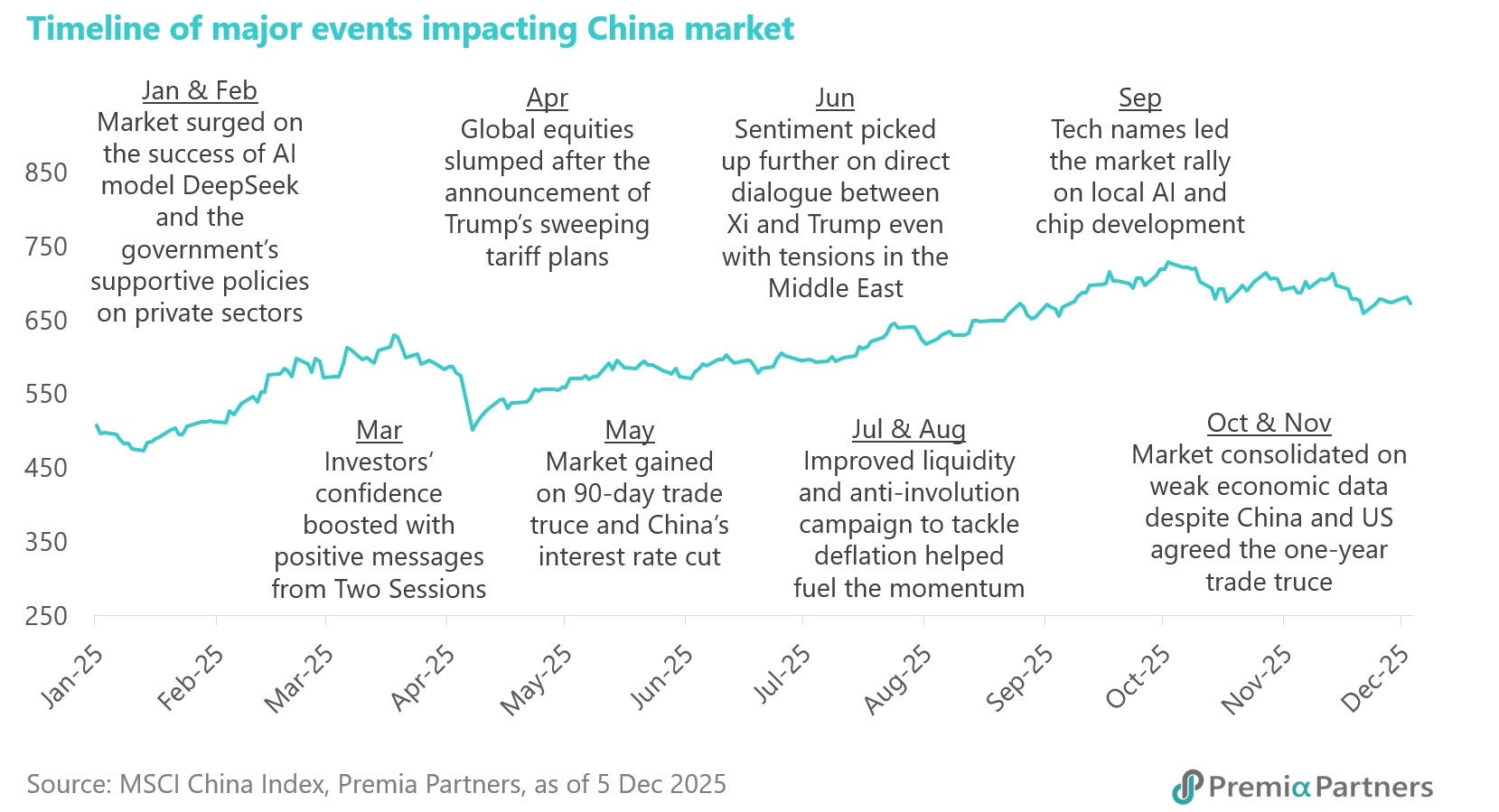

Chinese equities enter 2026 with renewed confidence following a solid two-year recovery. In 2025, onshore A-shares advanced over 22% while offshore H-shares gained 29%, marking a second consecutive year of double-digit returns despite a demanding macro backdrop. The year was dominated by unprecedented US tariff proposals, heightened geopolitical tensions, domestic deflationary concerns, and a still-fragile property sector. Yet the market proved resilient.

The emergence of locally developed AI models including DeepSeek, served as a catalyst that helped narrow the perceived competitiveness gap between China and global technology leaders. This momentum reinvigorated international interest in China’s innovation ecosystem and highlighted the country’s ability to adapt rapidly to new technological domains despite external constraints.

At the macro level, policymakers articulated a clearer stance throughout 2025, emphasizing private-sector vitality, industrial upgrading, and refined pro-growth measures. This alignment provided investors with greater predictability and boosted confidence that the policy cycle had shifted toward targeted stabilization and long-term support.

Looking ahead, consensus expectations suggest China’s GDP growth may ease moderately to around 4.5% in 2026, following two years of growth near 5%. External conditions are expected to improve after a turbulent 2025, supported by stabilizing US–China relations and resilient export competitiveness. Domestic demand remains the key variable, particularly the pace at which policymakers can re-stabilize the property market.

Despite the market rebound that has taken shape from September 2024, valuations remain attractive and far from stretched. With the broader market trading at a PEG ratio of roughly 0.97x, Chinese equities still offer meaningful headroom for significant upside in 2026. Besides, several structural drivers continue to underpin a constructive outlook for both equities and bonds: China’s deepening commitment to high-tech and manufacturing upgrading, an active “anti-involution” agenda to rationalize supply, a gradual reallocation of household savings into financial assets, improving geopolitics, and a strengthening RMB amid a weakening US Dollar cycle.

With foreign investors still structurally underweight China, these dynamics collectively enhance the market’s risk–reward profile, positioning Chinese assets to capture outsized gains should sentiment and capital flows continue to normalize.

Tech self-reliance & advanced manufacturing: Structural engines of growth

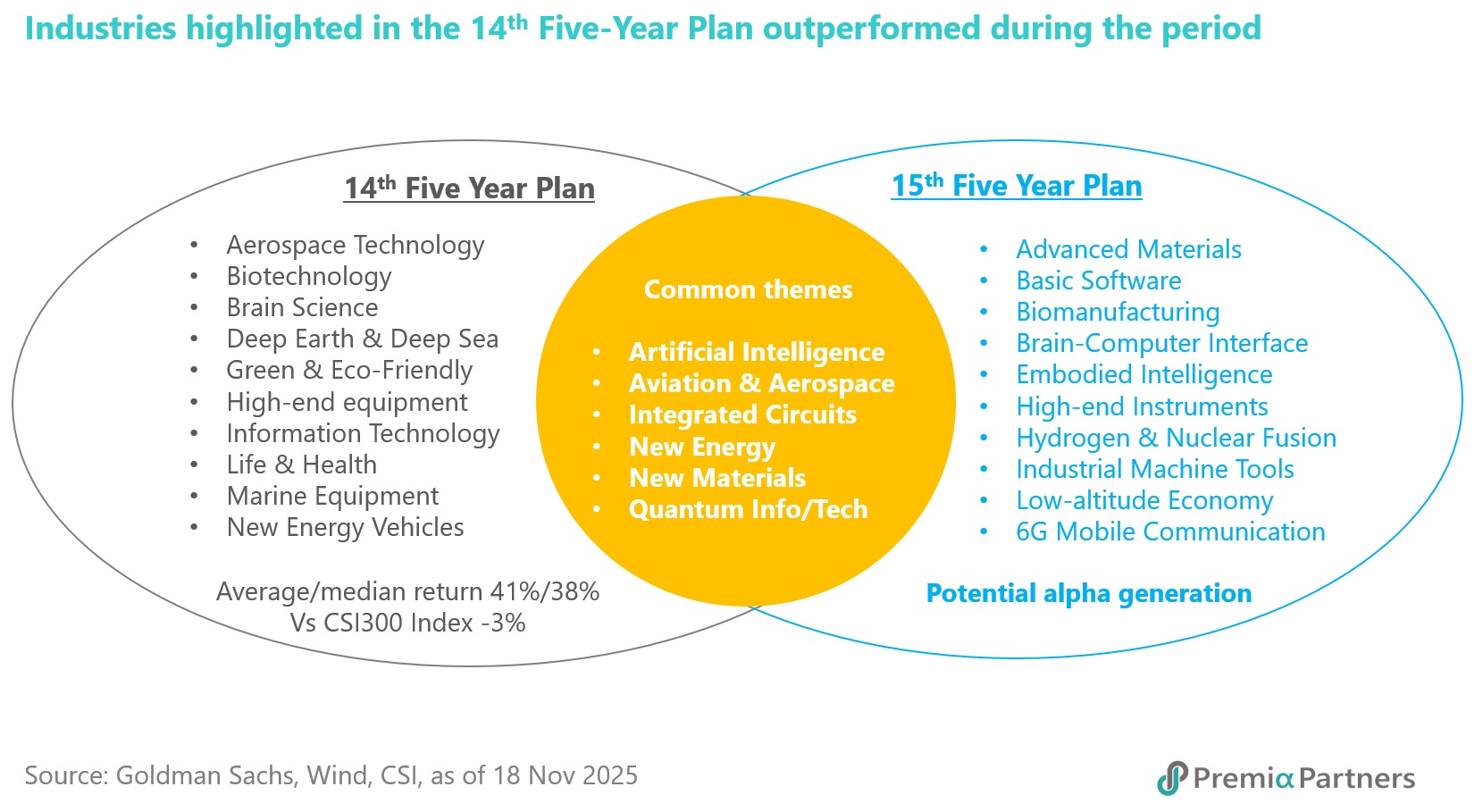

China is now harvesting the returns from decades of investment in innovation, industrial capabilities, and human capital. With the 14th Five Year Plan concluding in 2025, early directives for the upcoming 15th Five-Year Plan (2026–2030) highlight an even stronger commitment to technological self-reliance and innovation-driven growth. Priorities include advanced digitalization and automation, new energy and low-altitude economies, and emerging frontier technologies such as quantum computing, bio-manufacturing, hydrogen and fusion energy, brain–computer interfaces, and embodied intelligence — domains where China already provides distinctive and cost-effective solutions.

Evidence of China’s progress is increasingly well-documented. The Information Technology and Innovation Foundation (ITIF) highlights China’s expanding share of global scientific publications and patents, reflecting the breadth and maturity of its research momentum. Robust advancement is particularly visible in robotics, advanced batteries, clinical biotech trials, quantum communications, artificial intelligence, and advanced materials—areas benefiting from both long-term strategic investment and an increasingly sophisticated commercial ecosystem.

History also shows that sectors highlighted as strategic priorities in earlier Five-Year Plans—such as electric vehicles, high-end equipment, integrated circuits—have often been among the strongest performers in the years that followed. This pattern reflects the alignment of sustained policy support, coordinated capital expenditure, and accelerating commercial adoption. With similar innovation-led themes re-emerging as focal points of the upcoming 15th Five-Year Plan, investors may again find that tracking policy-backed industries offers a useful roadmap for identifying areas of structural growth and potential outperformance.

The strong debut performance of the recent AI chipmaker IPOs in the STAR market highlighted investors’ enthusiasm towards domestic semiconductor stocks. On their first trading days, Moore Threads Technologies’ share surged to RMB 600.5 from its offering price at RMB114.28 whilst MetaX Integrated Circuits jumped to RMB 829.9 from the initial level at RMB104.66. Beijing-based Moore Threads has unveiled a suite of new products, including its next generation of chip architecture and artificial intelligence processers as it seeks to challenge global leaders Nvidia and Advanced Micro Devices. Its forthcoming chips, “Huashan” for AI training and interference and “Lushan” for high-performance graphics processing, are scheduled to enter mass production in coming months. Shanghai-based MetaX is currently developing its flagship C700 GPU, which aims to deliver computer power, storage capacity, communication capabilities, and energy efficiency approaching the level of Nvidia’s H100 series.

For investors interested in opportunities arising from China’s growing independence in hardcore technology which often are missing in mainstream strategies, our Premia China STAR50 ETF would be the ideal tool to position for the leading cohort. Indeed, STAR market has already delivered significant outperformance over the broad A-share market in 2025, reflecting investor preference and capital flows towards innovative stock exposure within the onshore market. While China’s self-sufficient chip ecosystem is still in its formative stage, this phase offers a timely window for investors to participate in its long-term build out. Meanwhile, Reuters reported that Chinese scientists in early 2025 completed a prototype of an extreme ultraviolet lithography (EUV) machine capable of producing chips that power AI, smartphones and weapons, with the government targeting commercial production of working chips on the prototype by 2028.

In robotics, China has moved decisively ahead in the race to develop humanoid robots, filing 7,705 patents over the past five years, compared with 1,561 in the US and 1,102 in Japan. China also enjoys a clear cost advantage in robot manufacturing, with analysts estimating that building a supply chain for Tesla’s Optimus Gen2 would cost nearly three times as much without China’s participation. The G1 humanoid, developed by the leading Chinese firm Unitree Robotics, is among the most visible and accessible humanoid robot globally. China accounted for 54% of global industrial robot installations, more than the rest of the world combined, driven by the rapid expansion of its domestic robotics industry. Looking ahead, Morgan Stanley estimates the humanoid market could reach USD5tn by 2050, with around 930 million units deployed in primarily industrial and commercial purposes. China is expected to lead adoption with about 302 million units in use, followed by the US at 78 million.

On the other hand, Chinese biotech sector also continues to be on significant tailwind, with more licensing out deals in the pipeline amid what could be the most significant global patent cliff in the pharmaceutical history. According to DrugPatentWatch, from 2025 and 2030, a cohort of the world’s top-selling drugs are set to lose market exclusivity, placing over US$200-230 billion in annual revenue at risk for Western pharmaceutical companies. Chinese biotech companies, with burgeoning portfolios of novel therapies, have emerged with high-potential assets and as source for important innovations. Upfront payments from these licensing out deals would continue to drive meaningful positive earning revisions for the Chinese biotech leaders with strong research and assets.

Anti-involution campaign: A catalyst for reflation

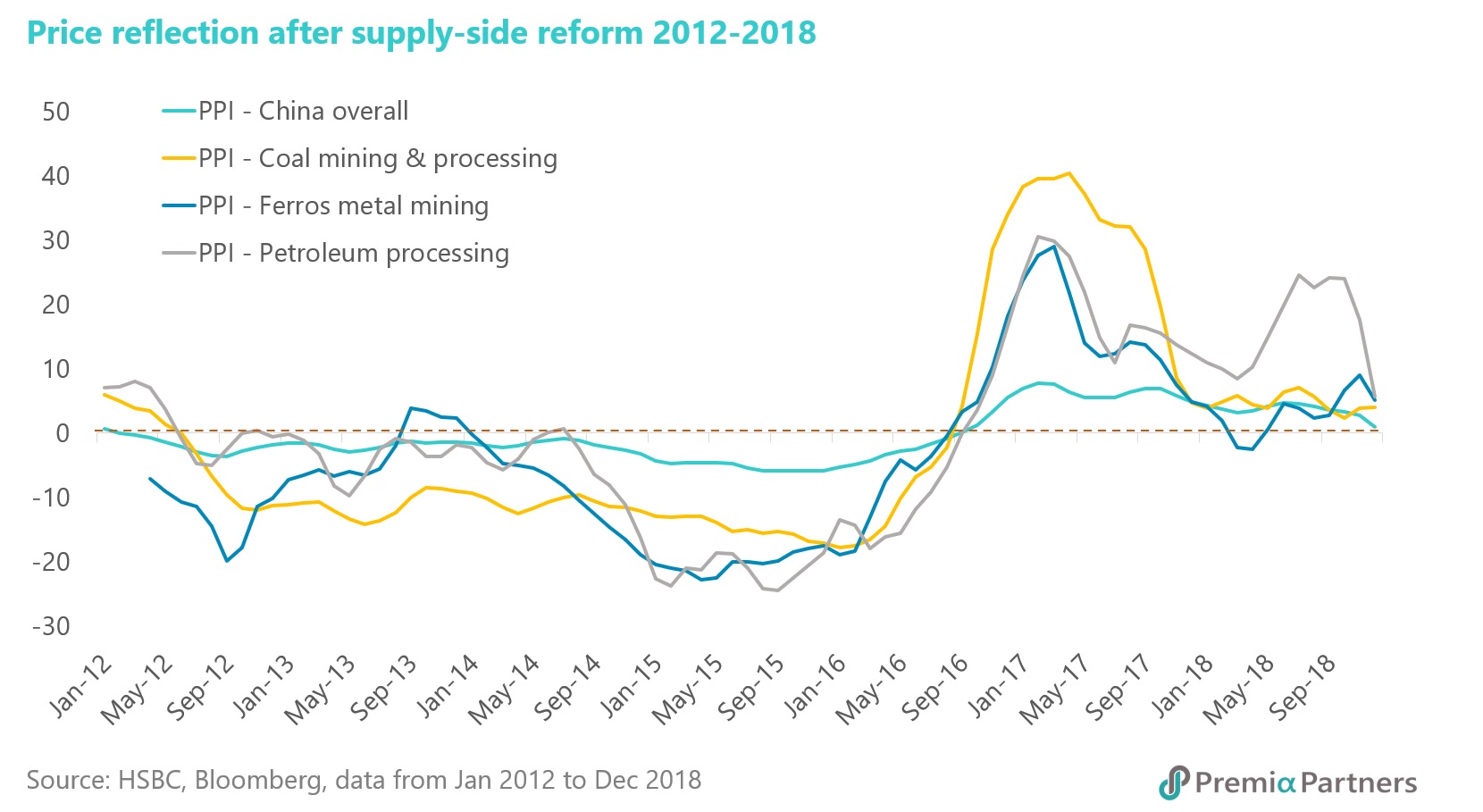

A central policy theme for 2026 is the “anti-involution” campaign aimed at addressing excess capacity, restoring pricing power, and improving sector profitability. With overcapacity concentrated in private-sector industries, authorities are encouraging consolidation through guided mergers and acquisitions, quota systems, and orderly capacity retirement. Several industries, such as steel, coal, solar, and EVs, have already begun implementing measures.

Historical precedent—from supply-side reforms in 2015–2016—shows that reducing overcapacity can help ease deflationary pressures and lift profitability. While the impact this cycle remains to be confirmed, initial indicators are encouraging, e.g. polysilicon prices have rebounded nearly 50% in recent months as supply and demand move towards better balance. Ultimately, the effectiveness and durability of the anti-involution drive will hinge on consistent policy enforcement, potential tax and fiscal reforms, and the authorities’ ability to balance longer-term structural rebalancing with the need to preserve near-term growth—particularly if economic momentum softens and cyclical easing becomes necessary. We believe that a successful anti-involution rollout would support reflation, corporate margins, and broader equity market sentiment through 2026. For example, the Premia CSI Caixin China New Economy ETF is estimated to deliver earnings growth of 18.4%, versus 14.6% for the CSI 300. Should capacity disciple translate into stronger-than-expected earnings improvement, this would create scope for further valuation re-rating and additional upside.

Domestic capital returning: A structural shift in asset allocation

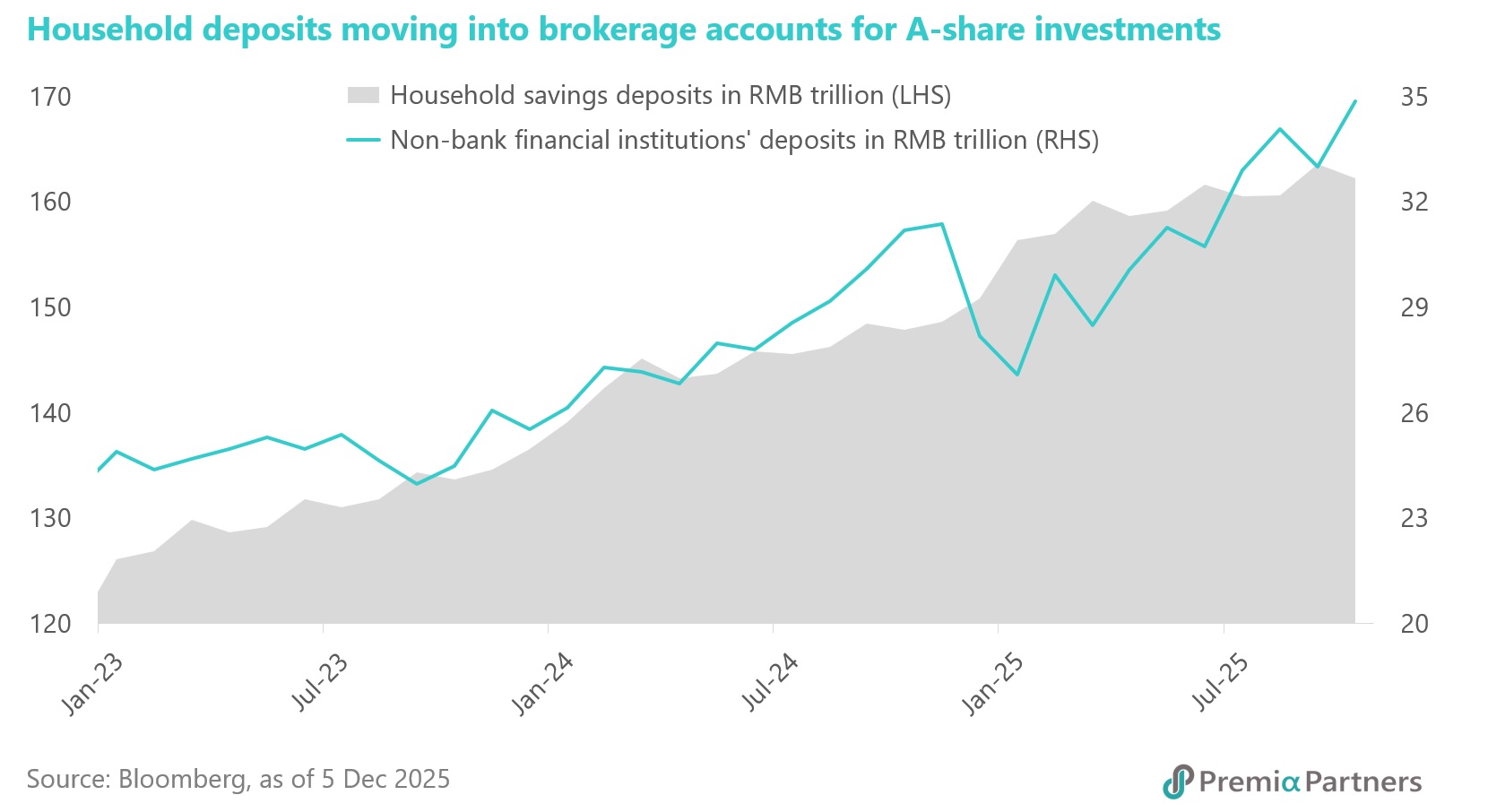

The strengthening onshore equity market in 2025 helped bring domestic investors back, as reflected by rising market turnover in the second half of the year. A key driver is the steady decline in deposit interest rates, which has led households to reallocate savings from traditional deposits toward higher-return assets. The People’s Bank of China (PBoC) data shows slowing growth in retail bank deposits and rising flows into non-bank financial institutions, including brokerage accounts—indicating increasing investor readiness to re-enter the equity market.

The narrowing gap between M1 and M2 growth further underscores a rising preference for liquidity among households, historically associated with sustained equity market participation. With three-year deposit rates having fallen from above 3% in 2022 to around 1.6% today, conservative savers are increasingly turning to financial markets in search of returns. Against this backdrop of declining deposit rates and rising investor participation, the Premia CSI Caixin China Bedrock Economy ETF would be a useful investment instrument, with its underlying benchmark yielding 3.57%.

Institutional flows also strengthened meaningfully. Regulatory guidance encouraged large state-owned insurers to allocate 30% of new policy premiums to onshore equities, while increases in equity investment limits and reduced capital charges improved insurers’ capacity to hold stocks. Equity allocations reached the highest level since 2022, and analysts expect inflows to continue into 2026. Bloomberg Intelligence estimates insurers could add RMB 1.0–1.5 trillion to equity holdings by end-2026—helping reinforce market stability and depth.

Geopolitics and the RMB: A more supportive external environment

Geopolitical sentiment improved after China and the US reached a one-year trade truce agreement in October. Although several components of the framework—such as commodity purchase commitments and licensing arrangements—remain in progress, the rollback of certain export controls and the resumption of high-level dialogue signal stabilizing relations. US President Donald Trump’s acceptance of an invitation to visit Beijing in April and an invitation extended to President Xi for a US state visit further indicate a less confrontational backdrop in 2026. For markets, this implies reduced headline risks and lower volatility for risk assets.

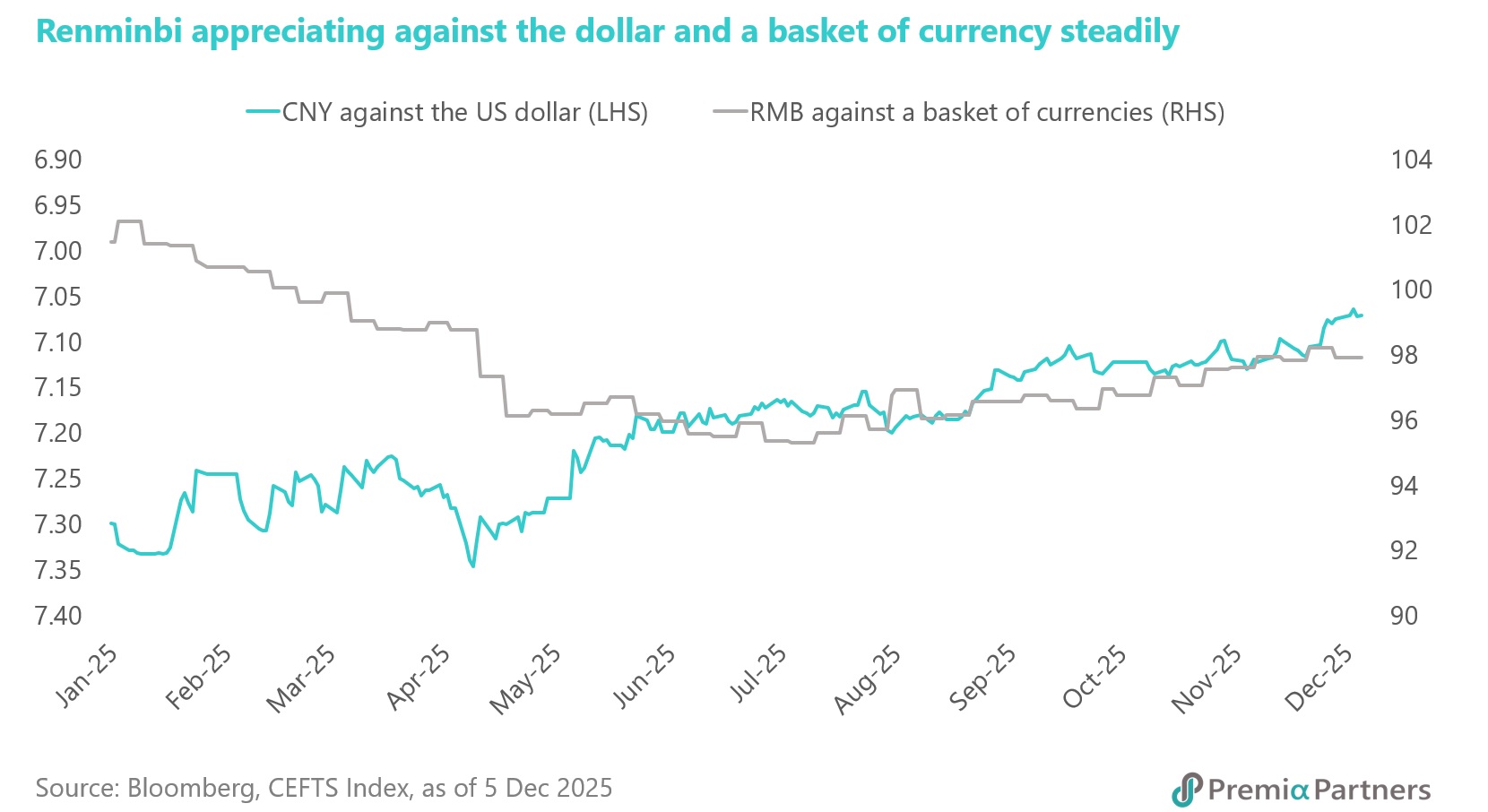

The RMB delivered its strongest annual performance in five years during 2025, supported by improving sentiment toward Chinese assets and expectations of prolonged USD weakness. Major institutions such as Goldman Sachs and Morgan Stanley now forecast USD/CNY in the range of 6.7–6.9 over the next 12 months. State-owned banks have also established option positions supportive of RMB appreciation, contributing to currency stability.

International investors, meanwhile, are rebalancing away from USD-based assets as the Federal Reserve enters a new easing cycle. Concerns around increasing concentration risk in US equities are also prompting diversification into under-owned markets such as China. While foreign investors remain cautious on policy and property-related risks, recent behavior shows measured confidence returning to onshore industrials and selective tech sectors. Many now view the recent consolidation as a healthy pause within a multi-year reallocation cycle back into China.

China government bonds: A renewed opportunity in 2026

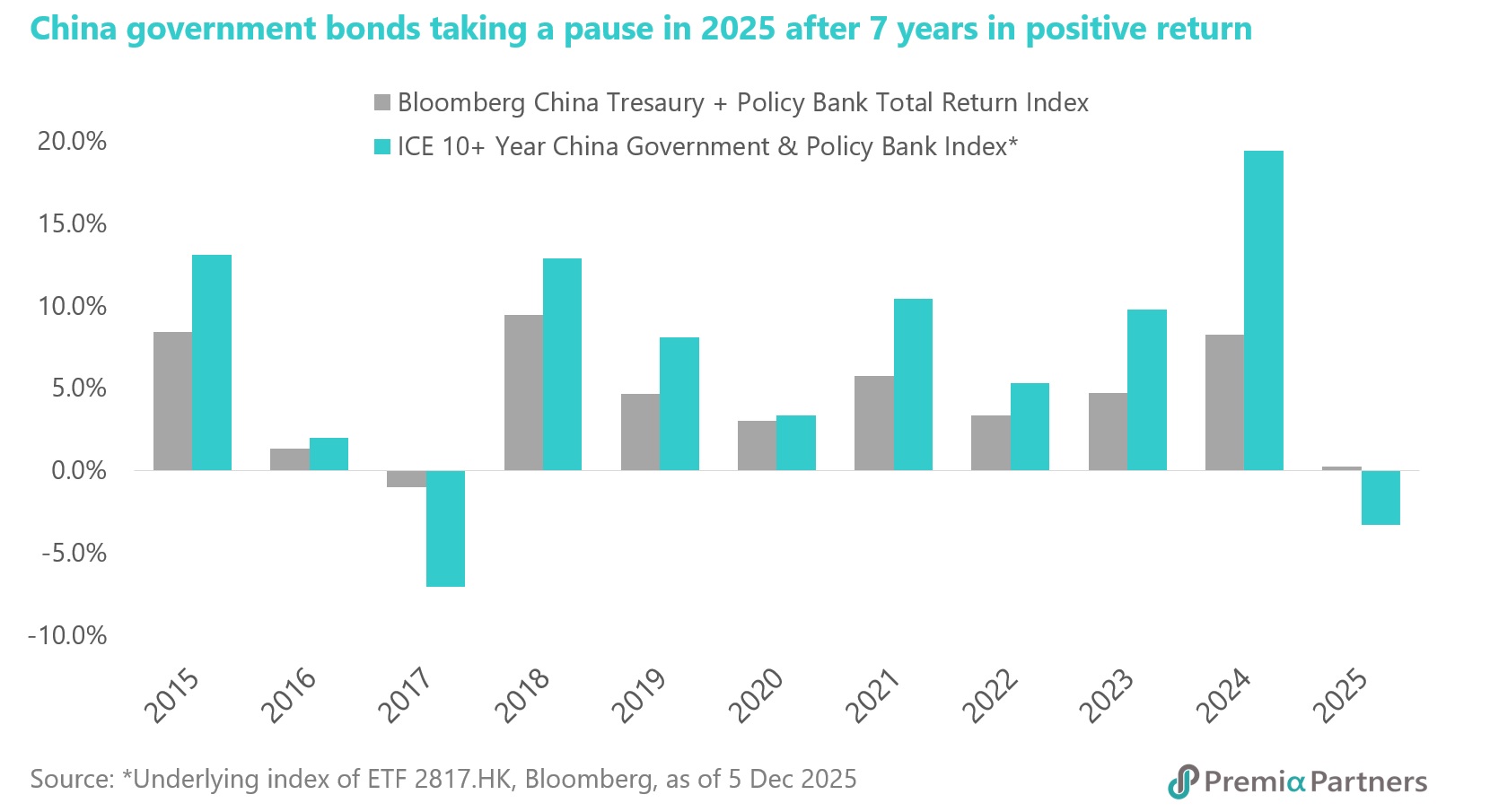

After delivering ~5.6% annualized returns for seven straight years since 2018, China government bonds (CGBs) paused in 2025 as expectations of increased supply, cautious PBoC easing, and renewed interest in equities pushed yields modestly higher. While the central bank shifted its stance from “prudent” to “moderately loose,” policy actions remained measured, with only a 10-basis-point policy rate cut and a 50-basis-point RRR cut during the year. Officials emphasized credit efficiency over quantity, cautious stimulus to avoid long-run distortions, and support for key sectors facing weak demand and property-related challenges.

Looking ahead, the outlook has turned more constructive. Several major global asset managers expect China’s 10-year government bond yield to decline by 20–25 bps in 2026, potentially revisiting or dipping below previous historic lows. With uneven economic recovery and disinflationary pressures, policymakers have room to lower rates at a measured pace as part of a broader easing package. If this scenario materializes, the Premia China Treasury and Policy Bank Bond Long Duration ETF would likely benefit the most, as its long-maturity feature is particularly sensitive to any downward shift in yields. The PBoC’s resumption of bond purchases in October 2025 provides an additional tailwind. Currently holding around RMB 2.1 trillion (5.4% of outstanding CGBs), the central bank could gradually increase its share toward 10%—equivalent to roughly RMB 200 billion of net purchases per month.

Structural demand also looks set to strengthen as the next phase of RMB internationalization gains momentum under the 15th Five-Year Plan. Beijing aims to expand CNY usage in trade settlement, promote CNY-financing by overseas entities, and deepen offshore markets such as panda bonds and dim sum bonds. Recent reforms granting global investors full access to China’s onshore repo market have amplified demand by enabling foreign institutions to obtain low-cost CNY liquidity against their CGB holdings. Since the reform’s implementation in September, foreign participation in repo transactions has surged alongside renewed net buying of China government bonds.

Expressing the China view: Premia Partners’ targeted and cost-efficient ETF Suite

Premia Partners offers a range of China-focused ETFs designed to help investors implement both strategic and tactical views across equities and fixed income:

A concentrated portfolio of 50 leading innovation-driven companies listed on the STAR Market. It captures emerging opportunities in China’s hardcore technologies—including AI, semiconductors, humanoid robotics, biotechnology, and renewable energy. It remains the largest STAR50 tracker globally and offers the lowest total expense ratio among international peers.

• Premia CSI Caixin China New Economy ETF

A diversified basket of ~300 growth-oriented stocks in new-economy sectors such as technological innovation, industrial automation and robotics, life sciences and ageing-related industries, and consumption upgrades. Our flagship all-cap strategy is well-positioned to benefit from structural trends under the 15th Five-Year Plan (2026-2030).

• Premia CSI Caixin China Bedrock Economy ETF

A multi-factor strategy investing in ~300 leading names across government-supported industries. Through factors such as quality, value, size, and low volatility, it has delivered over 40% cumulative return in the past five years—far exceeding the ~2% gain of the broad A-share market.

• Premia China Treasury and Policy Bank Bond Long Duration ETF

A unique global fixed income solution focusing on the long end of China’s yield curve. The fund invests in A1-rated sovereign and policy bank bonds with maturities above 10 years and has delivered over 42% total return since its 2020 launch.

• Premia China USD Property Bond ETF

A specialized income strategy investing in USD bonds issued by Chinese property developers. It offers a yield above 10% with a coupon of around 5.8%. Supported by the forthcoming Fed easing cycle and early signs of sector stabilization, the ETF provides a compelling income opportunity with potential recovery upside.