Macro Developments and Factor Performance

To understand factor performance in Q4, it is helpful to view the past three months as playing out in two acts. The first act was primarily a fear factor play, marked with significant surge in risk premium, as international investors responded apprehensively to President Xi Jinping’s consolidation of power at October’s 20th National Congress of the Chinese Communist Party (NCCCP) and de-risked China exposure. The massive sell off of Hong Kong listings and ADRs also spill over to mainland-listed A shares, where international investors pulled US$7.9 billion out through Stock Connect, the second-largest monthly outflow since the platform launched in 2014. Meanwhile at the socioeconomic level, as China’s strict pandemic policies dragged on, the world’s second-largest economy continued to stagnate. Local business and investor confidence hit record lows, given the lack of visibility for growth recovery in the absence of a serious policy pivot. With pessimism at its peak, Chinese stocks languished.

By late October/ early November however, signals for a policy pivot started to emerge as onshore A shares kickstarted a mild rebound, followed by the turbocharged abrupt rally in H shares and ADRs that took many by surprise. Investors with a bit of patience in the face of headline risk—and especially those with the confidence to buy a dip in Chinese stocks amidst post-Congress panic selling—enjoyed the beginning of the second act: a rally in Chinese equities, as the nation’s policymakers, their path cleared and mandate set by the National Congress, began refocusing on growth, and directing resources and policy support toward economic recovery which was in dire need, including restoring business confidence for China’s domestic tech sector and its embattled property market.

While we predicted the turnaround and relaxation of COVID restrictions earlier than later, the actual timing and the extent of immediate policy overhaul still came as great surprise. Propelled by increasing popular impatience over strict public health restrictions, as well as the evolution of Omicron as a much milder variant, Beijing responded by abruptly dismantling China’s zero-COVID policies, such that by the end of December, after nearly three years of some of the strictest pandemic policies on the planet, more or less full reopening was on the horizon.

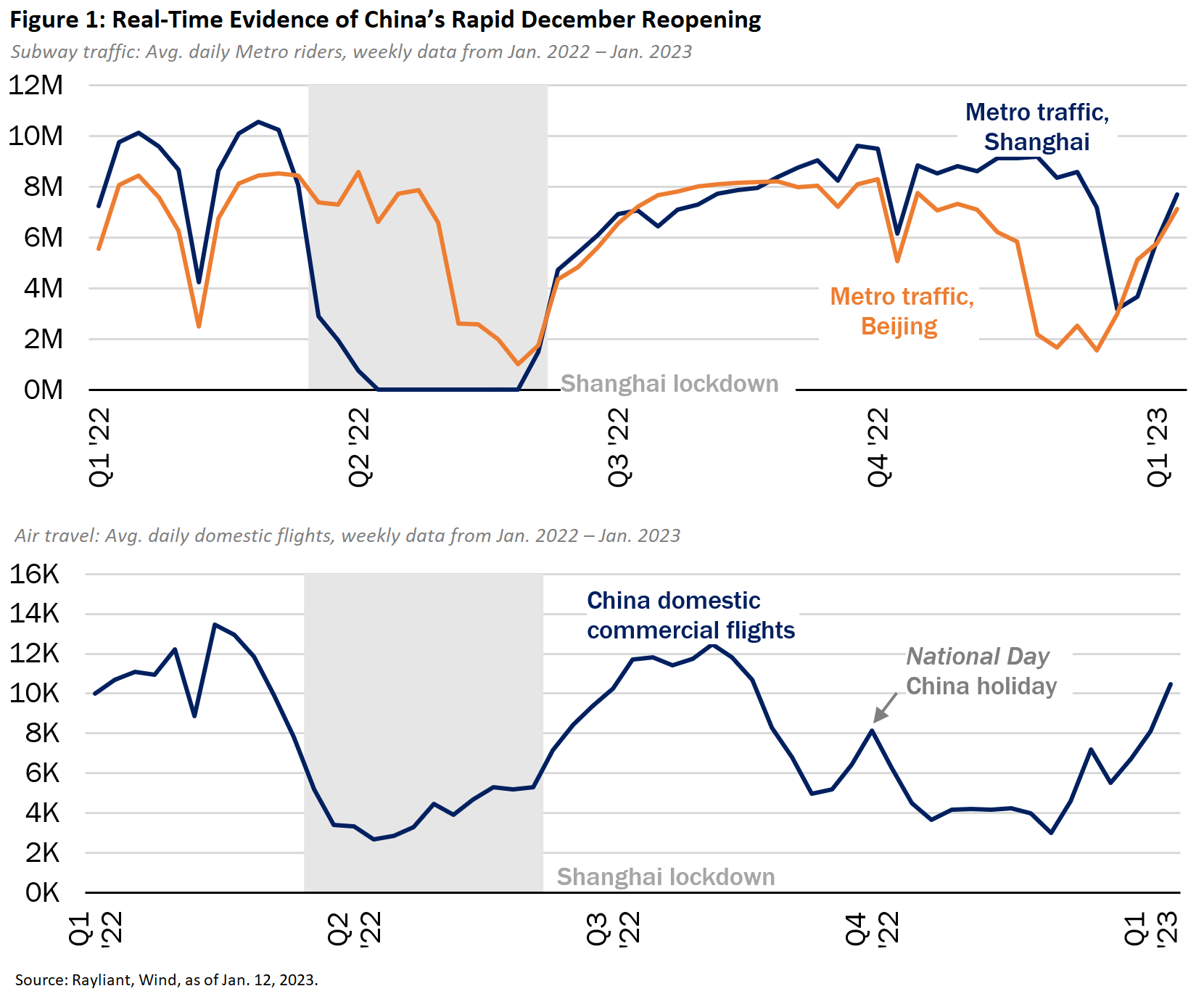

While it can take some time for such policy changes to show up in economic statistics, mobility data leave no doubt that changes were afoot in Q4 (see Figure 1, below). While a large decline in Metro activity in China’s major cities and dramatic reduction in Chinese domestic air travel during the first half of the year reflected widespread lockdowns in place at the time, more recent reductions in subway traffic and commercial flights observed during Q4 were in part a result of travellers voluntarily avoiding public spaces as restrictions were lifted and COVID ripped through China’s population. By late January, China’s Center for Disease Control and Prevention reported that an estimate 80% of the nation’s 1.4 billion people had already been infected in the zero-COVID ‘exit wave’, with spikes up in mobility data into early January suggesting ‘peak infection’ has passed, further speeding reopening.

While we have often cautioned that whenever it happened, China’s reopening would make for a bumpy ride given the massive population, in hindsight the transition through China’s COVID exit wave turned out to be well timed ahead of the big Lunar New Year holiday, which occurred early in late Jan this year.

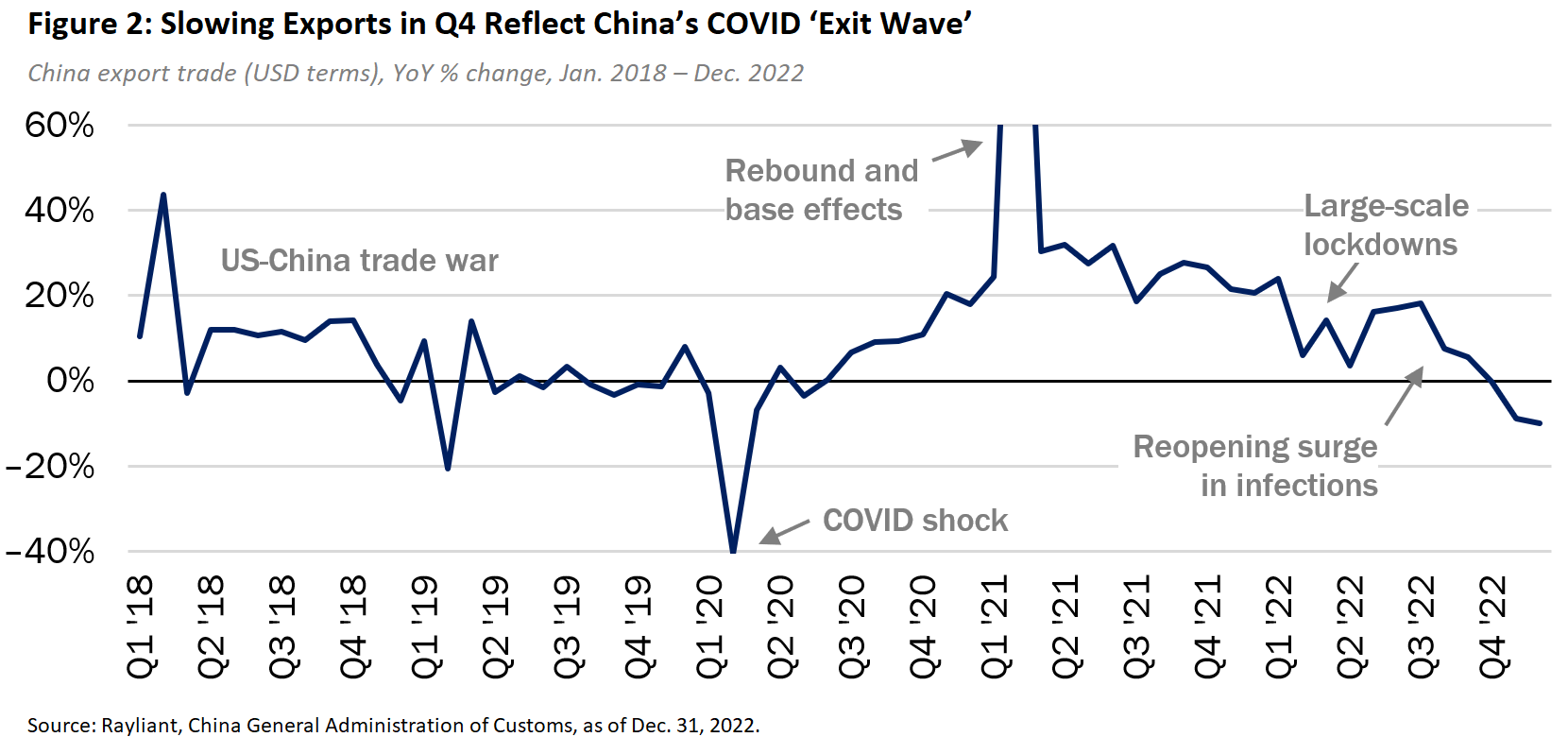

Although the initial infection waves posed a negative shock to both consumption and production in December—and noting that activity would have been at least as lacklustre under the strict restrictions--the December reopening also provided a few weeks of buffer around the festivities for the population to transition and recover before the peak season starts after the Lunar New Year. Chinese exports’ steady downward trend through the end of 2022 (see Figure 2 below), reflects a combination of headwinds from a slump in global demand brought on by budget-conscious global consumers facing an inflationary squeeze and central bank tightening, as well as COVID-induced disruptions at Chinese factories and in the nation’s logistics network. Chinese imports showed a similarly negative pattern in Q4, as domestic households also pressed pause on consumption during the worst of the country’s COVID exit wave.

Despite initial fear over vaccine effectiveness and empty pharmacy shelves, China’s health system has also averted collapse and its population has made an impressive shift in its mindset toward the virus. Indeed, in what seems like a blink of the eye, COVID has gone from a major stigma to a source of humor in online communities. One netizen recently joked amidst surging cases in Beijing: “If you don’t know any positive patients, please reflect on your social skills.” In light of this dramatic shift, we believe negative Q4 economic data—which may, as in the case of export data above, actually look more daunting than figures released during early-2022 lockdowns—should be taken with a grain of salt. While China’s annual Lunar New Year festivities are likely to confound January economic readings, as well, we are confident that as the ensuing reopening continues, growth will pick up serious steam, with Q2 being a more serious test.

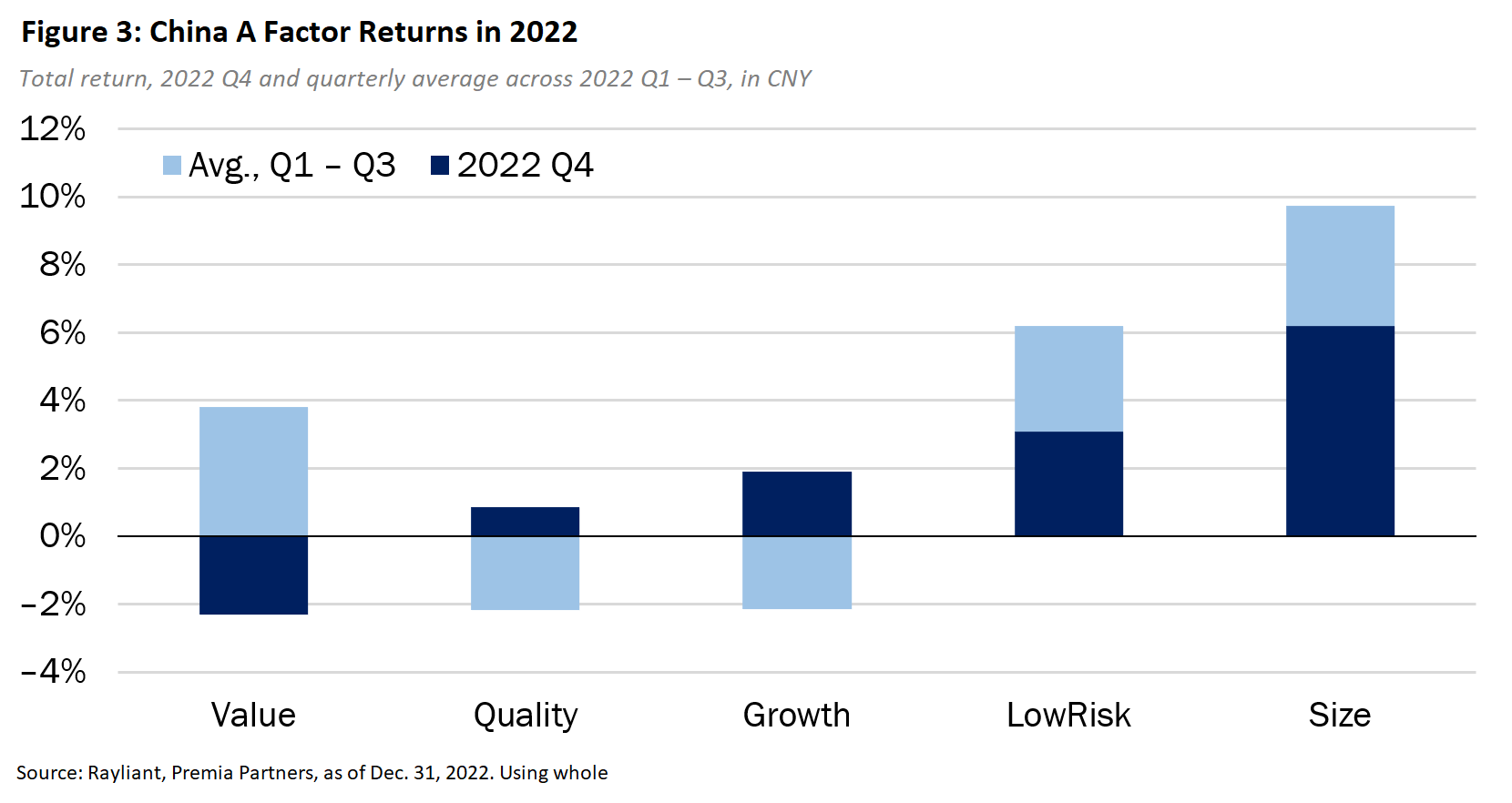

At the factor level (see Figure 3, above), the fourth quarter saw gains across most exposures. Size and Low Risk, which were big year-to-date winners going into Q4, extended their outperformance, as a third-quarter small-cap rally continued into October and investors once again flocked to companies featuring less volatility in a period of macro turbulence.

Perhaps a more interesting development in factor space, however, was the reversal in Growth and Value, also clearly visible in Figure 3, which took place as policy support in the wake of the National Congress and the promise of an accelerated reopening drove a sudden and extreme reversal in domestic retail investor sentiment. Despite improving investor mood and strong outperformance in growth, we should note that we do not see this as a ‘factor rotation’ story and actually believe there is still considerable alpha to be earned by factor investors as China’s economy and conditions for A shares strengthen in 2023. First, we observe that much of the quarter’s strength in growth stocks seems to have been in lower-quality shares bid up in frenzied trading by overly exuberant retail investors—an observation supported by the Quality factor’s modest outperformance—which bodes well for Quality (and ‘quality growth’), as emotional trading gives way to a focus on fundamentals. Moreover, the quarter’s underperformance in Value speaks to a looming rebound in ‘bargain’ stocks whose fundamentals support significantly higher valuations as macro conditions improve.

Index Performance and Outlook

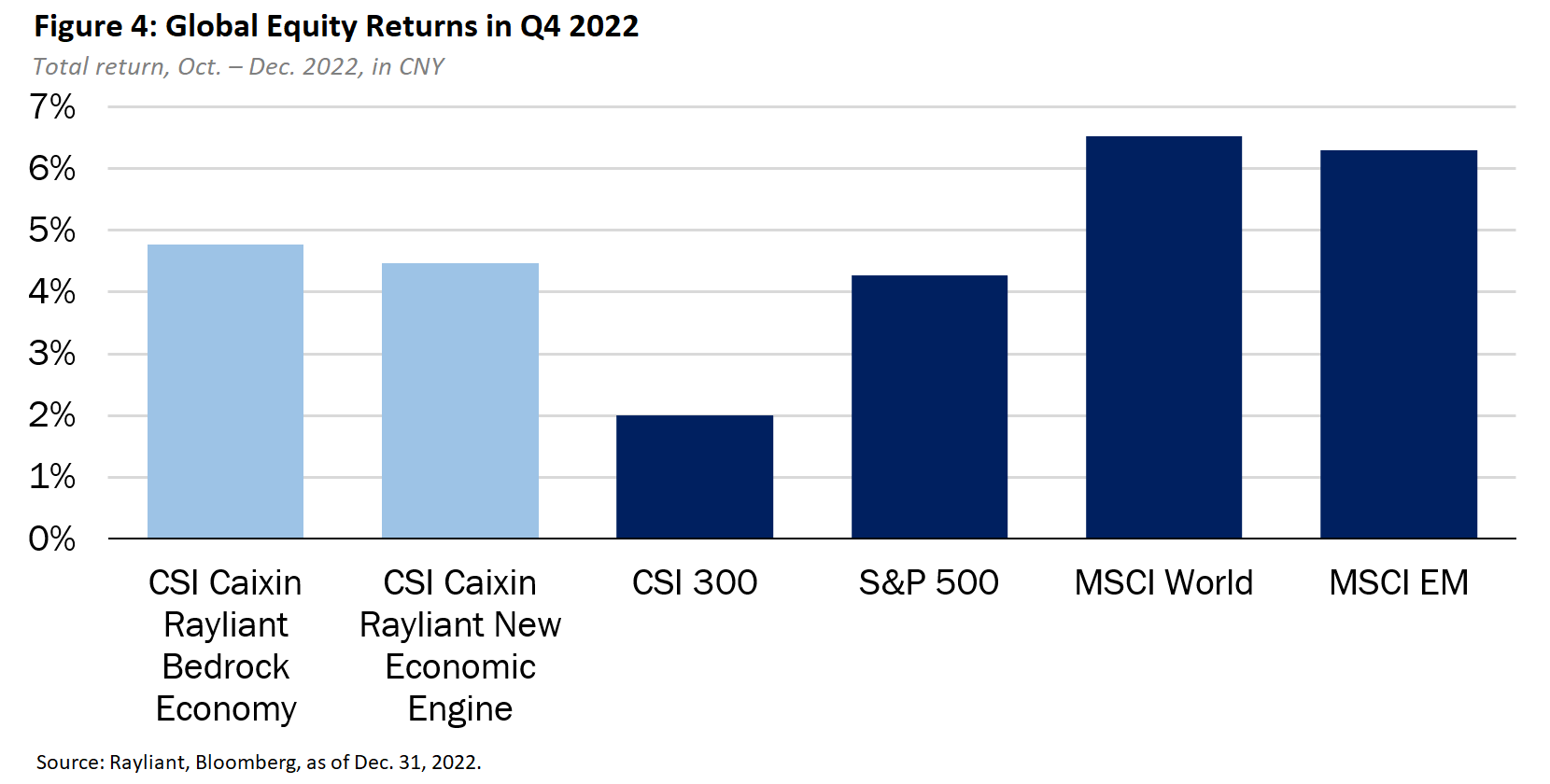

While A shares investors experienced a rollercoaster fourth quarter, policy developments in Q4 were undoubtedly positive and by quarter end had pushed onshore Chinese higher, with the CSI 300 Index gaining 2.0% (CNY) in Q4. U.S. stocks in the S&P 500 meanwhile rose by 4.3%, as hopes increased that the Fed might have engineered a soft landing and would, in any case, begin easing policy rights by the second half of the year. Optimism that China’s reopening might boost global demand and at partially offset the effects of last year’s restrictive central bank policy likely also contributed to a broader rise in equities, as both developed and emerging market stocks saw gains during the quarter (see below).

The CSI Caixin Rayliant New Economic Engine Index and the CSI Caixin Rayliant Bedrock Economy Index, tracked by Premia’s 3173 HK/9173 HK and 2803 HK/9803 HK ETFs, returned 4.5% and 4.8%, respectively, both strongly outperforming the CSI 300 Index, highlighting the broad-based success of factor bets through the last three months of the year.

- Both strategies once again saw the benefits of a measured tilt toward small cap companies, while the bedrock index reaped the benefits of its Low Risk and Quality exposures despite a downturn in Value stocks, and the new economy index clearly capitalized on a resurgence in Growth stocks.

- At the sector level, overweights to Financials and Communication stocks—two of the best performing sectors in the CSI 300 Index—and an underweight to lagging Consumer Staples shares provided the bedrock economy strategy with a boost.

- The new economy strategy, while hurt by its underweight position in Financials, benefitted from a large overweight to Health Care stocks, another strong performer in Q4, along with solid stock selection within the Information Technology and Consumer Discretionary sectors.

As mentioned last quarter, we believe China’s return to growth is not a short-term theme, but rather part of a much larger secular trend that will play out over a number of years as the second-largest economy on Earth continues its transition from ‘the world’s factory’ to a system driven much more by domestic consumption and true tech innovation—including green technology: an evolution which, of course, has motivated the construction of the bedrock and new economy strategies. China has long been on a path to overtaking the U.S. in terms of the size of its economic footprint. In the process of China’s transformative growth, we expect policy agenda to become increasingly important for these two great rival economies. In this regard, the policy supported sector tilts and financial health screens for both of the Premia ETFs would provide an ideal fit for such opportunities. The decoupling of the two biggest economies also creates opportunities for more uncorrelated returns through diversification.

We witnessed flashes of that shift throughout the last year. It was apparent in pandemic policy differences, which disproportionately restrained China’s economy, while sending shockwaves through global logistics and supply chains. We saw it again as competition escalated in the technology space, where China’s dominance in green tech met with a world seeking smarter energy strategies and U.S. attempts to contain China in areas like semiconductor manufacturing seem likely to drive domestic innovation toward technological self-sufficiency. China-U.S. decoupling was perhaps most obvious in terms of the widely cited ‘policy divergence’ between the two nations. As the Fed and other central banks around the world pulled liquidity out of the economy in an effort to subdue rising prices, low inflation in China has allowed the PBOC to pursue an increasingly accommodative stance designed to kickstart a broad rebound, made much easier now with the dismantling of zero-COVID measures that stymied much of the monetary and fiscal stimulus deployed in 2022.

We expect these trends to continue in 2023, as the Fed keeps policy restrictive to avoid a second surge of inflation and U.S. corporate earnings finally begin to show the damage done by rising costs and rate hikes of the last year. Meanwhile, in China, brick-and-mortar businesses will be lifted as the country’s reopening plays out and state support increasingly focuses on driving consumption by domestic households, which have been hoarding cash since the beginning of the pandemic. Policy will likewise be supportive of onshore innovation, providing a lift to stocks in the new economy—which, unlike U.S. tech, did not crater due to slowing growth and impossibly high valuations, but primarily as a result of pandemic policies’ temporary hit to spending, coupled with a regulatory crackdown on Chinese tech firms which has long passed its peak. We note that economists and Wall Street analysts have been forecasting China to show a robust turnaround this year, with positive spillover effects that will be the main driving force for outperformance of Emerging Markets, especially emerging Asia.

Ultimately, we believe this divergence is a good thing for investors, enhancing diversification in global portfolios and creating alpha opportunity for strategies with a focus on quality companies in the right sectors. It is important to note that it will be a ‘new normal’ ahead. Not only has the pandemic changed the way people and businesses think and operate, the geopolitical landscape and net zero diplomacy have also evolved significantly, such that the past decade might not be the perfect reference for actors and drivers ahead. As we look forward, it is critical that we are thoughtful when considering developing economic and market narratives—including the drama that plays out in our data—staying mindful of the fundamentals behind performance of our factor strategies.

*****************************************************************************************************

Dr. Phillip Wool is the Managing Director and Head of Investment Solutions at Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.