The S&P 500’s forward PE valuation now approximates Nasdaq Bubble highs. (The Magnificent 7 is of course even higher, at 28x forward earnings.) Depending on the source and the earnings estimate time frames used, it has either exceeded the year 2000 high or is just a bit below that. In the same vein, the equities risk premium for the S&P 500 is now negative on actual earnings and near zero on forward earnings. That too looks a lot like Nasdaq Bubble territory, give or take a fraction.

In the credit market too, valuation is an issue. Spreads approached historical lows and have started edging up. Significantly, the speculative grade default rate has been rising in the US from mid-2022, but US high yield spreads have seen a dramatic decline over the same time frame. This divergence highlights a possible mispricing of risk.

In the US Treasury market, the 30-year yield has been rising from October despite rates coming down from September. That hints of market-imposed limits on US monetary stimulus.

Nobody knows when the party will end – there will always be those who will dance until the lights go out. But the case for diversification away from US assets has gained in urgency as we head into 2026.

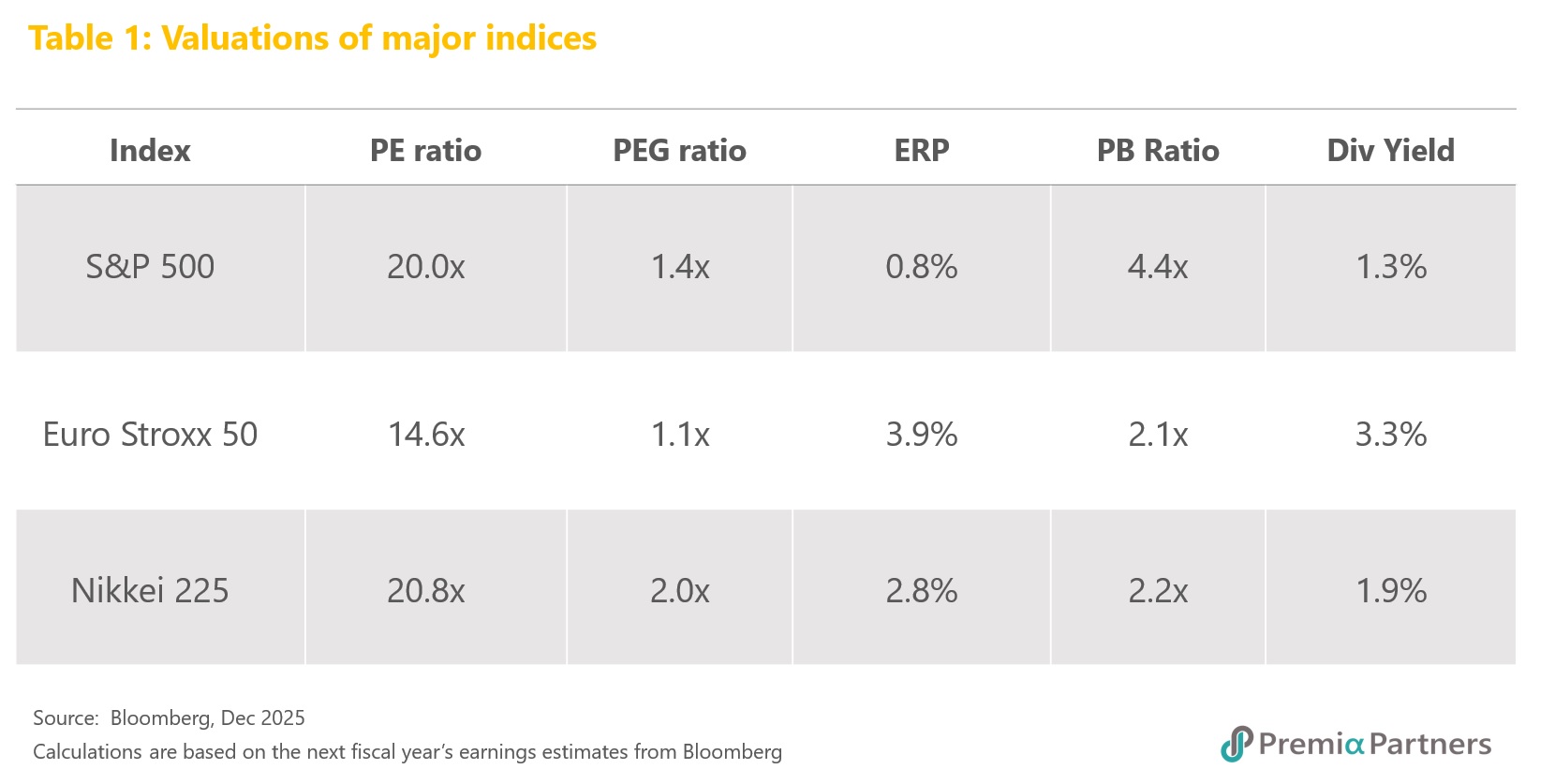

Europe and Japan – they are gaining because they are not American. European and Japanese equities have been outperforming US stocks recently – in 2025 for European stocks and in the last four months of the year for Japanese equities. Neither are favoured for economic fundamentals. Their economic growth is pedestrian. However, for European stocks, there is a valuation argument (Table 1).

For the Nikkei 225, which has quite a similar PE ratio and an even worse PEG multiple than the S&P 500, it is a selective diversification proposition. There are two themes. The first is controlled reflation” – a weakening Yen, wage increases and fiscal stimulus, as the Bank of Japan attempts to “normalise” monetary policy. The second is about Japan as part of the Asian tech and manufacturing supply chain.

Emerging Asia – buying the supply side success stories. The most distinct diversification opportunities are in Emerging Markets and Emerging Asia in particular. That is, they have distinguished themselves as supply side successes, as distinct from the economic demand side management stories of the US and other Developed Markets.

- China – international recognition for its breakthroughs in 2025. China, written off as “uninvestable” only two years ago, gained international attention and recognition last year for its supply side breakthroughs in artificial intelligence, robotics, semiconductors and biotech. Indeed, more broadly, the aborted attempts by the US to impose ultra-high tariffs on China served to highlight China’s successes on the supply side, and the contrast with the US’ repeated stimulus of domestic demand – at ever growing cost to deficits and government debt – is stark.

- Deep value compared to the US. Investors seeking diversification should consider Chinese equities for their more attractive valuations and their fundamental strengths in their respective industries. In the following insights, Premia Partner analysts highlight Chinese equities’ PEG ratio of around 0.97x, compared with 1.4x for US and 2.0x for Japanese stocks.

- Policy tailwinds favouring China Government Bonds. Our analysts also highlight the opportunity in China Government Bonds, where disinflation offers policymakers room to lower rates at a measured pace as part of a broader easing package, and where the PBoC’s resumption of bond purchases provides an additional tailwind.

- China continues to be a tale of two spaces as investors continue to jump to tailwind beneficiaries of policy and structural economic transformation Our analysts also showcase structural growth opportunities in deep-tech, innovation-led sectors in China, such as artificial intelligence, semiconductors, robotics, and biotechnology, as well as the earning supported cohorts under anti-involution and policy support.

- Taiwan – a low correlation “play” on the AI theme. With historically low correlation to other asset classes and an attractive yield profile, Taiwan offers distinct portfolio utility. The low correlation is driven by Taiwan’s strong corporate culture of returning cash to shareholders. Unlike the Nasdaq or other pure-play growth indices which rely almost exclusively on capital appreciation, Taiwan’s high dividend payout ratio provides a substantial "carry" component. This income stream acts as a stabilizer during periods of global volatility, creating a unique return profile that combines the upside of AI growth with the defensive characteristics of high-yield equities.

- Emerging ASEAN – the supply chain still rules. Emerging ASEAN appears to have priced in the bad news from the Trump tariffs and should benefit from the lagged impact of stimulus measures implemented in 2025. There is still no viable alternative to the China supply chain – and hence the China+1 supply chain – for the volumes, range, complexity and competitiveness of the products that the US needs to import. Meanwhile, the Dow Jones Emerging ASEAN Titans index offers a diversification opportunity with its high forward dividend yield estimated at 4.2% - which ranks with Taiwan as among the highest in the world.

- Vietnam stands out in ASEAN for its reforms and robust growth prospects. Doi Moi 2.0 reforms (Resolution 68) offer unprecedented policy support for the private sector, and the mandate to nurture 20 globally competitive large private firms provide strong cases for revaluation opportunities for large cap leaders. Exports should continue to grow strongly, with the US reciprocal tariff on Vietnam being lower than the average for other manufacturing-oriented competitors, excluding China. Domestically, the government has rolled out a raft of initiatives to boost consumption – an important engine of growth. Vietnam’s market valuation, with a forward PE of around 12.5x and earnings growth estimated at between 14% and 18%, offers one of the most attractive PEG ratios in Asia.

- Asian Investment grade bonds and Sukuk as alternatives to mispriced risk in US bonds. In fixed income, investor wariness of rising yields at the long-end of the US Treasury curve, the risk of revived inflation amidst rate cuts, and overvaluation/mispricing of risk in corporate credits highlight opportunities in better risk-adjusted returns in Asian Investment Grade credits and Saudi Arabia Sukuk bonds.

Implementation ideas

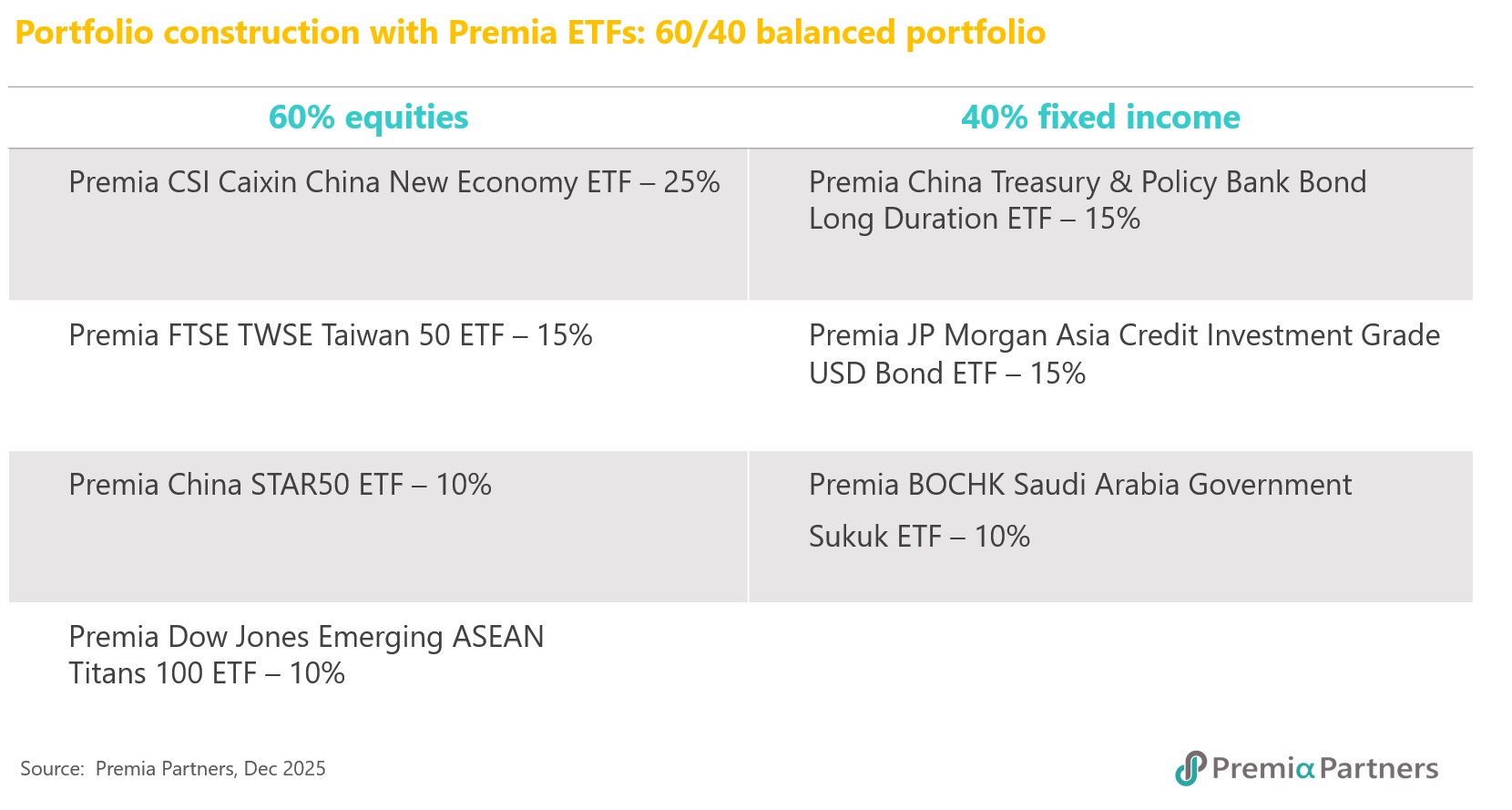

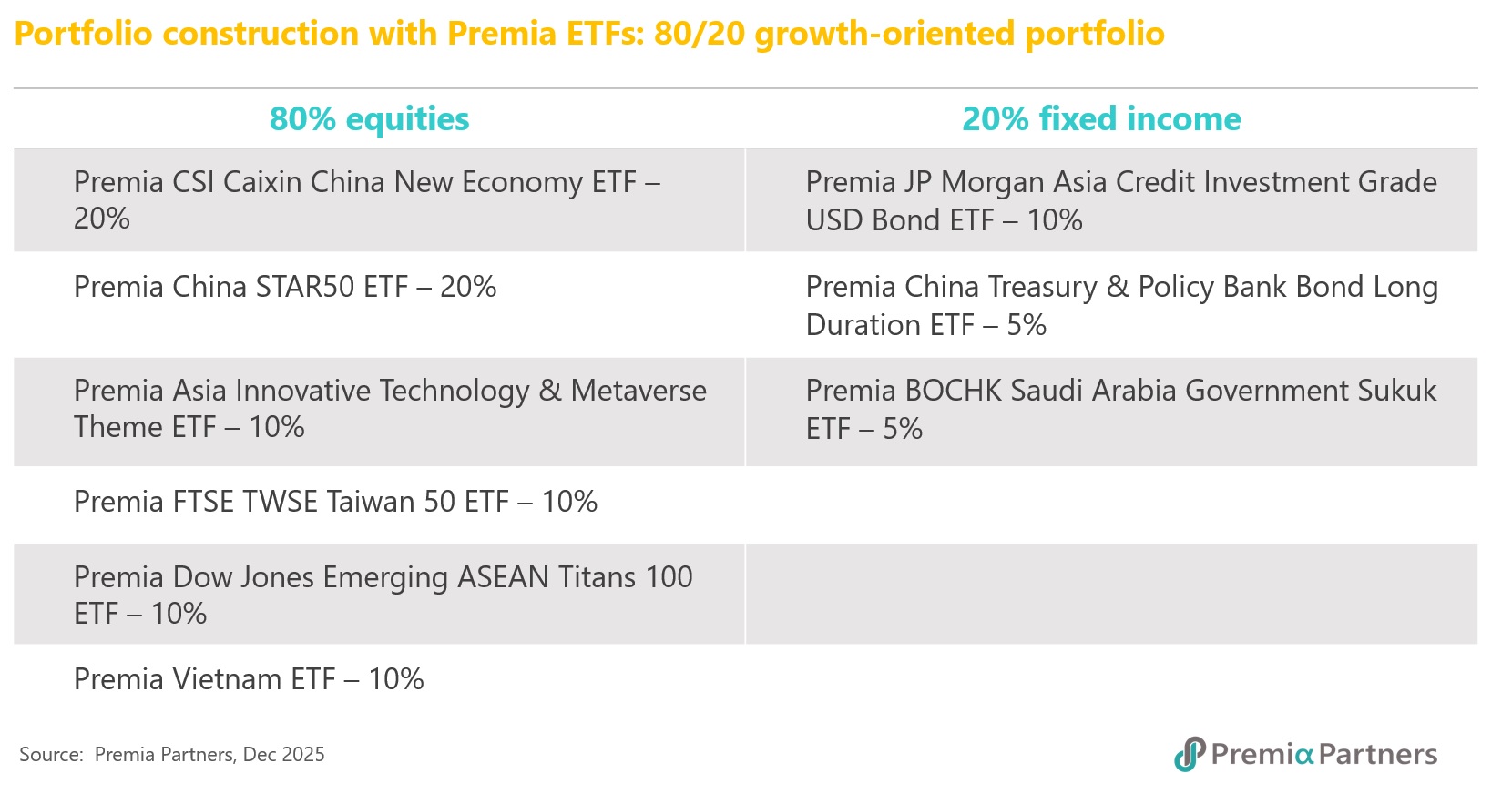

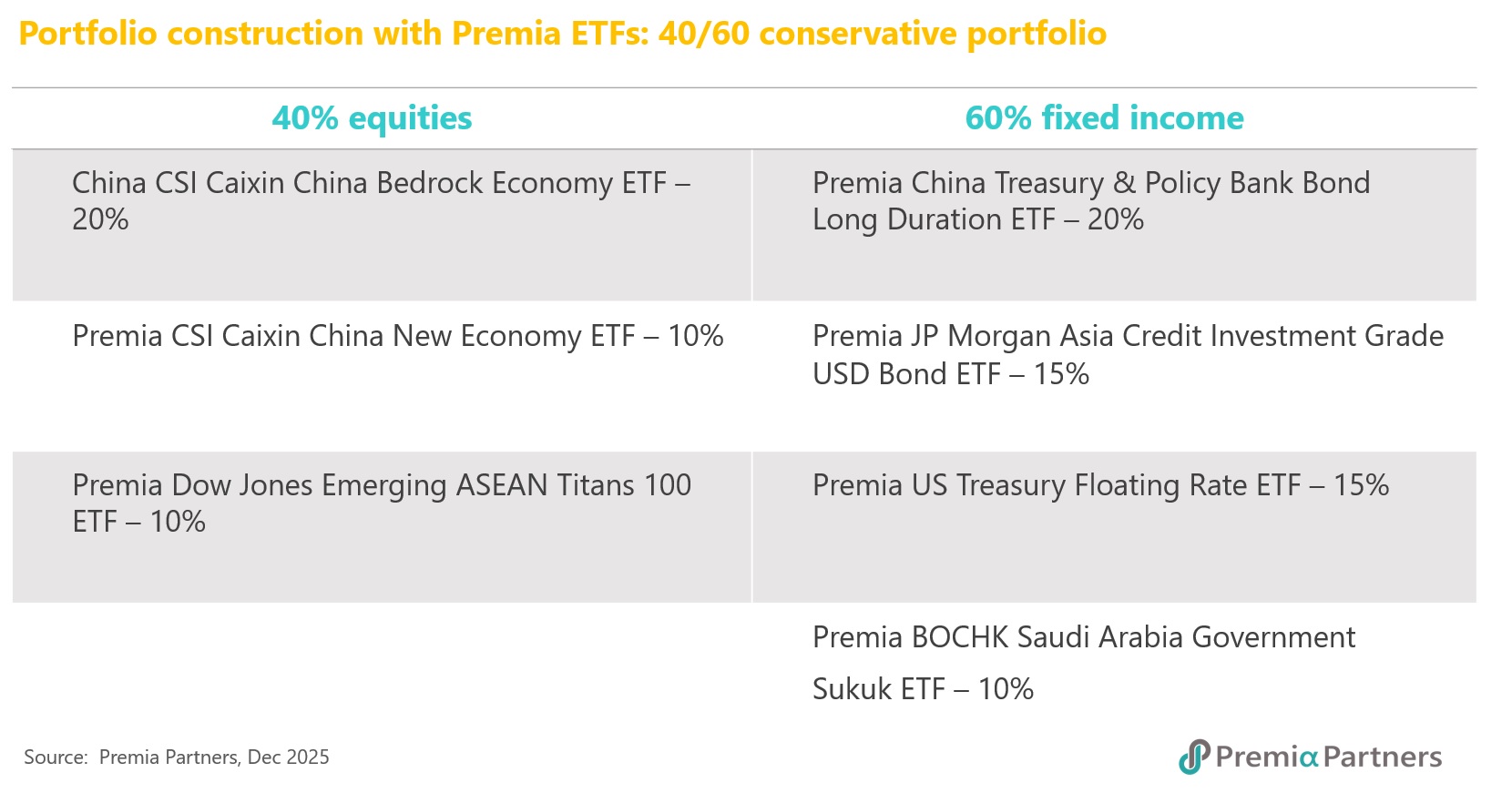

In summary, the investment landscape argues strongly for diversification away from US-centric portfolios, given elevated valuations, rising concentration risks, and growing uncertainty around the sustainability of fiscal and monetary dynamics. By contrast, several non-US markets offer a more attractive combination of valuation support, policy flexibility and structural growth drivers.

Equities: Rotate from valuation risk to structural growth and policy optionality

In equities, investors may consider underweighting the US market, where rich multiples, negative equity risk factors, and rising macro and policy uncertainties leave little margin for error. Instead, opportunities appear more favourable in Europe and selected emerging markets, where valuations are more reasonable and policy manoeuvre is greater.

Within emerging markets, China and Emerging ASEAN stand out for different but complementary reasons. Chinese equities offer attractive valuations relative to growth, alongside structural upside from innovation-led sectors such as semiconductors, robotics, AI and biotechnology, which are increasingly aligned with national policy priorities, and many of which are also unique global industry leaders. Emerging ASEAN, meanwhile, benefits from supply-chain repositioning, interest rate cuts and resilient economic growth, with dividend yields among the highest globally. Japan does not figure as a beta trade but offers selective opportunities from controlled reflation, with wage increases and fiscal stimulus to offset cost-of-living pressures. Japan may also offer opportunities through its trade linkages to Asia, particularly China.

Fixed Income: Seek stability, real yields and policy support

In fixed income, caution is warranted towards US duration and corporate credit, where the mix of rising long-end yields, revived inflation risks and historically tight spreads suggests asymmetric downside risks. Instead, investors may find more potential risk-adjusted returns in markets supported by disinflation, policy easing or structurally stronger balance sheets.

China government and policy bank bonds stand out in this regard, as disinflation provides room for further easing and the PBoC’s resumption of bond purchases offers an additional tailwind. Beyond China, Asian investment-grade credits and Saudi Arabia government Sukuk provide diversification benefits, relatively attractive carry and exposure to regions with stronger fiscal dynamics.