Recent “underperformance” of Emerging ASEAN markets is likely to be – to borrow a phrase from William Shakespeare – much ado about nothing.

See this in context:

· The underperformance, relative to Emerging Markets in general, has only been since February this year.

· There appears to have been a correction of expectations that a US-China trade war would boost ASEAN economic prospects at China’s expense.

· But this has to also be seen in the context of 10 years of outperformance by the MSCI EM ASEAN index versus the MSCI Emerging Markets Index.

· And note that EM ASEAN’s long-term market outperformance has been supported by 10 years of economic outperformance by the ASEAN-5.

· Further, the International Monetary Fund (IMF) expects continued ASEAN-5 economic outperformance over coming years relative to Emerging Markets in general.

What has been behind EM ASEAN’s underperformance relative to broader Emerging Markets in recent months?

Chinese equities markets’ breathless ascent since February did two things. One, China turbo-charged the performance of the MSCI Emerging Markets Index. Remember, China is 33% of the index. Two, it sucked money out of other markets.

It is not coincidental that MSCI Emerging Market’s outperformance against MSCI EM ASEAN really took off around February, when the Shanghai Composite Index went almost vertical. MSCI’s decision to increase the weights given to China A-shares in its indices – announced late February – was a factor in this rally.

China A-shares began the outperformance in Feb (Source: Bloomberg, Premia, 24/4/201)

China’s economic heft is a long-term advantage against other markets. But the attractiveness of a large market backed by the world’s second largest economy does not argue against diversification into other economically successful markets.

Related to the China factor is market expectation of an easing in US-China trade tensions. That improved sentiment towards Chinese equities. Conversely, the theme of ASEAN being a beneficiary of the re-alignment of the global supply chain – in the wake of US-China trade tensions – took a bit of a hit.

Yes, a trade deal could well be unveiled in coming weeks, sustaining the trade truce currently in place. But the many and profound issues surrounding US-China strategic rivalry – some of which, such as China’s state capitalism, go to the heart of the Chinese economic system – are unlikely to be resolved in a rush.

The re-alignment of the global supply chain, which is in part also driven by relative costs and diversification of geopolitical risks, is likely to continue.

ASEAN domestic politics have been blamed as an “overhang” on stock prices. However, that may just be market commentators force-fitting plausible explanations into a market phenomenon.

In Malaysia, the Pakatan Harapan ruling coalition lost three consecutive by-elections from the start of the year. But the Government is sitting with a comfortable majority of 139 seats in a 222-seat Parliament. The by-elections are of more interest to local political pundits than international investors.

In Thailand, the recent elections have yet to produce a clear result. But there is nothing new about the rural-urban divide and political gridlock in Thailand. Depending on the nature of the military interventions and the definition of a coup, there have been between 12 to 16 coups (successfully or failed) since 1932. It is doubtful the market had just woken up in shock and horror to Thailand’s tendency towards political gridlock.

Philippines’ general election in May is a mid-term election. Yes, the performance of the ruling PDP-Laban would be seen as either endorsement or criticism of President Rodrigo Duterte’s unconventional policies. But Duterte remains President until 2022. There is a one-term limit according to the Philippines Constitution. So that would be the end of the Duterte Presidency. There is little potential for significant instability arising from the coming general election.

In Indonesia, where there is the greatest potential for political disruption – not least given its size – the recent Presidential election looks set to maintain the status quo. Notwithstanding challenger Prabowo Subianto’s claim of victory, unofficial counts suggest “Jokowi” will retain the Presidency by a comfortable margin when results are released late May.

Bottomline: Politics has less influence on markets than the people who do daily commentaries make it out to have. Markets are generally apolitical. Do political events impact earnings and cash flow? If they don’t, “move along, nothing to see here”.

ASEAN vs EM: Just a blip in a broader trend of outperformance?

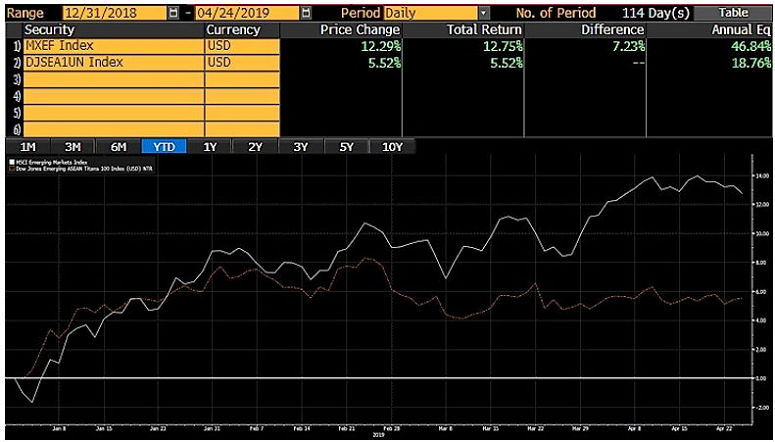

The MSCI EM ASEAN – which comprises Thailand, Malaysia, Indonesia and the Philippines – underperformed the MSCI Emerging Markets for the year to date, with total returns of 5.3%, versus 12.75% for the MSCI Emerging Markets.

MSCI EM outperformed MSCI EM ASEAN YTD (Source: Bloomberg, Premia, 24/4/2019)

But on a 12-month basis, the MSCI EM ASEAN index performed in line with the MSCI Emerging Markets. Both turned in total returns of around negative 2.3%.

MSCI EM on par with MSCI EM ASEAN on a 12-month basis (Source: Bloomberg, Premia, 24/4/2019)

On a 10-year basis, MSCI EM ASEAN outperformed impressively, with 207% total returns against 122% for MSCI Emerging Markets.

MSCI EM ASEAN outperformed significantly in 10 years (Source: Bloomberg, Premia, 24/4/2019)

Significantly, MSCI EM ASEAN achieved its 10-year outperformance against MSCI Emerging Markets with lower annualised standard deviation, and a significantly higher Sharpe Ratio. In short, EM ASEAN gave higher returns with lower volatility and risk.

Using the Dow Jones Emerging ASEAN Titans 100 Index, to include Vietnam, a similar picture emerges of short-term underperformance versus long-term outperformance.

The DJ Emerging ASEAN index similarly had total returns for the year to date of 5.52% versus 12.75% for MSCI Emerging Markets.

MSCI EM outperformed DJ EM ASEAN YTD (Source: Bloomberg, Premia, 24/4/2019)

On a 12-month basis, there was little to separate the two. DJ Emerging ASEAN had a slight negative total return of 1.51% against negative 2.28% for MSCI Emerging Markets.

Similar performance for MSCI EM and DJ EM ASEAN on a 12-month basis (Source: Bloomberg, Premia, 24/4/2019)

But again, longer-term, DJ EM ASEAN was way ahead. From its inception March 2010 to end-2018, DJ EM ASEAN turned in total returns of 88% against 21% for MSCI Emerging Markets.

DJ EM ASEAN performed much stronger than MSCI EM on a longer horizon (Source: Bloomberg, Premia, 24/4/2019)

ASEAN long-term market outperformance grounded on economic outperformance.

Over the same 10 years, from 2008 to 2018, the ASEAN-5 (Indonesia, Malaysia, Thailand, The Philippines and Vietnam) economy grew in US Dollar terms by a cumulative 79%. According to the International Monetary Fund, “emerging market and developing economies” grew over the same period by 70%.

ASEAN per capita income grew 58% in US Dollar terms over the same 10 years. Emerging market and developing economies grew 50%.

What about future growth?

The IMF continues to expect economic outperformance from the ASEAN-5 vis-à-vis “emerging market and developing economies”.

It expects the ASEAN-5 to grow 55% in US Dollar terms from 2018 to 2024, versus 49% for emerging market economies. Per capita, the IMF expects ASEAN-5 to grow 45% versus 39% for emerging market economies.

Indeed, the growth differential between China and the ASEAN-5 is likely to narrow in coming years. According to an OECD report, Vietnam and the Philippines are expected to average higher GDP growth rates than China in the period 2019 to 2023.

As China eases down to a more sustainable rate of economic expansion, the OECD forecasts its growth to average 5.9% a year in the period 2019-2023, down from 7.3% in the period 2012-2016. Meanwhile, the OECD expects higher average annual growth rates in the period 2019-2023 compared to 2012-2016 from Thailand (rising from 3.4% to 3.7%) and Vietnam (rising from 5.9% to 6.5%). Indonesia and the Philippines are expected to maintain their average annual growth rates at 5.3% and 6.6% respectively. Malaysia’s average annual growth rate is expected to ease though from 5.1% to 4.6%.

Of course, superior economic growth in itself does not guarantee market outperformance. But it is helpful. At the very least, if the IMF is right, the ASEAN-5 markets will enjoy an even more supportive economic backdrop in coming years than in recent past years.

Related Ticker:

Premia Dow Jones Emerging ASEAN Titans 100 ETF: 2810 HK