Through the cycles, the Chinese economy’s share of the world’s GDP continues to surge. The International Monetary Fund recently downgraded global economic growth in its World Economic Outlook July update. It revised its United States real GDP growth forecast for 2022 downwards by 1.4 percentage points from its April forecast. The IMF also downgraded China’s 2022 real GDP growth by 1.1 percentage points over the same time frame.

So, this is a global phenomenon. The Chinese economy is slowing. Meanwhile, the US economy has already confirmed two consecutive quarters of negative growth.

Was 2Q22 the bottom of the growth cycle for China? The latest data showed that the Chinese economy grew only 0.4% y/y, compared to 4.8% growth in 1Q22. There is now speculation in the market whether that’s the bottom of the China growth cycle. While we don’t know for sure, we do note policy stimulus has been ramping up over the course of 1H22.

Policy stimulus should support stronger growth in 2H22. We had recently noted Bloomberg estimates which put the total value of policy stimulus introduced in the 1H of this year at around CNY 35.5 trillion. This has exceeded the stimulus for the entire year, last year. And it is close to the value of stimulus for the entire year in 2020.

China and US – on divergent policy paths. Looking beyond that, China is now in policy easing mode while the US is in policy tightening mode. And the reason China can now engage in policy easing is because its overall inflation rate is 2.5% y/y, compared to the all-items CPI rate of 9.1% y/y in the US.

China’s 1 year Loan Prime Rate, at 3.7%, has room for easing. Meanwhile, the Federal Reserve’s target rate, having hit zero, had nowhere else to go but up. So, it is now 2.5% and heading higher. China’s Reserve Requirement Ratio of 8.1% allows more room to encourage bank lending if policy makers wish. In the US, it has been zero since the start of the pandemic.

And as the US is driving down M2 money supply growth through quantitative tightening, China is raising M2 money supply growth to support the economy.

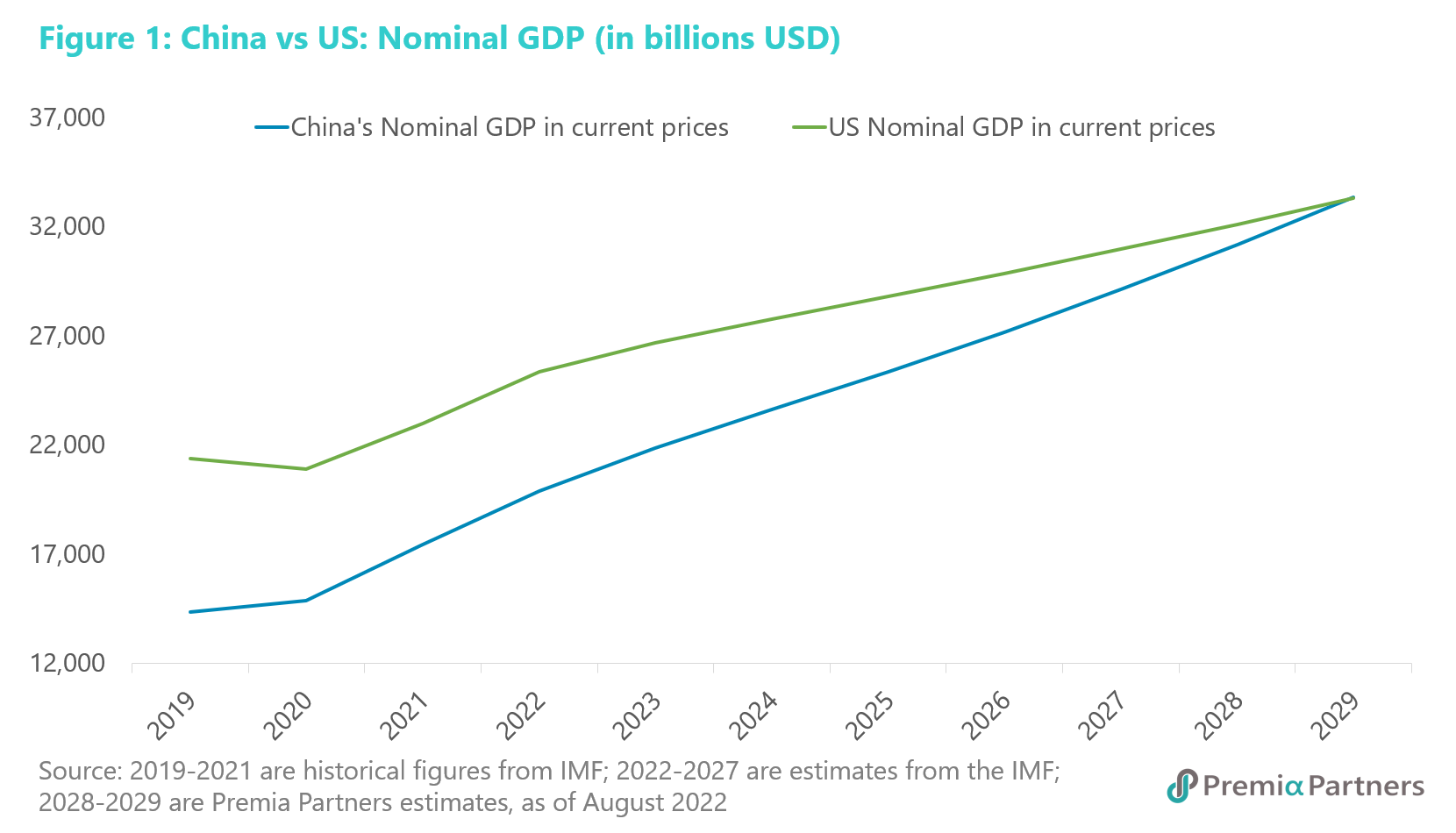

Despite the greatest policy stimulus since the Second World War, the US lost share of the world GDP to China 2020 and 2021. Looking back over the past three years, it is striking that China has narrowed the gap between its nominal GDP and that of the United States from 67% in 2019 to 76% last year.

China is headed to be the world’s largest economy in US dollar terms by 2029. And looking forward, on the IMF’s long-range nominal GDP forecasts for 2022-2027, it seems (on our extension of the IMF’s forecasts) that China’s nominal GDP will exceed that of the US by around 2029. On the IMF’s latest forecasts, China’s nominal GDP is expected to be worth US$29.1 trillion by 2027 versus US$31 trillion for the US.

This is pretty close to where we previously thought the situation might be. Over the past two years, we had variously estimated the size of the Chinese economy would exceed the US in US dollar terms by either 2028 or 2029.

The incremental economic activity generated by China each year is massive, and that should mean more business and investment opportunities. And while the estimates will move around a bit over time, depending on the sentiment around both economies’ growth outlook at the time, what is inescapable is the delta – the change – working in favour of the Chinese economy, and by extension, business opportunities in China. Ultimately, this should favour Chinese equities.

On the IMF’s forecasts, the increment in China’s nominal GDP between end- 2021 and 2027 would be US$11.7 trillion. That is almost the combined US$ value of the world’s next three largest economies – Japan, Germany and the United Kingdom – which was approximately US$12.4 trillion at the end of last year.

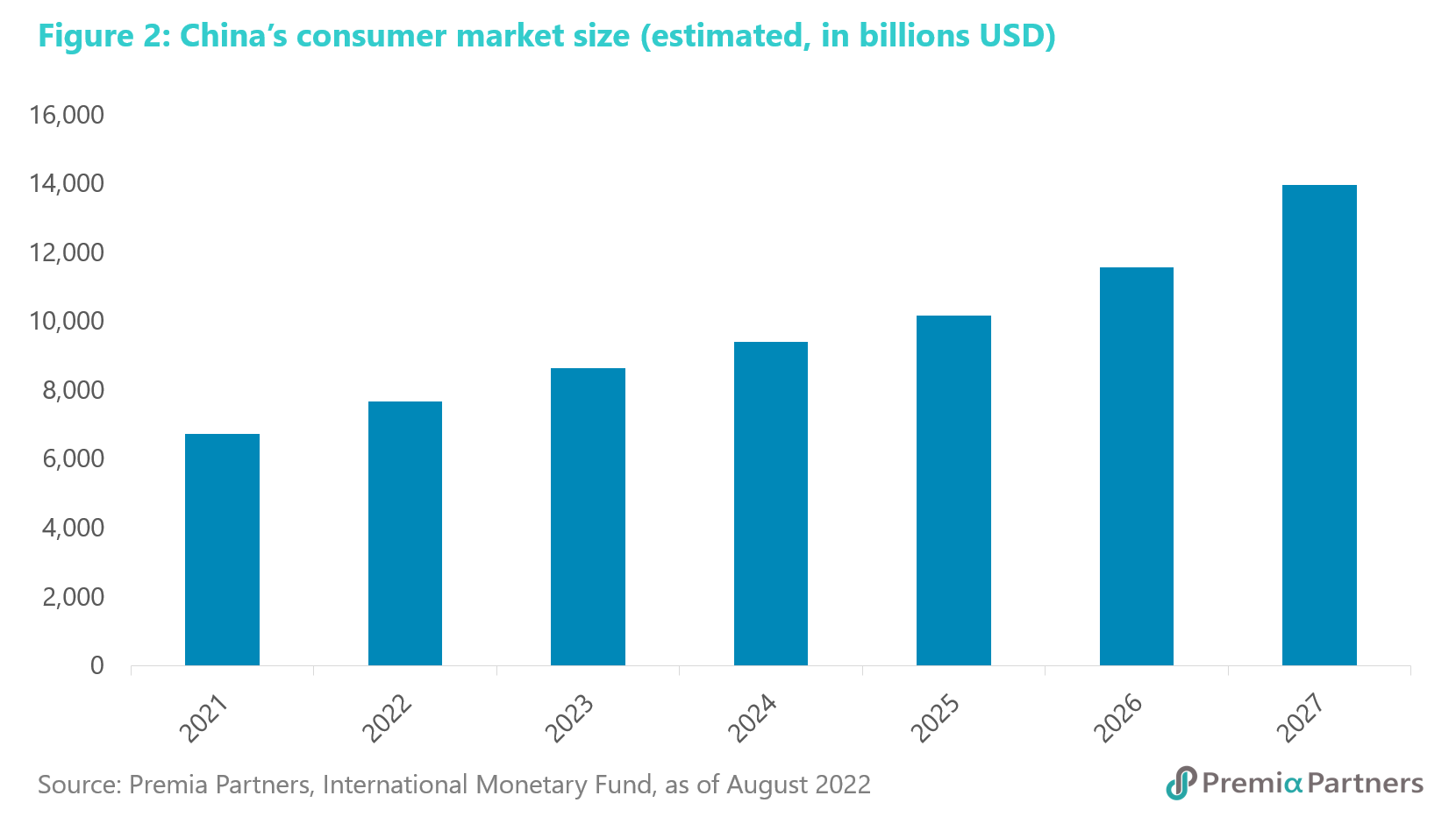

And we estimate that China’s consumer market should be worth around US$14 trillion by 2027. That is the almost the value of the entire GDP of the Euro Area last year. And the delta alone should be over US$7 trillion.

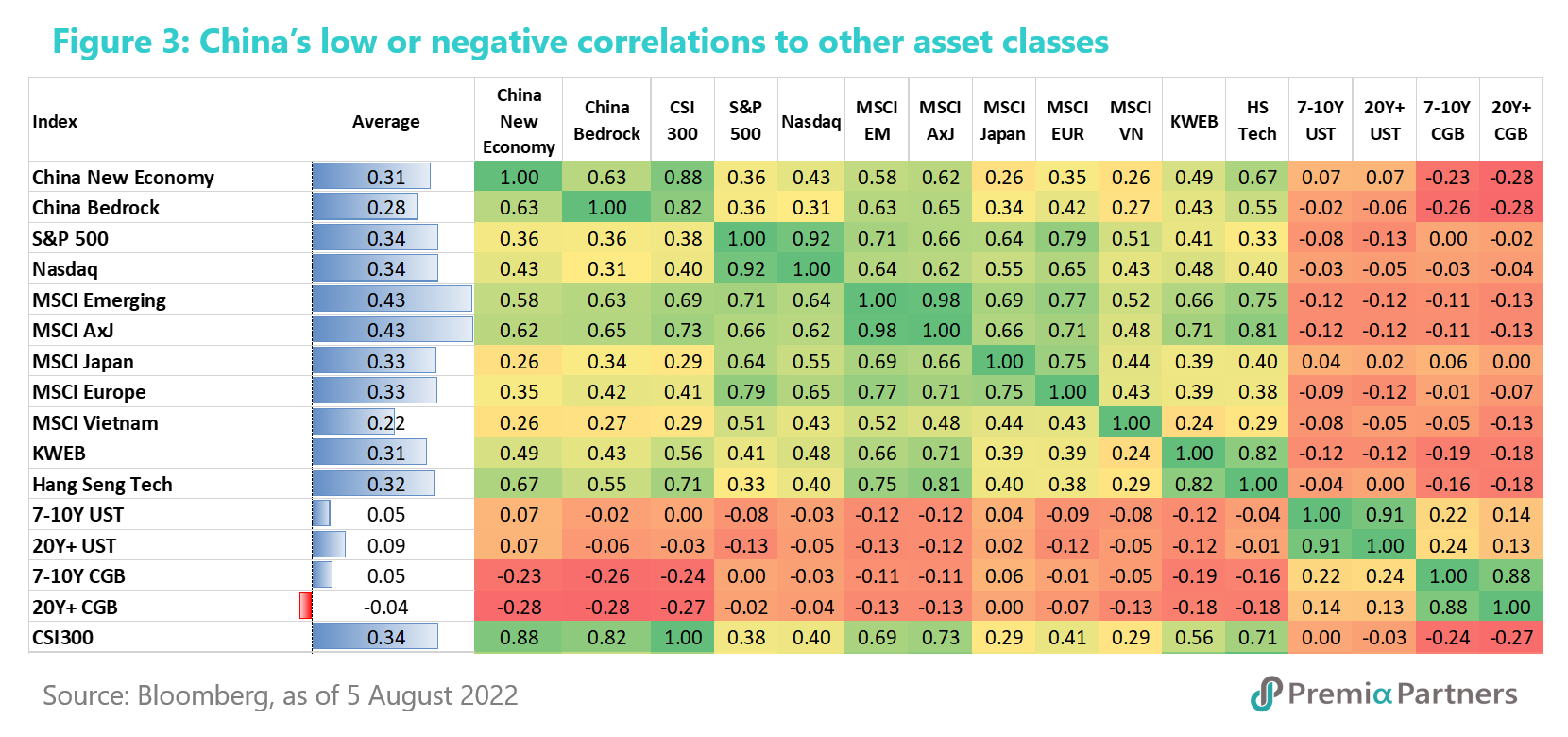

Chinese equities are under-represented in global indices. As it is, China is already grossly under-represented in global indices. It is currently 35% of the MSCI Emerging Market index. Yes, that is already overwhelming for a single country’s weight. But that is on an inclusion ratio of only 20%. Note that China’s market capitalization was 74% of total BRICs market capitalization in 2020. Indeed, at 13% of the world market capitalization in 2020, Chinese equities should be a standalone category in asset allocations, rather being subsumed under Emerging Markets. And that makes sense from a correlation perspective as well, given China’s low or negative correlations to just about every other asset class, except for Emerging Market, which anyway reflects its huge single country weight in the index.

While sentiment towards Chinese equities had been cautious over the past year, the fundamentals suggest that it would be increasingly difficult to ignore Chinese equities as its economic heft and importance continues to grow.