Asset Allocation

Asset allocation refers to the process of selecting a combination of investments in a portfolio among the major asset classes - which traditionally has been a basket of equity, bond, and cash equivalent assets, are recently evolved to include alternative assets such as REITs, private equity, commodities, and derivatives - and within those asset classes, looking at geographical exposures and styles.

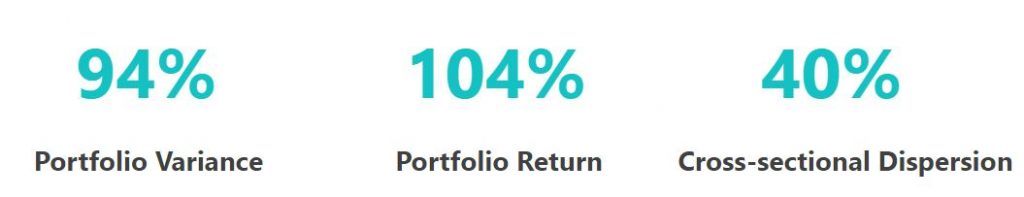

Many empirical studies have found that asset allocation has superior importance in portfolio performance versus security selection. "Determinants of Portfolio Performance (1986)", a famous study by Brinson, Hood and Beebower, found that asset allocation accounts for 94% of the variation in returns in a portfolio, with market-timing and security selection accounting for only 6%. Ibbotson and Kaplan (2000) found that asset allocation on average explains 104% of portfolio return and 40% of cross-sectional portfolio dispersion.

Prof. Raghavendra Rau from the University of Cambridge has further found based on a statistical simulation approach that asset allocation is especially important in times of greater volatility in markets - e.g. during economic crisis.

Depending on an investor's risk, return objectives and the time horizon, one's asset allocation will be different. An important component of asset allocation is ensuring appropriate diversification - i.e. "not putting all your eggs in one basket." Such diversification refers to diversified exposures across asset classes and within the asset class.

ETFs are cost-effective building blocks that gives easy access to a certain exposure with a diversified basket of securities. As a result, ETFs are commonly used in core strategic allocations, and more oftenly as a tool for tactical allocations as well.