精选观点 & Webinar

The Chinese economy continues to normalize across the board at an impressive rate, leading to the strong likelihood of it beating the current Bloomberg consensus GDP estimate growth rate of around 2% for 2020.

Oct 06, 2020

China economy recovered faster than the rest of the world from the pandemic as shown by various economic indicators ranging from official PMI, GDP number, steel output, excavator sales, to traffic data. China’s solid macro recovery stands out from the rest of the major economies which either remain in a lock-down mode or simply begin to resume economic activities. That explains Chinese listed companies outperformed in terms of earnings and stock price performance.

Sep 10, 2020

An overdue technical rebound in the US Dollar – which started a week ago – may give investors an opportunity to diversify their currency holdings away from the Greenback. What is emerging could well turn out to be a counter-trend rally in a bigger, multi-year Dollar decline.

Sep 09, 2020

在经历今年首季度的急剧抛售后,全球股市在近几个月表现亮眼。这个反弹看似是典型的非理性“大爆发”,因为全球主要经济体正在或即将进入衰退期,且全球新冠肺炎疫情仍未见缓和之势;然而,从另一方面而言,这具前瞻性的市场走势,可能反映出投资者已走出疫情阴霾,整装以待争相捕捉股市V型反弹所带来的投资机遇。 中国A股市场既拥有稳健的基本面,又具相当吸引人的估值。因应全球股市下跌,投资者可考虑稳步增持中国A股。本篇文章中,我们将简述当前市场动态与如何精准捕捉中国A股反弹的增长机会。

Sep 04, 2020

CSI 300 outperforms S&P 500, Chinese tech outruns Nasdaq 100. How has China’s new economy sectors including its recently launched “Nasdaq” – the STAR board (Shanghai Stock Exchange’s Science and Technology Innovation Board) – outperformed global indices despite being at the center of a trade-tech war with the United States?

Sep 01, 2020

Highest recorded yield spread between the China 10Y Government Bond and the 10Y UST. The yield spread between the China 10-year government bond over the 10-year US Treasury recently hit its widest ever recorded level.

Aug 25, 2020

In the midst of a US tech bubble, Chinese and Hong Kong equities have emerged in the sweet spot between valuations, profitability and balance sheet strength.

Aug 18, 2020

Are US indices rallying because of COVID-19? The most common narrative is that “US stocks have been rising despite the pandemic.” Perhaps a more accurate explanation is “US stocks have been rising because of the pandemic”.

Aug 12, 2020

After the fall in Q1, global equities recovered sharply in Q2 as the COVID fear eases and stimulus packages kick in around the world. YTD, China is the best performing emerging market, and the broad CSI 300 index gained 14% in the second quarter. From factor investing perspective, we continue to see the dispersion of a two-speed-economy despite an overall beta pick up. Quality growth new economy stocks continue to be the winner.

Aug 11, 2020

Premia 图说

赖子健 , CFA

CFA

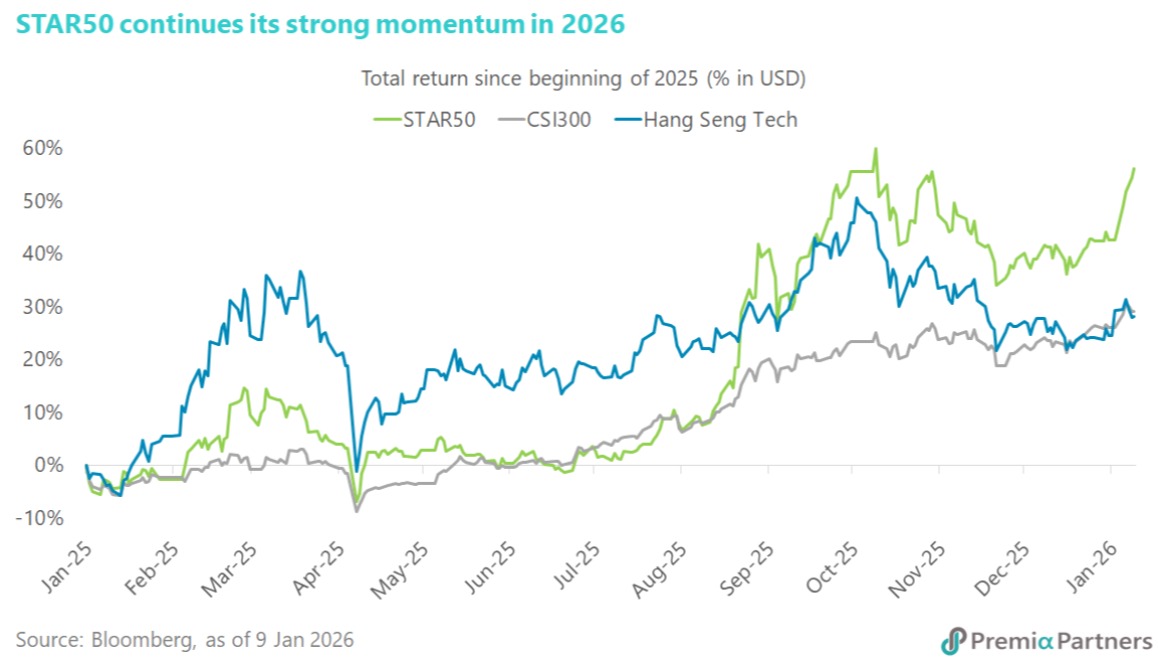

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026