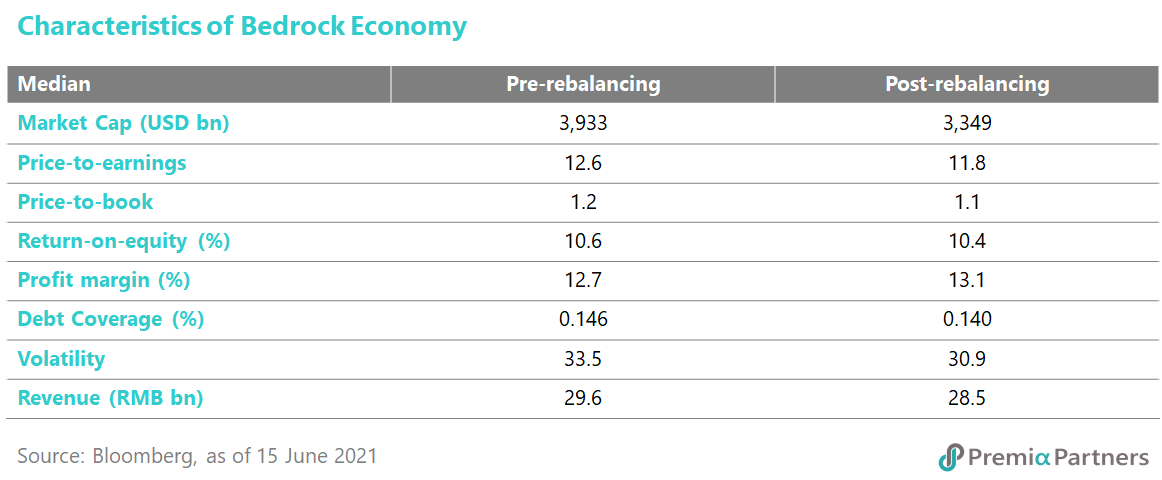

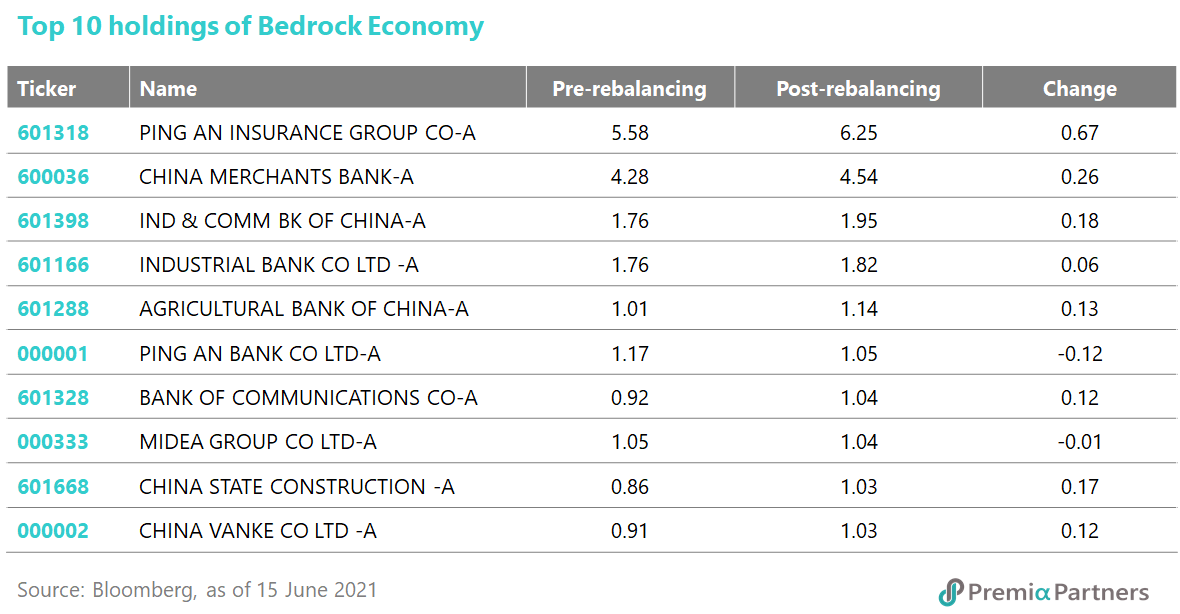

For CSI Caixin Rayliant Bedrock Economy Index, there were 114 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 37.7%, similar to the historical range between 30% and 40%. The value factor continued to work well with the Index becoming more attractive in terms of valuation by replacing overvalued stocks with undervalued ones, while maintaining the quality of the portfolio. The median of the price-to-earnings ratio dropped from 12.6x to 11.8x, but the ROE, profit margin and debt coverage stayed at round the same level. In addition, the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 33.5% to 30.9%.

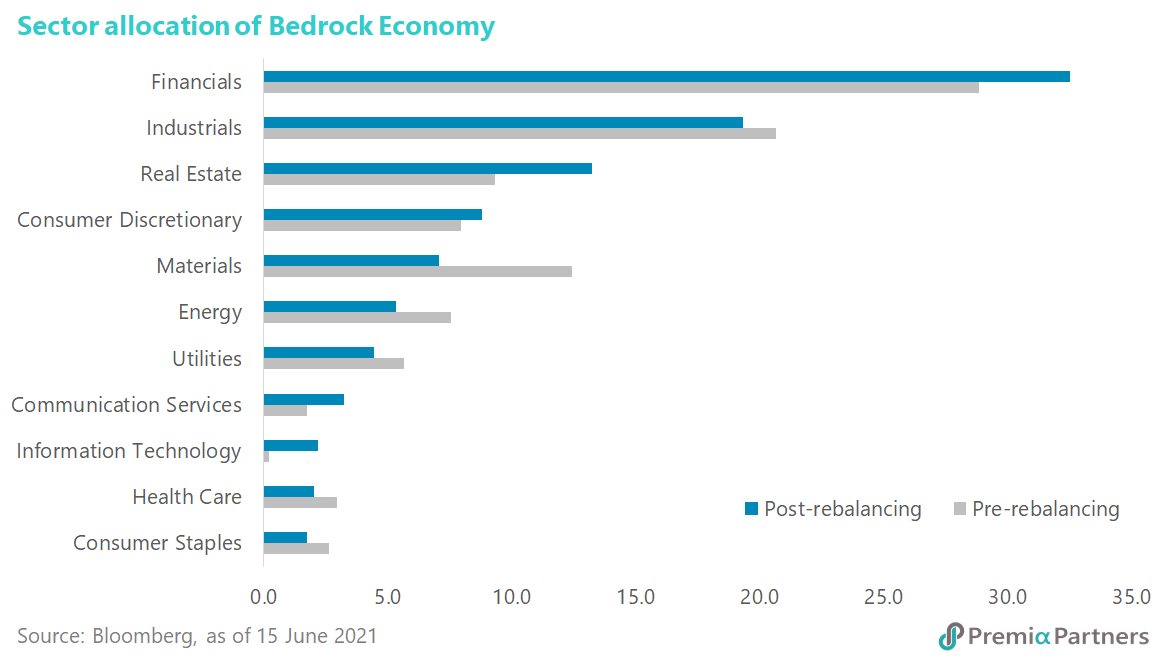

From a sector perspective, the major change was reducing exposure in Materials and Energy, and increasing weights in Financials and Real Estate. Drilling down into sub-segments, the additions in Financials are mostly banks and brokers, while the deletions in Energy and Materials are mostly upstream companies related to coal and metal mining. The less significant change was adding software and electronic equipment companies in Information Technology and media companies in Communication Services, while removing companies in Industrials and Utilities.![]()

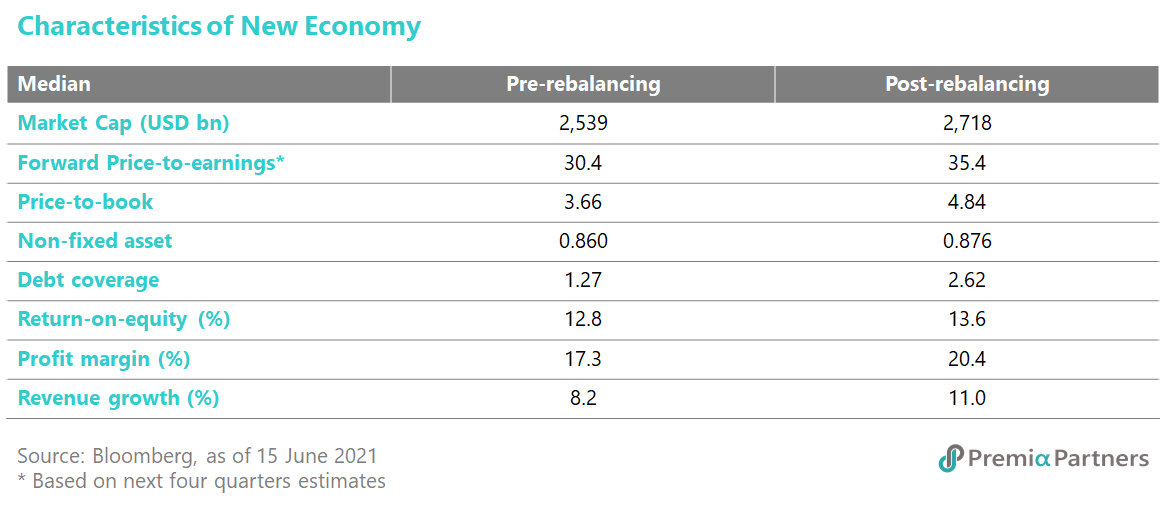

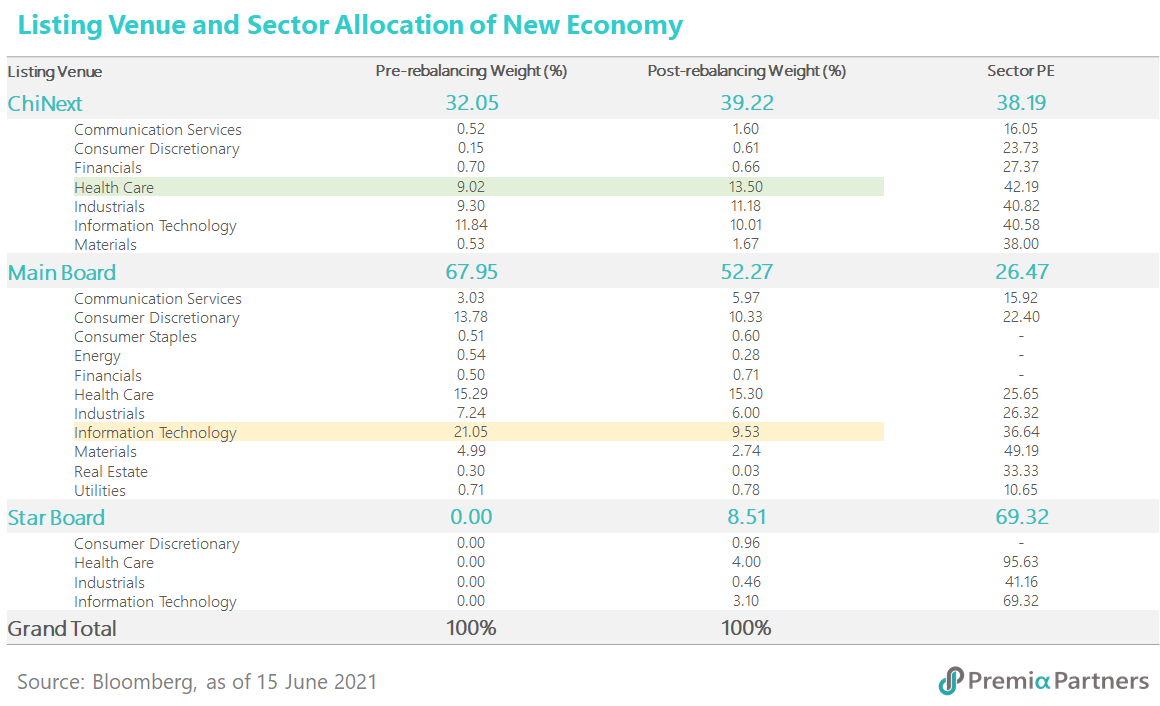

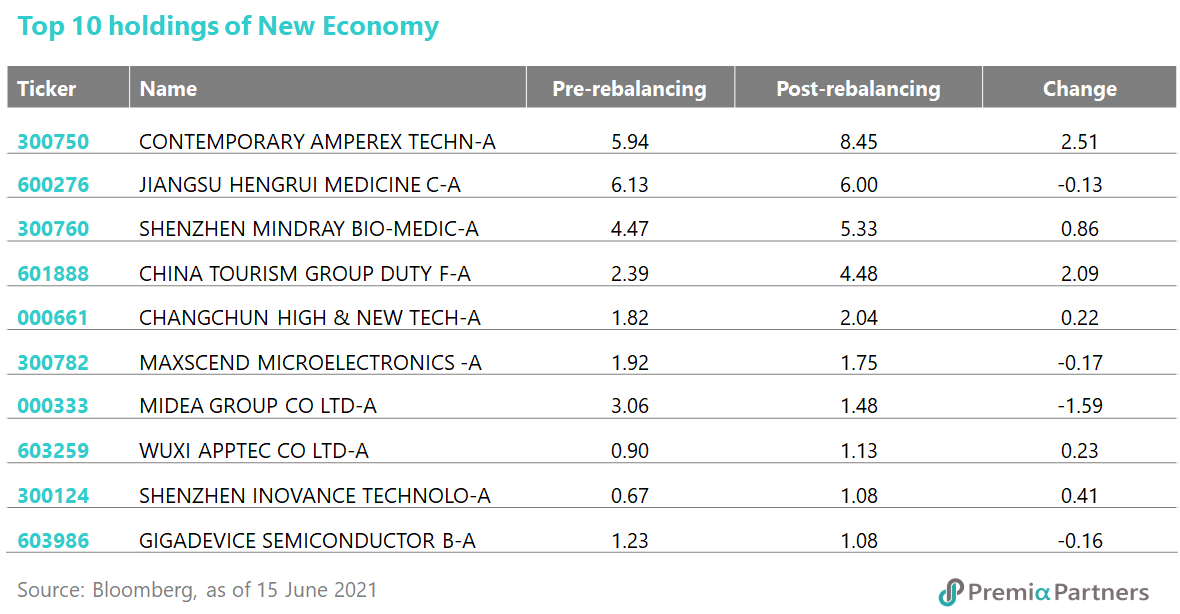

For CSI Caixin Rayliant New Economic Engine Index, its turnover rate was similar to the previous rebalance. There were total 109 replacements, and the one-way turnover was around 45.7%, slightly higher than the historical range of ~40%. In terms of financial health, the updated basket of stocks continued the trend of higher quality in general with siginifacnt improvement seen in the debt coverage (1.27x to 2.62x), return-on-equity (12.8% to 13.6%), and profit margin (17.3% to 20.4%). On top of that, the index consistuents are expected to grow faster with the estimated revenue growth rising from 8.2% to 11.0% after the resuffle.

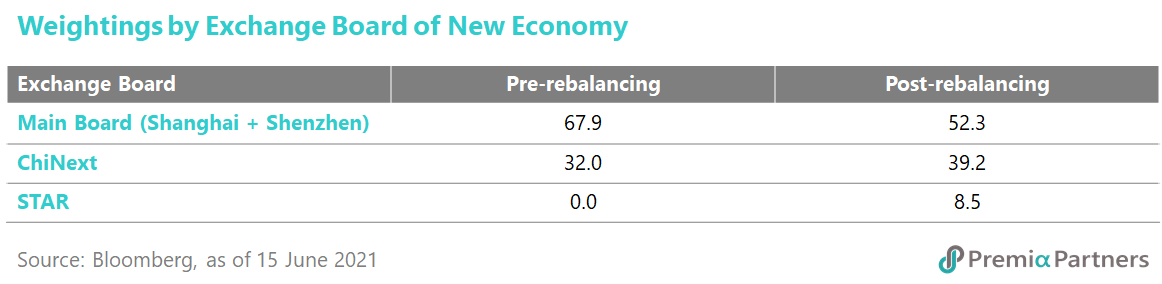

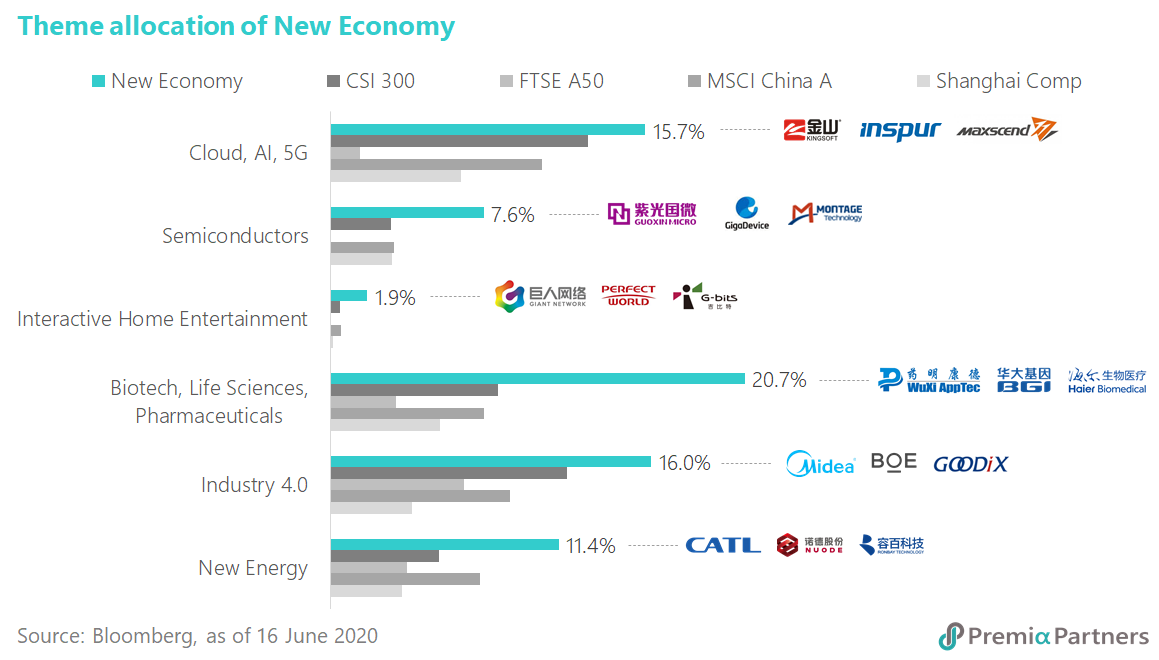

The Index PE after rebalance has increased from 30.4 to 35.4 due to the inclusion of the companies listed on the Science and Technology Innovation Board (STAR) in Shanghai, which have a higher PE than the stocks listed on the main board. The STAR was set up to support high-tech industries and strategic industries, such as New Generation IT, High-end Equipment, New Materials, New Energy, Energy Conservation & Environmental Protection, and Biomedicine which are all related the New Economy. As STAR has developed rapidly over last year, their weightings in the Index jumped from 0% to 8.5%.

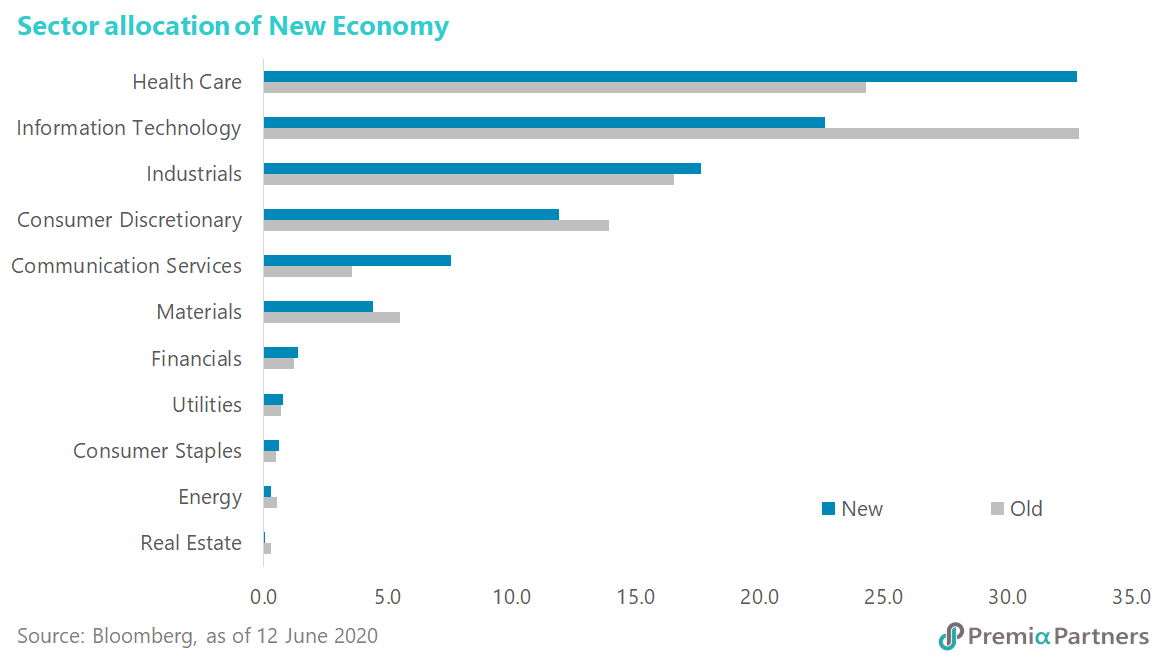

From a sector point of view, the major change is a reduction in Information Technology versus an increase in Health Care. The reductions in Information Technology were diversified into semiconductor, software and communications equipment. On the contrary, not all sub-sectors in Health Care got increase in weighting. The Index was selling pharmaceuticals companies while buying biotechnology companies. Also, the Index continued to have higher exposure than other major indexes in the mega trends, such as Cloud, AI, 5G, Semiconductors, Biotechnology, New Energy, etc., and allowed investors to gain exposure in all major themes in one product.

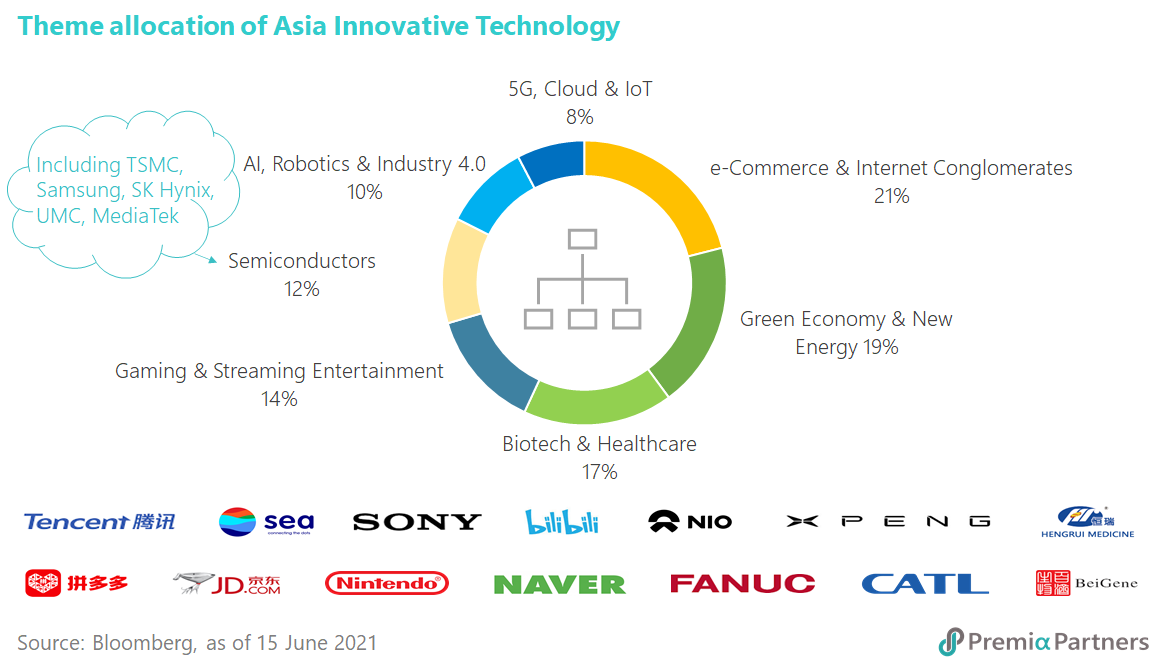

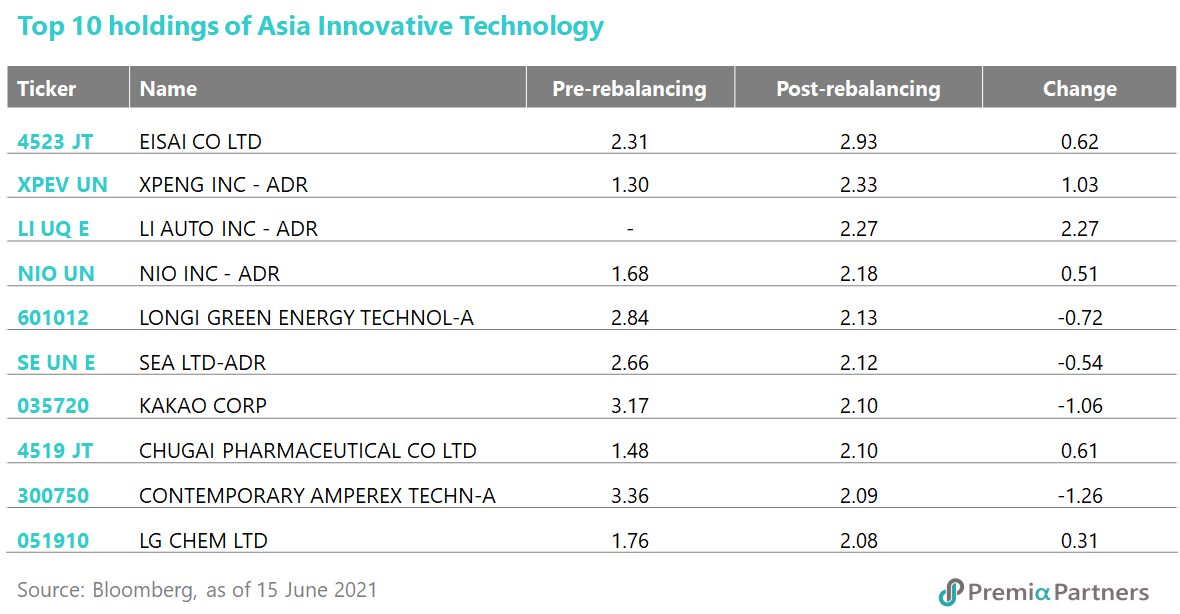

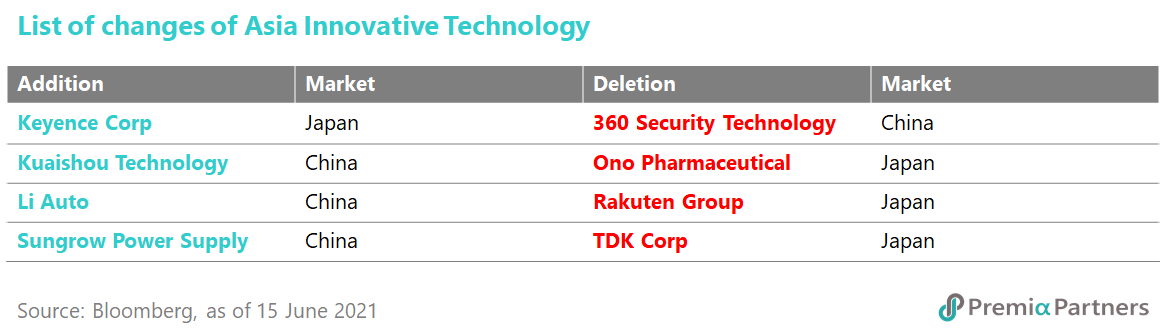

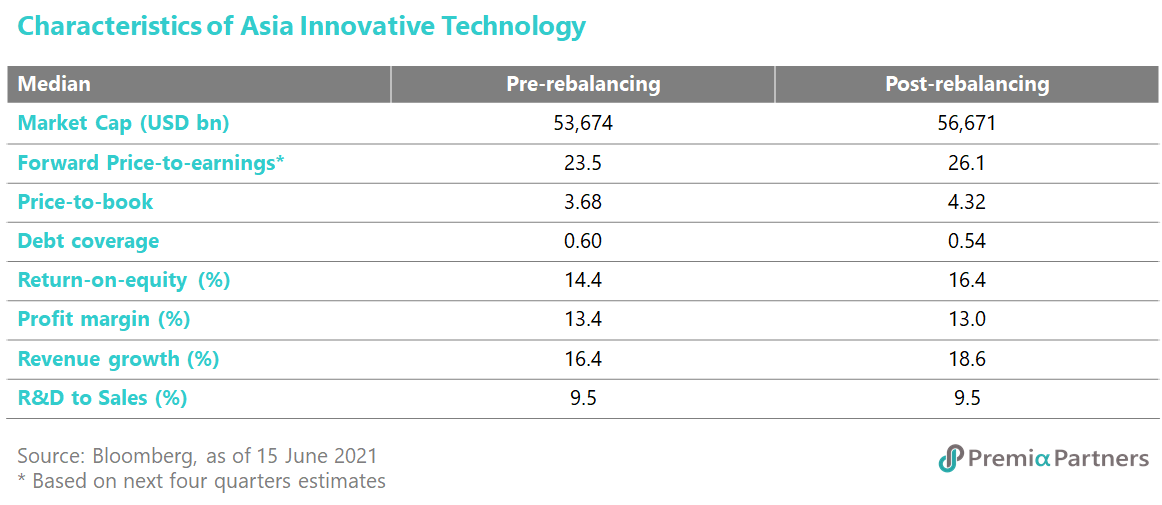

For Premia FactSet Asia Innovative Technology Index, there were 4 changes out of 50 stocks if excluding Baidu and Bilibili which were switching from the ADR to the shares listed in Hong Kong, due to a re-classification of the primary shares by the index company. Also, each stock is re-scaled to an equal weight of 2% in the portfolio. Among the 4 inclusions, there are 3 Chinese companies and 1 Japanese company covering themes including robotics & automation, media & web services, electric vehicle, and new infrastructure. On the other hand, 1 Chinese and 3 Japanese companies are in the deletion list, in which their businesses are mainly related to software, pharmaceuticals, e-commerce, and new materials.

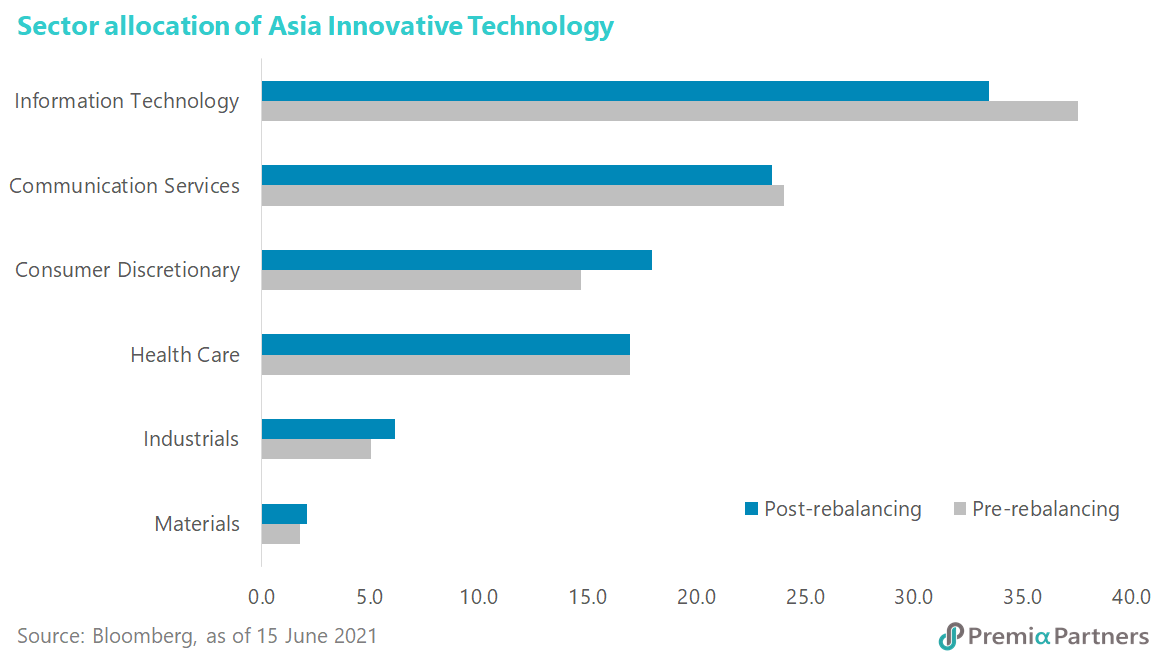

In terms of sector, although Technology remains the major components, its weightings was trimmed down as the Index sold software and semiconductors companies. The reduction in the former was due to the drop-out of 360 Security Technology while the latter was the result of the scaling down to 2% for existing semiconductor companies. A major portion of the decrease in Technology’s weightings was allocated to Consumer Discretionary. Although the addition of the electric vehicle company, LI Auto, was offset by the deletion of the e-commerce company, Rakuten, the remaining Consumer Discretionary companies got topped up to around 2% resulting an increase in the overall sector. For the rest of other sectors like Health Care, Industrials, and Materials, their respective weightings stayed around the same.