Evolving Chinese consumer trends: a shift towards quality, experience, and emotional value

Consumer spending in China continues to grow strongly by international standards, even as the pattern of that spending evolves. An understanding of how young Chinese spend is useful in identifying the winners of this quiet but significant sea change in consumer behaviour.

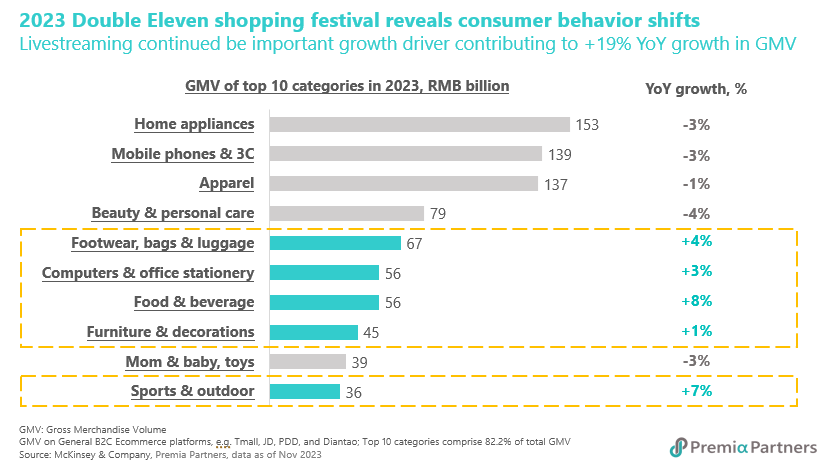

The image of weak consumerism in China – as portrayed by the media – is misleading in two ways. For starters, the growth in retail sales in China is only “low” relative to the very high (mostly double digit) rates recorded in the 2010s. However, at 7.2% y/y growth in the full year 20231, China’s retail sales growth compares very well internationally. For example, US retail sales growth for the year was 5.6%.

However, beyond that, there are also changing social trends which are driving different forms of consumption in China, which then support investments that are more reflective of the transformation in China.

The latest headlines in the financial media, noting the surge in the number of domestic tourist trips during the recent 8-day Lunar New Year holidays, speak to that changing pattern of consumption in China. Domestic trips rose 34% from the same period in 2023 and spending increased 47%2.

What is happening in China is not dissimilar to the trend in other global consumer markets after the pandemic, where there has been a sea change in the consumer mindset, and that is driving an overhaul in consumer behavior and consumption baskets in China and around the world. Think of the “Swifties” of America or Australia who spend thousands on tickets, travel and accommodation to see their superstar hero but make their own Taylor Swift outfits with glue guns and rhinestones and cheap plastic “cowboy hats” rather than paying for ready-made glittery costumes.

For young Chinese, who are the main driving force in China’s consumer market, “frugality” which used to be culturally a prized virtue has become a fashionable trend. This is about the pursuit of smart consumerism for minimalistic, value-for-money style.

The economic implications of such a major change and the implications for business opportunities is a topic that deserves much deeper exploration. This shift in the consumer psychology, marked by the interplay of decreases and increases in spending across different consumption pockets and items, reflects not only their lifestyle but also serves as a microcosm of China’s economic development and the evolution of the value and utility systems of young consumers in the modern economy – many of whom are also products of the one-child policy era.

This insight analyses the changes in several consumption habits to ascertain whether this generation of young people is willing to spend and where they choose to allocate their expenditure. Their changing preferences will reshape the consumer sector for decades to come.

Rational consumption has become the keyword. Today's young people prioritize practicality above all, eschewing brand chasing or following the latest trends. Instead, they pursue product functionality. An increasing number of young consumers tend to purchase based on "need," focusing on long-term satisfaction rather than fleeting gratification.

- They shun diamonds in favor of gold, seeking a safe-haven hedge against potential economic uncertainties. According to the National Bureau of Statistics data, gold and silver jewelry sales increased by 13.3% year-on-year in 2023, surpassing overall retail sales of consumer goods, which grew by 7.2%1.

- They are averse to impulse consumption – spending in a more considered and calculated manner than the generation before them. Being internet savvy, they are inclined to rely on reviews and trials rather than blindly trusting advertisements and promotions to make decisions. Over 90% of consumers refer to "third-party evaluations" before shopping and making decisions on the best cost-performance ratio products, according to a survey conducted by Deloitte3.

- They make budgets and are not afraid to tell everyone. Indeed, “loud budgeting”4, referring to loudly talking about own budget, is becoming a trend among young people. By openly celebrating and sharing budgeting efforts, young people are collectively paving the way for rational consumption habits.

- They may opt for preowned platforms or rentals to fulfill their expectations of functionality instead of purchasing at original prices. User numbers on Xianyu, Alibaba’s online flea market, have been growing in recent quarters, with daily active users rising 20%5 in the third quarter from a year earlier, according to Alibaba’s financial report.

- The above behaviours are quite similar to the description of the western “Gen Z” as presented by German marketing software company Talon. One, which said Gen Z people “tend to be ‘informed consumers, and will often research and weigh up options before making a buying decision…(and) tend to be much less attached to specific brands, instead preferring to shop around for the best deal.”

Seeking value for money, they opt for domestic substitutes over international brands. Frugality does not mean that young people are not interested in trends or that they compromise their living standards. Rather, they seek to enrich their life experiences via a wide array of choices. In terms of value for money, they may turn to domestic, budget-friendly alternatives of equivalent quality at half the cost.

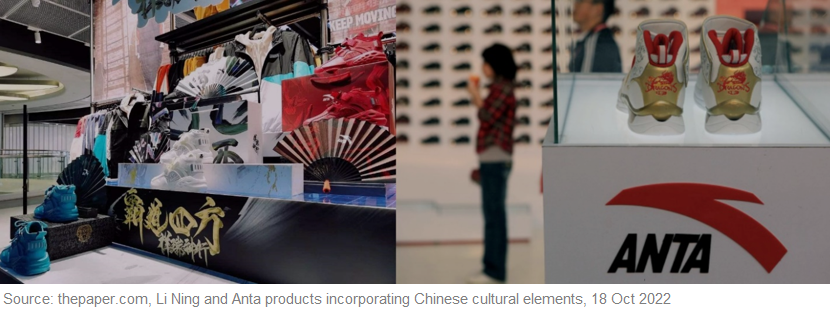

The trend of shifting from international brands towards locally made products is also seen in youth fashion. An example is the rise in demand for “guochao” (or "Chinese chic") fashion apparel, which are sleek local designs incorporating traditional Chinese elements and cultural symbols/icons elegantly in modernized fashion items, ranging from casual wear to the traditional “Hanfu” (traditional Chinese costumes) to chic luxury accessories with heavy influence of Chinese cultural elements. With the renaissance of such Chinese chic and renewed appreciation of cultural heritage updated with modern day interpretations, it is not unusual now to see young women dressed in classic or updated “hanfu” in streets and subways during public holidays.

Sports brands Li-Ning and Anta, established in the 1990s, have continuously introduced new products infused with retro elements such as Chinese dragons, phoenixes, cranes and Mahjong tiles in recent years to appear to this group of young consumers and have done so quite successfully.

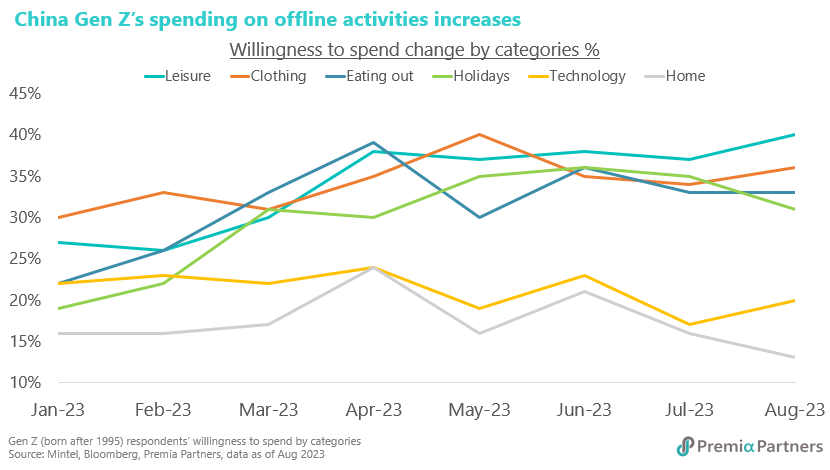

They prioritize experiences and hobbies over tangible “goods”. Some may perceive these young people as overly thrifty. Yet, what appears to be happening is a shift in patterns of spending and a change in these consumers’ perception of "value". Previously, the value of an item might have been associated with the product displaying social identity. However, these days, young Chinese are more willing to spend on interests and hobbies such as travel, concerts and movies. In the first nine months of 2023, the revenue of commercial performances increased 84.2%6 compared to the same period in 2019, with nearly 90% attributed to musical concerts. The flow-on effect of musical concert attendances can be seen in tourism-related activities, such as night markets and city day trips. Additionally, the box office revenue of films in 2023 also saw 82.6%7 growth from 2022. The mantra "save where possible and spend where necessary" epitomizes the consumption philosophy of this generation of young people.

Emotional value is a necessity for young people which generates proliferation of new monetization opportunities. While rationalism drives consumer demand towards intrinsic values of the subject, experientialism takes the purchase decision to a higher level that entails emotional connection with consumers, where the consumption experience derives utility from self-worth, personality, and emotional connection for consumers. While such phenomenon to some extent is global after the pandemic, in China it is especially pronounced among young consumers who are also the major drivers of domestic consumption in China. For instance among the top ten products announced by Taobao for the year 20238, "Einstein's Brain" stands out as the only virtual product priced between 0.01 and 0.5 RMB, with at least 150,000 purchases made to gain some brain. On online second-hand trading platforms, there are even listings for intangible, abstract items such as sunset moments, temple blessings as well as virtual companionship and omnipresence in the form of cloud supervision and study companions, etc. These seemingly unconventional products are saleable because they resonate with the emotional needs of young people.

Such growth in the “emotional economy” reflects Chinese people's pursuit of high-quality lifestyle and the long-term, positive development of society as GDP per capita moves up and people seek higher level demand according to Maslow’s hierarchy of needs.

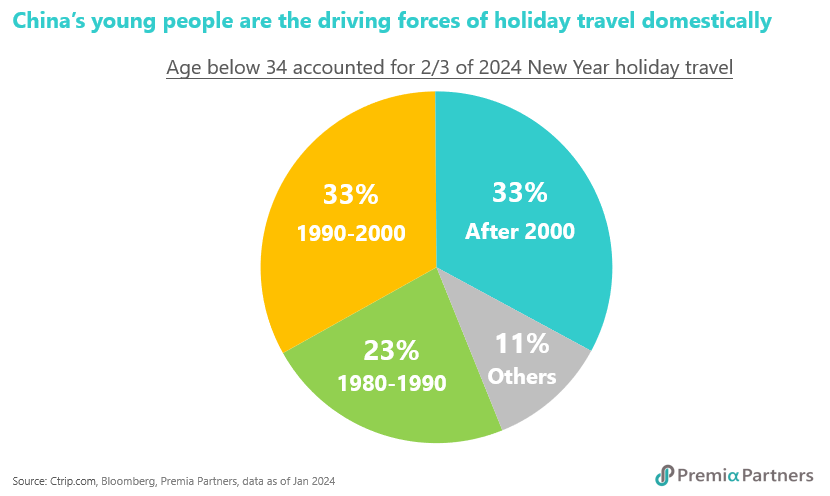

On the other hand, consumers also increasingly derive utilities from bargain hunting, and strategizing spends to maximize value for money. During the Labour Day holiday last May, young people flocked to the city of Zibo9, which saw a staggering surge in tourist numbers due to its promise of a low cost and value-for-money experience. In the snow season, the northeast city of Harbin becomes extremely popular due to its low prices and welcoming hospitality. In the latest Jan.1 long weekend, China’s domestic tourists totaled 135 million10, up 9% from the pre-pandemic 2019 level. Those aged below 34 were the driving force. The numbers for the Lunar New Year holiday were even more remarkable. The number of domestic tourist trips during the 8-day Lunar New Year holiday was up 19% from the same period in 2019 and 34% higher than the same period in 20232.

In short, open-minded and budget-conscious youth are drawn to quality products and services that offer value for money, especially experiences and services that provide emotional comfort and genuine hospitality. This in turn reflects China's transition towards higher quality development where consumers no longer blindly pay for brands without matching quality.

It had been a long-observed phenomenon that has intrigued a lot of western observers, that many young Chinese, when they travel abroad, would spend so much buying Chanel or Gucci bags, but then so little on food and hotel during their trips abroad. This has changed – young people are spending more experiencing Michelin star restaurants and staying at Instagramable boutique hotels and villas now, as showing off bags no longer offer relevant utility for them.

As Chinese consumers continue the pursuit of smart spending and high quality domestic brands that resonate with local tastes and values, it is natural for domestic champions as well as international brands that invest for localization, personalisation and quality upgrade to win the hearts and minds of Chinese consumers going forward. Premia CSI Caixin China Bedrock Economy ETF (2803), Premia CSI Caixin China New Economy ETF (3173), and Premia China STAR50 ETF (3151) which cover leading sector leaders in China across various new economy and hardcore technology drivers are very well placed for related opportunities. These funds comprehensively cover sectors benefiting from China's economic transformation and industries receiving significant policy support. They provide a viable avenue for capturing the alpha in high-quality transformation opportunities in China while offering resilient beta participation in the country's economic recovery.

-------------------------------------------------------------------------------------------------------------------

2 Source: CNBC, “China Lunar New Year travel spending surpasses pre-Covid levels”, 18 Feb 2024

3 Source: Deloitte, “2023 China Consumer Insight and Market Outlook White Paper”, 8 Mar 2023

4 Source: Bloomberg, “‘Loud Budgeting’ is the latest Tiktok trend for saving money”, 23 Jan 2024

6 Source: 36Kr, “2023年中国演出票务行业研究和报告(2023 China’s Performance Ticketing Industry Research Report)”, 10 Jan 2024

7 Source: Statista, “Box Office Revenue in China from 2013 to 2023”, Jan 2024

9 Source: Bloomberg, “Broke Chinese Gen Zs turn factory town into top tourist spot”, 29 Apr 2023

10 Source: Bloomberg, “China’s jobless divas hit the road”, 30 Jan 2024