Global supply chains still rule. After the bluster, the Trump Administration has settled on new tariffs that were much lower than initially threatened. The Trump Administration got the disguised consumption tax it needed to fund tax cuts for wealthier Americans. Yet, it did so without emptying retail shelves or driving inflation up sharply and suddenly, and it left Emerging ASEAN pretty much where it was before the Tariff turmoil – as an integral part of global supply chains under the China+1 strategy.

Despite the US narrowing the tariff differential between China and Emerging ASEAN, the China+1 strategy – and its benefits for ASEAN – will not go away. Global corporations will still want to hedge and diversify their supply chains, and they are not about to walk away from the investments they have already sunk into ASEAN.

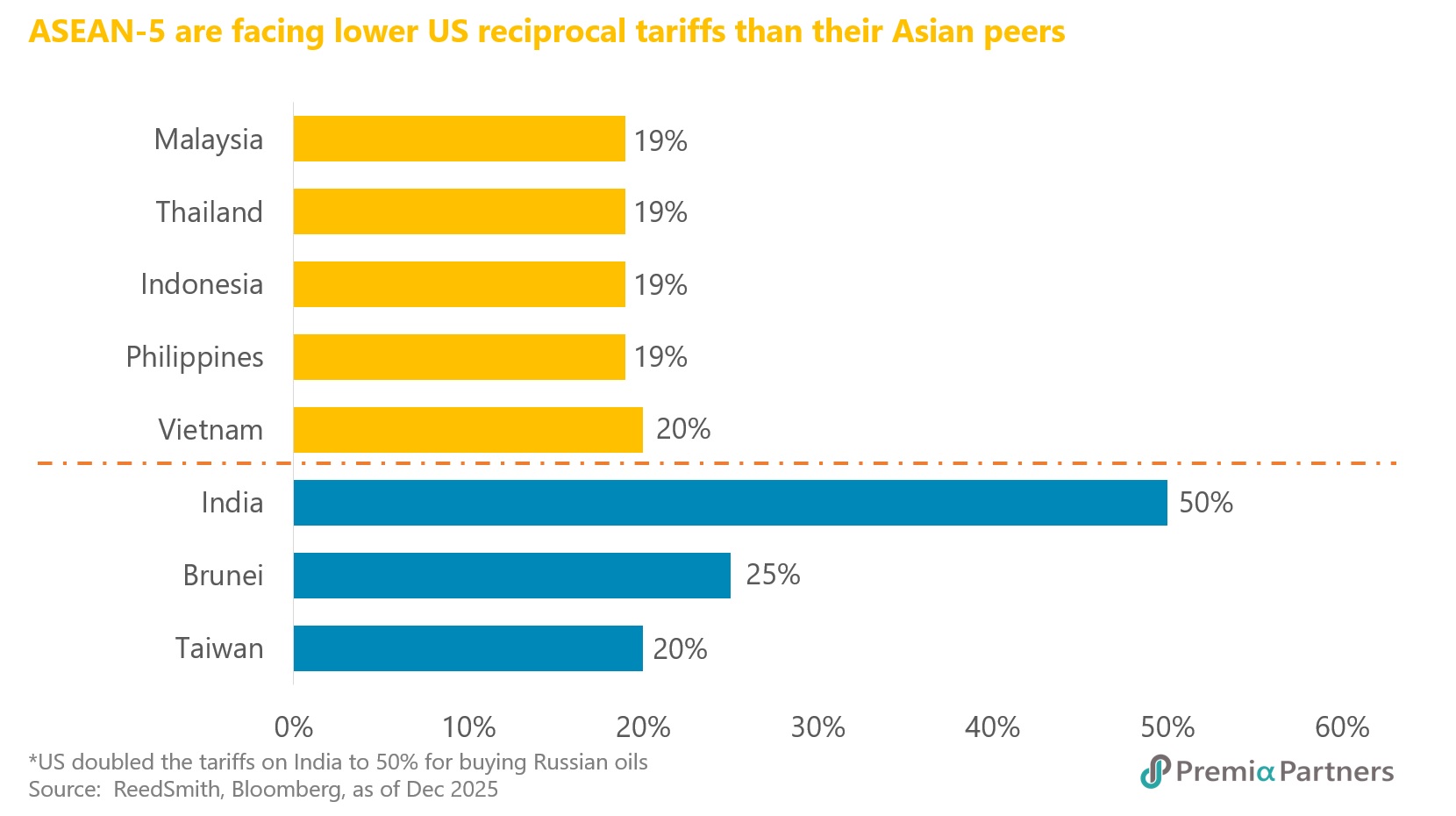

The new “reciprocal” tariffs are now 19% for Malaysia, Thailand, Indonesia and the Philippines, and 20% for Vietnam. But note that for Malaysia, because of exemptions for a basket of products, most notably semiconductors, the effective tariff is lower.

The travails of the Trump tariff twists and turns tell us that China has embedded itself as the indispensable global manufacturing power. There are no immediate substitutes for the volumes, range, complexity and competitiveness of the products the US needs to import. Emerging ASEAN which is a major supplier of the global manufacturing value chain is expected to continue to gain traction on the other hand.

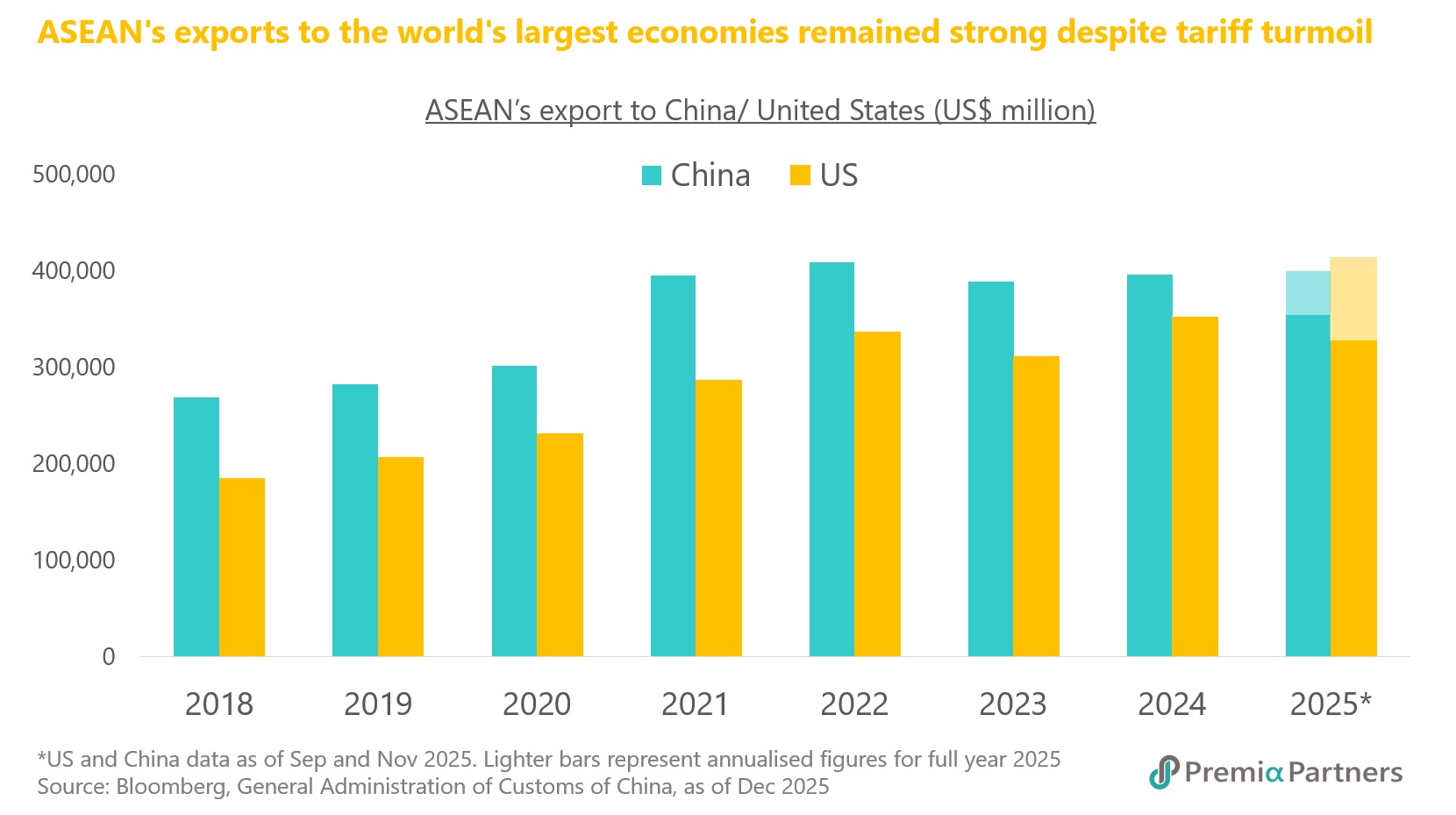

Resilience in the face of higher tariffs – the latest data showed ASEAN exports to the US were up 23% year-on-year. Just as ASEAN had increased its market share of both Chinese and US goods imports between 2018 and 2024, the region appears well positioned to continue to grow its exports strongly despite the tariff turmoil of 2025.

Recent research by the Lowy Institute found that ASEAN total goods exports were 15% higher in October 2025 than the same time in the preceding year, and ASEAN’s goods exports to the United States were around 23% higher in September 2025 compared to the same time in 2024. Vietnam and Thailand led the way, with US-bound exports surging by about 30% compared to last year. The recently signed Reciprocal Trade Agreement (RTA) between Malaysia and the US also reduces trade uncertainty, with Malaysia being the first economy in ASEAN to sign a deal.

Policy stimulus to offset the impact of higher US tariffs.

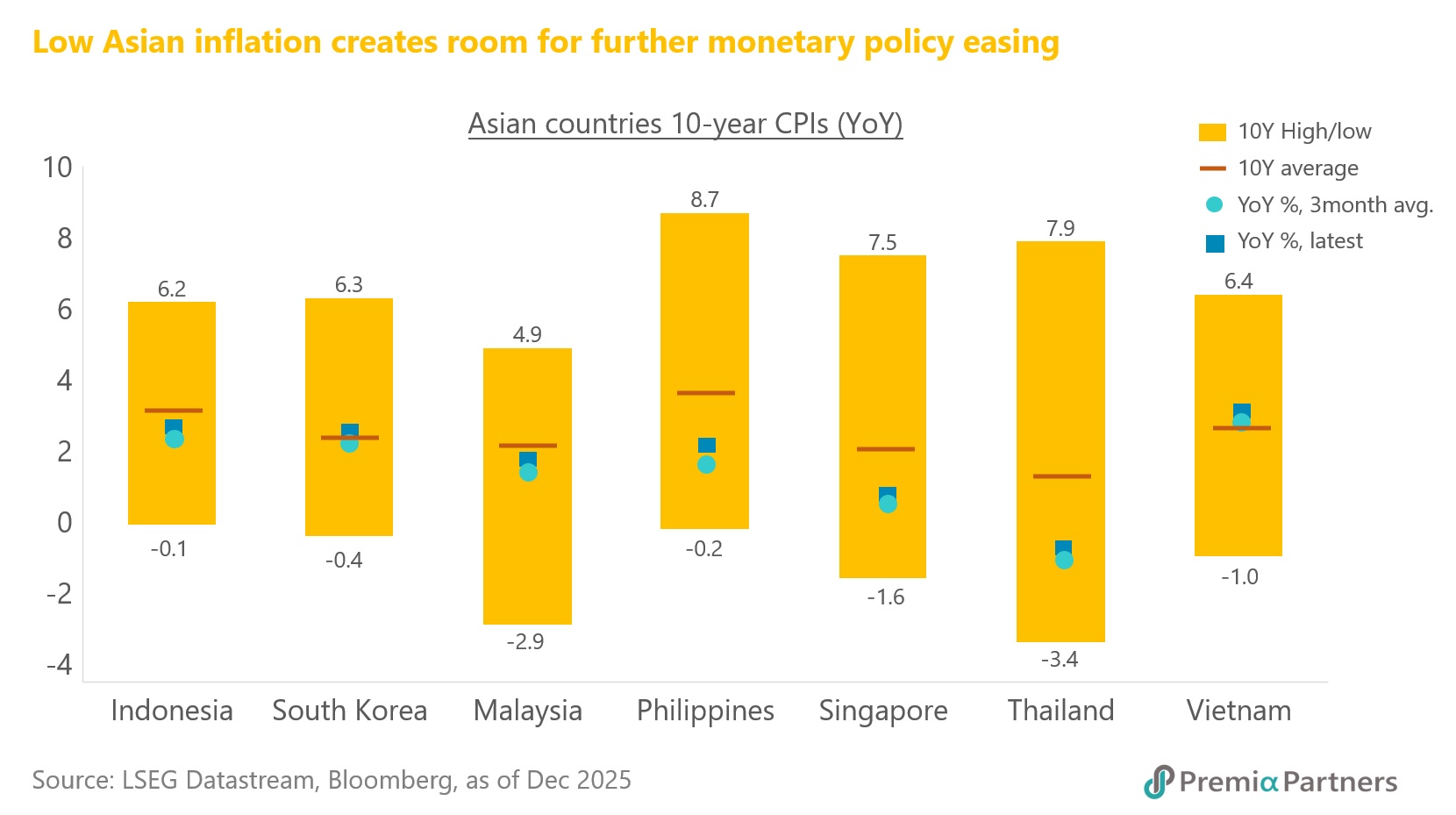

That said, the higher US tariffs will slow economic growth in Emerging ASEAN in 2026. Offsetting that, big interest rate cuts in 2025 in the Philippines, Thailand, and Indonesia will provide policy buffers against tariff-induced downside pressures on economic activity.

Looking ahead, more rate cuts are expected for the Philippines, Thailand, and possibly Indonesia, to add to the stimulus from 2025. The IMF forecasts higher GDP growth for the Philippines, that is 5.7% for 2026, up from 5.4% in 2025. It expects stable 4.9% growth for Indonesia, and it is looking for slower, but still robust, growth for Vietnam (5.6% in 2026 vs 6.5% in 2025) and Malaysia (4.0% in 2026 vs 4.5% in 2025). Thailand is expected to weaken from 2.0% to 1.6%.

In fact, fiscal policies are expected to play much larger role in 2026. Indonesia’s growth may tick up thanks to greater fiscal spending. In Thailand, a looming election could mean renewed delays in fiscal disbursements, though exports have been a surprising bright spot. Malaysia remains among the star performer, not only continuing to gain global market share in sectors like electronics, but also being a magnet for tourists that help power services. Vietnam which was the best performer in the region in 2025 (full year USD return of Premia Vietnam ETF was 73% vs broad market VN-Index of 39%) is expected to stay the course with robust export growth, and vigorous reforms under Resolutions 68 and 198 which would fuel private sector growth and creation of globally competitive national champions.

Consumption across Emerging ASEAN, including Thailand, Indonesia, the Philippines, Malaysia and Vietnam, also showed a strong recovery driven by low inflation, stable employment, recovering tourism and government stimulus, though the pace varied. Indonesia and Vietnam led with robust domestic demand, while Thailand saw slower recovery with improved sentiment late in the year, and the Philippines experienced slower growth hampered by natural disasters.

Tailwinds from likely weakening of the US Dollar, as a result of Fed rate cuts. The rise in the S&P 500 for much of 2025 followed the path of the inverse of the Dollar Index DXY, and that weakening of the Dollar has already eased financial conditions in Emerging Markets in 2025. If the Fed follows through with more rate cuts in 2026, as expected by the futures market, it will put more downward pressure on the Dollar, and that could provide tailwinds for Emerging Market assets in general – by easing fears of local currency depreciation; creating space for more accommodative fiscal and monetary policies; easing imported inflation; reducing US dollar debt burdens in local currencies; boosting USD commodity prices; encouraging portfolio inflows in search of higher returns; and improving USD returns from EM investments.

Emerging ASEAN valuations have priced in a lot of the negative tariff news. The Dow Jones Emerging ASEAN Titans 100 Index, the underlying index for the Premia Dow Jones Emerging ASEAN Titans 100 ETF, is trading at a forward PE of only 13.1x. Against an expected forward earnings growth rate of 9.4%, the PEG multiple is under 1.4x. This is similar to the PEG for the S&P 500, but Emerging ASEAN is among the highest dividend paying markets in the world. The Dow Jones Emerging ASEAN Titans 100 Index currently has an expected forward dividend yield of 4.2%, offering an income buffer against the impact of price volatility.

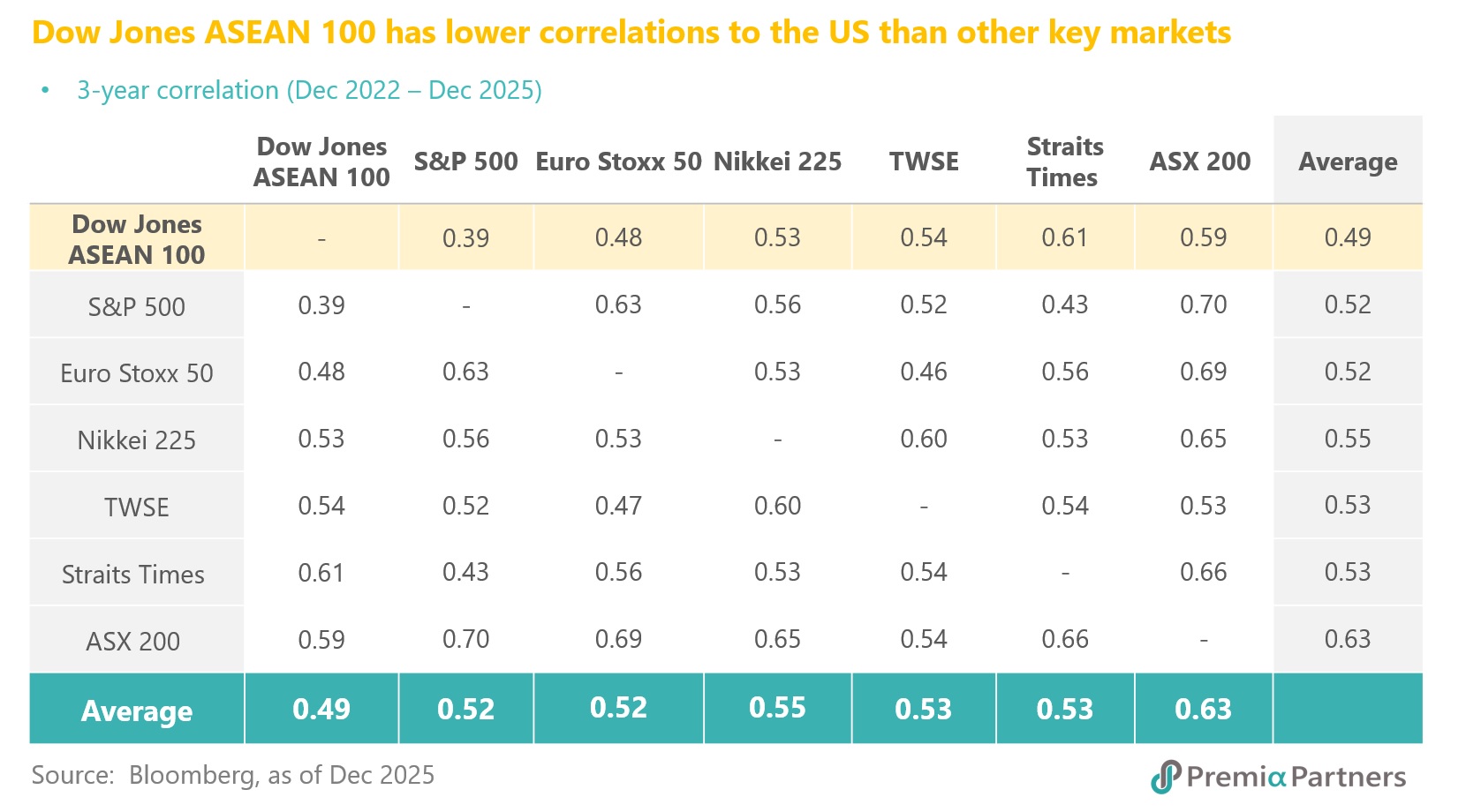

Emerging ASEAN in the search for lower correlations – for diversification out of the S&P 500. The Dow Jones Emerging ASEAN Titans 100 Index has a significantly lower 3-year correlation to the US than many other key markets – for example, Europe, Japan, Taiwan and Australia – offering diversification value.

Diversification away from MSCI ASEAN’s heavy weighting in three Singapore banks under headwinds from falling rate environment. Within ASEAN, Singapore carries an oversized weight of 45% in MSCI ASEAN, and apart from its market’s slightly higher correlation to the US compared to Emerging ASEAN, it is also in the midst of a growth slowdown, taking the IMF’s forecast for GDP growth from 2.2% in 2025 to 1.8% in 2026.

Note also that MSCI ASEAN is heavily weighted towards Singapore banks, with DBS, OCBC and UOB accounting, in aggregate, for around 22% of the index, and that worked well in 2024 and 2025, when DBS outperformed the S&P 500. Such concentration risk is a double edged sword– three banks accounted for 22% of the index and only one bank (DBS) substantially outperformed the S&P 500 in 2024 and 2025. (UOB underperformed in both years and OCBC outperformed only slightly.)

In fact, outperformance by DBS Bank against the S&P 500 already narrowed dramatically in 2025 compared to 2024. The market may have seen “peak Singapore banks”, with most of the positives likely already in the price while headwinds from falling rates and reduced earnings kick in.

ASEAN has very different growth engines from rest of the world. Within the bloc, Vietnam is the market for which most analysts including JPMorgan, HSBC and Standard Chartered have the highest ratings, and expect to be one of the fastest-growing economies in the region, with GDP growth potentially reaching 6.7% or more in 2026.

On the other hand, political uncertainty in Thailand pointed to more cautiously optimistic outlook for 2026. That said, Citi strategists maintain that the investment case for Thailand remains solid, recommending investors focus on sectors with stable earnings like banks, telcos, consumer staples and healthcare for their resilience against economic headwinds – which are also where the Thailand sleeve of our Premia Dow Jones Emerging ASEAN Titans 100 ETF focuses on. In fact, the Thai stock market's valuation premium has already largely disappeared, leading some analysts to view it as a "dividend play" with a current yield of around 4.0%-4.5%, which is attractive to some investors seeking income.

The Philippines in fact has the most mixed views with HSBC and JPMorgan maintaining overweight call where analysts see as a potential "superstar" in Asia with highest GDP growth in ASEAN at around 6.7% in 2026. They emphasize the country's young, working population and two decades of strong reforms as key tailwinds, and the risk-reward balance as attractive and expect equities to be resilient despite elevated political risk premiums.

For Indonesia, the new administration taking office in early 2026 is expected to continue pro-growth, reform-oriented policies which are set to support economic growth in 2026 to above 5%. Resilient consumer spending, supported by a large and young population, also remains a key driver for overall economic stability. In addition to monetary easing and fiscal policy support, Danantara, the new sovereign wealth fund is also coming into play. Its key objective is to manage the country’s State-Owned Enterprises (SOEs) efficiently, and act as a vehicle for investment in strategic sectors.

While Malaysia offers an attractive risk-reward profile for 2026, with expected capital returns of 7% to 8% and dividend yields above 4%. It is expected to benefit from a continued push for infrastructure and data centres, and the still-elevated AI-driven demand.

Finally for Vietnam, most analysts maintain a positive outlook for 2026 notwithstanding the stellar 2025 performance. Strong economic and corporate earnings growth are expected to continue to drive market performance (GDP growth forecast by HSBC Private Bank: 6.7%; Standard Chartered: 7.2%). Even after the strong 2025 performance, the market's forward price-to-earnings (P/E) ratio is considered modest (around 10.3x for 2026) compared to regional peers and historical averages, leaving room for further upside potential. Meanwhile, Vietnam also benefitted from surging AI-driven demand, and its electronics exports to the US alone jumped 150% in 2025, pushing Vietnam’s total exports to the US up by 30%.

The mandate under Resolution 68 to nurture national champions, and the anticipated upgrade of Vietnam's market status from "frontier" to "emerging" by FTSE Russell in March 2026 is also expected to attract meaningful passive flows for large cap leaders where the Premia Vietnam ETF is particularly well positioned for.

As volatility heightens in 2026 and investors turn more cautious towards expensive markets, for investors looking for diversification tool, our Premia Dow Jones Emerging ASEAN Titans 100 ETF would be an ideal tool.

Additional Broker/Analyst Insights (Including Deutsche Bank & Citi)

- Deutsche Bank1: Maintains a broadly constructive outlook for global equities in 2026, driven by AI demand and double-digit earnings growth forecasts. Their analysis emphasizes themes relevant to both the Philippines and Indonesia, such as growth in construction, utilities, and industrial/basic materials sectors, suggesting opportunities there.

- Citibank2: Equity strategists expect the MSCI Asia ex-Japan to deliver around 7% return by mid-2026. For Thailand, Citi recommends focusing on defensive sectors with stable earnings like banks, telcos, consumer staples, and healthcare.

- Morgan Stanley: Favors domestic demand-led markets like Singapore, while maintaining a neutral stance on other ASEAN countries. The firm sees a general Asia EM recovery by 2026.

- Goldman Sachs4: While their specific ASEAN country calls are less granular, they forecast that the MSCI Asia-Pacific (ex-Japan) Index will deliver a total return (in USD terms) of 18% in 2026, surpassing the S&P 500's projected 15% return.

- UBS5: Views ASEAN investment opportunities as attractive but highlights that investors should monitor political uncertainties in select countries. They favour Asia, particularly Singapore, India, and China's tech sector.

- Nomura6: Expects growth to surprise above consensus in Malaysia and Singapore, while being lower in Thailand and the Philippines.

- Invesco7: Maintains a constructive outlook for Asia equities in 2026, driven by supportive liquidity conditions and AI tailwinds, suggesting investment opportunities across the region.

- Societe Generale8: Highlights that Southeast Asia benefits from supply chain diversification and robust electronics demand but that the region faces challenges from US tariffs and a growth moderation.

1 https://www.db.com/news/detail/20251126-deutsche-bank-capital-markets-outlook-2026-artificial-intelligence-as-a-growth-engine-in-a-world-of-risks?language_id=1

2 https://www.aastocks.com/en/stocks/news/aafn-con/NOW.1454145/popular-news/AAFN

3 https://www.investing.com/news/stock-market-news/morgan-stanley-sees-asia-em-recovery-by-2026india-remains-top-overweight-4058537

4 https://news.futunn.com/en/post/66455703/goldman-sachs-2026-global-equity-market-outlook-a-broader-bull?level=1&data_ticket=1762337185452209

5 https://www.ubs.com/global/es/wealthmanagement/latamaccess/contact-us/year-ahead-escape-velocity-download-form/success/_jcr_content/root/contentarea/mainpar/toplevelgrid_copy_co/col_2/linklistnewlook/actionbutton_copy_co.0627532636.file/PS9jb250ZW50L2RhbS9hc3NldHMvd20vc3RhdGljL25vaW5kZXgvdWJzLXllYXItYWhlYWQtMjAyNi1lbi5wZGY=/ubs-year-ahead-2026-en.pdf

6 https://www.nomuraconnects.com/focused-thinking-posts/the-economy-next-week/

7 https://www.invesco.com/apac/en/institutional/insights/equity/asia-equities-outlook.html

8 https://www.societegenerale.asia/en/newsroom/press-releases/press-releases-details/news/asias-2026-market-outlook-resilience-amid-rotation/