Where are we after the DeepSeek moment

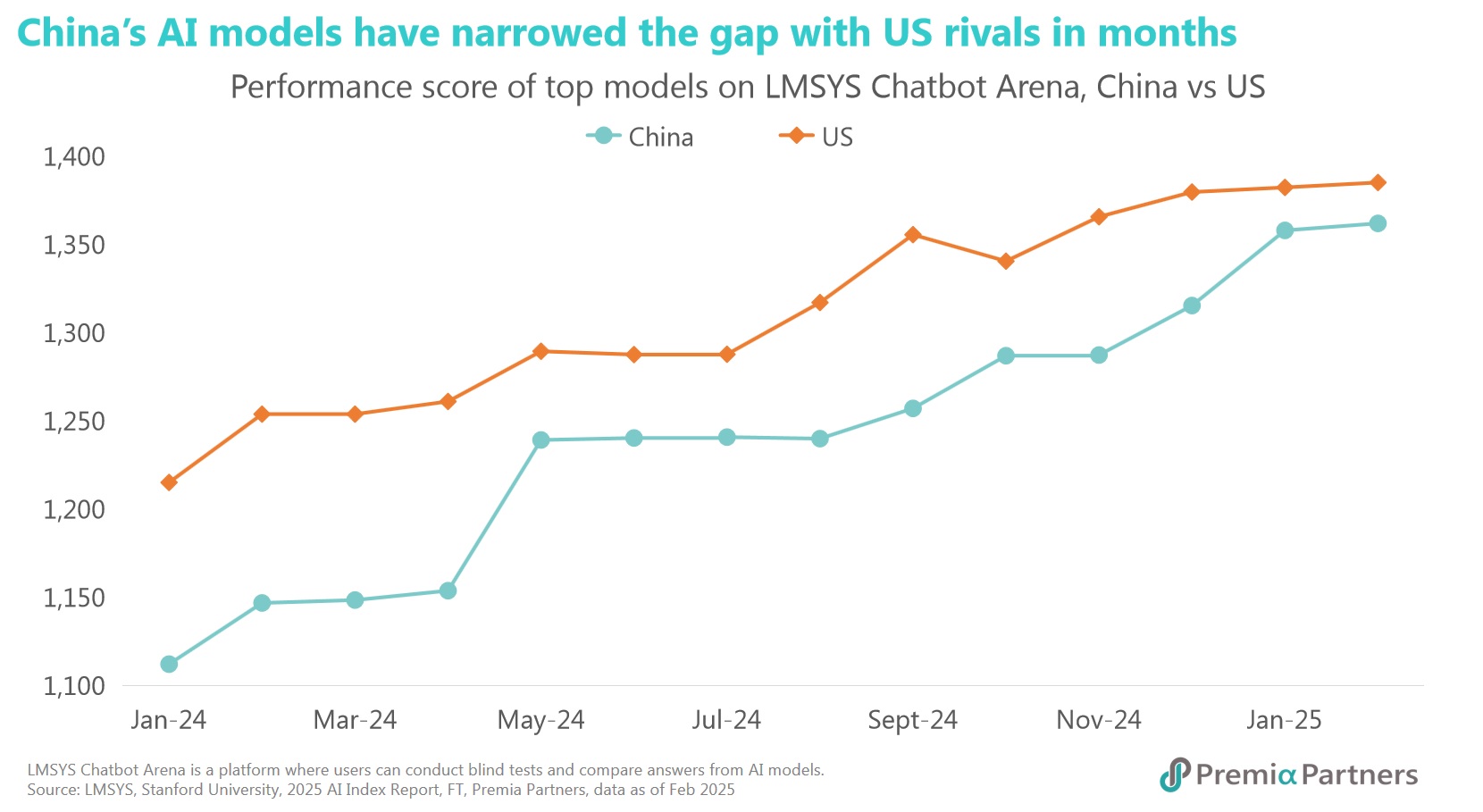

Similar to the US, China has seen a proliferation of powerful AI models including DeepSeek, Kimi K2, Qwen over the past year. Different from the US, China’s AI models including DeepSeek are mostly open-source AI models, and challenging fundamentals of Western proprietary general purpose AI models by focusing on cost-effectiveness, accessibility and performance. In addition to significant adoption across businesses and households domestically, many are also gaining traction globally given their high performance at much reduced costs. More recently, in addition to costs, efficiency and high performance, Chinese AI developers are also rapidly developing practical, scalable solution based models, with companies like Bairong pioneering a "Results-as-a-Service" (RaaS) model focused on measurable AI outcomes, while Huawei introduced an "R-A-A-S" framework (Reliability, Availability, Autonomy, Security) for resilient financial AI. In fact, RaaS in China often means deploying AI agents that deliver specific results (like in customer service or operations).

On the other hand, as demand for cloud computing data centres surged, placing exponential pressure on power and energy infrastructure globally, the strategic rationale of China’s "East Data, West Computing" initiative and its significance for China’s AI development also started to make sense to the world. Launched in 2020 to optimize cross-regional power transmission and integrated computing networks, this critical infrastructure advantage has provided China with much advantage in the global AI and data centre race given the much lower energy costs, and underpinned a broad rally across the computing ecosystem including the energy storage system (ESS) providers.

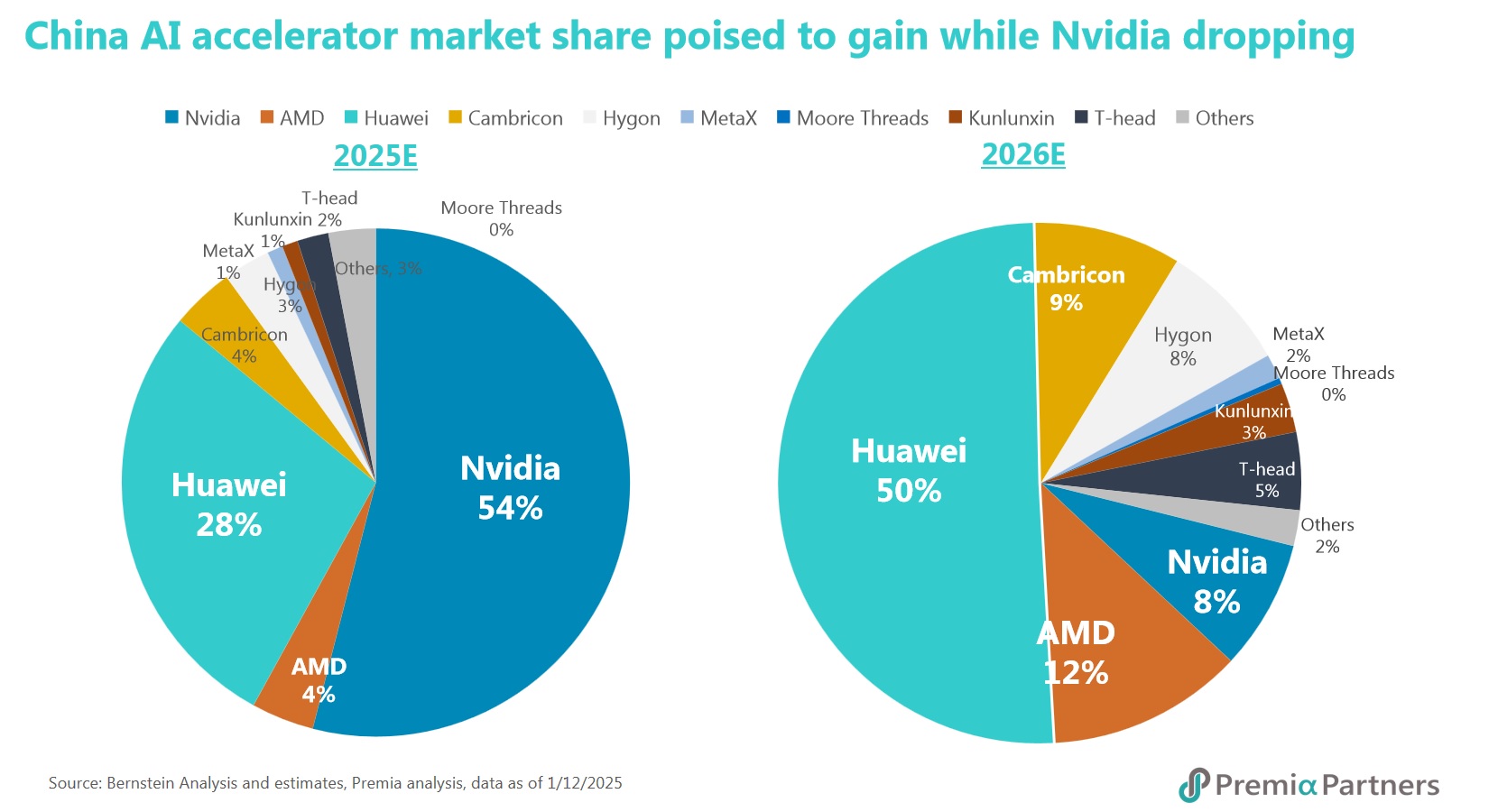

Meanwhile Chinese chip sector especially the AI chip leaders also made much leapfrogged during the year with technological breakthroughs and active financial activities. With meaningful backing of public and private sector funding, and domestic substitution policies that fast tracked product adoption, many Chinese chipmakers have much improved profitability profiles and are ready for A-shares or offshore listings. Through ASIC vendors focusing on training and inference (such as Cambricon and Kunlunxin), CPU-centric firms (like Hygon Information, Biren Technology and MetaX), and full-stack solution providers (including Huawei Ascend, Alibaba T-Head, Moore Threads and Enflame), domestic chips have realized significant leaps in both performance metrics and market share. Behind the vibrant STAR Board, Chinext and HKEX listings and robust tech IPO pipeline, it also underscores the improved capacity for Chinese chipmakers and equipment makers to fund the next cycles of innovations and breakthroughs faster and cheaper.

Evolution of China’s generative AI ecosystem: from DeepSeek to blooming of a hundred flowers

The launch of DeepSeek’s reasoning model, R1, in early 2025 sent shockwaves from Asia to Silicon Valley. Operating on only a fraction of the cost and computational resources required by its American counterparts, R1 delivered comparable performance, briefly propelling its market share to exceed 50%. This catalyst ignited rapid innovation within the industry, with major technology firms—including Alibaba (Qwen), ByteDance (Doubao), Tencent (Hunyuan), Baidu (Ernie), Kuaishou (Kling), Moonshot AI (Kimi), MiniMax (M1), and Zhipu AI (GLM)—releasing open-source models that drove a rolling enhancement of capabilities. By year-end, the market had evolved into a fragmented yet vibrant landscape where no single model commanded more than 25% of the market share. The likely emergence of oligopolistic or distributed AI leaders also provides diversity and reinforces resilience of the ecosystem from geopolitical and standard vulnerability risks.

For instance Alibaba’s Qwen series, first open-sourced in August 2023, has since matured into one of the world's largest open-source model families. A recent joint study by MIT and Hugging Face validated this shift, revealing that China now commands a 17.1% share of the global open-source AI model market, surpassing the United States' 15.8%. This data highlights a distinct divergence in strategy: while many US tech giants favour closed ecosystems, China’s embrace of open-source pathways has accelerated its iteration speed and expanded its international influence.

Coming of age: when high end manufacturing meets agentic and physical AI in China

As the large model market undergoes initial consolidation, the industry is poised to transition from Generative AI deployment to the era of Agentic AI and Physical AI in 2026. China with its world leading high end manufacturing ecosystem in particular is the best place for this. This phase focuses on autonomous, executable agents capable of delivering tangible user value, where reliability and scalable commercialization of AI Agents are paramount. This involves specifically addressing the "last mile" challenges of controllability in high-stakes sectors such as finance, healthcare, law and autonomous driving. Unlike passive models awaiting commands, Agentic AI possesses the capacity for autonomous decision-making and cross-module collaboration, acting proactively to achieve objectives. This technology is expected to reach peak application within five years, serving as the central nervous system for smart manufacturing and enterprise automation. In the automotive sector, for instance, Agentic AI demonstrates immense potential by orchestrating multiple agents to integrate perception, decision-making, and control in real-time, thereby enhancing safety. When combined with Physical AI simulations, manufacturers can accumulate vast driving experience in virtual environments, accelerating the validation and mass production of autonomous vehicles.

Sweet spots in the hardcore technology value chains in Asia and China

With AI large models iterating on a bi-weekly or monthly basis, domestic accelerators such as Alibaba Cloud, Tencent Cloud and Baidu AI Cloud are positioned as primary beneficiaries. Furthermore, internet leaders integrating AI servers—including Kuaishou, NetEase, Meituan, JD.com, and Xiaomi—stand to gain significantly from frontend deployment. Investors seeking exposure to this growth trajectory may consider the Premia Asia Innovative Tech & Metaverse Theme ETF, which provides targeted access to the aforementioned Chinese leaders while also covering established players across Japan, South Korea, Taiwan and Singapore, offering a diversified approach to the region’s innovation landscape.

How far is China from Nvidia and ASML free

The chip and equipment ban in the past years undoubtedly turbocharged China’s development of its own versions of AI chip and chip equipment. The recent launch of the billion dollar state venture capital funds, further to the state and private funds for the sector underscored the commitment of China to attain unconstrainted AI and technology developments. The market now features established leaders like Cambricon and Hygon Information, alongside newly listed entities on the STAR Market such as Moore Threads and MetaX. Concurrently, innovators yet to go public like Baidu’s Kunlunxin, Alibaba’s T-Head, and Enflame Technology continue to achieve product breakthroughs. While an absolute performance gap remains vis-à-vis global leaders, China has successfully developed a diverse portfolio of GPU products, ranging from those benchmarking Nvidia to specialized GPGPUs and ASICs. These companies are pursuing differentiated paths—enhancing performance through FP8/FP64 multi-precision support, optimizing High Bandwidth Memory (HBM), and utilizing advanced packaging —to secure advantages in specific verticals and energy efficiency. Bernstein Research forecasts a dramatic shift in market dynamics: Nvidia’s share of the China AI chip market is projected to contract from 54% in 2025 to just 8% by 2026, with domestic vendors absorbing the difference. Supply constraints are expected to persist through 2026-2027, with equilibrium returning by 2028.

Looking ahead to 2026, domestic semiconductor manufacturing capabilities are set to enter a phase of volume expansion. While the Electronic Design Automation (EDA) market remains 74% dominated by US incumbents like Synopsys, Cadence, and Siemens, domestic challengers are emerging. Notably, Qiyunfang—a subsidiary of the Huawei-linked SiCarrier—claims a 30% increase in design efficiency and a 40% reduction in hardware development cycles compared to US tools. Similarly, while EUV lithography remains a bottleneck for mass production below 5nm, collaborative efforts by SMIC, SiCarrier, and AMIES Technology are exploring pathways to bypass ASML’s monopoly, with further breakthroughs anticipated in 2026.

In the memory sector, YMTC (NAND) and CXMT (DRAM) are narrowing the gap with global giants SK Hynix and Samsung, particularly through joint R&D in HBM technology. With both companies undergoing IPO counselling and expected to list in 2026, the stage is set for a new chapter in Chinese memory chips. The STAR Market, where over 80% of listings are in next-generation information technology, remains the optimal venue for capturing the value of import substitution. As potential unicorns like Enflame and Biren Technology advance their listing processes, investors looking to position ahead of the curve can consider the Premia China STAR50 ETF, one of largest offshore China STAR50 ETFs listed and an efficient vehicle for accessing the top 50 "hard tech" companies driving China’s technological autonomy.

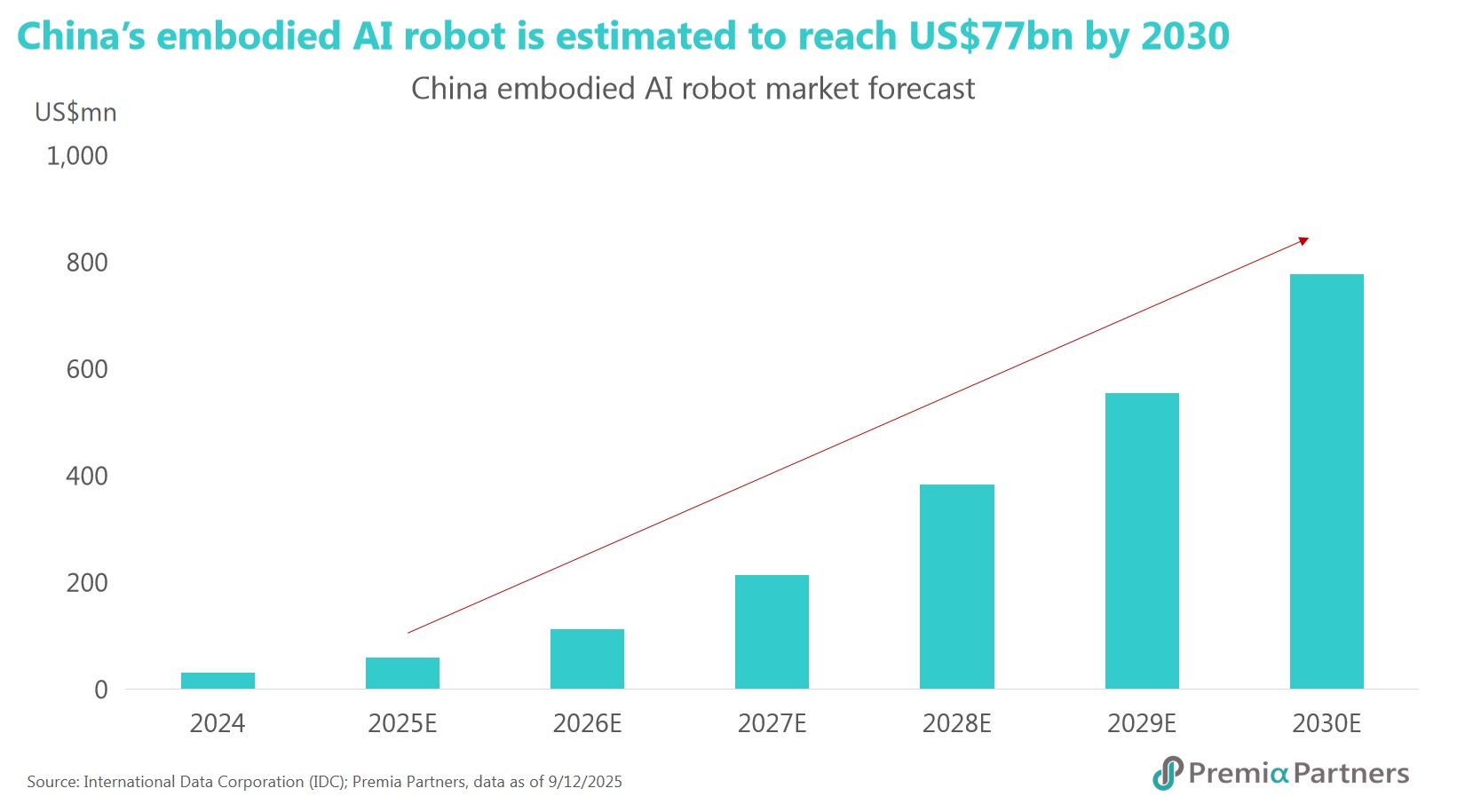

From industrial automation to commercialization and scalability of China’s physical AI innovations

China experienced a huge surge in the commercialization of robotics in 2025. This was vividly demonstrated during the Chinese New Year Gala, where Unitree’s general-purpose humanoid robot, H1, captivated the public with a traditional "Yangge秧歌" (a folk dance) performance, generating significant and sustained public attention. Other remarkable achievements built further the momentum through the year. In April, the world’s first humanoid robot half-marathon saw "Tiangong Ultra" cross the finish line in a time of 2 hours, 40 minutes, and 42 seconds. Furthermore, the World Robotics Games in August hosted 280 teams from 16 countries, competing with over 500 robots across 26 events. High-profile industry events, such as the World Robot Conference 2025 in August and the China Robot Industry Development Conference in November, showcased the comprehensive value chain evolution, spanning from core components (including domestically produced computing chips) to complete machines and diverse applications in service, inspection and manufacturing. Collectively, they made a stunning statement – China has entered a new phase of high-quality development in its robotics sector.

The humanoid robotics market in China is poised for explosive growth, and the surge in fame of Chinese humanoid robotics companies such as Unitree Robotics in 2025 was only a glimpse of the sector. IDC projects that the Chinese embodied AI robot market size will surpass US$1.4 billion in 2025 and reach US$77 billion in 2030. Crucially, 2026 is forecast to be the pivotal year for commercial adoption, driven by a powerful confluence of policy support, confirmed order fulfilment, and core technological breakthroughs. TrendForce forecasts global humanoid robot shipments to exceed 50,000 units in 2026, representing a staggering year-over-year increase of over 700%. The commercial landscape is characterized by increasing application diversity and distinct price stratification. Manufacturers like Unitree and AgiBot are pursuing large-scale pilot programs with cost-competitive products to tap into the consumer market. In contrast, UBTECH is leveraging its significant capital base for deep integration into automotive manufacturing, while Fourier is carving out a niche in healthcare and companionship applications, differentiated by its focus on emotional interaction and the medical experience.

For industrial robotics, China has maintained its position as the world's largest application market and producer of industrial robots for 12 consecutive years. By 2024, production volumes hit a new high of 556,000 units, with an installed base exceeding 2 million units. This growth has propelled China to having the world's third-highest robot density. The process of domestic substitution continues at pace, with homegrown industrial robot brands increasing their market share in the domestic market from 31.4% in 2020 to 58.5% in 2024. This acceleration continued through 2025, with industrial robot production reaching 602,700 units from January to October—a 28.8% year-over-year increase—already surpassing the total output for all of 2024 and setting a new production record.

Investment thesis for China tech has been shifting to hardware infrastructure and earnings and performance delivery

Entering 2026, the market is shifting its focus from mere "concept speculation" to "performance delivery" within the robotics sector. Positive fundamental developments are successfully attracting capital back to the sector. Recent corporate milestones underscore this transition: Unitree has completed its IPO counselling and is preparing to invest US$124 million in a "super factory" in Ningbo, targeting annual revenues surpassing US$140 million. AgiBot is anticipating ten-fold year-over-year revenue growth in 2025 following the delivery of over 5,000 units. UBTECH projects the delivery of 500 industrial humanoid robots in 2025, with confirmed orders for its Walker series alone totalling US$154 million. Looking ahead to 2026, UBTECH has set an ambitious delivery target of 2,000 to 3,000 units.

The Chinese robotics ecosystem is now a fully integrated chain, encompassing upstream critical components (such as precision reducers, servo systems and controllers), midstream manufacturing (including industrial, service and special-purpose robots), and downstream application integration. This comprehensive structure covers all necessary phases, from core material science to system integration and market deployment. To gain exposure to this critical sector, the Premia China New Economy ETF and the Premia China STAR50 ETF offer highly efficient investment access. Both funds provide diversified exposure not only to the necessary foundational technologies—including Cloud/AI (25% and 81% portfolio weights), semiconductors (15% and 67%), and Industry 4.0 (10% and 14%)—but also stand to benefit from the anticipated IPO catalysts of key players such as Unitree, Jaka Robotics, Fine Motion, and Sichuan Tianlian Robotics, serving as the most convenient pathways for capturing the significant market opportunities within China’s maturing robotics industry.

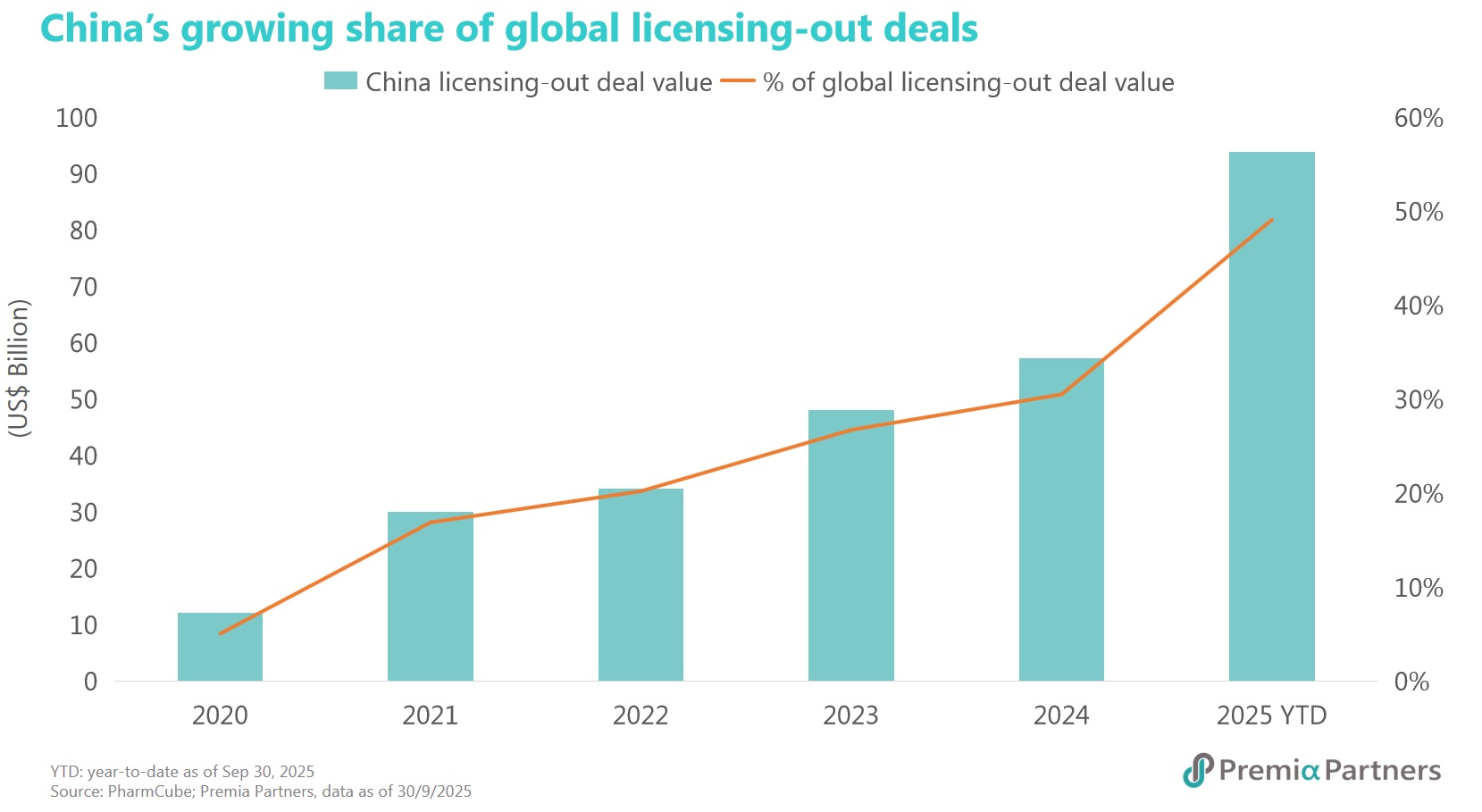

China’s innovative drug industry experienced its own "DeepSeek moment" in 2025 as well, as the robust earnings recovery backed by improved profitability and licensing-out deals prompted significant positive re-ratings for the sector and sector leaders that are still underway. Last year was defined not only by a "blowout" in domestic drug approvals but also by a series of blockbuster cross-border licensing deals that shattered historical records. The sector has decisively transitioned from a local market to a critical node in the global pharmaceutical supply chain.

Innovations in the right place at the right time

The pace of domestic approvals has accelerated dramatically. As of December 1, 2025, the National Medical Products Administration (NMPA) approved 66 Class 1 new drugs, spanning oncology, autoimmune, metabolic and respiratory therapeutic areas. To put this velocity into perspective, only 14 such drugs were approved in 2018. This represents a nearly fivefold increase, equating to the approval of a new innovative drug every five days. This surge reflects the maturation of domestic pharmaceutical companies, which have successfully translated aggressive R&D investment and expanded clinical pipelines into commercially viable assets.

US$100 billion milestone: from importer to global supplier

The robust domestic pipeline has fuelled an unprecedented wave of "license-out" transactions. According to PharmCube, the total value of Chinese pharmaceutical license-out deals reached US$93 billion in the first three quarters of 2025, nearly half of global total license-out deal value. Following the October agreement between Innovent Biologics and Takeda, the aggregate annual value of China’s license-out deal value breached the US$100 billion mark. This milestone signifies a fundamental structural shift: China is no longer merely "bringing in" innovation; it has evolved into a "Global Supermarket" for biopharma, offering a comprehensive, high-quality and diverse inventory of assets that meet global standards.

Record-breaking license-out partnerships

Within a span of just six months, three major transactions redefined the ceiling for Chinese biotech valuations, signalling a shift from "fast-follow" strategies to "first-in-class" leadership. In May, 3SBio and its subsidiary licensed the proprietary asset SSGJ-707 to Pfizer for a potential deal value of US$4.8 billion, setting a new record for upfront payments in overseas authorizations by a Chinese firm. This momentum intensified in July when Hengrui Medicine entered a strategic collaboration with GSK, granting global rights (excluding Greater China) for its PDE3/4 inhibitor HRS-9821 alongside options for up to 11 additional programs, with a potential deal value of US$12.5 billion. The year culminated in December with Innovent Biologics finalizing a massive US$11.4 billion collaboration with Takeda to co-develop cancer therapies, representing the largest cross-border licensing deal in the oncology sector in the history of Chinese pharmaceuticals.

The great patent cliff in global pharmaceutical history

A significant external driver of this global appetite for Chinese innovation is the looming global patent cliff, arguably the most precipitous in pharmaceutical history. According to DrugPatentWatch, between 2025 and 2030, a cohort of the world’s top-selling drugs will lose market exclusivity, placing approximately US$200-230 billion in annual revenue at risk for western pharmaceutical incumbents. Faced with this imminent revenue chasm, these giants are aggressively replenishing their pipelines through internal R&D, M&A and in-licensing. China’s mature innovation ecosystem has emerged as the primary solution to this supply-side crisis.

Entering 2026, this structural trend continues, with innovative drugs, particularly in oncology, the primary market theme. Supported by policies that bolster the entire value chain—from discovery to commercialization—industry leaders are positioned to widen their competitive moats. Key beneficiaries include Sunshine Guojian (3SBio’s subsidiary), WuXi AppTec, Sichuan Biokin Pharmaceutical, Jiangsu Hengrui Medicine, and Junshi Biosciences, etc. For investors seeking targeted exposure to this high-growth theme, the Premia China New Economy ETF and Premia China STAR50 ETF are efficient allocation tools, with portfolio weightings of roughly 14% and 10% respectively allocated to Biotech, Life Sciences and Pharmaceuticals, providing optimized access to the structural rise of China’s innovative drug sector.

As China kicks off the inaugural year its 15th Five-Year Plan with announcement of the billion-dollar chip sector incentive package and state venture capital fund, sector leaders from these strategic industries including semiconductor, AI, robotics and biotechnology continue to be on tailwinds that would take them from visionary speculation to tangible earnings for which analyst consensus are projecting net profit growth for STAR 50 constituents to exceed 25% in 2026. This "technological fortress" has already started rotation of domestic and international investor flows to these sectors, as well as market re-rating backed by improving company earnings and fundamentals under such policy tailwinds. For investors, the Premia China STAR50 ETF and Premia China New Economy ETF serve as efficient and optimized vehicles to capture this momentum, offering direct access to the primary beneficiaries and leaders of domestic substitution and global commercialization that define China’s 2026 growth trajectory.