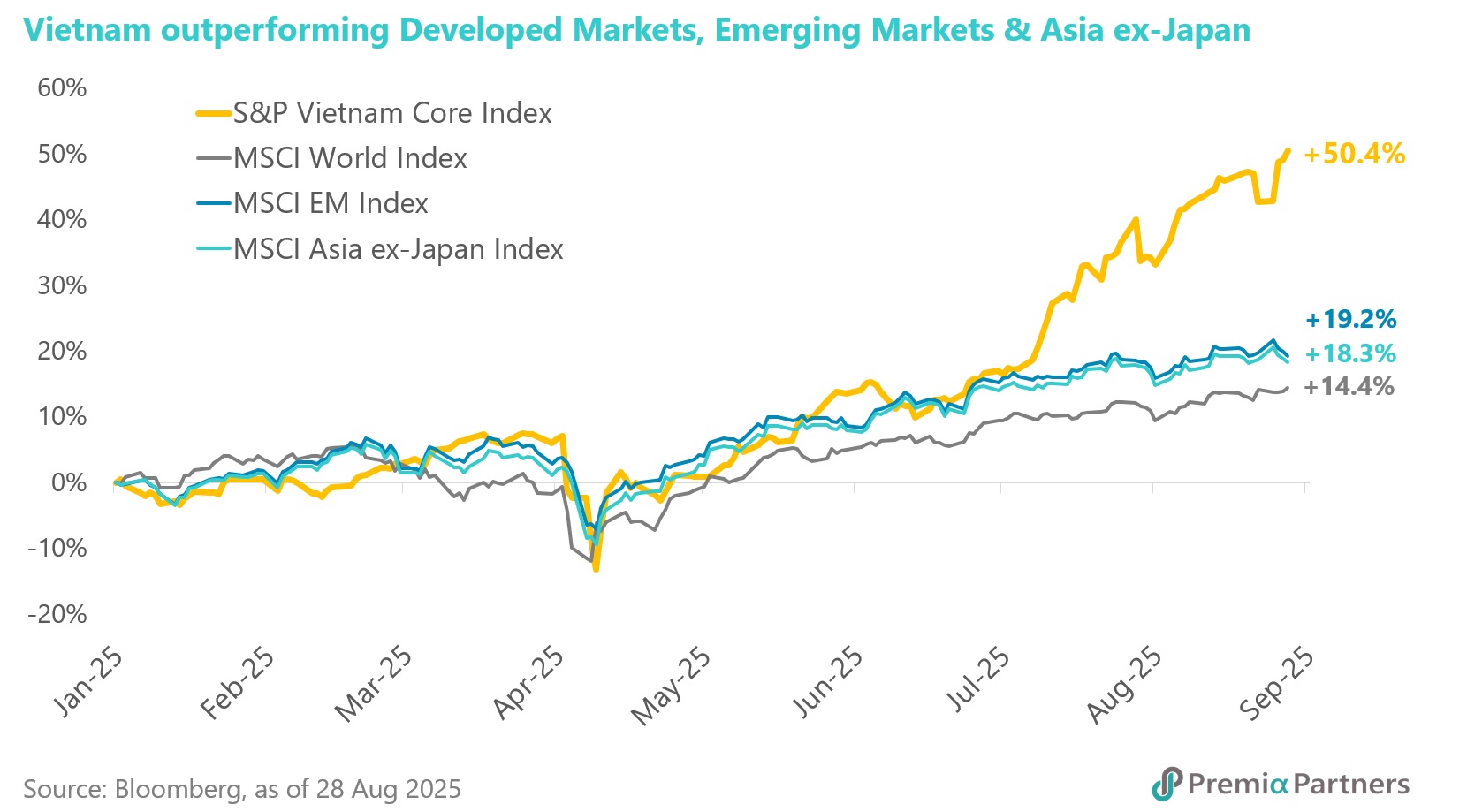

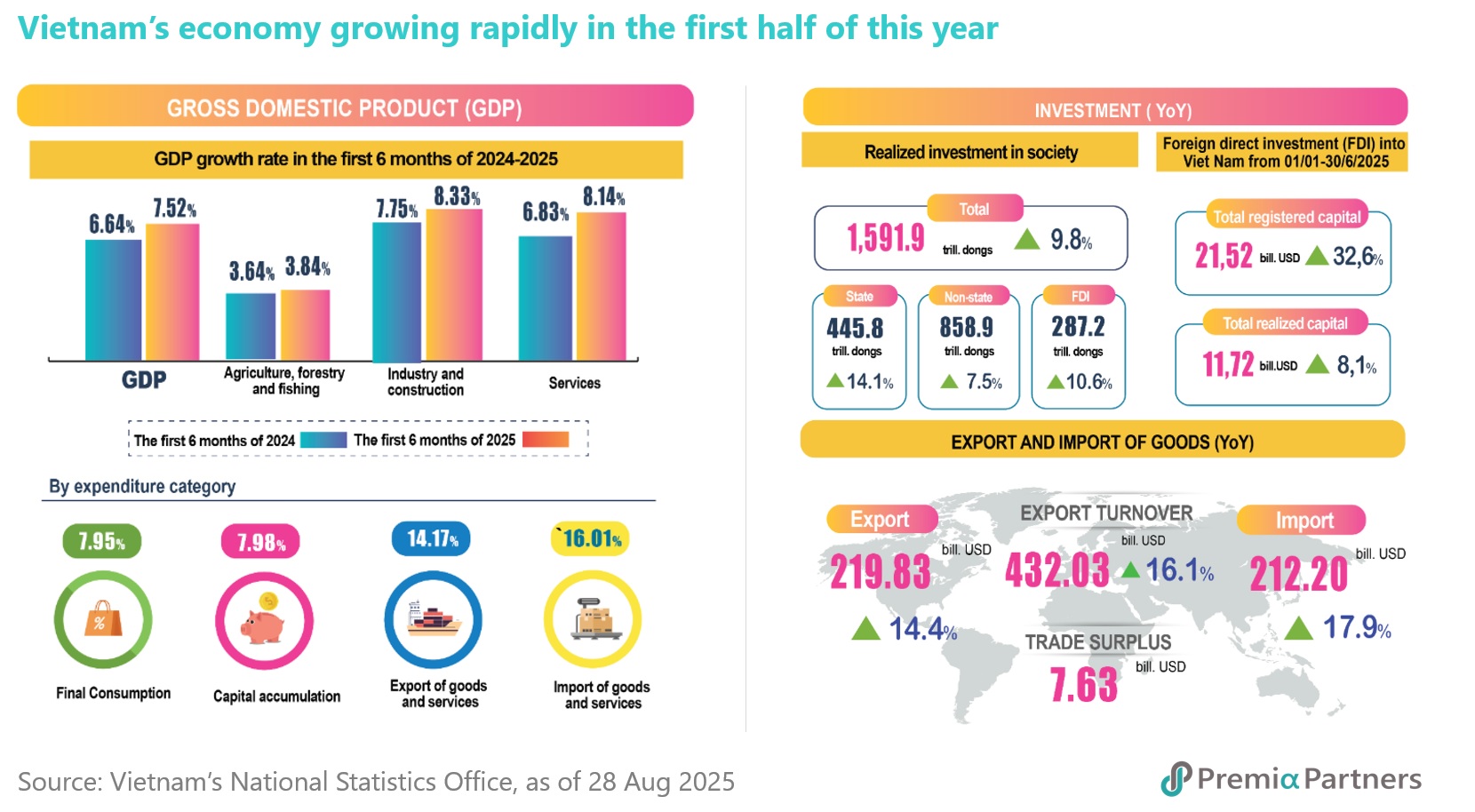

Vietnam’s equity market has been the standout performer in Asia year-to-date, significantly outperforming regional peers and drawing increasing attention from global investors. The stellar performance reflects not only cyclical recovery drivers—such as easing interest rates, recovering real estate activity, and rising corporate earnings—but also the structural transformation underway in the Vietnamese economy. With robust foreign direct investment (FDI) inflows, major infrastructure expansion, and a wave of ambitious policy reforms, the long-term trajectory for Vietnam looks increasingly compelling.

The critical question for investors is whether this rally can sustain. Our answer is “Yes.” The most important reason lies in Vietnam’s latest reform drive—arguably the most ambitious since the landmark Doi Moi reforms of the 1980s. These reforms are reshaping the economic landscape, with profound implications for capital markets and the private sector.

Near-term drivers: Cyclical recovery supporting earnings growth

Vietnam’s equity market rally is anchored by a recovery in fundamentals. Corporate earnings are on an upswing, supported by four key factors:

- Rebound in Real Estate and Public Investment – After a painful credit and property downturn, the real estate sector is showing signs of stabilization, aided by supportive government policies. At the same time, public investment has accelerated sharply, with disbursements up over 30% year-on-year in mid-2025, fueling growth in construction and related industries.

- Favourable Interest Rate Environment – With rates at multi-year lows, capital flows are returning to the market. Cheaper financing costs are boosting private sector activity, while liquidity remains abundant in the banking system.

- Easing of Tariff-Related Risks – While global trade uncertainty remains, especially with US tariff rhetoric under the Trump administration, Vietnam has thus far avoided the brunt of protectionist measures. Recent developments have helped stabilize investor sentiment and reduce external headwinds.

- Potential Market Upgrade – Perhaps the most powerful near-term catalyst is the anticipated upgrade of Vietnam’s equity market to emerging-market status, potentially as soon as October. Inclusion into global indices would attract meaningful foreign inflows, deepen liquidity and enhance market visibility.

Together, these cyclical drivers are expected to lift earnings and sustain investor interest through 2025–2026. Yet the real differentiator lies in Vietnam’s reform story, which sets it apart from regional peers.

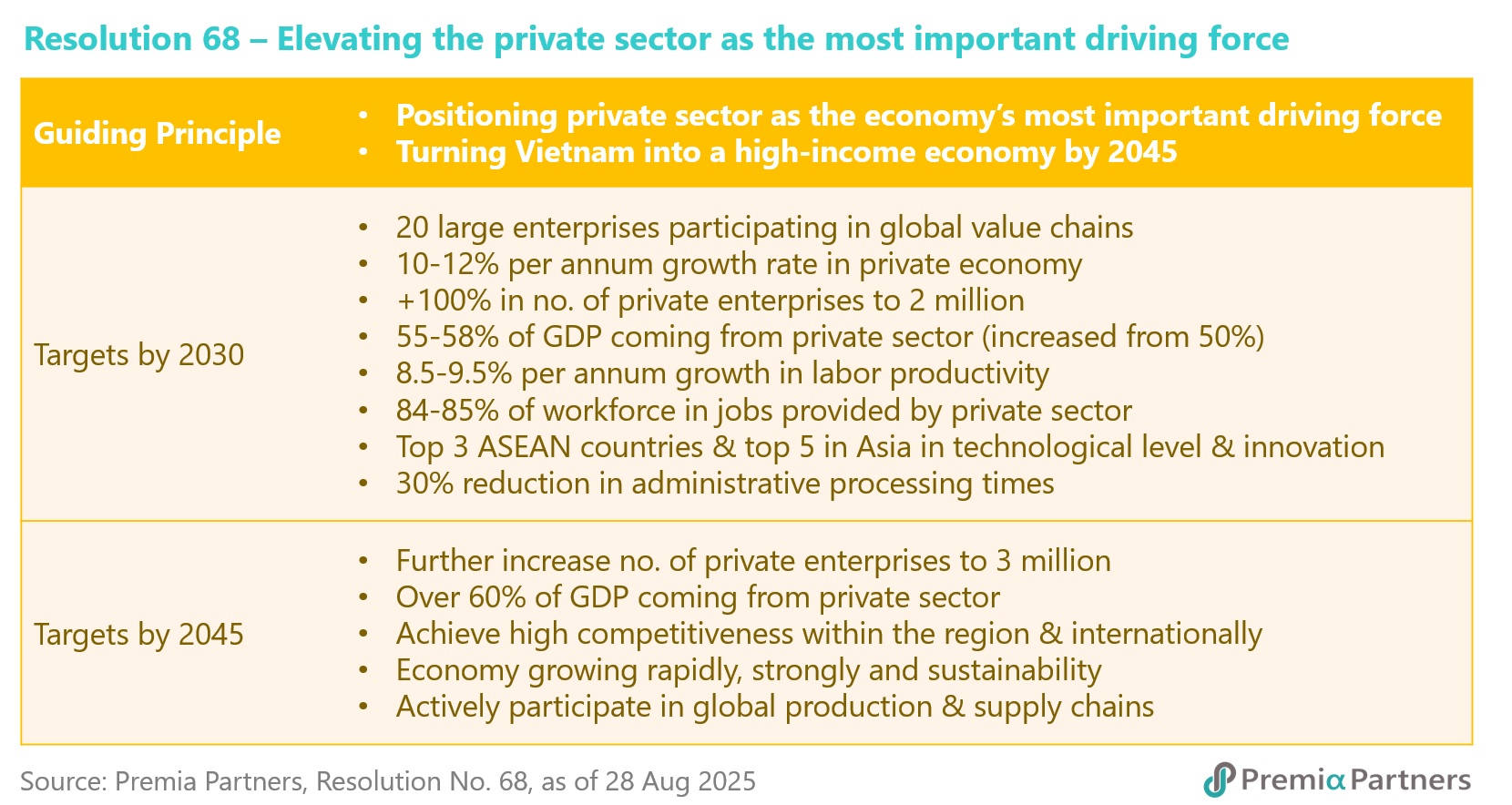

The reform engine: Resolution 68 and beyond

Vietnam’s leadership has launched its most ambitious reform drive in decades under Resolution 68, elevating the private sector as the economy’s ‘most important driving force.’ Analysts, including MUFG Bank, see this as a pivotal turning point—a move away from state-led development toward private-sector dynamism. For investors, these reforms are more than policy statements: they lay the groundwork for deeper capital markets, stronger corporate governance and faster earnings growth, making Vietnam one of the most promising structural stories in Asia.

Key elements of the reform program include:

- Public sector downsizing and bureaucratic streamlining – Vietnam plans to reduce the size of the public sector, merging and streamlining provinces, and cutting bureaucratic red tape by 30% by 2025. These moves free up resources and improve efficiency.

- Decentralization with flattened hierarchy – The number of provinces and municipalities will fall from 63 to 34, with a two-tier system (province and commune) replacing the old three-tier structure. This simplification is designed to boost administrative efficiency without sacrificing local autonomy.

- Legal and institutional overhaul – Reforms aim to move from a pre-approval licensing regime to a post-approval supervision system, reducing costs for businesses. Legal changes will also strengthen property rights, improve dispute resolution and enhance corporate governance.

- Capital market deepening – Authorities are accelerating stock market modernization, insurance market development, and corporate bond regulation. The SME Development Fund and credit guarantee frameworks are being upgraded to channel more capital to private firms.

Nurturing national champions

The government aims to develop 20 large private firms capable of competing globally, reminiscent of South Korea’s chaebol model. These firms will play a central role in strategic infrastructure projects and global value chains.

These reforms are not aspirational; they are already being implemented. For example, administrative units have been consolidated, new corporate bond regulations are in force, and infrastructure disbursements are rising sharply. Together, they represent a structural inflection point for Vietnam’s economy.

Infrastructure and innovation: Catalysts for growth

The cornerstone of the reform agenda is infrastructure expansion. The government has announced projects worth over 10% of GDP across transport, industrial and urban development. State capital will fund around 37% of the total, with private and foreign investors covering the remainder.

This investment spree serves two purposes: it alleviates bottlenecks that have constrained growth, and it provides a platform for local companies to build scale and expertise. The policy preference is for domestic firms to take the lead on national projects, often in partnership with foreign companies to ensure knowledge transfer.

Parallel to this is a push into innovation and technology, with Resolution 68 setting explicit targets for Vietnam to become one of Asia’s leading innovation-driven economies. Investments in public education, science, and human capital are being ramped up, positioning Vietnam to transition over time from low value-added manufacturing to higher value-added sectors.

Macro backdrop: Balancing growth with risks

The reforms unfold against a complex macro backdrop. Vietnam targets GDP growth above 8% in 2025, while consensus forecasts are slightly lower at 6.6% for 2025 and 6.2% for 2026. Strong imports and moderating exports may narrow the current account surplus, but the dong should remain resilient in a weak-dollar environment. Inflation is expected to stay contained, with forecasts of 3.4% in 2025 and 3.2% in 2026.

Risks remain. Vietnam’s demographics dividend is fading, while the economy remains reliant on low-cost manufacturing. The painful credit and real estate downcycle from 2021 to 2024, triggered by the corporate bond freeze, banking stresses and the pandemic, still leaves scars. Moreover, global trade tensions and tariffs could weigh on exports over the medium term.

Nonetheless, the reform agenda directly addresses many of these vulnerabilities. By empowering the private sector, streamlining governance and deepening capital markets, Vietnam is building resilience against external shocks while unlocking new engines of productivity.

Valuations: Attractive in a regional context

Despite the recent rally, Vietnamese equities remain attractively priced at a forward PE multiple of 12.06x, versus the 10-year average of 12.36x. Compared with regional peers, valuations are still below those of India, Indonesia and the Philippines, while earnings growth prospects are stronger. The anticipated MSCI and FTSE upgrades could further compress this valuation gap as institutional inflows accelerate.

In addition, structural reforms are likely to reduce the equity risk premium, making Vietnam an increasingly mainstream allocation for global EM portfolios in medium-term. With domestic retail participation still dominant, the market offers ample scope for foreign institutional penetration.

Conclusion: Vietnam at an inflection point

Vietnam is on the cusp of a new growth phase. Its equity outperformance is not a short-term anomaly but a reflection of deep structural change. The reform agenda—focused on private-sector empowerment, bureaucracy reduction, and capital-market deepening—echoes the transformational spirit of Doi Moi in the 1980s.

While risks persist, the long-term outlook is compelling. Infrastructure spending, corporate earnings recovery, and an imminent market upgrade all serve as powerful catalysts. Valuations remain supportive, offering investors a favorable entry point into one of Asia’s most exciting reform stories.

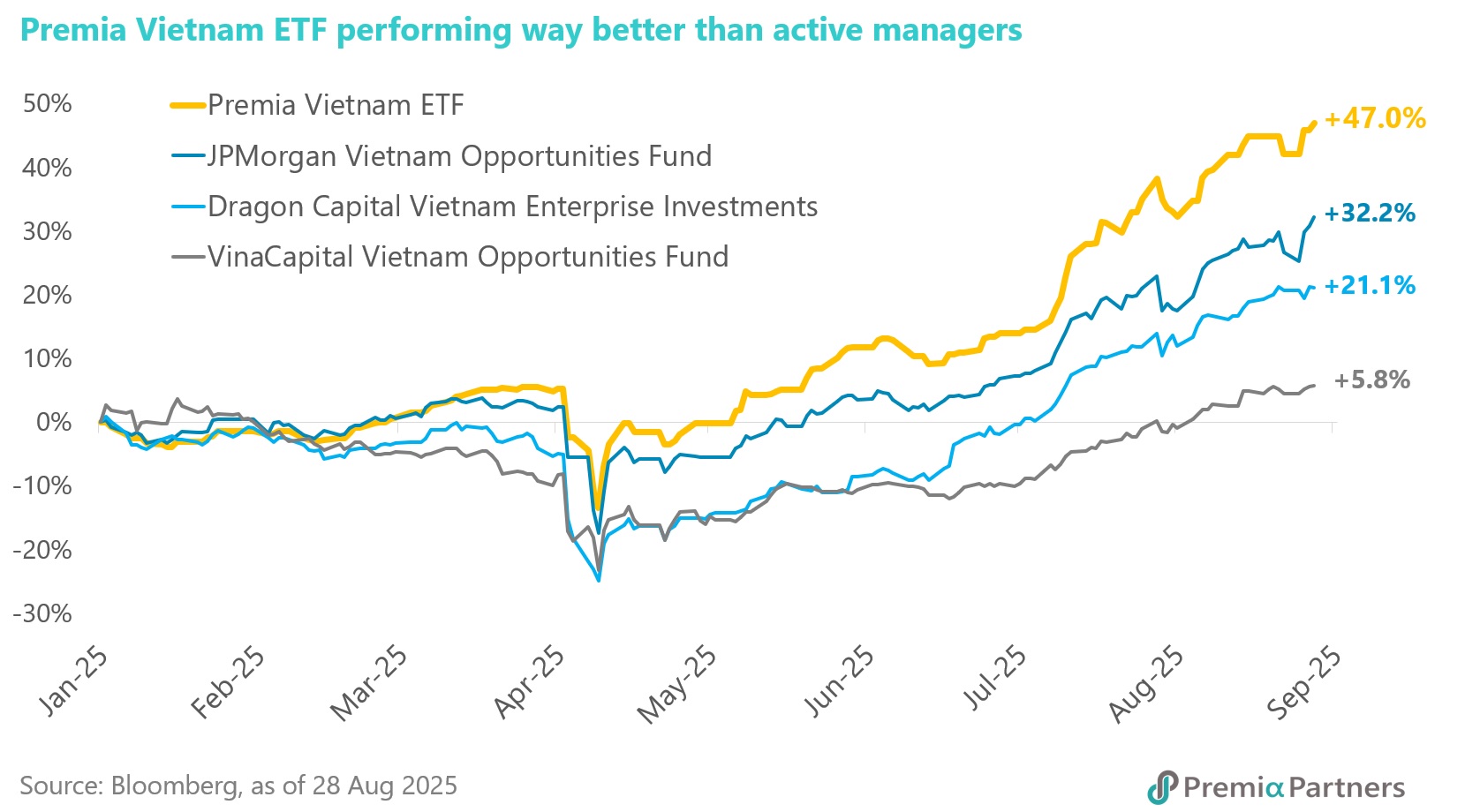

SSI Research projects the VN-Index could advance toward the 1,750–1,800 range by 2026. More importantly, today’s rally is underpinned by reforms that promise to unlock Vietnam’s full growth potential over the coming decade. For investors, choosing the right instrument is critical. The Premia Vietnam ETF stands out as a cost-efficient and transparent vehicle, consistently outperforming most active funds through a diversified basket of over 50 leading companies listed in Ho Chi Minh City. This challenges the notion that only active strategies thrive in emerging or frontier markets, particularly with an impending upgrade that will favor mid-to-large caps accessible to foreign investors.

Vietnam’s story is no longer just about low-cost manufacturing—it is about reform-driven growth, private-sector dynamism, and the emergence of a market too significant for global investors to ignore.