Sichuan, immediately after partial resumption of power supply after two weeks of power rationing due to extreme heatwave and historic drought, faced a fresh warning this week as alert for emergency response[1] of level IV to flood risks was issued.

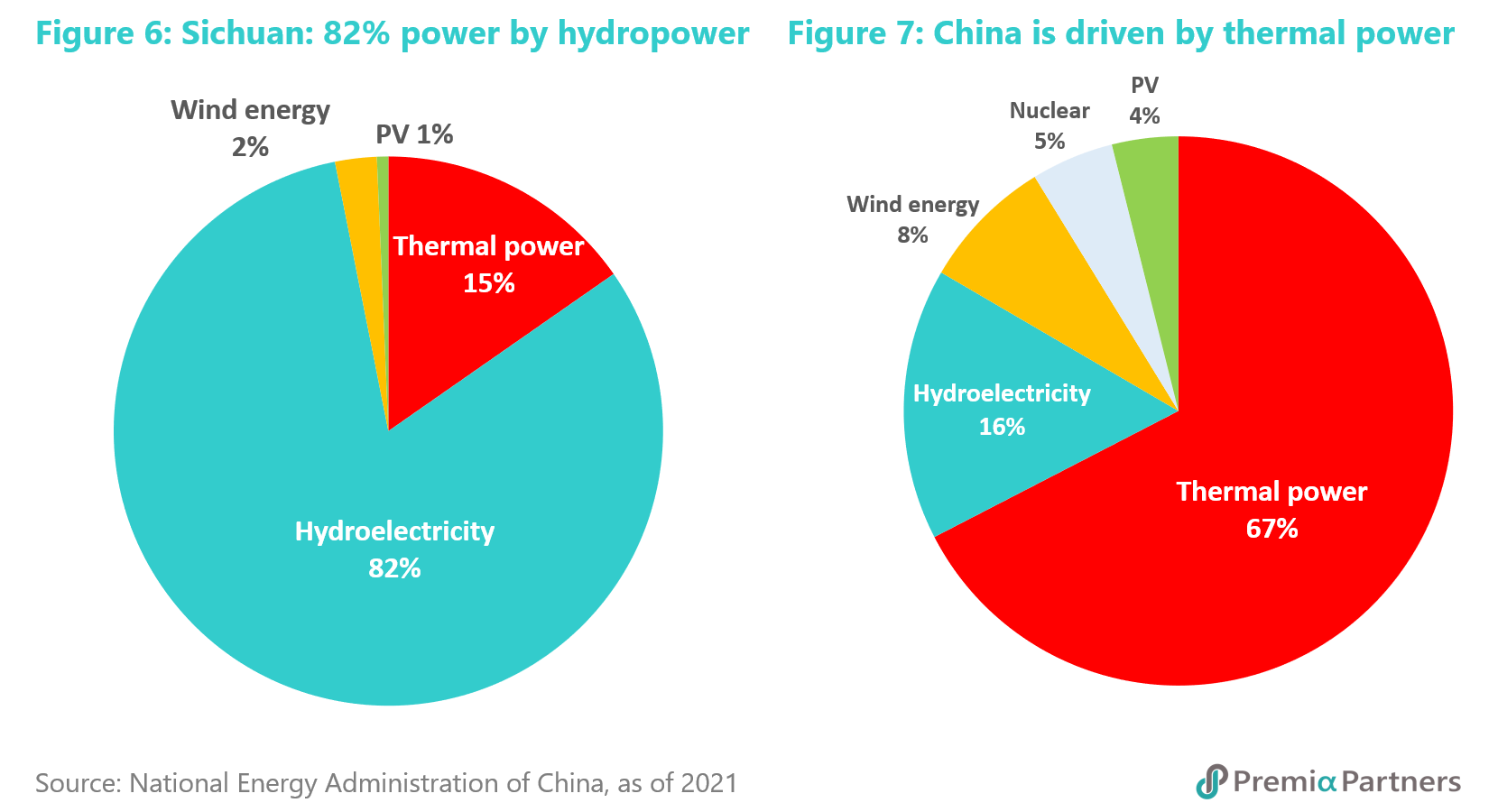

The southwestern province in China has over 80% of its electricity reliant on hydropower. As the hydroelectric is normally converted by gravitational power from height of reservoirs, deluge and mudslides would cast great pressure on flood regulation capacity and equipment security of the power stations. Contrasting with the previous heatwave and drought, the flood equally is unlikely to ease immediately the power supply shortage in Sichuan. Such extreme weather conditions naturally raised concerns given memories from China’s energy crunch last September when supply shortage for coal (which is the largest contributor in China’s energy mix) coincided with government administrative control measures.

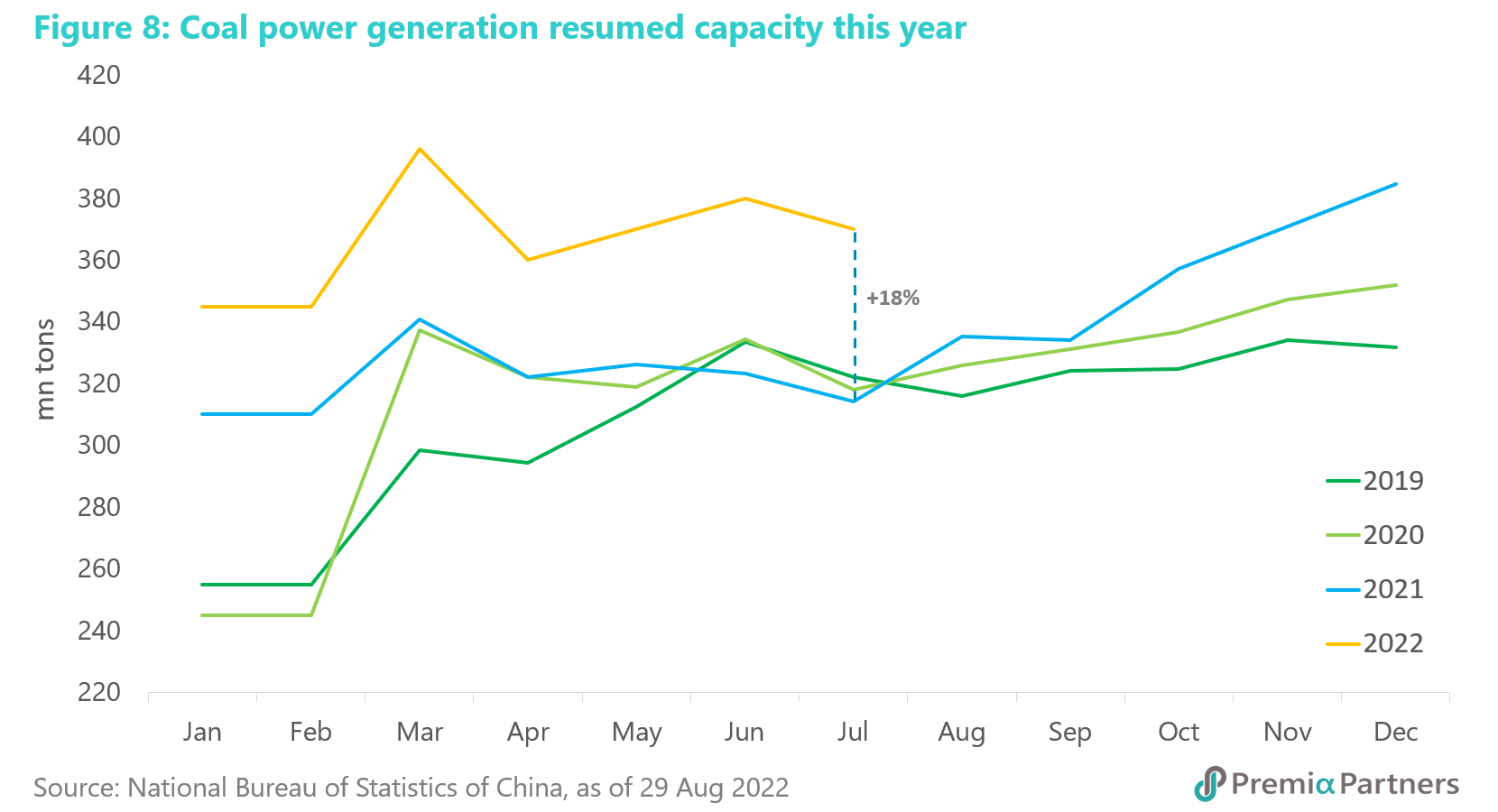

However, the energy supply shortage of this year is far different from last year, as coal supply constraints that caused the energy crisis last year have already been eased this year.

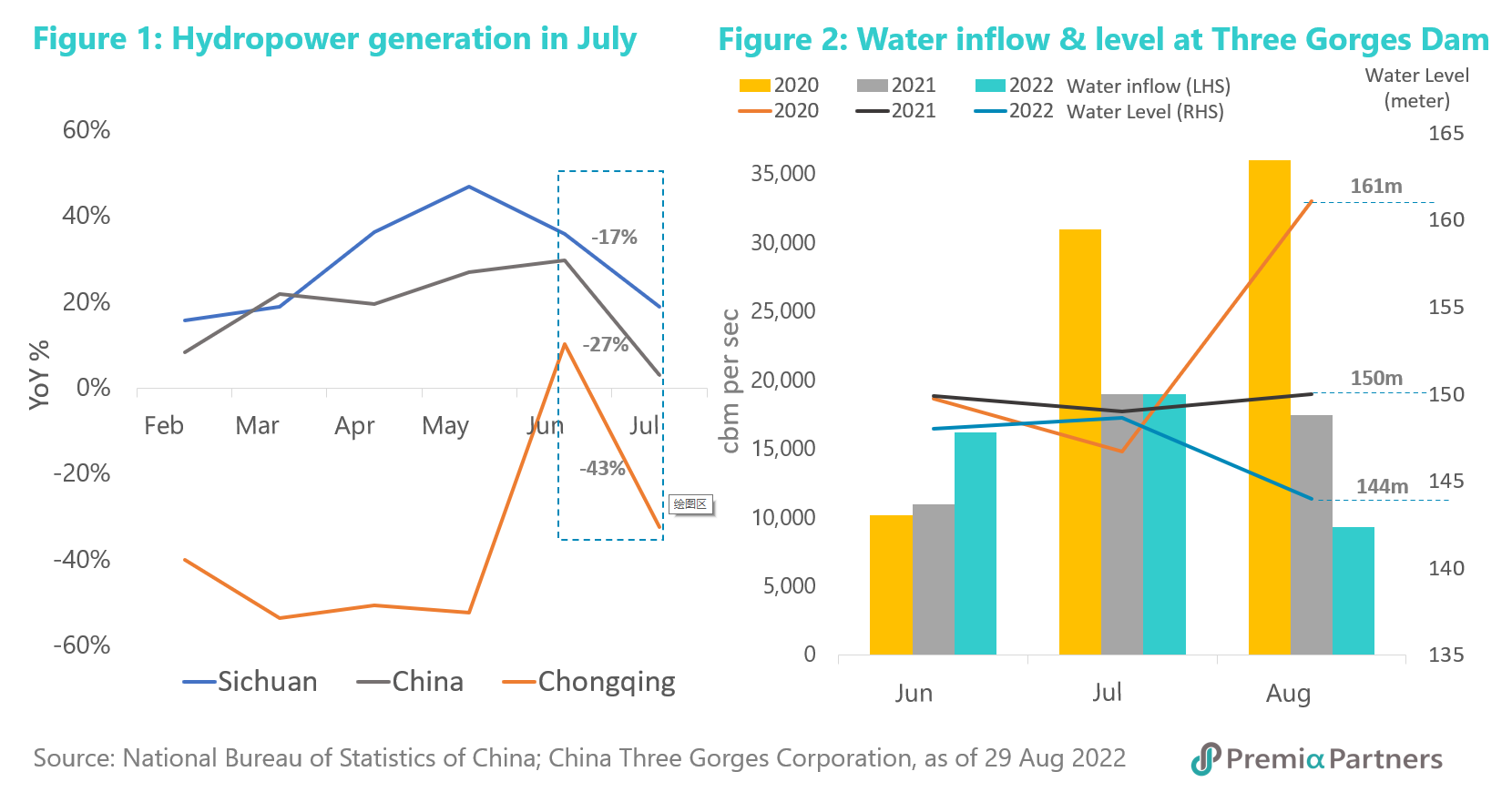

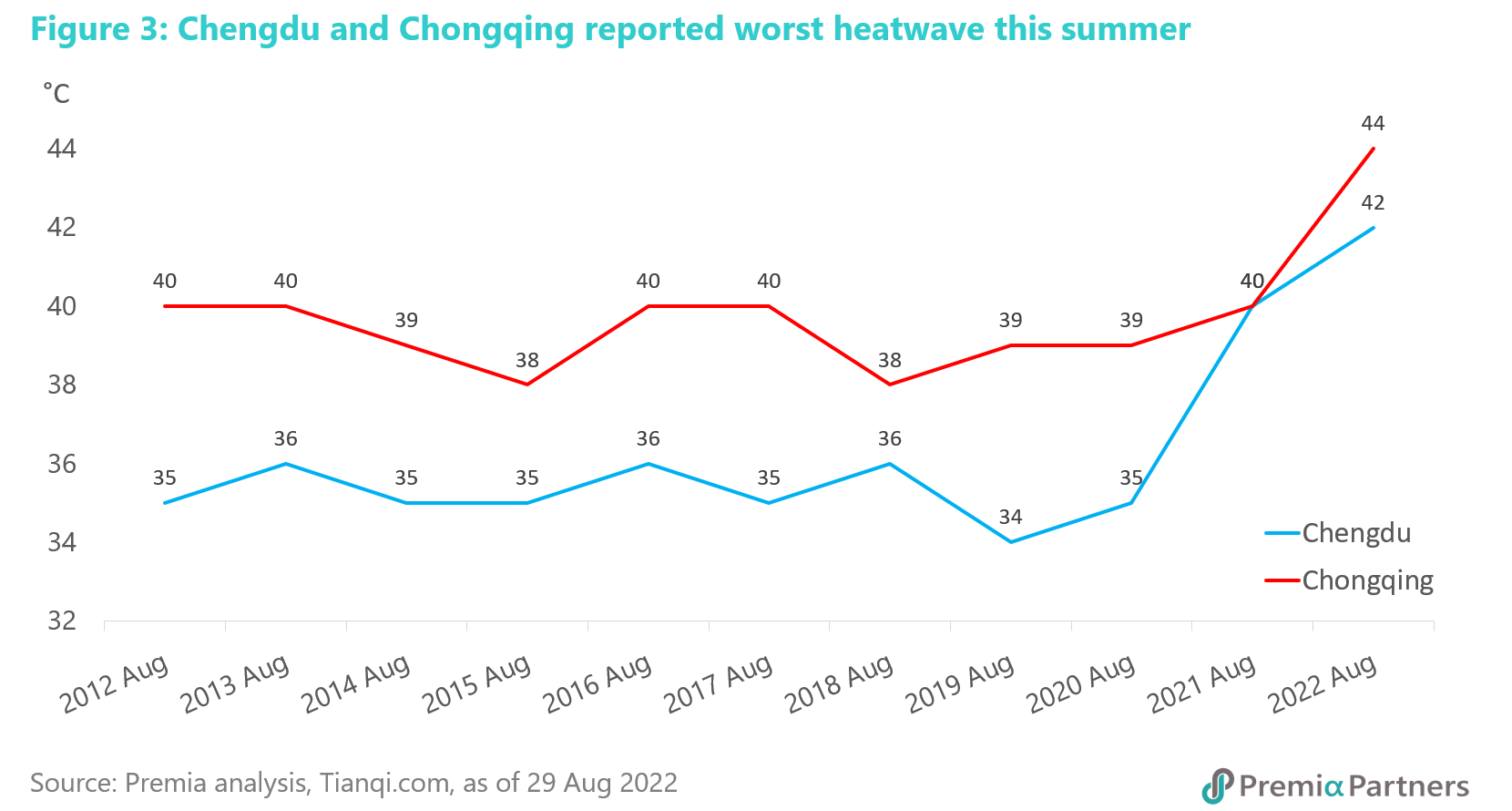

This year’s power shortages have been first triggered by two factors - severe drought and an unprecedented heatwave in August as red alert (temperature over 40 °C) was issued for the first time in six decades and lasted for 12 days. As a result of the severe drought, the Yangtze River is seeing its water level fall to a record low in August and significantly affecting hydropower production.

[1] China has a four-tier flood control emergency response system, with level I being the most severe response

[1] China has a four-tier flood control emergency response system, with level I being the most severe response

As the water cycle gets going, and the heatwave eased into not drizzles but heavy rainfalls, Sichuan’s hydropower went back up by 9.5% compared to lowest level in mid-August and most factories were able to resume production. While most energy intensive industries remain under power suspension at this stage, we believe the hydropower rationing within the region will fully ease in the next few days as downpour provides natural cure and continues to alleviate the hydropower production problem. Power supply shortage of provinces of Jiangsu and Anhui in downstream of Yangtze River that are heavily reliant on electricity transfer from Sichuan would not become a nationwide issue.

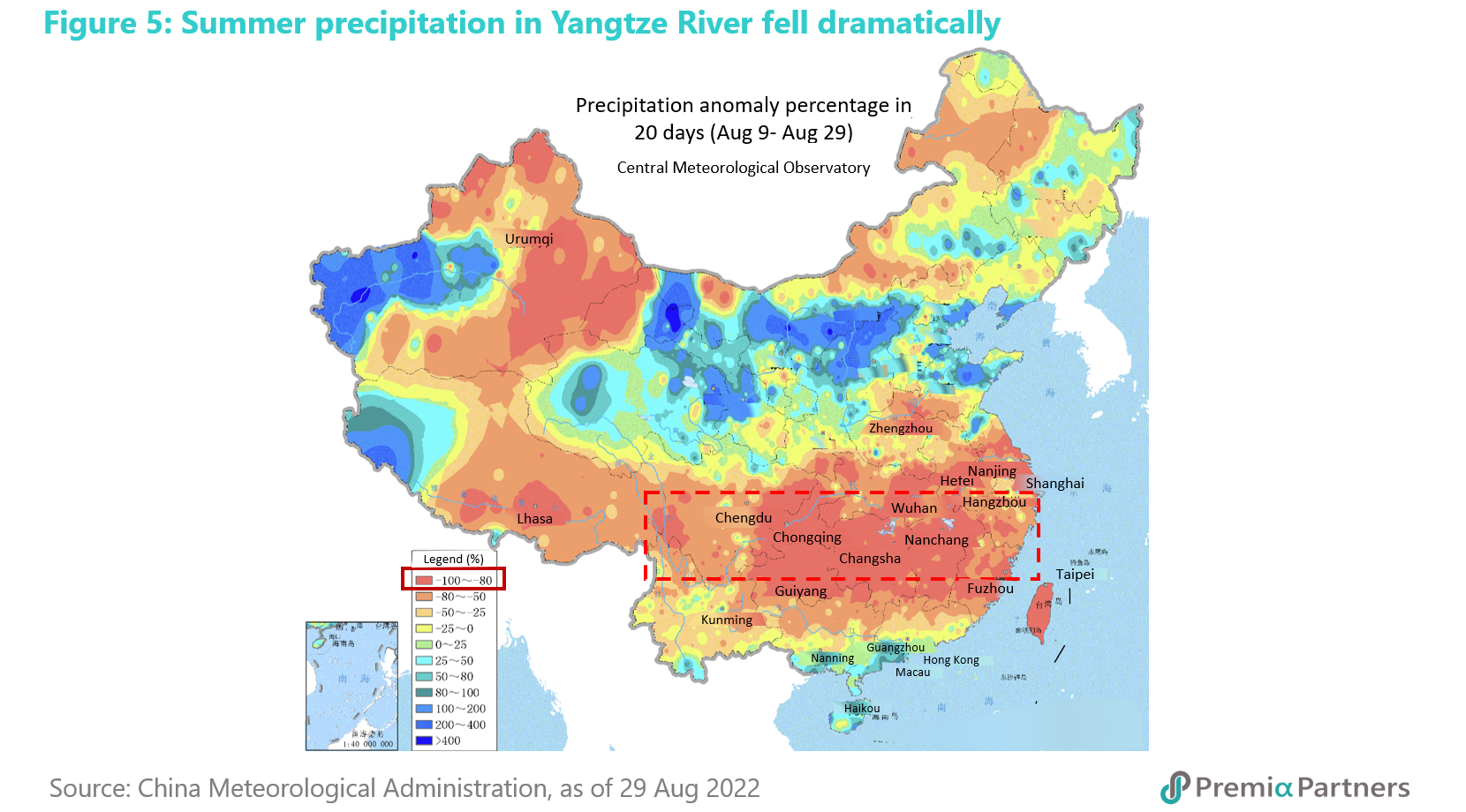

This year Sichuan has been squeezed with abnormal weather and peak electricity demand. This summer, the temperature of Chengdu and Chongqing hit a record high in decades, with maximum temperatures surpassing their historical peaks of 4 and 5 Celsius degree respectively. Concurring with scorching heat, southern China is exposed to the least amount of precipitation in history until the rain falls. According to the China National Climate Center data, precipitation during Aug 5 and Aug 28 is significantly lower than the average level of same period in history, especially in the middle and upstream of Yangtze River like Sichuan and Chongqing which are more than 80% lower than the historical average.

Sichuan province is highly reliant on hydropower and demand surged to a historical high this year. Over 82% of power in Sichuan is generated by hydropower, and the largest hydropower supplier, followed by Yunnan and Wuhan with all three combined accounting for 2/3 of China’s total hydropower supply. In this summer, the abnormal weather caused drought in Sichuan and resulted the local hydropower supply to plunge by more than 50%, which is the main reason why Sichuan encounters shortage of power this summer. However, the drought has been lightened by the rainfall.

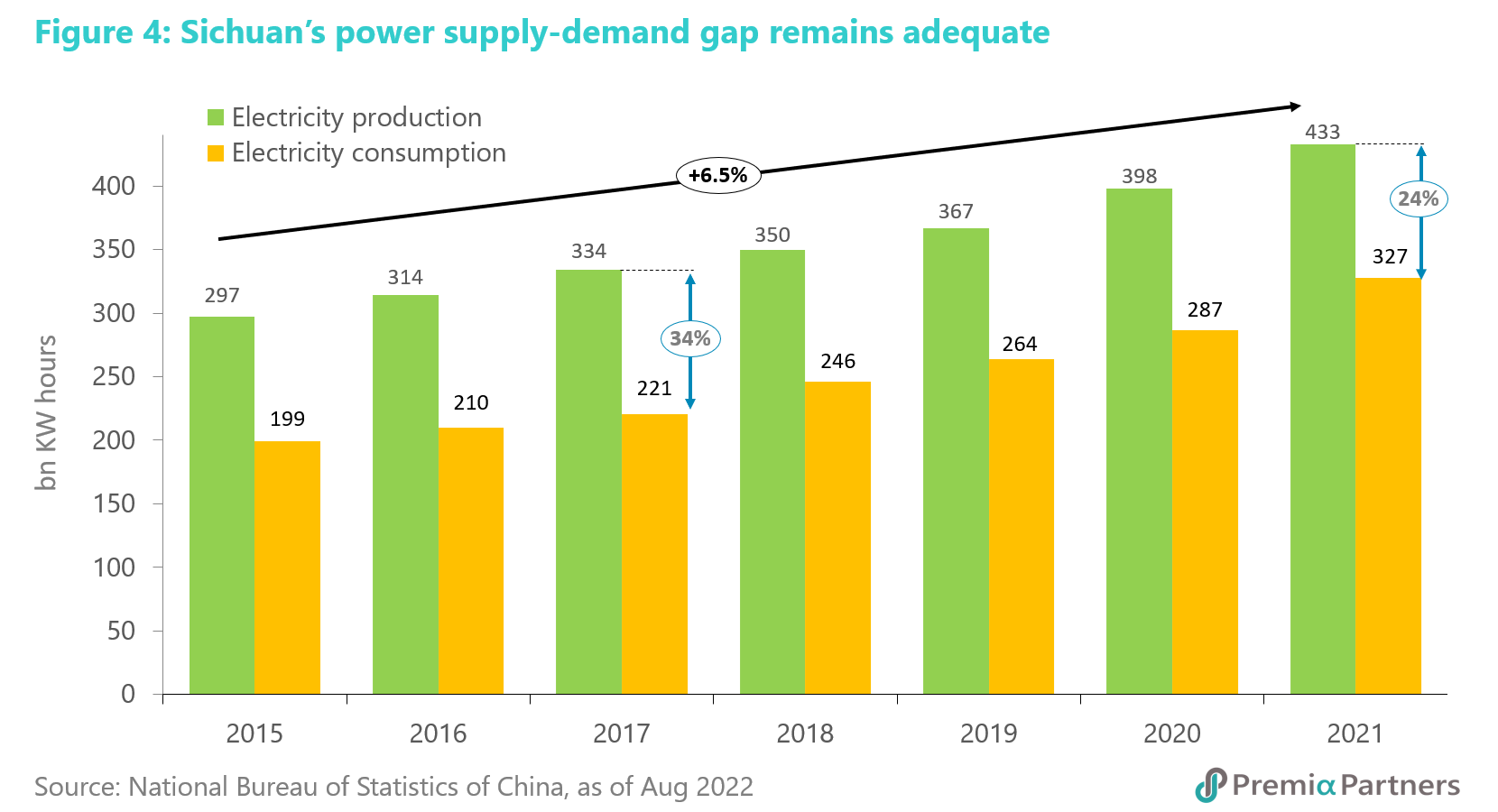

Sichuan normally is quite self-sufficient and does not have power shortage problems – in fact, Sichuan is also an important power supplier in China’s East Data West Computing project.

In 2021, Sichuan’s annual electricity production reached 433 bn KW hours while electricity consumption is only 327 bn KW hours. In fact, such excess in electricity has already narrowed from 34% in 2017 to 24%, as Sichuan provides cross-provinces electricity transmission which continues to surpass 110 bn KW hours level in last several years. In the first seven months this year, Sichuan has already witnessed more than 97 bn KW hours transmission, 47% growth year-on-year, accounting for 9% of total West-East transfer nationwide, which has limited the province’s flexibility in power re-allocation for its usage.

In 2021, Sichuan’s annual electricity production reached 433 bn KW hours while electricity consumption is only 327 bn KW hours. In fact, such excess in electricity has already narrowed from 34% in 2017 to 24%, as Sichuan provides cross-provinces electricity transmission which continues to surpass 110 bn KW hours level in last several years. In the first seven months this year, Sichuan has already witnessed more than 97 bn KW hours transmission, 47% growth year-on-year, accounting for 9% of total West-East transfer nationwide, which has limited the province’s flexibility in power re-allocation for its usage.

Meanwhile as Sichuan sharply turned from drought to flood, the region has scheduled over 120,000 personnel emergency evacuation in potential geological disaster areas across 24 cities. The mudslides together with deluge will continue to challenge the security and production capacity of power stations in the next 10 days that strong rainfall will likely sustain. Besides Sichuan, the middle to downstream of Yangtze river still remain scorched by heatwave and drought worst in years.

Looking ahead, it is unlikely that the situation in Sichuan would mirror what happened a year ago, as Sichuan has a very different power structure compared to China’s overall power supply landscape where thermal power accounts for 67% and hydropower for 16%. The energy structural imbalance has eased this year as we can see China’s national power generation accelerated to 4.5% YoY in July from 1.5% in June amid increased use of coal power. Coal power generation rose 5.3% YoY in July, ending eight months long of contraction. Thanks to higher flexibility in the coal pricing mechanism, mostly directly impacted provinces like Sichuan and Chongqing and indirectly influenced provinces like Zhejiang, Anhui and Jiangsu will resume power supply gradually.

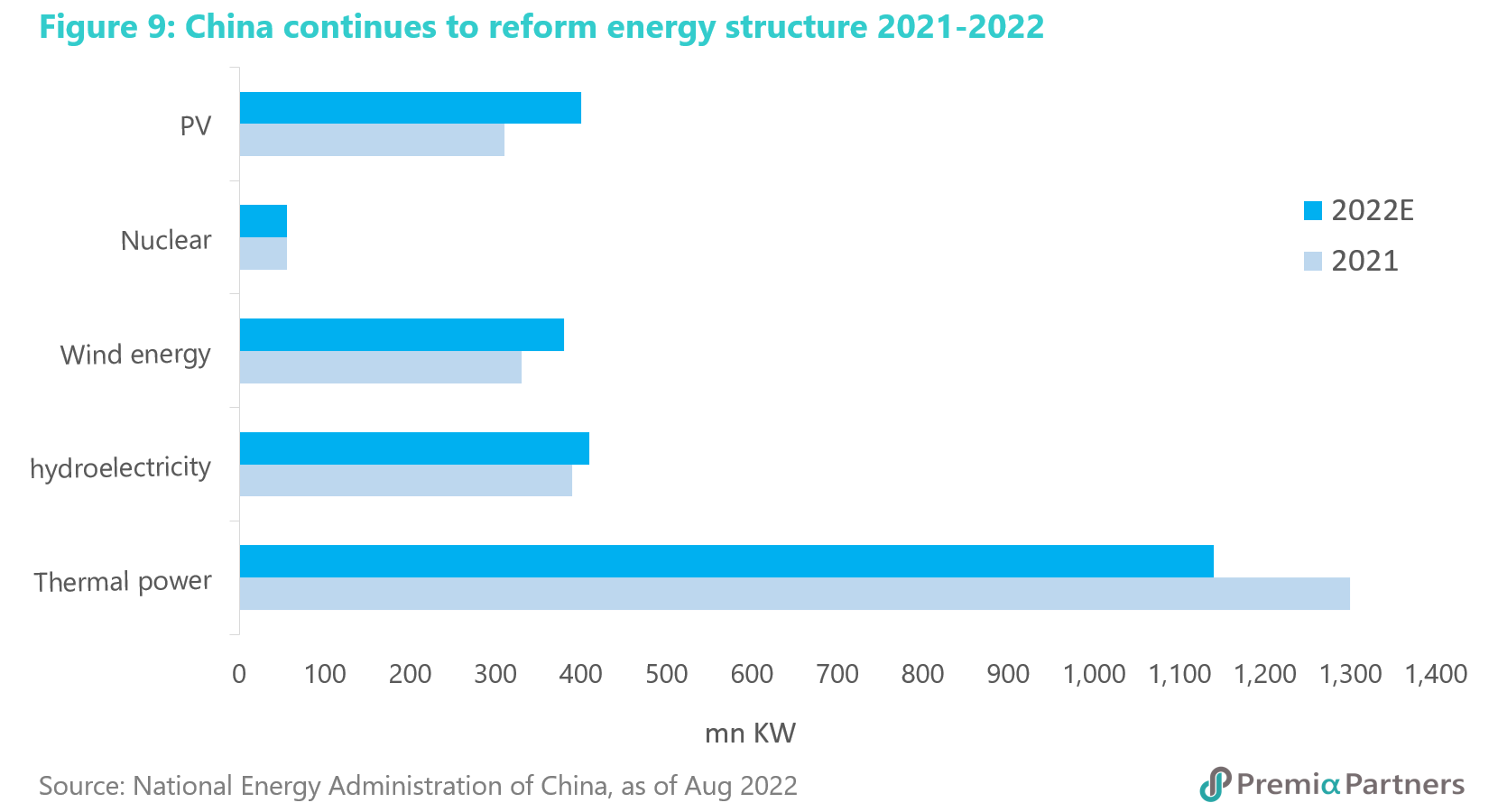

In fact, before committing for its 2060 net zero goals, China has already been undergoing significant reforms for its power structure by heavily installing new energy power equipment and improving energy generation efficiency. According to China Electricity Association, China is expected to increase non-fossil power equipment, including PV, hydroelectricity, wind and nuclear power generation by 29%, 5%, 16% and 0.1% respectively, and will decrease thermal power by 12% in 2022. In such context, Sichuan that contributes 9% of national electricity coordination, beneath Inner Mongolia and Yunnan combined accounting for 26%, will not upend the trajectory of China’s energy supply chain.

For the more immediate term, it is probable that the drought/ flood situations would weight on the Jul/Aug macro numbers, as industrial manufacturing and outdoor activities by companies and consumers alike are restrained, and the extreme weather may also have implication for the food inflation as the Yangtze River and Sichuan basin contribute to almost half of China’s rice production. However, one may take comfort that major nationwide power crunch like last year would be unlikely to repeat.

There is no doubt of China’s commitment to accelerate its investment in renewables energy with or without the drought happening in Sichuan. In fact, even before the recent announcement of the RMB 6.8 trillion budget for infrastructure project, the construction of a key project linking China’s two mega water infrastructures – the Three Gorges project and the South-to-North Water Diversion Project – has already begun in early July. On solar energy, the country built nearly 31GW of new power capacity in the first half of this year, up 137% year-on-year, with full-year installations on course to hit a record high. Deserts in north China are set to host an unparalleled build-up of wind and solar energy, with the first phase of about 100GW of turbines and solar panels due to be completed by next year.

It is also worth noting that China has always been carefully managing its domestic energy market to ensure energy security and to mitigate major disruption and price spikes. It may in fact have an energy advantage over many countries due to that China’s current energy consumption mix still reflects coal dominance and China would be able to ramp up coal production to ensure energy security despite at the expense of its long-term net zero goal. As such, while China is not immune to temporary energy shortages on extreme weather conditions, Chinese manufacturers and exporters would potentially be in a better position than those in net energy importing countries.

With the backdrop of the aforesaid, it is important for investors to understand that China’s roadmap in energy development is highly tied to the goal of achieving carbon neutrality and maintaining energy and national security. As a manuscript for the planned economy, China’s 14th Five Year Plan also explicitly laid out green infrastructure as an important pillar where resources and growth drivers converge. With this backdrop, green economy and clean energy will continue to be the major themes in the stock markets as well, as that is where public and private sector capital and market liquidity would consistently flow to over the next decade. Notwithstanding sector and factor rotations and valuation movements from time to time, investors would be highly encouraged to pay close attention to the leading companies in these fields, such as Trina Solar in the PV industry and CATL in battery manufacturing as they will be important drivers for economic growth in China moving forward. Currently, Trina Solar is one of the top holdings at Premia China Star 50 ETF (3151.HK) whilst CATL is the largest position at Premia China New Economy ETF (3173.HK).