Observations in 2021

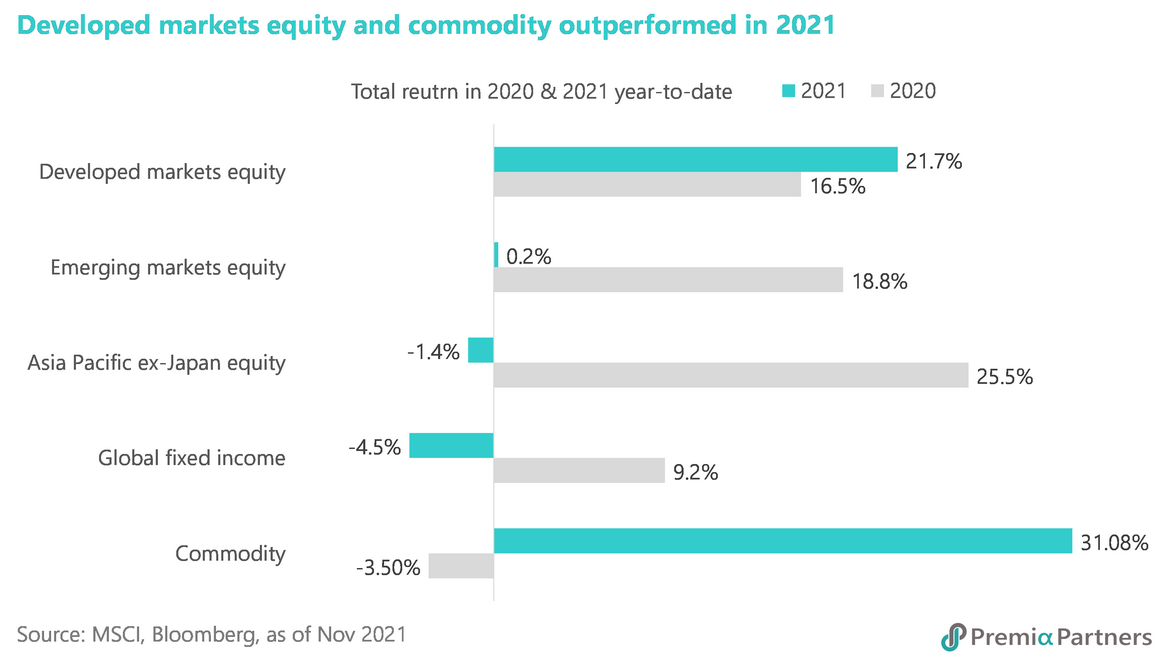

The developed market equities outperformed their peers in emerging markets and particularly China in 2021, reversing the trend in the previous year. The loose monetary policies in addition to the massive COVID-related stimulus introduced in the US and Europe helped drive the strong rally on abundant liquidity. The benchmarks like S&P 500 Index, Nasdaq Composite Index and Euro Stoxx 50 Index all reached new highs during the year, while Nikkei 225 Index hit its highest point in three decades.

On the contrary, Asia Pacific ex-Japan equities had a good start until mid-February, but then returned all the gains and stayed largely flat on increasing regulatory crackdowns from the Chinese government, extended COVID-lockdowns in southeast Asia, threats of power crunch and credit defaults among Chinese property developers.

Meanwhile, global fixed income market suffered a mid-single-digit percentage loss in return, but China sovereign bonds bucked the trend with a high-single-digit percentage gain. The total balance of the China's onshore bonds held by overseas institutions have reached RMB 3.5 trillion, doubling the amount two years ago. Analysts see the increase in foreign holdings reflects the confidence of global investors in holding renminbi denominated assets and the inflows driven by the FTSE index inclusion. On the currency front, the US dollar strengthened against all major currencies except renminbi and Canadian dollar.

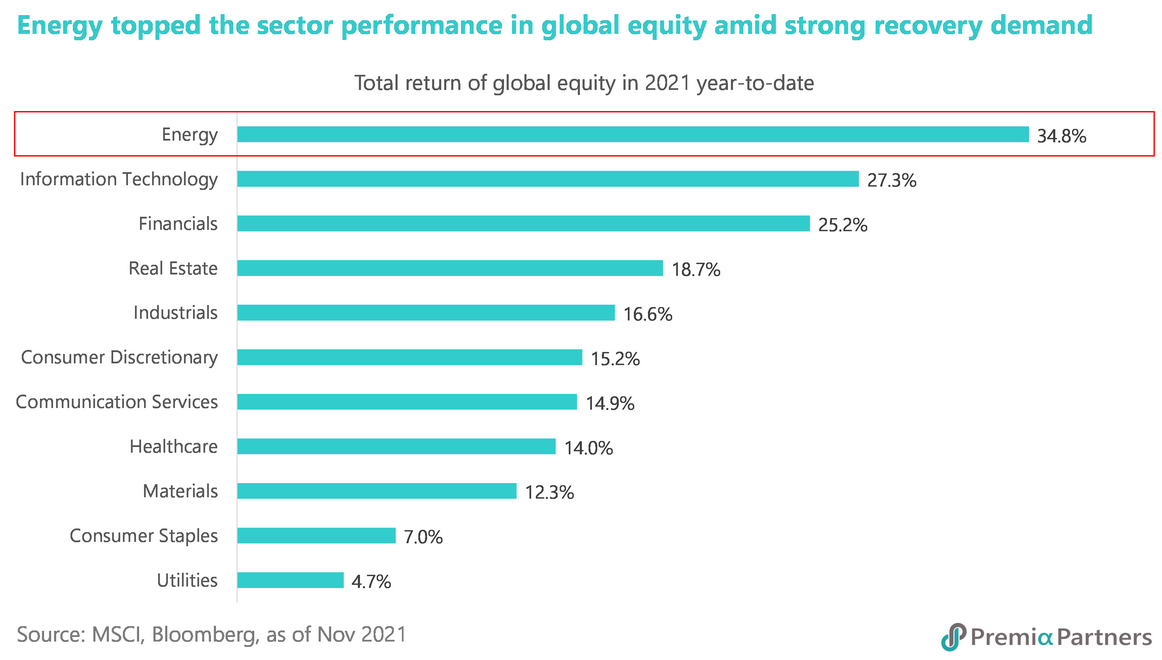

Sector-wise, energy names led the markets as oil price went up significantly amid the strong recovery demand and insufficient supply. Crude surged past USD 80 a barrel as soaring coal and natural gas prices prompted a switch to oil products such as diesel and kerosene. Besides, the OPEC's decision to hold back from a bigger than scheduled increase in output did not help resolve the tight market. Financials did well on the global improving macro environment, steepening yield curves and robust capital market activities. Technology stocks were also benefited from the exceptional booms in semiconductor. Chip lead times, the gap between ordering a semiconductor and taking delivery, increased from ~14 weeks in January to 22 weeks in November this year. The shortages have been felt the most in the automotive industry, which is reported to suffer from a loss of USD 100 billion in sales of vehicle. Consumer products ranged from iPhone to Sony PlayStation and internet routers all faced substantial delays in production because of the supply constraints of chips. Utilities and consumer staples stocks underperformed as investors were busy in loading up high beta exposure in a bull market globally.

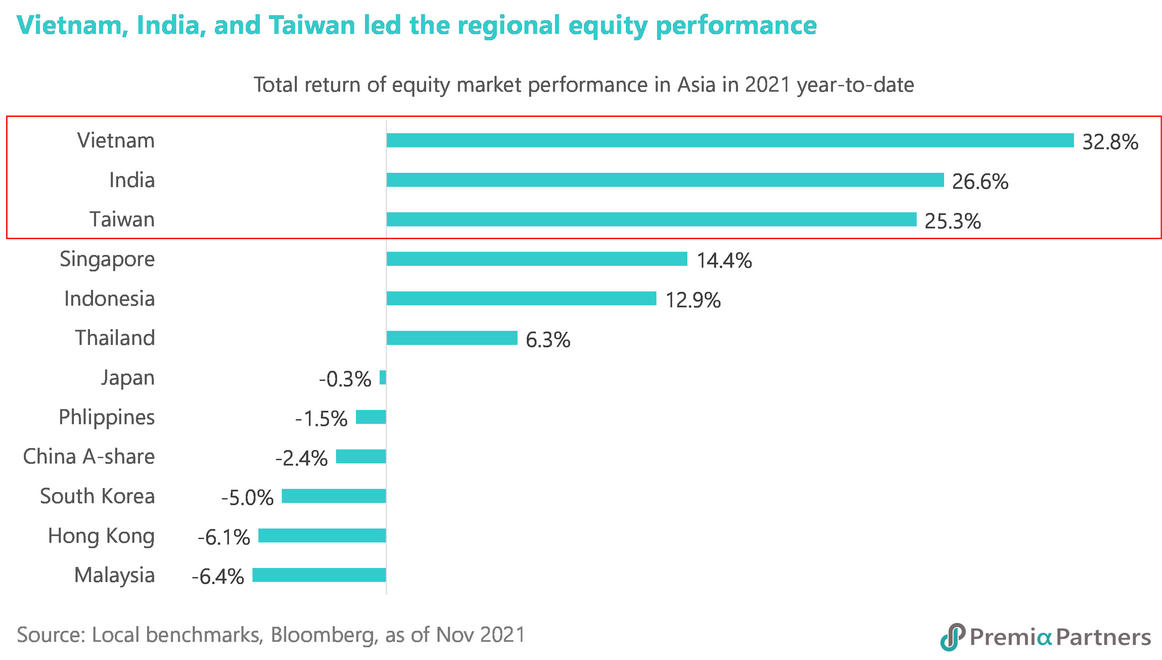

In Asia, Vietnam, India and Taiwan were top gainers with returns of over 20% in 2021. Investors were willing to look beyond the rising COVID cases in Vietnam and India, building up the equity exposure to capture the post-pandemic recovery opportunities. Taiwanese stocks were well supported by the record export orders due to resurgent worldwide demand, especially for electronic devices and new technologies such as 5G. Chinese equities recorded a double-digit return right before the Lunar New Year, but then faced mounting downward pressure on policy headwinds and eventually dipped into the negative territory. The ban of profit-making business model in private tutoring surprised the market and crushed the education stocks. Although the rule change may be in good faith from the Chinese government's perspectives like reducing unnecessary pressure for students and financial burdens for parents, it did force market participants to reprice any hidden policy risks.

For internet platforms, data security has become the top concern as these companies have accumulated millions if not billions of users' data. Without proper monitoring, the Chinese government is worried that they may pose significant privacy threat to the users, the industries and the nation. Simultaneously, an initial oligopoly market is forming as these service providers could easily lock users in a closed ecosystem across messaging, payment, micro lending, e-commerce, music, and gaming and live streaming. China market saw a new wave of weakness in the second half of the year on the back of rising credit defaults in property bonds, wide-spreading power curtailments and concerns of an economic slowdown. China's onshore A-share market outperformed the offshore ADRs listed in the US and the H-share in Hong Kong, as the stocks listed in Shanghai or Shenzhen were less exposed in the tightening industries.

What to expect for the new year?

Looking forward to 2022, investors should note that market landscape may have dramatic changes in the post pandemic time.

The fiscal and monetary stimulus with cheap liquidity may no longer be valid for some key economies since they have been recovering steadily from the gradual reopening. The pent-up demand pushed prices higher with the world economy weighted inflation increased from 2.1% at the beginning of this year to the latest 5%.

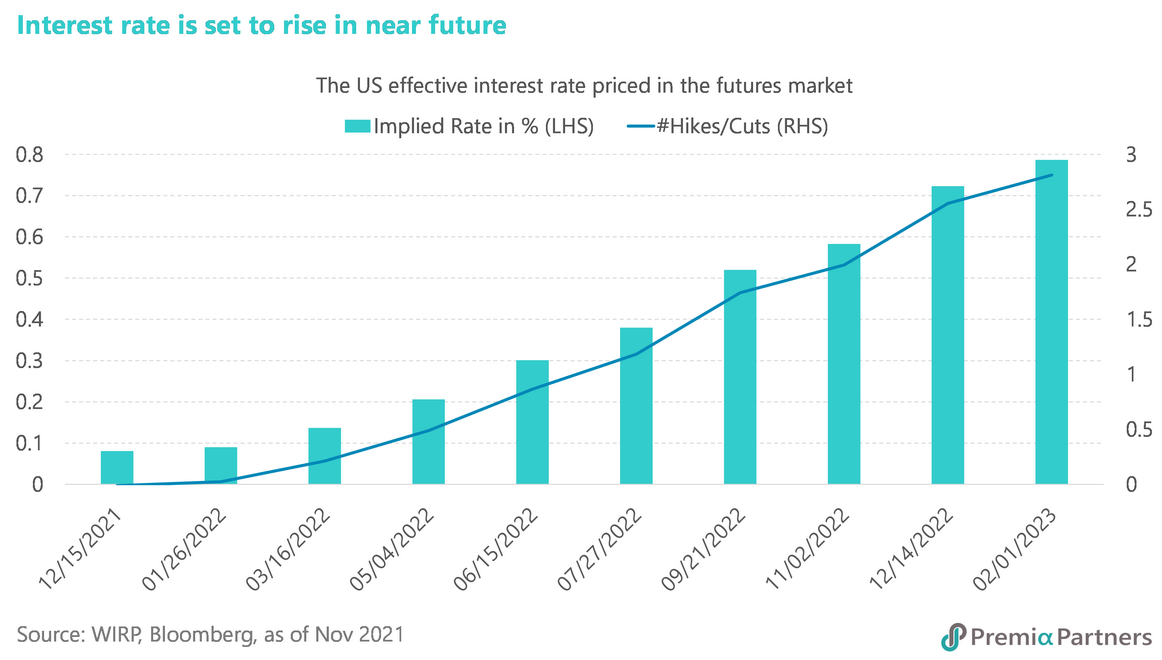

The US has started the tapering since November, cutting the size of its monthly bond purchases from the original USD 120 billion to zero by June 2022 with a monthly reduction amount of USD 15 billion. With the inflation pressure climbing high in various countries, the governments have no choice but to normalize the monetary policies. A few of them including New Zealand, Norway, Poland, Brazil, Russia, Mexico, Chile, Peru, Colombia and Korea have already begun the rate hike cycle in the past couple of quarters to curb a surge in prices.

The imbalance between supply and demand will be disappearing some time in 2022. Investment flew in the upstream and midstream spaces and will be reflected gradually in higher capacity and production output, matching the flattening downstream orders. That said, key assumptions would include minor or immaterial COVID-related lockdowns, adequate labour supply along the supply chain, vibrant global trade flows with receding geopolitical risks, undisturbed logistics network operating at rational shipping and freight rates, etc.

Global GDP growth is forecasted to decelerate from 5.8% in 2021 to 4.4% in 2022, but the slower expansion is still higher than the average annual growth rate in the past 4 decades, according to the World Bank. For investors, this macro backdrop should provide the right conditions for taking risks in (i) the markets which do not build in an excessive rate hike expectation, (ii) the mid-to-downstream segments which shall benefit from plateauing or falling commodity prices, and (iii) the companies that may continue to ride on the megatrends offering sustainable growth opportunities.

Geographically, the US market may no longer be the sweet spot due to stretched valuations, rising inflation pressures, imminent rate hikes and reducing excessive liquidities. Morgan Stanley suggested clients to stay away from the US stocks and bonds in 2022, whilst Goldman Sachs expected less impressive returns for the US risk assets as the economic cycle matures. In fact, Warren Buffett's flagship Berkshire Hathaway has been net trimming stock exposure in the past 4 quarters and now sits with a record amount of idling cash in its balance sheet.

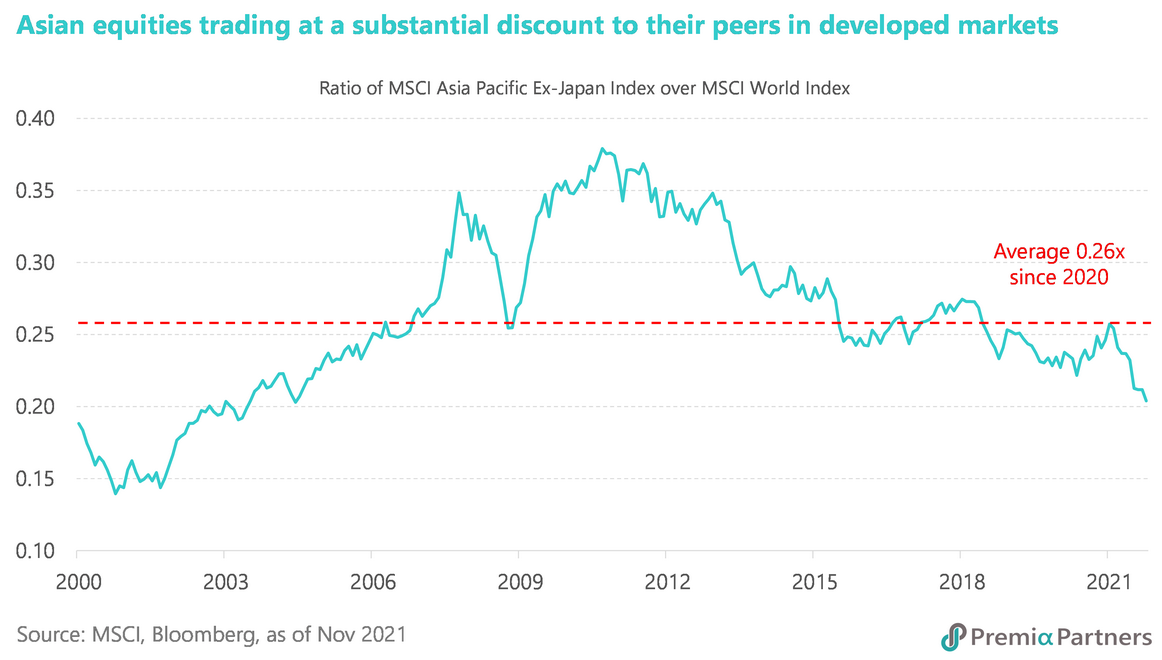

On the flipside, Asian equities are trading at 14.5x in forward earnings multiples and 1.8x in book value, a significant discount compared to the developed markets' 19.0x in forward PE and 3.0x in book value. Coincidently, a few sell-side brokers are upgrading China from underweight to overweight for 2022, citing tighter economic regulation has been priced in, while corporate earnings and valuation are set to improve.

China's regulatory crackdown remains the focal point in this region. We believe that the peak of the scrutiny has passed, and the government is willing to loosen the grip gently going forward. The Politburo Standing Committee fully understands there is always a balance to strike between the short-term tactical pain and the long-term strategic gain for the development in China. Based on the recent comforting tones from the top officials and the weak economic data released, it is not surprising to expect the government will roll out some easing monetary policies and implement less aggressive regulatory measures in various industries including the property sector.

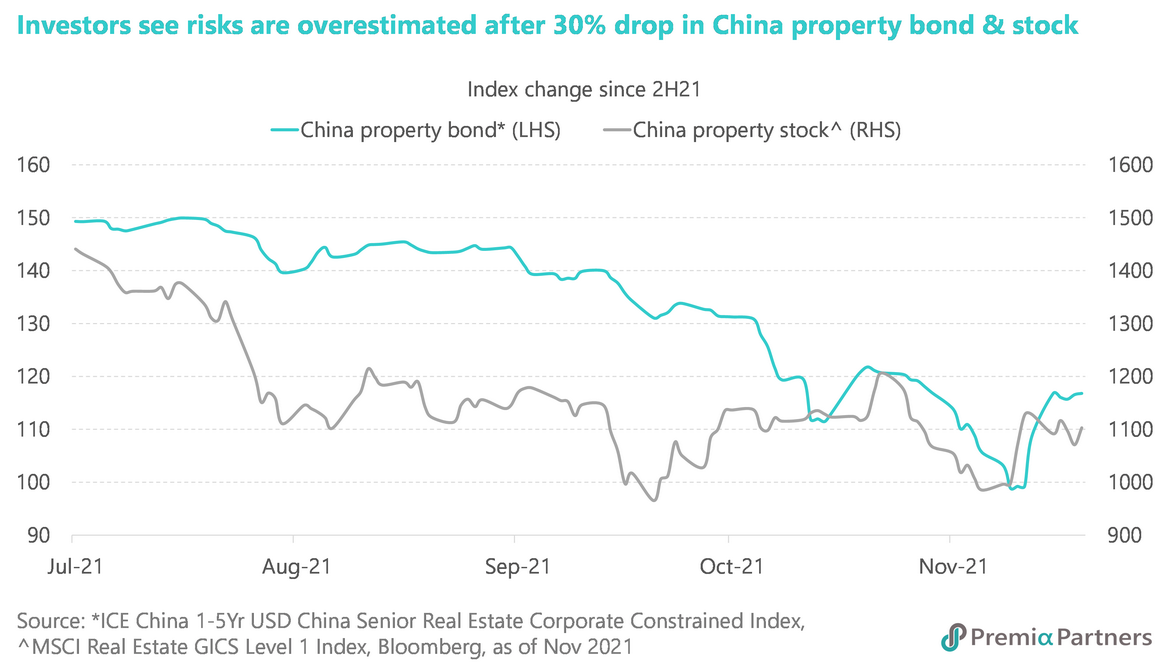

China's property and construction industries contracted in the third quarter for the first time since the start of the pandemic, and the combined sales of the country's top developers plummeted in September and October, the usual peak season for residential home sales. The credit crunch ignited by the highly leveraged China Evergrande Group and its junk-rated peers has been spreading to investment-graded issuers such as banks and tech companies. In order to avoid a systematic debt crisis and ensure social stability, policy direction has fine-tuned with regulators planning to let property companies resume issuance of asset-backed securities, speeding up the approvals of onshore debts issued by developers, and promoting home purchases with relaxed mortgage terms. Investors who have stronger risk appetites may consider bargain hunting the dollar bonds issued by China's leading property firms. Some buy-side managers including Goldman Sachs Asset Management and T. Rowe Price are buying these high-yielding debts as they believe the risk is overestimated and out of alignment with the true extent of distress.

One key concern in the market is related to the concept of “common prosperity” which has been frequently mentioned by the Chinese leaders. Some wonder if it means egalitarianism and is negative to the capital market, but we do not agree with it.

The term consists of two words – “common” referring to equality whilst “prosperity” emphasizing growth, so the agenda is to take care of both economic expansion and financial stability. World Bank estimates of the Gini coefficient – an economic measure showing the level of income inequality in a country – put China among the most unequal major global economies. It is sensible for the Chinese government to minimize the income gap by providing more support to the low-income population and accelerating the development of the rural areas. Providing access to basic needs like housing, education and health care services to the underprivileged segment will be prioritized.

Meanwhile prosperity is equally important. It's hard to imagine achieving all these social responsibility goals without a modest macro growth and increasing outputs. As investors, we shall expect that the new development model is shifting to a balanced and sustainable growth for China. For 2022, even 5% in GDP growth, the lower bound of the consensus forecasted range, remains high in absolute number given China's economic size and should be supportive to the capital market.

Besides, the recommenced dialogue between China and the US should help reduce the overall risk premium as the cold-war scenario can now be fully eliminated. An improved bilateral relationship may be useful to calm down the domestic roaring pricing pressure in the US by reducing the trade tariffs of imported goods from China. President Biden said that inflation hurts Americans' pocketbooks and reversing this trend is a top priority for him. So far, the Biden administration seems quite predictable in handling the diplomatic relationship with China, but investors should not expect things can dial back to pre-Trump era.

Cooperation and confrontation between the world's two leading economies will co-exist. Fortunately, market is getting used to the new norm. One thing can be certain is about the restriction of technology transfer, and the status quo will remain unchanged in near future.

Thematically, China’s new economy stocks may resume the momentum in 2022 after taking a pause in the past 12 months. We shall see more execution of various projects in the second year of the 14th Five Year Plan after having completed the initial planning and resources allocation. At the same time, the market response to any pandemic impacts would be short-lived as investors should be well-prepared after living with the virus for almost two years.

Addressing the strategic goal of becoming a prosperous, modern society under the 14th Five Year Plan, President Xi emphasized that the digital economy encompassing elements such as the Internet, big data, cloud computing, artificial intelligence and blockchain, is reshaping the economic structure worldwide and changing the competitive landscape. The top national agenda is to develop core technologies and achieving self-sufficiency in the key areas including semiconductor. In a way, the recent regulatory measures can be interpreted as the essential steps to prevent monopoly and disorderly expansion of capital.

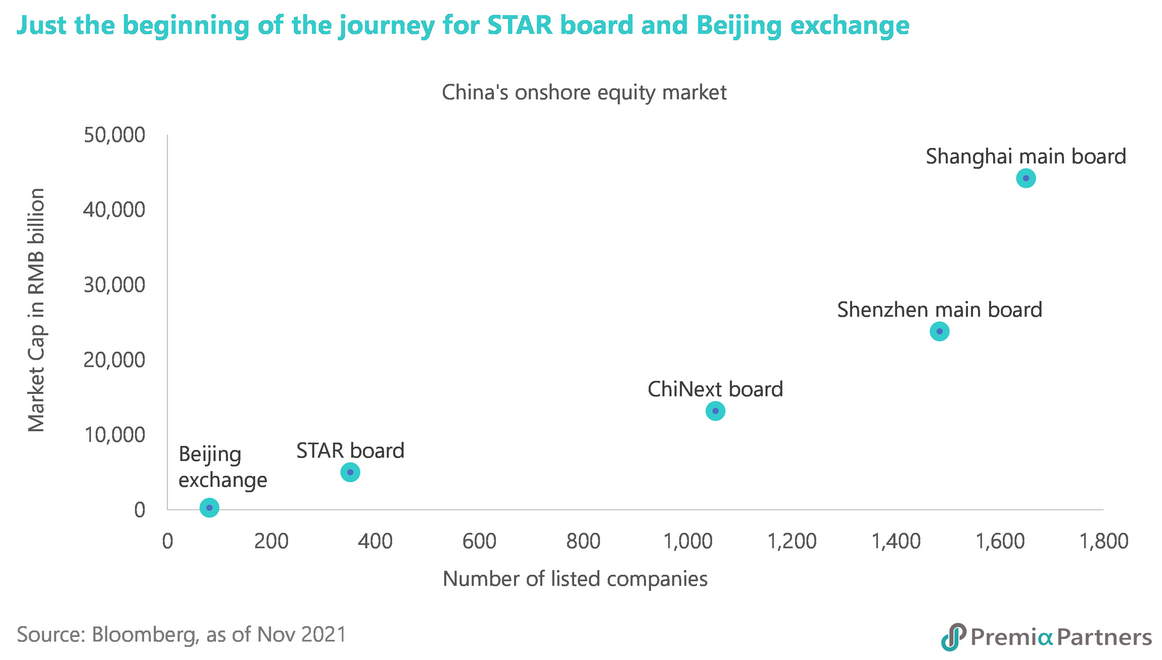

To assist the home grooming of future leaders in hard core technologies, China has been reforming the capital market to quicken the facilitation – with the launch of the STAR Board at Shanghai Stock Exchange and the Beijing Stock Exchange. The STAR market has assisted a total of 358 innovative and strategically important companies to raise funds locally since it was launched in July 2019. The National Equities Exchange and Quotations (NEEQ), an over-the-counter market, is also transforming into the Beijing Stock Exchange, which is positioned as a primary funding platform for service-oriented and innovative small businesses.

Climate change and green economy will be another key focus despite the watering down version of the Glasgow Climate Pact from COP26 seems like a disappointment. In China, carbon neutrality is pledged by President Xi himself, so the policy direction is highly certain with a clear roadmap and milestones to be met. New capacity in wind and solar power will continue to roll out whilst carbon peaking will be reached in less than 10 years. The power curtailments in the second half of 2021 were just a hiccup. Local governments will have to meet the green economy targets like energy conservation and emission reduction by lowering the reliance on fossil fuels. Even India, the world’s fourth biggest emitter of carbon dioxide after China, the US, and the EU, has promised to reach net zero by 2070, a timeline 10 years after China’s target.

The US sanctions and delisting risks remain an overhang for Chinese ADRs with continuing scrutiny from the US SEC. More companies will return home by listing in either Hong Kong or Shanghai in 2022.

Beyond China, the north Asia stays interesting as technology supply chain and the concept of “Metaverse” start to make meaningful foray into the stock and investment markets. Markets like Japan, Korea and Taiwan will carry on their positive momentum among the companies involving digital gadgets, electronic components, chips and gaming.

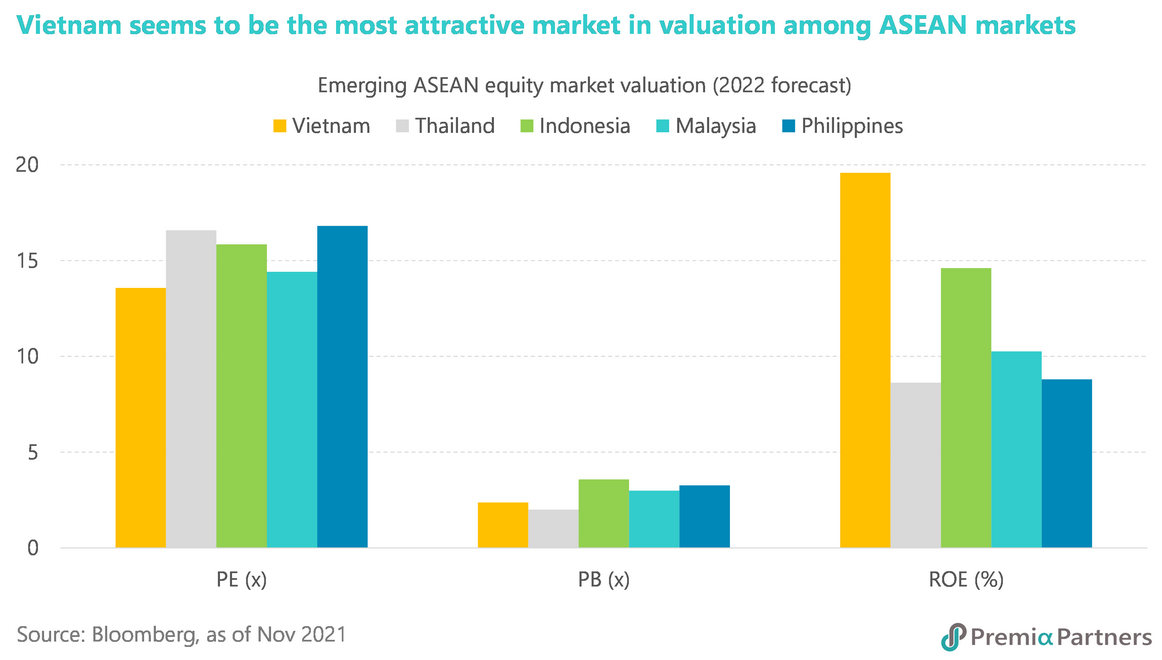

It is also expected that the ASEAN region will finally catch up in economic activities as government policies are moving from pandemic control to economic recovery in the next few quarters. Thanks to accelerated vaccinations, the cluster of five emerging ASEAN countries, namely Indonesia, Thailand, Malaysia, The Philippines and Vietnam, will grow at 5.9% in 2022. Vietnam is identified as one of the prioritized destinations among emerging economies due to tits development potential and open-door policy, according to Standard Chartered Bank. The country is expected to take full advantage of free trade agreements and establish itself as an important production base of the global supply chain. Valuation-wise, Ho Chi Minh stock market is trading at 13.6x in forward P/E, lower than its neighbors such as Indonesia’s 15.6x, Thailand’s 16.8x, Malaysia’s 14.5x, and The Philippines’ 16.9x.

And finally here are the relevant Premia ETFs that you may find relevant as convenient building blocks to position for opportunities ahead -

ETF | Trading counters | Market | Strategy |

China A-share | It leans towards stocks with light-asset models, stronger financial positions and better growth prospects in information technology, healthcare, consumer discretionary and communications. New economy space is clearly benefiting from policy support and showing a clear roadmap in medium-to-long term. | ||

China A-share | It tracks the top 50 stocks listed in the Shanghai Stock Exchange Science and Technology Innovation Board, a specialized platform to grow and incubate innovative, technology-enable national champions in strategic policy supported sectors that needs intensive research and development input. | ||

China A-share | This multi-factor approach emphasizing value, quality and low volatility is appropriate for investors trying to profit from the sector rotation from time to time. Its diversified basket with a balanced sector exposure may help generate alpha performance potentially when market is narrowing the deep discount offered by the value stocks. | ||

Vietnam equity | It aims to gain market access by tracking MSCI Vietnam index. Vietnam is expected to be among the fastest growing economies with a GDP growth of 6% to 7% in the next few years and fits perfectly to the “China plus one” model when multinational companies are reconfiguring their supply chains, looking for alternatives from China. | ||

ASEAN equity | It invests in the emerging ASEAN markets including Indonesia, Thailand, Malaysia, the Philippines and Vietnam, which may be a catch-up play on reopening after lockdowns and macro recovery. In the medium-term, the region is supported by increasing urbanization, rising consumption, booming infrastructure and favorable demographics. | ||

Asian equity | It utilizes FactSet’s Revere Business Industry Classification System to identify the Asian leading innovators riding on the megatrends of digital transformation covering also blockchain and metaverse players, robotics & artificial intelligence, health and life science. The result is an equal-weighted portfolio of the top 50 industry leaders in China, Japan, South Korea, Taiwan and Singapore. | ||

China onshore RMB bond | It invests fully in Chinese government and policy bank bonds with A1 ratings, which is not subject to the high volatility in the credit markets. The long duration exposure will not only have an absolute higher yield but also capture any mark-to-market gains on potential downward movement of the yield curve if market expects further easing in near-term. | ||

China offshore USD bond | It provides easy access to a basket of diversified dollar bonds issued by leading Chinese real estate firms. The features of 5% weighting cap per issuer group, short maturity and senior claims would enable the fund to minimize the potential drawdown in recent wave of credit defaults. Investors may consider using it for bargain hunting the distressed bonds with quarterly dividend distribution from the ETF. | ||

US Treasury Floating Rate Note | It invests in the floating rate notes issued by the US Treasury. Investors may see it as a dollar cash tool with no withholding tax, minimal credit and duration risks, low cost and trading daily in Asia time zone. The characteristics of the floating rate notes may enable the ETF to immediately reflect any rate hikes in near future without being subject to the potential mark-to-market loss. |