精選觀點 & Webinar

China has emerged as the world’s largest consumer and producer for industrial robots and equipment. In fact, the country recorded US$6.6 billion sales of industrial robotics in 2022, most of which were produced domestically, far more than the second largest country Germany which registered US$2 billion sales during the same year. Propelled by its changing demographics and its evolution from low-cost manufacturing to high-value added processes, China will continue to drive the development of a homegrown robotics sector and pursue manufacturing upgrade, as underscored by China’s 14th Five Year Plan which explicitly laid out the national strategic goal of building a modern high tech society. Sector leaders would be natural beneficiaries of support measures for this broad policy. In this article we discuss more about how along with development of a highly integrated ecosystem of high tech processes and smart manufacturing systems, China is also integrating new materials, new energy, smart grids and energy saving systems, etc. to its technology-enabled ecosystem that sits well with China’s 2060 net zero targets, and its national strategic goal towards a modern, high tech society.

Sep 29, 2023

The youth unemployment rate in China has been much talked about, however the phenomenon is often poorly interpreted without addressing the important nuances behind the structural, transformational and societal factors in China. In fact, the elevated unemployment rate is a transitional legacy from COVID and many countries also shared the experience of high youth unemployment. There is a lag in China’s youth unemployment data compared to western countries, given China’s relatively late reopening from the COVID pandemic. In this article, we discuss the structural factors contributing to the youth unemployment rate in China, and explain why the number will likely to decline and why the unemployed youth will be absorbed into workforce as China continues on its path of recovery.

Aug 24, 2023

In a refreshing break from the consensus of gloom surrounding China, Cambridge Associates wrote recently that the Chinese economy was not stalling. Meanwhile IMF holds steady its China GDP growth forecasts in the World Economic Outlook Update report released last week, at 5.2% for 2023 and 4.5% for 2024. In this article, our Senior Advisor Say Boon Lim shares more about why China may surprise to the upside and the appeal of Chinese equities as a relative value play.

Aug 03, 2023

The “Urban Village Redevelopment” initiatives outlined at the Politburo Meeting in July could potentially create new housing demand which is valued at over RMB 2 trillion per year and property fixed asset investment worth RMB 0.4 trillion per annum. What is urban villages, and why is it a significant development to monitor? In this article, we discuss why urban villages are an integral part of China's new phase of urbanization, and how this links up with China's smart and green city planning, and a holistic set of initiatives that roll up to building China towards its goals of building China into a high tech, modern society under the 14th Five Year Plan.

Aug 02, 2023

While global equities generally performed well in Q2 amidst a frenzy around A.I., sentiment toward Chinese stocks remained lacklustre as investor enthusiasm waned. That said there remained bright spots in the market that quietly outperformed - including our multi-factor China Bedrock Economy ETF which delivered YTD USD return of ~12.6% as of Aug 2nd 2023. In this article, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, reviewed the performance of various style factors during the quarter, and discusses why we see China as grossly undervalued going into the second half.

Aug 01, 2023

The US Treasury’s recent – and ongoing – dash for cash highlights the economy’s enormous fiscal challenges. To quote Bloomberg: “The barrage of fresh Treasury bills poised to hit the market over the next few months is merely a prelude of what’s yet to come: a wave of longer-term debt sales that’s seen driving bond yields even higher. Sales of government notes and bonds are set to begin rising in August, with net new issuance estimated to top USD 1 trillion in 2023 and nearly double next year to fund a widening deficit.” On top of that, according to calculations by asset manager Horizon Kinetics and as quoted by gold fund manager Incrementum, the US will have to refinance around half of its national debt of more than USD 35 trillion by 2025. That’s a lot of debt maturities to digest in two years. In this article, our Senior Advisor Say Boon Lim cautions that even if Fed rates stabilise, the longer-term outlook for US Treasury yields would likely remain risky as persistent deficits drive up debt relative to GDP, in turn driving interest payments as a percentage of GDP up “vertically”. Indeed, the Congressional Budget Office is warning of the “risk of a fiscal crisis”.

Jul 24, 2023

With the world except for China busy taming inflation, the China “lost decade” narrative has been driving pessimism over Chinese assets in recent months. How much of this fear could be substantiated and how much of it is fear of shadows? In this article our Senior Advisor Say Boon Lim reviews this topic from multiple angles, and explains why China today is unlikely to be Japan 1990 given significant differences in labour forces, total factor productivity (TFP), government policy focus, R&D spendings, financial resources and tools available to the government as well as structural growth from urbanisation and well capitalised state-owned banks that continue to support the case for China to avoid Japan’s secular stagnation.

Jul 10, 2023

As China’s post reopening recovery has taken a slower pace than the high hopes of the markets, there have been concerns that China’s economic growth will be lower for longer resembling Japan’s "Lost Decade". However it is important to note China and its people do have a solid track record of resilience, and there are several structural features of China that differentiates it from other emerging markets or Japan in its growth trajectory. In this article, our Senior Advisor Say Boon Lim shares 12 interesting charts to review in the context of China’s relatively high economic resilience (as measured by the Swiss Re Institute’s Resilience Index), comparing with MSCI Emerging Markets ex-China’s key constituents namely India, Brazil, South Korea, Taiwan, and Saudi Arabia. Economic resilience being a product a policy stability and prudence, are pointing to an undervalued opportunity in Chinese equities and the appeal of Chinese government bonds for its stable yield at a time when other countries’ government rates and bond yields are surging.

Jul 03, 2023

Premia CSI Caixin China Bedrock Economy ETF (2803.HK), Premia CSI Caixin China New Economy ETF (3173.HK), Premia China STAR50 ETF (3151.HK), and Premia Asia Innovative Technology and Metaverse Theme ETF (3181.HK) recently completed the annual rebalancing exercise after market close on Jun 9th 2023. In this article we highlight the changes and provide a brief analysis of the post-rebalance profiles of each ETF.

Jun 19, 2023

While China's April data did miss market expectations, the disappointment was off very high expectations set by the market itself. In fact, the so-called April “disappointment” looks very different when viewed in a global context. In this article our Senior Advisor Say Boon Lim discusses why it is important to look beyond the underperformance of those high expectations, to properly address opportunities leading to China's own 5% growth target and IMF’s estimates for China to contribute around 30% of the world’s GDP growth for this year which still very well hold.

Jun 08, 2023

Premia 圖說

賴子健 , CFA

CFA

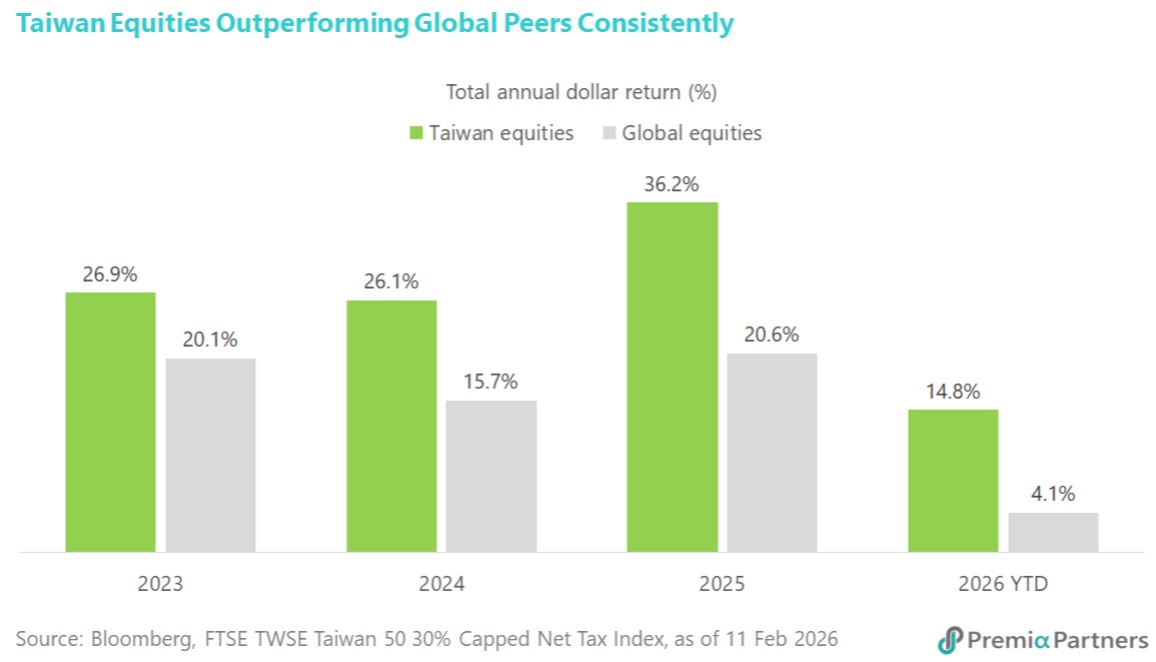

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026