featured insights & webinar

Most investors agree that EM economy drivers are shifting from financials and energy to technology, consumption, healthcare, education and sustainable growth. Yet when we actually invest in EM, and onshore China, we simply focus on the largest listed stocks, i.e. yesterday’s drivers. One size does not fit all in China beta and today we dive into a new economy approach for A-shares that is a must for the long-term.

Oct 18, 2017

We are modernizing the Asian beta landscape and lowering costs as well. For those reading our past posts, you’ll know we are planning to list new A-share beta strategies, improving on what exists today in both design and cost. We are finally at our destination, with HKEx listing scheduled for Oct 24 subject to final regulatory approvals.

Oct 13, 2017

A-shares are a deeper, broader, cheaper and less correlated market than offshore Chinese equities. Investors should review their portfolios given the benefits of A-shares to overall asset allocation.

Sep 28, 2017

Size works in A-shares, but for this article we'll put that aside and focus on implementation feasibility.

Aug 01, 2017

Without any screening or selection, solely investing in all SOEs or the largest market cap SOEs may not be optimal strategies. What is important for investors is how to capture the current contributors and engines for future growth of China economy regardless whether the underlying stocks are SOEs or non-SOEs.

Jul 04, 2017

A quick review of what MSCI did and didn't do, its impact, why it matters and how investors should approach China going forward.

Jun 23, 2017

Our advisor, Dr. Jason Hsu, recently did a podcast with Meb Faber (co-founder and CIO of Cambria Investment Management) on China opportunities, investors' preference for complexity over simplicity, and key takeaways for investors implementing smart beta strategies in China.

Jun 08, 2017

This morning Bloomberg ran a story about LeEco, a Chinese technology conglomerate that has been growing rapidly until recently.

May 24, 2017

Are all smart beta products smart? This is a question I've asked a few times over the last few years but always got a "nuanced" answer depending on the product being marketed.

May 15, 2017

Can you trust the numbers reported by all Chinese listed corporations? Absolutely not. But that doesn't mean smart beta can't generate alpha. With help from our friends at Rayliant, we dive into a factor metric that allows us to deprioritize earnings manipulators and to generate alpha from their efforts.

Jan 17, 2017

BY TOPICS

Chart Of the Week

David Lai , CFA

CFA

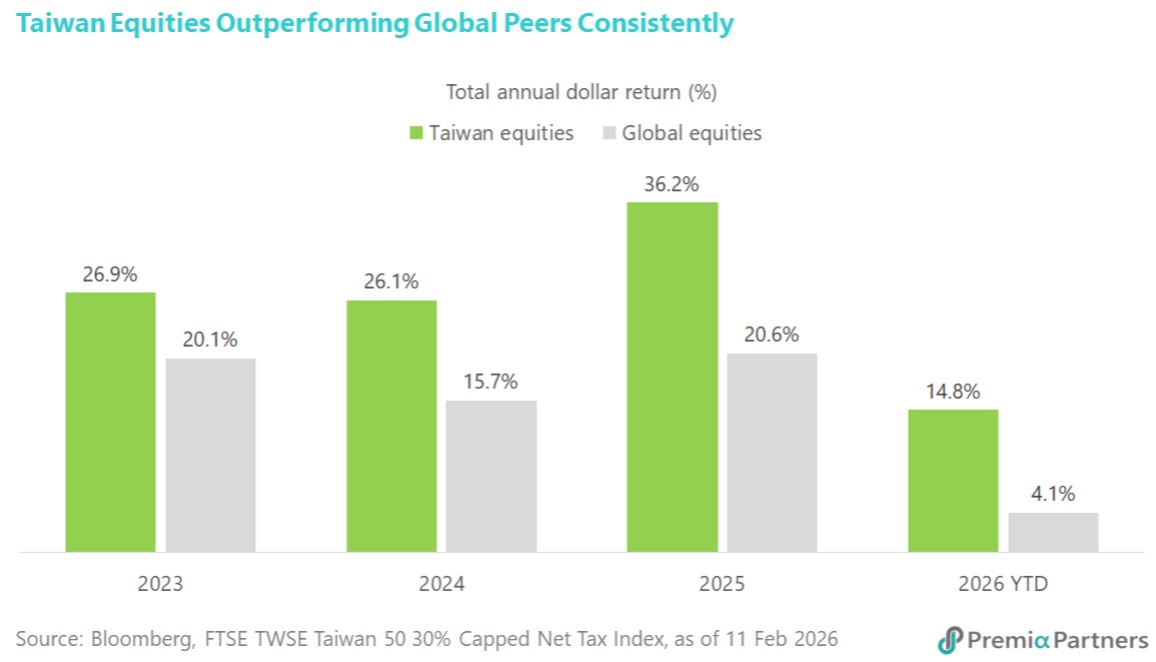

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026