What is Smart-Beta?

Smart beta has gained great notoriety in the past several years. To stem any misconceptions, the phrase "smart beta" is relatively new, but the investing concept is not novel by any means. Smart beta is primarily rooted in factor investing, a methodology explored as early as 1934 through value investing by Graham & Dodd and later with William F. Sharpe’s study of risk factors on return in the 1960s.

Smart beta strategies are designed using a rules-based portfolio construction process of systematically selecting, weighting, and rebalancing portfolio holdings on the basis of factors - that are driven by risk preferences or behavioural anomalies - other than merely price or market capitalization.

Why one should consider Smart-Beta?

Improve Outcome

Seeks to enhance

risk-adjusted returns through

exposures of proven

factor drivers

Reduce Cost

Retains many benefits of

traditional passive indexing,

more cost-effective than

active strategies

Increase Transparency

Rule-based process and

transparent disclosures allow

investors to make informed

decisions

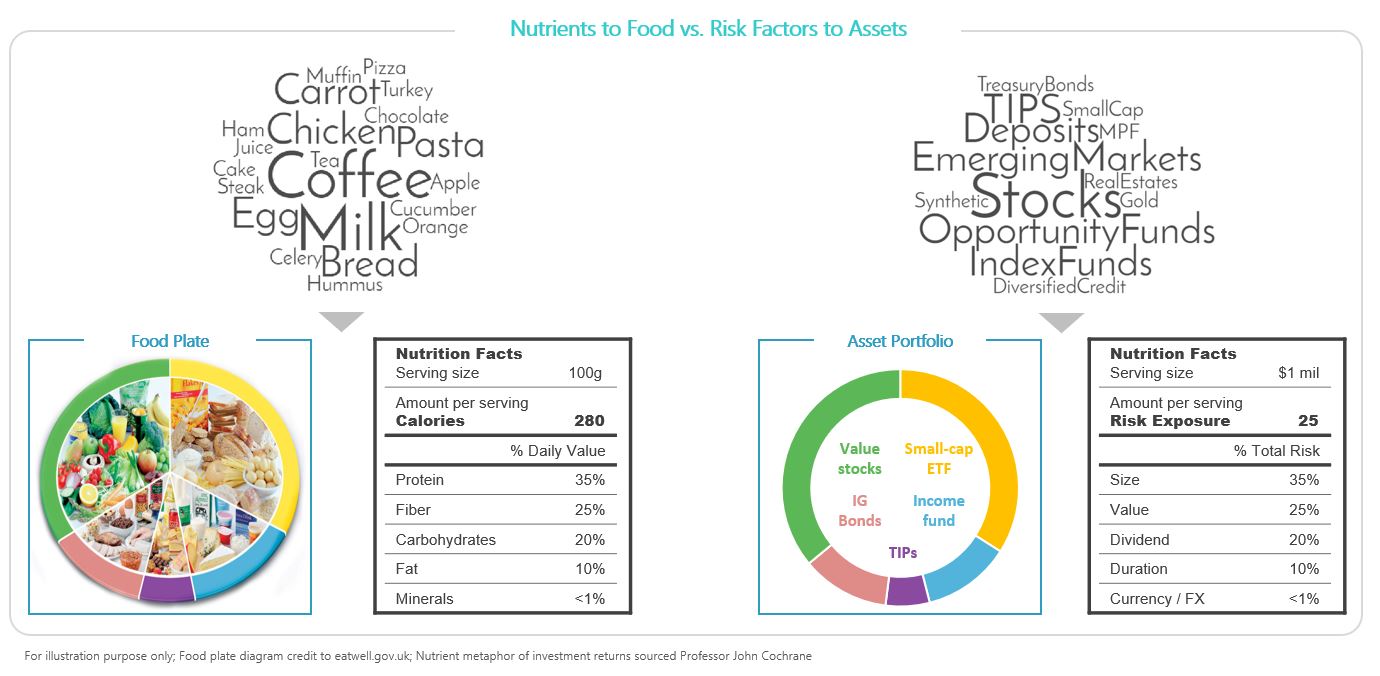

Eating Right vs. Investing Right

The food analogy used by Professor John Cochrane from the University of Chicago is very effective at illustrating the risk-based framework - think of risks as nutrients, assets as foods and portfolios as meals.

This widely quoted beautiful analogy of what risk factors are to assets vs. what nutrients are to food illustrates both the power of the factor framework for helping investors invest better and the danger associated with undesired or unintended exposures. Recognizing which factor exposures one has is similar to recognizing whether one had a slice of turkey breast, a cheese omelette, or an almond shake - the seemingly very different intakes are nonetheless protein consumptions, with little other nutrients like fiber, vitamin C, or complex carbohydrates. This intuition helps investors to examine portfolio allocation and diversification in a more scientific approach.