주간 차트

STAR50 going strength to strength in 2026 - Jan 12, 2026

David Lai , CFA

CFA

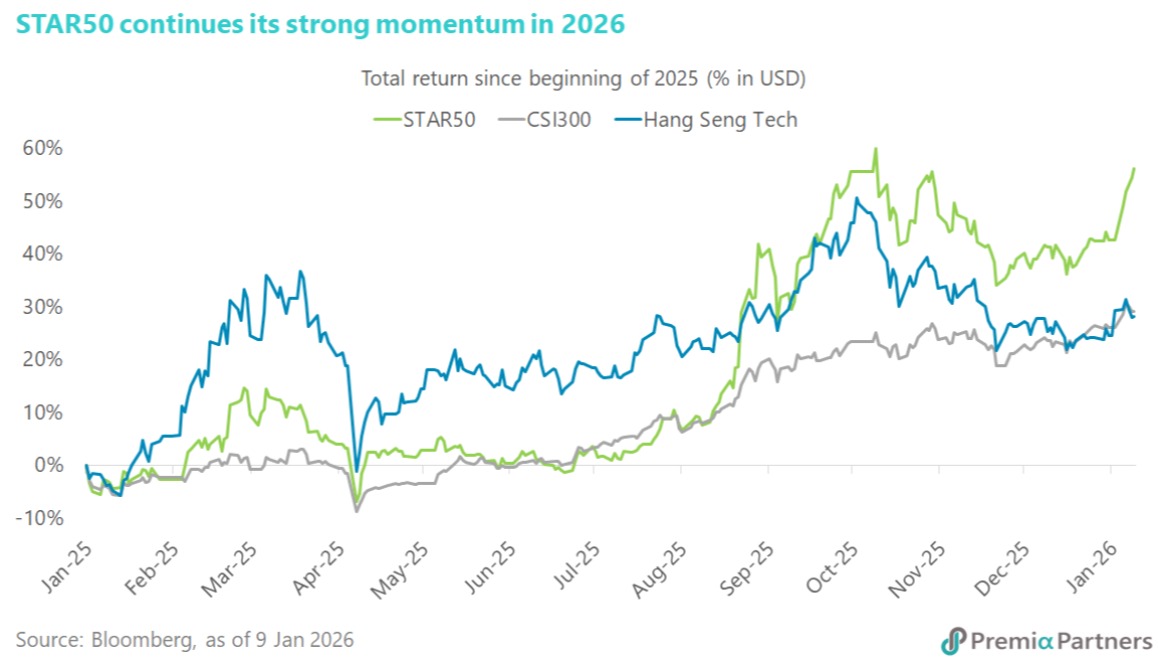

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

STAR50 - Consolidation paves the way for the next breakout - Dec 29, 2025

Alex Chu

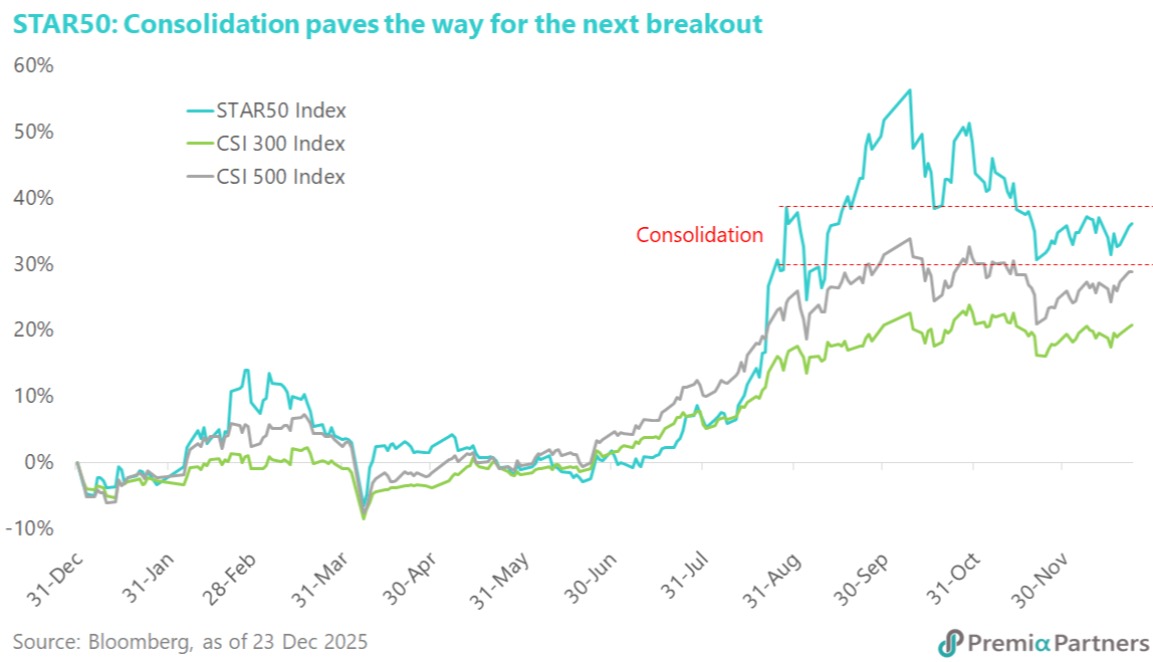

China’s push for self-sufficiency in advanced manufacturing is showing no signs of slowing down as we approach year-end. Reuters report that China has completed a prototype EUV lithography machine, bypassing Western export controls, with working chip production targeted by 2028. Meanwhile, researchers at Shanghai Jiao Ton University have developed the world’s first all-optical computing chip capable of supporting large-scale generative models. This represents a paradigm shift beyond traditional silicon: by using photons instead of electrons, the chip eliminates heat resistance and allows data to travel at light speed—offering a critical solution to the energy and bandwidth bottlenecks currently facing global AI development. Extending the frontier further, the University of Science and Technology of China (USTC) achieved a critical milestone in quantum computing. Using the “Zuchongzhi 3.2” processor, the team made a breakthrough in quantum error correction; by suppressing errors below the critical threshold, they have validated a technical route for building future megabit-level quantum computers. Corporate innovation is equally robust. Moore Threads, which recently saw a 600% upside debut on the STAR Board, unveiled its 'Flower Harbor' GPU architecture, boasting a 10x improvement in energy efficiency. In robotics, Unitree’s G1 humanoid robot stunned audiences with a backflip—a feat Elon Musk called 'impressive.' As momentum builds in hard-tech sectors, the STAR Board is becoming an unmissable destination for growth. To capitalize on these opportunities, consider our Premia China STAR50 ETF, which offers direct exposure to these leaders with a market-leading capped expense ratio of just 0.58% p.a.

China building deep expertise across a wide range of frontier technologies - Dec 08, 2025

David Lai , CFA

CFA

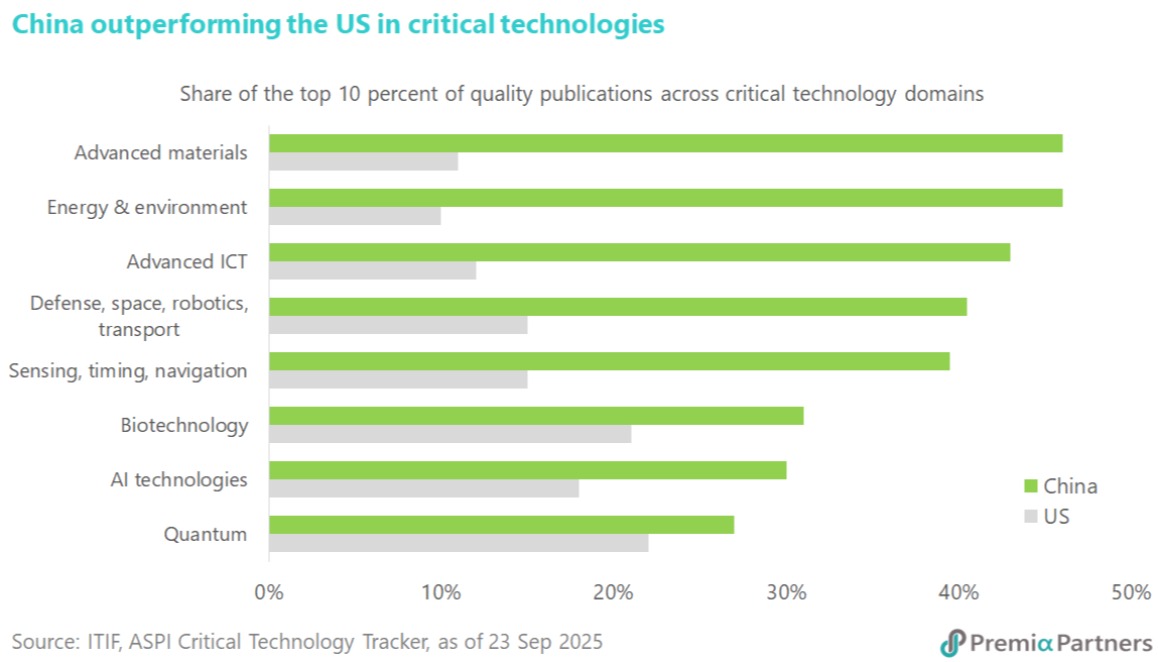

China’s rapidly advancing innovation ecosystem has positioned the country as a pivotal force in the global technology landscape. Its sustained commitment to research, strategic industrial policy, and talent development has enabled China to build deep expertise across a broad range of frontier technologies. Information Technology and Innovation Foundation (ITIF), a non-profit policy think tank based in Washington, D.C., highlights the scale of this progress. China now produces an increasingly large share of global scientific publications and patents, reflecting both the breadth and maturity of its research output. Momentum is particularly strong in high-growth areas such as robotics, advanced batteries, clinical biotech trials, quantum communication, artificial intelligence, advanced materials —fields where China’s state-supported infrastructure and robust innovation pipeline are translating into commercially meaningful breakthroughs. Further evidence from the Australian Strategic Policy Institute’s Critical Technology Tracker reinforces this trend. The analysis shows China holding a leadership position in the majority of the 64 critical technologies assessed, underscoring the effectiveness of its long-term investment in science, engineering, and education. China’s emphasis on STEM talent cultivation has created the world’s largest cohort of technical graduates, providing a deep and scalable foundation for continued innovation. These structural strengths—ranging from its research base to its industrial execution—collectively support a long runway of technological development and commercialization. For investors aiming to gain exposure to this accelerating innovation cycle, our Premia CSI Caixin China New Economy ETF and Premia China STAR50 ETF would be the essential tools.

Accumulation opportunity in China’s hardcore tech amid market consolidation - Nov 10, 2025

David Lai , CFA

CFA

Following the Xi–Trump meeting at the recent APEC Summit, market sentiment has turned cautiously optimistic on hopes of a renewed trade truce between China and the US. Some investors, however, view this détente as a sign that China’s drive for technological self-sufficiency could ease. Although the meeting did not address whether Nvidia’s latest Blackwell-series AI chips might be exported to China, speculation has risen that improving relations could lead to a relaxation of export restrictions — a development some perceive as negative for Chinese semiconductor and hardcore tech names. We take a different view. China’s determination to reduce reliance on imported technology remains firm. Recent initiatives, such as the reported requirement for state-funded data centers to adopt domestically produced chips, underscore the government’s resolve to build a self-sustaining semiconductor ecosystem. In mid-October, China Mobile also announced plans to construct the nation’s largest intelligent computing infrastructure by 2028, featuring a “100,000-GPU cluster” that will fully utilize domestic chips. Top Chinese officials have reiterated that innovation and advanced manufacturing remain core national priorities. These developments suggest that even if US export curbs were relaxed, China’s policy direction will continue to favor domestic research, production, and technological substitution. For investors looking to capture this structural growth opportunity, the Premia China STAR50 ETF provides an efficient and diversified vehicle. It offers focused exposure to leading STAR Market companies at the forefront of China’s innovation agenda — from semiconductors and AI to next-generation industrial technologies — positioning investors to benefit from the country’s ongoing technology upgrade.

Vietnam's EM upgrade marks the beginning of a re-rating cycle - Oct 14, 2025

David Lai , CFA

CFA

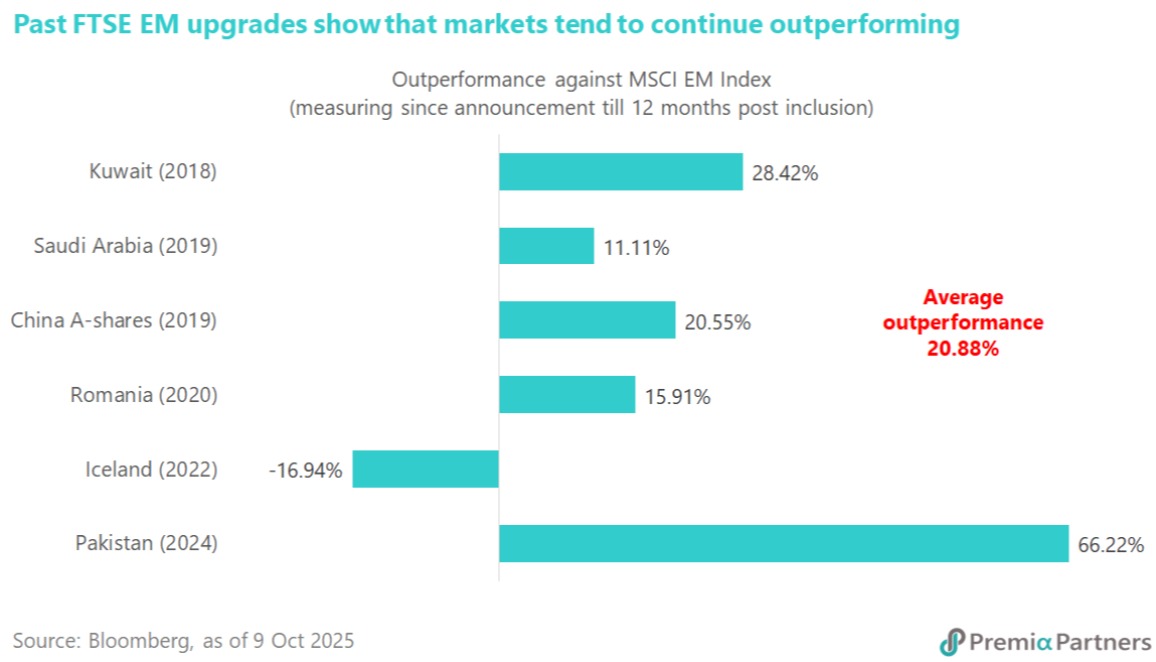

Vietnam’s long-awaited upgrade to Emerging Market (EM) status by FTSE Russell marks a pivotal milestone in the evolution of its capital markets. Yet, contrary to the notion that “the good news is already priced in,” history suggests it is far from too late to gain exposure. Past FTSE EM upgrades show that markets tend to continue outperforming well after the announcement—with Pakistan, Kuwait, China A-shares, Romania, and Saudi Arabia outperforming the MSCI EM Index by 66.22%, 28.42%, 20.55%, 15.91%, and 11.11%, respectively, in USD terms during the period from announcement to 12 months post-inclusion. Only Iceland proved an exception at -16.94%. These precedents highlight how structural inflows, valuation re-ratings, and improved investor access typically sustain positive momentum well beyond the initial upgrade news. In Vietnam’s case, the reclassification is just one milestone in a broader reform journey. Ongoing initiatives — including the rollout of a Central Counterparty Clearing (CCP) system, stronger corporate governance, digitalization of market infrastructure, and enhanced foreign access — signal a deepening commitment to transparency, efficiency, and sustainability. As Prime Minister Pham Minh Chinh has reiterated, Vietnam aims to build a market that meets global standards and supports long-term economic growth through efficient capital mobilization. With key reforms still progressing and passive EM fund inflows yet to commence, Vietnam’s re-rating cycle is likely in its early stages. Investors seeking to capture this structural opportunity may consider the Premia Vietnam ETF, which targets mid- to large-cap companies poised to benefit most from Vietnam’s EM inclusion and the ensuing wave of institutional participation.

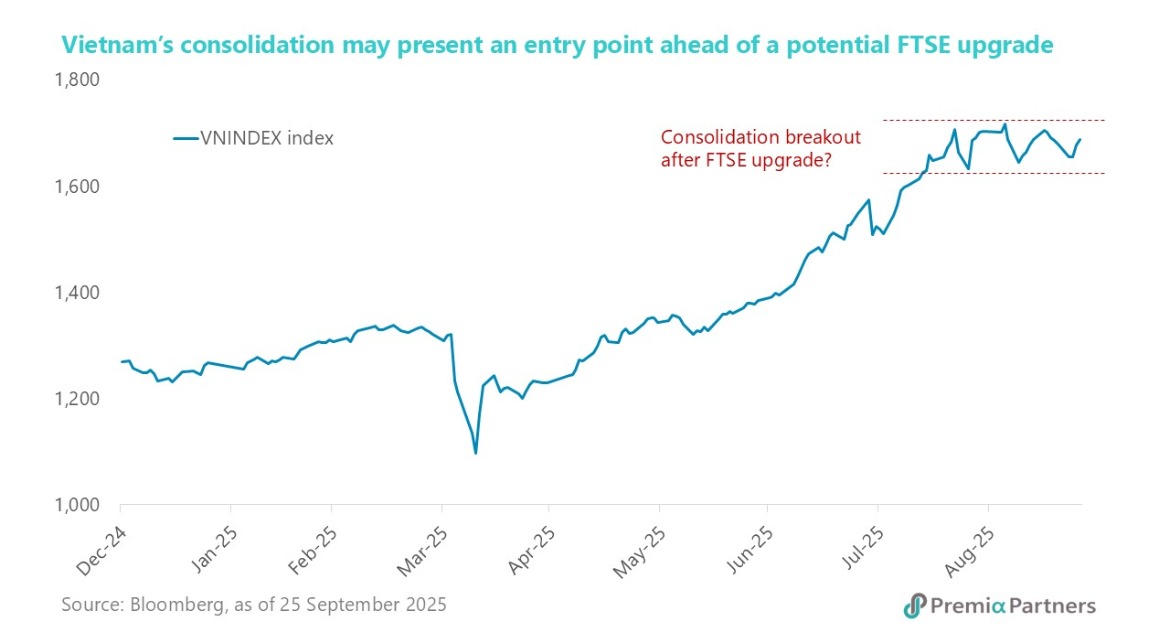

Vietnam’s consolidation may present an entry point ahead of a potential FTSE upgrade - Sep 29, 2025

Alex Chu

Vietnamese equities have entered a consolidation phase after the VNINDEX briefly touched 1700 points, a record high. This consolidation may offer an attractive entry point ahead of the FTSE emerging market status upgrade, with Vietnam’s finance minster signaling confidence after meeting with FTSE Russell and London Stock Exchange officials in London: “Basically and fundamentally, we have satisfied the criteria of the index providers.” Since summer 2023, Chairwoman Phuong has spearheaded transformative capital market reforms to unlock market access and boost investor confidence, including introducing a Non-Prefunding Model (NPF), implementing a buyback-like mechanism for failed trades, launching the KRX trading platform, enhancing transparency with IFRS reporting and English-language disclosures, removing consular legalization requirements for foreign investors, and establishing an Industry Advisory Group (IAG). FTSE will announce the emerging market upgrade result on October 8th. Vietnam has been seeking the upgrade to "secondary emerging market" status since 2018; analysts estimate that a successful upgrade could drive an extra $5-7 billion of international cash into the country's $350 billion stock market and propel the VNINDEX beyond recent highs. On a longer-term basis, supportive policy measures (such as the government’s target of 8% GDP growth in 2025 and plans to promote private-sector growth) and ongoing corporate earnings improvements (local brokers forecast 14% earnings growth in 2025-26) should provide support on a fundamental level. Amid global market uncertainties, Vietnam offers both diversification and growth opportunities; and our Premia Vietnam ETF is positioned to capture these opportunities and the potential benefits from an EM upgrade.

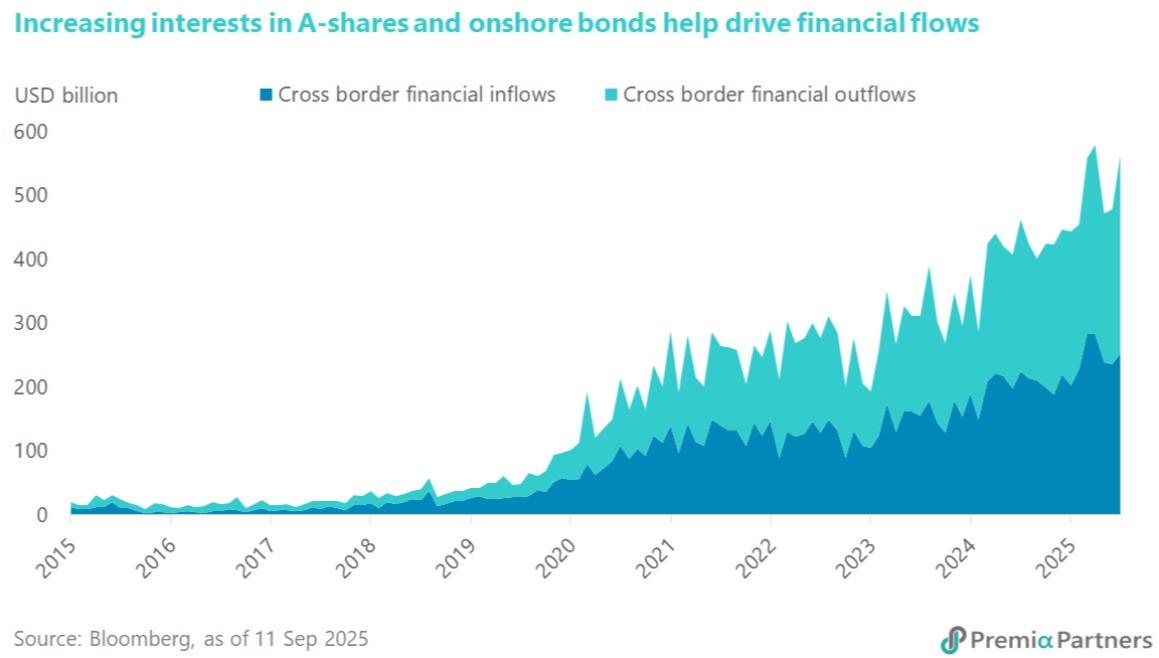

Increasing interests in A-shares and onshore bonds help drive financial flows - Sep 15, 2025

David Lai , CFA

CFA

Despite a slower pace of economic growth, international investors are showing renewed appetite for Chinese equities. According to Morgan Stanley, US investor interest in China has climbed to its highest level since 2021, supported by the country’s global leadership in key technology fields such as humanoid robotics and biotech, steady policy steps to stabilize the economy, and clear signs of government support for capital markets. In recent meetings with the bank, over 90% of investors expressed a willingness to raise their China exposure — the strongest conviction since Chinese equities peaked in early 2021. Liquidity conditions have also improved, creating a more supportive environment for equity performance. At the same time, a structural shift is taking shape: for the first time, China’s financial flows have surpassed trade flows, reflecting the rising role of portfolio capital in driving the country’s economic and market dynamics. For global investors, this trend underscores the case for diversification beyond US-centric allocations and into China’s structural growth opportunities. To capture these themes, vehicles such as the Premia CSI Caixin China New Economy ETF, which offers exposure to innovative and consumption-driven sectors, and the Premia China STAR50 ETF, which focuses on China’s leading science and technology champions, provide targeted access to the areas where investor interest is returning most strongly. While short-term growth concerns remain, the combination of policy support, sectoral innovation, and improving capital flow dynamics suggests a more constructive backdrop for long-term participation in China’s equity market.

Structural tailwinds driving the A-share rally - Aug 25, 2025

David Lai , CFA

CFA

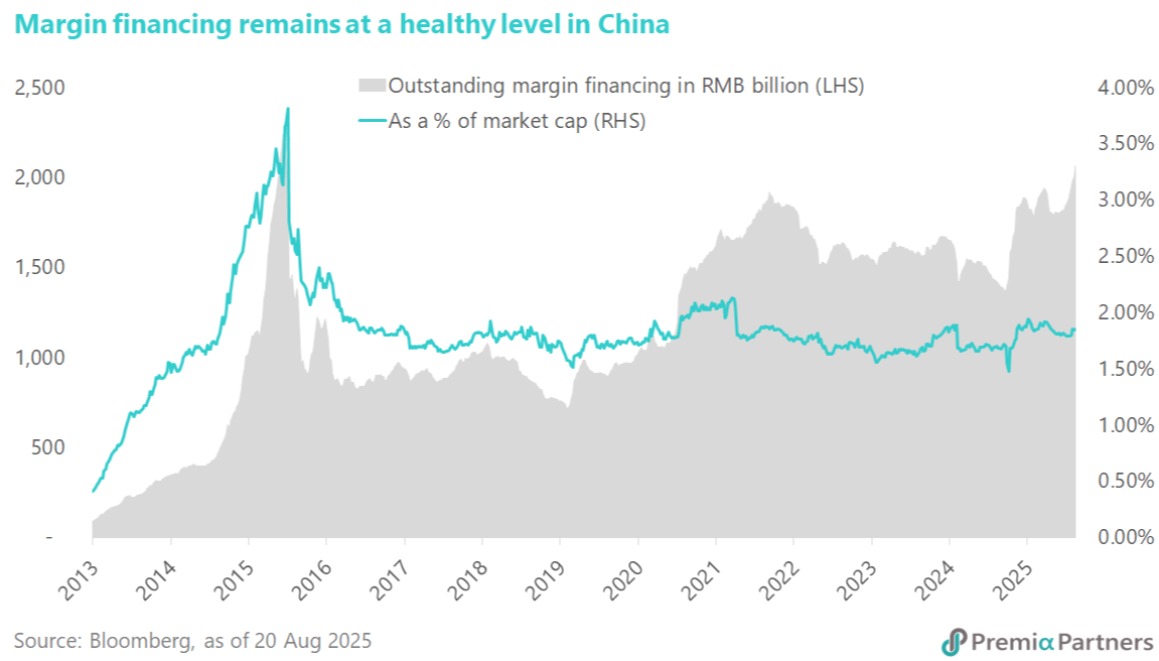

China’s A-share market has broken out since early July, handily outperforming offshore H-shares and global equities. The rally is being fueled by easing geopolitical tensions, Beijing’s “anti-involution” reforms to curb price wars and excess capacity, and renewed risk appetite from both institutional investors and retail flows. Concerns about surging margin financing look overdone. While balances have topped RMB 2.1 trillion, they remain just 1.85% of total market cap — less than half the 2015 peak — signaling leverage is not yet a systemic risk. More importantly, fundamentals are turning decisively supportive:

- Resilient returns – Stable dividends and accelerating buybacks are anchoring valuations, while low bond yields push capital toward equities.

- Underweight positioning – Global investors remain light on China; sustained outperformance could force incremental inflows.

- Attractive valuations – A-shares trade at a ~30% discount to global equities, with the AH premium near five-year lows.

- Policy visibility – The upcoming Fourth Plenum is expected to reaffirm Beijing’s pro-growth stance and set the tone for the next Five-Year Plan.

- Currency stability – The RMB looks steady with upside bias, reinforcing investor confidence.

Together, these dynamics suggest the rally is more than a short-term bounce — it’s the start of a re-rating story supported by policy, positioning, and valuations.

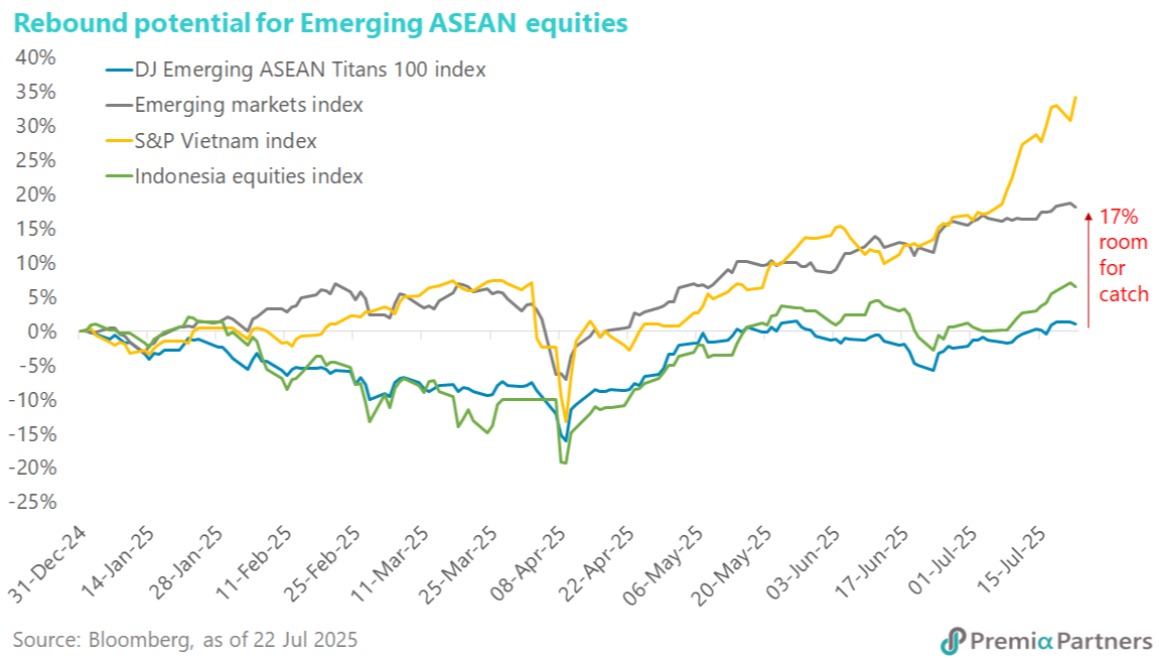

EM ASEAN equities are set to catch up - Jul 28, 2025

Alex Chu

Emerging ASEAN equities have underperformed compared to other emerging markets, but they have the potential to catch up due to improved US tariff rates, increased foreign investment, and more relaxed monetary policies. Vietnam was among the first to secure a trade deal with the US, establishing a reciprocal tariff of 20%. Since the announcement, Vietnamese equities have rallied, outperforming the emerging market index. Similarly, Indonesia and the Philippines have both secured 19% tariff deals in later stages, with Indonesia already showing market improvements and the Philippines expected to follow suit. Thailand is actively negotiating with US trade officials to reduce its current 36% tariff, with potential progress expected before the August 1 deadline. If other emerging ASEAN markets follow Vietnam’s lead, the overall equities index could recover the 17% year-to-date underperformance. Foreign investors are pouring into the region, with Vietnam experiencing a surge in inflows. Thailand’s equities market is also attracting foreign interest, driven by improved sentiment ahead of the central bank governor nomination, who supports more relaxed policies. Amid lower tariff uncertainties and a weaker USD, ASEAN central banks are focusing on growth risks, with room to lower interest rates to support the economy. Recently, Bank Indonesia surprising many economists with a 25 bps policy rate cut. With lower tariffs, returning foreign investors, and eased local policies, Emerging ASEAN equities could gain momentum. To capitalize on these shifts, investors can consider our Premia Dow Jones Emerging ASEAN Titans 100 ETF, offering strategic exposure to the region’s growth dynamics. Additionally, the ETF has announced a record dividend payout of USD 0.43, yielding 4.8%, reflecting consistent dividend improvements from the underlying and providing investors with extra protection.

Chinese SOEs may be worth revisiting - Jun 16, 2025

Alex Chu

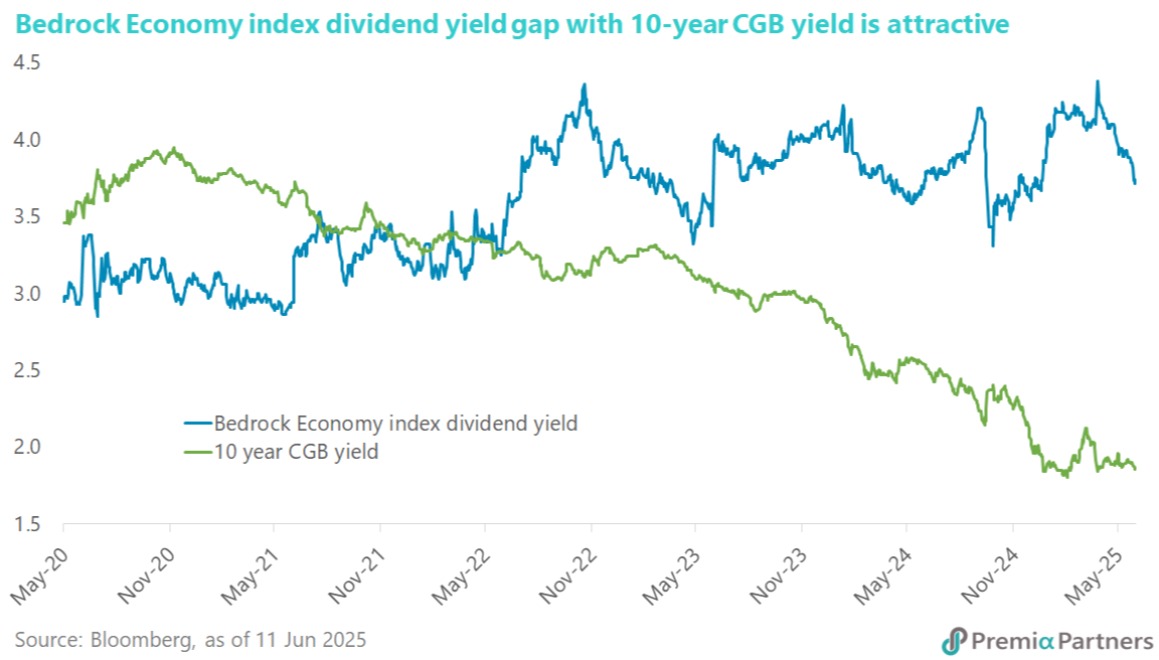

Chinese state-owned enterprises (SOEs) may gain traction again amid Chinese government’s commitment to stabilize the capital market, market value management implementation, and attractive yield against the government bonds. Central Huijin, often considered to be the national team, is approved by CSRC to be the new controlling shareholders of 8 small to mid-size financial companies, with an aim to stabilize the capital market and mitigate potential risks. Investors are also anticipating further policy support for the financial sector, expected to be announced at the Lujiazui Forum in Shanghai. This led to the strong capital inflow to nonbanking financials and outperformance of the sector. Moreover, a couple of SOEs have revealed their market value management plans or valuation improvement plans. Local brokers believed this trend will continue and gain momentum in the rest of this year, leading to the revaluation of these SOEs. On the short-term yield, China’s one- and three-year bonds fell to a four-month low due to heavy purchases of state banks. Onshore traders speculated that the PBOC was involved in the purchases. The PBOC’s potential purchases is one of the tools to bring liquidity to the market. As the bond yield drops and liquidity increases, the relatively higher SOE’s dividend yield would look appealing to investors, further supporting their share prices. To capitalize the above trend and diversify from growth related stocks, investors may consider our Premia CSI Caixin China Bedrock Economy ETF, which places a significant emphasis on SOEs, accounting for over 70% of its portfolio, benefiting from the government support and the potential high dividend yield.