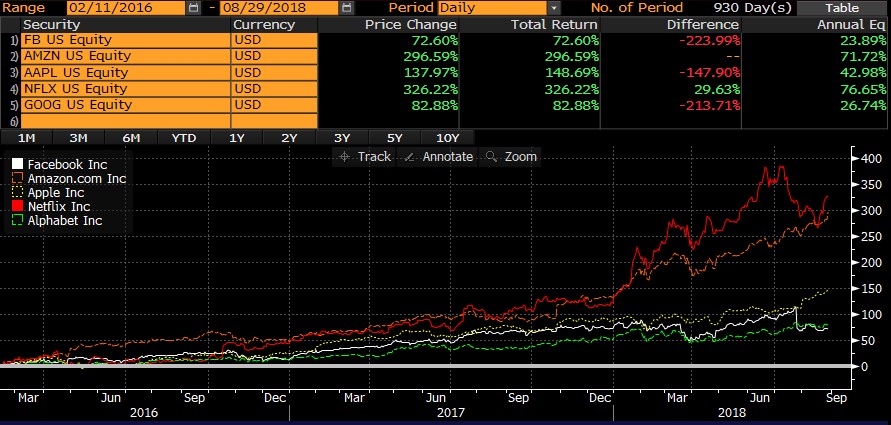

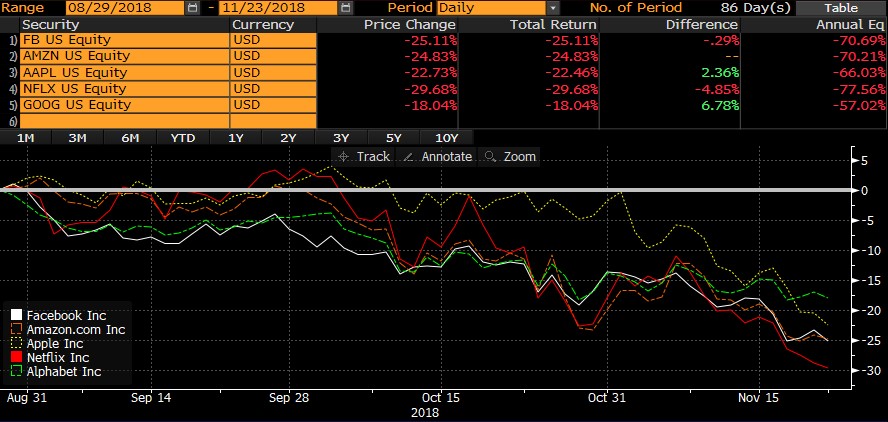

We’ve been traveling and talking to investors across Asia during the past few weeks and the most frequent topic so far has been the recent volatility in the US, particularly the technology space. Investors are understandably worried – many have been overweight the US tech sector for quite some time. In hindsight, investors made the right decision to overweight Nasdaq and FAANG (Facebook, Amazon, Apple, Netflix, and Google) directly as these stocks had a fantastic rally during the bull cycle in the past couple of years. The Nasdaq Composite Index was up 90.0% from February 2016 to August 2018, whilst FAANG stocks were up 72.6% to 326.2%. However, the latest negative move is creating questions around the heavy exposure to Nasdaq and FAANG. Those stocks are down 20-30% on average since August. We all know that mean reversion usually happens when asset pricing runs too extreme in a short period of time. The catalysts are often incidental, but in this case may include overstretched valuations, softening growth prospects, the beginning of the shrinking balance sheet at Fed, continuing rate hikes, etc.

Nasdaq’s strong performance from February 2016 to August 2018

Source: Bloomberg as of 2018.11.23

FAANG stocks were up between 72.6% and 326.2% during the bull market

Source: Bloomberg as of 2018.11.23

FAANG stocks stepped into a bear market technically since Nasdaq peaked in August

Source: Bloomberg as of 2018.11.23

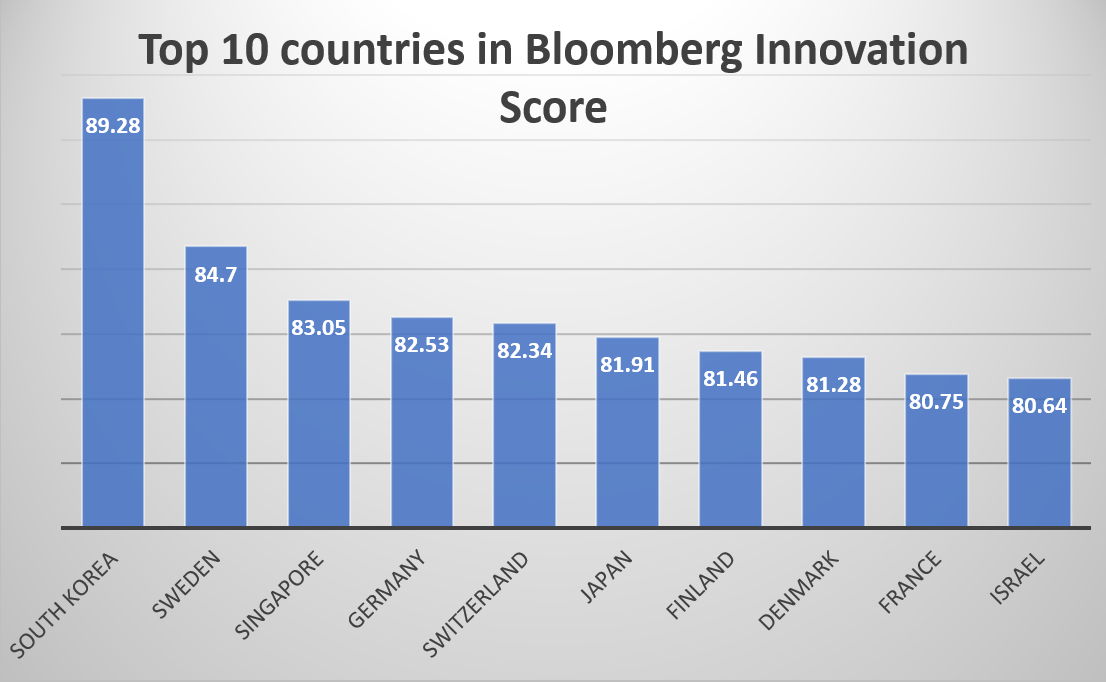

As investors review their US exposures, and whether to trim, the immediate question is what to do with the proceeds once taking profit from Nasdaq and FAANG holdings. Cash is not a bad option for those investors who want to reduce risks due to bearish views on overall equity markets. However, if investors remain constructive about innovation and do believe in the megatrends of digital transformation, life sciences and automation, then what is the alternative for investing? We believe that it may be the right moment to look at Asia as a source of innovation now. In the past, most people may only refer to the US market when looking for opportunities in innovation, assuming the lack of right industry landscape, capital flow and entrepreneurship culture in Asia. The reality, however, is quite different from that. The US dropped out of the top 10 in the 2018 Bloomberg Innovation Index for the first time in the six years the gauge has been compiled. The index scores countries using seven criteria, including research and development spending and concentration of high-tech public companies. The U.S. fell to 11th place from 9th mainly because of a slump in the post-secondary, or tertiary, education-efficiency category, which includes the share of new science and engineering graduates in the labor force. Value-added manufacturing also declined whilst improvement in the productivity score couldn’t make up for lost ground. Surprisingly, Asian countries ranked high in the scoring with South Korea topping the table for the 5th consecutive year and Singapore jumping ahead of European economies Germany, Switzerland and Finland into 3rd place. Japan settled at the 6th spot, while China moved up slightly to the 19th, buoyed by its high proportion of new science and engineering graduates in the labor force and by the increasing number of patents from emerging innovative companies.

US is not one of the top 10 countries in Bloomberg Innovation Score

Source: Bloomberg as of 2018.11.22

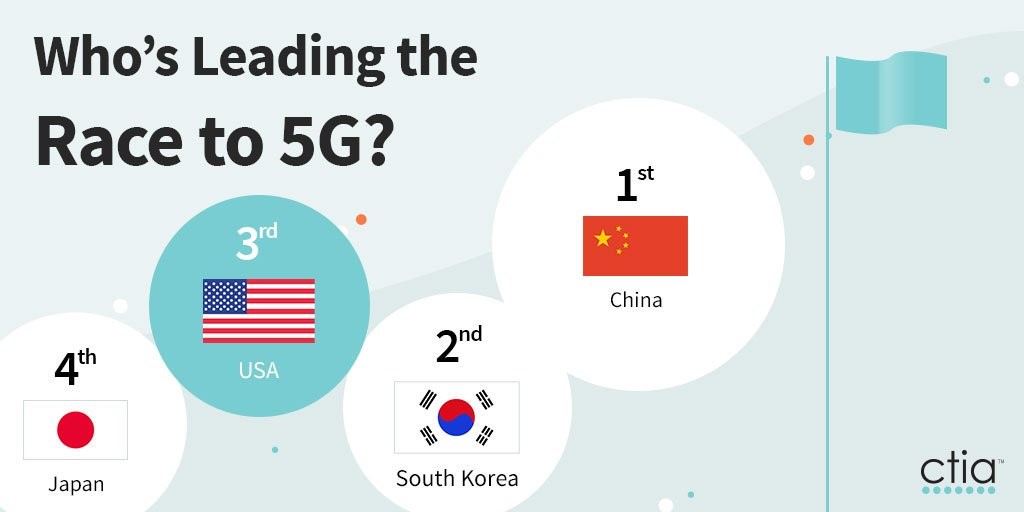

Over the past decade, Asia has transitioned rapidly from being the world’s factory to a leading developer of next-generation technologies, such as artificial intelligence, automation, big data, blockchain, cloud computing, connected devices, robotics, and virtual/augmented reality. We began to see Asian countries taking the lead in certain innovative technological areas such as 5G, robotics and electric vehicles. South Korea, China, and Japan are expected to launch commercial operations of 5G mobile telecommunications networks next year. The new 5G technology will provide users gigabit transmission speeds and much more network capacity. It will be able to connect to 100 times more devices including everything from baby monitors to self-driving cars, smartwatches, drones, VR headsets, and smart refrigerators. The low latency and faster speed enable possible breakthroughs in healthcare, such as remote patient monitoring and surgery.

China, South Korea, the US, and Japan will be the first batch in 5G deployment

Source: CTIA, Analysys Mason report as of 2018.11.22

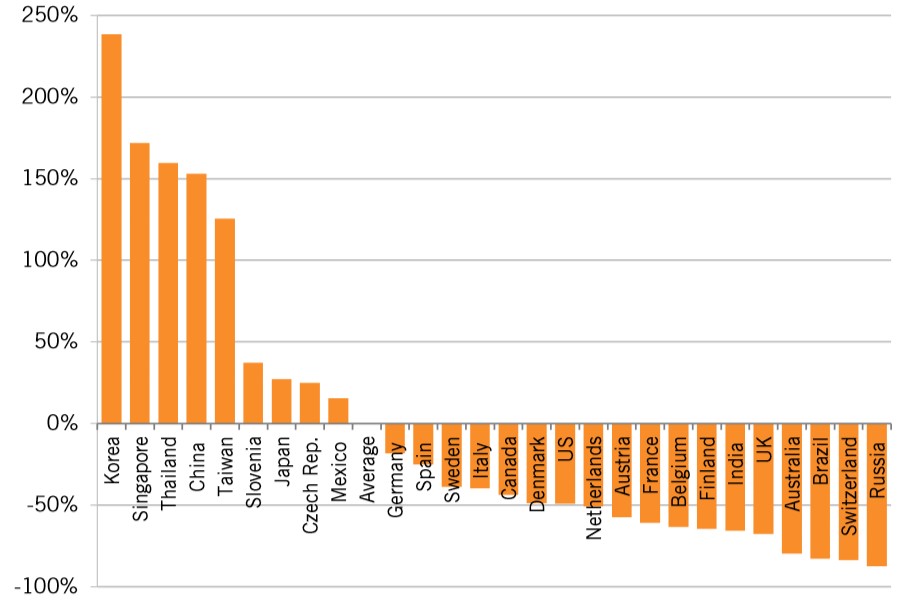

Robots are being adopted by companies around the world. According to the International Federation of Robotics, the global average for industrial robots per 10,000 manufacturing workers grew from 66 robots in 2015 to 74 robots in 2016, to 85 in 2017, a 15% increase in the last year. South Korea was the world’s largest adopter of industrial robots in 2017, with 710 robots per 10,000 workers, followed by Singapore with 658 robots per 10,000 workers, Germany (322), Japan (308) and Sweden (240). It should come as no surprise that high-wage Germany has a higher penetration rate of robots than low-wage India. The more interesting question is how do national economies perform in robot adoption when controlling for wage levels? Below is a chart that adjusts for payback time from installing a robot in different economies, showing the actual robot adoption rate as a share of expected robot adoption rate. The result: Asia holds the top 5 spots by a mile.

South Korea, Singapore, Thailand, China and Taiwan led in robot adoption

Source: Information Technology & Innovation Foundation as of 2018.11.22

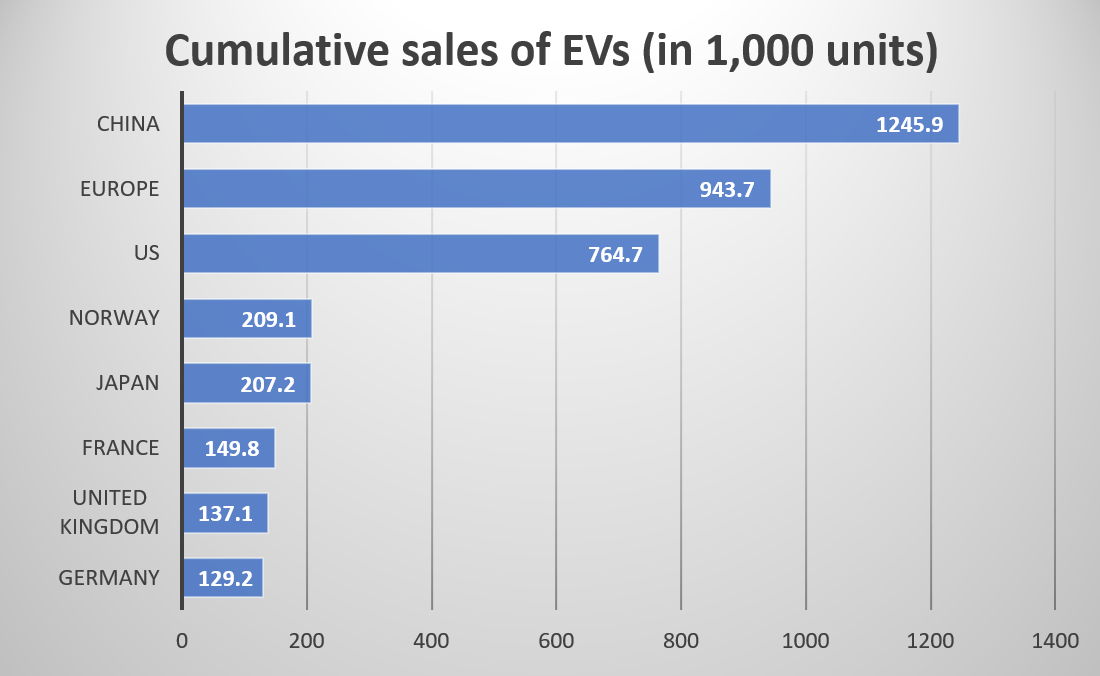

In the electric vehicle (EV) segment, China continues to lead the market with the most EVs running on the road and sales reaching 1 million units this year for the first time. EVs have become a large part of Chinese people’s daily lives in a way that has not happened in countries like the US. And there is no better place to see that than in Shenzhen, one of China’s technological hubs in the southern part of the country. Shenzhen is the world’s only city to have 100% electric buses. It is also one of the first Chinese cities to set a goal to replace all gasoline-run taxis with new electric vehicles, which includes pure battery vehicles and plug-in hybrids. Nationwide, the Chinese government went so far as to release a “road map” to replace at least one-fifth of new car sales with alternative fuel vehicles by 2025.

China may even widen the lead in EVs on the back of favorable government policies

Source: International Energy Agency 2018.1.20

These trends are well-understood by the global tech industry and VC firms, but not yet by public market investors. You may be wondering how this relates to actual stock performance. Using our Premia Factset Asia Innovative Technology Index as a reference, the Asia innovation space recorded a similarly strong return of 93.2% during the bull run in the past few years. It, however, peaked much earlier in March this year, 5 months ahead of Nasdaq. Since then it dropped 31.4% in the past 7 months, compared to the drop of ~15% of Nasdaq in the past 3 months. This is why we believe investors should look into accumulating exposure to innovative companies in Asia, taking advantage of market consolidation.

Asia innovation space corrected earlier and might rebound sooner potentially

Source: Bloomberg as of 2018.11.23

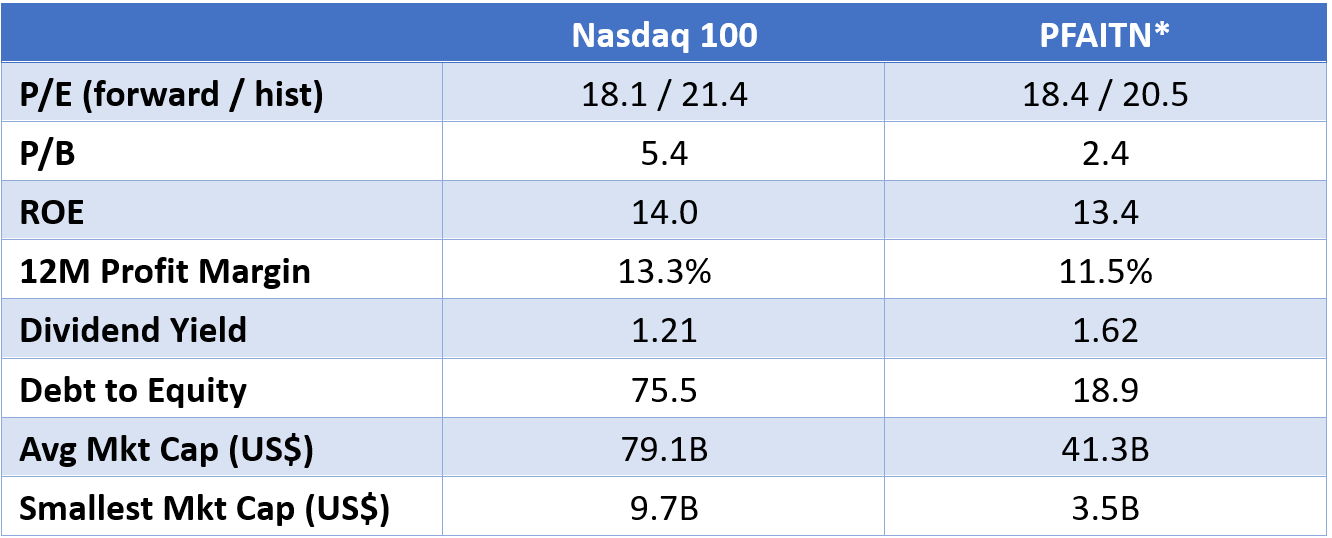

Comparing Nasdaq 100 (the index for QQQ US) with the Premia FactSet Asia Innovative Technology Index (the index for 3173 HK), we find that the latter corrected earlier and more steeply, making for an attractive entry point. With a 25% discount vs Nasdaq 100, the Premia FactSet Asia Innovative Technology Index offers similar valuations (based on PE, lower based on PB), ROEs and Margins, but higher dividend yields and lower debt to equity ratios. And while investors obviously know Nasdaq company names quite well, the stocks in the Premia FactSet Asia Innovative Technology Index are anything but unknown. With an average market cap of US$41B, this index includes the BATs (Baidu, Alibaba, Tencent), but equal weights them with the other 47 names, ensuring that the portfolio is a truly broad representation of Asia Innovative Technology rather than a handful of stocks.

Nasdaq 100 Index and Premia FactSet Asia Innovative Technology Index side by side

Source: Bloomberg as of 2018.11.23

*PFAITN: Premia FactSet Asia Innovative Technology Index; Source: Bloomberg as of 2018.11.23

For details of our Premia Asia Innovative Technology ETF (3181.HK/9181.HK), please click here.

Regards,

David