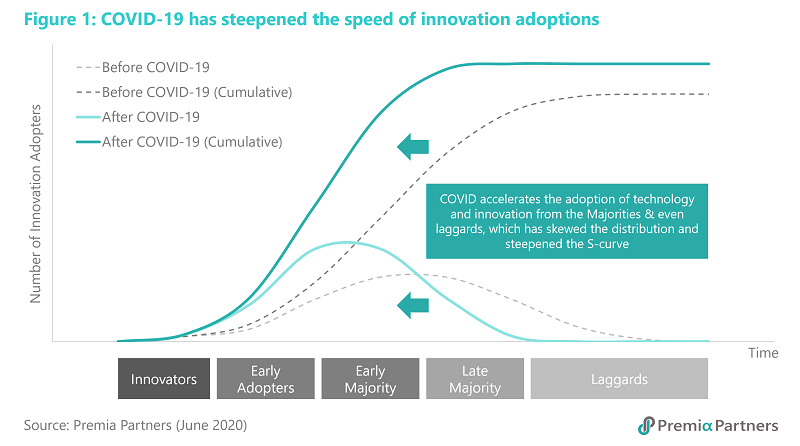

As we (hopefully) relieved into the aftermath of the COVID pandemic, we realized the COVID crisis has certainly proved to be a catalyst that accelerates the development and adoption of innovation and technology. More importantly, an acceleration from vertical technology development to a wide-spanning horizontal expansion of technology application that enables innovation and better efficiency across sectors.

Digital Consumption “BOOM” Amid “Social Distancing”: Behavioral Change in Media, Gaming, E-commerce

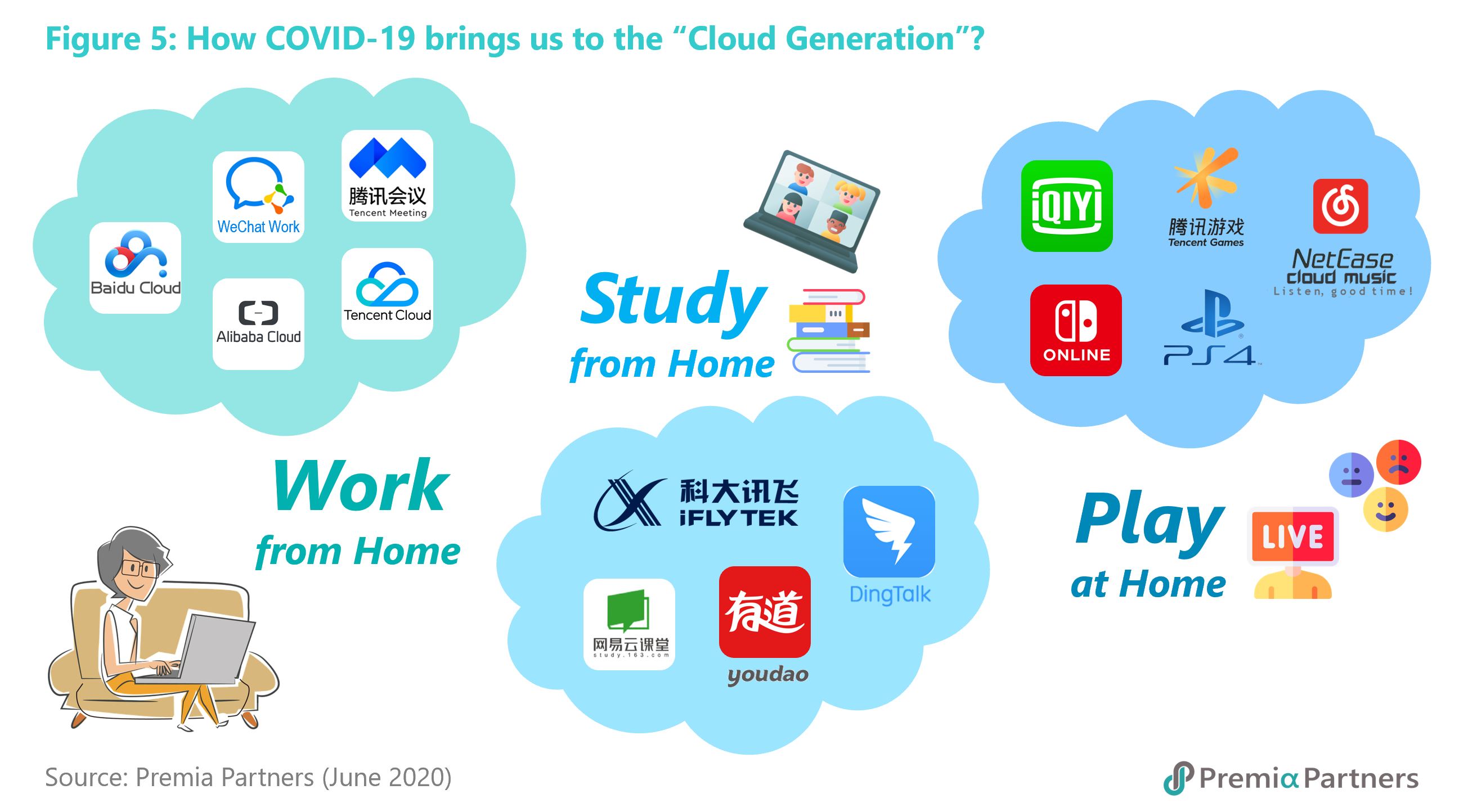

Online activity increases by leaps and bounds as people are staying home. Social media, video streaming, mobile gaming and online shopping – these used to be tags of the millennials and genZs. A GenX would be considered quite “avant-garde” if he or she spends a lot of time engaging with smartphone apps such as Instagram, TikTok or Taobao, not to mention the baby-boomers.

It would have taken years if not forever for laggards to accept and adopt new innovations. Yet in this locked down world of “social distancing” where many activities are moved from offline to online, and people had little choice but to learn a life “online”, we saw an exponential increase in adoption of online habits, even from the BOOMers. We discussed briefly right after the COVID breakout in Account of an atypical, tech-enabled CNY holiday. And now in hindsight, we see the most prominent areas as follows:

E-commerce & Social E-Commerce – this is gradually becoming a commodity and go-to option for everyday life. E-commerce has proved its efficiency in sourcing goods when shops on streets are closed (or sold empty). Moreover, in certain countries like China where the delivery workforce is large and relatively cheaper, online shopping can range from apparel and homeware to fresh produces for everyday cooking. Instead of going to the wet market every early morning, many Chinese housewives now set alarms on their phones to pre-order the “best bargain” of fresh meat and veggies the day before via some apps and simply wait for those to be delivered to their doorsteps the next day.

Livestreaming, Gaming and e-Sports – In our late webinar series Through the looking glass - the virtual lands of eSports, gaming and live streaming in China we shared our interesting findings in these areas. You may think the gaming sector wouldn’t shift much in the demographics of its audience, but tell you what – there’s an increasing number of top amateur players at very young ages; on the other hand, many BOOMers are also exhibiting a new habit of playing card games or mahjong on their phones & iPads as we discovered from the latest Appstore download leagues.

Virtual presence in Social Media / Media – staying home makes social media and online streaming platforms the only channels to keep in touch and get updated with friends, family and possibly the rest of the world. This is the easiest to adopt, and COVID just further pushed the late majorities and some laggards from elder generations to the audience while also increasing average time spent across all users. According to QuestMobile’s latest statistics, average online usage per person in China has increased from less than 6 hours a day last year to over 7.3 hours a day during COVID lockdown, an increase of over 20%! Usage of social media and streaming activities is among the top time spent - and no longer just among the younger generation.

Digital Transformation for Enterprise & Industrial 4.0: New Infrastructure, Robotics & Automation

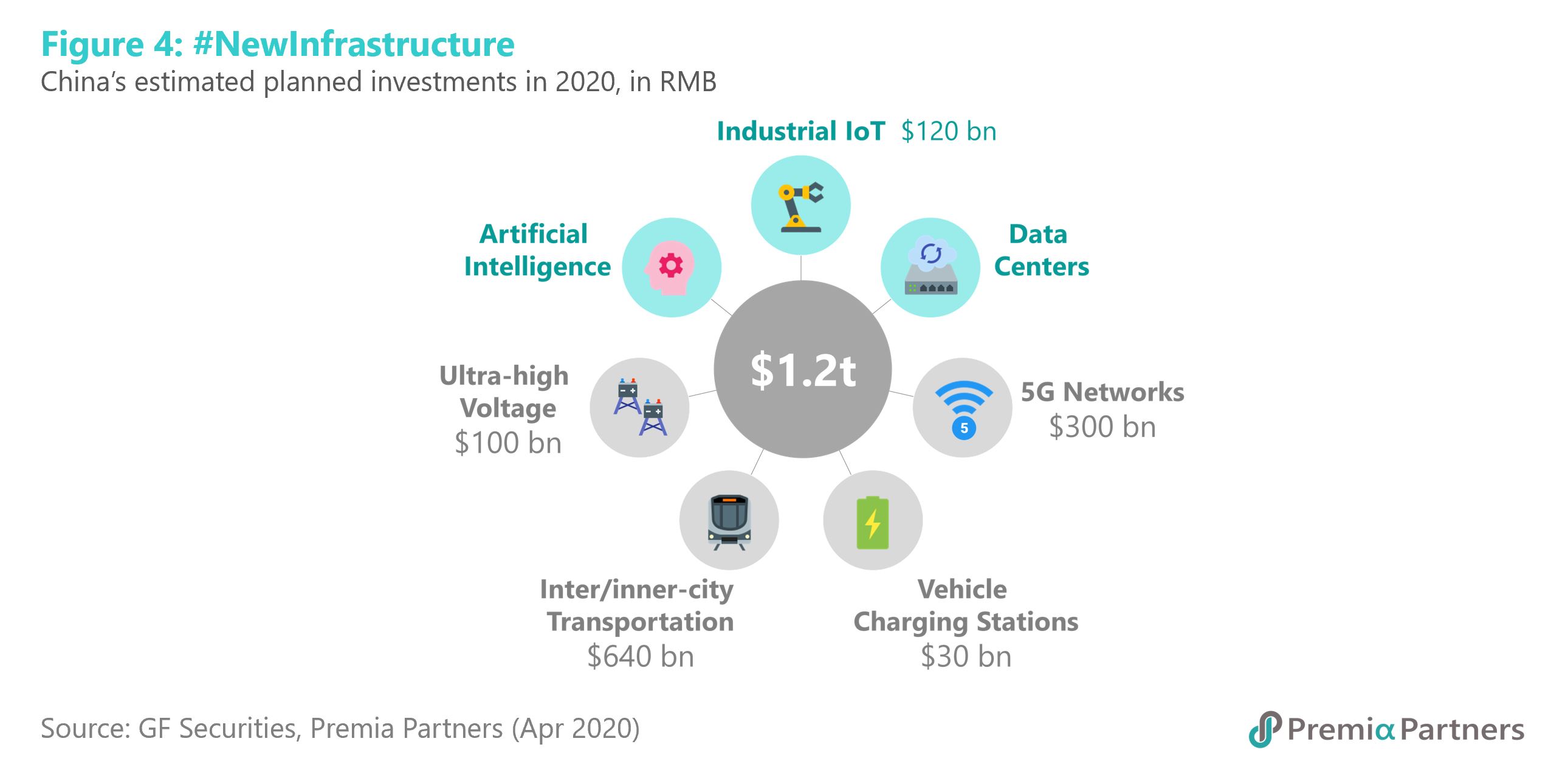

Apart from the consumer world, COVID has also transformed the design thinking of work environment, enterprise solutions and a nation’s overall advancement in technological capabilities. While the Chinese government came up with this buzzword of #NewInfrastructure as we shared in a previous piece, the structural trend of governments making more investments into these digital-related infrastructures is everywhere.

Industrial IOT – we talked about IIOT recently in IIoT: Enterprise digital transformation and Industry 4.0 in China as it is a crucial part of the new infrastructure theme. We see a strong pick up in SaaS, PaaS and IaaS solutions to support enterprise digital transformations across sectors. The industrial sector is at the forefront of digitalizing and automating manufacturing capabilities, and IIOT is just a broad concept of marrying Industrial 4.0 and Internet of Things.

Cloud computing & related surge in demand for cloud infrastructure, security and applications – work from home, study from home, all via the cloud. Globally, we see significant revenue increase from Amazon’s AWS, Microsoft’s Azure & Teams features, and of course one of the hottest companies lately – Zoom. In Asia, Alibaba has been the leading player in cloud offerings, but that is just the beginning. The COVID pandemic not only further increased Alibaba’s business in Cloud services but was also an accelerant to the other regional internet giants Tencent and Naver for fast-tracking their Cloud offerings as well as other SaaS, PaaS, IaaS -type enterprise solutions, including domestic leaders such as Sanfor in cloud security, Yongyou in enterprise applications that are well established in the mainland enterprise market. Consider the emergence of internet and web-based applications to our lives in the 1990s, and the massive proliferation of mobile and IoT applications that followed have only been phenomance in the last decade or so, with 5G, big data, and the build out of digital infrastructure around the world, one can only expect an even faster adoption cycle as cloud-based consumer and enterprise applications soon become the new norm.

Automation, Robotics & AI – needless to say, the COVID crisis has brought huge disruption to manufacturing and supply chains around the world. On the flip side, industrial companies and manufacturing economies learned from the crisis the importance of automation and how advanced manufacturing with the use of robotics could minimize the impact of labour shortage due to these unforeseeable events. Yet, robotics & AI is more than having machines replacing humans at factories. Our first coverages on this topic dated from almost two years ago in How is “digital revolution” in Asia transforming the way we live? and Leading companies in AI & Robotics. As stated then, robotics & AI is not a kind of product, but a kind of technology and an enabler– an enabler that can be applied across sectors, and COVID has really fast-tracked the development of such when contactless and robot-aided processes have been critical in continue functioning of the economy during lockdown. We saw drones delivering medical supplies, robots spraying disinfectant, big data to analyze virus spread-out, surveillance technology to track confirmed cases and thermos sensors used to monitor passenger temperatures.

When Healthcare is no longer a defensive play: Innovative technology-enabled growth in Pharmaceutical, Biotech, and Medical Devices

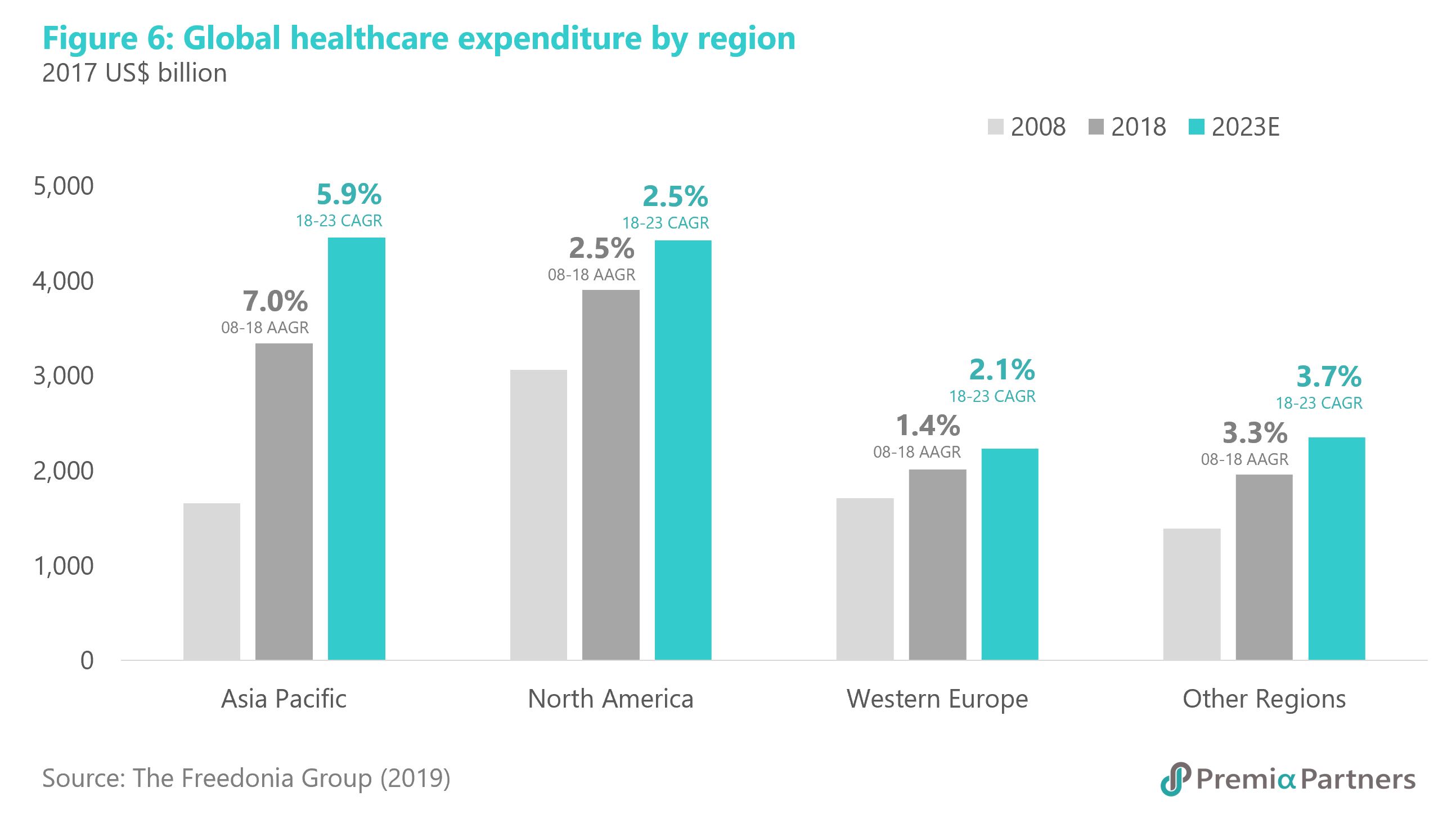

Technology seems to gain much of the attention during the COVID pandemic, yet Healthcare should probably be the most directly related sector, especially as the world is still waiting for a vaccine. Interestingly, while the Healthcare sector is typically viewed as a defensive sector in developed markets, investors in emerging Asia often take a different lens. Pre-COVID forecasts have already expected healthcare spending in APAC to grow at around 6% to surpass North America by 2023. The COIVD pandemic would only further accelerate the growth.

As a result, the Asia healthcare sector and predominantly those companies with significant R&D is viewed as a big growth theme. The recent large inflows into Asia-based biotech companies from leading private equity firms is one clear evidence. We also shared our views in COVID-19 Fighters: Who are working at full speed to help flatten the curve?on the leading Chinese players, and the case is similar for other Asian countries like Japan and South Korea.

LIVING THE TRENDS? INVEST IN IT.

Thematic investing has gained strong traction in recent years, especially in the technology sector where we have seen growing number of funds launched on the hot topics of internet, semiconductor, AI, etc. We believe the COVID pandemic would not only accelerate advancements in these specific tech segments, but also fast-track the transformation of the general public’s perception of technology – from the “cool gadgets & wow concepts” for young people to an infrastructure and backbone of society that enables productivity improvement across sectors for all. The adoption s-curve of such perception shall be shifted upward due to COVID as well.

The Premia Asia Innovative Technology ETF is a thematic strategy designed to invest in a handful of technology-enabled high growth themes, allowing investors to efficiently capture the growth opportunities while diversified across themes and Asia geographies in a one-trade solution. The index methodology of this strategy is heavily based on world leading financial analytics platform FactSet’s RBICS system, which employs a genomic taxonomy that looks into companies’ detailed revenue breakdown to identify those making money in the priority themes.

As of last Friday close (Jun 5th, 2020) the Premia Asia Innovative Technology ETF has generated an NAV return of 37.6% in the last one-year period, and 17.8% since listed in Aug 2018 in USD terms (Source : Premia Partners). To learn more about why this strategy is well-positioned for post-COVID growth and how investors could make use of this strategy either as a standalone long-term growth-oriented portfolio, a strategic allocation for Asia exposure, or a tactical complement to US tech strategies, please stay tuned for our next piece: Deciphering the Alpha in Asia Innovative Technologies.