精选观点 & Webinar

According to the United Nation Environment Programme, an inclusive green economy is an alternative to today's dominant economic model, which exacerbates inequalities, encourages waste, triggers resource scarcities, and generates widespread threats to the environment and human health.

Jan 22, 2021

The US Federal Reserve pumps out an endless stream of zero interest rate money to finance the Government’s deficit spending. The handouts make most American workers better off financially during the pandemic than before. Meanwhile, the stock market soars. Not bad for the worst pandemic in 100 years. What can possibly go wrong?

Jan 20, 2021

随着COVID疫情走向复甦,中美摩擦等地域风险逐渐晴朗,2021投资者可以如何佈局? 我们的联合首席投资官赖子健先生与我们团队的郭子豪先生为大家分享对亚洲高成长地区及高成长行业的展望,「我们可以如何通过Premia的投资策略来捕捉这些大趋势下的盈利机遇,并讨论了对近期市场环境相关热门话题的看法。

Jan 04, 2021

Outperformer from first news of successful vaccines. Emerging ASEAN has been one of the best performers among major global equity indices since the start of November. And that was likely due to the region’s high economic leverage to normalisation after the distribution of COVID-19 vaccines and its high trend GDP growth rates relative to other Emerging Market economies.

Dec 24, 2020

To summarize the year of 2020, the opening lines from Charles Dicken’s A Tale of twin cities sounds like an accurate description. It was certainly the best of times and the worst of times. Global equities have been doing reasonably well with developed market up by 12.0% and emerging market up by 11.7%. Fixed income managed to gain by 7.4% whilst gold price was up by 19.1%. On the other hand, real economy has been suffering from the pandemic with almost all major economies getting into recession. International Monetary Fund sees the world would contract by 4.4% in total output, the worst crisis since the 1930s Great Depression with -5.8% among advanced economies and -3.3% on developing countries.

Dec 02, 2020

From a total portfolio perspective, global asset owners and allocators are increasing wary about the overall portfolio sensitivity to interest rate changes and ultimately risk diversification. The concept of “equity duration” was raised long ago and has been subject to debate for decades. While some absolute calculations fail to work in today’s markets, we believe the economic and financial intuition beneath still hold. In this working paper, we took a renewed approach to analyze the relationships from a relative perspective and with an overarching objective of total portfolio risks in mind.

Nov 26, 2020

Premia 图说

赖子健 , CFA

CFA

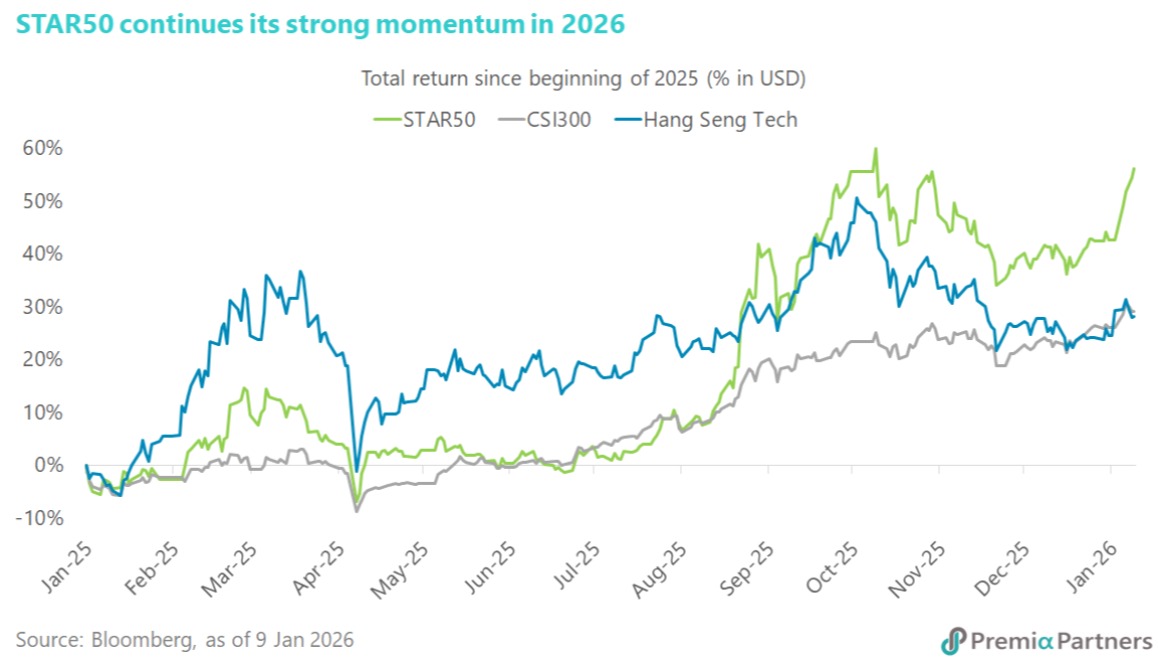

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026