featured insights & webinar

The Two Sessions have delivered a strong signal: China’s economy remains focused on steady growth, with robust government support, despite mounting global uncertainties. With an economic target of 5% growth for 2025 and the highest budget deficit in three decades, policymakers are set to implement a more proactive fiscal policy. This will include increasing government financing to drive domestic demand and boost private sector confidence. In this article, our Partner & Co-CIO David Lai highlights growth and policy supported areas to focus, during this ideal window to add exposure for Chinese equities, particularly opportunities from leaders in artificial intelligence (AI), semiconductors, robotics, and biotech that are still trading at attractive valuation via a via global and even offshore listed China peers.

Mar 09, 2025

After a stellar third quarter on renewed hopes of powerful fiscal stimulus, Chinese stocks followed shares in other emerging markets down in Q4, giving back some of those gains as the CSI 300 Index slipped 1.7% (CNY). Weighing on mainland stocks were investors’ fears that Trump 2.0 tariffs, along with a lack of follow-through by Chinese policymakers, might hinder the country’s growth revival. In this article, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, discusses what will spur Beijing to inject more stimulus, where it might go, and what Trump’s trade war and the DeepSeek saga might tell us about where A shares outperformance could come from in 2025.

Feb 24, 2025

Robust projected earnings growth for 2025 – part of a multi-year growth story driven by Artificial Intelligence – will give the Taiwan market a helpful buffer amidst geopolitical and trade uncertainties. Also, Taiwan has added protection from being the indispensable total supply chain for the tech industry – with its dominance driven by semiconductor and technology manufacturing leaders like TSMC, Hon Hai, and MediaTek. Economic growth is expected to remain solid at around 3.3% for this year. Beyond the tech sector, the government’s push to upgrade its financial services capabilities, with high domestic penetration and receptiveness of financial products, also provide promising tailwinds. The risks of Trump 2.0 make Taiwan a nuanced opportunity this year. It threatens volatility. But the AI revolution remains a multi-year growth driver, and Taiwan's strategic role, indeed global leadership in semiconductor manufacturing, offers strong long-term potential. Notwithstanding geopolitical considerations and general market risks, the medium to long term growth trajectory remains robust. In this article, our Portfolio Manager Alex Chu suggests that corrections could provide the long term investors attractive entry points into Taiwan’s technology-driven equity market which has a low correlation with global equity market as well as other major asset classes.

Jan 27, 2025

Asia ex-Japan investment grade credits should continue to outperform their global peers in 2025, amidst risks in the US of a continued rise in US Treasury yields, at a time when corporate credit spreads in the US are already at cyclical lows. On the other hand, Asia ex-Japan credits will likely be supported by a combination of monetary easing, shorter duration, the offer of significant yield pickups, credit upgrades and likely lower issuance. Further to Part 1 and Part 3 of our 2025 outlook which dealt with the US and ASEAN market outlook, in this article we discuss how Asia ex-Japan US Dollar Investment Grade Credits (using JACI IG as the investment universe) generate allocation alpha in a complex landscape dominated by concerns over economic uncertainties in the U.S – about its fiscal outlook, a resurgence in inflation, rapidly rising government debt and the impact of radical policy plans.

Jan 27, 2025

Emerging ASEAN stock valuation has likely overpriced the trade threat posed by the incoming Trump Administration. This has created a value opportunity that has priced a catastrophe akin to the COVID pandemic which is unlikely to play out. The forward PE ratio for the Dow Jones Emerging ASEAN Titans 100 Index is almost at COVID-19 lows. The valuation of the index also hit a low late in 2016, when Donald Trump was elected to the Presidency the first time. In tis article, our Senior Advisor Say Boon Lim discusses why the region could be a sweet spot for value investing, given the growth trajectory and drivers in Emerging ASEAN, which could be benefited rather than suffered from US tariffs.

Jan 07, 2025

China’s financial markets stand on the cusp of resilience and opportunity, buoyed by proactive government interventions and structural reforms. Beijing’s commitment to fostering innovation in artificial intelligence, semiconductors, and renewable energy highlights its strategic pivot towards self-reliance. Meanwhile, reforms aimed at enhancing corporate governance and shareholder returns signal a shift toward greater efficiency and market appeal. While challenges persist, including heightened US tariffs and soft domestic demand, the leadership’s “all-in” growth strategy and flexible policy framework highlight a clear long-term vision for sustainable development. For investors, China in 2025 presents a wealth of opportunities across a range of sectors—from cutting-edge technology and dividend-focused equities to stable government bonds and a recovering real estate market. In this article, our Partner & Co-CIO David Lai suggests that this year could be one of the strategic investments for China with potential for substantial returns.

Jan 07, 2025

US equities sentiment is now maximum bullish despite great policy uncertainties – altogether posing considerable risk to late-cycle momentum chasers. The US economy had barely cooled down before it was stimulated by 100 basis points in rate cuts in just three months from September 2024. The cuts started just when the US economy was rebounding. More importantly, they came after US inflation started picking up again. In fact, the US stock market is now in the grip of “Trumpian euphoria” because market expects the incoming administration will likely be supportive of even stronger growth, through more debt and deficits and extreme economic nationalism. The imminent risk now is that the US will have to pay more for its borrowings despite its dominance of the global debt market. This is not about other countries bypassing the Dollar in trade. It is about inflation – which will likely be worsened by President-elect Trump’s inflationary policies – and the term premia. In this article, our Senior Advisor Say Boon Lim discusses why US equities are in a bubble, drivers behind the Trumpian Euphoria 2.0, and that the stubborn or even revived inflation are credible risks in 2025.

Dec 24, 2024

The latest developments in the battery industry continue to favour the world’s biggest players. Apart from their gains from the robust growth in EV sales, the latest developments in battery technology also work in their favour, given their significant investments in R&D spending. Over the next five years or so, lithium iron phosphate (LFP) and ternary (NCM) lithium batteries will remain the mainstream products in the mass and high-end segments respectively. These are the products that CATL and BYD lead globally. Beyond that, CATL and BYD are already moving rapidly in the area of solid-state batteries (SSBs), a potentially disruptive technology. In this article, we discuss about why the Chinese battery makers will continue to dominant the global market and benefit from their technological advancements that revolutionize the energy storage landscape.

Nov 15, 2024

The third quarter ended with a bang for mainland Chinese stocks, as twin announcements from China’s central bank and top fiscal policymakers gave both foreign and domestic investors plenty to think about over an extended market holiday during China’s October Golden Week. In this insight, Dr. Phillip Wool, Global Head of Research of Rayliant Global Advisors, explores the shift in sentiment that sent the onshore China markets higher for the quarter, breaking down the economic implications of a renewed and forceful stimulus push, the factor drivers of Q3 equity performance, and the data investors should be looking forward to as 2024 draws to a close.

Nov 15, 2024

Further to the insight piece on “Taiwan: The Quiet World-Beater” shared by our Senior Advisor Say Boon Lim, in this article we share more about our new ETF Premia FTSE TWSE Taiwan 50 ETF, which covers the 50 largest flagship companies in Taiwan by market capitalization. The strategy aims to capture the strong market performance from the robust growth in demand for semiconductors and the broader economic growth activities in Taiwan in the coming years. It is designed as a low-cost, tax efficient access tool, with versatility of having both HKD (distributing) and USD (accumulating) unit classes.

Oct 09, 2024

BY TOPICS

Chart Of the Week

David Lai , CFA

CFA

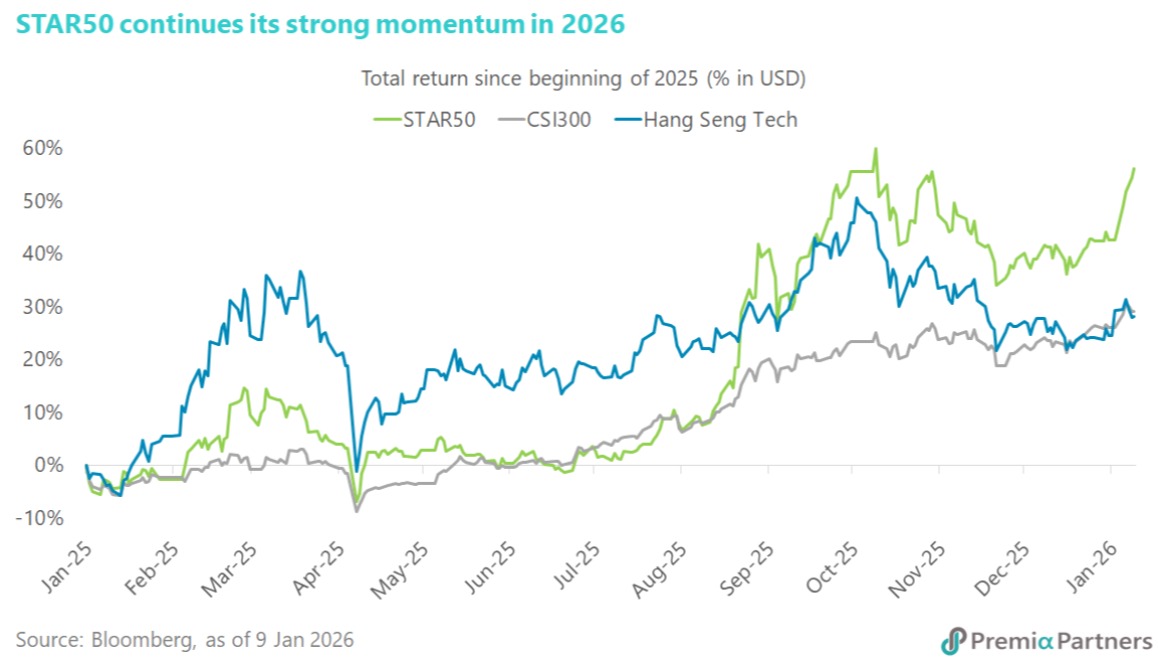

Chinese equities got off to a strong start in 2026, led by the STAR Market. Since onshore trading resumed, the STAR50 Index has risen 9.9% in dollar return, outperforming CSI300’s 2.9% and offshore Hang Seng Tech’s 3%. This extends the strong momentum seen in 2025, when the STAR50 delivered a dollar return of 42.6%, well ahead of CSI300’s 26.3% and Hang Seng Tech’s 24.5%. Policy signals remain supportive. In his New Year’s Eve address, President Xi highlighted China’s progress in artificial intelligence and semiconductors, reinforcing innovation as a core pillar of high-quality economic development. Advances in humanoid robotics, drones, aerospace, and defence were cited as key examples. At the corporate level, the China Integrated Circuit Industry Investment Fund (“Big Fund”) increased its stake in SMIC, the largest constituent of the STAR50 Index, from 4.79% to 9.25%, showing state support for advanced-node capabilities. Among the outperforming stocks, Guobo Electronics rose close to 40% over the past five trading days, following reports that China aims to scale up to 100 rocket launches annually by 2030. As a leading supplier of RF chips and T/R modules, Guobo is a major beneficiary of rising demand for satellite and launch-vehicle communications. AMEC shares also surged after announcing the acquisition of a 64.7% stake in Hangzhou Zhongsilicon, expanding its offering from dry processes into chemical mechanical polishing. Meanwhile, VeriSilicon Microelectronics reported a 130% year-on-year increase in new orders last quarter, driven by accelerating AI chip demand. Against this backdrop, the Premia China STAR50 ETF allows investors to align portfolios with China’s strategic push in advanced technology and innovation through the STAR Market.

Jan 12, 2026