Review of 2025: A Breakout Year

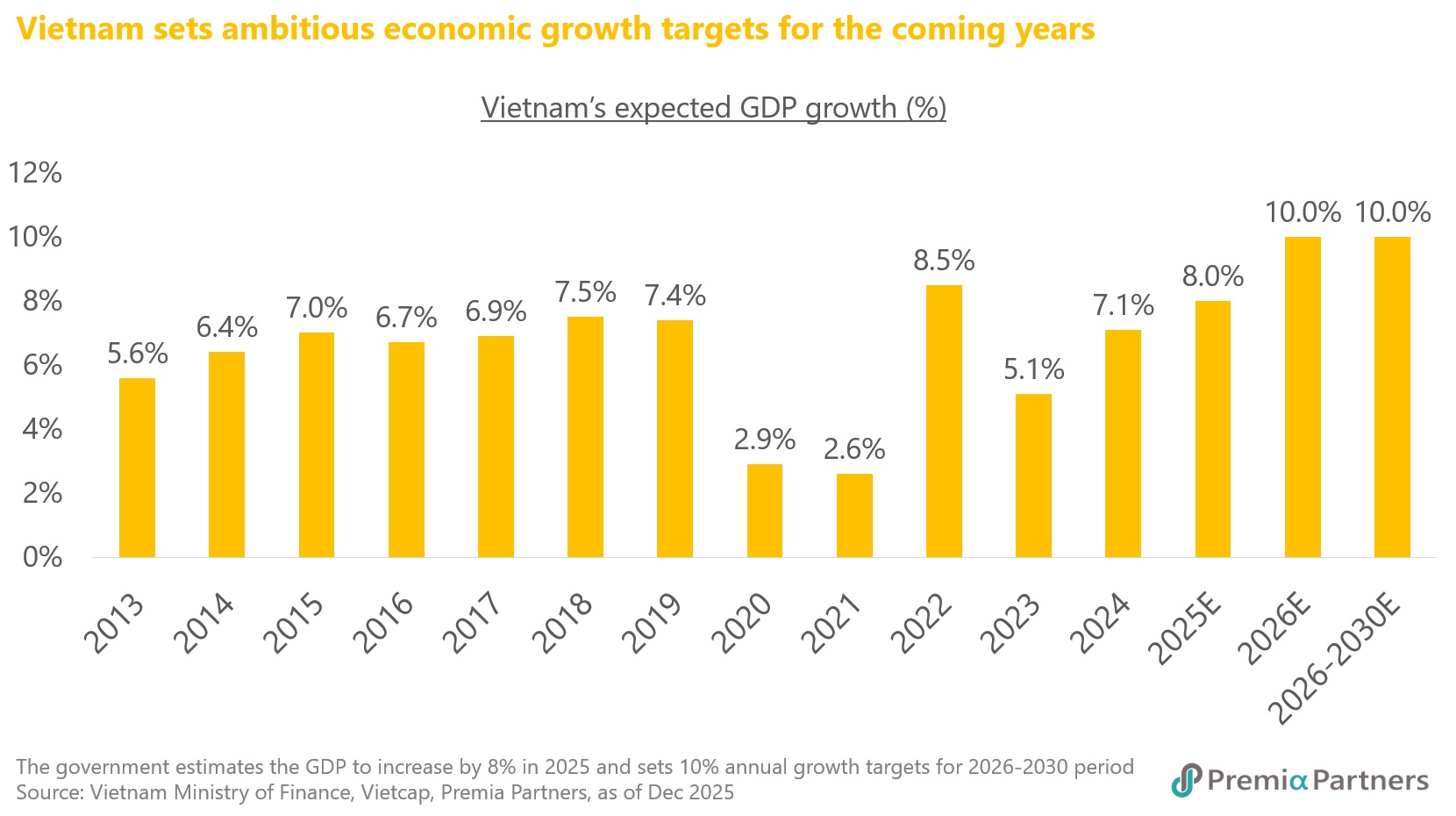

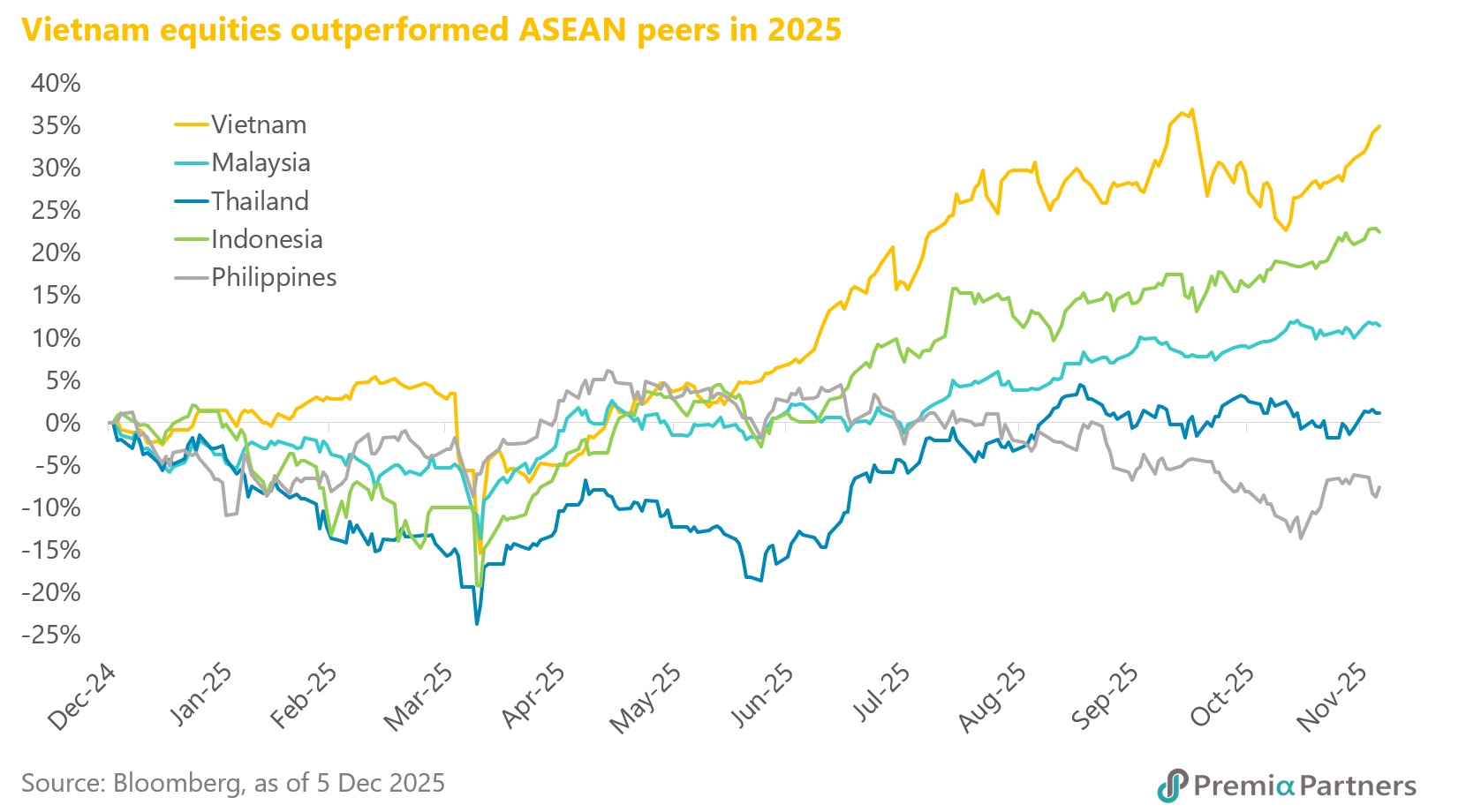

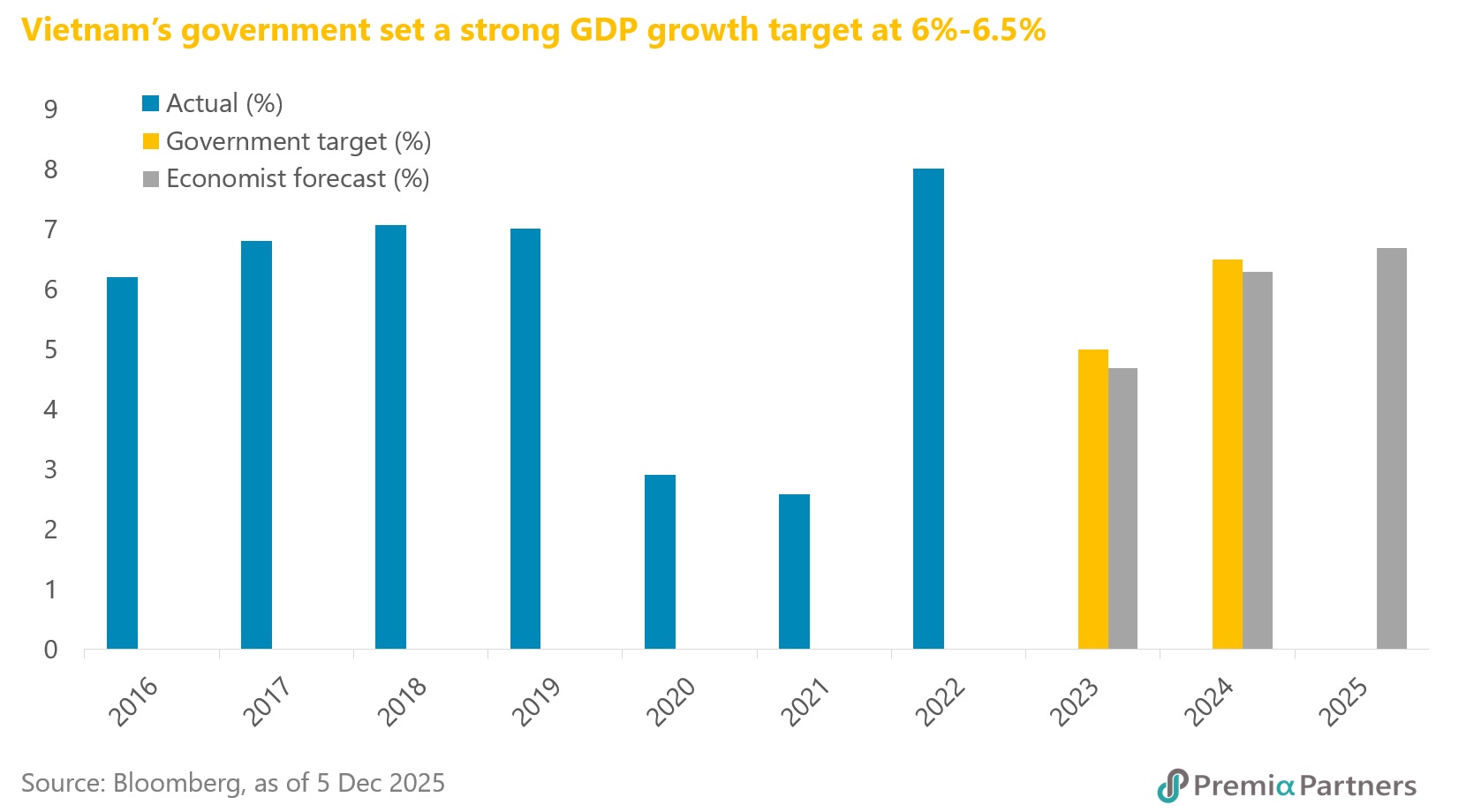

Vietnamese equities market delivered a stellar performance in 2025, rising around 36% year-to-date and significantly outperforming regional ASEAN peers. Despite starting the year under a cloud of uncertainty arising from US tariff policies and trade tensions, the Government maintained an aggressive growth target of 8%, and solidified Vietnam's position as a primary beneficiary of global supply-chain diversification. The market responded well with a strong rally through the April trough. It was further boosted by the government’s determination to deliver its double-digit GDP growth target and the boldest reform agenda since the 1980s in the roll-out of Resolution 68, dubbed "Doi Moi 2.0" by investors.

Conducive policy environment ahead

The positive momentum is expected to accelerate in 2026 given several macro and market tailwinds. Policymakers have been very pro-growth and reforms. The 10th Session of the National Assembly concluded with adoption of 51 draft laws and 39 resolutions, marking a major step in institutional reforms to address immediate practical needs and establish a stronger legal framework for Vietnam’s next stage of development.

Accommodative monetary and fiscal environment. The State Bank of Vietnam is also expected to maintain an accommodative monetary policy to support growth. Meanwhile public investment in 2026 is projected to increase by 9.2% vs the 2025 estimate. With public debt expected to remain manageable at 36%–37% of GDP in 2026 (which is well below the 60% cap) according to the Ministry of Finance, there is also room for additional fiscal stimulus later in the year as seen in 2025.

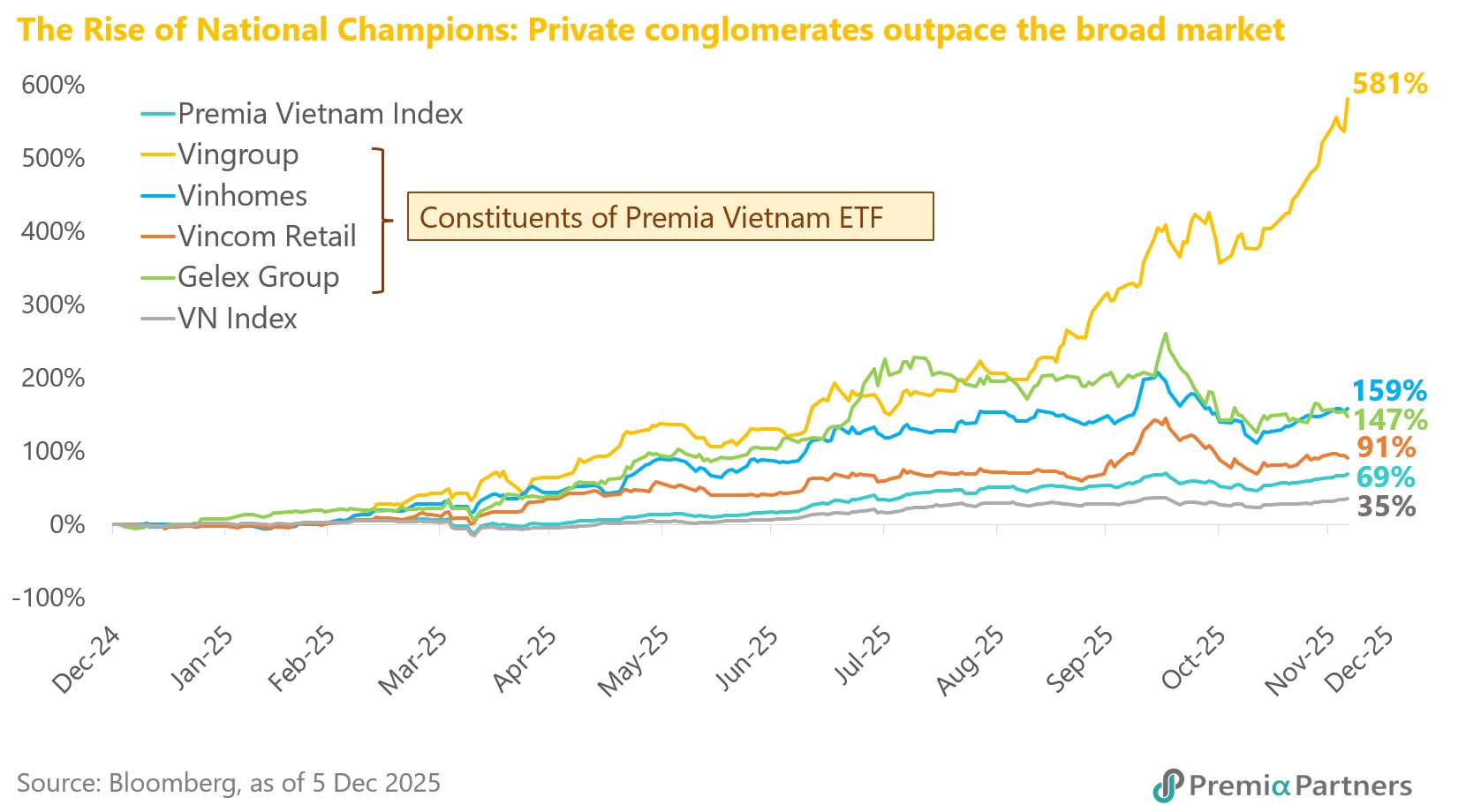

Resolutions 68 and 198 provide unprecedentedly strong policy support for private sector growth, and the mandate to nurture 20 globally competitive large private firms provide strong cases for revaluation opportunities for leading large cap leaders.

2026 marks the start of Vietnam’s new five-year development plan (2026–2030), with a strong commitment from policymakers to mobilize public and private sector capital and resources to support ambitious growth plans. Central to this are Resolutions 68 and 198: Resolution 68 sets the strategic direction to recognize the private sector as the main economic driver, while Resolution 198 translates this into concrete laws, introducing special policies like abolishing the flat tax for household businesses from 2026, streamlining regulations, and offering support to boost private enterprise growth and innovation.

One important mandate under Resolution 68 is the creation of 20 large private companies as globally competitive National Champions that are intended to lead Vietnam's integration into global value chains, drive innovation, and help the country avoid the "middle-income trap" to become a high-income nation by 2045.

Under Resolution 198 and other directives, including the new "public investment, private management" model, large conglomerates are the direct beneficiaries. Private firms are ensured equal access to land, capital and technology compared to state-owned enterprises (SOEs). Resolution 198 also encourages private-sector participation in key national infrastructure projects including metro lines and high-speed rail.

In addition, Resolution 198 provides a three-year tax exemption for households and individuals transitioning into small and medium-sized enterprises. The government is undertaking an Administrative Revolution by reducing administrative units and cutting red tape by 30%, aggressively lowering business costs to unleash private sector speed.

The market has already started to price in the ‘value-up’ in 2025, with valuation of large cap leaders transformed from a "conglomerate discount" to a "policy premium". Evidence of this is seen in how private conglomerates such as Vingroup and Gelex Group significantly outperformed the broad market in 2025.

Vietnam’s exports competitiveness remains intact notwithstanding the US’s reciprocal tariff. Currently, the US reciprocal tariff on Vietnam stands at 20%, compared to an average of 26% among other manufacturing-oriented competitors (excluding China). It is expected that Vietnam’s exports in 2026 and 2027 should grow at 12% and 14% respectively, reflecting the state of the world including the US economy. Meanwhile Vietnam has also been actively upgrading relations with a long list of countries to diversify its export markets to limit geopolitical risks.

In addition, as Vietnam continues to benefit from de-risking in the global supply chain, it is expected to maintain its attractiveness for foreign direct investments (FDI), supported by the country’s fundamental advantages (location, long list of FTAs and competitive labour costs). Vietnam’s recent upgrades of diplomatic ties and comparable or more competitive US reciprocal tariff rate compared to its manufacturing peers also support the case for Vietnam. It is expected that disbursed FDI in Vietnam could grow 7.0% in 2026/27.

Consumption is also expected to recover progressively, supported by stronger production activities, resulting job creation and improved income. The Government has introduced a range of measures including a 7.2% increase in minimum wages, higher personal income tax (PIT) deductions, a 2% VAT cut, and other policies aimed at supporting consumption.

Other drivers for consumption growth include:

- Strong growth in tourism: The Government is targeting 25 million international arrivals in 2026 (up from 22–23 million in 2025)

- Rising household income: the average salary is expected to increase by 10% in 2026

- Strengthened social security policies including tuition exemption for public pre-school through to 12th grade nationwide, free annual health check-ups for all citizens, pensions and social allowance increases for vulnerable groups, and promotion of cultural and artistic activities to generate positive spillover effects on tourism and domestic consumption, while also attracting international visitors.

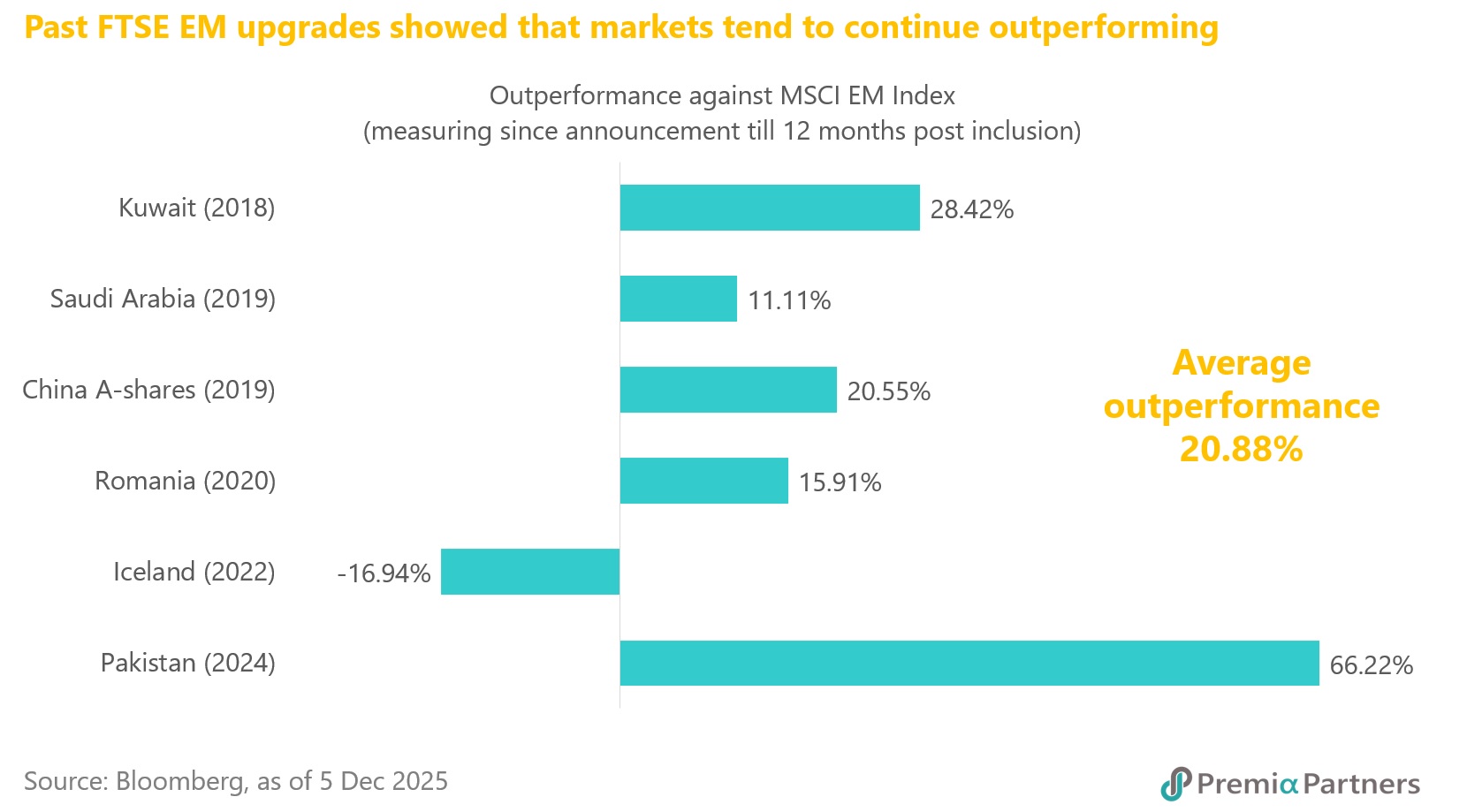

Liquidity boost from index inclusion – private conglomerates will benefit more than SOEs. With the actual FTSE Emerging Market upgrade effective in September 2026, local brokers estimate USD 1.6 billion in inflows from passive ETFs and significantly more from active funds. Crucially, private conglomerates—which typically possess higher foreign room and free-float—are mathematically positioned to receive the lion's share of these inflows compared to State-Owned Enterprises (SOEs) or those that are already at their foreign ownership limit (FOL).

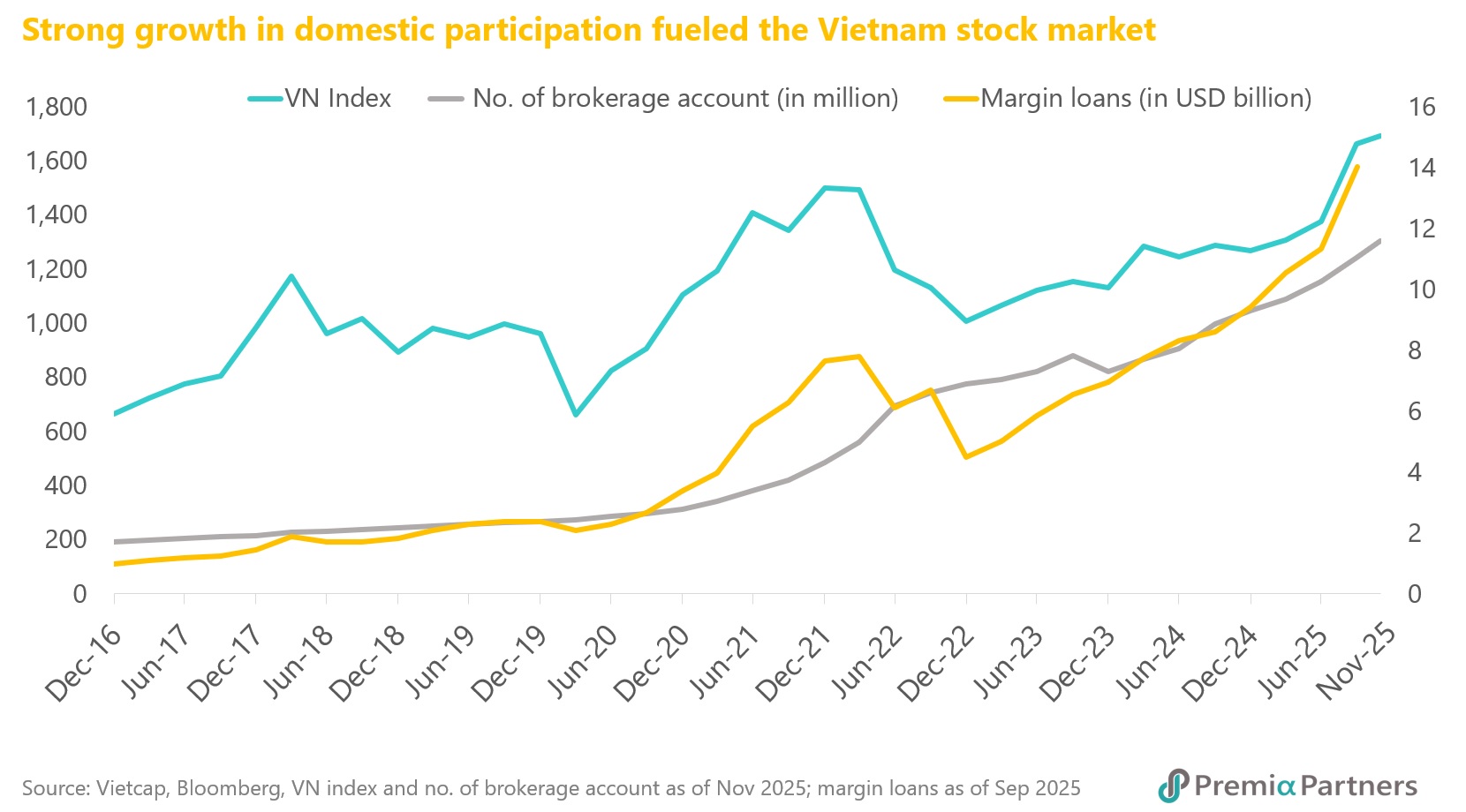

After FTSE announced the EM status upgrade for Vietnam, the government continued to work on improving access for global brokers ahead of the FTSE interim review in March 2026. Concurrently, the Ministry of Finance is drafting revisions to Circular 98/2020 for asset management sector reform. With the industry asset under management (AUM) representing only ~6% of GDP, the market has historically been volatile and daily trading rather retail dominated. These revisions aim to foster greater professionalism and product diversity, creating a roadmap to shift Vietnam from a retail-based to an institutionalized market. This structural maturity is the prerequisite for attracting long-term capital and securing future upgrades from providers like MSCI.

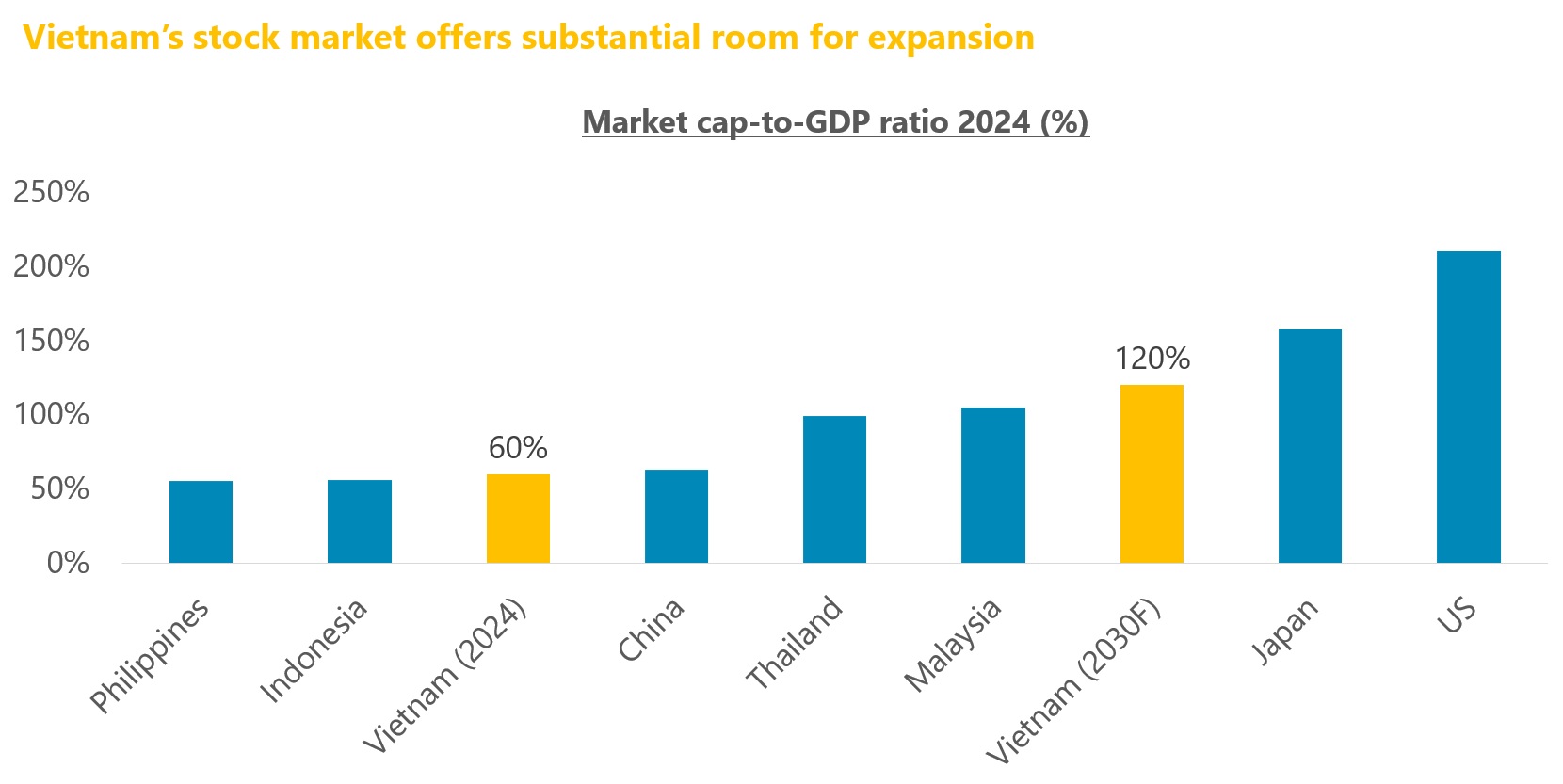

Meanwhile, retail brokerage penetration and the level of margin loans continue to increase. A vibrant equity market has fuelled a new wave of IPOs in Vietnam as well. In fact, Vietnam’s equity market capitalization accounted for only 56% of GDP as of Q3 2025, well below regional peers such as Thailand and Malaysia. This significant gap indicates substantial room for the domestic equity market to expand as the economy grows.

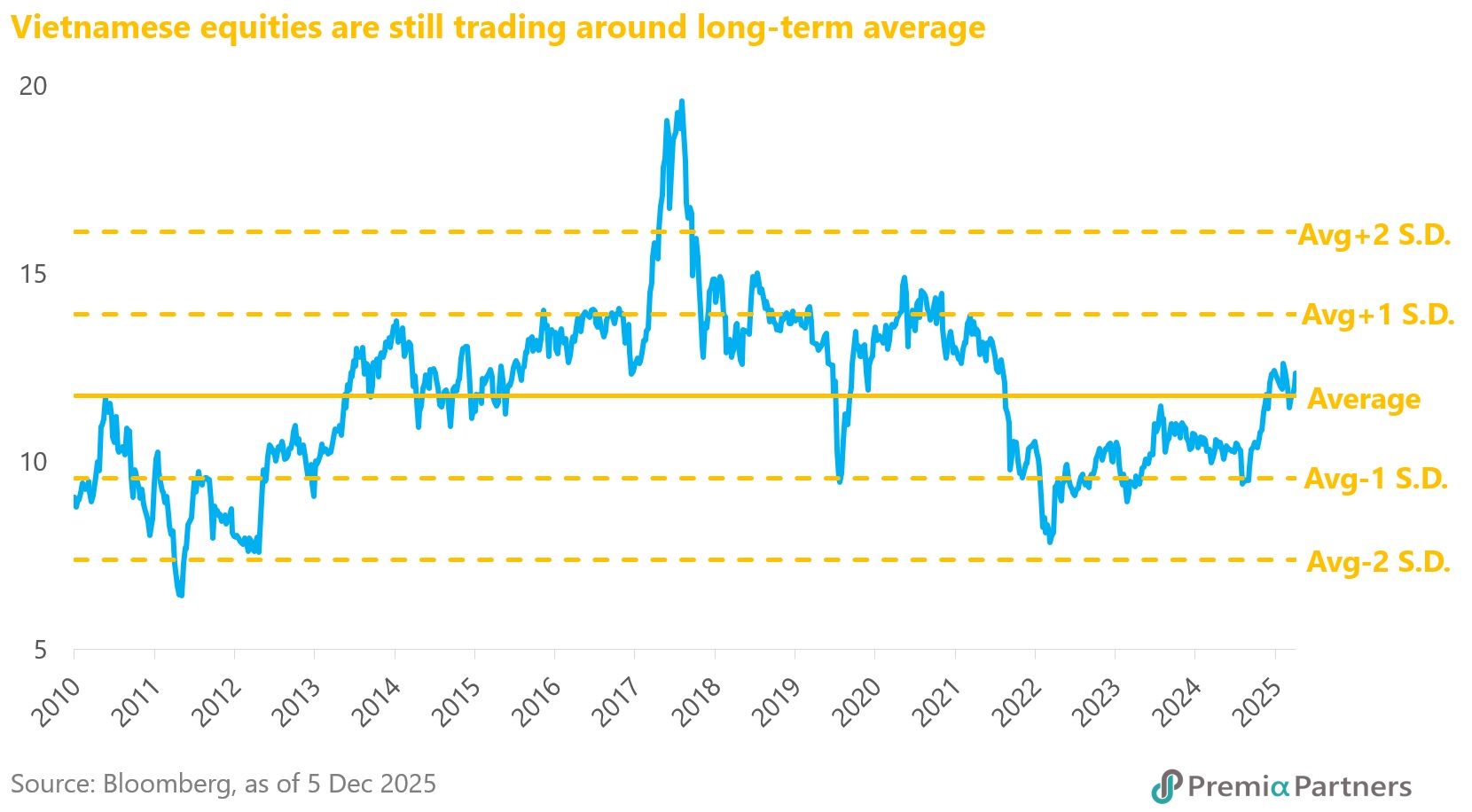

Attractive valuation at historical average: Growth at a Reasonable Price

Even after the significant rally in 2025, the VN-Index's 12-month forward P/E, at 12.4x, remains aligned with its long-term historical average, suggesting the price increase has been driven by fundamental earnings recovery rather than speculative multiple expansion. With the consensus forecasting 14%–18% earnings growth (with upside potential if GDP targets are met), Vietnam offers one of the most attractive PEG ratios (Price/Earnings-to-Growth) in Asia. So, on the range of earnings growth forecasts, its PEG ranges from 0.7x to 0.9x. Unlike peers with high multiples and slowing growth, Vietnam offers reasonable valuations against accelerating earnings.

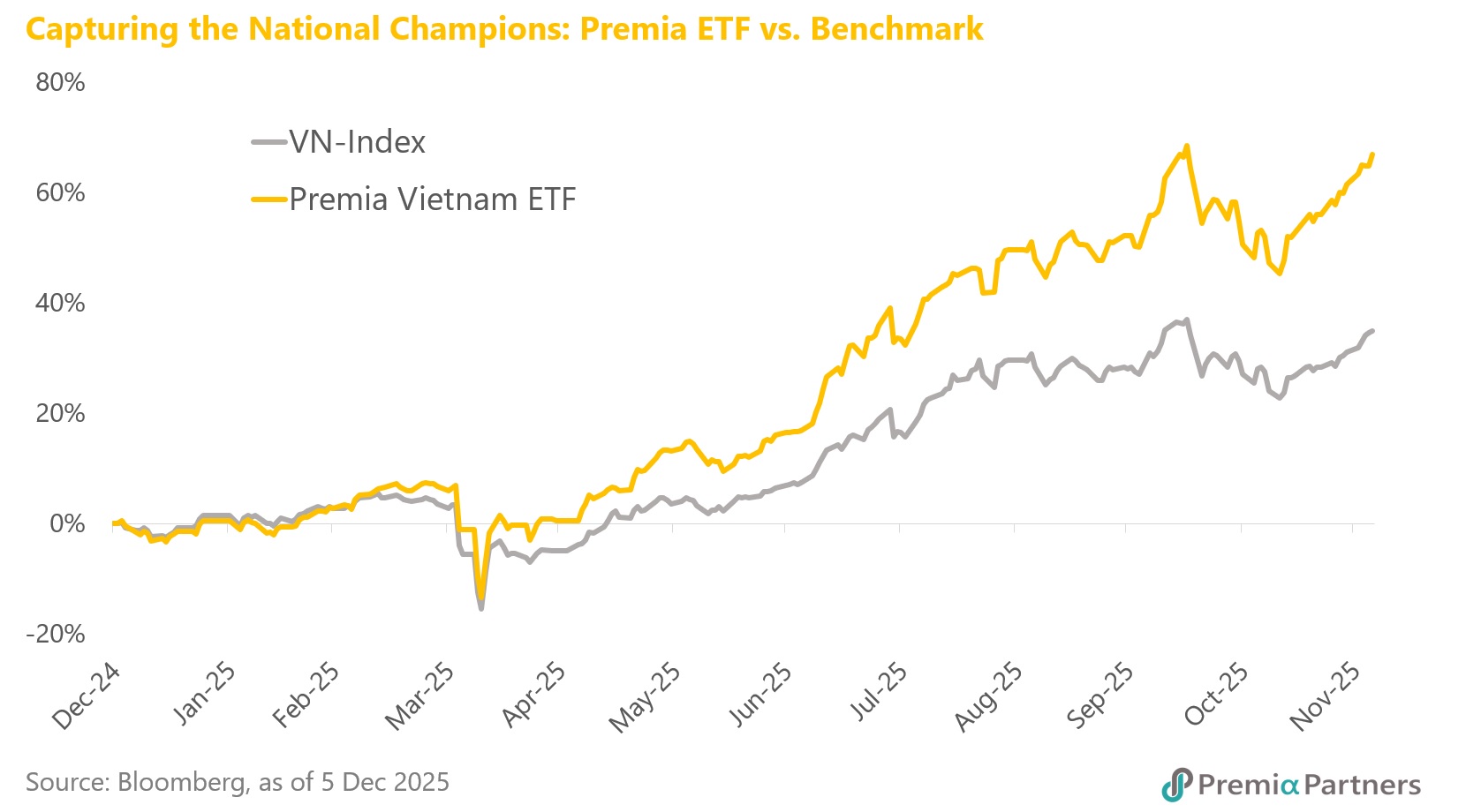

Capturing the policy aligned opportunities with Premia ETF

As Vietnam charges forward on its growth trajectory, Premia Vietnam ETF is an appropriate access tool that provides efficient capture of market opportunities from pro-growth policies, that importantly include recognition of the private sector as the main economic driver, support for large private companies to be developed into globally-competitive National Champions, and numerous initiatives to grow domestic consumption. The Premia Vietnam ETF strategy overweighs private conglomerates (such as Vingroup and Gelex) that are the direct beneficiaries of FTSE upgrade inflows and domestic reforms, while the diversified strategy also captures the leading mid-cap companies that are often missed in concentrated large cap strategies. These companies are often beneficiaries of the national infrastructure build out and the consumption recovery under the tax reforms. By aligning with the "National Champions" and the structural economic reforms, the Premia Vietnam ETF offers an efficient vehicle to capture the full potential of this multi-year secular growth story.