The Investment Case for US Treasury Floating Rate Bonds

1. Cash and dry powder are needed: many investors are increasing cash levels as the cycle gets long in the tooth and uncertainties pile up

2. Bank yields remain low: readily available cash doesn’t pay very much

3. Cash with risk seems to be the norm: credit risk in money market funds, counterparty risk in repos, timing/duration risk in long-dated deposits

4. Cash is not operationally straightforward: rolling t-bills and time deposits, identifying the best yielding bank product – all this takes time away from more important investment thinking

Overview of the Bloomberg Barclays US Treasury Floating Rate Bond Strategy(click here to skip to this section)

1. Shortest duration instrument: only 1 week of duration with coupon resets every Wednesday

2. No credit or counterparty risk: 100% physical exposure to US treasury obligations only

3. Risk-free does not mean low yield: ~2.3% gross yield, higher than all US treasuries up to 10 years

4. No rolling or rate shopping required: yields reset weekly to latest 3m t-bill rate automatically

Click here if you’d like us to contact you about this upcoming strategy

WHY US TREASURY FLOATING RATE BONDS?

Cash is always an interesting topic, but its utility went down quite a bit after 2008, when the Federal Reserve dropped rates to 0. Many countries slowly followed and now we have a large part of global fixed income in negative yield territory. However, over the last few years, this has begun to change, at least for US dollar fixed income, and the Federal Reserve has now raised rates to 2.5%. The challenge for investors who can’t directly access the Federal Reserve (all of us) is getting to this yield without taking undue risk. That’s where US Treasury Floating Rate Bonds come in – they are as close as you can get to the Fed Funds Target Rate.

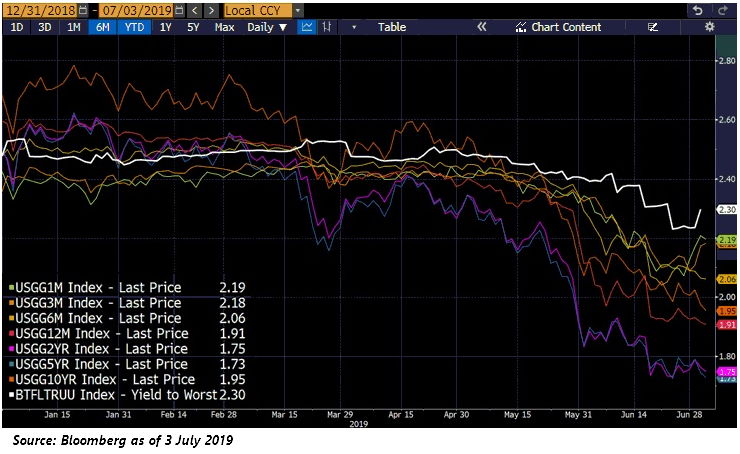

Treasury Floating Rate Bonds (BTFLTRUU Index) closely follow Fed Funds Target Rate

What are the alternatives for cash?

Before talking about US Treasury Floating Rate Bonds and how they work, let’s cover the alternatives. There are 4 main ways we see investors handle their cash balances:

1. Leave in custody/bank account – typically yields next to nothing

2. Buy a money market fund – can result in quite high yields, but not without risks

3. Buy time deposits – yields vary, but requires shopping around and involves bank risk

4. Buy t-bills – risk-free, but yields vary and requires monitoring of liquidity and rolls regularly

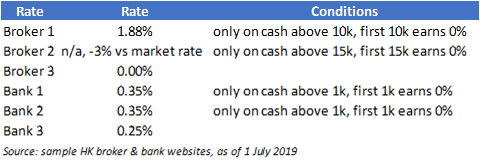

We won’t spend much on #1 above as it is quite self-explanatory. Leaving cash at the bank or broker usually does not pay much and involves complete risk exposure to that bank or broker. Below are the latest bank and broker yields advertised in Hong Kong for USD savings accounts:

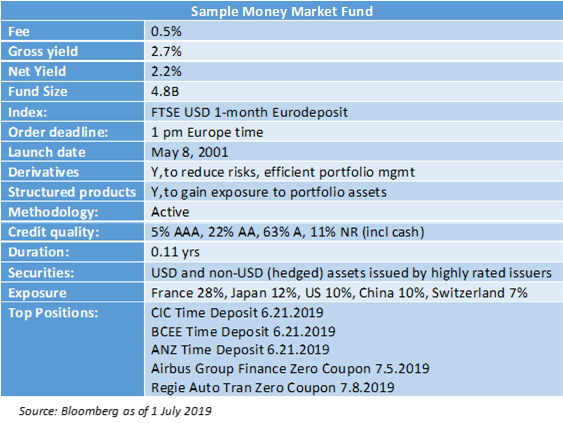

With the Fed Funds at 2.25-2.5%, it’s obvious that investors seek out alternatives. How about money market funds? Those typically offer a higher yield of course, but they are run actively and invest in not just treasuries, but in commercial paper, longer-dated government securities, repos – you get the idea. These securities are not risk-free – they involve either credit risk, counterparty risk, interest rate risk, etc. Of course, the money market funds are run by professionals and they seek to minimize risks. That said, these funds often charge relatively higher fees for the privilege of investing in them and don’t always get it right. Below is a snapshot of a sample money market strategy used by many investors:

While there is nothing wrong in principle with this type of cash management approach when investors understand what they are getting, 2008 served as an important reminder of just how quickly things can go wrong. The oldest US money market fund broke the buck, investors fled prime funds to the safety of government only investments and questions arose regarding what custodians did with the cash balances left in their care. Below are a few headlines from ~10 years ago:

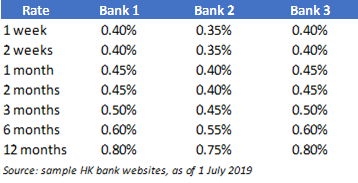

Time deposits are another popular way to invest cash, but again, we run into 4 problems. Problem 1 is that you have to constantly roll them and shop around, or at least keep an eye on your bank, for good rates. Problem 2 is that you are 100% exposed to the default risk of the bank you get your time deposit from. Problem 3 is that retail and institutional rates are different – retail rates are lower and standard, institutional rates are higher but you still have to negotiate to get a good rate. Problem 4 is that you are locked in and cannot use or reinvest the cash until the time deposit is finished. Below are sample rates from a few Hong Kong banks – nothing to write home about. Please note that these are the publicly disclosed rates for retail and institutional rates are likely to be higher (though still as much hassle).

Finally, many investors simply buy t-bills and roll them on a regular basis themselves. For small sizes, this is quite difficult as treasuries typically trade in increments of at least 100k, though even at that size the pricing is inefficient. For larger sizes, there is the hassle of rolling and monitoring, which is an operational process and does not add material value to an investment portfolio. The bigger risk is exposure to interest rates over longer periods – t-bills are issued in 1 month, 3 month, 6 month and 12 month tenors and have the same coupon throughout their life. This means that unless a t-bill is held to maturity, investors are exposed to mark-to-market volatility as rates change. When rates are dropping, this can be a good thing as selling the t-bill will result in a small gain. However, then the problem is one of reinvestment – especially in the current environment when the US curve has inverted. When rates are going up, as they did until late 2018, long-dated t-bill investment for yield results in underperformance due to the increased duration of the securities.

In short, there’s no perfect solution. But if your goal is risk-free cash yield in USD, then we’d like to introduce the Bloomberg Barclays US Treasury Floating Rate bond strategy as an alternative.

WHY THE BLOOMBERG BARCLAYS US TREASURY FLOATING RATE BOND STRATEGY?

Our US Treasury Floating Rate strategy was borne out of client frustrations. Our clients were using some of the above methods for cash management and were frustrating with either the low yields of custody accounts, the operational nature of time deposits and t-bill rolls, or the higher risk levels of most money market funds. A few clients made clear that their cash balance was dry powder due to the late stage of the economic cycle we’re in and that they wanted their cash to be as close to risk-free as possible. We thus went about looking for a way to provide USD yield without taking unnecessary risks and believe we found it in US Treasury Floating Rate Bonds.

So, what are these bonds?

US Treasury Floating Rate Bonds are issued by the US Treasury and are relatively new. They were first issued in 2014. The bonds are issued on a quarterly basis and have a 2 year maturity. But that’s not what makes them special. They are special because these are the only treasuries with floating rate coupons – the coupon resets to the latest 3 month t-bill plus a spread fixed at auction. Since the 3 month t-bill is issued every week on Wednesday, that means these bonds have a new yield every Wednesday. There are a few implications of this:

1. A new coupon every week means maximum of 1 week duration – these are the shortest duration treasuries available

2. The spread is compensation for the 2 year tenor (vs 3 month t-bill rate) and adds extra yield to the coupons – the range has been 4 bps to 15 bps

3. The floating component generates outperformance when yields back-up and the spread provides a buffer as yields rally

4. With only 1 week duration and 0 credit risk (issued by US treasury), these bonds are as close to risk-free as we’ve been able to find

As mentioned earlier, these bonds follow the Fed Funds Target Rate quite closely, much better than other t-bills. In fact, right now, with the curve inverted, Treasury Floating Rate Bonds offer the highest yield among treasuries, except the 30 year bond. Not bad for a risk-free investment.

How big is this market?

There are roughly ~350B USD of Treasury Floating Rate Bonds outstanding, which is ~2.3% of all Treasuries outstanding. The bonds are issued quarterly with 2 year maturities, so there is a total of 8 bonds outstanding at any point in time. The 8 bonds currently outstanding have averaged ~2.1B USD in turnover per day during May. In short, this market is big and liquid – exactly what we want for a cash mgmt and ultra-short duration strategy. (Source: Bloomberg as of 31 May 2019)

What do I actually own?

The Bloomberg Barclays US Treasury Floating Rate Bond strategy (don’t worry, we’re working on a better name), is very simple – it buys all the Treasury Floating Rate Bonds outstanding in their respective amount outstanding weights. That’s it. Shortest explanation I’ve ever had to write! The strategy physically owns all the relevant bonds directly and does not have any derivatives, repos, or any other risks.

How do these bonds differ from most corporate floating rate bonds?

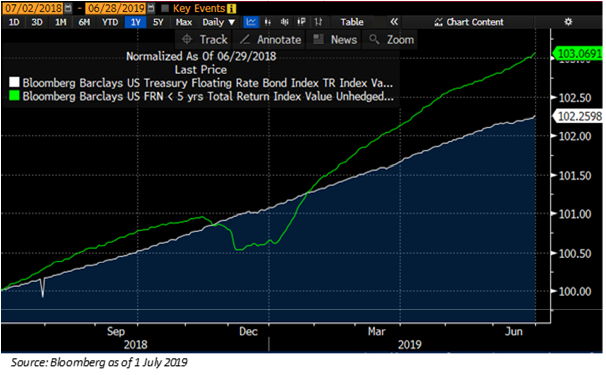

Most floating rate corporate bond coupons are set to the 3 month LIBOR plus a spread. Their coupons reset quarterly. Needless to say the obvious difference is that US Treasury Floating Rate Bonds are set against the 3 month t-bill (not LIBOR) and their coupons reset weekly (not quarterly). You get a greater yield but also greater risk. Corporate floating rate bonds involve credit risk and greater duration – leading to situations like 4Q18, where market stress led corporate floating rate bond prices to drop materially while treasury floating rate bonds held up just fine.

How can investors use this strategy in their portfolios?

Although funds that hold these Treasury securities should not be viewed as “money market funds,” in our view, floating rate Treasuries can function as a core alternative for short-term bond exposure with reduced interest rate and credit risk. Given that U.S. government securities are assumed to be free of default risk, the value of the security is determined by the interest rate at each weekly auction. The Treasury decided to offer this floating rate option as an alternative to investors who were rolling t-bills every quarter. Floating Rate Treasuries can help investors reduce transaction costs and extend the holding period of their investments. From an operational perspective, floating rate Treasuries can be an important addition to the investment opportunity set available to today’s investor. Although interest rate risk is not as prevalent on the minds of many investors these days, we believe that floating rate Treasury securities represent an effective way for investors to help reduce their exposure to rising interest rates, if such concerns do re-emerge. In addition, they generate income payments that are backed by the full faith and credit of the U.S. government. Whereas other investments may also pay a rate of interest that resets each month or quarter, such securities are exposed to credit risk or the risk that the borrower will not be able to meet its financial obligations

That just about sums it up. US Treasury Floating Rate Bonds are 1 week duration securities that do not have any credit or counterparty risk. As long as costs are managed, they offer an alternative to money market funds (less risk), t-bills (no rolls or mark-to-market), time deposits (no lock-ups or bank risk) and most other common cash management tools.