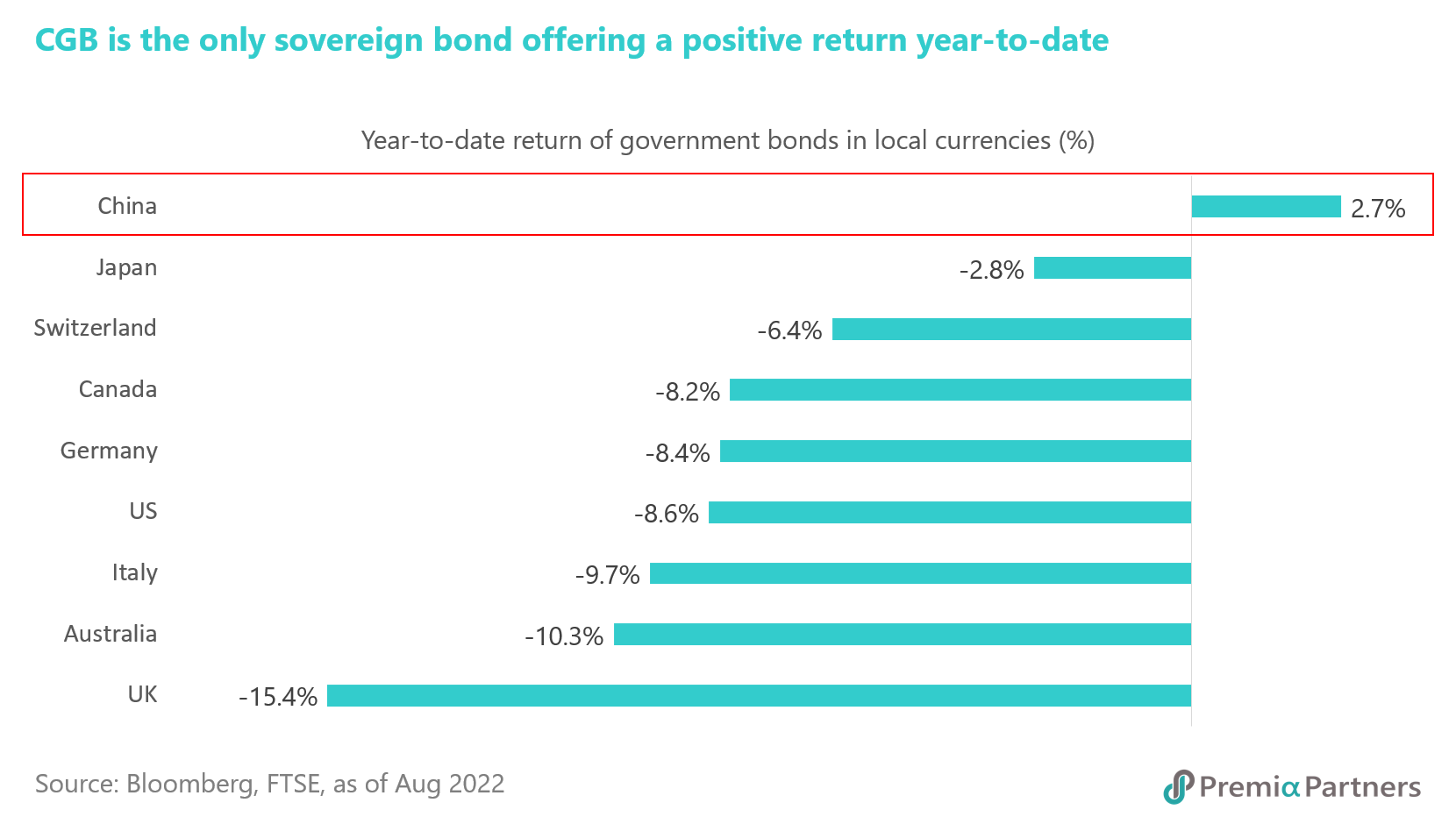

This year turned out to be extremely challenging for most investors, with double-digit negative returns seen commonly in both global equity and fixed income amid the mounting inflations, recession concerns and rising geopolitical risks. Sovereign bonds would usually act as a safe haven in a volatile market, but they have failed spectacularly this time. Major government bonds including US treasuries, UK gilts, German bunds, Swiss government bonds and Japanese government bonds recorded negative returns between 2.8% and 15.4% in local currencies. Most economies are now facing high pricing pressure on the back of tight labor markets, advancing energy and food prices. The authorities have no choice but to tighten their monetary policies by increasing interest rates. The US has raised the federal funds target rate four times since March this year, lifting the benchmark rate from 0.25% to 2.5%. Economists see more hikes will come in the next 6 months until the rate reaches the level of around 3.75%. The only bright spot is China government bonds (CGBs) which have held up well, providing a decent positive return of 2.7% year-to-date.

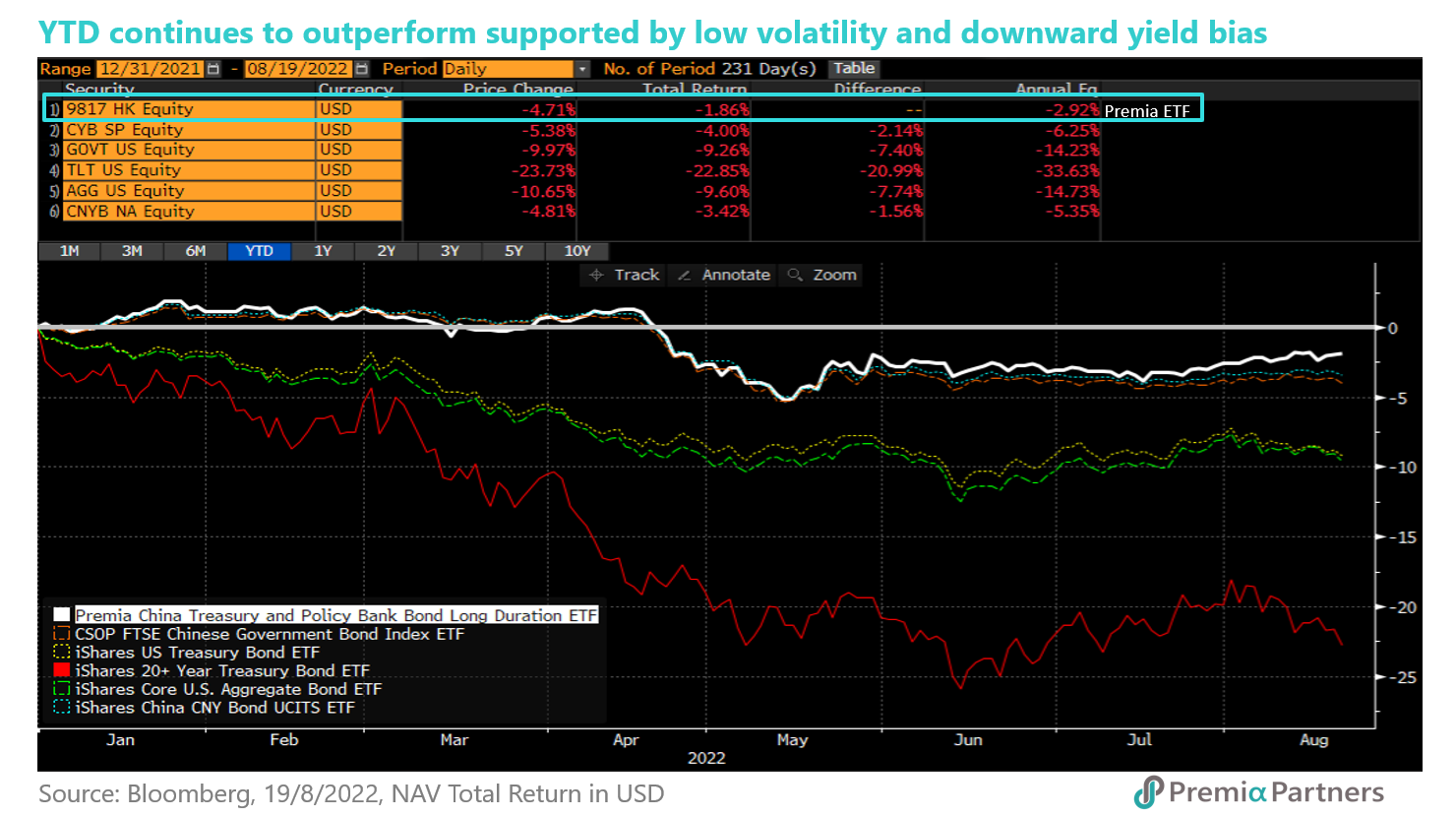

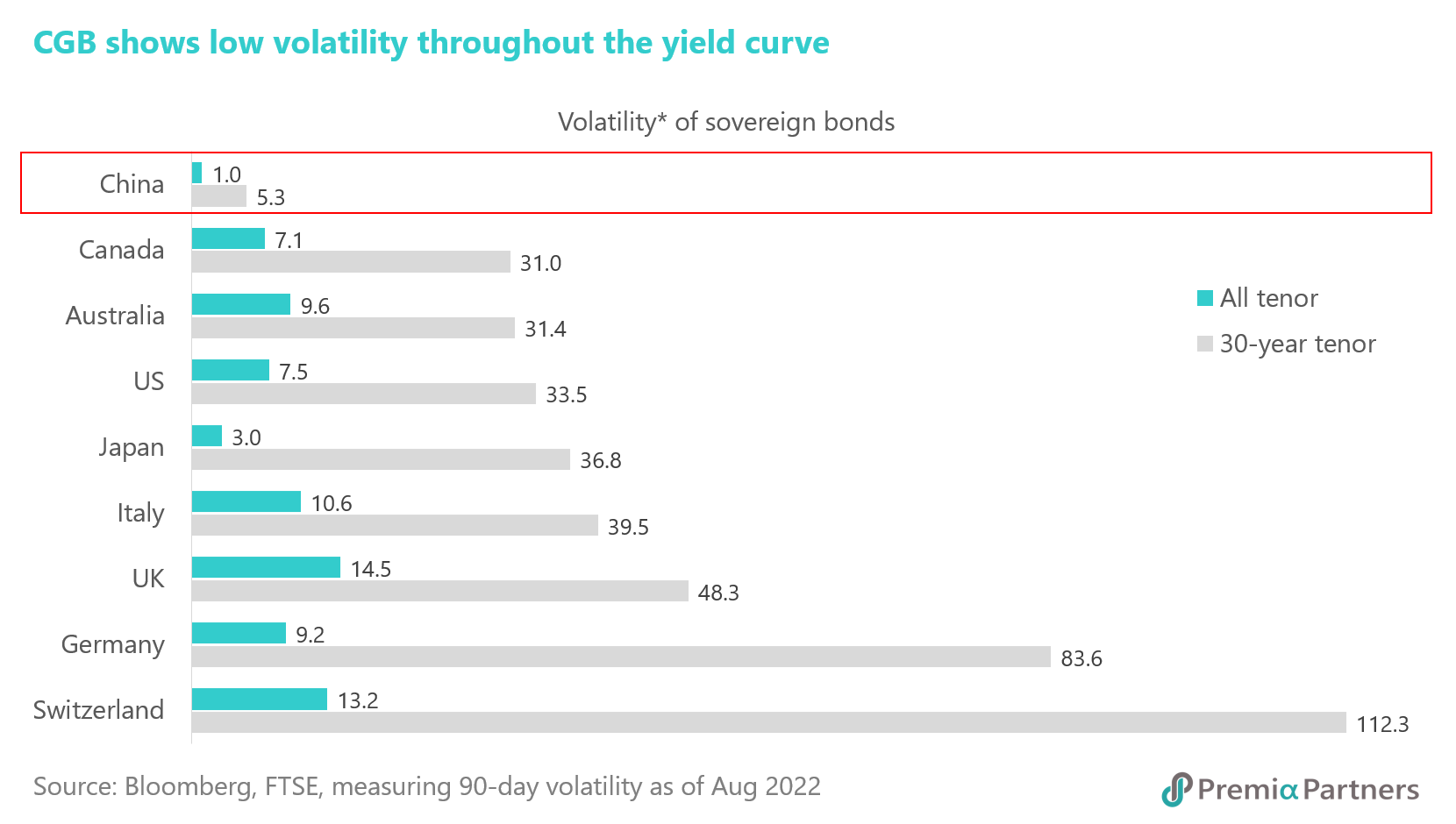

In addition to the superior return, CGBs are showing their stability in value with the lowest volatility in the past 90 days among their peers. Japanese government bonds are the closest one with a relatively low volatility whilst all the rest have a volatility level about seven to fifteen times of CGBs’. If looking at the long-duration bonds such as the 30-year tenor, the gap between CGB’s volatility and its peers’ has widened further. The long-duration CGBs are subject to a mild fluctuation only as China’s yield curve has remained largely unchanged, with a gentle downward shift of about 12 basis points year-to-date for the 30-year tenor. In comparison, the long-duration US treasuries are seeing a volatility of 33.5 and a negative return of 22.8% so far this year. For investors who may be worried about the high volatility nature in the long-duration bonds, CGBs seem to be an optimal choice which can help capture higher yields but have lower volatility.

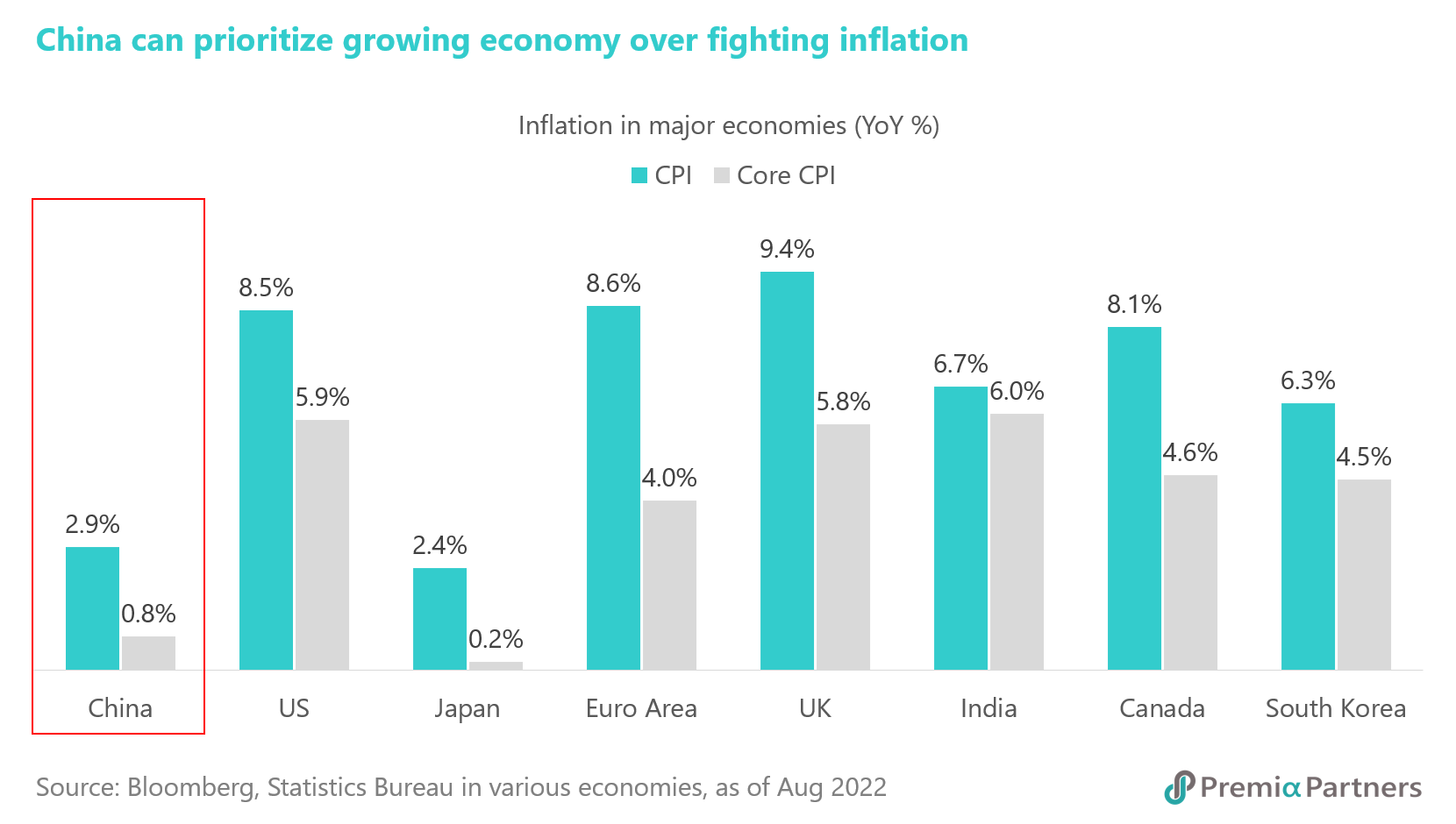

The People’s Bank of China (PBOC) has announced another round of rate cut, trimming both one-year and seven-day lending rates by 10 basis points, to help stimulate the economy. Retail sales, industrial output and investment all pointed to a slowdown in July. The Chinese authority is eager to support economic activities by lowering the financial burdens of both corporates and individuals and boosting borrowing demand in coming months. Although most major economies have also faced a similar situation with growth decelerating or even moving into an outright recession, they cannot follow the PBOC’s footstep in monetary loosening due to their inflationary environment. China’s CPI increased 2.9% year-on-year lately whilst its core CPI edged up at a hardly noticeable rate of 0.8%. This provides a lot of room for the government to deploy various policy tools in strengthening its economic recovery. On the contrary, the US and Europe have reported an inflation of 8.5% and 8.6% respectively. Economists expect the rate cycle in most developed and emerging economies will continue to be hawkish for the rest of the year, with central bankers prioritizing in tackling inflation or stagflation.

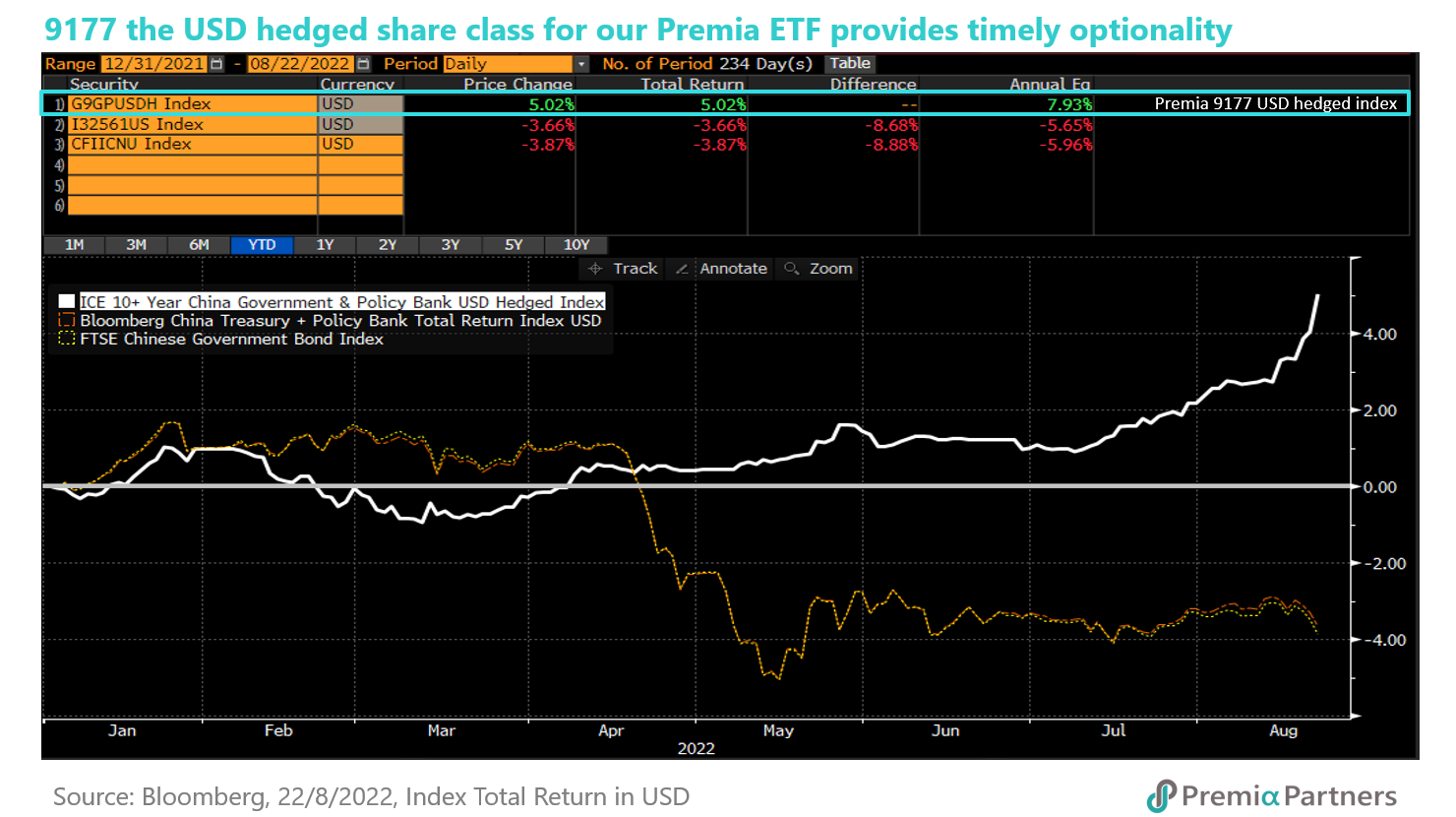

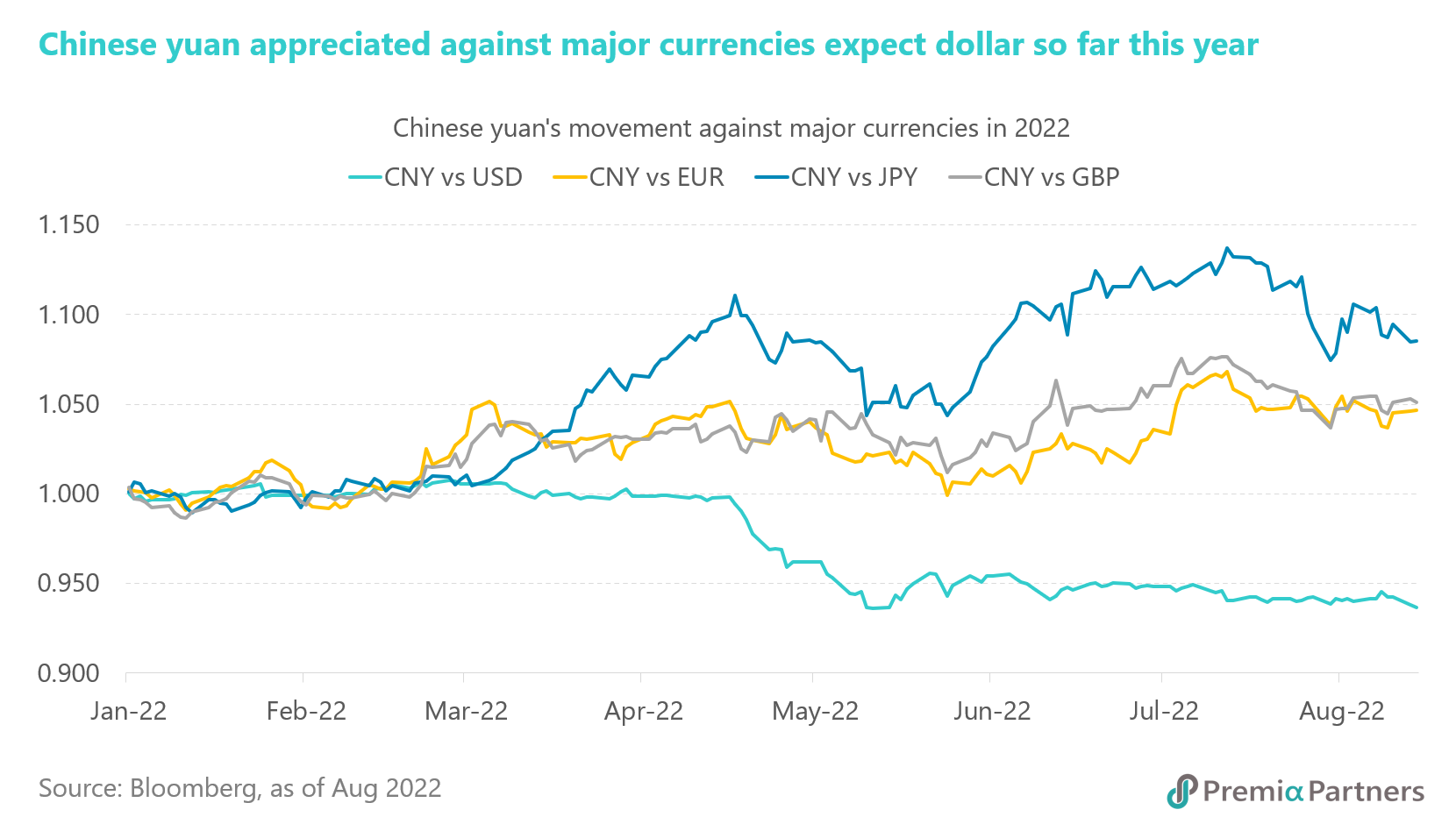

Bloomberg dollar spot index has gone up by 8% year-to-date, leading to a widespread depreciation of all major currencies against the US dollar, such as -9.8% in euro, -13.7% in Japanese yen, -10.3% in UK sterling, and -5.7% in Chinese yuan. This dollar strengthening movement does hurt the returns of sovereign debts in dollar terms. CGBs are no exception. Taking the Premia China Treasury & Policy Bank Bond Long Duration ETF (2817.HK) as an example, the fund recorded a positive return of 4.3% in Chinese yuan but a negative return of 1.8% in dollar so far this year. The depreciated currency has wiped out all the gains of the underlying long-duration CGBs and policy bank bonds. The year-to-date negative move of Chinese yuan, however, is getting close to the maximum annual change of 7% seen in the past since the exchange rate regime reform in 2005. The downside potential of Chinese yuan should be limited if its trading pattern does not deviate much from the history. After shunning the CGBs in the previous five months, overseas investors have begun to net purchase China’s onshore sovereign bonds in July as forex market stabilizes.

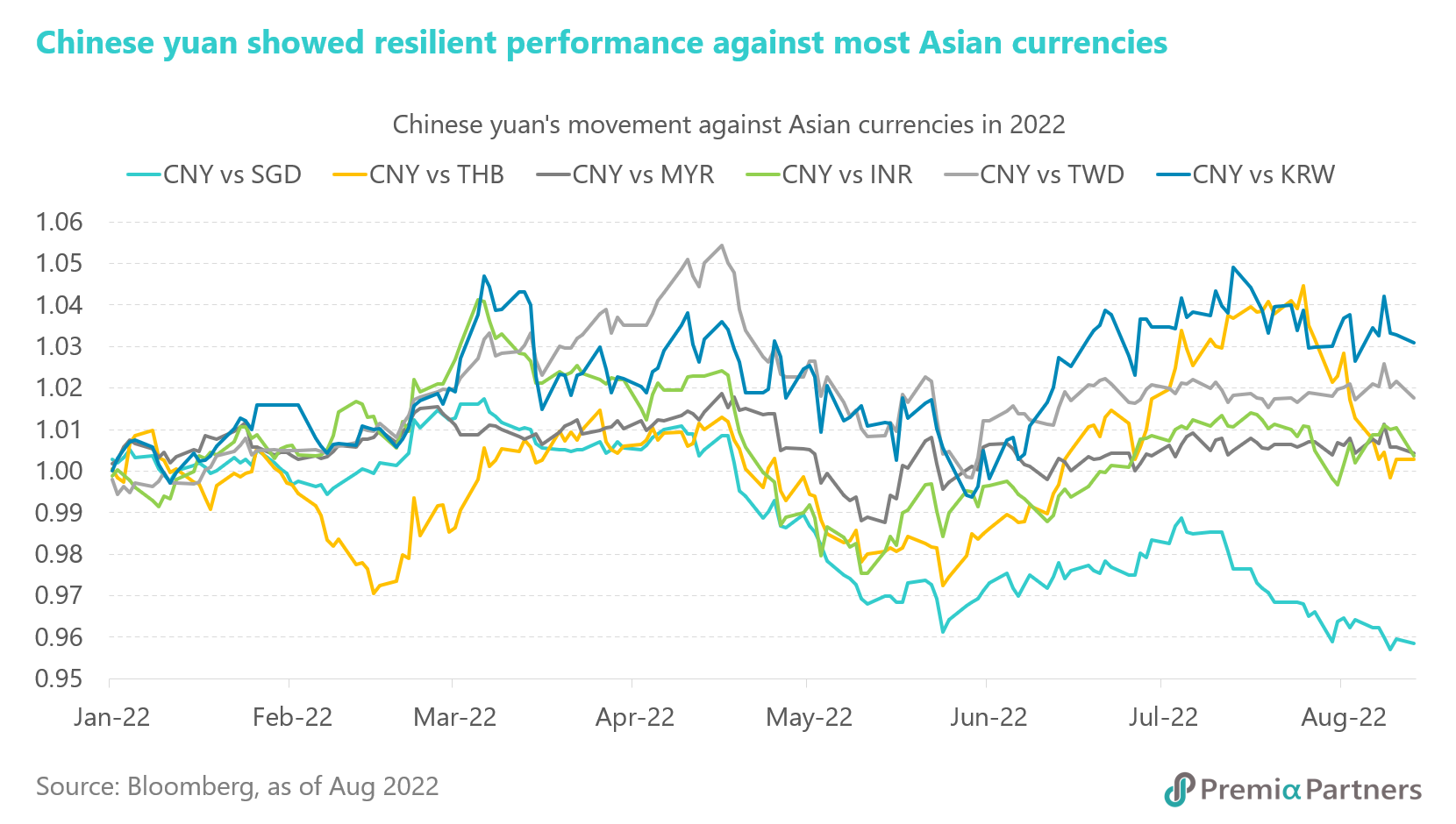

The fundamentals of Chinese yuan remain solid. China’s economic growth is decelerating in 2022 amid periodic COVID-related lockdowns and slumps in real estate sector, but market consensus is still expecting a decent GDP growth rate of 3.8%. The pace is faster than the global growth forecast of 2.9%. Besides, China’s trade balance climbed to a record USD 101 billion in July, while exports continued to expand rapidly in the past few months. The nation’s utilized foreign direct investment increased 17.4% year-on-year in the first half of the year whilst foreign reserve maintained at above USD 3.1 trillion. Indeed, Chinese yuan did appreciate against a few major currencies except the dollar so far this year. It has also moved favorably against most Asian currencies including Korean won, Taiwanese dollar, Indian rupee and Malaysian ringgit during the same period. Asian investors, therefore, owning CGBs with the direct exposure of Chinese yuan do not need to sacrifice any performance based on the return in local currencies.

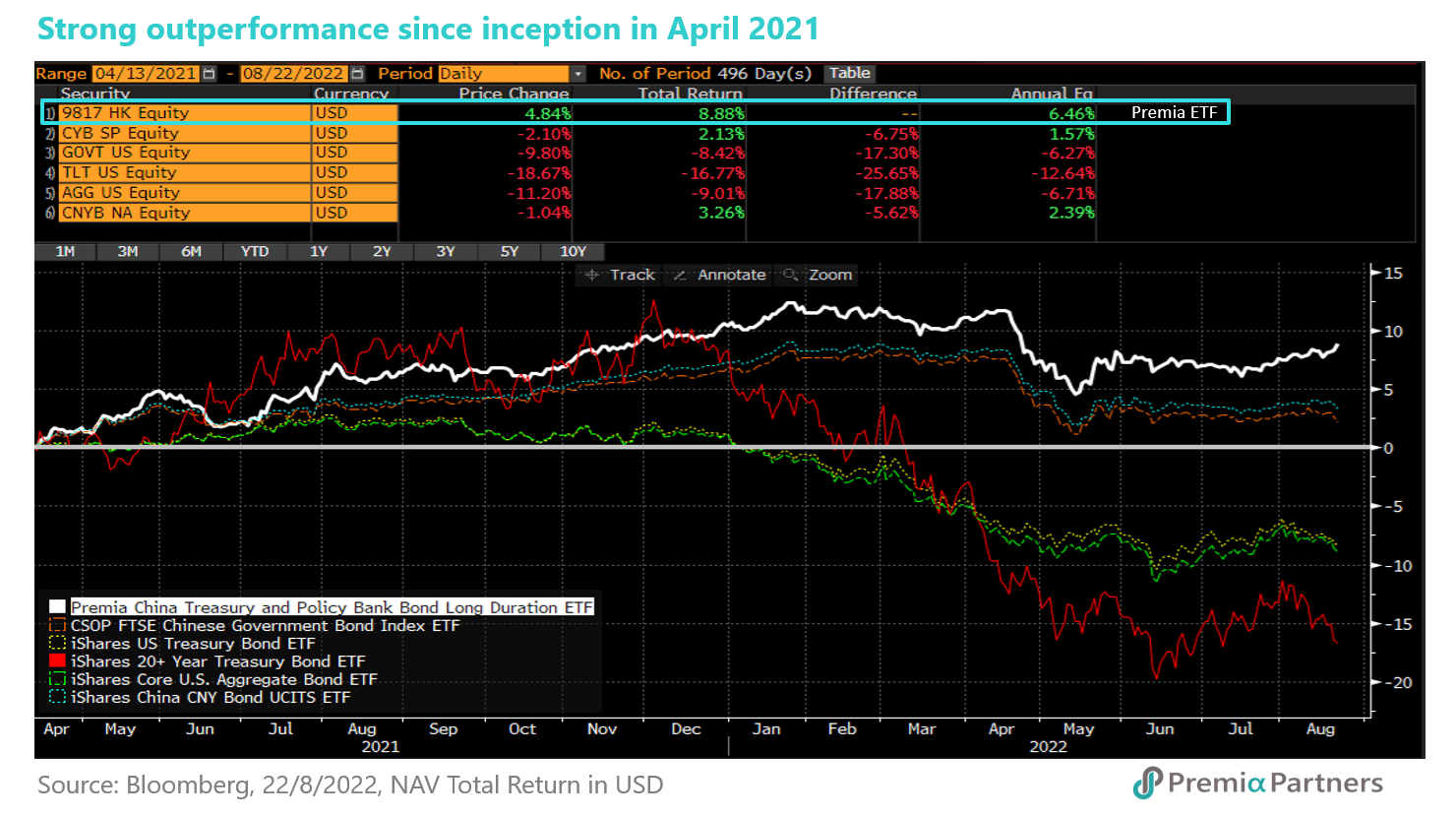

That said, for the investors who would like to have further protection from the forex movement, we have now launched the US dollar hedged unit class of Premia China Treasury & Policy Bank Bond Long Duration ETF (9177.HK) to cater for the market needs. This hedged unit class intends to fully hedge the exposure of Chinese yuan and provide a net return in US dollar. It is globally the first and only ETF provides direct access to ultra-long duration China treasury and policy bank bonds traded in onshore China, with stable A+/A1 sovereign ratings and much lower yield volatility among sovereign bonds. The unhedged unit class has recorded a positive return of 11.9% in Chinese yuan or 8.3% in dollar since incepted in April 2021.