精選觀點 & Webinar

It’s been a month since we launched our ETFs and we’ve been asked by a few clients to walk through a quick synopsis of A-shares vs rest of world, as well as the various options available within A-shares. I thought it would be easiest to cover these topics through a valuation and mean reversion lens, as that seems to be the angle missing from many of the comments I see about continued performance upward.Valuations overallNick Ferres, Vantage Point’s CIO, covers the risks quite well here, so I’ll start with a summary of his points. Technology stocks have seen positive price movement justified by their earnings so far, but the latest moves up have been parabolic and likely entering the last phase of the bull market before a potentially aggressive correction. Speculative excess can be seen elsewhere as well, from bitcoin to art auctions. Here’s my very simple monitor for the same thing: Source: Bloomberg, as of 21 November 2017 Forward P/E ratios are higher than their 10yr averages in every major DM and EM market except Japan. The premium ranges from 12% to 24%. The highest is in China offshore stocks while the lowest, curiously enough, is in China A-shares. Similarly, on a Price to Sales (P/S) basis, all markets are higher than their 10yr averages. EM has the lowest premiums (again, with China offshore stocks being the exception), but that is likely driven by the tech rally, which you can see all the way on the right. The tech sector has a P/S premium of ~60-70%! Tech sector earnings growth justifies some of the premium, but the valuation levels today suggest a recovery not far on the horizon. A-shares vs rest of world In a world of high valuations across the board, a long-only investor needs to do 2 things to protect their portfolio: 1) identify the catalyst likely to cause the rally to sputter, and 2) identify a market that has lagged (and is therefore cheap) and has relatively low correlations with the rest of the world. The charts above give us a hint for the latter, but let me quickly share my thoughts on potential catalysts. In my mind, there are 2 catalysts big enough for investors to stand up and notice and geopolitics is not one of them. Short of outright war, investors have from time and time again shown a willingness to ignore geopolitical risk. The bigger issues in my mind are a failure of US Congress to pass tax reform and disappointing news from the FANGs, BATs or any of the other major tech firms. US tax reform is far from a done thing and as the debates on travel bans and healthcare reform have shown, a desire to act is far from an ability to act. A failure on this front would cement a mindset that President Trump cannot accomplish much of anything and that the lofty valuations and confidence underpinning current market levels may not be warranted. On the tech side of things, I don’t think it would take much for investors to take profit. Earnings growth expectations are quite high and even a “just OK” number might be an opportunity for some to exit. The looming possibility of greater regulation is also not out of the question. If either of these events occur, where can we seek refuge? You guessed it! A-shares are not only relatively cheap, but are also under-owned by investors, uncorrelated with the rest of global markets and have a large wall of money (both foreign and domestic) coming their way. From a fundamental asset allocation point of view, A-shares volatility has trended down materially in recent years, the RMB is stable, IPOs are decreasing, and the economy is quite robust. All in all, a good story that can be summed up in 6 quick charts. Source: Shanghai & Shenzhen Exchanges, Bloomberg, as of 21 November 2017 A-shares with nuance If you agree with the above logic and are thinking of adding A-shares to your portfolio (or already have them), then the next question is deciding how to obtain the exposure. We’ve already spoken about the issues with existing beta options for mainstream exposures here and the lack of new economy options here. Today, I’d like to dig into style and sector performance to show why a simple mkt-cap construct is not your best bet. From a style point of view, the 2 most common strategies globally are value and small size. In developed markets, value has consistently outperformed since the ‘70s, but has suffered vs growth over the last few years. Small caps have not had such issues, showing consistent outperformance across pretty much every period. You can see the details below: Source: Bloomberg, as of 21 November 2017 What do these charts look like in A-shares? Given their uncorrelated nature, we see the exact opposite pattern over the last few years! Value has consistently outperformed but small caps have experienced a massive correction over the last 1 year. Coming off non-sensical highs in 2015, small caps have re-rated massively vs large caps, underperforming by ~12% annualized since the peak of 2015. Source: Bloomberg, as of 21 November 2017 Some investors might view this as proof that one should invest in China mega-caps only and leave the rest alone, but we take a different view. Coming back to valuations, it is evident that 2015 small cap multiples were unrealistic and have simply corrected to their long-run average (in fact, below it if you include the peaks as the chart below does). In contrast, large caps are flirting with their 2011 and 2015 valuation peaks. Source: Bloomberg, as of 21 November 2017 Size on its own can be quite volatile and we suggest that a singular focus on the size factor be handled with caution. As a result, we decided to take a multi-factor approach for our Bedrock Economy and New Economy ETFs. 2803 HK (Bedrock) provides a value, balance sheet health, low vol and low size bias. While this has resulted in underperformance so far in 2017, the combination of value and size exposure should generate substantial excess return going forward. 3173 HK (New Economy) is a services sector play – focused on consumer discretionary, technology and healthcare sectors. Its diversified sector exposure and balance sheet health, profitability and R&D bias has resulted in material outperformance vs Chinext so far this year, but significant size bias has detracted from performance relative to the large cap benchmarks. Source: Bloomberg, as of 30 September 2017 To wrap up, A-shares are a relatively cheap alternative to global markets’ increasingly stretched valuations. The challenge is what type of China exposure investors want to have in this market. Mainly large cap banks and some industrials and real estate? Then FTSE A50 or CSI 300 are the way to go. For a broader but still traditional exposure, 2803 HK lowers financials to more reasonable levels, adds consumer discretionary and prioritizes value and size factors to deliver excess return. Or, for those who want to focus on new vs traditional economy sectors, 3173 HK offers close to 0 financials, real estate and energy stocks and instead targets consumer discretionary, technology and healthcare stocks while prioritizing size and balance sheet health factors.

Nov 28, 2017

創新逐漸成為經濟增長的關鍵要素——「中國山寨」成功轉型為「中國製造」,而亞洲地區的整體趨勢亦如是。然而,目前為止,市場上仍缺乏簡單有效的方法投資亞洲創新機遇。本篇文章,我們將討論亞洲創新發展的現況即行業影響,並介紹Premia與FactSet合作推出的亞洲創新科技策略,亞洲創新科技指數為投資者系統化、精確地捕捉亞洲創新科技大趨勢——數位轉型、生物科技與醫療創新、人工智能與機械自動化。

Oct 18, 2017

A-shares are a deeper, broader, cheaper and less correlated market than offshore Chinese equities. Investors should review their portfolios given the benefits of A-shares to overall asset allocation.

Sep 28, 2017

Size works in A-shares, but for this article we'll put that aside and focus on implementation feasibility.

Aug 01, 2017

Without any screening or selection, solely investing in all SOEs or the largest market cap SOEs may not be optimal strategies. What is important for investors is how to capture the current contributors and engines for future growth of China economy regardless whether the underlying stocks are SOEs or non-SOEs.

Jul 04, 2017

A quick review of what MSCI did and didn't do, its impact, why it matters and how investors should approach China going forward.

Jun 23, 2017

Our advisor, Dr. Jason Hsu, recently did a podcast with Meb Faber (co-founder and CIO of Cambria Investment Management) on China opportunities, investors' preference for complexity over simplicity, and key takeaways for investors implementing smart beta strategies in China.

Jun 08, 2017

This morning Bloomberg ran a story about LeEco, a Chinese technology conglomerate that has been growing rapidly until recently.

May 24, 2017

Are all smart beta products smart? This is a question I've asked a few times over the last few years but always got a "nuanced" answer depending on the product being marketed.

May 15, 2017

Premia 圖說

賴子健 , CFA

CFA

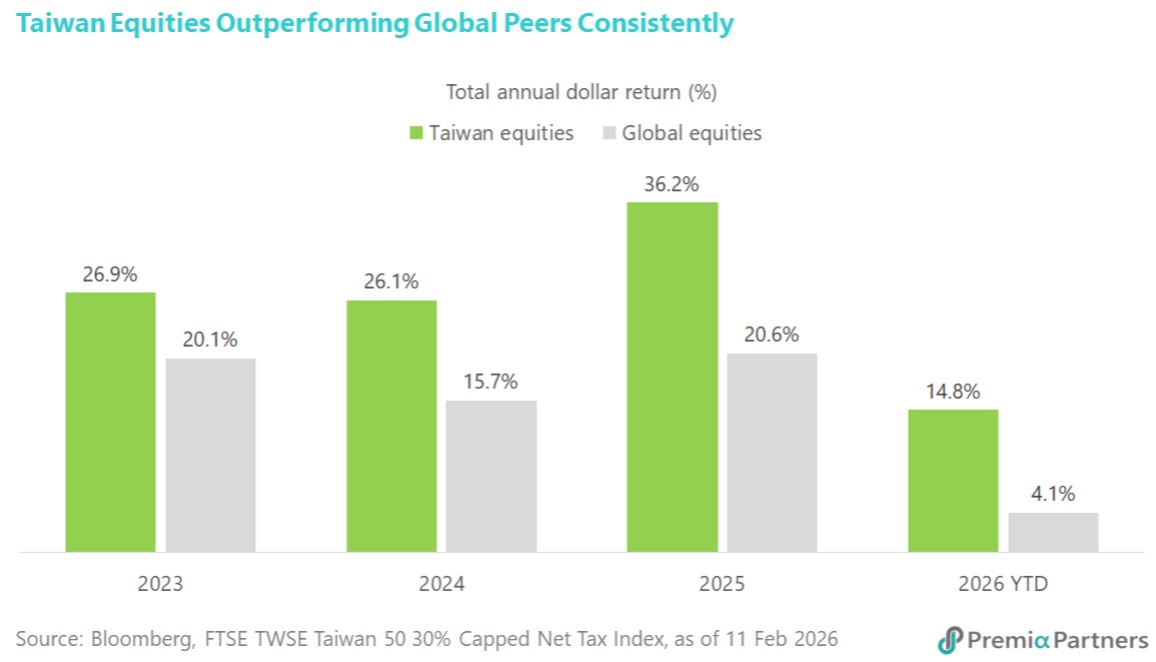

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026