精选观点 & Webinar

As business activities in China mostly resume to a normal level, we also observed some mean-reversion in factor returns, and interesting rotation in sector returns. Still, China A shares continue to outperform the US and global equity markets. With “high-quality” growth emphasized by the 14th Five-Year Plan and “Dual Circulation”, we believe “Quality Growth” will continue to be the main tone of China A equities.

Nov 11, 2020

So, it is official: Exit Donald Trump, enter President Joe Biden. And when the cheering and crying is done, we are likely to see that the election meant more emotionally to Americans than it does economically for the nation, or financially for the markets. The big economic and market trends are unlikely to be changed by the election.

Nov 09, 2020

The term "dual circulation” is one of the hot searches in China and receives great attention after President Xi first expressed this idea at a top official meeting held earlier this year. He then elaborated further that China’s economic model will be involving an internal circulation developing a substantial domestic market, and an external circulation deepening the international trade. The latest meeting of Communist Party’s Central Committee reinforced this policy will be the core component of the 14th five-year plan for the development between 2021 and 2025.

Nov 04, 2020

The latest economic data confirms the upward trajectory of Chinese growth, putting China on track to be the only major economy to register growth for the full year 2020. And it highlights the attractiveness of China’s asset markets and supports the case for continued outperformance against other major markets.

Oct 28, 2020

Two separate news items last week focused our attention on the gap in understanding about the rapidly changing energy landscape in China.

Oct 20, 2020

自新冠疫情爆发以来,我们观察到许多Premia ETF的成分股为风口下的受益者,尽管面临市场动荡、新冠疫情和中美关系恶化,这些强势股仍持续带领Premia ETF绩效蒸蒸日上。在本场研讨会中,我们的联合首席投资官赖子健、吕霭华及销售副总裁罗宁雨将探讨与日常客户对话中,常见的问题及热门主题,特别是我们旗下的Premia中国新经济ETF (3173/9173 HK),此档ETF年初迄今绩效录得40%*,且自今年四月以来资产管理规模暴涨三倍达2.85亿美元,成为香港第四大的中国A股ETF。请点击这里查看讨论的纪录。*截至2020年10月12日

Oct 15, 2020

Yield curve steepening – which has been accelerating in recent weeks as the market contemplates a whopper of a stimulus package under a possible Biden White House – is likely to continue regardless of the winner on November 3.

Oct 14, 2020

Premia 图说

赖子健 , CFA

CFA

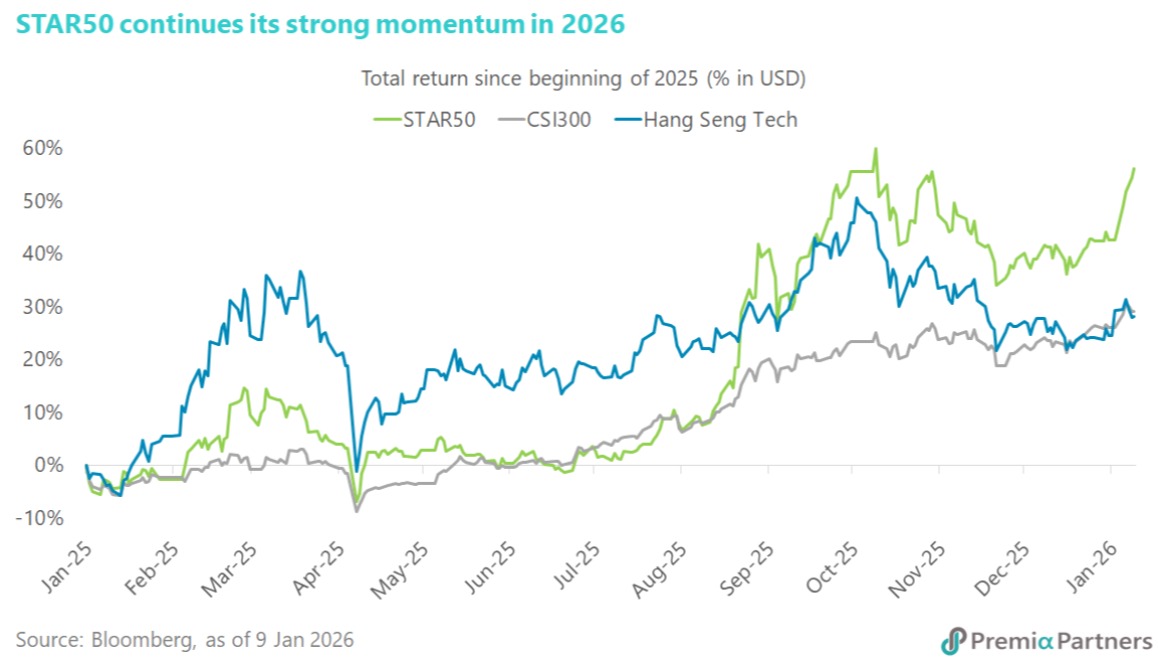

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026