Fighting the battle against COVID-19 was not only a test of China’s healthcare system, but also an inspection parade of the country’s technology capabilities. While many are familiar with China’s tech story from the BATJs in respect of e-commerce and social media, technology-enabled innovations have taken place far beyond the consumer space – industrial automation for example, is a segment that has seen significant growth. Robots and drones, for example, has been widely used in this pandemic to help authorities and society in various ways to battle the coronavirus outbreak, including monitoring and broadcasting, delivering the critical supplies such as medicine and grocery, spraying disinfectants, and detecting body temperature in public crowds.

In the face of lockdown, Alibaba was among the first to move, leveraging its IIoT logistics platform. The company collaborated with its manufacturing partners, in less than 48 hours, to produce N95 masks and other medical supplies during the Chinese New Year vacation, fast-tracking the shipping of warehouse stocks and offering essential supplies through its e-commerce platforms. Alibaba also initiated online donations through its digital payment system Alipay, collecting US$10 million in the first eight hours alone. JD also deployed its technologies of IIoT logistics networks during the Wuhan lockdown, shipping smart vehicles to the city border, loading the local map and remotely operating (from Beijing, about 1200 km away) deliveries of goods to hospitals and communities in Wuhan. Chinese technology giants have all entered the challenge of keeping the quarantined cities supplied during the outbreak. Those responses and actions have shown the superpower of IIoT with a high degree of innovation and flexibility.

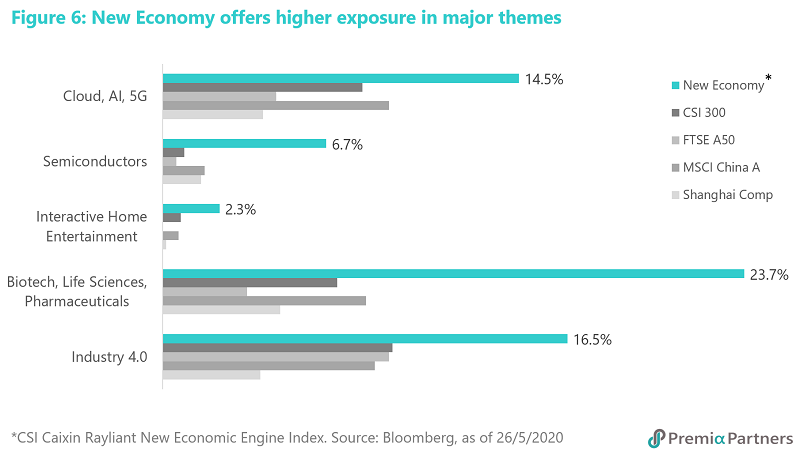

The genesis of IIoT is the integration of Industry 4.0 and the internet of things – an integration of information technology and industrial excellence (Figure 1). The most prominent examples of IIoT includes smart manufacturing, dark factory (lights out), and smart city.

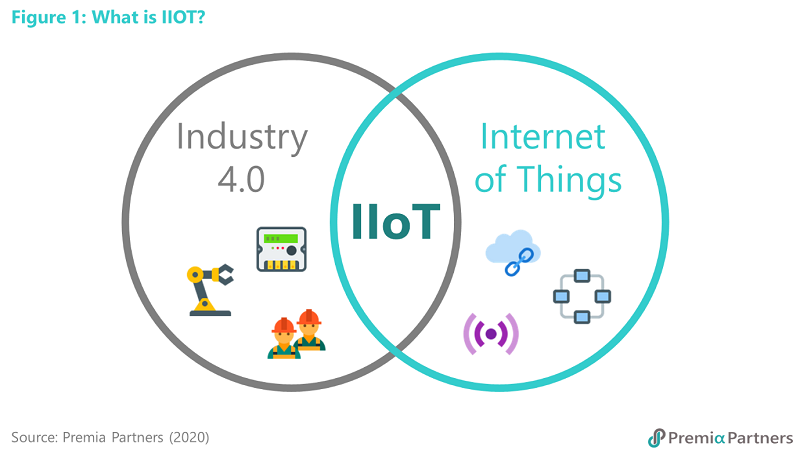

China, traditionally seen as the world’s manufacturing factory, has spent significant effort to transform from (cheap) labour-intensive manufacturing to high-end manufacturing through the development of digitalization and industrialization. Over the past years, China’s IIoT market has seen a rapid growth, reaching nearly 700 billion yuan this year with a 5-year CAGR of 14% (Figure 2). IIoT adoptions of cloud computing, analytics, artificial intelligence and robotic automations have led to incremental growth in productivity across the industrial sectors. According to GSMA, China will account for one-third of the global IIoT market by 2025.

Chinese tech giants such as Tencent, Alibaba, JD and Baidu have all taken aggressive plans to scramble into the IIoT game. JD has ambitiously developed 5G and IIoT in logistics. The low latency, high speed and ability to support a broad spectrum of simultaneous connections provided by 5G networks creates an unprecedented level of real-time connectivity, significantly improving the efficiency of JD’s fulfilment operations. With warehouses, robots and trucks all communicating, JD can realize cost reduction, route and space optimization, more precision fuel consumption and smart dispatching. Of its current aggregate gross floor area of over 15 million square meters, around 2.5 million square meters are managed in this space under the JD Logistics Open Warehouse Platform. E-commerce giants such as Alibaba, Tencent and Meituan are working on something similar, leveraging AI, robotics and 5G to move beyond current IoT and create ubiquitous connectivity at scale.

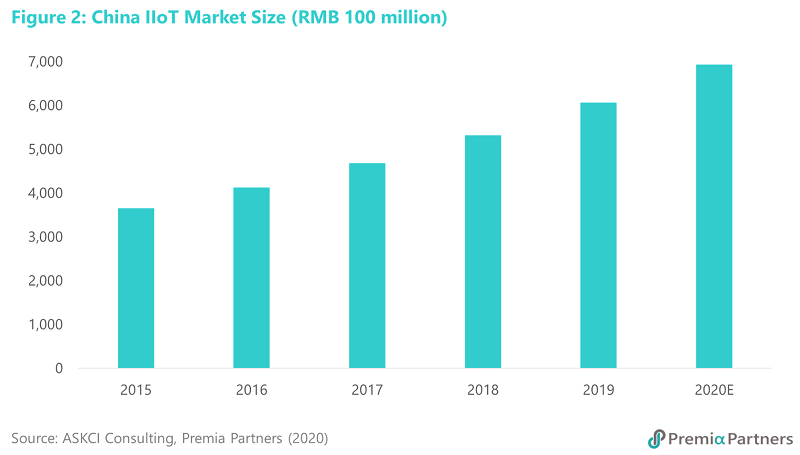

Here, we would like to give you an overview of IIoT ecosystem with leaders in the building blocks (Figure 3). While tech titans BAT have provided cloud services as solutions to enterprise clients around the world, there are several emerging firms playing in the niche areas with their expertise.

Edge: The Edge layer is to connect the operation technology (OT) layer to the IT system to form a converged network, which is the target of IIoT. Chinese semiconductor leaders GigaDevice (fabless flash memory developer), Goodix (integrated chip designer who specializes in fingerprint sensors), Jingjia Microelectronics (GPU manufacturer) and Unigroup Guoxin (intelligent secure chip leader) play the key role in the field of edge modules for connectivity, controlling and sensing. Chinese electronic connector manufacturer AVIC Jonhon is also a key contributor for networking infrastructures to connect all the devices.

IaaS: IIoT applications require special cloud services with higher levels of reliability, security and responsiveness to meet industrial requirements. Many major IIoT platforms, accordingly, leverage open-source technologies and industry capable cloud foundry (IaaS) as the foundation to build the platform, in order to save on costs and time. Chinese IaaS players includes Inspur (the world’s third server provider), Sinovatio (Chinese leading developer of network visualization infrastructure and network content security) and BDStar (Chinese expert in navigation and communication infrastructure).

PaaS: Chinese IIoT PaaS are mainly industry vertical platforms, which are tailor-made for a specific industry to satisfy the vertical demand. China’s manufacturing giants has been jumping into the IIoT game by designing the platform in-house to optimize operations. Chinese home appliance leader Midea Group, for instance, has developed its own industrial IoT platforms M.IoT. The platform is established to integrate software and hardware to enable digitalized precision control, machinery automation, and other means of intelligent manufacturing. Through M.IoT, Midea’s electric appliance manufacturing has reduced raw materials inventory by 80%, lowered fault response time by 57%, slashed inspection costs by 55%, improved external appearance assessment accuracy by 80%, and decreased abnormal response time by 75%. Midea’s major competitors GREE and Haier have developed the similar industrial platform, while Baosight adopts the technologies in iron and steel industry.

SaaS: The software player develops industrial application on IIoT platform that enable capabilities. Chinese leading software leaders such as Yonyou (China’s leading ERP and cloud services vendor), BONC (China’s big data leader who has successfully built the world's largest centralized data system platform for the telecom industry), Weaver (Chinese leading collaborative management software provider) and Glodon (leading software provider in the Chinese construction industry) are the key contributors to the emerging IIoT segment as SaaS plays the significant role in the evolution of IIoT.

Cyber Security: The rich number of devices in the IT and an OT system makes the IIoT security more complex. Although the hardware and software vendors have embedded the security features in their product, the IIoT security needs to be implemented from the system level. There have been several Chinese industry leaders involved in the industrial security, including Sangfor, Venustech, NSFOCUS, Nanyang Topsec and Westone.

Industrial applications may be less noticed during daily lives and not as eye-catching as the digital applications in the consumer space, yet it is indeed a segment experiencing exponential growth in a low-profile way. Rome wasn't built in a day, the robots and drones we presented in the opening story could have been commercialized only after days-and-nights of hard work in research & development by many scientists and engineers, and that is merely a tip of the iceberg of China’s aggressive IIoT development plan.

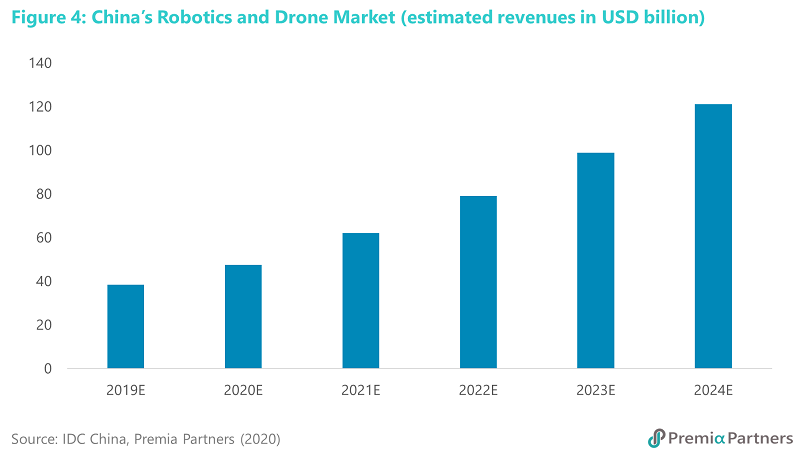

According to IDC, China's robotics and drone market will achieve US$121 billion by 2024 (Figure 4). China-based DJI, one of world’s biggest drone manufacturers, currently has about 70% of the global drone market share.

IIoT is enabled by the adoption of technologies such as AI, big data, automation and cloud computing, and it is one of the fast-growing, policy-supported new economy sectors in China. For those interested, our co-CIO David Lai also shared in one of his recent articles Why is China-A New Economy more resilient and captures opportunities better through COVID and beyond? about the post-COVID impact and how to capture the secular growth opportunities in China.

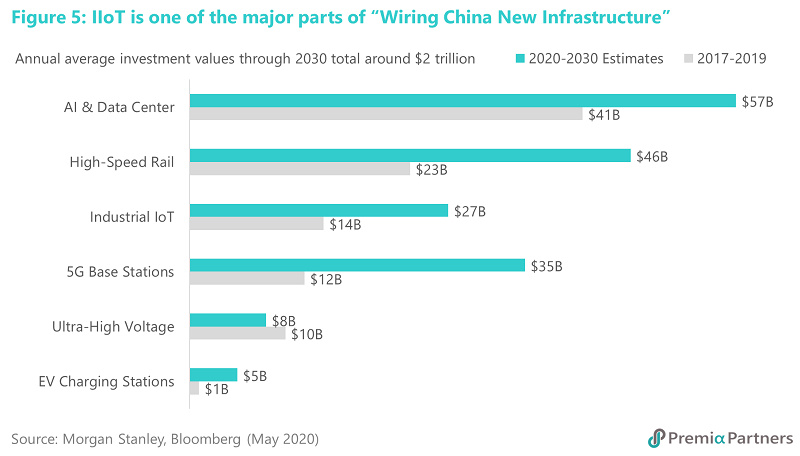

Given the backdrop of the heightened US China tension especially in the technology front, it is expected that investment drive to reduce China’s dependence on foreign technology would continue to be an important trend to watch out for. In fact, as reported by Bloomberg News, the government-backed China Centre for Information Industry Development estimated that China will invest US$1.4 trillion over six years to 2025, on new infrastructure including 5G networks, IoT and AI technology as well as items such as ultra-high voltage lines and high-speed rail that will underpin autonomous driving to automated factories and industrial IoTs. Separate Morgan Stanley report also specified Industrial IoT as one of the major areas of investment (Figure 5).

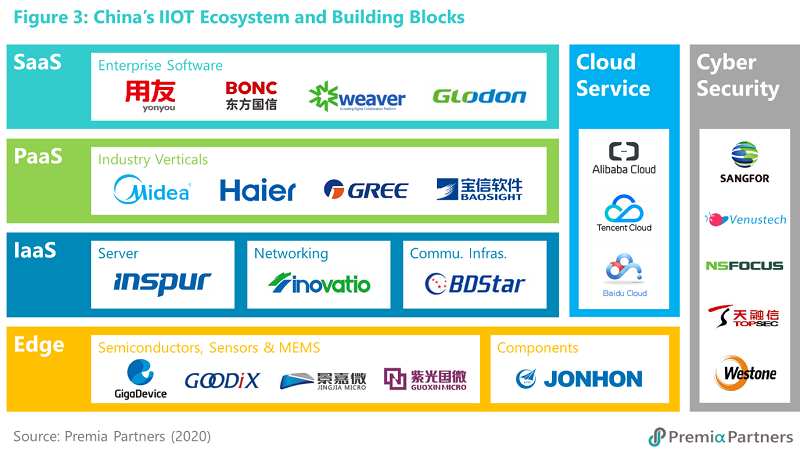

For investors who are interested in gaining exposure to IIoT and the related themes of cloud, AI, 5G and Industry 4.0, the Premia Caixin CSI China New Economy ETF would be very well placed for such purpose, with its much higher sector allocation for such compared to conventional broad based indices (Figure 6). For those looking for more broader coverage of across Asia covering also global sector leaders from Japan, Korea and Taiwan, please do check out our Premia Asia Innovative Technology ETF or reach out to any of us for discussion.