精選觀點 & Webinar

China’s tough new regulations on its tech giants will result in competitive gains for consumers, level the playing field for small and medium enterprises, and generate productivity gains for the economy.

May 24, 2021

KOSPI and TWSE outperformed the S&P 500 over 6 months and 12 months. South Korea’s KOSPI and Taiwan’s TWSE indices have outperformed the S&P 500 over the past 6 months and 12 months. However, on a year-to-date basis, the S&P 500 has done better than the KOSPI but continues to lag the TWSE by a long way.

May 06, 2021

It is inevitable that the traditional 60/40 asset allocation split between bond and equity no longer work well as the fixed income portion is not generating sufficient stable income.

May 06, 2021

As our Senior Advisor Sayboon Lim stated in the article “Gimme shelter” that it is essential for investors to have China sovereign bonds in their asset allocation, it would be timely for us to introduce the newly launched Premia China Treasury and Policy Bank Bond Long Duration ETF for your consideration.

Apr 28, 2021

Index provider FTSE Russell will add Chinese Government Bonds (CGBs) to the FTSE World Government Bond Index (WGBI) over three years from the end of October – a move that is expected to draw billions of Dollars of new portfolio inflows. Already, there has been a sharp increase in foreign inflows into RMB bonds over the past 12 months, accelerating soon after the start of the pandemic. In this 2-part series, our Senior Advisor Say Boon Lim highlights the drivers for new demand for CGBs and the reasons to own them.

Apr 22, 2021

A popular media narrative for the recent correction in Chinese equities was that it was caused by tightening of financial conditions in China.

Mar 31, 2021

Being the first-in-first-out, China has been the first one to reopen and recover from the pandemic last year. While the recovery has been uneven and is still underway going into 2021, in Q4 we observed sector and factor rotation started to kick in, with Value and LowRisk being the best performers toward the year end.

Mar 23, 2021

Economic policy settings between the United States and China – which have been diverging since the onset of the COVID-19 pandemic – are now on stark display as a result of the recent outcomes of the annual plenary session of the National People’s Congress.

Mar 18, 2021

The great divergence between economic growth in China versus the rest of the Emerging Markets post-COVID-19 has increased the likelihood of a parting of ways between China and EM in asset allocations.

Mar 09, 2021

US sanctions on trade, technology, and financial market access have done little to dampen foreign investor enthusiasm for China. There has been a surge in foreign investment flows, both portfolio and direct, into China over the course of 2020: All of which begs the questions “why” and “how sustainable is this”?

Feb 25, 2021

Premia 圖說

賴子健 , CFA

CFA

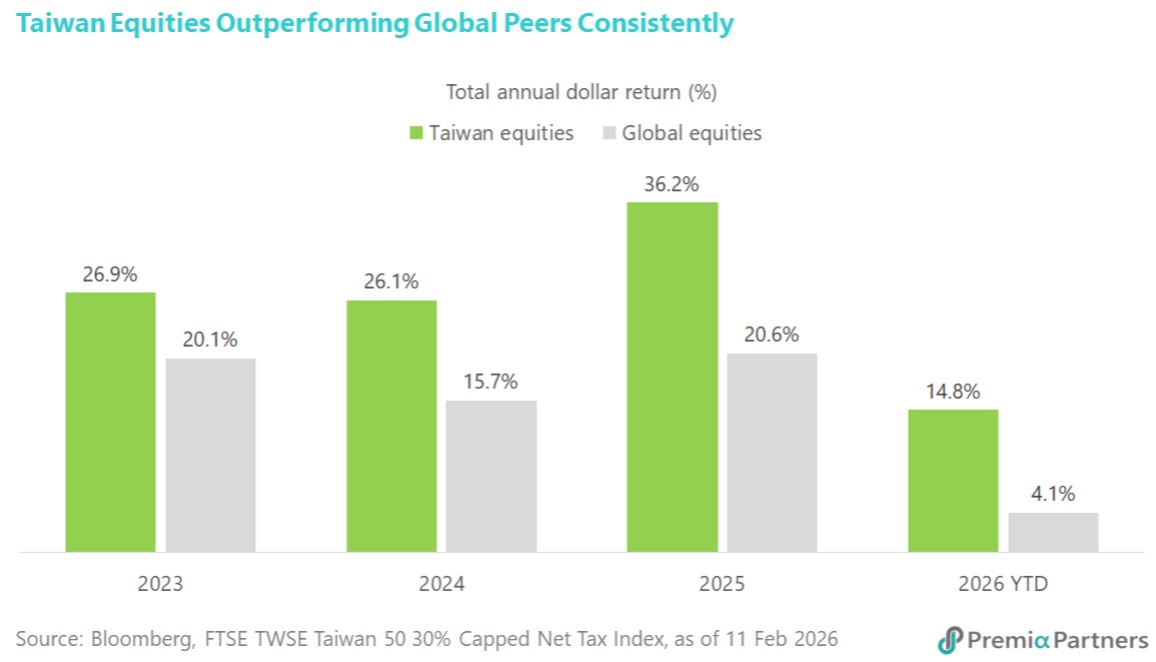

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026