· China’s NPC takes a cautious approach to debt and deficit while the US Congress passes a US$1.9 trillion stimulus bill

· China focuses on sustainability and quality of growth – which should support Chinese assets medium to long-term

· US dive into more deficits and debt risks painful payback through higher inflation, policy rates and bond yields

· Fed will have few painless options if bond vigilantes dump USTs

· Buying more USTs will accelerate inflation fears and Dollar weakness

· Allowing UST yields higher could collapse both the equities and high yield bond markets

Economic policy settings between the United States and China – which have been diverging since the onset of the COVID-19 pandemic – are now on stark display as a result of the recent outcomes of the annual plenary session of the National People’s Congress.

Markets may right now prefer big spending US policies to China’s more cautious – and more orthodox – approach to economic management. But over the medium to longer-term, China’s policies are likely to be more sustainable than those in the US and other Developed Markets.

US chooses to “go big” on stimulus while China sets the scene for gradual tapering. US political leaders and central bankers have been synchronised in their imitation of Mario Draghi’s Euro Area debt crisis battle cry (“whatever it takes”). Well, what US Treasury Secretary Janet Yellen actually said of economic stimulus was “we need to go big….we can afford to go big.” Her boss, President Joe Biden used the same words “go big”. Senior Federal Reserve officials played their supporting roles, reassuring markets of their commitment to continued monetary stimulus.

On the other hand, Chinese policy makers have taken a more nuanced approach to stimulus, possibly setting the scene for a very gradual tapering of fiscal and monetary stimulus.

China has opted for an approach to economic policy focused on sustainability, control of sovereign debt and supply/production. The US has focused its policies around misery alleviation, debt monetisation and demand stimulation.

Fixing supply/production is more sustainable than “goosing” demand through debt. The idea that demand creates supply versus the alternative of supply creating demand is a long-contested debate between Keynesian versus classical economists. We won’t go into that here.

We would, however, simply say that extreme stimulus of demand via debt is not sustainable. To the extent that Developed Market governments intend to pay down that debt, it is borrowing from future demand. If those governments’ intention is to monetise the debt, it will debase their national currencies, fuel inflation and potentially create financial instability. In any event, despite the massive stimulus, the demand side has disappointed, as evident from the plunge in Developed Market economies’ GDP. The money went into swelling savings accounts, boosting asset prices and widening wealth inequality.

Messages from China’s National People’s Congress. While the US Congress was in the midst of passing a US$1.9 trillion stimulus package, China’s National People’s Congress (NPC) was signaling a more conservative approach towards economic growth and stimulus, targeting only “over 6%” GDP growth this year, although most economists have forecast much higher, with the International Monetary Fund (IMF) expecting 8.1%.

China’s policy makers seem to be giving themselves room for manoeuvre, given it is targeting to reduce the budget deficit from 3.6% of GDP last year to 3.2% this year. The special local government bond quota is targeted to reduce from CNY 3.75 trillion to 3.65 trillion this year. Significantly, the government wants inflation down from around 3.5% for 2020 to 3.0% in 2021.

China is not in a mad rush for growth – it is already growing strongly and it will hit “high income” status by 2023 at a canter. The targets are “conservative” in a literal sense – the net effect is the government will be conserving policy ammunition. There is no desperation for aggressive stimulus because the economy had already been growing creditably in 2020 and is poised to “shoot” the proverbial “lights out” anyway in 2021.

By the way, at an average of 6% GDP growth for the next two years, it would hit the 2020 updated World Bank per capita income target of US$12,535 to achieve “high income status” by 2023. China was estimated by the IMF to have had a per capita income level of US$10,839 last year.

China’s economic targets going forwards are more complex and subtle than just sheer speed. China is continuing with structural reforms despite the pandemic; climbing up the productivity/technological/value-add ladder for more sustainable growth; and taking environmental concerns seriously.

As the IMF said recently in the report on its Article IV Consultation with China: “Structural reforms have progressed despite the pandemic, but not evenly across key areas. The opening of the financial sector has advanced with a further shortening of the negative lists for foreign investment and the removal of restrictions on the investment quota for foreign institutional investors. Labor market reforms, such as hukou reforms, have improved labor mobility, and the patent law was amended to strengthen intellectual property protection and foster innovation.”

Hukou reforms incidentally will not just improve labour mobility but likely unleash more consumption growth. Migrants from rural to urban areas in China often have limited access to public services. That inhibits consumption and promotes precautionary savings. Granting more access to public services for migrants from the rural-urban drift can be a powerful driver of more consumption growth.

Meanwhile, the US has dug itself into a huge policy hole and there are no easy ways to get out of it. The US federal government debt to GDP ratio has more than doubled from before the global financial crisis, taking the government debt to GDP ratio from 62% in late 2007 to 127% by mid-2020.

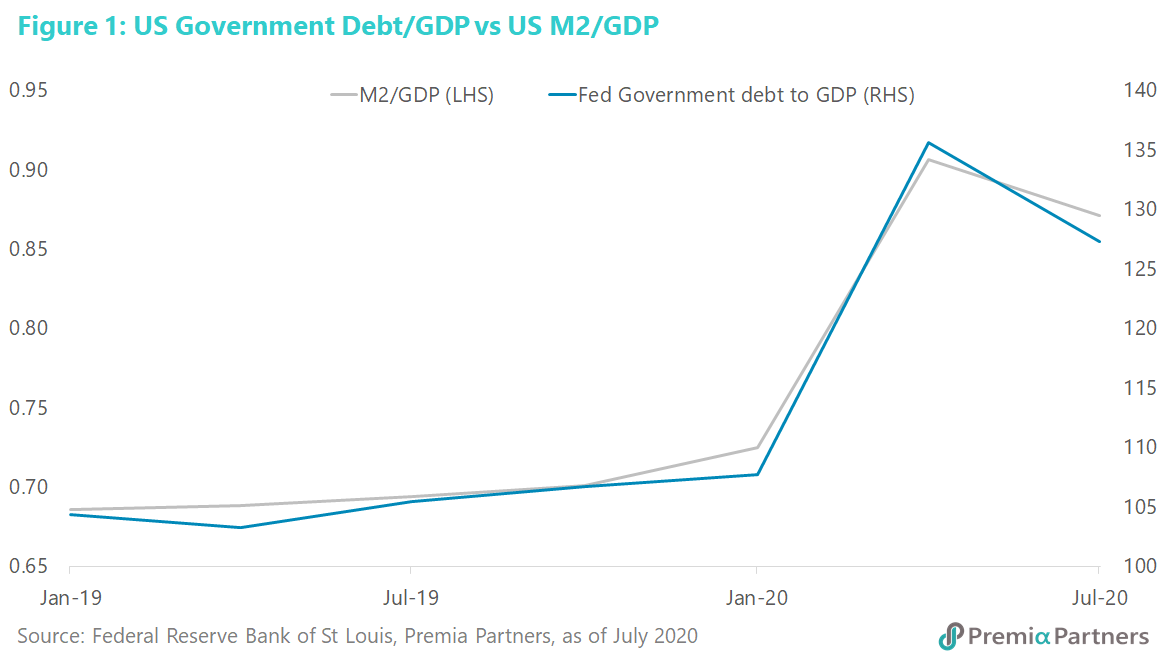

The most alarming rise was the spike from 3Q19 level of 105% to the 3Q20 level of 127%. US government debt grew 19% in those 12 months, largely as a result of its responses to the pandemic. US M2 money supply grew 25% last year.

Given the body-hugging relationship between US federal government debt and its money supply (figure 1), it would seem the Modern Monetary Theory idea of central banks financing government spending is already reality in the US and, indeed, many other Developed Market economies.

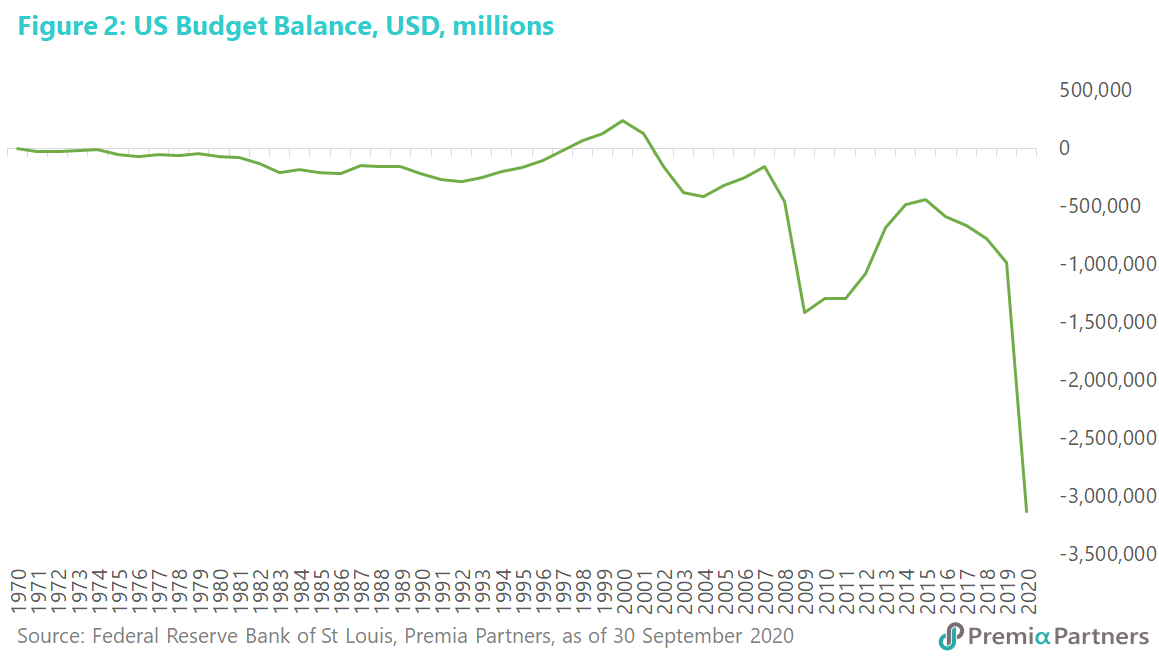

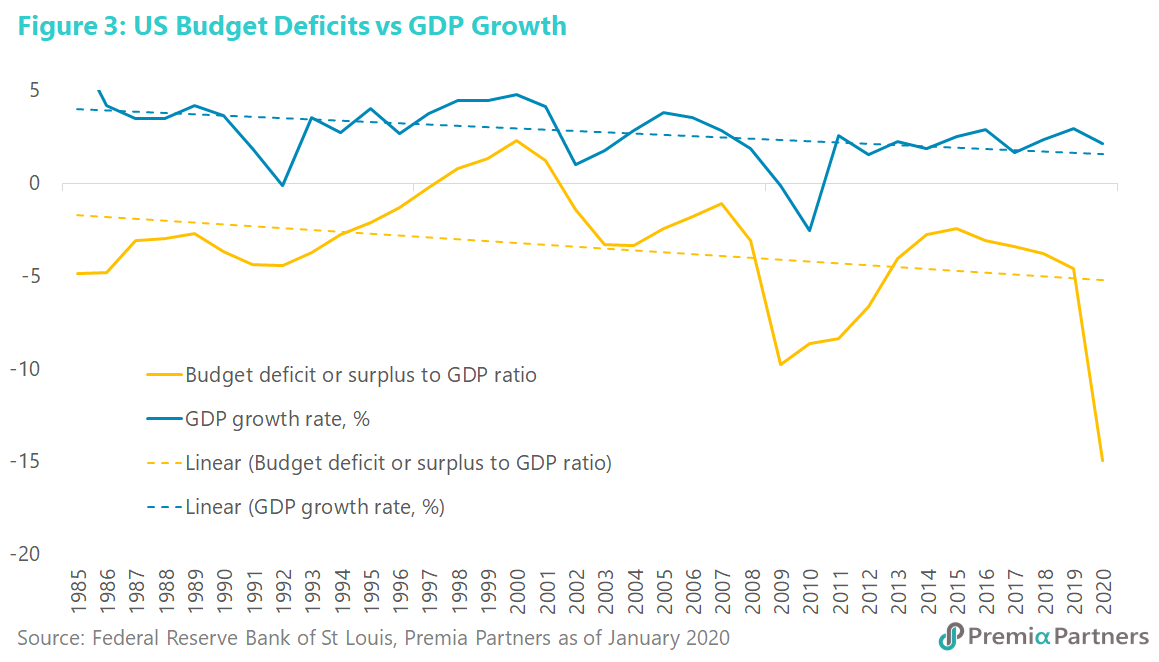

Decline into debt, deficit, and slower growth. In historical context, the great US decline into debt and deficit started from around the time of the Nasdaq Crash of year 2000. Each crisis – the Nasdaq Crash of 2000, the Sub-Prime Debt/Lehman Brothers Crash of 2008, and the COVID-19 pandemic – drove the US federal budget deficit deeper into the red (figure 2). Not coincidentally, US debts and deficits track broadly with the downtrend in the GDP growth rate (figure 3).

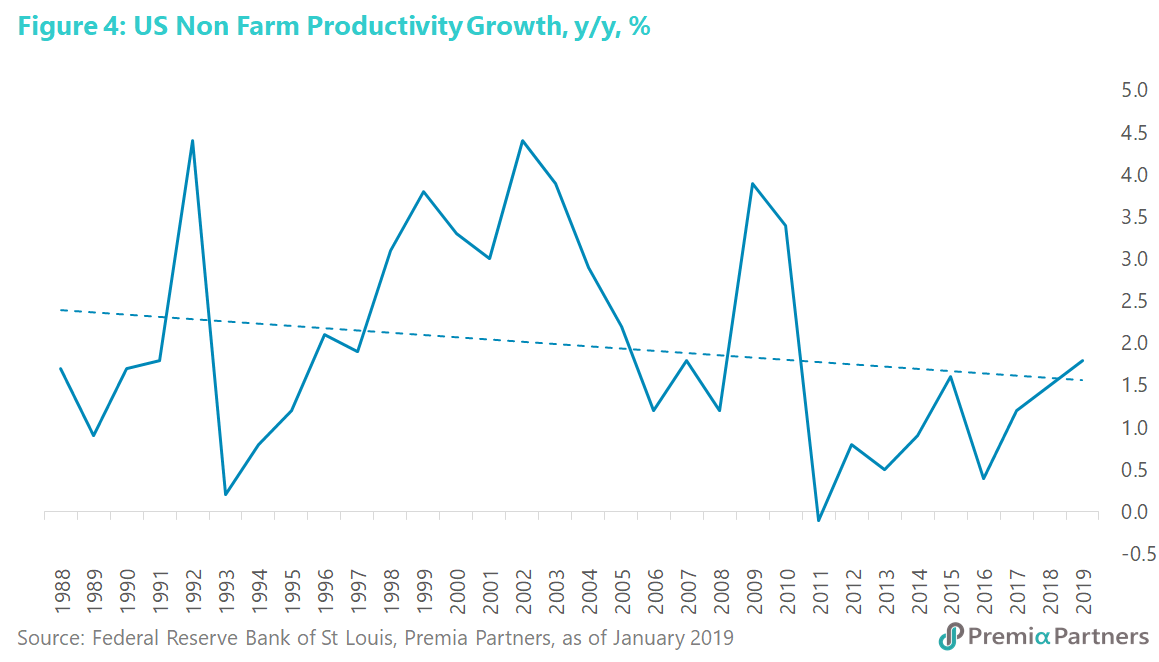

Linked to that has been the structural decline in US productivity growth (figure 4). But instead of fixing the supply side, a succession of political leaders and policy makers found it more expedient to “goose” demand through fiscal and monetary stimulus.

Forever stimulus – easier to give than to take back. The traditional application of Keynesian counter-cyclical policies in the US and indeed many parts of the Developed Markets – where stimulus was meant to be cast out during economic downturns and wound back during upturns – became “corrupted” by the election cycles. Often, when stimulus was due to be reined back, governments flinched because the next election was around the corner. Meanwhile, painful supply-side reforms were pushed further and further back – damaging productivity growth.

Negative economic consequences of debt snowball. If government debt was ever meant to be paid back, a Dollar borrowed today should be a Dollar less in demand in the future – hence the structural lowering of the economic growth rate over time, caused by the accumulation of debt. (The related neglect of supply side reforms played its part too.)

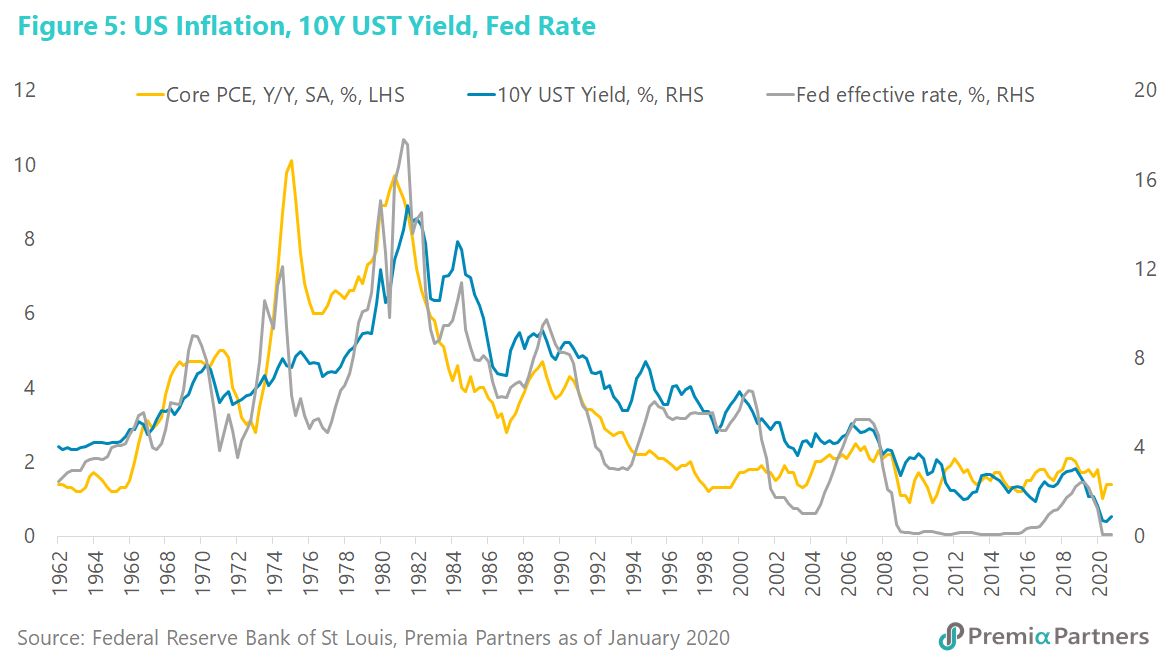

The longer-term consequences are now coming into shorter-term focus. The recent stock market fright around rapid rises in US inflation expectations (as captured by the 10-year breakeven inflation rate) and the 10-year US Treasury yield could be a forewarning of things to come.

Yes, the United States has had some 20 years of declining inflation and 10-year US Treasury yields from 1981, followed by 10 years of flat and low inflation and Treasury yields. Yet, almost everything is at or close to extremes. If not at rock bottom (policy rates are certainly at rock bottom unless the Fed takes them negative), they are very close to rock bottom.

When US inflation, bond yields and rates start turning back up from such lows, the impact on asset markets can be catastrophic. Hence our long-term negative outlook on US assets (figure 5).

Higher inflation and rates – it’s not here yet but it’s coming. Three factors suggest headline inflation (as distinct from the Fed’s preferred measure of core PCE inflation) will rise in coming months:

1) The speed at which money has been pumped into the economy over the past 12 months is unprecedented in post-war history. As a result of the stimulus, US households’ net wealth rose a stunning 17% in the nine months of the pandemic from end-March to end-December last year – from US$111.4 trillion to US$130.2 trillion. Cash and bank deposits rose US$643 billion.

Meanwhile, the velocity of M2 money recently hit 1.1 – a low not seen since the period immediately after the Second World War. As the US economy reopens, the velocity of money should rise, putting upward pressure on prices.

2) Commodity prices appear in the midst of a major upward cycle, with oil prices already driving a divergence between core and headline inflation, which rose sharply in February to 1.68% from 1.37% in January. Higher commodity prices are in part a reflection of the decline in the value of the US Dollar caused by the Fed’s aggressive monetary expansion.

3) Supply chain disruptions have pushed up producer prices everywhere, with the OECD producer price index now significantly above pre-pandemic level. There have also been supply chain disruptions from both the pandemic and the US-China trade war.

The end of alchemy? In his book “The End of Alchemy”, former Bank of England Governor Lord Mervyn King likened modern central banking to alchemy – endowed with mysterious powers to metaphorically transform base metals to gold, as claimed by the medieval alchemists who inspired that particular modern use of the word.

Yet, over the years, the Fed and other Developed Market central banks have boxed themselves into a smaller and smaller policy corner.

If bond vigilantes continue to sell US Treasuries, it will force the Fed to draw a line in the sand, and undertake something akin to Yield Curve Control, to stand there and buy whatever Treasury paper the market throws at it. That would further weaken an already very weak US Dollar.

In the process, it runs very real risk of accelerating the inflationary tendency – the weaker the US Dollar, the greater the inflationary expectations are likely to be. That’s the logic of the buying power of paper currency. Remember also that a weaker Dollar will import higher inflation into the US.

If the Fed doesn’t stand and defend the US Treasury market, the rise in US Treasury yields will likely collapse the equities market, which may not matter as much as the damage it will also inflict on the high yield bond market, causing rising junk bond yields and corporate failures.

So what happens when inflation eventually rises in a sustained manner? It is doubtful if the Fed can continue financial repression in the face of sustained inflation. Yet, rate rises will almost certainly collapse US equities and credits.

Some wilder imaginations have suggested government debt write-offs. But even that is not plausible, without destroying financial stability, remember that a liability written off by one entity is also an asset written off for another entity. The US government’s debts are assets on the Federal Reserve’s balance sheet, against which stand bank reserves as liabilities, which are in turn held by private sector banks as assets.

China’s focus on supply meant the economy paid its own way despite a big government budget deficit during the pandemic. From the start of the pandemic, China’s policy focus had been to “crush the curve” of the spread of the virus, and then to head towards reopening. This is restoring supply instead of trying to force out demand with debt.

The rest is, as they say, history, but worth summarising anyway. Except for February and March 2020, China’s manufacturing output grew from April to now. January-February industrial production surged 35.1% y/y. US industrial output was in y/y contraction every month over the 12 months to January 2021. China’s GDP grew 2.3% last year while US GDP contracted 3.5%.

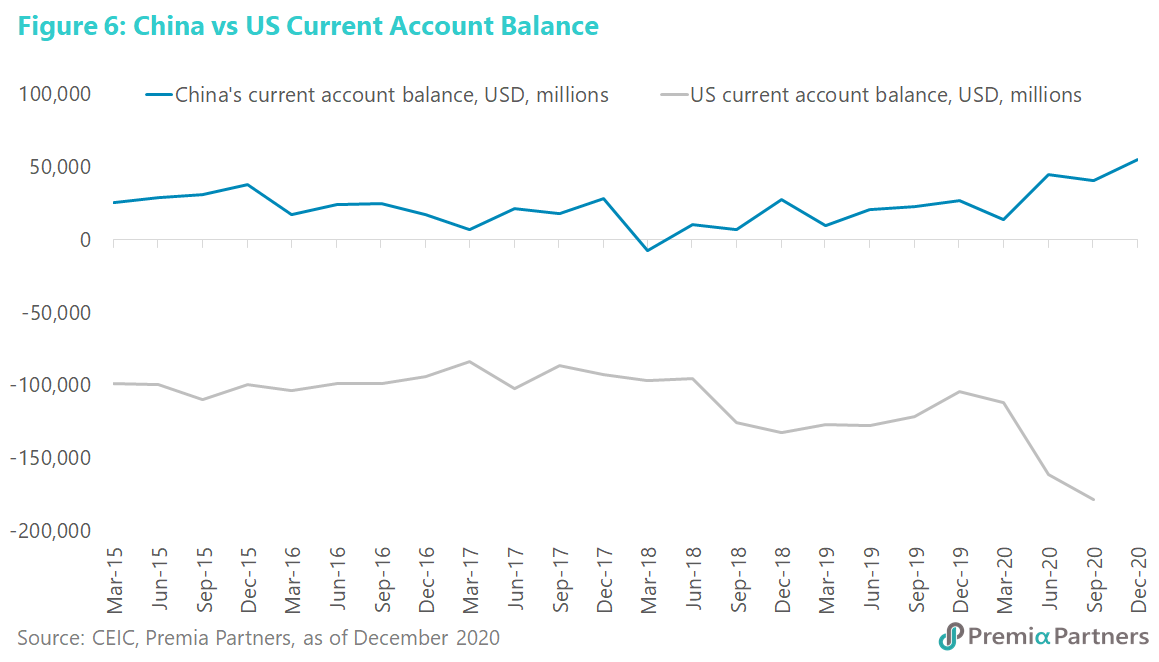

Since China kept the wheels of commerce and industry turning, it ended the year of the worst pandemic in a century with yet another current account surplus. Yes, the Chinese government’s budget balance blew out deep into deficit as well. But that it still ended with a current account surplus meant the economy was living within its means (figure 6). At risk of stating the obvious, demand doesn’t necessarily pay the bills. Supply does.

China is now restraining expansion to reduce its fiscal deficit and moderate its debt. Both the US and Chinese governments ran up large budget deficits in 2020. According to IMF estimates, China’s general government deficit, (the IMF’s estimate is much higher than the Chinese Government’s official budget deficit figure because the former includes off-balance sheet items), hit 18.2% of GDP in 2020. Its estimate for the US federal government deficit was very similar at 18.0% of GDP.

This is where the two governments start to part ways. As mentioned above, the Chinese government has indicated it wants to start reducing its budget deficit, even though the economy as a whole has been living within its means, as indicated by the current account balance.

Meanwhile, the US government has just passed a US$1.9 trillion stimulus bill, of which US$1 trillion will be spent in 2021. We estimate this will leave the US Government fiscal deficit for this year pretty much where it was in 2020. This could maintain or even worsen the country’s current account deficit, adding to US government debts.

The IMF estimates that China’s “augmented” government debt (which is “augmented” to include local-government financing vehicles and off-budget activities) at 92% of GDP. The Federal Reserve estimates total US federal government debt of much higher at 127% of GDP.

“Go big” on stimulus, lose big somewhere down the line? Given the escalation of US policy profligacy, questions are not unreasonably being asked about whether capitalism is safe and well in the United States? Not least, we will point out that while China had allowed the financial system the flexibility price debt upwards, financial repression in the US has meant distortion of market signals. Indeed, the relationship between the Fed, the credit market and the stock market is looking like a massive socialisation of risk, also known as the “Powell Put”.

Flowing from that, three big questions in the market now are: 1) Are there tax hikes coming? Most likely – President Biden will start by repealing Trump era tax cuts. 2) Are rates and yields rising? The Fed will likely hold rates at zero for as long as it can. But yields are already rising. 3) What happens to the US Dollar? Well, it has already been declining over the past 12 months and will likely decline further, long-term.

On that last point on the Dollar: It is a valve to allow an over-indebted US economy to let off steam. Dollar devaluation is US debt diminution.

China expanded its M2 money supply by 10% in the 12 months to end-February this year. The US expanded its M2 money stock 25% last year and 26% in the 12 months to end-January this year.

It is not coincidental that the USDCNY was 9.5% lower at time of writing, compared to its May 2020 high. That might help the US economy at the expense of China, but it is very painful for US Dollar investors.

This may go some way to explain Co-Chairman of Bridgewater Associates, Ray Dalio’s comments in a recent article: “I believe a well-diversified portfolio of non-debt and non-dollar assets along with a short cash position is preferable to a traditional stock/bond mix that is heavily skewed to US dollars. I also believe that assets in the mature developed reserve currency countries will underperform the Asian (including Chinese) emerging countries’ markets.”

We have been saying much the same thing as Ray Dalio for over a year now. Fast forward to the present: Use the current pull back in Chinese equities to bargain hunt for medium to longer-term holdings.