Like many investors in Chinese stocks, we entered 2023 with the hope that Beijing’s sudden pivot on COVID policy a month prior would unleash massive pent-up consumer demand, accumulated through a year of widespread lockdowns, driving a strong reopening trade in the months ahead. While spending on services promptly rebounded in the wake of public health restrictions being lifted, it soon became clear the vaunted ‘exit recovery’ was not to be. Consumer sentiment faltered in the face of a struggling property sector and a gloomy labor market, while business held back on investment as the prospects for a global recession seemed to increase.

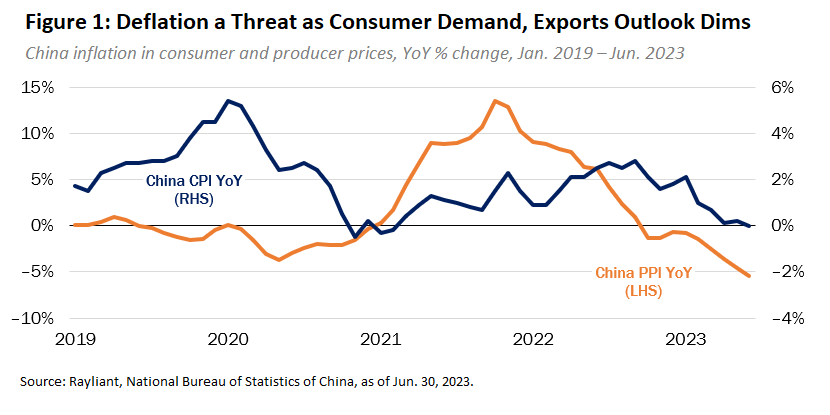

China’s stalling recovery was painfully apparent in June inflation prints (see Figure 1, below), which showed consumer prices plummeting on soft spending and signs of deflation on the producer side, as upstream inputs like mining and raw materials suffered on weak domestic demand, the risk of global downturn continued to weigh on exports, and China’s history of encouraging fixed asset investment in the sector resulted in major excess production capacity.

An underwhelming second-quarter GDP report reinforced deflationary concerns, with China’s economy posting just 6.3% growth year-over-year vs. expectations for a 7.3% expansion—especially disappointing given the soft comparison with Q2 2022 GDP, meaningfully depressed during the peak of last year’s zero-COVID lockdowns. By mid-July, analyst expectations for full-year 2023 GDP had slipped to 5.4%, putting Beijing’s official target of “around 5 percent” in serious jeopardy and leading the CSI 300 Index to drift lower with each bit of macro news confirming China’s macro predicament.

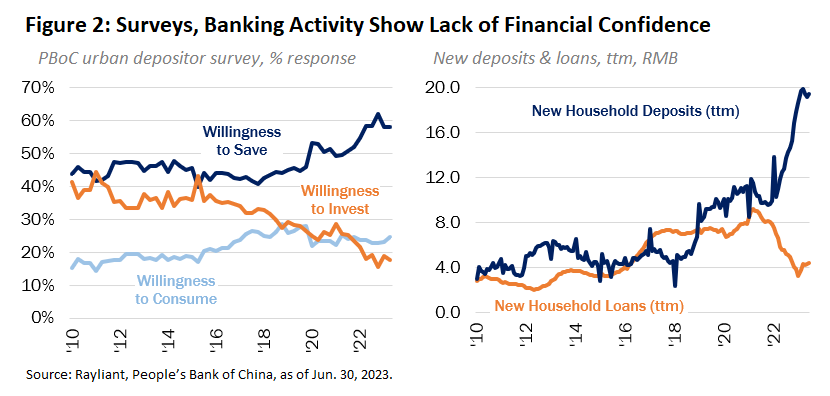

To understand what’s gone wrong in China’s recovery—and what policymakers might do about it—one need look no further than recent People’s Bank of China (PBoC) surveys of Chinese households. Data plotted in the left panel of Figure 2 (below) show a miniscule uptick in consumers’ willingness to spend and invest at the end of the sample, as China’s zero-COVID exit made it possible to even conceive of such activities. That said, the trend toward precautionary savings still very much dominates.

The same pattern is evident in the revealed preferences of Chinese households, with statistics on new deposits and loans (right panel of Figure 2, above) exhibiting a surge in savings since the beginning of the pandemic, with only a minor blip down in the last few months; likewise, as reflected in a dismal property market and soft demand for big-ticket purchases in granular retail sales data, demand for loans remains low. All of this speaks to a lack of confidence on the part of Chinese households, and as long as consumers are afraid to spend or borrow, monetary stimulus, including cuts to policy rates enacted by the PBoC in Q2, will be of little help in rekindling the reopening rally.

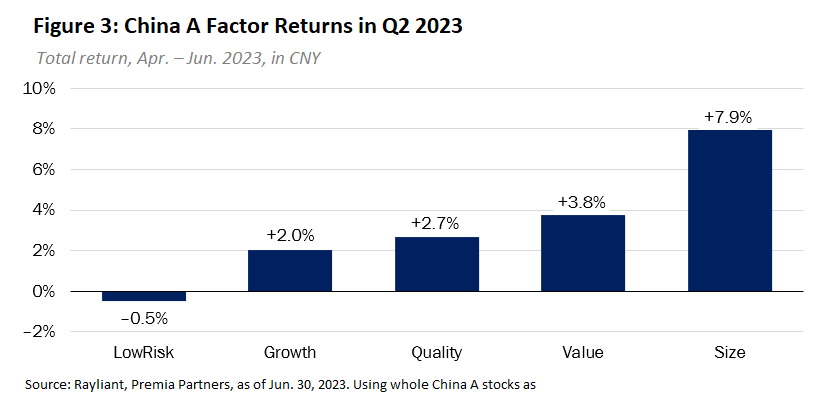

Looking at Q2 performance through the factor lens (see Figure 3, above), Low Risk—which we note is typically one of the best-performing tilts during a deep market selloff—surprised with its second consecutive quarter as the only negative exposure, though losses to the factor were modest. The Size factor, i.e., tilting toward smaller stocks, was by far the biggest outperformer over the last three months, which might actually help to explain weakness in lower-volatility stocks, as rallying small-caps tend to signify a greater risk-taking appetite among individual retail investors. Interestingly, despite the apparent increase in retail activity, the second quarter witnessed a heightened focus on fundamentals, as Value, Quality and Growth exposures all accrued gains, the latter two factors posting their second month in a row of solid performance.

Index Performance and Outlook

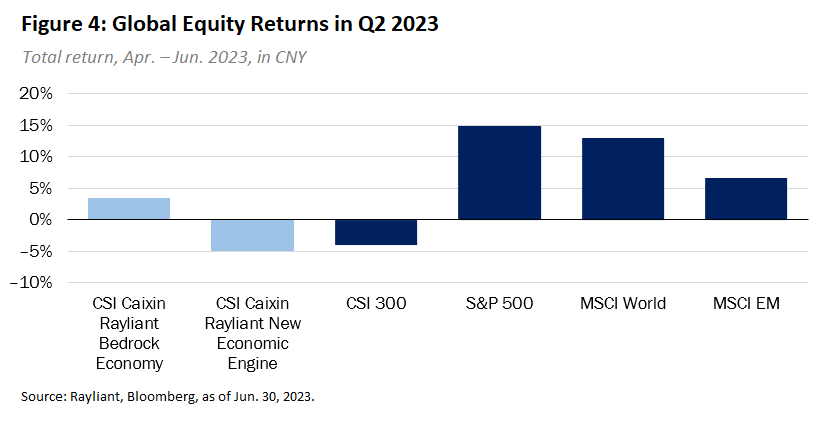

Weak macro data and softening sentiment saw A shares giving back most of their gains from the prior quarter, sliding by -4.0% (CNY) over the three months ended June 30th (see Figure 4, below) and putting the CSI 300 Index’s year-to-date return at a modest 0.5%. By contrast, U.S. stocks officially entered a bull market in early June, adding nearly 15% for the quarter, as concerns around the March banking crisis dissipated early in the quarter, and a potentially disruptive standoff over the debt ceiling resolved at the start of June without too much drama, removing some potential headwinds, while the Fed chose to pause at their last FOMC meeting of the quarter, signaling to some that US policy rates may be near their peak, and A.I. mania continued in full force. Developed markets generally performed well, with the MSCI World Index up almost 13% in Q2, while emerging markets in the MSCI EM Index only managed a 6.7% climb, in no small part under the weight of Chinese stocks’ decline.

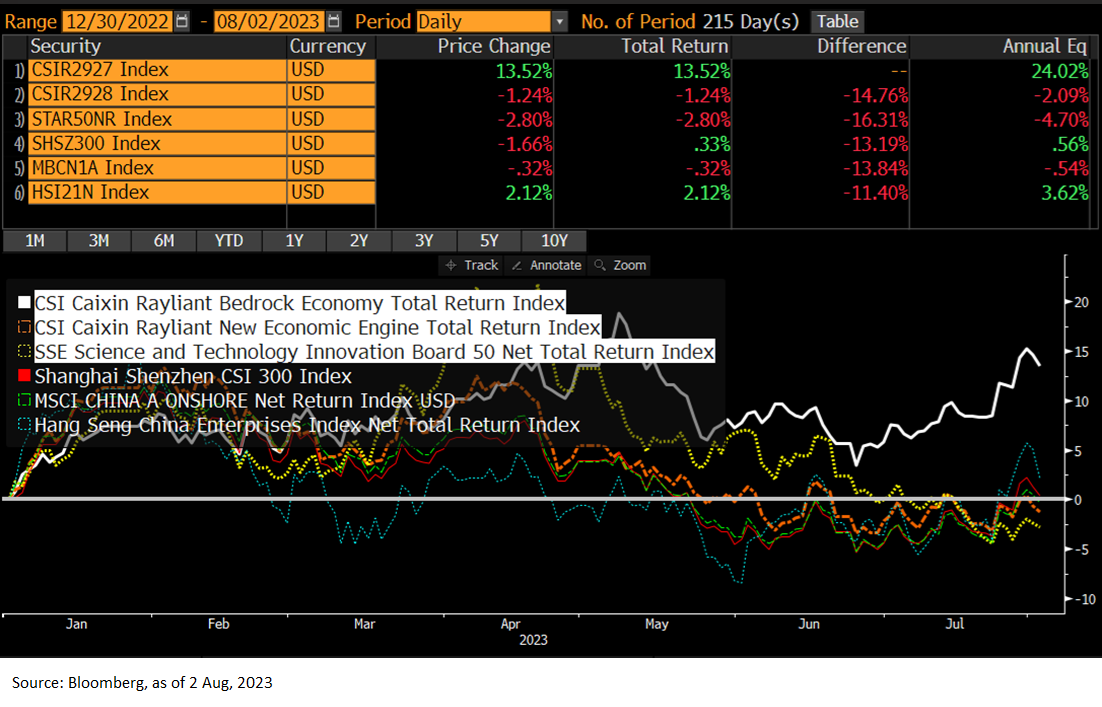

In spite of the drawdown in China’s broader market, which weighed on performance of the CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs), down by roughly -5% for the quarter, the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) managed to post a solidly positive return, adding 3.7% in Q2 or a stellar year to date return of 17.6% as of Jul 28th 2023 . Rallying small-cap stocks continued to offer both strategies a boost, given their measured tilt toward smaller companies’ shares, though it was the combination of strong Value and Quality performance that made the difference for the bedrock index during the quarter—more than enough to offset mildly negative performance in the strategy’s Low Risk exposure. A positive return from the Growth factor was not enough to counteract the effect of weakening sentiment on the new economy index, and although the strategy enjoyed modestly positive selection effects, particularly among Communication Services stocks, the strategy’s sector tilts ensured it would slightly trail the CSI 300 in Q2. The principal detractors turned out to be a heavy underweight to Financials, one of the best sectors over the last few months, and a large overweight to Health Care, the second-worst performer in the benchmark. The bedrock index, on the other hand, performed best in terms of stock selection within sectors—selection effects were positive within every sector for the quarter, and especially strong within the IT sector—though allocation effects were also a contributor to outperformance in Q2, with an overweight to Financials and an underweight to Consumer Staples adding the most to returns.

As for what might happen going into the second half, it’s useful to consider the original premise of policymakers’ zero-COVID exit plan: namely, that an economic recovery would start under the sheer power of reopening, but be increasingly driven by domestic consumption, such that fiscal stimulus in 2022—with its emphasis on infrastructure spending—would give way this year to household spending and business investment from the private sector. Instead, what we have witnessed thus far in 2023 is consumer activity concentrated in services, especially tourism, restaurants and leisure, which is definitely not enough to get China’s economy where government and investors want it to be. Ironically, the failure of Beijing to continue pumping in fiscal support has left households and businesses feeling increasingly uncertain about the longevity of the recovery, which is preventing them from spending and investing: essentially a self-fulfilling prophecy.

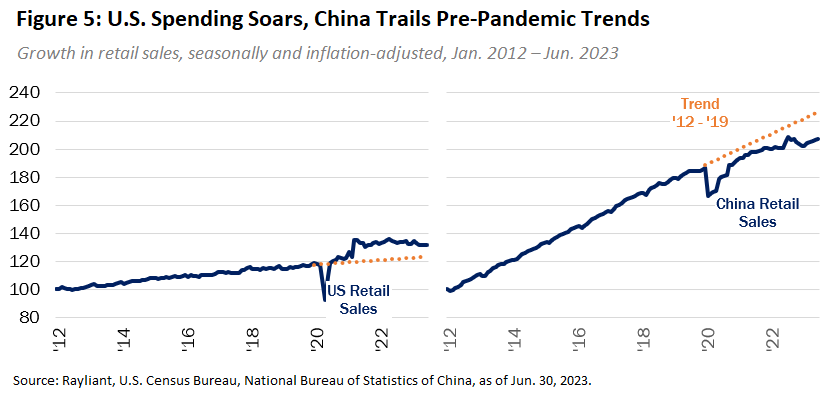

Of course, that’s not the way things have to be. The United States makes for a good case study in what can happen when the state stimulates consumption directly, having printed plenty of money for that purpose much earlier in the pandemic. As we know, the result was a big boost to consumer confidence, with quite a different impact on spending (see Figure 5, below), which explains at least part of the inflation Americans are now feeling—though China would likely welcome such an outcome at this point.

It goes without saying that we would much rather have spent this quarterly update describing an accelerating post-COVID recovery in China, but facts are facts. That said, we remain confident as ever in the medium-term prospects for China’s market. Indeed, revisiting the last chart above, and considering the difference in the slope of consumer spending between the U.S. and China, it’s clear why we continue to believe in China’s strategic growth story—both in terms of the old and new economy. We just need to see policymakers correct course with moves that restore confidence to domestic households and businesses, allowing an economy primed for rapid expansion to resume its pre-pandemic trajectory. Along those lines, we suspect China has entered a phase familiar to U.S. Fed-watchers in which “bad news is good news”: The closer policymakers get to an unconscionable loss of face if they miss the exceedingly soft 5% growth target, the more dire the need for stimulus.

China’s recent Politburo session could be just the right catalyst for a sea change in sentiment. Indeed, reading reporting from these meetings and speaking with friends around China, we perceive that Beijing is definitively shifting its tone, moving from a cautious posture of risk mitigation to actively promoting growth through creative problem solving. In official statements, we’ve seen explicit references to weak domestic demand and support for consumption, suggesting authorities recognize what the real problem is and will enact measures that directly benefit China’s real economy and, consequently, lifting those high-quality companies within the bedrock index. Meanwhile, proclamations in support of innovative sectors represented by the new economy index, along with emerging signs of a much more collaborative attitude on the part of authorities toward the nation’s tech firms jibe with a renewed focus on growth. With China’s broad market trading at roughly 11x cyclically adjusted P/E (vs. around 34x for U.S. stocks), we see plenty of upside opportunity for China equity believers once it’s clear the tide has turned.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.