF to have a diversified exposure from leading Chinese property firms whilst reducing concentration risks if simply following a market cap weighted approach.

· Operational efficiency: Listed on Hong Kong Stock Exchange with intraday liquidity and minimal operational hassle. Both primary and secondary markets are available with our in-house capital market team standing by for assistance.

· Flexible trading arrangement: Trading counters in Hong Kong dollar (3001.HK), US dollar (9001.HK) and renminbi (83001.HK) enable investments with a preferred currency. The round lot size of 5 shares help investors gain exposure even with small tickets.

· Minimizing cost structure: The flat ongoing total expense ratio of 58 basis-point per annum was among the lowest offerings for index trackers or funds investing in China high yield space globally.

· High transparency with all physical holdings: Daily disclosure of full holdings and intraday net asset value is provided every trading day. No derivative and related hidden cost/counterparty risk.