Strong growth with moderate inflation. 2023 will likely present investors with a stark economic divergence – between a West in recession and an East where growth will be boosted by recovery in China. ASEAN-5, which already enjoyed its own reopening rebound in 2022, will likely ride the tailwinds of China’s turn at a reopening recovery in the coming year. ASEAN-5 comprises the Emerging ASEAN economies of Indonesia, Malaysia, the Philippines, Thailand and Vietnam. Indeed, it will likely continue to be in a sweet spot in 2023, offering some of the highest economic growth rates with relatively moderate inflation. Overweight.

As the West struggles with recession, ASEAN-5 could maintain strong growth on the back of China’s COVID controls pivot. The Euro Area is likely either already in a recession or heading into one very soon. The US looks, on the Fed’s own unemployment forecast for end-2023, headed into a recession in 2H2023. Both of these events have a large element of a winding back of the extreme stimulus undertaken during the worst of the pandemic. Meanwhile, China should stage a strong economic rebound if it continues on the present pace of relaxation of COVID control measures, and that should give ASEAN economies its “second wind” after the strong performances in 2022.

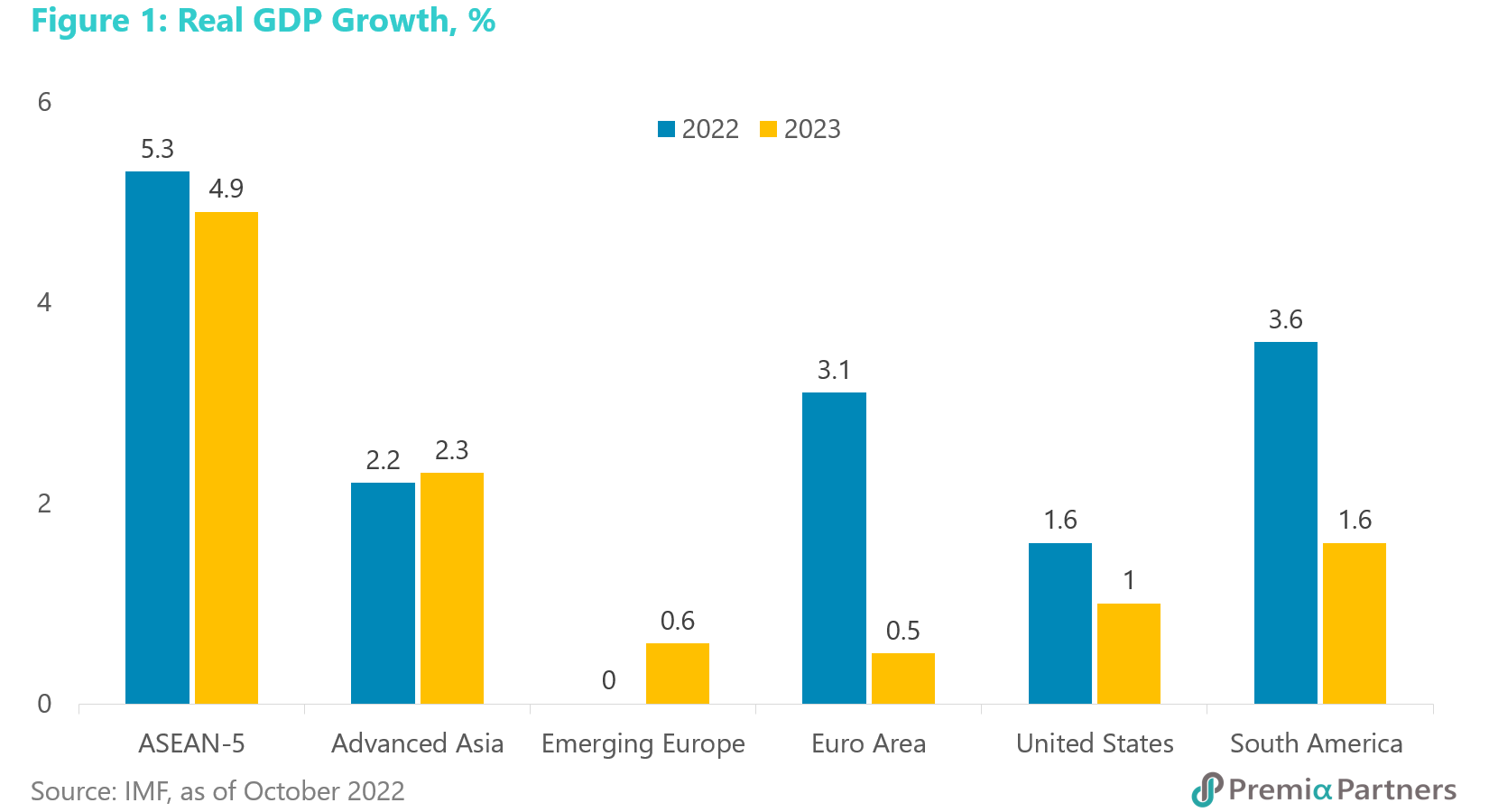

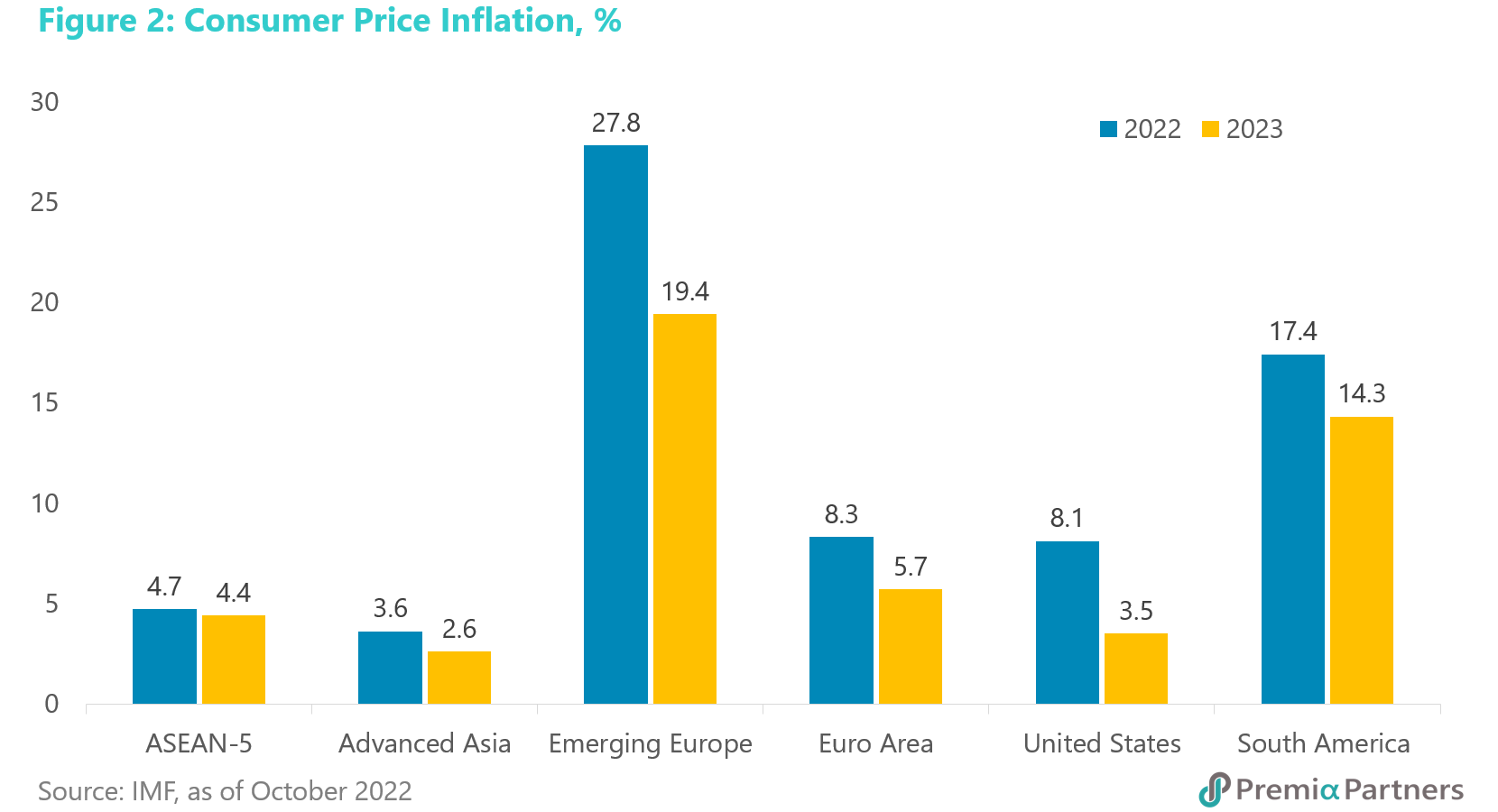

Growth with price stability. ASEAN-5 will likely turn in some of the best economic growth performances in the world for 2022, with some of the lowest inflation rates. It appears it might do the same again for 2023, with the IMF expecting 4.9% real GDP growth for the group, with an inflation rate of 4.4%.

It has been in the sweet spot between growth and prices, and could well pull it off again this coming year.

Their central banks’ relative dovishness helped in 2022. A slower pace of interest rate hikes in ASEAN-5 compared to the US and the Euro Area helped to sustain its growth edge over most of the world in 2022. The price it paid for that was currency weakness against the Dollar. The worry was always that acceleration of that currency weakness could raise inflation rates in ASEAN-5, forcing the hands of central banks to play catchup on rates.

ASEAN-5 could get a reprieve from having to catch up with US rates if the Fed pauses rate hikes by end 1Q2023. But this is a problem it may not have to deal with if US inflation has peaked and the Fed, as we expect, pauses rate hikes at end-1Q2023, ahead of a recession sometime 2H2023.

That would offer Emerging Markets in general a reprieve from further weakening of their currencies putting upward pressure on rates. In any event, ASEAN currencies are deeply undervalued now on PPP and the so-called “Big Mac Index”. Indeed, the bias from 2Q2023 onwards could be Dollar weakening, taking pressure off EM currencies.

It has to be said though that US inflation – after so much fiscal and monetary stimulus in 2020-2021 – could return at a later date. Yet, that is a potential problem for another time.

An ASEAN-5 story for 2023 told in two halves. For now, the coming year could unfold in two halves for ASEAN-5. In the early months of the year, higher rates in the US – albeit raised at a slower pace – are likely to see a short period of renewed downward pressure on ASEAN-5 currencies against the Dollar. But the pressure should ease if, as we expect, the Fed pauses rate hikes as the US economy slows more substantially.

Indeed, with China’s economic growth accelerating from a progressive easing of COVID health measures, 2H2023 could present ASEAN-5 a “Goldilocks” combination of reasonably strong growth with an easing of pressures on inflation, rates and currencies.

Emerging ASEAN as a value trade in the first half and a China recovery play in the second half. 9810 HK (USD) or Premia Dow Jones Emerging ASEAN Titans 100 ETF outperformed both the MSCI ASEAN and the MSCI World – the latter by a very large margin – for the year to December 5. 9810 HK’s outperformance was in line with the global value trade theme, with the market seeking lower risk alternatives to growth stocks, in the midst of rising rates. The global growth trade has of course been dominated by tech stocks, which have more distant earnings in their valuations, saddling them with more earnings duration risk than value stocks.

Meanwhile, a factor which caused MSCI ASEAN to underperform 9810 HK was Singapore’s 33% weighting in the MSCI ASEAN index, and Singapore has been underperforming the MSCI ASEAN index.

In the early months of the coming year, as US rates continue to rise, the global value trade should continue to outperform growth, and by extension, the broad US market. That should help ASEAN-5 markets in 1H2023, before a switch later to the China recovery theme.

China reopening meets the “China+1” supply chain strategy. That is the point at which ASEAN-5 short-term/tactical advantages meet longer-term/strategic strengths. The point of intersection will likely be global corporations’ “China+1” supply chain strategy. Premia Partners has written in the past disagreeing with suggestions that global supply chains were pivoting away from China. Supply chains are built around critical mass and nowhere in the world has the critical mass of manufacturing ecosystems that China has.

Instead, what we said was the most likely outcome was that global corporations would diversify parts of a China-centric supply chain to neighbouring countries, and those neighbours are the ASEAN-5. So, growth recovery in China in 2023 will see a tactical spin on ASEAN-5’s long-term strategic strength as part of “China+1”.

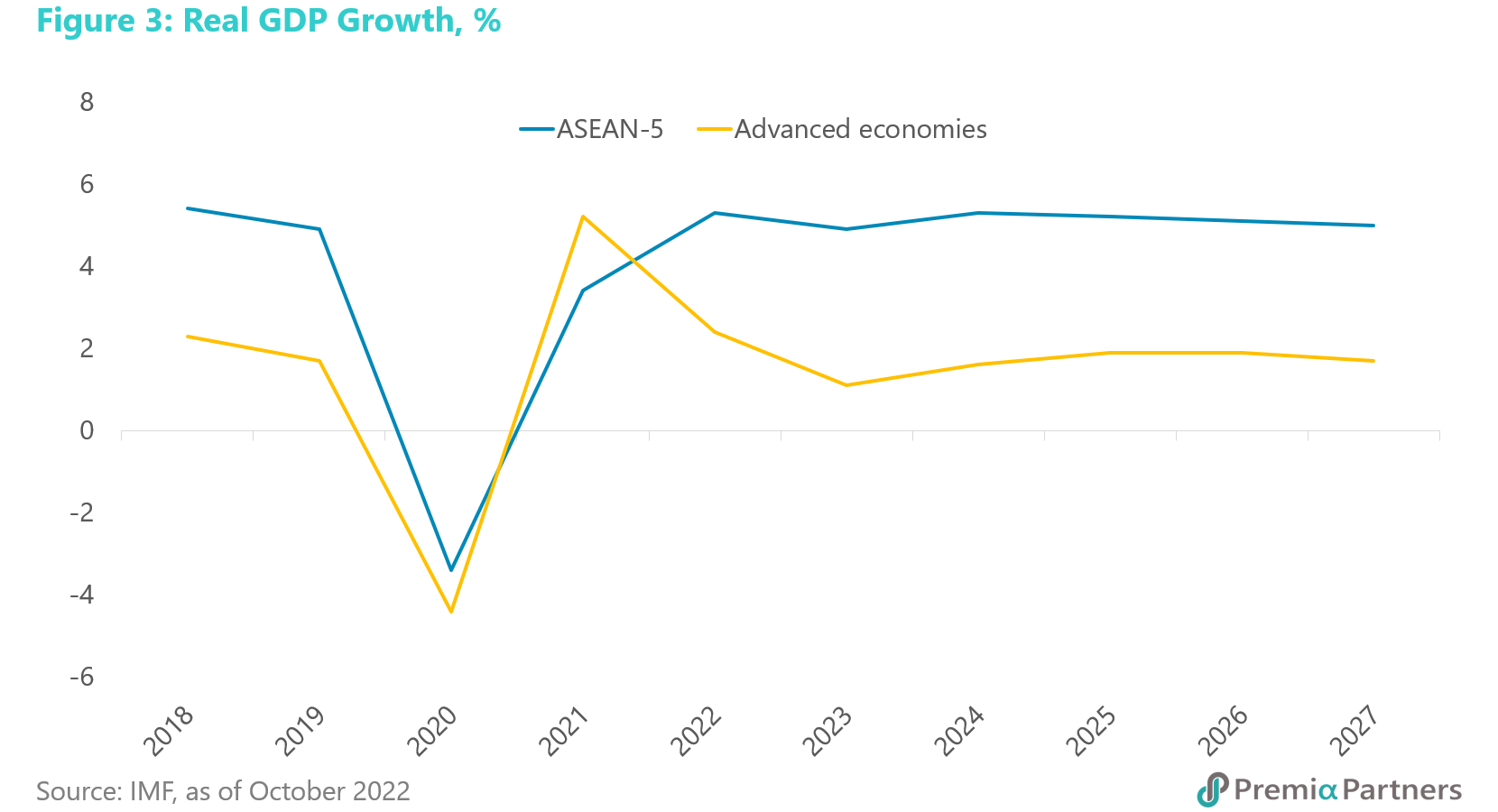

ASEAN-5 economy projected to grow by up to 4.5 times that of Advanced Economies. Beyond that, there are other, longer-term themes such as secular growth trends, middle-class consumerism, housing, transport, environmental solutions and digitisation. The IMF estimates that in five years from now ASEAN-5’s nominal GDP will be around 60% larger than where it was as at end-2021. Its real GDP growth rate is estimated to run from 2.7x to 4.5x the equivalent rate in the Advanced Economies over the next five years.

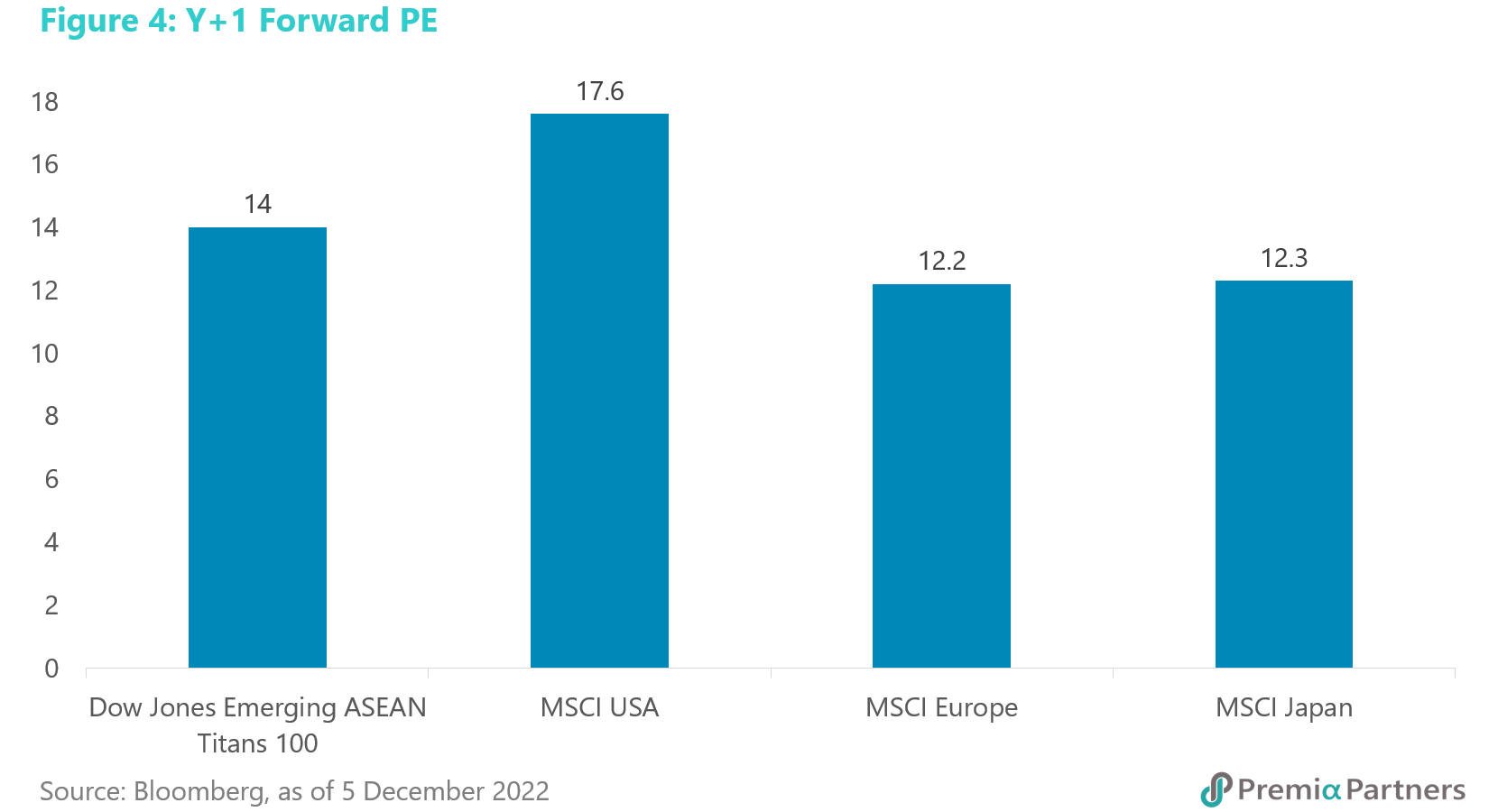

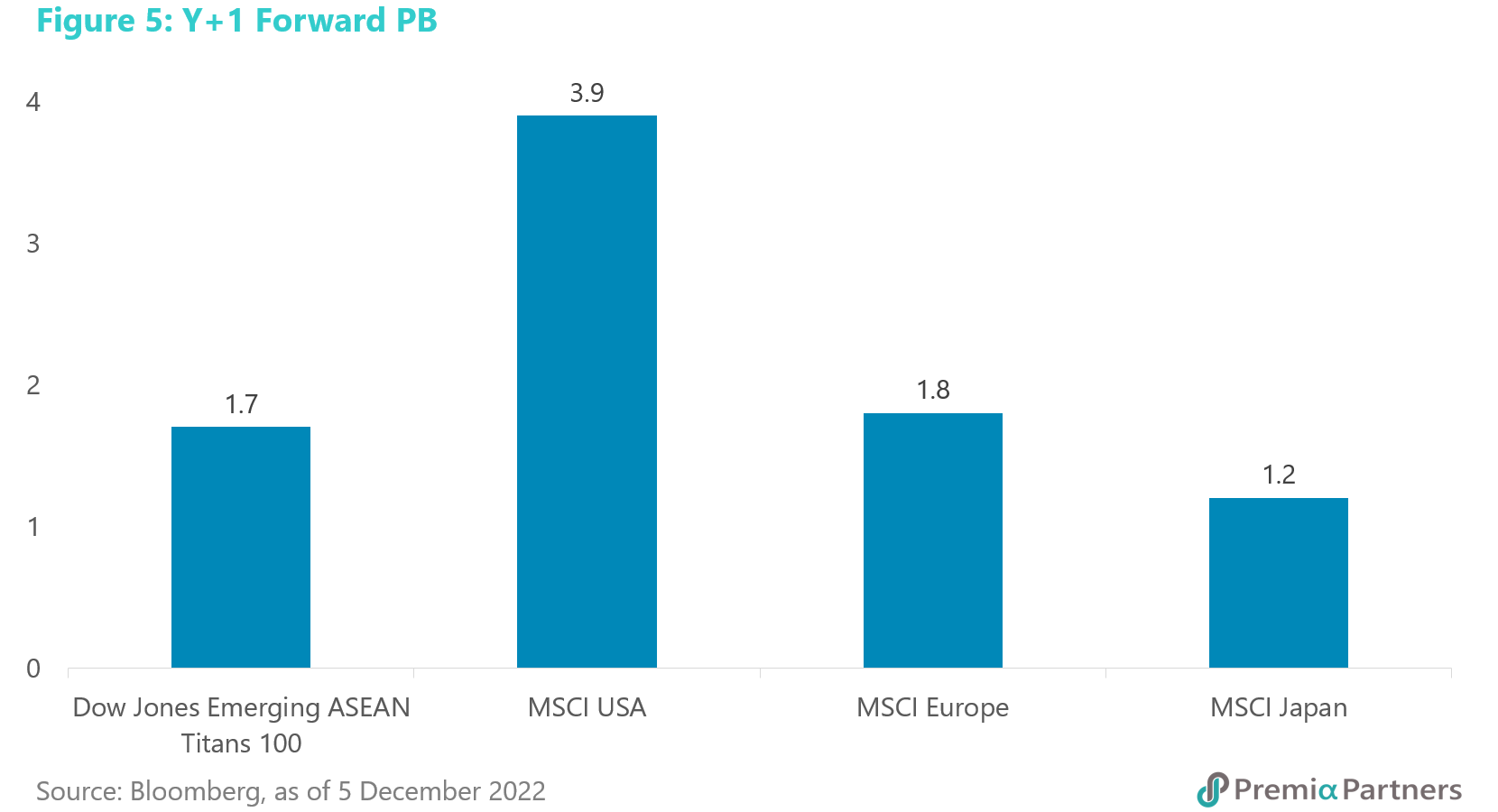

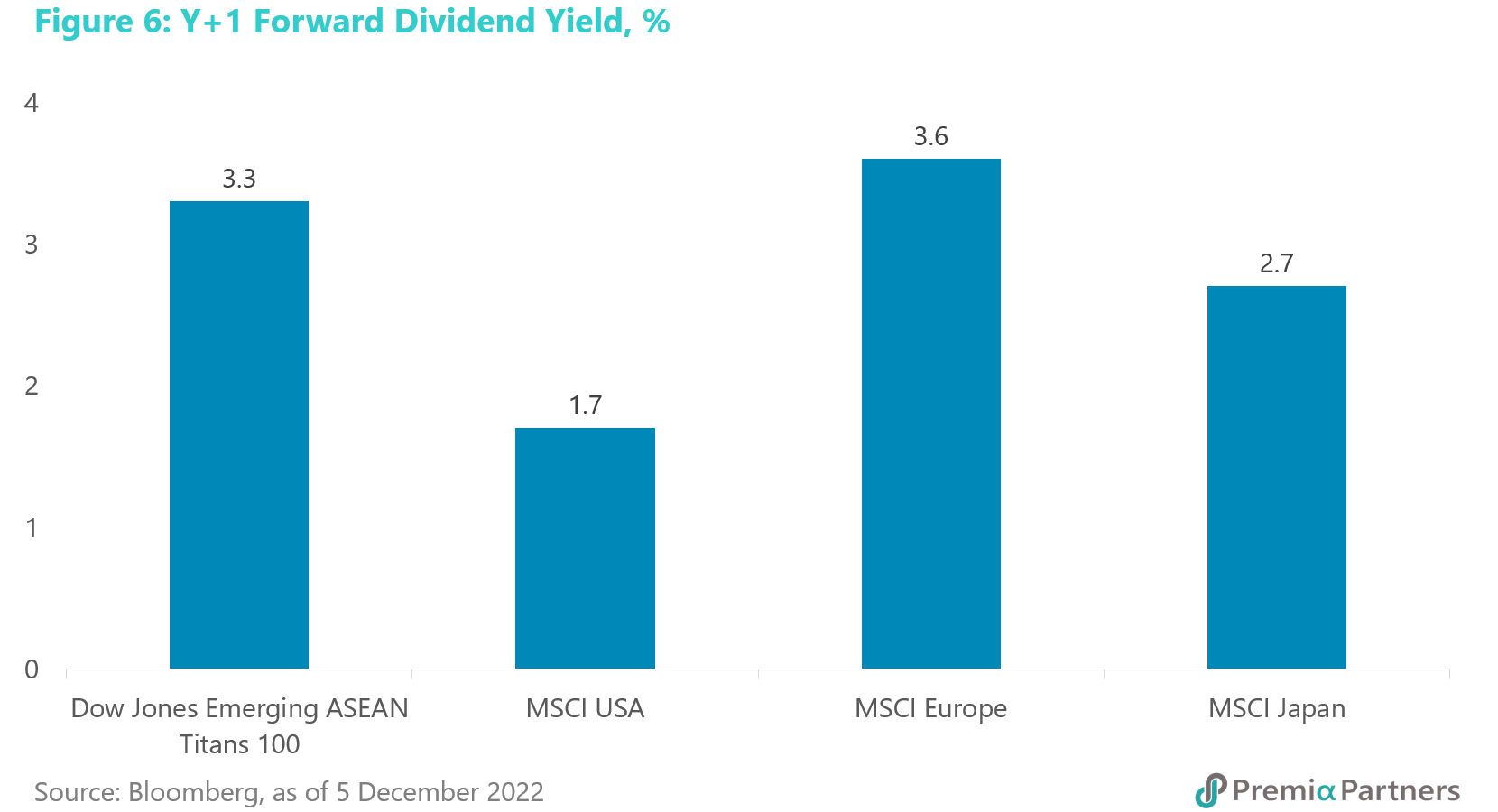

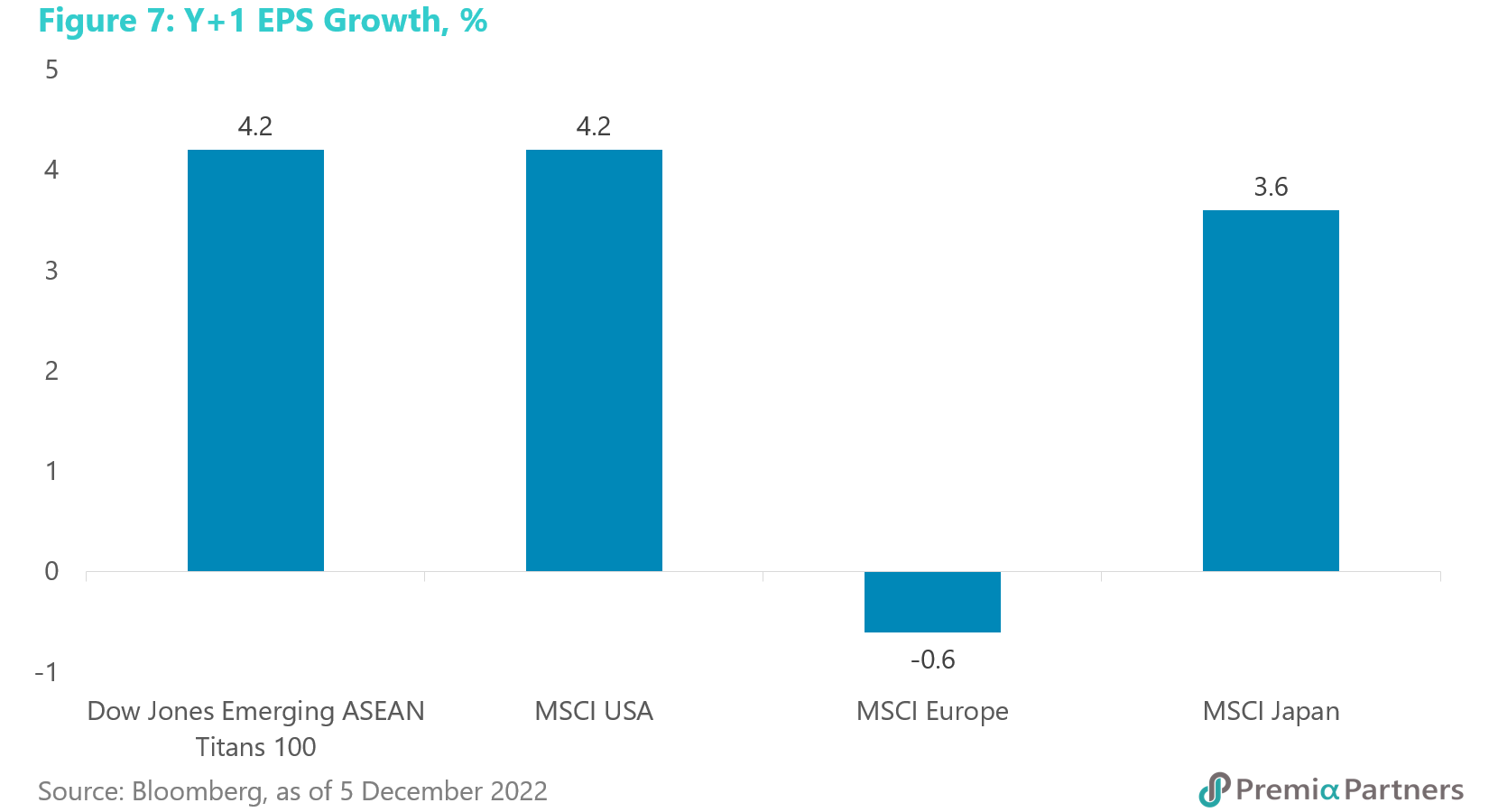

Valuation – growth at a reasonable price. ASEAN-5 equities valuations are broadly comparable with the deep value markets of Europe and Japan.

But it doesn’t suffer the negative forward earnings growth and geopolitical risk premium that applies to Europe and it doesn’t have the massive government debt overhang that forces the Bank of Japan to own more than half the JGB market.