주요 인사이트 & 웨비나

It is inevitable that the traditional 60/40 asset allocation split between bond and equity no longer work well as the fixed income portion is not generating sufficient stable income.

May 06, 2021

As our Senior Advisor Sayboon Lim stated in the article “Gimme shelter” that it is essential for investors to have China sovereign bonds in their asset allocation, it would be timely for us to introduce the newly launched Premia China Treasury and Policy Bank Bond Long Duration ETF for your consideration.

Apr 28, 2021

Index provider FTSE Russell will add Chinese Government Bonds (CGBs) to the FTSE World Government Bond Index (WGBI) over three years from the end of October – a move that is expected to draw billions of Dollars of new portfolio inflows. Already, there has been a sharp increase in foreign inflows into RMB bonds over the past 12 months, accelerating soon after the start of the pandemic. In this 2-part series, our Senior Advisor Say Boon Lim highlights the drivers for new demand for CGBs and the reasons to own them.

Apr 22, 2021

A popular media narrative for the recent correction in Chinese equities was that it was caused by tightening of financial conditions in China.

Mar 31, 2021

Being the first-in-first-out, China has been the first one to reopen and recover from the pandemic last year. While the recovery has been uneven and is still underway going into 2021, in Q4 we observed sector and factor rotation started to kick in, with Value and LowRisk being the best performers toward the year end.

Mar 23, 2021

Economic policy settings between the United States and China – which have been diverging since the onset of the COVID-19 pandemic – are now on stark display as a result of the recent outcomes of the annual plenary session of the National People’s Congress.

Mar 18, 2021

The great divergence between economic growth in China versus the rest of the Emerging Markets post-COVID-19 has increased the likelihood of a parting of ways between China and EM in asset allocations.

Mar 09, 2021

US sanctions on trade, technology, and financial market access have done little to dampen foreign investor enthusiasm for China. There has been a surge in foreign investment flows, both portfolio and direct, into China over the course of 2020: All of which begs the questions “why” and “how sustainable is this”?

Feb 25, 2021

Little speculative manias are bubbling up to the surface in the US markets. But while financial instability is growing in the United States as a result of aggressive monetary expansion, a collapse in the equities market does not appear imminent given tame inflation and ultra-low rates and yields.

Feb 16, 2021

The only major economy to grow in 2020. China has turned adversity from the COVID-19 pandemic into the best growth performance in the world for 2020.

Jan 27, 2021

토픽별

주간 차트

David Lai , CFA

CFA

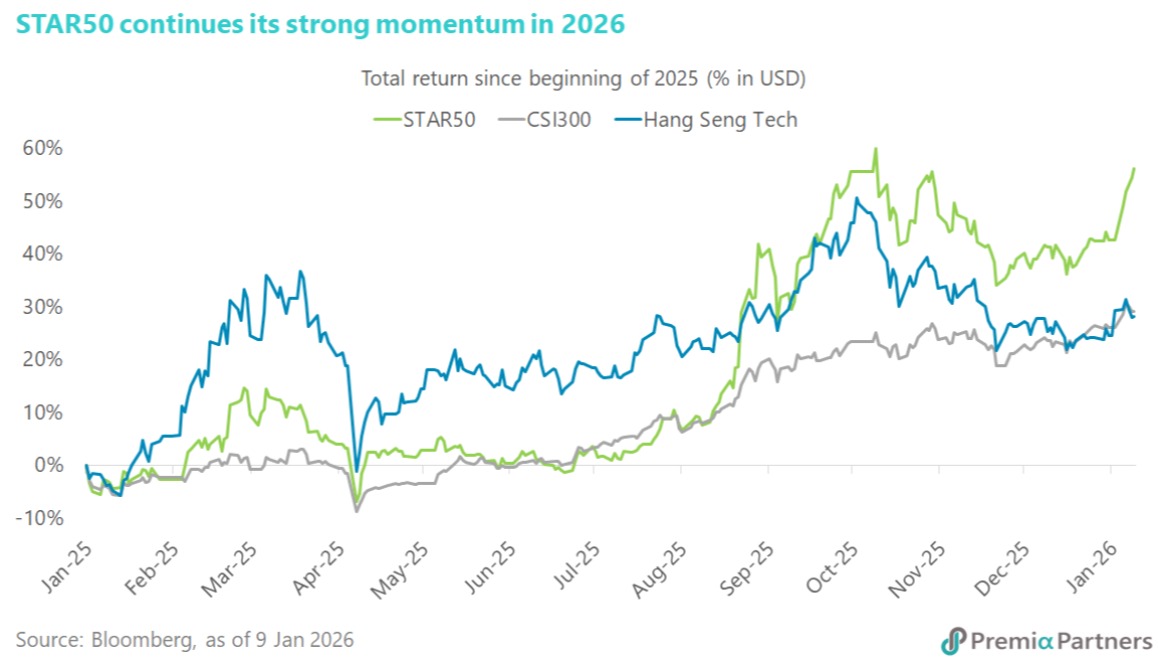

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026