featured insights & webinar

The COVID-19 pandemic has slowed down productivity and daily lives, stagnated the global supply chain, and affected financial market returns across almost all asset classes. In the first quarter of 2020, all markets around the world reported negative returns with varying degrees. While it seems that all is going the same direction, especially in the equities’ world, the fundamental risk factors were not. Among the fundamental factors we employ for China A shares, some has performed better than others amidst the market drawdown.

Apr 28, 2020

Premia CSI Caixin China New Economy ETF performed well and went up by 3% in a down market. In this article, we would like to share with you the reasons behind the strong performance and the comparison of this strategy with the other mainstream indexes that investors usually track in respect to performance attribution, sector allocation, niche thematic exposure and top drivers.

Apr 24, 2020

The Chinese government recently launched a stimulus package around the idea of “New Infrastructure” in light of the COVID-19 pandemic. What exactly does this new buzzword #NewInfrastructure entail? And more importantly, where do the investible opportunities lie beyond the tech giants Alibaba and Tencent?

Apr 17, 2020

The market performance of gold in the midst of the COVID-19 crisis has left its fans a little puzzled. From a peak of USD 1703 on 9 March, it retreated to USD 1451 on 16 March - a 15% decline. Should one hold gold now, or rather park in cash tools? Our senior advisor Say Boon Lim demystifies in this piece.

Apr 14, 2020

As global asset prices have slumped on the back of the COVID-19 outbreak, concerns have arisen from supply chain disruptions to about global recession and a liquidity crisis. In this webinar, David Lai and Larry Kwok would discuss the lessons learned from the GFC, share our observations of some pandemic-led trends and implications, and suggest a few related investment ideas.

Apr 13, 2020

The COVID-19 outbreak has led to a worldwide pandemic, a global slowdown, arguably a recession and hopefully not a depression. Business activities globally have been halted due to the outbreak and demand has been shrinking significantly as well. Apart from some of the Asian countries including China, we have yet seen an inflection point of the case curves in most countries. In this article, we’d like to share some notable leading Chinese players in the space that have been working hard to fight against the virus for the domestic and global community.

Apr 03, 2020

The virous outbreak becomes one of the largest threats to the global economy and financial markets in decades. Will China, the one which has been suffered from the pandemic first, be able to bounce back first and lead the recovery worldwide like the Global Financial Crisis back in 2008? The latest call in new infrastructure investment maybe the key.

Mar 20, 2020

COVID-19 spread accelerating in the US, even as the number of new infections in China eases Impact will be significant on the largely consumer-driven US economy Markets are either in or on the brink of bear territory, and this is an angry bear Recession likely already in progress in Japan; possible recession in Europe; near zero GDP growth likely in the US by 2Q20 Corporate credit protection costs have started rising – more trouble ahead Seek safety in cash and US Treasury-related instruments

Mar 10, 2020

The coronavirus situation in China seems to have improved a lot, and now many are worried about what will happen as the factories get back on their feet. How's the progress so far?

Mar 10, 2020

Relief rally unlikely to last Beyond COVID-19, economies could flatline or enter recession Corporate earnings could stop growing at a time of heightened valuations There is a tail risk of credit defaults on liquidity and cashflow squeeze

Mar 03, 2020

BY TOPICS

Chart Of the Week

David Lai , CFA

CFA

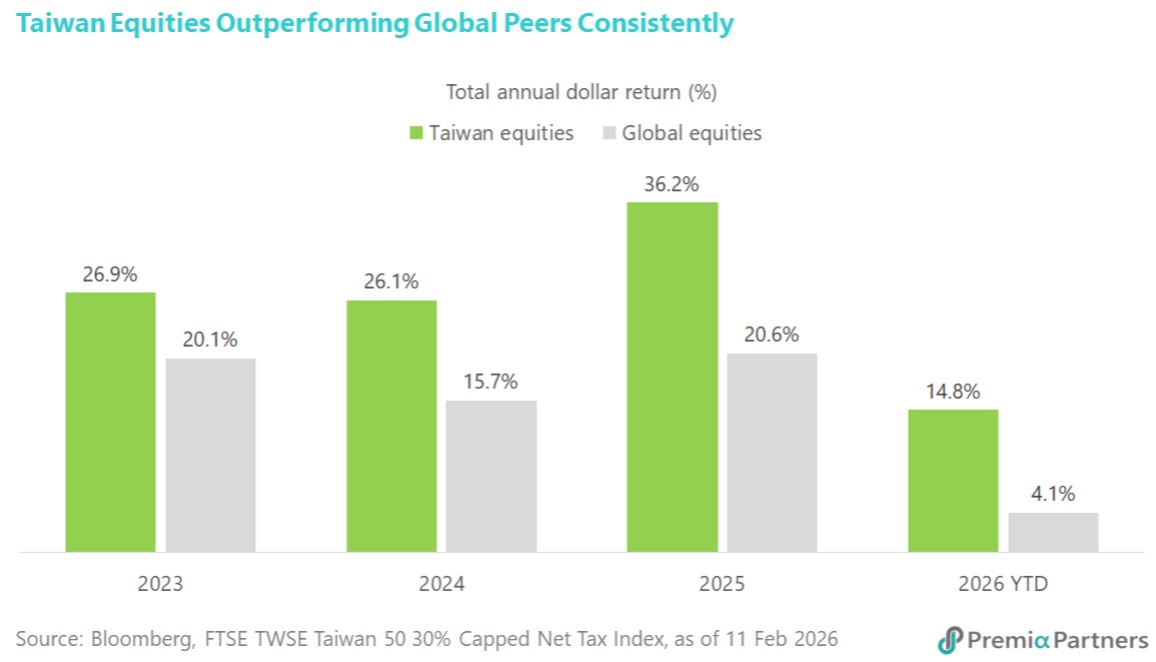

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026