Positioning between conflicting signals from the equities and bond markets

What happens now for global equities after what has been a good first quarter?

The S&P500 has just pushed through the 2870 resistance marked by the January 2018 high. And there appears considerable momentum that could take it higher. The same upward momentum is apparent in the European equities markets as well.

But the bullishness appears less about good news in the economy than relief that the monetary tightening cycle has ended very prematurely in both the US and Europe. And while that may be enough to power stocks higher near-term, the risk-reward considerations should give investors cause for caution.

Central bank action lifts sentiment. The US Federal Reserve has performed the financial equivalent of a “handbrake turn” – yanking the handbrake and spinning the vehicle into a U-turn. At the December 2018 Federal Open Market Committee (FOMC) meeting, the Fed hiked its policy rate to 2.25%-2.50%, and signalled another three hikes to 3.0%-3.25% in this cycle. The Fed’s policy committee also signalled it would continue “quantitative tightening” (QT) – that is, running down its balance sheet – at a rate of US$50 billion a month. Only weeks later, by late January, the Fed signalled it would end the rate hiking cycle and stop QT.

Federal Reserve’s rate hike cycle began in late Dec 2015 and raise 225bps

Source:Bloomberg, Premia, as of Apr 8, 2019

The European Central Bank (ECB) similarly committed to keep its key rates at where they have been for the past three years – from -0.4% to 0.25%. It also committed to maintaining the size of its balance sheet – that is, there will be no QT. For good measure, it introduced a new series of the “targeted long-term refinancing operations”. This new series is called “TLTRO-III”.

The global economy isn’t getting any better. Central bankers do not normally do “handbrake turns” for cheap thrills. Such manoeuvres are embarrassing to say the least – they speak of policy misjudgement. Further, they speak of alarm. The reason for this renewed dovishness from the central banks is simple – economic signals in the US and actual conditions in the Euro Area are worrying.

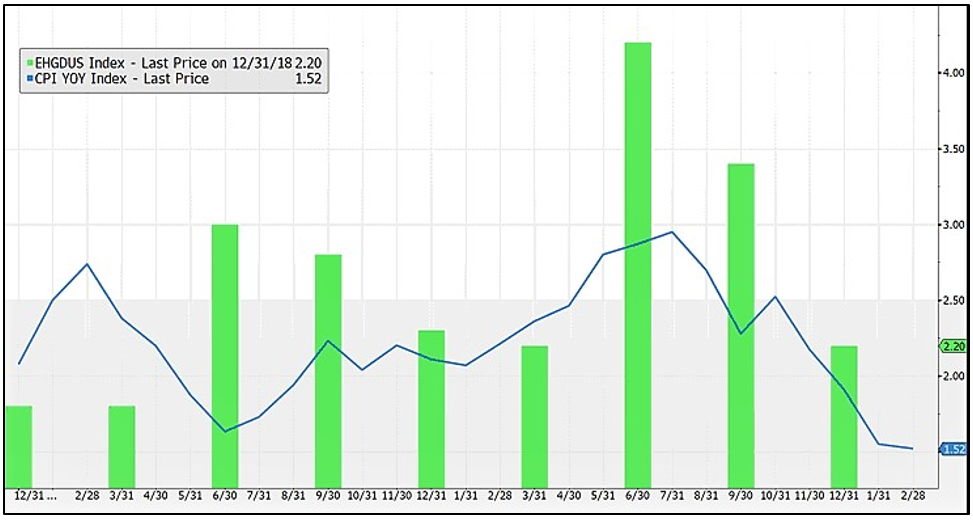

US GDP growth has been decelerating – from 4.2% q/q in 2Q18 to 2.2% q/q in 4Q18. The headline still presents a decent figure, until you consider the relentless inventory build up in 2017 and 2018. Inventory to sales spiked abruptly in 2018. There are limits to the build-up of inventories relative to sales. Coming drawdowns on stocks will further slow economic growth. Indeed, the US is back into disinflation – with the inflation rate falling from the mid-2018 high of 2.9% to 1.5% in February.

US is back into disinflation (in blue line) with slower macro growth (in green bar)

Source: Bloomberg, Premia, as of Apr 8, 2019

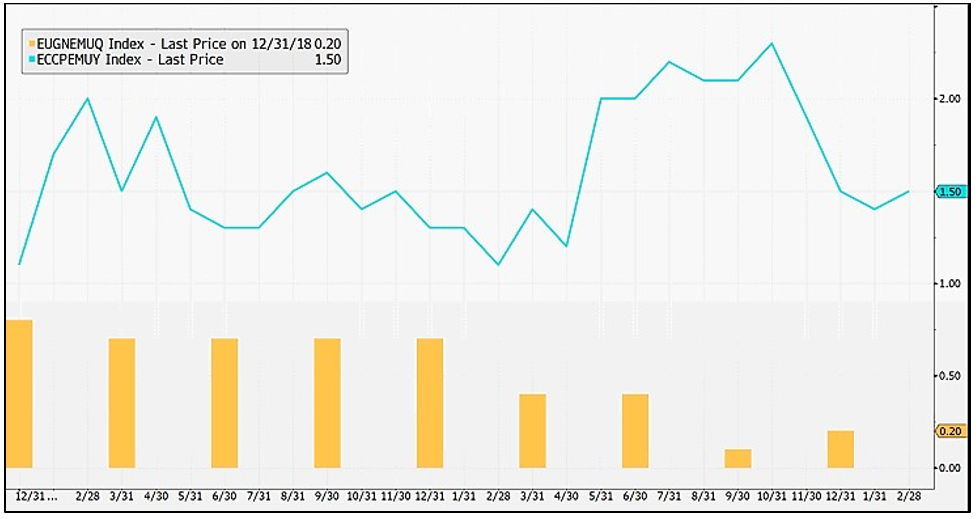

In the Euro Area, the backdrop for the ECB’s renewed dovishness was against borderline recessionary conditions 0.1% q/q GDP growth in 3Q18 and 0.2% q/q growth in 4Q18. Inflation languishes around 1.4%-1.5%, significantly below the ECB’s target 2% rate. And Japan has been flitting in and out of economic contraction over the past year.

Inflation (in blue line) is below the ECB’s target while macro growth (in yellow bar) is minimal

Source: Bloomberg, Premia, as of Apr 8, 2019

Hope for renewed policy stimulus – be careful what you wish for. This can’t be just about the cessation of policy tightening. That should already be in the price.

The problem with wishing for more policy stimulus should be obvious. The Federal Reserve has very little by way of interest rates to cut. Historically, 225 basis points (before we get back to the “zero lower bound”) is not enough to stimulate recovery should the US fall into recession. The ECB and the Bank of Japan have nothing to cut.

What about a resumption of quantitative easing? Yes, that could be the next step when central banks hit the “zero bound” on interest rates. The problems are legend by now. But they are worth recapping:

Monetary stimulus works ultimately by encouraging (or at least attempting to encourage) consumers and companies to bring forward spending and investment from the future. If it is successful, it merely works by hollowing out future demand.

As central bankers explain it, QE works by forcing yields lower and asset prices higher via the so-called “portfolio balance effect”. A side-effect would be asset bubbles, in everything from stocks to bonds to real estate.

Another potential transmission mechanism for QE could be through currency debasement/devaluation. But if the major economies engage in this – as they have – they would end up cancelling each other out through competitive currency devaluation.

QE damages the profits of banks and the ability of defined-benefits pension fund managers and insurance companies to meet future liabilities.

Taken to extreme, QE will eventually force central banks down the scale on asset quality, leading them to join the Bank of Japan in buying corporate bonds, real estate investment trusts and stocks. Against the deterioration of quality on the asset side of the balance sheet, the stability of the financial system sits nervously on the liabilities side (reserve money, central bank securities and equity capital).

A major reason why investors will load up on negative yielding bonds – as they are doing again – is they expect a deterioration in economic conditions and yet lower yields and higher bond prices. A dangerous proposition.

And over the longer-term, QE may not even work to bring forward future demand, without destabilising severely the economy. People do either one of these two things: One, they believe central banks will unwind monetary stimulus when they achieve the target inflation rate – in which case, they will be wary about bringing forward future spending. Or two, they believe central banks and governments no longer care about inflation – in which case, Venezuela and Zimbabwe could be the future.

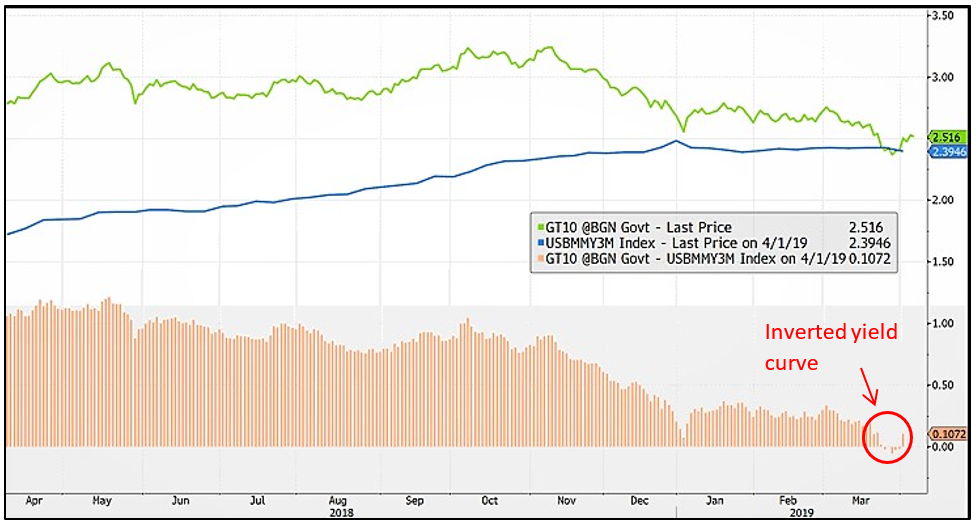

Clear and present danger. The market may relegate the above concerns about “QE infinity” to the theoretical future. But the bond market is already pricing in a sharp slowing in economic growth, and possibly even recession. There has been a creeping inversion of various parts of the US Treasury yield curve over recent months. The 3m-10y portion of the US Treasury yield curve – the part of the yield curve seen to have the best predictive powers of economic slowdown/recession – has just inverted. And that inversion comes ironically amidst renewed bullishness in equities. As I wrote at the start of this piece, it is possible that equities could continue higher on the economic slowdown that the bond market fears. But this is picking up pennies in front of a steamroller.

US Treasury 10Y (in green line) dipped below 3M (in blue line), resulted in an inverted yield curve

Source: Bloomberg, Premia, as of Apr 8, 2019

A more prudent strategy. I would maintain my late January recommendation of going defensive – switching from growth to value. And to switch to stocks/sectors with lower GDP-sensitivity – healthcare, consumer staples, telcos, and utilities. A recent publication by independent research house TSL Lombard pointed out that during the last three yield curve inversions, materials, banks, consumer discretionary and tech tended to underperform. Energy, healthcare, utilities and consumer staples tended to outperform. So, while staying invested, it would seem sensible to rotate towards more defensive positions.