Premia CSI Caixin China Bedrock Economy ETF (2803.HK)

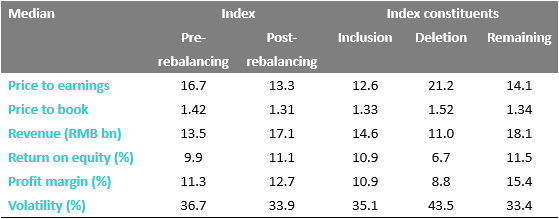

In June, we saw 117 replacements in the index, maintaining a steady universe of 300 stocks total. The one-way turnover ratio was 36%, in line with the historical range of 30-40%. The index methodology emphasizing quality, value and low volatility worked well in the rebalancing as shown by the following table. Valuations went down significantly after the rebalancing, with newly added constituents valued at 12.6x P/E and 1.33x P/B versus deleted stocks at 21.2x in P/E and 1.52x in P/B. As it is a fundamental index, we care about representation of the overall China market. The index saw a revenue increase from RMB 13.5bn to RMB 17.1bn, capturing a higher economic exposure of the overall China market. On the quality front, both return on equity and profit margin went up after the rebalancing, with better quality companies getting into the index to replace poorer ones. Lastly, volatility also dropped by 2.8% points to 33.9% by simply removing the highest volatility stocks.

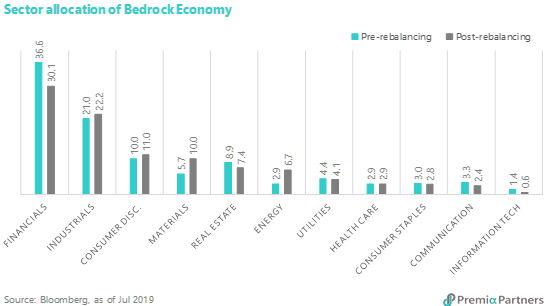

From a sector perspective, the major change was reducing exposure to financials and increasing weights in both materials and energy. The change in most of the other sectors was minimal and under 1%. Drilling down into sub-segments, a few broker names were replaced by coal and steel companies as the former could not pass the volatility screening whilst the latter got included on the back of improving financial health with better profitability. The top 5 sectors post-rebalancing are financials (30.1%), industrials (22.2%), consumer discretionary (11.0%), materials (10.0%), and real estate (7.4%).

Premia CSI Caixin China New Economy ETF (3173.HK)

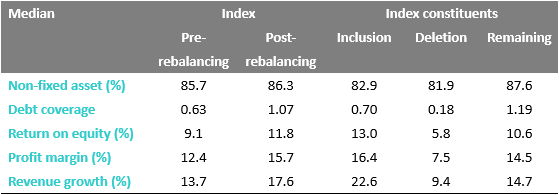

Like the bedrock index, there were 100 replacements in the index, maintaining a steady universe of 300 stocks. The one-way turnover ratio is 38%, which is similar to the historical average of 40%. The methodology emphasizes light-asset business model, quality and growth – which is exactly what the rebalancing accomplished in June. The improvement in non-fixed asset ratio after the rebalancing may look minimal, but the original level is already quite high at 85.7%, so even a slight advancement pushing the number to 86.3% is desirable. In terms of quality, there is a significant enhancement in debt coverage (1.1x vs 0.6x), return on equity (11.8% vs 9.1%) and profit margin (15.7% vs 12.4%). Quality is an area where this strategy differs from ChiNext, which uses a simple market-cap approach that leads to a high-beta, mid-to-small-cap concentrated, and historically highly volatile investment. Lastly, as new economy is a growth focused exposure, it is interesting to note that revenue growth increased from 13.7% to 17.6% during the rebalancing.

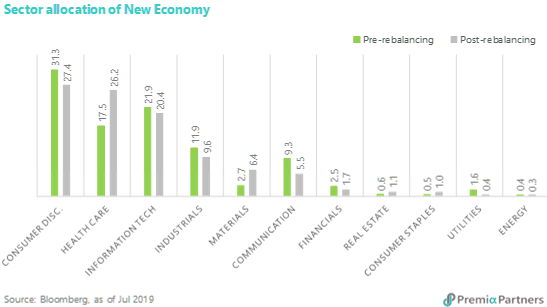

From a sector point of view, the major change is an increase in health care and materials versus a reduction in consumer discretionary and communication. The former sectors gain weightings on the back of improving financial performance such as stronger profitability. On the contrary, some of the stocks in consumer discretionary and communication get excluded from the final stock pool due to their low scores in the screening of financial health. The rest of the sectors showed minor changes of less than 2%. At the sub-segment level, the increase came mainly from pharmaceuticals and chemicals, while the drop was driven by household appliances, automobiles, entertainment and media. The top 5 sectors post-rebalancing are consumer discretionary (27.4%), health care (26.2%), information technology (20.4%), industrials (9.6%), and materials (6.4%), with the index staying true to its new economy theme.

Premia Asia Innovative Technology ETF (3181.HK/9181.HK)

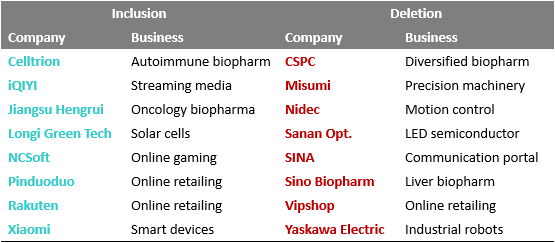

Out of 50 stocks, we saw 8 changes and a flattening of weights back to 2% each during June’s rebalance. The new additions are consisted of a Korean biotech firm, a Korean online gaming developer, a Japanese leading e-commerce operator and 5 Chinese companies with business lines across streaming media, oncology, solar cells, online retailing and smart device manufacturing. Two of them, Xiaomi and Pinduoduo, were listed less than 12 months ago whilst some of the others got included due to the positive change in market cap. The deletions include 3 Japanese companies and 5 Chinese companies with businesses covering biotech, industrial automation, LED, internet services, and online retailing. Major reasons for their removal from the universe are either not satisfying the criteria of revenue growth/R&D investment or falling out from the list of the top 50 innovative companies in Asia.

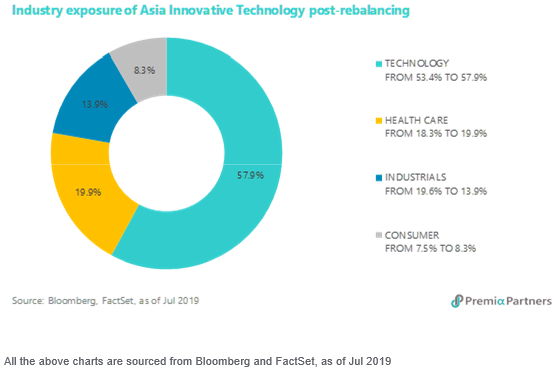

The dominant industry exposure remains Technology, in which electronic components, software and hardware accounted for 23.7%, 21.5% and 8.2% respectively. As a reminder we use FactSet’s Revere Business Industry Classification System, not GICS, to define sectors. When we drill down to revenue streams, this Technology exposure includes companies engaged in semiconductor, global positioning system, surveillance, artificial intelligence, and gaming development. The second biggest industry exposure is Healthcare, with biopharmaceuticals in the field of oncology, hematology, autoimmune disorders and viral infection leading the way. Lastly, Industrials focused on robotics, automation and optical sensors rounded out the top 3.

Related Premia ETF tickers

High quality China A blue chips: Premia CSI Caixin China Bedrock Economy ETF – 2803.HK

High quality China A new economy stocks: Premia CSI Caixin New Economy ETF – 3173.HK

Asia leading innovators: Premia Asia Innovative Technology ETF – 3181.HK/9181.HK