featured insights & webinar

The Chinese economy continues to normalize across the board at an impressive rate, leading to the strong likelihood of it beating the current Bloomberg consensus GDP estimate growth rate of around 2% for 2020.

Oct 06, 2020

The COVID-19 pandemic could accelerate new thinking about Emerging Markets in asset allocations.

Sep 23, 2020

China economy recovered faster than the rest of the world from the pandemic as shown by various economic indicators ranging from official PMI, GDP number, steel output, excavator sales, to traffic data. China’s solid macro recovery stands out from the rest of the major economies which either remain in a lock-down mode or simply begin to resume economic activities. That explains Chinese listed companies outperformed in terms of earnings and stock price performance.

Sep 10, 2020

An overdue technical rebound in the US Dollar – which started a week ago – may give investors an opportunity to diversify their currency holdings away from the Greenback. What is emerging could well turn out to be a counter-trend rally in a bigger, multi-year Dollar decline.

Sep 09, 2020

CSI 300 outperforms S&P 500, Chinese tech outruns Nasdaq 100. How has China’s new economy sectors including its recently launched “Nasdaq” – the STAR board (Shanghai Stock Exchange’s Science and Technology Innovation Board) – outperformed global indices despite being at the center of a trade-tech war with the United States?

Sep 01, 2020

Highest recorded yield spread between the China 10Y Government Bond and the 10Y UST. The yield spread between the China 10-year government bond over the 10-year US Treasury recently hit its widest ever recorded level.

Aug 25, 2020

In the midst of a US tech bubble, Chinese and Hong Kong equities have emerged in the sweet spot between valuations, profitability and balance sheet strength.

Aug 18, 2020

Are US indices rallying because of COVID-19? The most common narrative is that “US stocks have been rising despite the pandemic.” Perhaps a more accurate explanation is “US stocks have been rising because of the pandemic”.

Aug 12, 2020

After the fall in Q1, global equities recovered sharply in Q2 as the COVID fear eases and stimulus packages kick in around the world. YTD, China is the best performing emerging market, and the broad CSI 300 index gained 14% in the second quarter. From factor investing perspective, we continue to see the dispersion of a two-speed-economy despite an overall beta pick up. Quality growth new economy stocks continue to be the winner.

Aug 11, 2020

BY TOPICS

Chart Of the Week

David Lai , CFA

CFA

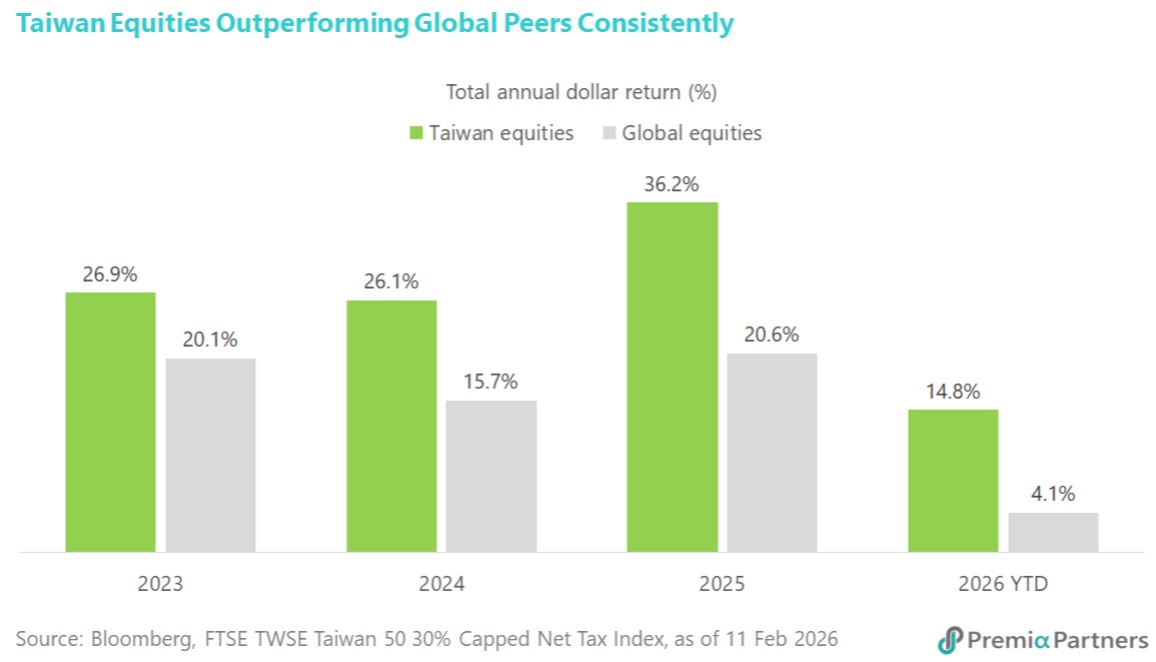

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026