In fact, on the one hand these bonds benefit from the anticipated monetary easing by the US Federal Reserve, which is projected to implement a substantial 240-basis-point rate cut over the next 12 months. On the other hand, Asia’s economic outlook remains robust. The region is expected to sustain healthy growth, with forecasts indicating that many Asian economies will expand at an accelerated pace in both 2024 and 2025. This positive economic trajectory supports strong corporate performance and profitability, which in turn benefits investment grade bonds issued by companies in the region in particular.

We believe that Asian IG bonds check lots of boxes as a core component of global investors’ portfolios, and are well positions with their stable credit quality and attractive yields to take advantage of the upcoming credit cycle.

Navigating a different rate regime

US rate cut cycle is kicking in imminently with key questions on investors mind now are the size and speed of the cut, an overhanging cloud over emerging economic weakness in the US, and policy uncertainty following the up-coming US president election. Regardless of the outcome, the outlook for the USD based risk assets has inevitably become more vulnerable. Need not mention the stretched valuation of the US equities, with the Buffett Indicator value of 194.9% which is 1.4 standard deviations above the trend line.

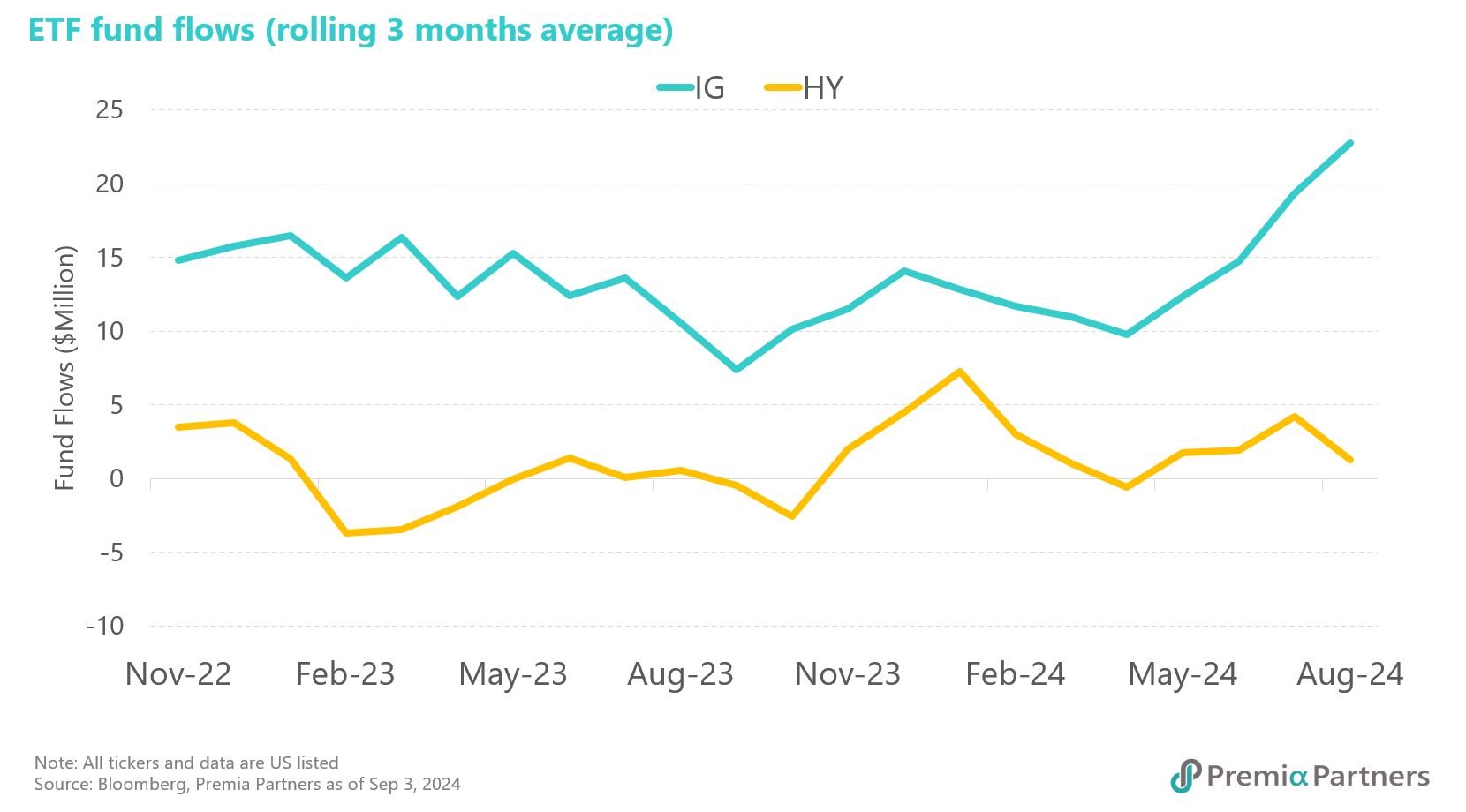

In fact the asset migration has happened already, as global investors are increasingly rotating into defensive and higher-quality assets as preemptive moves against such potential challenges, and positioning portfolio for the rate cut already. Since last quarter investment grade credit ETFs experienced their highest inflow in the past three years, reflecting an increased participation from investors looking to rotate into higher quality assets.

Historically, periods of US rate cuts have often made Asia US Dollar credits more attractive. When the US Federal Reserve reduces rates, it could signal increased recession risk in the US, which typically results in widening credit spreads on US-based assets. In contrast, for bonds issued by Asian entities, although denominated in USD, the underlying issuers benefit from strong economic growth in Asia.

Asia offers stronger economic fundamentals

Asian economies are projected to grow at 4.9% in both 2024 and 2025, significantly outperforming the US, where growth is forecasted at 1.9% and 1.7%, and the Eurozone, with projected growth rates of 0.7% and 1.4%. This robust regional growth supports the creditworthiness of Asian issuers, providing a stable foundation even when global market conditions are challenging.

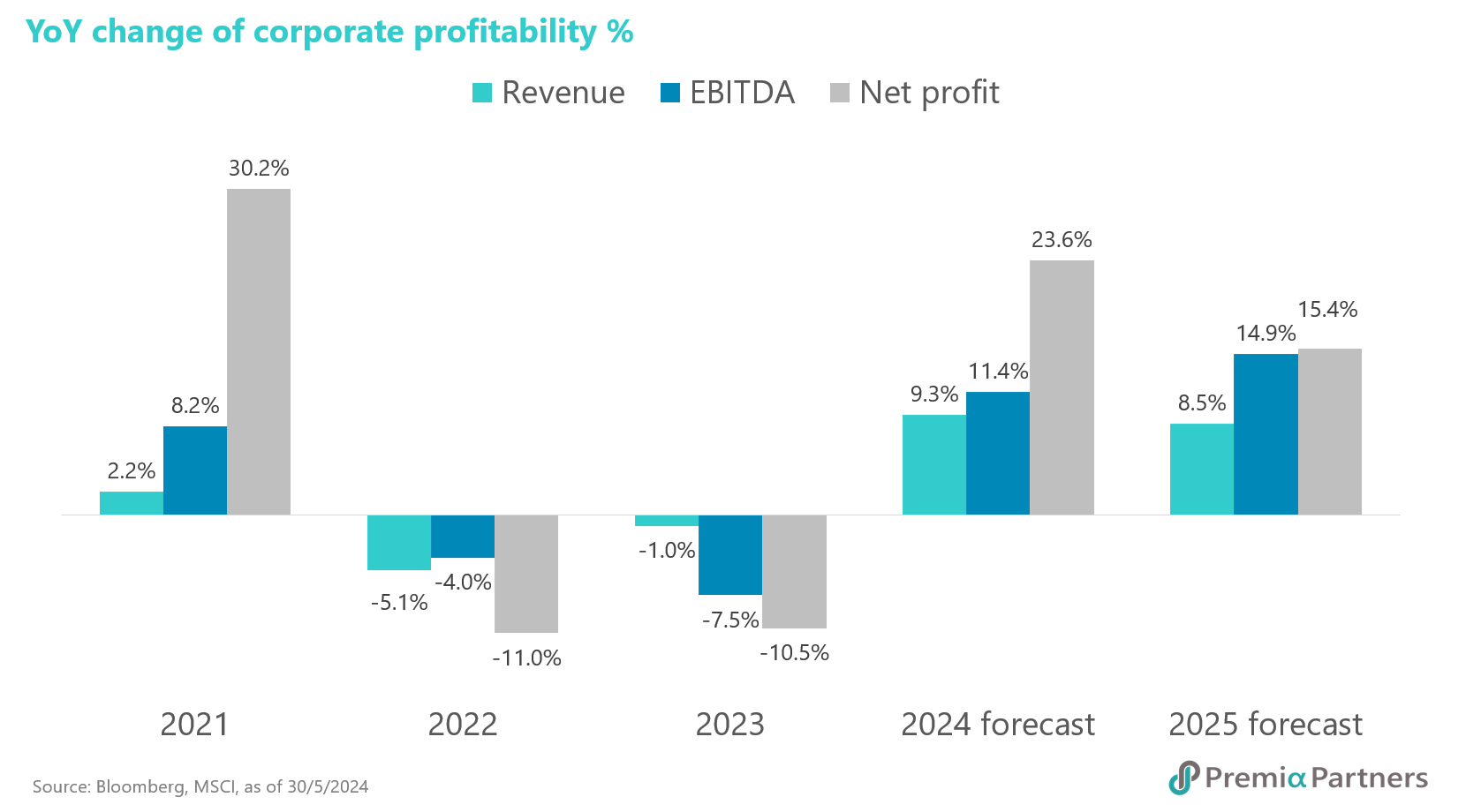

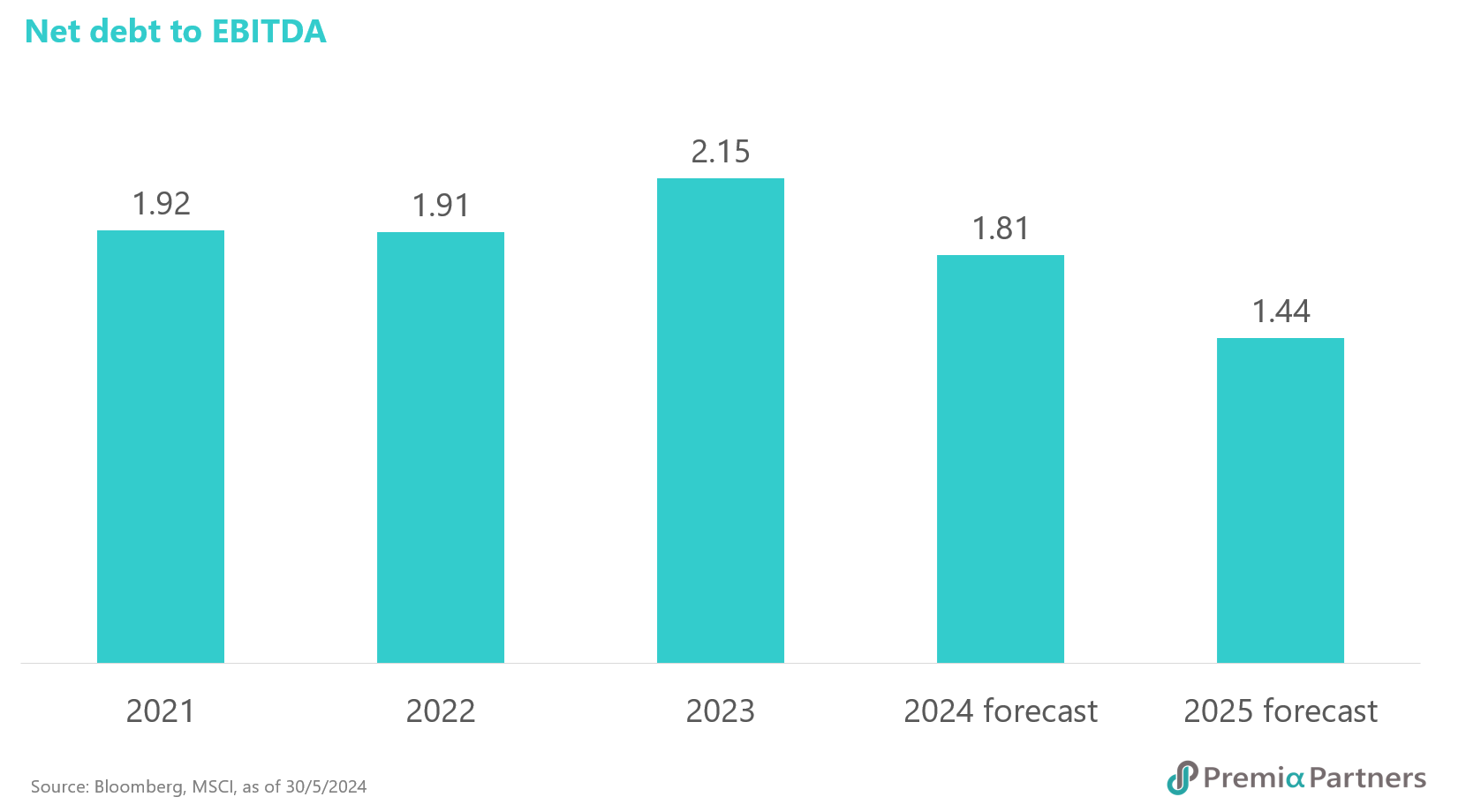

Additionally, US rate cuts provide central banks in Asia with greater leeway to manage their own monetary policies and currencies. This enhanced flexibility fosters a more favorable business environment, which supports and strengthens the credit ratings of Asian issuers. The earnings and leverage outlook for companies in the region is particularly promising. For instance, EBITDA is expected to grow by 12.6% in 2024 and 21.9% in 2025, net profit is projected to increase by 27.2% in 2024 and 15.4% in 2025, and net debt to EBITDA will likely reduce to 2.08 in 2024 and 1.66 in 2025 from 2.15 in 2023.

In times of heightened market risk originating from the US, these advantages further highlight the importance of geographical diversification in investment strategies. Investing in Asian credits not only offers the potential for attractive returns but also serves as a strategic hedge against volatility in the US market.

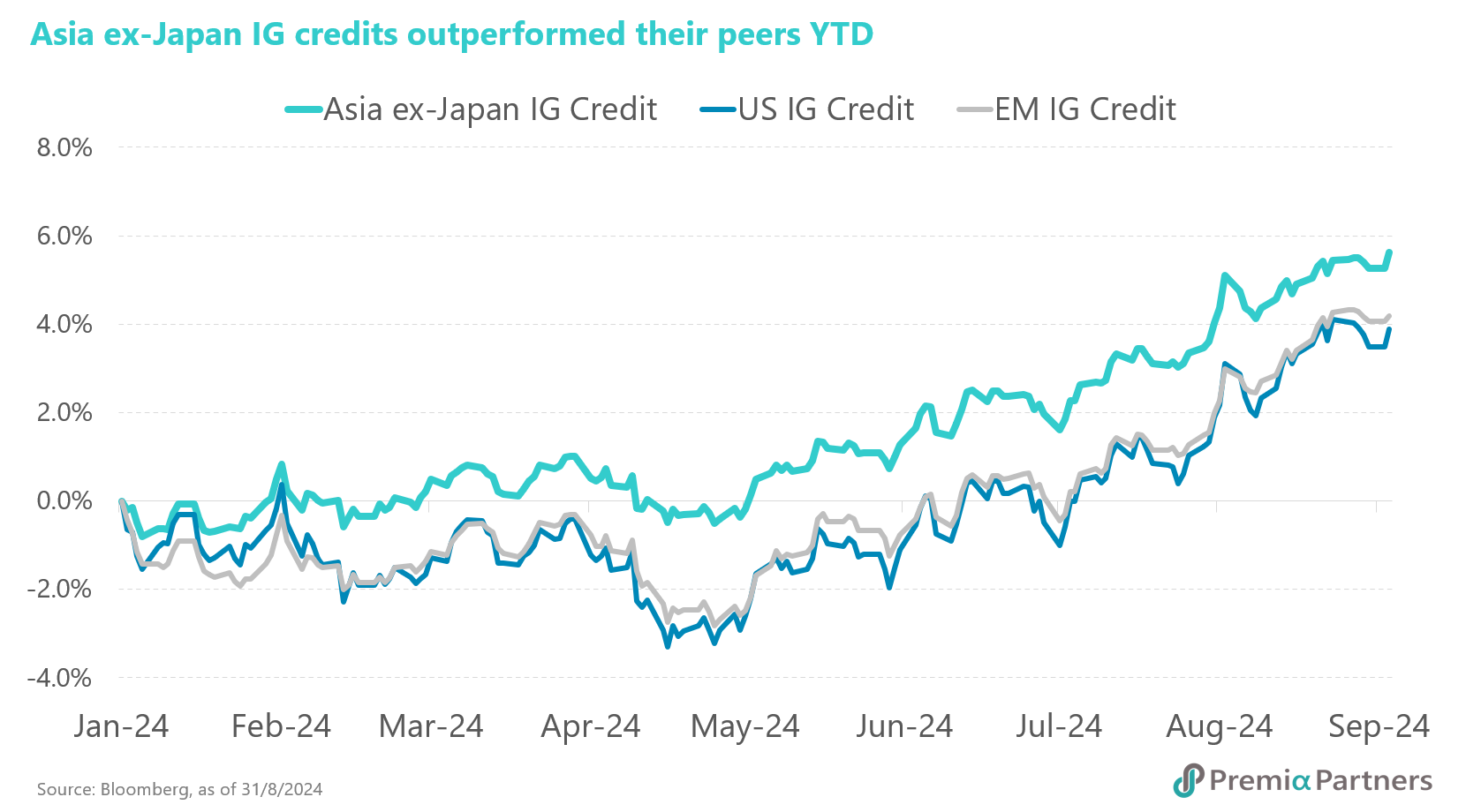

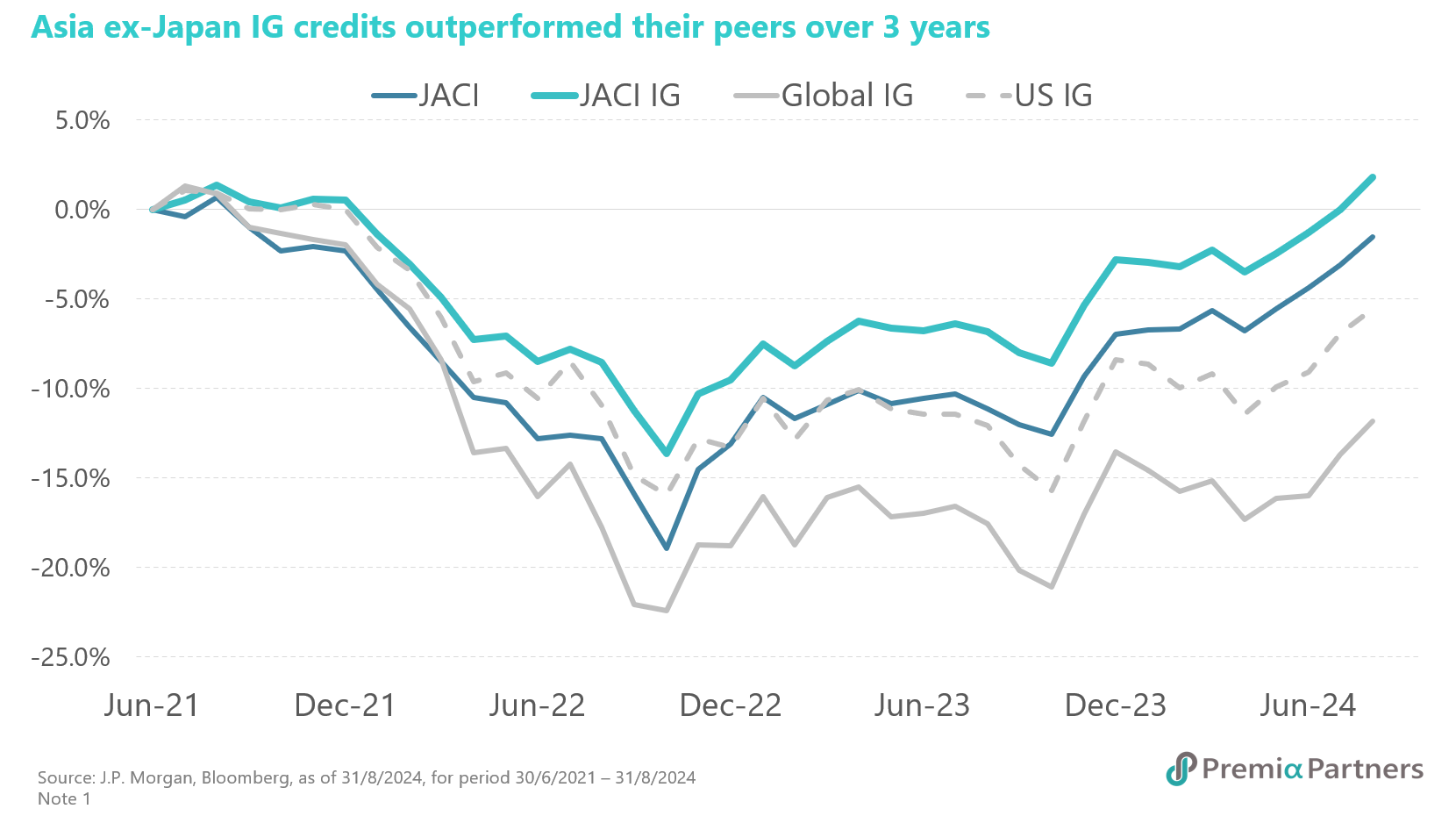

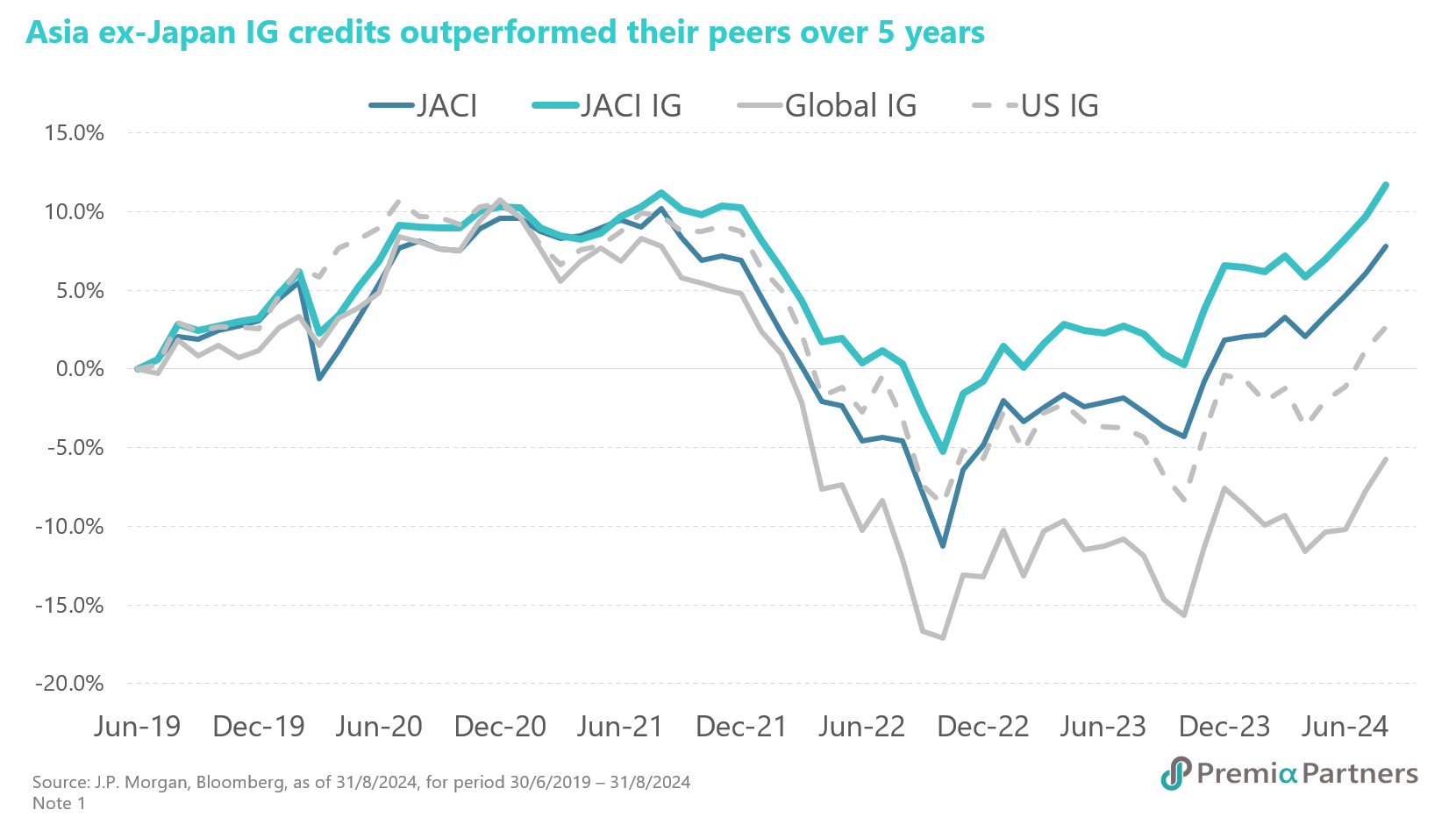

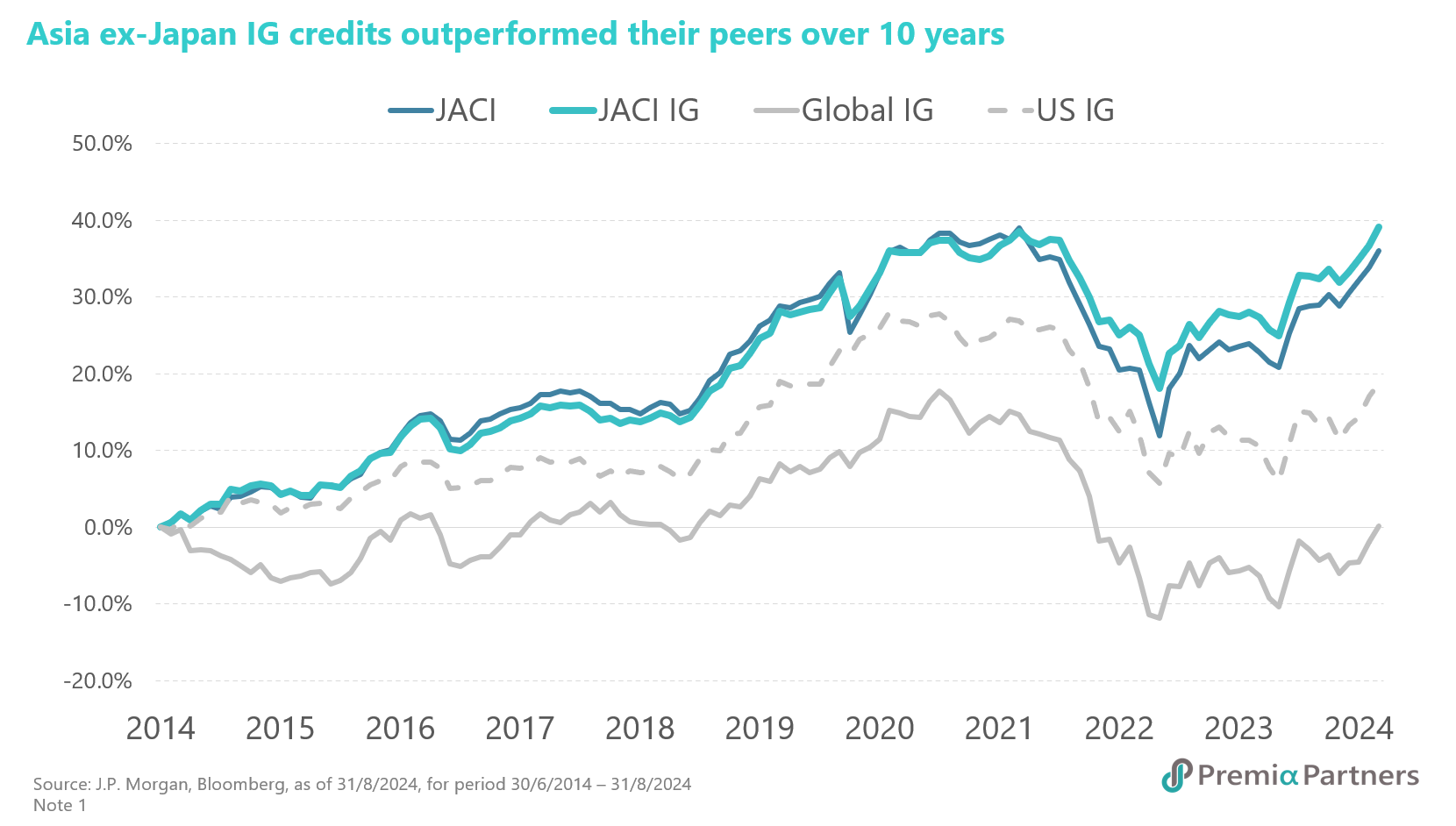

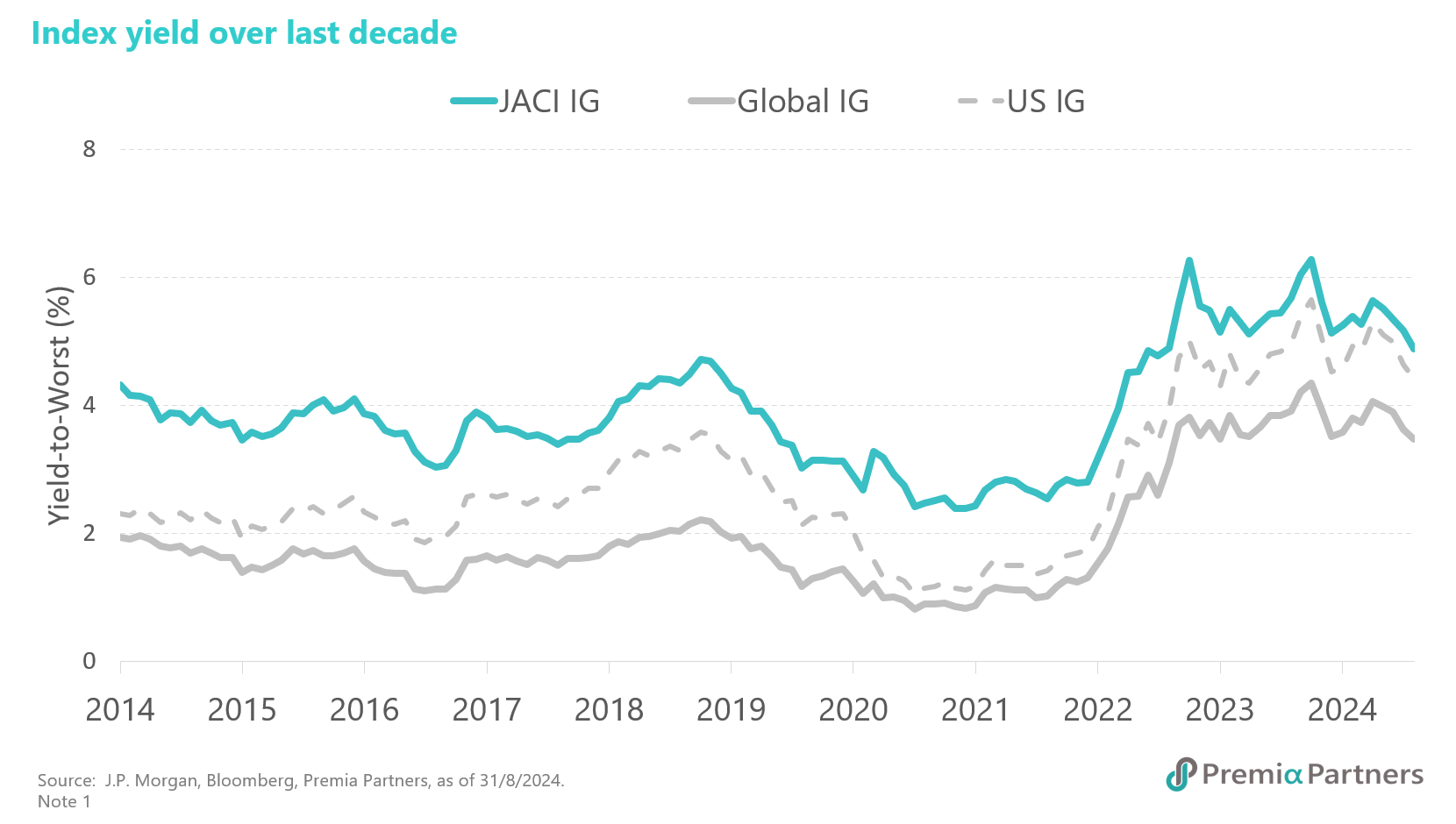

Asian IG credits is the sweet spot that consistently outperformed their global and US peers

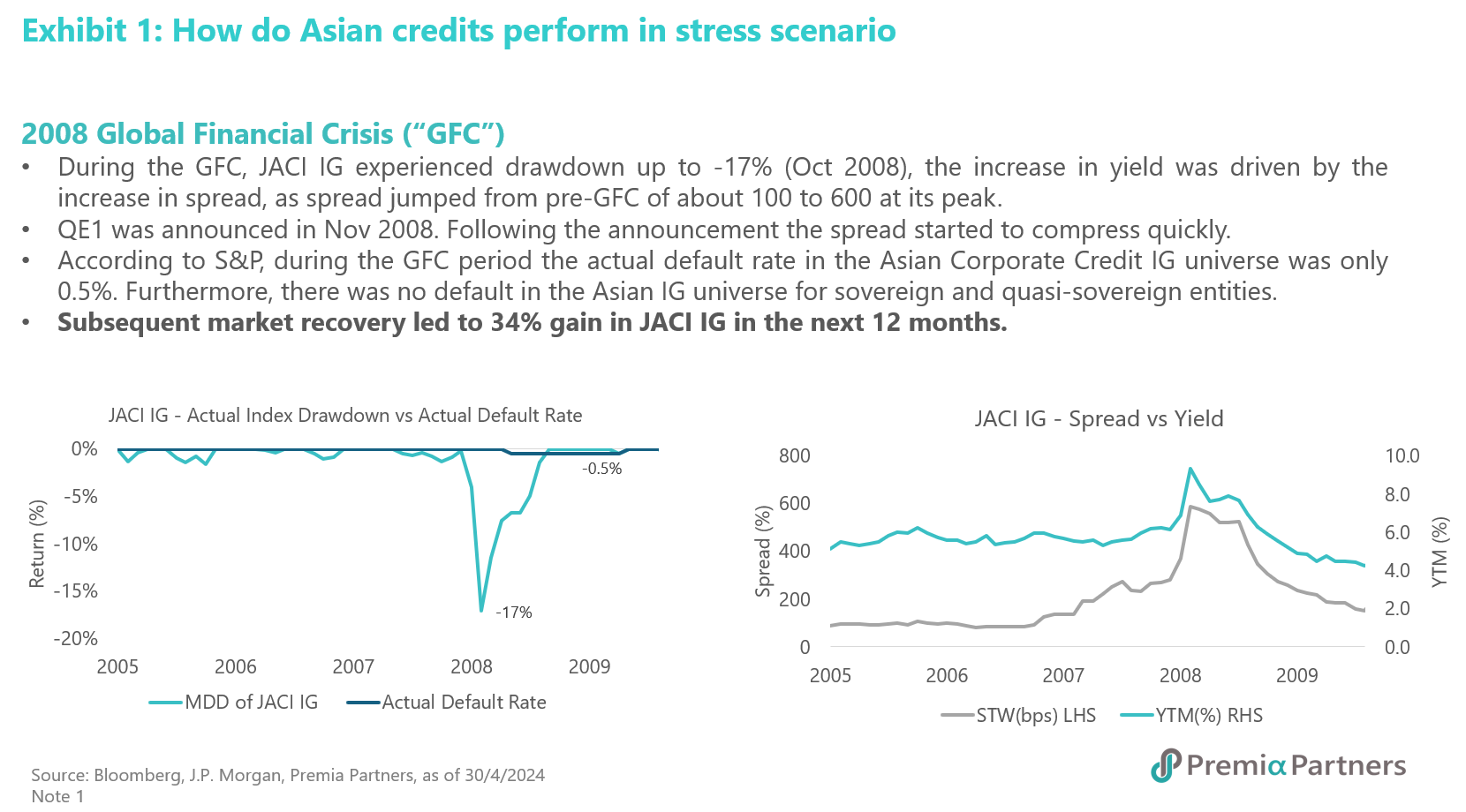

While each instance of market stress is distinct, one constant principle in effective risk management is diversification. This approach is particularly valuable when it can enhance returns and offer improved downside protection. Based on historical data, Asian IG credit has consistently delivered superior risk-adjusted returns compared to other major fixed-income asset classes over medium-to long-term periods. By diversifying into Asian IG credit, investors can potentially achieve better performance while mitigating risks associated with broader market fluctuations.

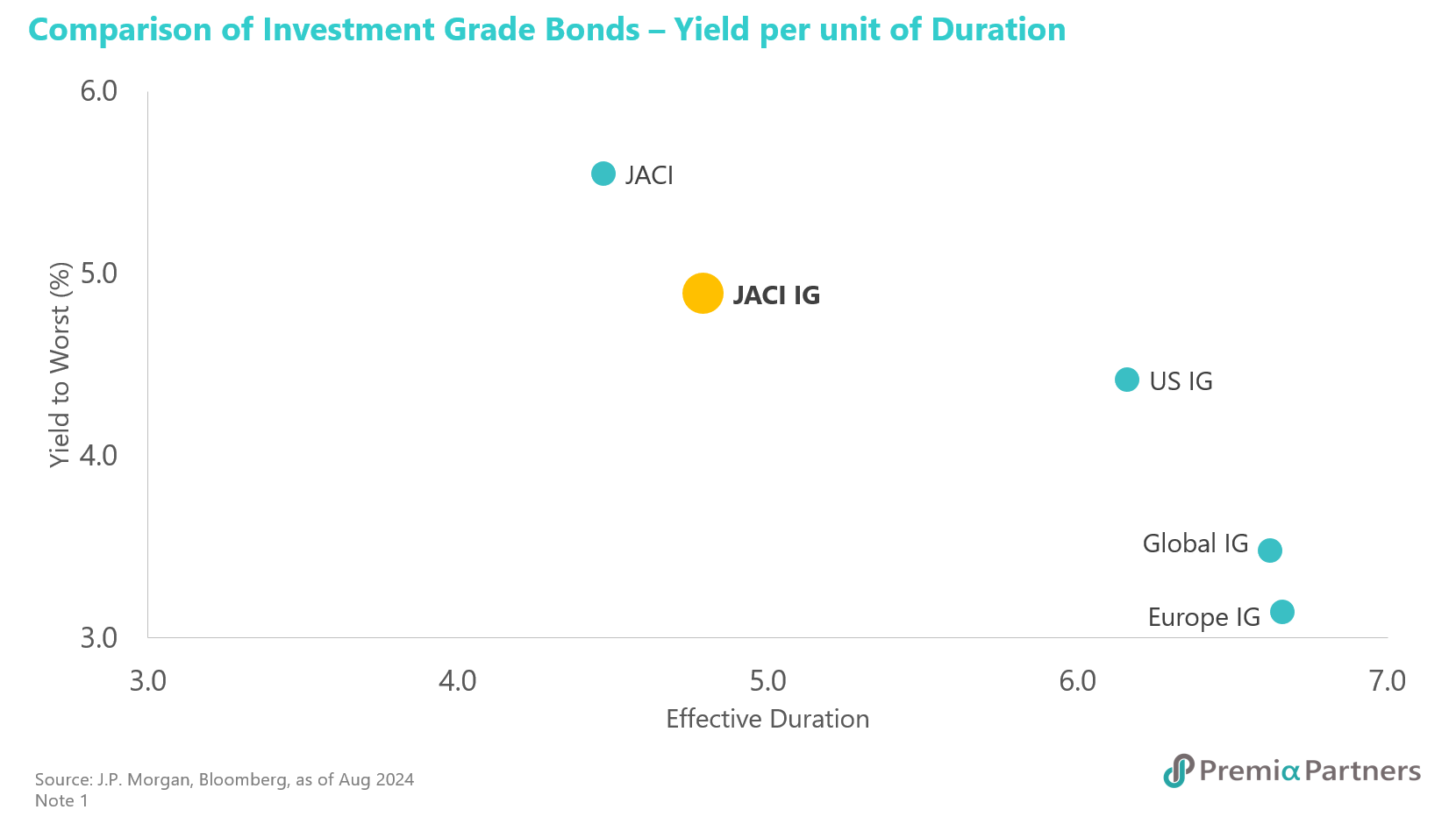

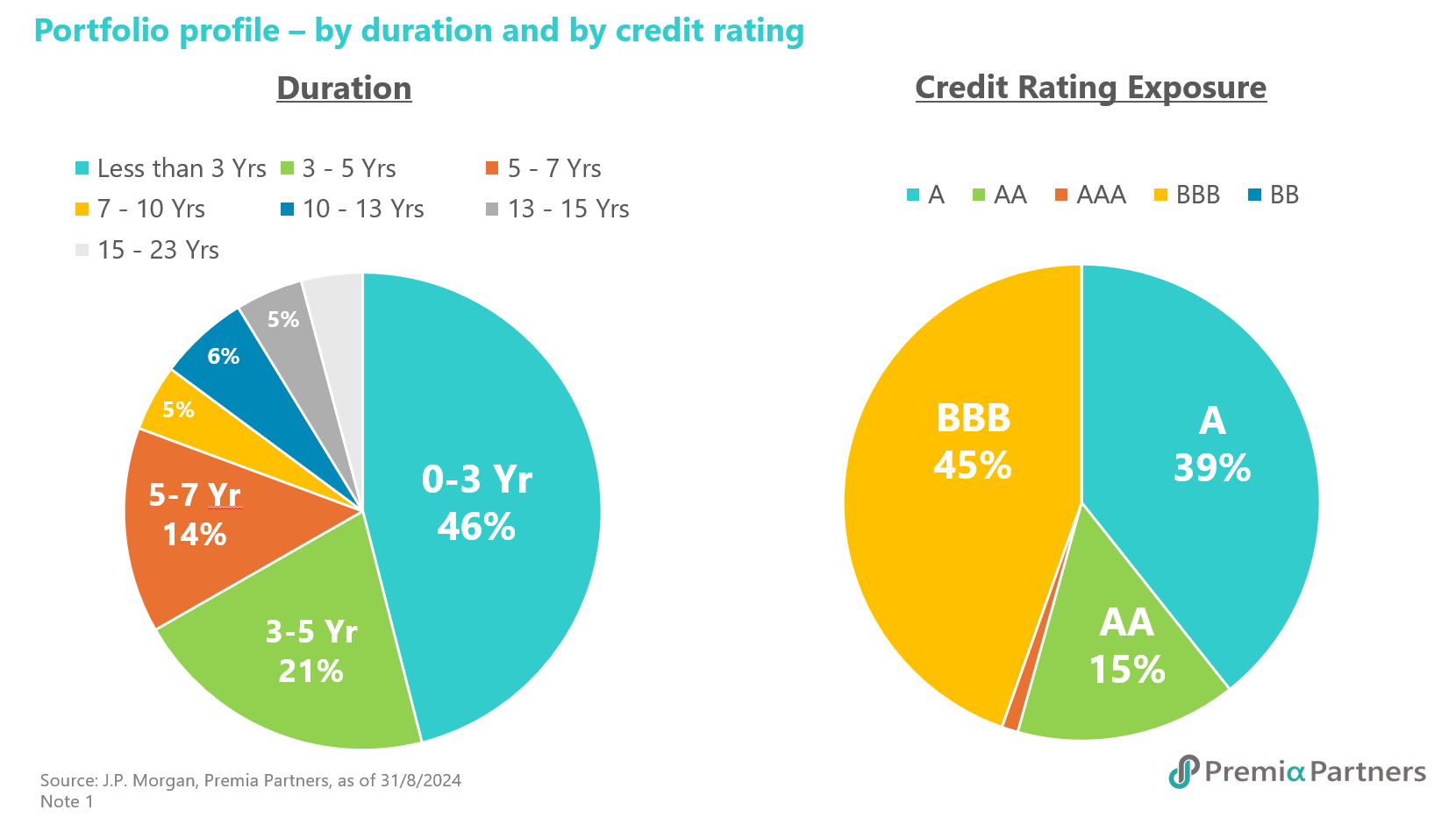

The outperformance of Asian IG bonds relative to global and US IG benchmarks can be largely attributed to their balanced exposure to high-quality sovereign, quasi-sovereign, and corporate securities across geographies. This strategic allocation allows investors to benefit from higher yields without needing to extend maturities or accept lower credit quality for additional returns. In essence, Asian IG bonds provide the opportunity to achieve enhanced yield while maintaining a robust investment grade credit profile.

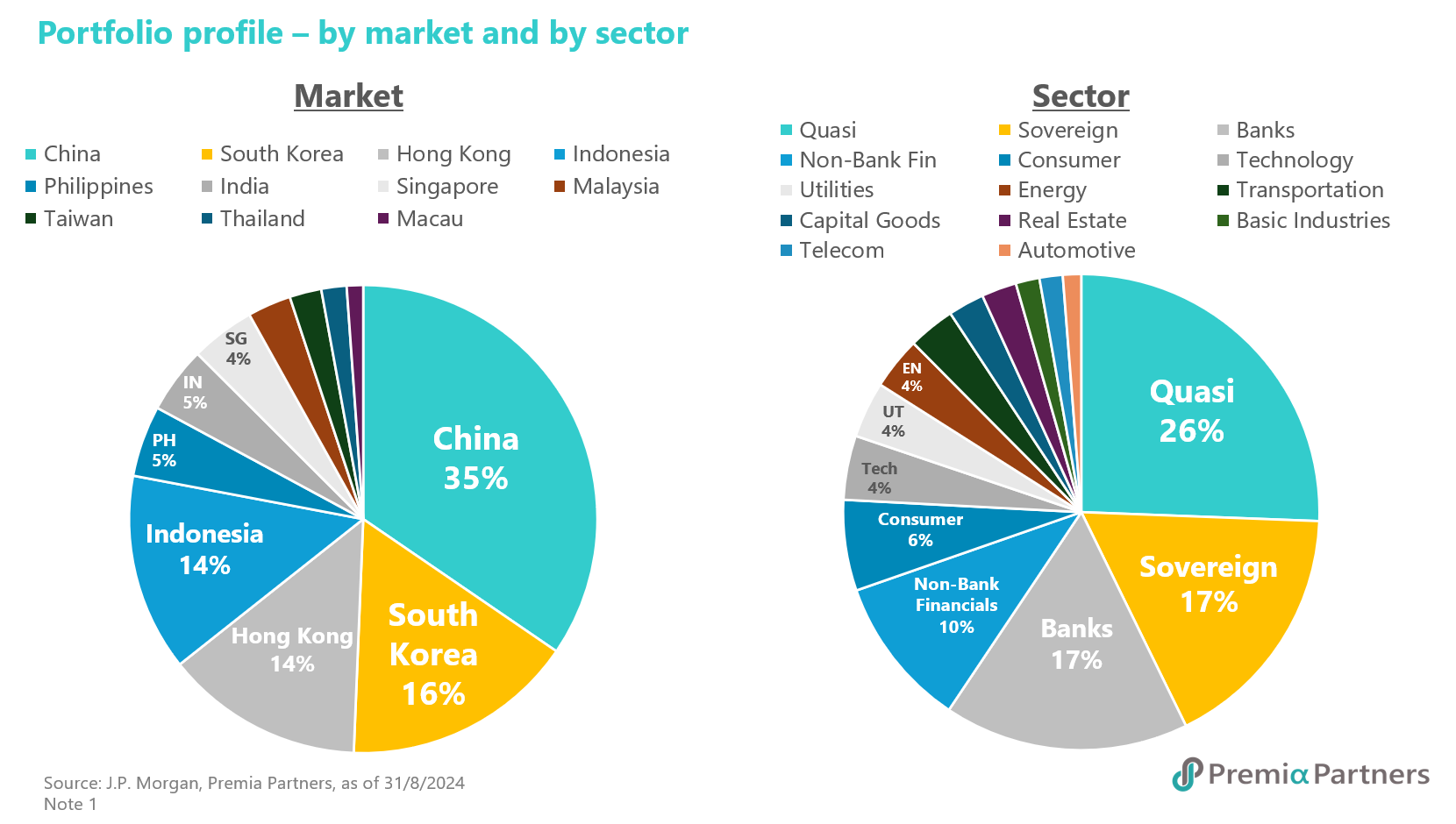

A liquid, expanding and well diversified IG universe in Asia

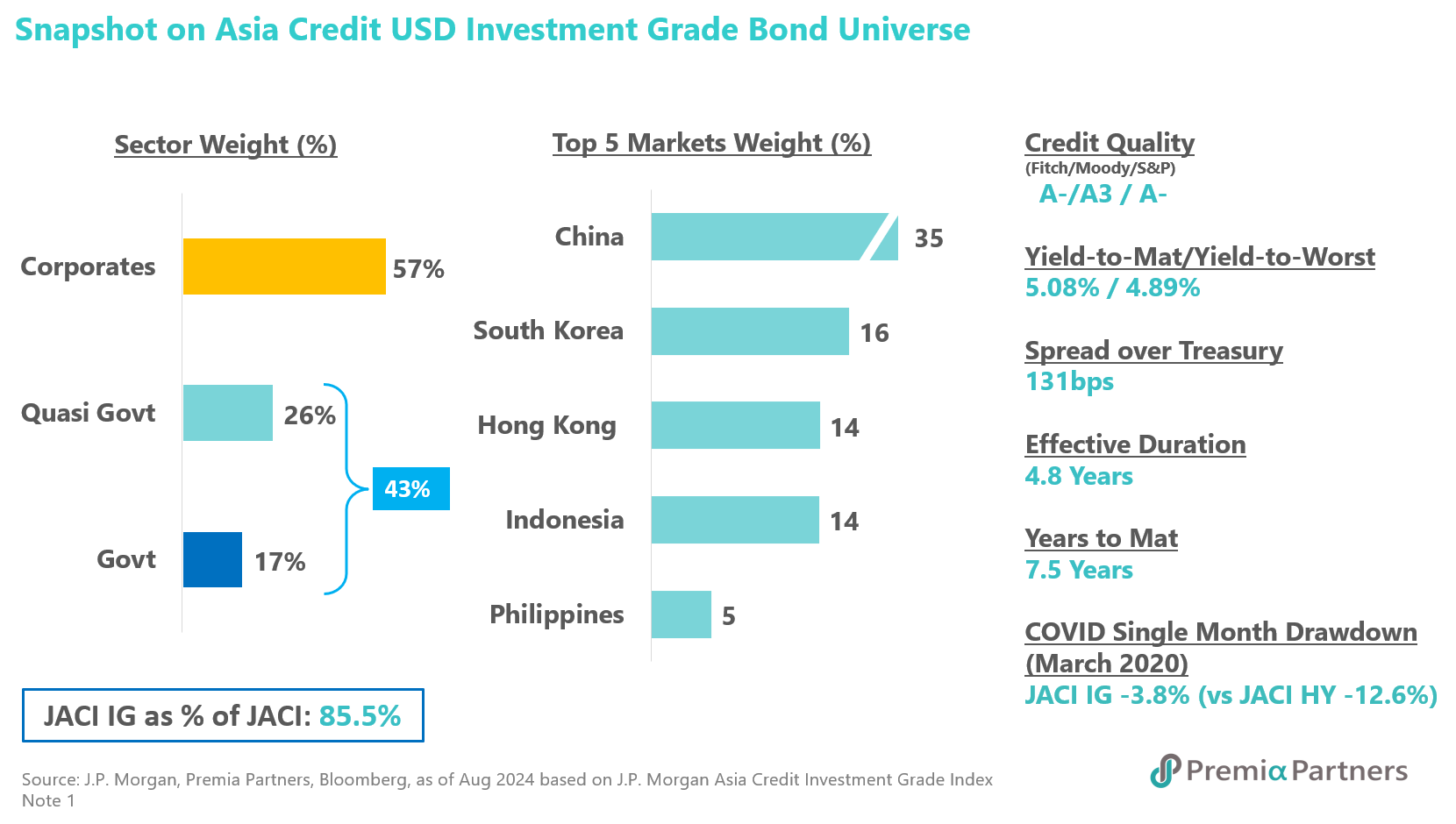

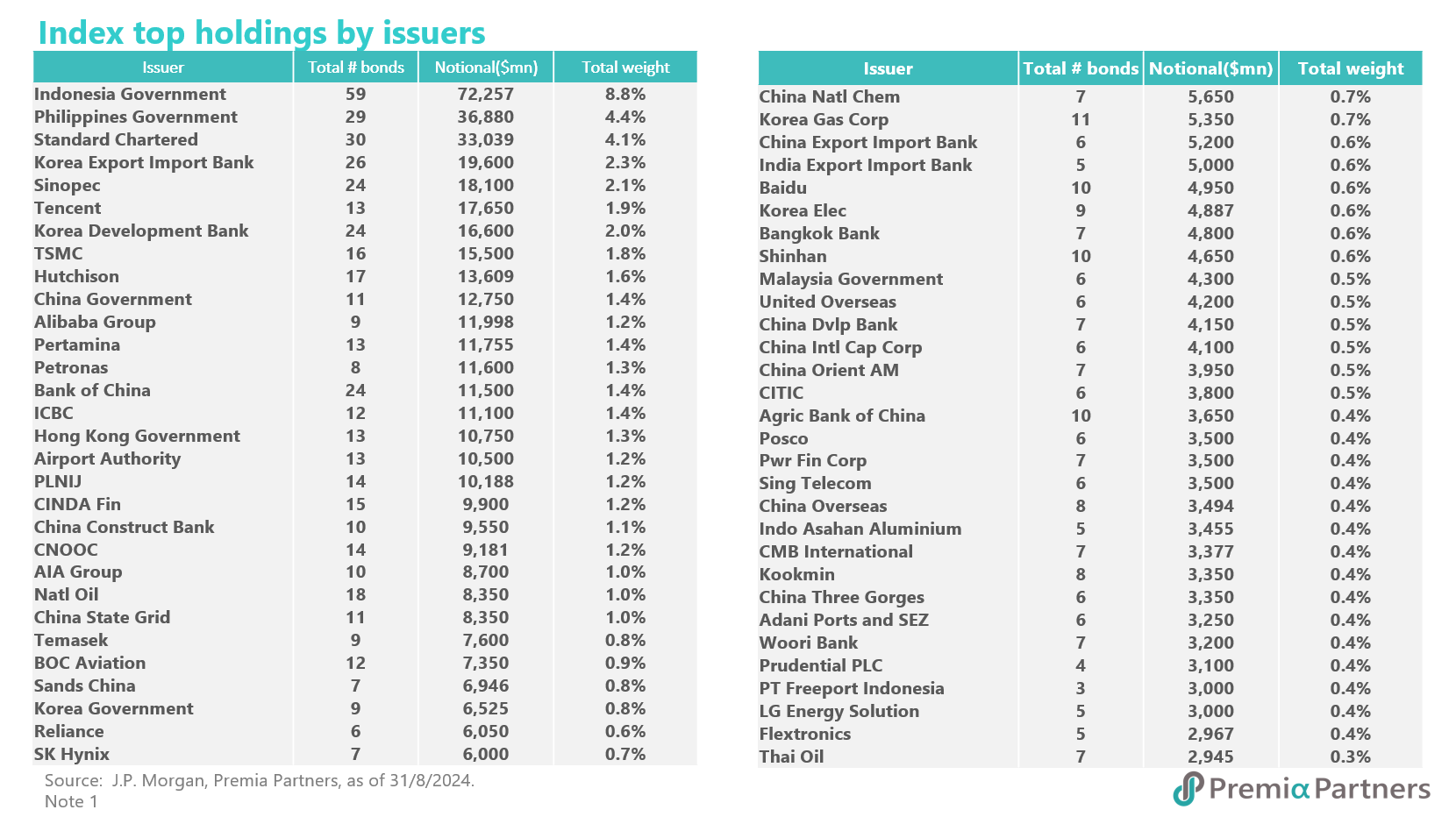

The Asia US dollar credit universe (as represented by the J.P. Morgan Asia Credit Index “JACI”) has expanded significantly over the past 2 decades, having grown from a market size of less than US$200 billion in 2006 to more than US$1 trillion today. As of August 2024, more than 85% of the bond issues within the JACI are IG-rated by Moody’s, S&P, or Fitch.

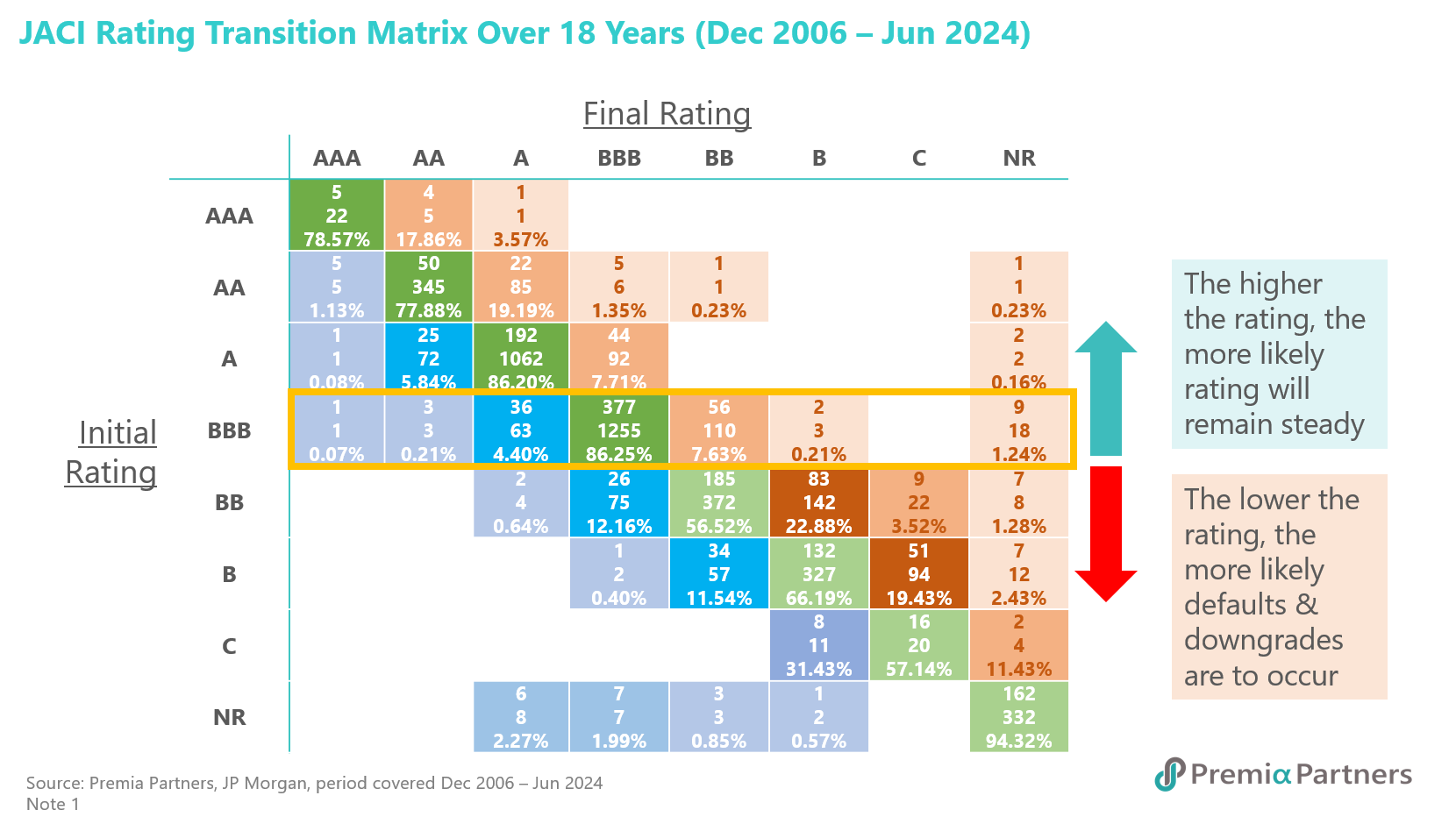

In fact, the Asian IG universe (as represented by the J.P. Morgan Asia Credit Investment Grade Index “JACI IG”) has historically appeal to domestic Asian investors, both retail and institutions, for its better value (higher yield, shorter duration, better rating) and more stable, robust credit profile (better rating, more stable credit migration profile, better drawdown history and better diversification against idiosyncratic risks through geographic and issuer diversification).

Asia IG ETF offering flexibility in managing credit risks

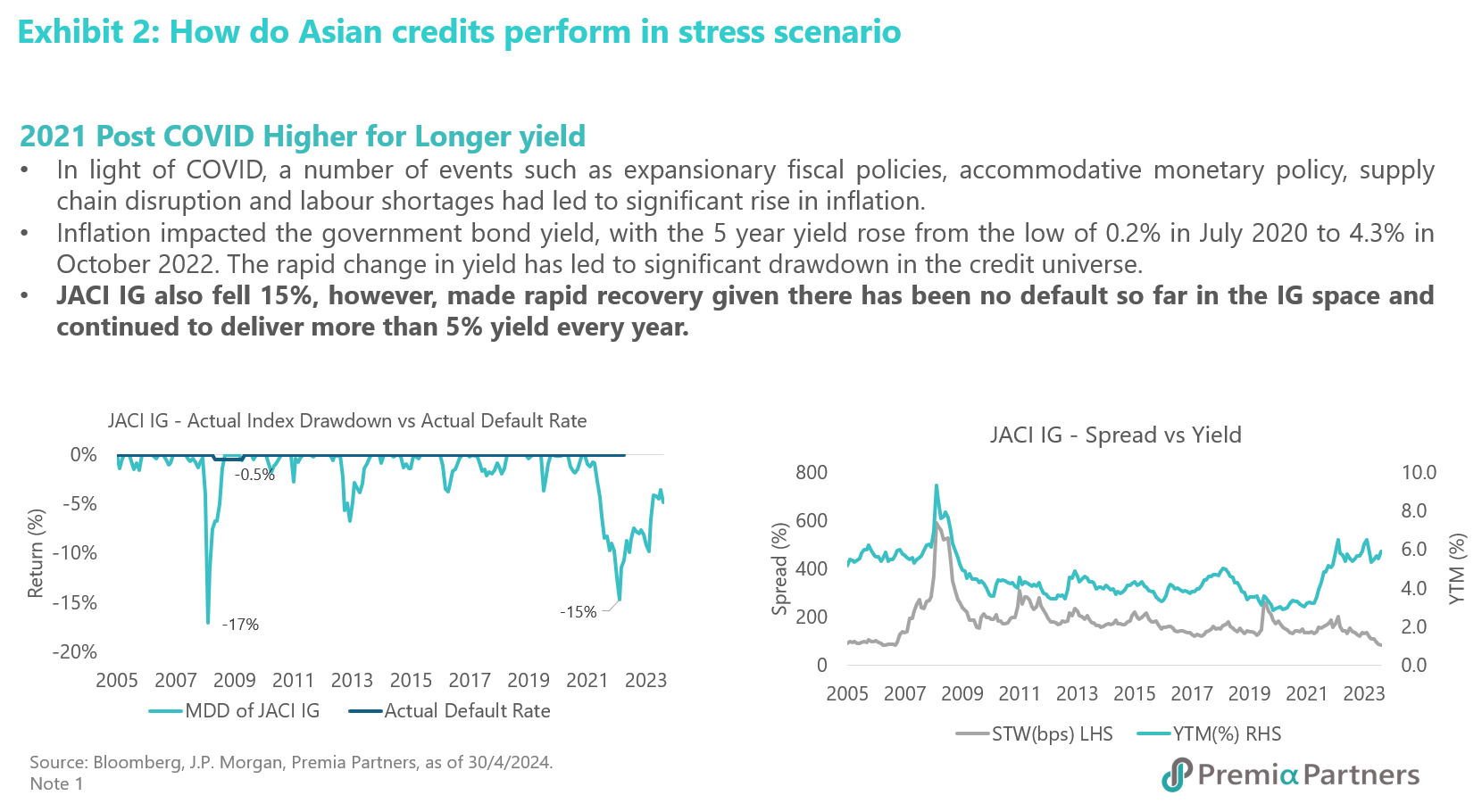

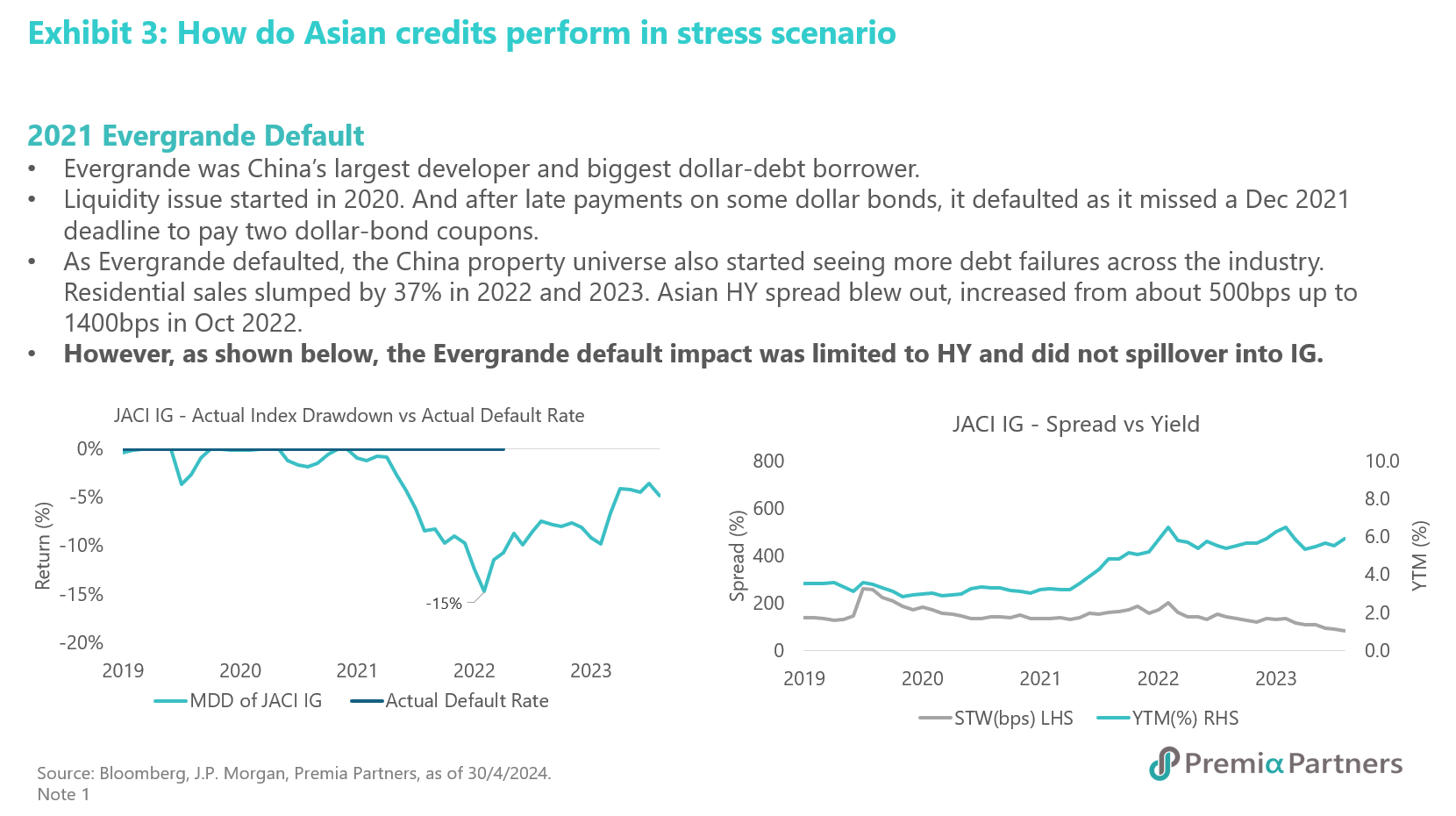

At Premia, we believe that separating IG and high-yield (HY) bonds provides investors more flexibility to respond through credit cycles, especially at the time when we are entering a new era when monetary policies around the world are making directional shifts. Historical data shows that while HY offers significantly higher yields, it also comes with more than double the volatility and worst drawdowns compared to IG while investors often are not sufficiently compensated for such additional risks. In fact, during previous credit cycles, Asian USD IG bonds exhibited much better resilience and superior return, including during the recent Black Monday in August 2024 when the unwind of the Yen carry trades kicked in.

For multi-asset allocators and investors seeking diversification benefits from adding bonds to their equity or private credit heavy portfolios, HY also may not serve the purpose as well given its much higher downside correlation to equity, while IG exhibits minimal to no correlation.

When investing in liquid Asian credits, we are also mindful that taking the simplistic passive approach may not be appropriate for HY – as it inherently takes the wrong way risks by allocating more to the more indebted issuers and would demand more fundamental evaluation approach to address the idiosyncratic risks associated with issuers. IG bonds, on the other hand, are generally more liquid, with a more robust drawdown pattern from default/ downgrade risks, and feature smoother pricing with better market efficiency. This makes passive allocation through an ETF an ideal method for accessing IG credit, providing a straightforward and efficient means for investors to gain exposure to this segment with a one-ticker trade.

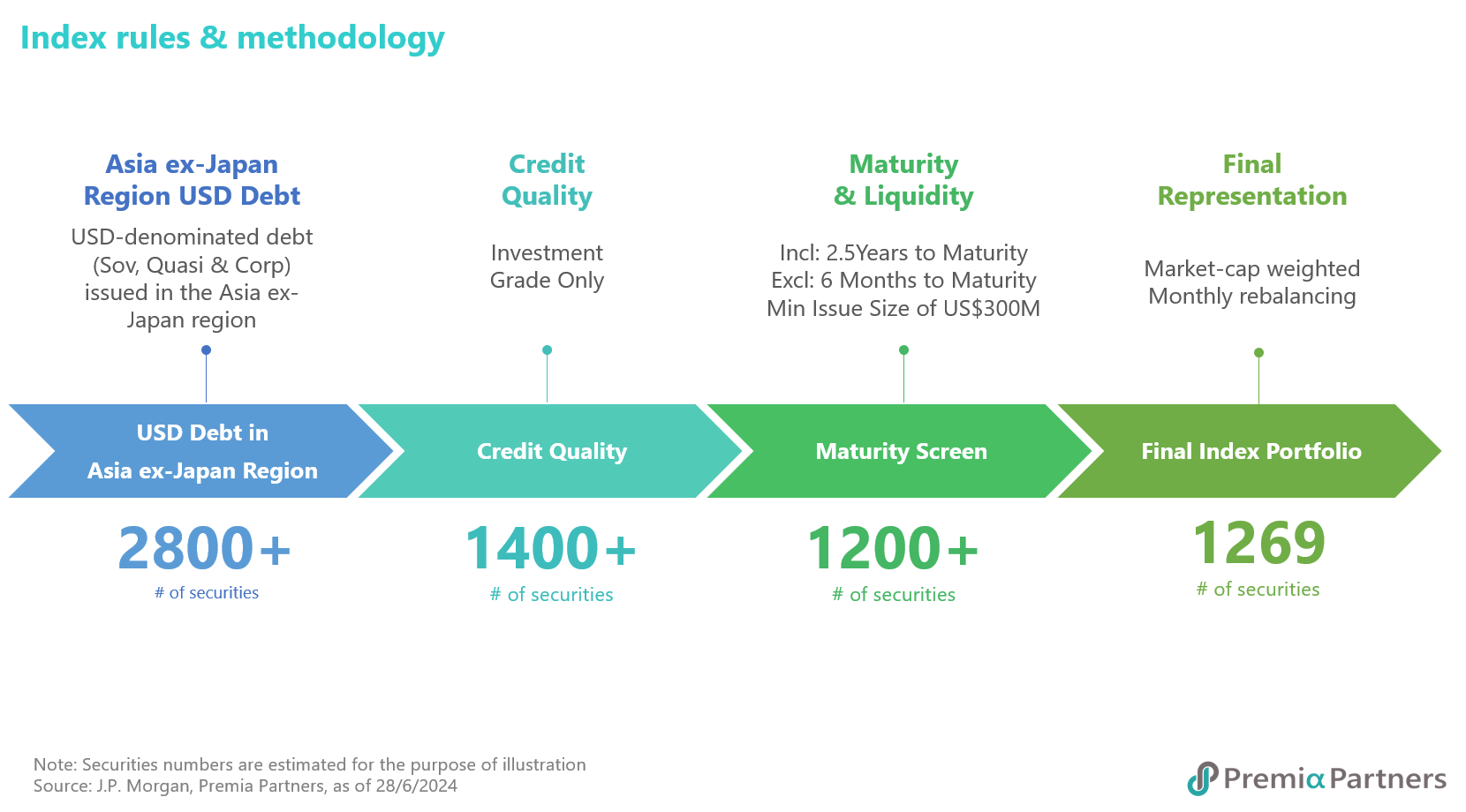

As of June 2024, the Asia US Dollar IG Credit universe comprises nearly 3,000 bonds, encompassing sovereign, quasi-sovereign, and corporate issuers across Asia ex-Japan markets, including China/ Hong Kong/ Macau, South Korea, Indonesia, the Philippines, India, Singapore, Malaysia, Thailand and Taiwan. To facilitate efficient allocation to such, we shall be launching a new ETF tracking the J.P. Morgan Asia Credit Investment Grade Bond index, using the representative sampling replication approach covering USD IG bonds from the aforesaid universe, while applying credit, maturity, and liquidity screens for those with at least 2.5 years to maturity with issuance size of at least US$300 million.

Case Studies

Note1 - Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2024, JPMorgan Chase & Co. All rights reserved.