Emerging ASEAN equities – enjoying faster growth with lower inflation than other EM markets in 2024, and the standout growth story in Vietnam.

Emerging ASEAN is one of the most compelling investment stories of 2024 – offering what is now an uncommon combination of growth and undervaluation. Having come to the end of it rate hiking cycle, with economic growth very much intact, Emerging ASEAN now benefits from tailwinds from a cyclical transition to stimulus amidst solid structural growth fundamentals. Vietnam in particular moved early and decisively in 2023 towards stimulus and its market is now favourably positioned with a PE to 2-year earnings CAGR ratio of only 0.36.

For 2024, we see the following tailwinds favouring Emerging ASEAN economies and markets:

- As Developed Markets (DM) slide into recession or near-recession in 2024, the search for growth will turn to Emerging Markets. And the Emerging ASEAN-5 economies are positioned at or close to the top of the world GDP growth table for the coming year.

- The Emerging ASEAN-5 will also likely deliver that superior economic growth with lower rates of inflation than most other EM economies, including India and Brazil.

- Its valuations are mostly modest compared to DM, and grossly undervalued in the case of Vietnam.

- Emerging ASEAN equities will also generally benefit from a weaker US Dollar and lower energy prices.

- The cyclical advantages are also supported by a secular uptrend driven by supply chain diversification; youthful demographics; urbanisation; high rates of capital formation; income convergence; middle class consumerism; and digitisation of the economy.

In search of growth with low inflation as Developed Markets slide into recession. Both Europe and Japan went into GDP contraction in 3Q23. And even if they manage to avoid another quarter of negative growth, the outlook is for sluggish to no growth for most of 2024 as the ECB is likely to lag the Fed in rate cuts and as the Bank of Japan transitions out of negative rates; towards higher JGB yields; and a stronger Yen. In the US, the Fed is signalling 4.1% unemployment, which suggests a mild recession in 2024.

So, where can investors find growth with strong underlying fundamentals? Emerging Asia has a clear growth advantage over most other EM economies in 2024, with generally much lower inflation than the rest of EM. Then, when you deep dive into Emerging Asia, the economy to beat is of course India, which is likely to have a higher GDP growth rate than the Emerging ASEAN-5 in 2024. But the price it will pay though is a much higher inflation rate too.

Cyclical upturn in growth in 2024. Key to this is the likelihood of more accommodative policies driving consumption growth as the economies head towards lower inflation. The IMF is forecasting Emerging ASEAN GDP growth to rise from 4.2% in 2023 to 4.6% in 2024. Deep diving into the individual countries, the IMF is forecasting stronger economic growth in 2024 for Malaysia, Thailand, Philippines and Vietnam, with stable growth for Indonesia. And those forecasts would have been on the IMF’s assumption of slower growth for China, decelerating from 5.0% to 4.2%, which we think is too pessimistic. On the stimulus underway, we expect China should outperform the IMF forecast, closer to the 5.0% Government target. That should give Emerging ASEAN an added fillip for GDP growth for 2024.

The end of the US Dollar bull is likely to also help the relative performance of Emerging ASEAN equities against Developed Market stocks. The US Dollar bull cycle may be turning with the Fed on hold and with expectations of rate cuts in 2024. Indeed, the US Dollar may be resuming its secular downtrend from its 1985 peak. Since 1978, the Dollar Index DXY has moved up and down in long cycles of 5 to 7 years. The current cycle is now 9-10 years old – very long in the tooth, so to speak. And that is useful to note because DXY bull cycles have tended to be accompanied by Emerging Market equities underperformance versus Developed Markets (proxy: MSCI World). The reverse has tended to be true – DXY bear markets has tended to be accompanied by EM equities outperformance. This should be helpful for Emerging ASEAN equities.

Lower oil prices should overall also be helpful for Emerging ASEAN. With the exception of Malaysia, Emerging ASEAN economies are net importers of oil, with the Indonesian government subsidising domestic consumption at considerable cost to its budget. Continued moderation of crude oil prices should generally be beneficial for the economies of Emerging ASEAN.

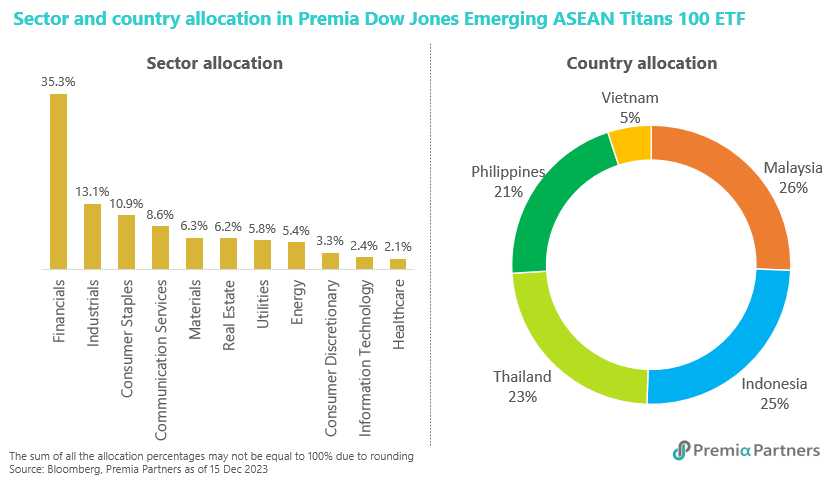

Valuations range from modest to cheap. Thinking of GARP (growth at a reasonable price), Emerging ASEAN – using the Dow Jones Emerging Market ASEAN Titans as our proxy – is trading on a one year forward PE of 12.7x; PB of 1.49x; and a PEG (forward PE to 2-years earnings CAGR) of 1.12x. Vietnam is outstanding value for growth with a PEG of 0.36x.

Structural tailwinds driving Emerging ASEAN to being the fourth largest economy in the world by 2028. As we recently reported in an insight (Emerging ASEAN – Fast Track to 2030) Emerging ASEAN is expected by the IMF to be joint fourth largest economy in the world – neck-to-neck with Japan – by 2028.

- On the industrial front, it will continue to benefit from supply chain diversification as part of the so-called China+1 concept, enjoying in parts even lower labour and land costs than China.

- In demographics, it has one of the most youthful populations in the world, with a dependency ratio for 2022 of 0.48, significantly below the global average of 0.55.

- In urbanisation, Emerging ASEAN, with the exception of Malaysia, has even lower levels of urbanisation than China.

- Relatively low levels of per capita income in Emerging ASEAN suggest a long runway ahead for high economic growth. This is the income convergence theory of economic growth. Using Japan as the benchmark, Malaysia’s per capita income is at levels in Japan circa 1985; Thailand is around 1977; Indonesia is 1975; Vietnam is around 1974; Philippines is around 1973.

- And even as its per capita income rises, a robust consumer culture – measured by a relatively high level of private consumption as a percentage of GDP – drives growth through middle class consumerism.

Vietnam Focus

On cycle to higher economic and earnings growth. Despite considerable volatility, the Vietnam Ho Chi Minh Stock Index is up over 9% for the year to date, with most of the gains kicking in from the end of April, coinciding with the start of the policy rate cutting cycle. Looking ahead, further monetary easing and very large salary increases planned for public sector workers (under salary reforms passed by the national legislature) will be big boosters for economic growth in 2024.

In the first half of 2023, there was a slew of stimulus measures to support the real estate market. Then came the loosening of monetary policy, which saw the State Bank of Vietnam (SBV) cutting the policy rate four times in three months between March and June. The momentum was carried forward by the State Securities Commission of Vietnam (SSC) meeting with index providers to discuss an upgrade to emerging market status, and by US President Joe Biden’s visit to Vietnam to deepen cooperation between the two countries.

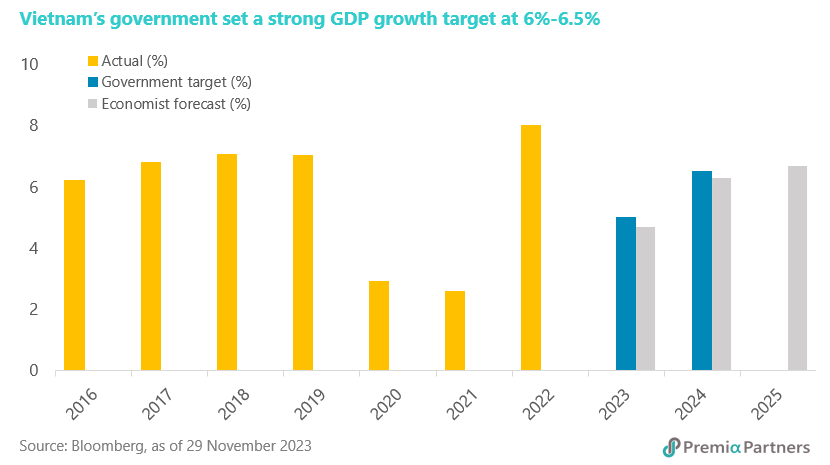

On track to the Government’s 5.0% GDP growth target for 2023. Vietnam’s GDP growth moderated in 2023 due to weaker exports to the US and the EU, which were experiencing slowing economic growth. The 9-month GDP growth rate was for Vietnam was 4.24%, but the 3Q GDP growth rebounded to 5.33%, making the full-year target of 5.0% set by the government still reachable.

60% y/y growth in manufacturing foreign direct investment in 1H2023, with the prospect of that FDI momentum continuing. Beyond 2023, future economic growth prospects will likely be supported by strong FDI flows into manufacturing, which saw a year-on-year increase of more than 60% in the first half of 2023, according to Vietnam Ministry of Planning and Investment. The FDI inflow momentum is likely to carry on after the visit of the US President, out of which both parties signed the Memorandum of Cooperation on Semiconductor Chains, Workforce and Ecosystem Development to help Vietnam become a global semiconductor powerhouse.

The Government is pushing for even stronger 2024 GDP growth – to 6.0%-6.5%. The government is also determined to push for strong growth in 2024, by setting the 2024 target at 6.0%-6.5%, which is higher than the 5.8% forecast by the IMF. According to the Bloomberg consensus, economists expect GDP growth at 6.3% and 6.7% in 2024 and 2025, respectively, due to emerging middle-class consumption; the reopening of tourism; and a surge of investments into the manufacturing sector.

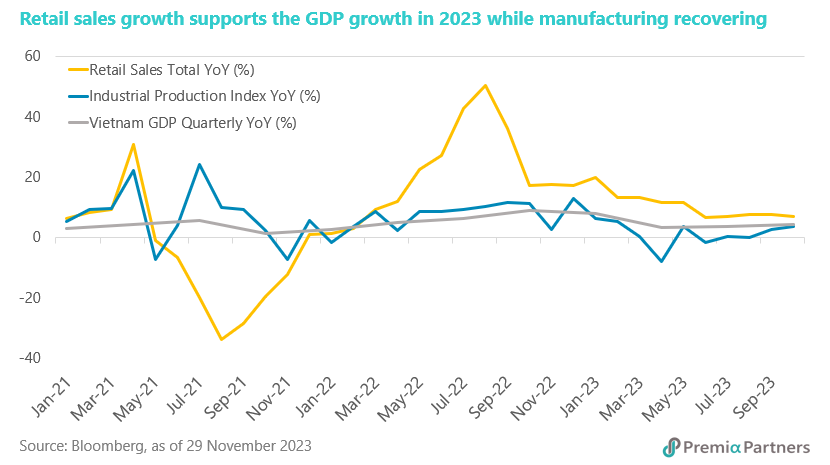

Salary reform – delivering a 32% increase in public sector wages with continuing increases of 7% thereafter – will deliver a huge boost to consumption growth. While manufacturing was hit by weak global demand in 2023, consumption countered as a key support to GDP growth in 2023. Retail sales growth held up above 6%. This strength is likely to continue from 2024 to 2026 as the National Assembly has passed a salary reform bill, which will lift the monthly average salary in the public sector by 32% in 2024, continuing to increase by 7% per year from 2025 onwards, until the lowest salary catches up with the private sector. This salary reform should give a huge boost to the number of middle-class households, which would, in turn, further drive retail sales growth.

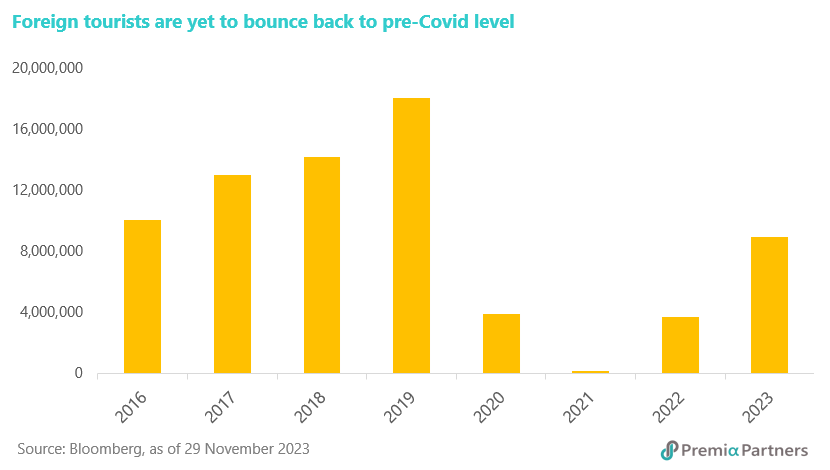

Continuing return of Chinese tourists will be another driver of economic growth. In tourism, the number of foreign visitors to Vietnam has yet to normalise from COVID. It is still at only around 70% of the pre-COVID level, mainly because China outbound tourist numbers have not yet normalised. As China's economic growth bounces back up, we expect the number of Chinese tourists to Vietnam will normalise, providing yet another driver for retail sales growth.

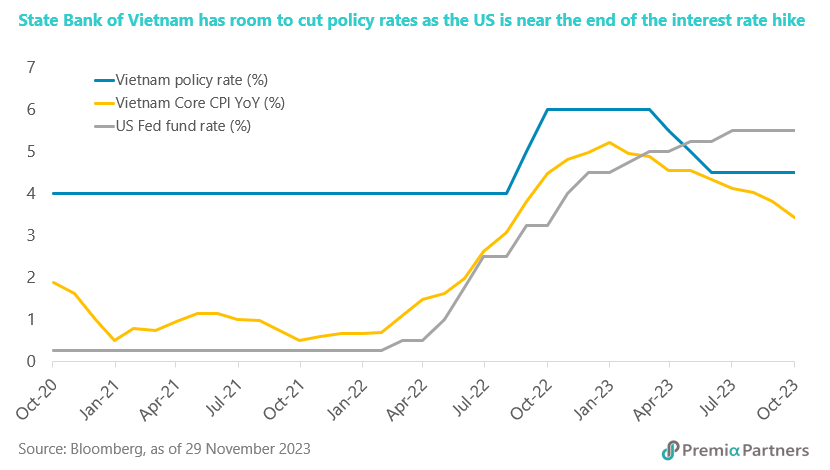

US Fed rate cuts in 2024 will make it safer for SBV to further cut rates without risking the Dong. On the monetary policy front, SBV is likely to maintain a relatively easy monetary policy to promote growth and credit demand due to favourable external and internal factors. One primary concern constraining the SBV from monetary easing in 2023 had been Fed rate hiking, as that could have resulted in a higher interest rate differential and risk of weakening of the Vietnamese dong. But with US inflation cooling and Fed expected to cut its interest rate in 2024, this barrier to further policy easing in Vietnam will be lowered. Easier monetary policy is also supported by the National Assembly, which asked the government to continue ensuring the stability of the monetary and credit markets while boosting loans with lower interest rates to support economic growth, according to the resolution passed by the legislature.

More rate cuts and more liquidity likely ahead for Vietnam. Given the CPI is mild at around 3%, economists expect that the SBV will lower the key refinancing rate by another 50 bps from its current 4.5%. Moreover, the SBV may stop issuing T bills, a measure that is used to drain liquidity from the system to rein in the local currency depreciation.

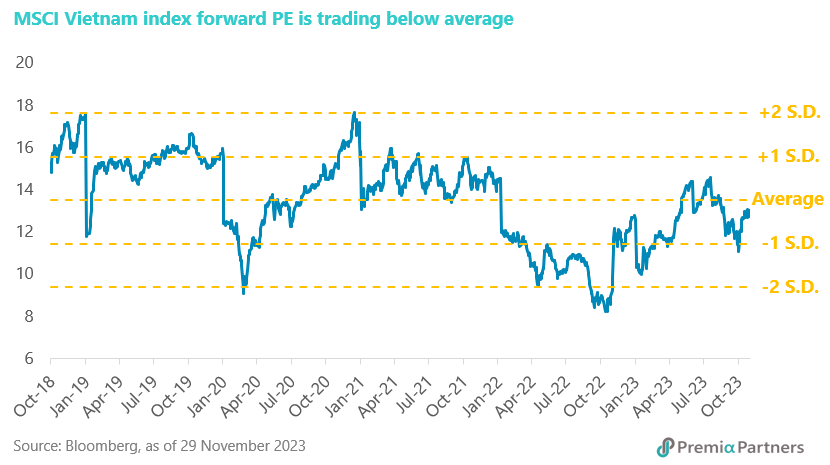

Forward PE of 12.9x against 25% estimated earnings growth for 2024. Long-term growth prospects and an easier monetary environment should translate into higher and more resilient corporate earnings, making the equities market look even more favourable at the current low valuation.

Analysts expect the EPS for the MSCI Vietnam index to bottom out in 1Q24, and the EPS for full year 2024 to increase by 25% year-on-year. The index 2024 forward PE is trading at 12.9x and below its 5-year historical average, indicating that the market is inexpensive, providing a good valuation buffer for investors.

The forward PE had previously traded at a lower level, around two standard deviations below the average, in 2020 and 2022. But those were exceptional years due to the pandemic and the anti-corruption campaign, which are unlikely to recur in 2024. Given the more pro-growth stance of the government and the US interest rate peaking out, we believe the valuation should be on the trend to trade above the average.

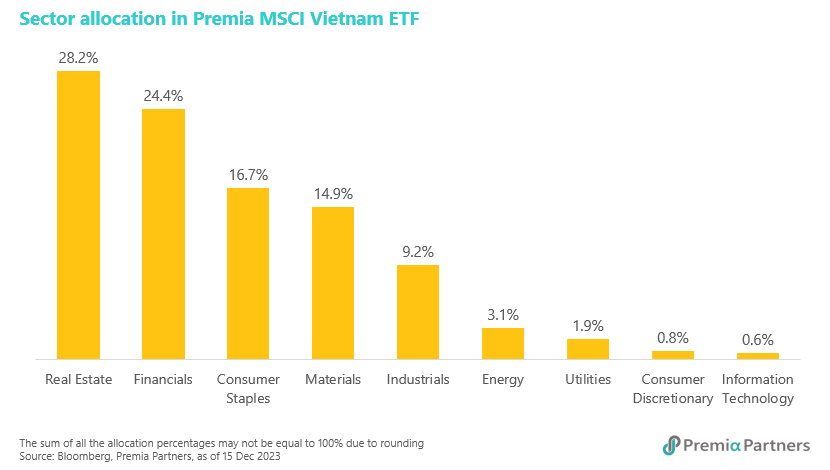

Our Premia MSCI Vietnam ETF which invests in Vietnam's largest and most liquid companies with currently 50 constituents provides a balanced sector exposure would be well positioned to capture Vietnam’s long-term economic growth and leading position in the supply-chain diversification.

As for allocating for the emerging ASEAN opportunities, our Premia Dow Jones Emerging ASEAN Titans 100 ETF would be a good tool to consider. It tracks the largest 100 companies in the ASEAN-5 markets of Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, and is the world’s largest ETF tracking the ASEAN region as of Dec 2023.