精選觀點 & Webinar

Notwithstanding the cautious sentiment towards Chinese equities over the past year, the fundamentals suggest that it would be increasingly difficult to ignore Chinese equities as its economic heft and importance continues to grow. In this article, our Senior Advisor Say Boon Lim analyzes the fundamentals of the Chinese economy and why it makes sense for global allocators to deploy Chinese equities for diversification and growth opportunities as the alternative would be a deliberate underweight decision for a large part of the world's GDP and the key driver for global productivity growth.

Aug 11, 2022

After lithium, coal and pork, polysilicon appears to be the next in line for potential government price interventions. In fact, polysilicon prices which have been on nine consecutive weeks of spiking spree, have reached 10-year high and the high prices have caused severe supply chain disruptions and suppressed domestic demand for solar panels – and in the process slow down the solar infrastructure build out in China. Such price intervention thus is envisaged to be a positive regulating event, that would shift the industry dynamics from upstream biased to more midstream and downstream actors, to rebalance the supply chain economics for long run sustainable growth of the industry ecosystem. In this article, we shall analyze this in greater details, and explain why despite the headline concerns it would be a positive event for the sector leaders including related constituents in the Premia ETFs, while the polysilicon market is expected to remain tight throughout the year due to persistent strong global demand and supply shortages.

Aug 04, 2022

Although a lot of unprecedented events happened in the past few years, financial market rallies have bolstered positive wealth effects and expanded the balance sheet for many investors – until recently. This year has been extremely challenging for even the most astute and well-researched investors. How do we make sense of so much uncertainty around inflation, geopolitical tension, recession, pandemic and more? Recently our Senior Advisor Dr. Jason Hsu, Chairman and CIO of Rayliant Global Advisors has published 7 Predictions for a Stagflation Economy, which raised some bold and perhaps uncomfortable possibilities that would be helpful for us all to reflect and prepare for. In this webinar, we shall discuss with Dr. Hsu live to decipher what might be the best way to weather the turbulent markets ahead, and while acknowledging diversification remains the free lunch in investing – what to diversify with? [Watch Replay Here]

Aug 03, 2022

As stocks around the world struggled in Q2 2022, China A shares produced a positive return, with the CSI 300 Index adding +6.2% for the quarter. This muted number nevertheless belies an action-packed three months, as investor sentiment toward mainland shares reached a low in April, with Shanghai and other major cities entering growth-stunting lockdowns amidst a rapid spread of COVID variants, only to recover sharply in May and June, as easing public health restrictions allowed Beijing to start ramping up a massive stimulus program intended to set the nation’s economy up for a strong second half leading into Q4’s National Congress. Here we offer some perspective on factor drivers in China’s market during the second quarter and comment on what might come next for Chinese stocks.

Aug 01, 2022

What will the next era of China’s economy look like? Invest in the leading companies driving China’s New Economy through the Premia CSI Caixin China New Economy ETF.

Jul 28, 2022

As the Developed Markets are weathering havoc from increasingly hawkish rate hike actions, ASEAN equities continue to retain relative calm and outperform DM as a regional expression of global value trade. While the trajectory for economic upgrades and earnings growth prospects remain intact, as DMs slide deeper into bear markets, some tweaking of the ASEAN trade – as a pure Emerging Market play – might achieve even better relative outperformance. In this article our Senior Advisor Say Boon Lim discussed drivers behind the outperformance of our Emerging ASEAN strategy against MSCI World Growth, and what investors with the flexibility for a spread trade might consider as the dynamics will likely remain in place for the rest of this year.

Jul 04, 2022

The American dilemma – recession by policy tightening or stagflation by policy avoidance. US GDP growth is running so low now that a recession is a very high probability event within 12 months as rates rise further. The drivers of that coming recession will be both inflation and higher rates: There can be many different variations of the balance between the pace of rate hikes and the pace of inflation. As US economic growth slows further in coming months, the US Federal Reserve will be tormented over the awful choice between the longer-term impact of inflation and the more immediate risk of recession. Yet in the end, if rate hikes do not crush US economic growth, inflation will eventually do the same, albeit with a greater lag. In this article, our Senior Advisor Say Boon Lim explains why bounces in US equities are likely to be “get out of jail” cards, with lower lows and lower highs the most likely outcome.

Jun 29, 2022

Chinese equities have been putting on breakouts above technical resistances just as Developed Markets are breaking down and US stocks have been collapsing into bear territory – and this does not seem coincidental. At opposite ends of the policy cycle. At the heart of this may be the policy tightening in the US, the looming consequent recession, and the search for alternatives to US assets – stocks, Treasuries and corporate credits. China’s recent commitments to fiscal and monetary stimulus are a welcome counterpoint to the falling monetary aggregates, surging rates and yields, and fiscal consolidation in the US. In this article, our Senior Advisor Say Boon Lim discussed the significance of onshore A-shares breaking above the technical resistance of 100-day moving average, as it has a tendency to be followed by quite substantial periods of gains.

Jun 17, 2022

It’s again time for annual rebalance of our Premia Asia Innovative Technology and Metaverse Theme ETF (3181 HK) as well as our China A-shares ETFs - Premia CSI Caixin China New Economy ETF (3173 HK), Premia CSI Caixin China Bedrock Economy ETF (2803 HK), Premia China STAR50 ETF (3151 HK). The rebalances were successfully completed on Jun 10th 2022, and in this article we highlight the changes made and also provide brief analyses comparing the profiles before and after the rebalance exercise.

Jun 16, 2022

Metaverse has rapidly become a buzzword in the recent year, with significant development in technologies, user base and content around the world. In fact, many of the related Metaverse themes have long been among the sub-sectors covered by the Premia FactSet Asia Innovative Technology Index that our namesake ETF tracks. With the FactSet RBICS technology, it is possible to overcome the constraints and sometimes mislabelling of traditional GICS sector definition, and identify the relevant themes at more granular level including for technology conglomerates with multi-disciplinary functions. As part of the ongoing review, the index was recently updated and renamed as Premia FactSet Asia Metaverse and Innovative Technology Index (AMIT) to better reflect the core elements and spirits of the strategy. In this article we discuss more about the rationales behind the update, and how the strategy captures the innovative technologies and metaverse related opportunities in Asia.

Jun 16, 2022

Premia 圖說

賴子健 , CFA

CFA

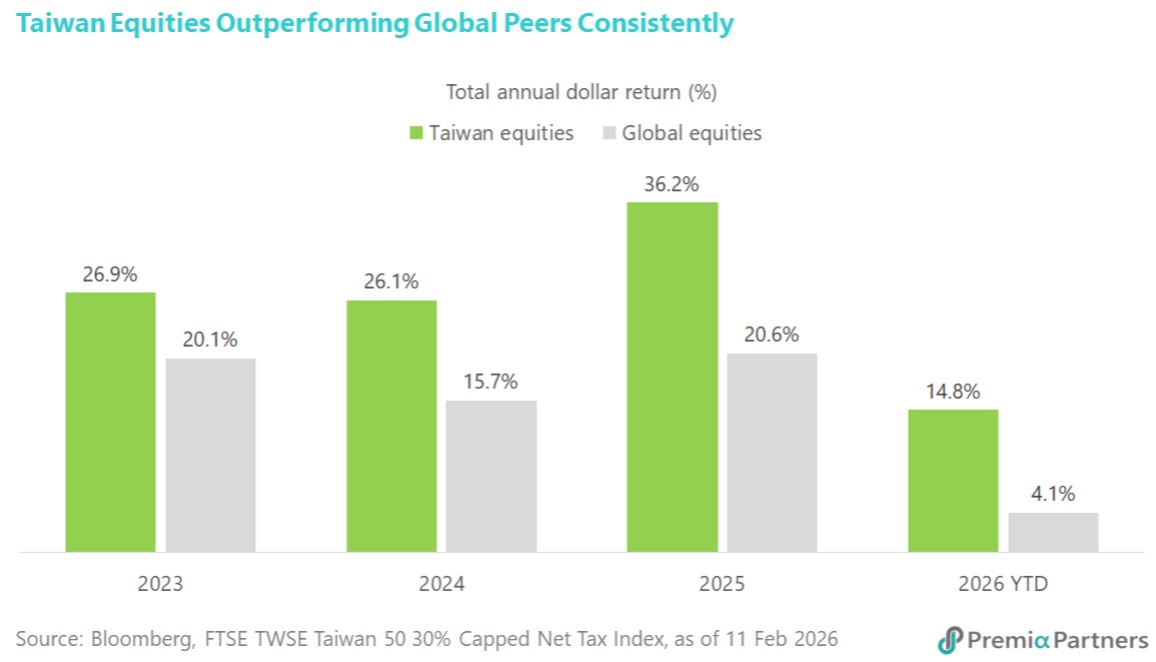

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026

![[Premia x Rayliant Webinar] Conversation with Dr. Jason Hsu – 7 Predictions for a Stagflation Economy](https://etfprod.premia-partners.com/articleImg/pic/220728155334853.jpg)