精選觀點 & Webinar

Whatever happens over coming weeks and even months in the US-China trade war, Donald Trump has irreparably broken the global trade architecture. And with it, he has also forced a realignment of the global supply chain that will likely see ASEAN emerge as a new manufacturing centre.

Jun 27, 2019

As we head toward the G20 meeting in Osaka, we take a moment to review the latest status of the trade war between the two largest economies today. Is it about containment or tariffs? How does the current situation compare to Japan in the ‘80s? Do either China or the US actually want to make a deal? What are the possible paths going forward?

Jun 12, 2019

As we approach the end of 1H19, it is clear that the market now finds itself in a tug of war between the Fed Put and the potential for recession. We explore this dynamic, discuss Q1 vs future growth across the 4 major economies (US, Europe, Japan and China) and remind investors to stay defensive going forward by tilting toward value and quality where possible.

Jun 12, 2019

The Global Mobile Communication Systems Association estimates that by the end of this year, 5G services will be available in 29 markets around the world, with 10 million connections. What is 5G and where do we see potential investment opportunities from this significant technology upgrade in Asia?

Jun 06, 2019

As the issuer of world’s first two fundamental multifactor China A-shares ETFs, we look closely into the factors. The China A shares market went on a roller coaster ride since late 2018, and how about the factors – are they on the same ride or rotating around a Ferris wheel? In this piece, we re-cap the research on China A fundamental factors and share the recent observations on factor performances.

Jun 03, 2019

Investors looking for China’s NASDAQ seem to have settled on ChiNext as the default index to follow. BUT what if there is an even better option in the market, offering a more appropriate China new economy exposure with better performance, higher quality, lower volatility and discounted valuations?! It may sound too good to be true, but it is exactly what the Premia China New Economy ETF (3173.HK) has achieved so far.

May 20, 2019

Most investors assume that the more liquid the ETF, the easier and cheaper it is to trade. This is true in markets like the US, where on-screen liquidity is prevalent, but Asia markets are not as straightforward. China A ETFs with on-screen liquidity are easy to trade, but easier does not always mean cheaper to trade. There is market risk in trading on-screen and though it is easier, it can actually be more expensive than trading via the underling liquidity of China A stocks inside the ETF.

May 16, 2019

ASEAN equity markets have underperformed so far this year. Is it the start of a new trend, or simply a blip given the strong reversal in China? Say Boon Lim shares his views on why ASEAN is likely to outperform going forward.

May 06, 2019

Nasdaq has made new highs and investors are understandably excited. Similarly, here in Asia we have seen innovative technology companies outperform YTD but with much less fanfare. David Lai explores the major megatrends in Asia and why you need to invest in tech leaders across this region.

May 03, 2019

Looking past stellar Q1 returns, we discuss positioning going forward and the need to navigate the conflicting signals offered by equity and bond markets today

Apr 10, 2019

Premia 圖說

賴子健 , CFA

CFA

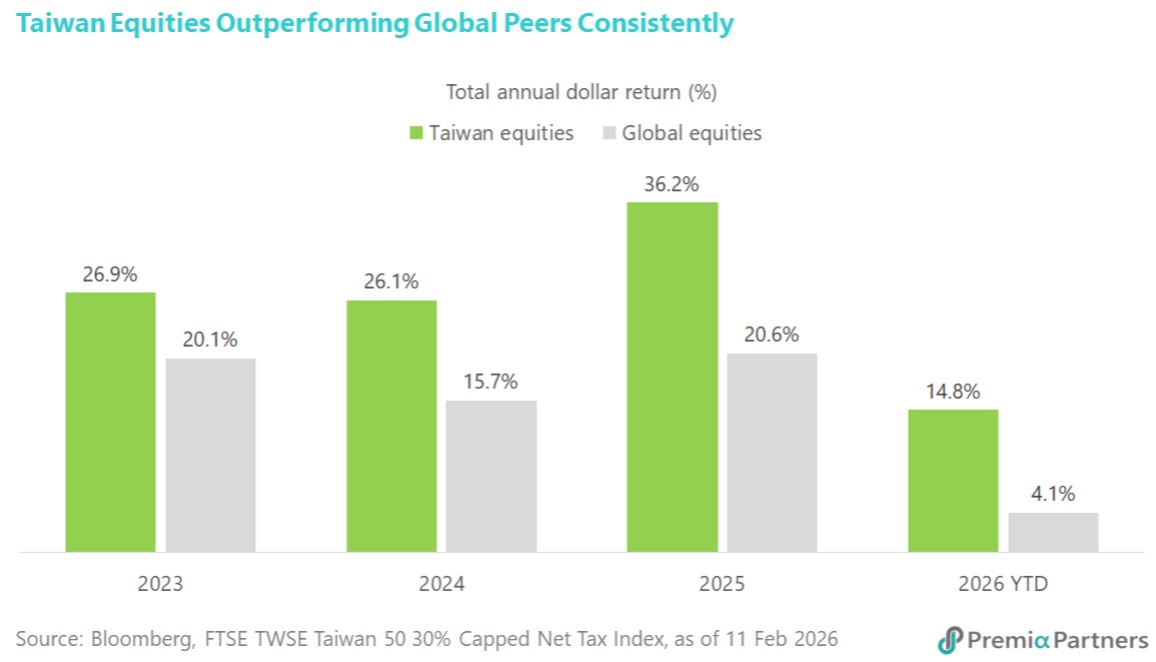

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026